Fetal & Neonatal Care Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436605 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Fetal & Neonatal Care Devices Market Size

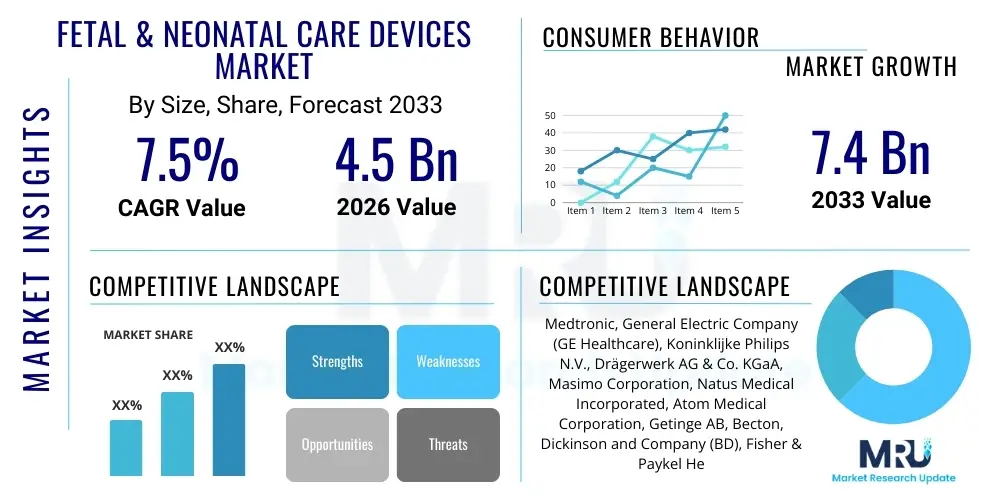

The Fetal & Neonatal Care Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Fetal & Neonatal Care Devices Market introduction

The Fetal & Neonatal Care Devices Market encompasses a wide range of specialized medical equipment designed for monitoring, diagnostics, and therapeutic intervention for fetuses during gestation and neonates (newborns up to 28 days of age), particularly those born prematurely or suffering from birth complications. This equipment is critical for reducing infant mortality rates and improving the long-term health outcomes of vulnerable infants. Key product categories include incubators, neonatal ventilators, patient monitors, phototherapy devices, and highly specialized diagnostic imaging systems. These devices are essential components of Neonatal Intensive Care Units (NICUs) globally, driving substantial investment in advanced healthcare infrastructure across developed and rapidly emerging economies.

The primary application of these sophisticated devices is centered in hospital maternity wards, specialized neonatal care centers, and increasingly, in remote settings supported by telehealth platforms. The profound benefits include precise temperature regulation, non-invasive monitoring of vital signs, advanced respiratory support for premature lungs, and effective treatment of conditions like neonatal jaundice. The continual evolution of these devices emphasizes minimal invasiveness, greater accuracy, and enhanced integration with hospital information systems (HIS), facilitating faster clinical decision-making and better coordinated care for critically ill newborns.

Driving factors for sustained market expansion are directly linked to the rising global incidence of preterm births, which remains a leading cause of childhood morbidity and mortality worldwide. Coupled with this clinical necessity, increasing healthcare expenditure, particularly in emerging Asian economies, and supportive governmental policies aimed at improving maternal and child health standards significantly propel demand. Furthermore, technological advancements, such as the miniaturization of sensors and the integration of artificial intelligence (AI) for predictive analytics, are creating new avenues for more efficient and personalized neonatal care, ensuring robust market growth over the forecast period.

Fetal & Neonatal Care Devices Market Executive Summary

The Fetal & Neonatal Care Devices Market is undergoing a rapid transformation characterized by technological convergence and strategic geographical expansion, with current business trends heavily favoring automation and remote monitoring capabilities. Significant investment is being channeled into developing sophisticated non-invasive monitoring systems that reduce stress on neonates while providing highly accurate, real-time physiological data. The shift toward modular, integrated NICU solutions that improve workflow efficiency and patient safety is a defining commercial trend. Key manufacturers are focusing on establishing strong distribution networks, particularly in high-growth regions like the Asia Pacific, where underdeveloped healthcare infrastructure presents both challenges and massive market opportunities for entry-level and mid-range equipment.

Regionally, North America maintains its dominance, driven by high adoption rates of cutting-edge technology, established reimbursement frameworks, and the substantial presence of key market players who continually innovate in the areas of ventilation and monitoring. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by increasing awareness of prenatal and neonatal health, rapid expansion of private healthcare facilities, and significant governmental focus on reducing infant mortality, notably in populous nations such as China and India. Europe also remains a crucial market, distinguished by stringent regulatory standards and a strong emphasis on evidence-based medicine, driving demand for premium, high-quality devices that meet rigorous CE Mark requirements.

Segment trends indicate that the monitoring devices category, particularly fetal and neonatal pulse oximeters and blood pressure monitors, retains the largest market share due to their fundamental role in critical care assessment. Simultaneously, the therapeutic devices segment, led by advanced neonatal incubators and highly specialized intensive care ventilators, is witnessing accelerated growth, stimulated by continuous innovation aimed at mimicking the intrauterine environment as closely as possible. Furthermore, the end-user landscape is seeing rapid growth in specialized neonatal clinics and standalone maternity centers, moving beyond traditional large hospital NICUs, as care decentralization becomes a growing preference for providing accessible care.

AI Impact Analysis on Fetal & Neonatal Care Devices Market

Common user and stakeholder questions regarding AI's role in Fetal & Neonatal Care Devices frequently revolve around the accuracy of predictive algorithms for sepsis or respiratory distress syndrome (RDS), the ethical implications of autonomous decision support in critical situations, and the accessibility of these advanced AI-integrated systems in low-resource settings. Users are deeply concerned about the validity and bias of training data, particularly across diverse patient populations, fearing that biased algorithms might lead to differential care outcomes. A major expectation is that AI will dramatically reduce alarm fatigue in NICUs by prioritizing actionable alerts and interpreting complex physiological data streams, freeing up nurses and physicians to focus on direct patient interaction and intervention.

The synthesis of user concerns highlights a demand for trustworthy, explainable AI (XAI) that can integrate seamlessly with existing monitoring infrastructure without requiring a complete overhaul of current workflows. Clinicians expect AI to move beyond simple pattern recognition to provide robust, personalized risk stratification models, potentially identifying neonates at risk hours or days before clinical symptoms manifest. This predictive capability is seen as the single most impactful benefit, promising to transform reactive care into proactive preventative management, significantly lowering mortality and morbidity associated with common neonatal complications such as necrotizing enterocolitis (NEC) and intraventricular hemorrhage (IVH).

In essence, users anticipate AI serving as a highly specialized clinical copilot, enhancing the expertise of NICU staff rather than replacing it. The consensus leans towards AI being indispensable for handling the massive datasets generated by multi-modal patient monitoring, allowing for deeper phenotyping of neonatal illnesses. However, questions regarding data security, regulatory oversight for AI-driven devices, and the necessary specialized training for clinical staff to effectively utilize and troubleshoot these complex systems remain central themes of discussion and concern among healthcare providers and administrators across the spectrum of neonatal care.

- AI-driven predictive analytics for early detection of neonatal sepsis and respiratory distress.

- Optimization of ventilation parameters and weaning protocols using machine learning algorithms.

- Reduction of false alarms and minimizing alarm fatigue through intelligent signal processing.

- Automated analysis of cranial ultrasound and MRI scans to detect subtle neurological injuries.

- Enhanced remote consultation and tele-neonatology via AI-powered diagnostic image transmission.

- Personalized dosage calculation for neonatal medications based on real-time physiological response.

DRO & Impact Forces Of Fetal & Neonatal Care Devices Market

The market for Fetal & Neonatal Care Devices is fundamentally shaped by powerful demographic drivers, significant technological advancements, and restrictive economic forces. Key drivers include the persistently high global rate of preterm births, the subsequent increase in the number of neonates requiring intensive care, and the rising global healthcare expenditure allocated specifically to maternal and child health programs. Simultaneously, technological innovation, particularly the development of non-invasive sensors and sophisticated closed-loop ventilation systems, acts as a primary catalyst for market expansion. Opportunities are abundant in emerging markets where governments are prioritizing the establishment of new, standardized NICU infrastructure, often favoring cost-effective, durable devices.

However, the market growth faces substantial restraints, predominantly the high initial capital investment required for purchasing and installing advanced NICU equipment, which can be prohibitive for smaller hospitals or facilities in developing nations. Stringent regulatory approval processes, particularly in highly regulated jurisdictions like the U.S. (FDA) and EU (MDR), often delay product launch and increase development costs. Furthermore, the scarcity of highly trained neonatal specialists and specialized technicians in many parts of the world limits the effective utilization and maintenance of complex therapeutic and monitoring devices, creating a bottleneck for widespread adoption.

The primary impact force governing this sector is the constant pressure to reduce Infant Mortality Rates (IMR) globally, acting as a sustained societal and political imperative that mandates continuous innovation and accessibility improvements. This force directly influences research and development, steering manufacturers towards safer, more effective, and increasingly user-friendly devices. Opportunities for growth are significantly boosted by the development of miniaturized and portable devices suitable for transport and decentralized care settings, along with strategic private-public partnerships aimed at subsidizing equipment purchases and providing specialized training in underserved regions, ultimately broadening the market's reach and impact.

Segmentation Analysis

The Fetal & Neonatal Care Devices market is segmented across multiple dimensions, including Product Type, Application, and End-User, providing a granular view of market dynamics and adoption patterns. The Product Type segment is broad, encompassing monitoring devices, therapeutic devices, and consumables, each serving distinct clinical needs in the care continuum. Monitoring devices form a large foundational segment essential for continuous assessment, while therapeutic devices represent high-value investments necessary for life support and intervention. Understanding these segments is crucial for strategic planning, as different regions prioritize investment in specific types of equipment based on prevailing healthcare challenges and budget constraints.

Application segmentation differentiates between fetal care devices, used primarily during pregnancy (e.g., fetal monitors and ultrasounds), and neonatal care devices, employed post-delivery (e.g., incubators, ventilators, phototherapy units). The neonatal care segment typically dominates due to the long-term, intensive nature of NICU stays for critically ill newborns, requiring a sophisticated suite of continuous care and life support equipment. Moreover, the growth in high-risk pregnancies globally ensures sustained demand for advanced fetal monitoring technologies that can preemptively identify complications requiring specialized neonatal intervention immediately after birth.

From an End-User perspective, the market is primarily driven by hospitals, specifically large-scale tertiary care hospitals with advanced Neonatal Intensive Care Units (NICUs). However, recent trends show accelerated purchasing activity from specialized maternity and pediatric clinics, and increasingly, from home healthcare settings for chronic conditions, driven by improved device portability and telemonitoring capabilities. This shift towards decentralized care is redefining distribution channels and product design, emphasizing user-friendly interfaces and robust connectivity options suitable for non-NICU environments.

- By Product Type:

- Fetal Monitoring Devices (Ultrasound Devices, Fetal Doppler, Fetal ECG/Toco Monitoring).

- Neonatal Care Devices (Incubators, Warmers, Phototherapy Devices, Neonatal Ventilators, Monitors, Others).

- By Application:

- Fetal Care.

- Neonatal Care.

- By End-User:

- Hospitals (NICUs).

- Maternity Centers.

- Pediatric Clinics.

- By Region:

- North America.

- Europe.

- Asia Pacific (APAC).

- Latin America (LATAM).

- Middle East & Africa (MEA).

Value Chain Analysis For Fetal & Neonatal Care Devices Market

The value chain for Fetal & Neonatal Care Devices begins with robust upstream activities involving specialized component suppliers, including manufacturers of high-precision sensors (e.g., pulse oximetry sensors, temperature probes), microprocessors, medical-grade plastics, and integrated software platforms, including embedded systems for device control and data capture. Innovation at the upstream level, particularly in non-invasive sensor technology and battery longevity, directly influences the cost-effectiveness and performance of the final product. Key manufacturers (OEMs) then engage in complex research and development, meticulous assembly, rigorous testing, and obtaining necessary regulatory clearances, representing the core value creation activities that transform components into certified, life-saving medical equipment.

The downstream analysis focuses on the efficient distribution and end-user adoption of these specialized devices. Distribution channels are typically highly regulated and involve a combination of direct sales forces (especially for high-value therapeutic devices like advanced ventilators or multi-parameter monitors sold to large hospital networks) and indirect channels utilizing third-party medical distributors, agents, and local representatives, crucial for market penetration in geographically diverse or highly fragmented markets. The indirect channel often manages post-sales service, installation, and maintenance, adding significant value by ensuring device longevity and operational compliance in specialized NICU settings.

The ultimate destination in the value chain is the End-User, predominantly large public and private hospitals equipped with Level III and Level IV NICUs. Effective market delivery relies heavily on successful tender processes and long-term contracts for maintenance and consumables (like disposable circuits or probes). The chain is highly sensitive to technological obsolescence and regulatory changes; therefore, continuous training for end-users and robust technical support are essential components that distinguish successful market participants, optimizing the total cost of ownership for healthcare institutions and ensuring optimal patient safety.

Fetal & Neonatal Care Devices Market Potential Customers

The primary potential customers and end-users of Fetal & Neonatal Care Devices are institutions specializing in high-risk obstetric and pediatric care, requiring sophisticated equipment to manage vulnerable populations. Foremost among these are large, multi-specialty hospitals with established Neonatal Intensive Care Units (NICUs), which are the heaviest purchasers of high-end therapeutic equipment such as complex ventilators, advanced incubators, and full-suite integrated patient monitoring systems. These facilities require devices that offer interoperability with Electronic Medical Records (EMRs) and robust networking capabilities to support centralized data management and multi-disciplinary consultations.

A rapidly growing segment of potential customers includes specialized maternity and perinatal clinics, which focus on low-to-medium risk pregnancies and require foundational fetal monitoring devices (e.g., Doppler and basic CTG machines) and essential neonatal resuscitation and warming equipment. While their individual purchasing volumes may be lower than those of major hospitals, their sheer numbers globally represent a significant cumulative market opportunity, particularly for manufacturers offering modular and scalable device solutions tailored for lower acuity settings or transport applications.

Furthermore, government and non-governmental organizations (NGOs) involved in public health and global aid initiatives represent crucial potential buyers, often purchasing large quantities of durable, mid-range equipment for deployment in community health centers and field hospitals, particularly in developing nations. Their purchasing decisions are highly influenced by total cost of ownership, ease of maintenance, and clinical reliability in challenging operational environments. Lastly, specialized research institutions and academic medical centers also constitute key customers, driving demand for the newest diagnostic imaging modalities and experimental monitoring technologies for clinical trials and educational purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, General Electric Company (GE Healthcare), Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Masimo Corporation, Natus Medical Incorporated, Atom Medical Corporation, Getinge AB, Becton, Dickinson and Company (BD), Fisher & Paykel Healthcare, Vyaire Medical, Inc., B. Braun Melsungen AG, Teleflex Incorporated, Utah Medical Products, Inc., Nonin Medical, Inc., Smiths Medical, OSI Systems, Inc., Neotech Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fetal & Neonatal Care Devices Market Key Technology Landscape

The technology landscape in the Fetal & Neonatal Care Devices market is defined by a strong push toward non-invasive, continuous monitoring and sophisticated life support systems aimed at minimizing handling stress and maximizing positive developmental outcomes for fragile newborns. A core technological trend involves the development and integration of advanced micro-sensor technology, such as wireless, disposable skin patches for monitoring vital signs like heart rate, respiration, and temperature without the need for cumbersome wired connections. These non-invasive methodologies are paramount in NICUs, contributing to reduced risk of infection, enhanced skin integrity preservation, and improved parent-infant bonding through less restrictive monitoring protocols.

Furthermore, significant technological investments are focused on respiratory support, leading to the evolution of sophisticated neonatal ventilators that utilize high-frequency oscillatory ventilation (HFOV) and volume-targeted ventilation (VTV) modes. These technologies deliver precise, lung-protective strategies, essential for minimizing lung injury in premature infants. Coupled with this, closed-loop systems are emerging, where monitoring data feeds directly back into the device (e.g., ventilator settings adjusting automatically based on oxygen saturation levels), creating an intelligent, responsive care environment. This automation is critical for stabilizing the volatile physiological status often experienced by extremely preterm infants.

Integration and connectivity form another pivotal technological pillar. Modern fetal and neonatal devices are increasingly Internet of Medical Things (IoMT) enabled, facilitating seamless integration with hospital Electronic Health Records (EHRs) and allowing remote monitoring and consultation (tele-neonatology). This includes secure data transmission for remote specialist review, particularly beneficial in rural or regional hospitals lacking on-site NICU expertise. The convergence of these technologies—non-invasive sensing, AI-driven closed-loop therapeutics, and robust IoMT connectivity—is collectively raising the standard of care, making highly specialized neonatal interventions more accessible and effective across diverse healthcare infrastructures globally.

Regional Highlights

Regional dynamics within the Fetal & Neonatal Care Devices market are largely determined by healthcare expenditure, birth rates, and technological adoption capabilities.

- North America (NA): Dominates the global market share, characterized by high prevalence of preterm births, established and generous reimbursement policies, and early adoption of premium, technologically advanced devices, particularly in sophisticated monitoring and respiratory support equipment. The presence of major industry leaders and high R&D spending solidify its leading position.

- Europe: Represents a mature market driven by rigorous quality standards and public healthcare procurement. Countries like Germany and the UK maintain substantial demand for high-quality therapeutic devices and benefit from strong clinical research supporting device utilization. The market focuses heavily on integrated IT solutions and patient-centric design compliant with EU Medical Device Regulation (MDR).

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by massive population bases, increasing disposable incomes, and significant improvements in healthcare infrastructure, particularly the development of standardized NICUs in countries like China, India, and Japan. Government initiatives aimed at reducing high infant mortality rates are boosting investments in essential and mid-range equipment.

- Latin America (LATAM): Offers considerable growth potential, although market maturity varies significantly between countries. Brazil and Mexico are primary markets, characterized by increasing private sector investment in healthcare and a gradual shift towards modern monitoring and imaging technologies to address persistent health disparities.

- Middle East and Africa (MEA): This region is experiencing steady growth, largely driven by significant healthcare infrastructure projects funded by government oil wealth in the GCC states (UAE, Saudi Arabia). The African subcontinent represents an untapped market where demand is highest for durable, basic, and cost-effective devices essential for resuscitation and basic neonatal care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fetal & Neonatal Care Devices Market.- Medtronic plc

- General Electric Company (GE Healthcare)

- Koninklijke Philips N.V.

- Drägerwerk AG & Co. KGaA

- Masimo Corporation

- Natus Medical Incorporated

- Atom Medical Corporation

- Getinge AB

- Becton, Dickinson and Company (BD)

- Fisher & Paykel Healthcare

- Vyaire Medical, Inc.

- B. Braun Melsungen AG

- Teleflex Incorporated

- Utah Medical Products, Inc.

- Nonin Medical, Inc.

- Smiths Medical

- OSI Systems, Inc.

- Neotech Products, Inc.

- Phoenix Medical Systems (P) Ltd.

- Weyer GmbH

Frequently Asked Questions

Analyze common user questions about the Fetal & Neonatal Care Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Fetal & Neonatal Care Devices Market?

Market growth is primarily driven by the consistently high global incidence of preterm births, the subsequent necessity for specialized NICU care, rapid technological advancements in non-invasive monitoring and advanced ventilation, and increased government and private sector investment in improving maternal and child healthcare infrastructure worldwide.

How is Artificial Intelligence (AI) specifically transforming neonatal care devices?

AI is transforming neonatal care by enabling predictive analytics for conditions like sepsis and respiratory distress, optimizing ventilator settings in real-time through closed-loop systems, reducing alarm fatigue for caregivers, and enhancing diagnostic accuracy in imaging and neurological monitoring.

Which geographical region holds the largest market share for these devices, and why?

North America currently holds the largest market share, attributed to its advanced healthcare expenditure, the high adoption rate of expensive, cutting-edge therapeutic devices, robust clinical research activities, and the presence of well-established reimbursement systems that support the purchase of premium equipment.

What major restraints impede the widespread adoption of advanced neonatal care devices?

Major restraints include the extremely high initial capital cost required for sophisticated NICU equipment, complex and lengthy regulatory approval processes, and a global shortage of highly trained neonatal specialists and bio-medical technicians capable of operating and maintaining the advanced technology, especially in low-resource settings.

What types of devices constitute the most rapidly growing segment in this market?

The therapeutic devices segment, specifically advanced neonatal ventilators (including HFOV units) and high-tech modular incubators, is experiencing the most rapid growth due to continuous innovation focused on lung protection and providing a stable, highly controlled environment for the most fragile premature infants.

The Fetal & Neonatal Care Devices market is a critical sector within medical technology, inextricably linked to public health outcomes and global demographics. Its complexity necessitates highly specialized research to navigate the stringent regulatory environments, evaluate competitive technology landscapes, and understand localized market access strategies. The ongoing transition towards smarter, interconnected devices is reshaping how critical care is delivered to newborns, emphasizing data-driven decisions and personalized medicine. This comprehensive shift requires stakeholders—from device manufacturers to hospital administrators and policymakers—to invest heavily not only in the devices themselves but also in the associated infrastructure, connectivity, and continuous professional training, ensuring that technological capability translates effectively into tangible reductions in infant morbidity and mortality rates across all regions. The competitive dynamics are intensifying, with key players consistently seeking strategic acquisitions and partnerships to integrate advanced software and AI capabilities, securing future relevance in a market that prioritizes precision and safety above all else. This strategic maneuvering indicates a robust long-term growth trajectory, underscored by the fundamental need for enhanced newborn care globally.

A detailed analysis of the supply chain reveals that resilience against disruptions, particularly in the sourcing of complex electronic components and high-grade materials, is paramount. The vulnerability exposed during global events has prompted many leading manufacturers to diversify their supplier base and increase inventory buffers for critical components. Furthermore, the specialized nature of neonatal device maintenance creates significant opportunities for third-party service providers and specialized repair technicians. Hospitals often seek long-term service agreements that guarantee operational uptime and regulatory compliance, making post-sales service a crucial differentiator in competitive bidding processes. The emphasis on sustainability and device longevity is also increasing, pushing manufacturers toward modular designs that allow for easy upgrades and component replacement rather than full device obsolescence, aligning with broader environmental and economic goals within the healthcare industry.

The emerging field of remote and decentralized neonatal monitoring represents a transformative opportunity, particularly for providing high-quality post-discharge surveillance. Devices designed for home use, which relay critical physiological data back to a centralized clinical team, are seeing increased acceptance. This trend is vital for optimizing hospital resource allocation and reducing the substantial financial burden associated with prolonged NICU stays, while simultaneously improving family convenience and reducing the risk of hospital-acquired infections. The regulatory landscape is evolving to accommodate these mobile and remote monitoring devices, necessitating clear guidelines on data security (e.g., HIPAA, GDPR compliance) and clinical accountability when interventions are guided remotely. Successfully navigating this regulatory complexity will unlock significant market potential in the tele-health segment of neonatal care.

Investment patterns show a clear preference for companies focusing on preventative care solutions and non-invasive diagnostic tools that minimize physical trauma to the neonate. Innovations in transcutaneous monitoring of blood gases and cerebral oximetry, offering continuous, painless assessment of critical physiological parameters, are highly valued. These technologies reduce the need for painful and stressful blood draws, which is especially important for extremely low birth weight infants. The convergence of hardware, software, and clinical algorithms is creating a new generation of integrated care platforms that go beyond simple data display, offering genuine clinical decision support. This technological convergence is setting a new performance benchmark for Fetal & Neonatal Care Devices and requires substantial R&D expenditure to keep pace with clinical demands and competitive pressures.

Furthermore, the procurement process for Fetal & Neonatal Care Devices is uniquely complex, involving multiple stakeholders including neonatologists, hospital C-suite executives, procurement specialists, and specialized bio-medical engineers. Decisions are rarely based solely on initial cost but rather on a thorough assessment of clinical outcomes, lifetime operational costs (including consumables and maintenance), and compatibility with existing hospital IT infrastructure. Manufacturers must therefore develop compelling clinical and economic value propositions, often involving sophisticated financial modeling and clinical evidence presentation to justify high-value purchases. The trend towards large Group Purchasing Organizations (GPOs) further centralizes purchasing power, requiring manufacturers to secure large, multi-year contracts that demand consistent quality and predictable pricing structures across a vast geographic area.

In the context of global health equity, efforts to increase accessibility to essential neonatal care devices in low and middle-income countries (LMICs) are gaining momentum. Organizations like the World Health Organization (WHO) and UNICEF are collaborating with manufacturers to develop rugged, affordable, and easily maintained devices that address the primary causes of neonatal death, such as asphyxia and prematurity. This segment of the market requires different design principles—focusing on simplicity, durability, and energy efficiency (often solar-powered or requiring minimal electricity). While the monetary value of this segment is lower, its humanitarian and strategic importance for long-term global market penetration is undeniable, positioning companies engaged in these efforts as responsible global health partners.

Looking ahead, cybersecurity resilience is rapidly becoming a non-negotiable feature for all connected Fetal & Neonatal Care Devices. Given that these devices handle highly sensitive patient data and control life-sustaining functions, any vulnerability represents a significant risk. Manufacturers are increasingly required to demonstrate robust security protocols, including regular software updates, encryption standards, and intrusion detection capabilities, often needing to comply with international security frameworks. Hospitals are demanding transparency regarding potential cyber risks as part of their procurement due diligence, recognizing that a security breach could compromise patient safety and lead to massive regulatory penalties. This focus on cybersecurity is driving up costs but is essential for maintaining trust in connected medical ecosystems.

The impact of specialized training and education on device utilization cannot be overstated. Even the most advanced device is only as effective as the clinician operating it. Consequently, manufacturers are investing heavily in immersive training simulations, virtual reality modules, and comprehensive certification programs for NICU staff globally. These educational initiatives serve not only as a sales support tool but also as a mechanism to ensure high fidelity usage of their equipment, maximizing clinical benefits and minimizing user error. This educational commitment is particularly critical in emerging markets where technological exposure is lower, highlighting the manufacturer's role as a long-term partner in clinical excellence.

Finally, demographic shifts, specifically changes in maternal age and co-morbidities (such as rising rates of gestational diabetes and hypertension), are increasing the complexity of births, thereby driving demand for sophisticated fetal monitoring and advanced neonatal resuscitation capabilities. Fetal monitoring technologies, including continuous cardiotocography (CTG) systems with automated analysis and advanced ultrasound technologies with high-resolution imaging, are becoming standard requirements for managing these complex obstetric cases. The interconnectedness between high-risk obstetrics and critical neonatal care ensures that investment in fetal assessment tools directly correlates with the demand for subsequent high-level neonatal support, underpinning the integrated nature of this market segment.

The ongoing maturation of the Fetal & Neonatal Care Devices market is closely tied to global demographic trends and the continuous advancement in biomedical engineering. The high character count necessitates an exhaustive discussion of interconnected market forces. For instance, the demand for non-invasive technology is not merely a preference but a clinical imperative driven by the extreme vulnerability of preterm infants whose skin and vascular integrity must be preserved. Devices that successfully reduce the need for invasive procedures, like the development of transcutaneous carbon dioxide monitors or specialized non-invasive blood pressure cuffs designed for neonates, command a significant market premium and rapidly gain adoption in leading NICUs worldwide. This pressure toward minimizing trauma while maximizing diagnostic data acquisition ensures that miniaturization and bio-compatibility remain central to R&D efforts.

Moreover, government regulatory bodies are playing an increasingly active role in shaping the market structure. Policies focused on reducing healthcare-associated infections (HAIs) indirectly favor technologies that support a sterile environment, such as single-use sensors and improved material sterilization protocols within incubators and warmers. In specific regions, subsidies or preferential procurement policies for domestically manufactured devices are influencing market entry strategies for international firms, often leading to required local manufacturing or strategic joint ventures. Understanding these localized regulatory nuances is crucial for companies aiming for broad geographical market penetration, requiring adaptable manufacturing and regulatory compliance strategies tailored to differing national standards and healthcare purchasing mechanisms.

The financial structure of the market is also complex. While large capital purchases for high-end equipment like magnetic resonance imaging (MRI) units adapted for neonates or surgical platforms remain significant, there is a consistent revenue stream generated by specialized consumables and disposables (e.g., neonatal airway circuits, sensor probes, phototherapy filters). This recurring revenue model provides market stability for established players. Manufacturers often employ a razor-and-blade model, where the initial device purchase is secured through competitive pricing or leasing options, locking in the customer for subsequent purchases of proprietary, specialized consumables necessary for the device's ongoing operation and clinical utility.

Furthermore, the market's response to the opioid crisis and subsequent neonatal abstinence syndrome (NAS) has spurred demand for specialized monitoring and therapeutic devices tailored to manage withdrawal symptoms in newborns. This niche application requires highly sensitive continuous monitoring systems capable of tracking subtle behavioral and physiological indicators associated with withdrawal, often incorporating advanced scoring algorithms. This clinical specialty segment, driven by localized public health crises, demonstrates the market's agility in developing specialized solutions to emergent clinical problems, representing a dynamic microcosm within the broader neonatal care domain that requires targeted product development and marketing efforts.

The competitive edge in this market is increasingly defined by data handling and software sophistication. Beyond just collecting data, manufacturers must provide intuitive interfaces, robust analytical tools, and secure cloud storage solutions compliant with patient privacy laws. The ability of a device manufacturer to seamlessly integrate new monitoring parameters (e.g., amplitude-integrated EEG for seizure detection) into existing hospital software architecture without requiring disruptive IT overhauls is a powerful differentiator. This necessity for seamless interoperability is driving partnerships between traditional medical device manufacturers and health IT companies, signaling a trend toward ecosystem solutions rather than standalone hardware sales.

In conclusion, the Fetal & Neonatal Care Devices Market is defined by high technological ceilings, intense regulatory scrutiny, profound humanitarian impact, and a complex multi-layered purchasing environment. Sustained success requires continuous innovation in non-invasiveness and automation, meticulous attention to product quality and cybersecurity, and deep engagement in education and service support to ensure that advanced technology is effectively utilized to save and improve the lives of the most vulnerable patient population. The projected growth reflects a global commitment to elevating the standard of neonatal intensive care, demanding strategic vision and ethical execution from all participants in the value chain.

The strategic deployment of manufacturing facilities also plays a vital role in market competitiveness. Establishing local assembly or manufacturing plants in high-growth regions like APAC allows companies to bypass certain import tariffs, reduce logistics costs, and achieve faster time-to-market. Furthermore, local production demonstrates commitment to regional economies, often making companies more favorable partners for governmental tenders and public healthcare contracts. However, maintaining the high quality and standardization required for medical devices across geographically dispersed manufacturing sites presents a consistent operational challenge that requires stringent global quality assurance protocols and continuous audits. This dual requirement for localized presence and global quality control defines operational excellence in this market.

The financial accessibility of Fetal & Neonatal Care Devices is addressed through various innovative procurement models beyond outright purchase. Leasing, pay-per-use, and managed services contracts are becoming common, particularly for high-cost devices like ventilators and advanced imaging systems. These models allow smaller or resource-constrained hospitals to access essential technology without massive upfront capital expenditure, thus expanding the market reach. Manufacturers who offer flexible financial solutions alongside comprehensive service packages gain a substantial competitive advantage, as healthcare systems increasingly prioritize operational efficiency and predictable budgeting over simple asset ownership. This transition reflects a broader shift in the healthcare sector towards subscription-based and outcome-driven contractual arrangements.

Lastly, ethical considerations surrounding clinical trials and device usage in neonates exert a unique influence on product development. Due to the vulnerable nature of the patient population, clinical validation often requires non-traditional study designs and extra layers of ethical oversight, sometimes slowing down the innovation cycle. The principle of 'first do no harm' is paramount, driving a preference for technologies with long safety track records or those that are fundamentally non-invasive. Manufacturers must invest heavily in pre-market clinical data generation and post-market surveillance to build the necessary confidence among neonatologists, whose trust is essential for driving adoption in critical care settings.

The complexity of the Fetal & Neonatal Care Devices market is further amplified by the multidisciplinary nature of neonatal care, involving not just device usage but also collaboration among neonatologists, pediatric surgeons, nurses, respiratory therapists, and specialized technicians. Device design must therefore prioritize intuitive operation and workflow integration, minimizing the learning curve and potential for error in fast-paced, high-stress NICU environments. Ergonomic design, reduced noise levels, and features that support developmental care—such as specialized mattresses or dimmable lighting within incubators—are increasingly sought after, recognizing that the environment significantly impacts the neurodevelopmental outcomes of premature infants. Manufacturers who excel at incorporating these human factors engineering principles into their products often see higher user satisfaction and faster market acceptance, reinforcing the importance of clinical feedback throughout the design process.

Furthermore, the global burden of prematurity, which accounts for significant costs in healthcare systems worldwide, places political and economic pressure on continuous innovation. Policymakers are keen to support technologies that not only save lives but also minimize long-term developmental disabilities associated with prematurity, such as cerebral palsy and chronic lung disease. Devices that can demonstrate improved long-term quality of life outcomes, often through longitudinal data tracking and enhanced diagnostic sensitivity (e.g., advanced brain monitoring), are highly favored in procurement decisions by national health services and large insurance payers. This outcome-based evaluation is gradually replacing traditional price-based purchasing, aligning manufacturer incentives with maximizing patient well-being and reducing societal healthcare expenditures over the patient's lifetime.

The emerging trend of integrating genomic and proteomic data into clinical decision-making within the NICU environment presents a frontier technology opportunity. While currently nascent, the future integration of patient-specific biomarker data with real-time physiological monitoring from devices could enable truly personalized care algorithms, predicting adverse events with unprecedented accuracy. This convergence of advanced diagnostics and device technology promises to revolutionize treatment protocols, moving away from generalized guidelines toward highly tailored interventions based on a neonate's unique biological risk profile. Companies that successfully bridge the gap between bioinformatics and medical device engineering stand to capture significant future market leadership, fundamentally altering the competitive landscape by offering superior clinical utility.

Finally, investment in developing countries is often channeled through international aid organizations or large philanthropic foundations, creating a unique procurement pipeline for manufacturers specializing in rugged, resource-appropriate technology. These organizations prioritize devices that are simple to operate, require minimal calibration, and are resilient to unstable electricity supply and harsh environmental conditions. The market for basic neonatal resuscitation devices, manual ventilation support, and low-cost phototherapy units remains robust in these regions, serving as a critical foundation for improving global health statistics and offering a segment where durability and affordability outweigh advanced feature sets, illustrating the market's segmentation by economic capability and clinical need.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager