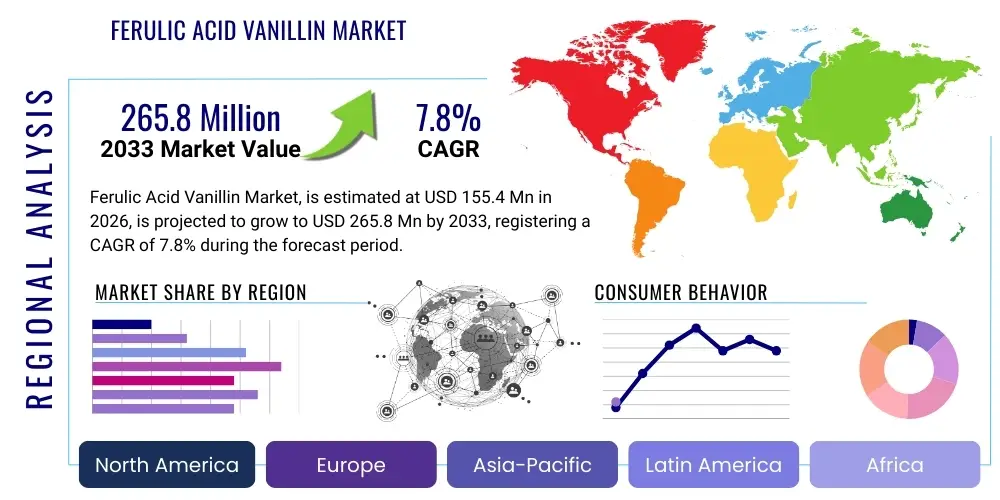

Ferulic Acid Vanillin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435499 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ferulic Acid Vanillin Market Size

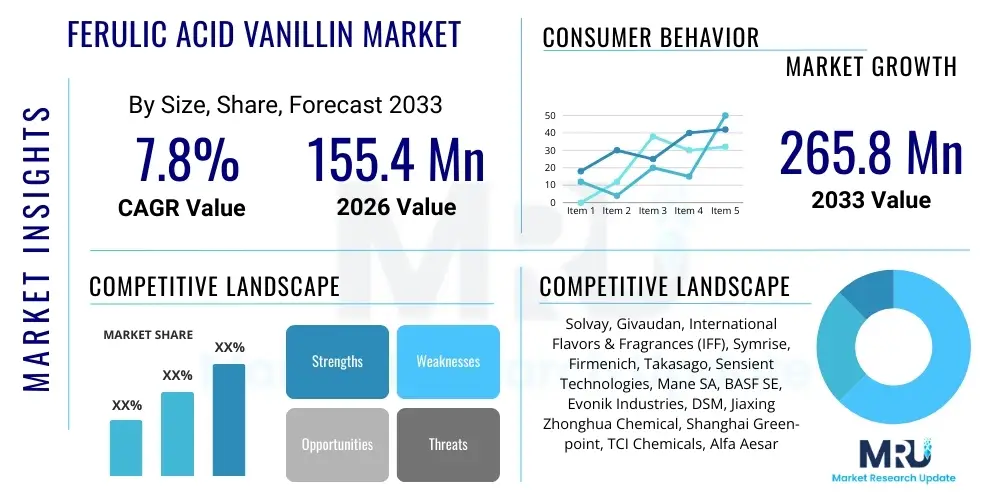

The Ferulic Acid Vanillin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $155.4 Million in 2026 and is projected to reach $265.8 Million by the end of the forecast period in 2033.

Ferulic Acid Vanillin Market introduction

The Ferulic Acid Vanillin market involves the production and commercialization of Vanillin derived primarily from ferulic acid, a natural phenolic compound abundant in plant cell walls, such as those found in rice bran, wheat bran, and beet pulp. This pathway is highly valued as it offers a bio-based or natural route for Vanillin synthesis, catering to the increasing consumer demand for natural ingredients, especially within the food and beverage and fragrance sectors. Vanillin, being the primary component responsible for the flavor and aroma of vanilla, is one of the most widely used flavoring agents globally, making the efficiency and sustainability of its production methods critical to market dynamics.

The primary driver for this specialized market segment is the premium consumers and regulatory bodies place on "Natural Vanillin." While synthetic Vanillin (derived mainly from petrochemicals or lignin) dominates volume, Vanillin sourced or synthesized from ferulic acid via biotransformation processes (using microorganisms like fungi or bacteria) is recognized as natural, thus commanding significantly higher prices. Major applications span high-end food products, premium fragrances, and specific pharmaceutical formulations where natural sourcing is a mandatory requirement. The process offers better environmental compatibility compared to traditional chemical synthesis, aligning with global sustainability trends.

Key driving factors include stringent clean label regulations in North America and Europe, technological advancements in microbial fermentation and biocatalysis that improve yield and reduce production costs, and the rising global penetration of processed foods and beverages that require stable and high-quality flavoring agents. Furthermore, the cosmetic industry utilizes ferulic acid for its antioxidant properties, and the derived Vanillin is incorporated for both fragrance and mild preservative functions, further diversifying the market base and solidifying the necessity for advanced production methods.

Ferulic Acid Vanillin Market Executive Summary

The Ferulic Acid Vanillin Market is characterized by a strong dichotomy between high-volume synthetic production and high-value natural alternatives, with the ferulic acid route firmly positioned in the premium segment driven by stringent consumer preferences for natural ingredients. Business trends indicate significant investment in biotechnology and fermentation scaling by major flavor and fragrance houses to secure reliable, cost-effective natural supply chains. Strategic collaborations between biotech firms and established chemical manufacturers are pivotal to navigating regulatory hurdles and achieving high-purity standards essential for food and pharmaceutical applications. The market structure is highly competitive, focusing on intellectual property related to efficient bioconversion strains and purification technologies.

Regional trends show Asia Pacific emerging as a critical manufacturing hub for ferulic acid sourcing and initial Vanillin synthesis, benefiting from abundant agricultural residues and lower operational costs. However, North America and Europe remain the primary consumption centers, dictated by high disposable incomes and robust clean-label movements, which ensure sustained demand for premium natural ingredients. Regulatory frameworks, particularly the FDA and EFSA definitions of "Natural Flavoring," heavily influence market entry and pricing strategies across these key consuming regions. Furthermore, Latin America is showing accelerated growth due to increased industrialization of its food and cosmetic sectors.

Segmentation trends highlight the dominance of the Food & Beverage segment, especially within dairy, confectionery, and baked goods, necessitating high-purity grades. The Pharmaceuticals segment, although smaller in volume, demands the highest purity and traceability, leading to premium pricing for specialized batches. Technological advancement in enzyme immobilization and process control (such as continuous fermentation) is crucial for improving the yield efficiency of the Synthetic Ferulic Acid Vanillin segment, making it more competitive against petrochemical-derived alternatives while still retaining its favorable bio-based origin status.

AI Impact Analysis on Ferulic Acid Vanillin Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ferulic Acid Vanillin market primarily revolve around optimizing the complex biotransformation processes, ensuring quality control, and managing volatile raw material sourcing. Key themes include the use of machine learning to enhance microbial strain efficiency, questions about how AI predictive analytics can stabilize highly fluctuating natural raw material prices (ferulic acid derived from agricultural waste), and expectations for automated quality assurance in high-ppurity batch production. Consumers and industry stakeholders are keen to understand if AI can reduce the current cost premium associated with natural Vanillin, thus making it accessible for broader commercial application without compromising its natural status.

AI's role in this specialized flavor market extends significantly into R&D and manufacturing intelligence. Predictive models using vast genomic and metabolic data can identify superior microbial strains capable of higher Vanillin yield from ferulic acid precursors under varying industrial conditions. This drastically reduces the time and cost associated with traditional strain engineering. Furthermore, in the operational sphere, AI-driven process control systems monitor fermentation parameters—such as pH, temperature, and nutrient uptake—in real-time, adjusting conditions dynamically to maximize conversion rates and minimize batch contamination, which is critical for maintaining high-purity natural certifications.

The integration of AI also addresses critical supply chain vulnerability. Ferulic acid supply can be erratic, depending on agricultural cycles and the efficiency of extracting it from biomass waste. AI algorithms can analyze satellite imagery, agricultural yield forecasts, and global commodity prices to provide accurate demand forecasting and procurement timing, helping manufacturers buffer against price spikes and inventory shortages. This optimization ensures a more stable and resilient supply of natural Vanillin, supporting the market's overall goal of scaling up sustainable production methods.

- AI-driven optimization of microbial fermentation kinetics for enhanced Vanillin yield.

- Machine learning for predictive quality control and purity assessment using spectroscopic data.

- Advanced supply chain forecasting models to stabilize fluctuating ferulic acid raw material costs.

- Automated robotic systems for high-throughput screening of biocatalysts and enzyme immobilization techniques.

- Generative AI used in R&D to design novel, highly efficient bioconversion pathways.

DRO & Impact Forces Of Ferulic Acid Vanillin Market

The Ferulic Acid Vanillin market is propelled by a confluence of strong regulatory mandates favoring natural ingredients, significant consumer health trends, and technological breakthroughs in industrial biotechnology. However, it faces constraints related to the high cost of raw material extraction and the complex scalability challenges inherent in biotransformation processes. The primary opportunity lies in replacing synthetic Vanillin in mainstream applications by leveraging cost efficiencies gained through superior bioprocessing techniques. These market dynamics are shaped by critical impact forces, including stringent global definitions of natural flavorings and the necessity for continuous innovation in biocatalysis to maintain a competitive edge over cheaper, synthetically produced Vanillin alternatives.

Drivers: The dominant driver is the accelerating consumer preference for clean-label, plant-derived ingredients, amplified by increasing regulatory scrutiny on artificial additives, particularly in developed economies. Biotechnological advancements, specifically in microbial engineering and enzyme utilization, have significantly improved the feasibility and economic viability of converting ferulic acid into high-grade Vanillin, moving the production needle closer to large-scale industrial output. Furthermore, sustainability goals adopted by major multinational corporations require sourcing natural flavors to meet Environmental, Social, and Governance (ESG) targets, bolstering demand for traceable, bio-based products like Ferulic Acid Vanillin.

Restraints: The market faces considerable restraints primarily centered around economics and technical complexity. The initial cost of isolating and purifying ferulic acid from agricultural biomass remains high, directly influencing the final price of the natural Vanillin, often making it significantly more expensive than synthetic variants. Furthermore, maintaining the stability, purity, and consistency of biotransformation processes at industrial scale is challenging. Regulatory ambiguity in certain developing markets regarding what constitutes "natural" flavorings also acts as a dampener, creating uncertainty for large-scale investment.

Opportunities: Significant market opportunities exist in expanding the utilization of low-cost agricultural residues (like lignin and waste bran) as sustainable ferulic acid sources, which can dramatically lower input costs. Strategic opportunities also include penetrating emerging economies in APAC and LATAM, which are rapidly developing sophisticated food processing industries but lack entrenched natural Vanillin supply chains. Developing hybrid Vanillin products that combine the best attributes of bio-based production with cost-effective engineering represents a mid-market entry opportunity. The utilization of Ferulic Acid Vanillin in functional foods and nutraceuticals, driven by its dual properties as a flavor and an antioxidant precursor, also represents a promising avenue for specialized growth.

Segmentation Analysis

The Ferulic Acid Vanillin market segmentation is fundamentally driven by the source and purity of the final product, which dictates its end-use application and premium pricing strategy. The primary differentiation exists between Natural Ferulic Acid Vanillin, derived entirely through approved biotransformation pathways, and Synthetic Ferulic Acid Vanillin, which might involve chemical steps following initial ferulic acid sourcing. The distinction is critical for regulatory compliance in the food and fragrance industries. The purity grade, ranging from Food Grade to Pharmaceutical Grade, further refines the market, with higher purity demanding extensive purification processes and consequently, higher costs.

Application analysis shows the Food & Beverage industry as the dominant consumer due to the pervasive use of Vanillin in mass-market products, although the Fragrance and Perfumery segment places a high value on the nuanced aroma profile offered by natural variants. The pharmaceuticals sector, while low in volume, requires the highest levels of safety and traceability for its excipients and masking agents. Understanding these segments is paramount for manufacturers to tailor production capabilities and certification efforts, ensuring alignment with specific client needs regarding regulatory compliance (e.g., kosher, halal, non-GMO) and technical specifications (e.g., solubility, thermal stability).

Geographically, market segmentation reflects consumption patterns and regulatory environments. North America and Europe lead in natural Vanillin consumption due to strong consumer purchasing power and well-established clean-label movements. In contrast, the APAC region, while a significant producer of raw ferulic acid materials, is transitioning from prioritizing cost over natural sourcing, presenting a future growth area for premium Vanillin products as regulatory standards tighten and consumer awareness rises across major economies like China and India.

- By Type

- Natural Ferulic Acid Vanillin (High premium, stringent regulatory compliance)

- Synthetic Ferulic Acid Vanillin (Bio-based origin, lower cost than fully natural)

- By Application

- Food & Beverage (Flavoring agents in confectionery, bakery, dairy)

- Fragrance & Perfumery (High-end cosmetic and household fragrances)

- Pharmaceuticals (Excipients, masking agents, intermediates)

- Cosmetics & Personal Care (Aroma, mild preservation, antioxidant inclusion)

- By Purity Grade

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

- By Source of Ferulic Acid

- Rice Bran

- Beet Pulp

- Lignin Derivatives

Value Chain Analysis For Ferulic Acid Vanillin Market

The value chain for Ferulic Acid Vanillin is highly specialized and complex, beginning with the sourcing of agricultural residues rich in ferulic acid, such as rice bran or sugar beet pulp. The upstream analysis involves the efficient and sustainable extraction and purification of ferulic acid, which is often a capital-intensive process requiring advanced chemical engineering or enzymatic treatment. This step is followed by the core value addition: the biotransformation of ferulic acid into Vanillin, which relies heavily on proprietary microbial strains and optimized fermentation technology. The efficiency of the upstream process dictates the competitive pricing of the final bio-based Vanillin.

Midstream activities focus on purification and quality assurance. Given that Ferulic Acid Vanillin primarily targets the premium, natural flavor segment, rigorous purification (chromatography, crystallization) is necessary to meet stringent international standards (e.g., FEMA GRAS, European Pharmacopoeia). This stage adds significant value and ensures the necessary purity grades (Food Grade or Pharma Grade). Manufacturing plants often require certifications like ISO and HACCP. Failure to maintain extremely high purity can lead to the loss of the "natural" designation or rejection by sophisticated end-users in pharmaceuticals or premium confectionery.

Downstream analysis involves distribution channels, which are typically segmented into direct and indirect routes. Direct distribution involves large-volume sales to major flavor houses (Givaudan, IFF, Symrise) or pharmaceutical companies that integrate Vanillin directly into their formulation matrices. Indirect distribution utilizes specialized chemical distributors and regional agents who serve smaller food processors, cosmetic manufacturers, and compounding pharmacies. The distribution strategy must emphasize temperature control and lot traceability to maintain product integrity and comply with regulatory requirements across international borders, especially concerning natural product documentation.

Ferulic Acid Vanillin Market Potential Customers

Potential customers for Ferulic Acid Vanillin are concentrated in sectors requiring natural, high-purity flavoring or fragrance ingredients with verifiable traceability and sustainable sourcing credentials. The largest volume consumers are multinational Food and Beverage conglomerates that utilize Vanillin in mass-produced dairy, confectionery, bakery products, and beverages. These customers are driven by brand reputation and the necessity to meet the increasing consumer demand for clean labels and natural ingredients.

The second major category encompasses Flavor and Fragrance houses (F&F). These entities purchase Ferulic Acid Vanillin as a core building block to formulate complex flavor profiles and high-end perfumes, often blending it with other natural extracts. F&F houses act as intermediaries, serving thousands of small and medium-sized consumer goods manufacturers, and their demand is highly sensitive to price fluctuations and consistent supply volume. Their focus is on ensuring the sensory profile and stability of the natural Vanillin remains consistent across various application bases.

Finally, pharmaceutical and nutraceutical manufacturers represent a niche but highly profitable segment. These customers require Ferulic Acid Vanillin for masking the bitter tastes of active pharmaceutical ingredients (APIs), or as a specialty excipient due to its antioxidant properties. For this segment, the criteria of selection include exceptionally high purity (USP/EP standards), detailed toxicology reports, and guaranteed batch consistency, leading to long-term contractual relationships and premium pricing far exceeding that seen in the standard food market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155.4 Million |

| Market Forecast in 2033 | $265.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay, Givaudan, International Flavors & Fragrances (IFF), Symrise, Firmenich, Takasago, Sensient Technologies, Mane SA, BASF SE, Evonik Industries, DSM, Jiaxing Zhonghua Chemical, Shanghai Green-point, TCI Chemicals, Alfa Aesar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferulic Acid Vanillin Market Key Technology Landscape

The technological landscape of the Ferulic Acid Vanillin market is dominated by advancements in industrial biotechnology, specifically focusing on biocatalysis and microbial fermentation. The crucial challenge is overcoming the inherent difficulty of scaling up complex biological processes while maintaining product consistency and high yield. Primary innovations center on identifying and optimizing specific microbial strains, such as certain species of Aspergillus or Pseudomonas, that naturally or through genetic modification exhibit high efficiency in converting ferulic acid into Vanillin, often involving intermediate products like feruloyl-CoA or coniferyl alcohol. Continuous fermentation systems, monitored by advanced sensors and process control software, are increasingly replacing traditional batch processing to improve output stability and lower operational costs per unit volume.

A second pivotal technology area involves the upstream preparation of the ferulic acid precursor. Traditional extraction from rice bran or beet pulp can be inefficient and environmentally burdensome. Newer enzymatic hydrolysis techniques use tailored enzyme cocktails to release ferulic acid efficiently and purely from the lignocellulosic matrix, dramatically improving precursor availability and purity. Furthermore, technologies focusing on lignin depolymerization are gaining traction, aiming to convert massive, low-value lignin waste streams from the pulp and paper industry into usable ferulic acid, thereby securing a highly sustainable and potentially vast raw material supply for future market expansion.

Downstream technology development focuses intensely on separation and purification techniques crucial for achieving pharmaceutical and high-end food grades. Techniques such as simulated moving bed chromatography (SMBC) and continuous crystallization are employed to efficiently remove minute impurities and unreacted intermediates, which are essential for securing the "Natural Vanillin" certification. Nanofiltration and membrane separation are also being explored to reduce energy consumption in the purification stages. The convergence of these advanced biotechnological tools ensures that Ferulic Acid Vanillin maintains its competitive edge and meets the exceptionally high purity demands of the global market.

Regional Highlights

Regional dynamics significantly influence the Ferulic Acid Vanillin market, primarily segregating the global landscape into key consumption centers (North America, Europe) and major manufacturing/sourcing regions (Asia Pacific). North America commands a substantial share of the market value, driven by robust consumer demand for natural flavors and fragrances, coupled with high regulatory clarity concerning "natural" labeling. The region hosts major global flavor and fragrance houses that actively invest in securing natural Vanillin supply chains. The stringent quality control measures and high consumer willingness to pay a premium for certified natural products ensure that pricing remains robust here.

Europe mirrors North America's consumption trends, amplified by strong EU mandates favoring sustainable and bio-based ingredients (such as the REACH regulation influence indirectly promoting bio-based sourcing) and powerful clean-label movements across countries like Germany and the UK. The European market emphasizes traceability and comprehensive supply chain documentation, making certified Ferulic Acid Vanillin highly desirable. Investment in European biotech facilities focused on advanced biotransformation is rising, often supported by government incentives aimed at reducing reliance on Asian manufacturing.

The Asia Pacific (APAC) region is vital for the market's raw material sourcing, particularly the abundant availability of agricultural residues like rice bran in countries such as China, India, and Thailand. While the region is a powerhouse for ferulic acid extraction, its consumption of premium natural Vanillin is still accelerating but catching up. China, however, is rapidly becoming a significant center for industrial fermentation technology, focusing on scaling production efficiently. The future growth of this region is expected to be exponential as its middle-class population grows and regulatory bodies begin to adopt standards aligning with Western requirements for food safety and natural ingredient definition.

- North America: High consumption volume; strict clean-label adherence; major R&D hub for fermentation optimization; strong influence of FDA labeling standards.

- Europe: Leading high-value market; driven by EU sustainability goals and stringent flavor regulations; high adoption rate in premium confectionery and organic products.

- Asia Pacific (APAC): Key raw material sourcing hub (rice bran, agricultural waste); increasing focus on production scale and competitive pricing; burgeoning domestic demand for natural flavors.

- Latin America (LATAM): Emerging market with increasing industrialization of food and beverage sectors; gradual shift towards natural ingredients; regulatory harmonization ongoing.

- Middle East and Africa (MEA): Niche market driven primarily by high-end fragrance applications and imported processed goods; limited local production infrastructure for advanced bioconversion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferulic Acid Vanillin Market.- Solvay

- Givaudan

- International Flavors & Fragrances (IFF)

- Symrise

- Firmenich (now part of DSM-Firmenich)

- Takasago International Corporation

- Sensient Technologies

- Mane SA

- BASF SE

- Evonik Industries

- DSM Nutritional Products

- Jiaxing Zhonghua Chemical Co., Ltd.

- Shanghai Green-point Fragrance & Flavor Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Borregaard AS (Lignin Vanillin producer with competitive technology focus)

- De Monchy Aromatics B.V.

- Advanced Biotech

- Global Bio-Chem Technology Group Company Limited

- Synthite Industries Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Ferulic Acid Vanillin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ferulic Acid Vanillin and why is it preferred over synthetic Vanillin?

Ferulic Acid Vanillin is produced by the biotransformation of ferulic acid, a natural compound found in plant biomass. It is preferred because this production method allows the Vanillin to be legally classified as a "Natural Flavoring" in major regulatory jurisdictions, commanding a premium over cheaper, petrochemical-derived synthetic variants.

How does the cost of Ferulic Acid Vanillin compare to traditional Vanillin sources?

Due to the complexity of ferulic acid extraction and the high capital investment required for industrial bioconversion (fermentation), Ferulic Acid Vanillin is significantly more expensive than standard synthetic (guaiacol) Vanillin. Its pricing is comparable only to natural Vanillin extracted directly from vanilla beans, often serving as a cost-effective, sustainable alternative to bean extract.

Which microbial strains are commonly used for the bioconversion process?

The bioconversion process commonly utilizes proprietary strains of microorganisms, including certain bacteria like Amycolatopsis and Pseudomonas, and fungi such as Aspergillus niger. These strains are selected or genetically engineered for high efficiency in metabolizing ferulic acid into high-purity Vanillin precursors.

What are the primary applications driving the growth of this market segment?

The primary growth drivers are applications requiring certified natural ingredients, particularly in the high-end Food & Beverage sector (dairy, premium confectionery, natural beverages) and the Fragrance industry, where natural sourcing is a key differentiator for high-value products.

What role does sustainability play in the Ferulic Acid Vanillin market?

Sustainability is critical, as Ferulic Acid Vanillin often utilizes agricultural waste (rice bran, beet pulp) as its raw material, reducing waste and reliance on fossil fuels. This bio-based sourcing aligns with corporate ESG goals and appeals directly to environmentally conscious consumers and regulatory pressures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager