FGSS Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433176 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

FGSS Module Market Size

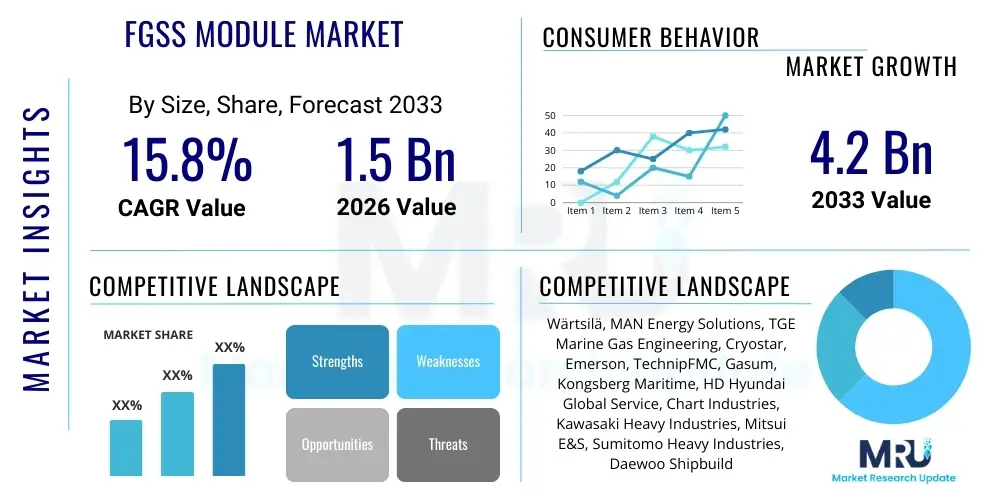

The FGSS Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

FGSS Module Market introduction

The Fuel Gas Supply System (FGSS) Module Market is integral to the global maritime industry’s transition towards cleaner energy sources, primarily Liquefied Natural Gas (LNG), but increasingly accommodating methanol and ammonia-ready designs. FGSS modules are highly specialized, integrated systems designed to safely store, process, and deliver cryogenic or low-flashpoint fuels to dual-fuel or pure gas combustion engines onboard vessels. These systems ensure the fuel is vaporized, conditioned (pressure and temperature adjusted), and supplied according to the precise specifications required by the marine propulsion machinery, adhering strictly to stringent international safety standards, notably the IMO IGF Code. The complexity of handling cryogenic fuels, particularly LNG, necessitates robust system engineering encompassing storage tanks, vaporization units, gas valve units (GVUs), control systems, and comprehensive safety measures, including inert gas generation and leak detection.

The primary application of FGSS modules lies in facilitating compliance with the IMO’s increasingly strict sulfur cap regulations and contributing to greenhouse gas reduction targets. Major applications span across various vessel types, including large container ships, LNG carriers (which often use boil-off gas), crude oil and product tankers, bulk carriers, and passenger cruise ships. The benefit of adopting FGSS is multifold: reduced operational costs associated with cheaper LNG fuel compared to traditional marine diesel oil (MDO), significant reduction in sulfur oxides (SOx) and particulate matter emissions, and substantial cuts in nitrogen oxides (NOx) when using high-pressure injection technologies. The modular nature of these systems allows for optimized integration into newbuild vessel designs and, in some instances, retrofitting existing fleets, thereby accelerating the green transition of global shipping fleets.

Driving factors for sustained market growth include mandatory decarbonization initiatives such as the IMO’s EEXI (Energy Efficiency Existing Ship Index) and CII (Carbon Intensity Indicator), which incentivize the adoption of gas-fueled engines. Furthermore, the growing global LNG bunkering infrastructure, expanding significantly in major ports across Asia, Europe, and North America, diminishes range anxiety for ship operators considering LNG as a primary fuel. Government subsidies and financial incentives for green ship construction also play a critical role, making the initial investment in complex FGSS technology more financially viable. The persistent volatility and high price point of conventional bunker fuels further solidify the economic case for switching to LNG and subsequent dual-fuel engine technologies utilizing advanced FGSS modules.

FGSS Module Market Executive Summary

The FGSS Module Market is experiencing robust expansion, fundamentally driven by the maritime sector’s urgent need for environmental compliance and operational efficiency. Business trends indicate a shift towards comprehensive modular solutions, reducing installation complexity and enhancing scalability, with key players focusing on developing multi-fuel FGSS platforms capable of handling future alternative fuels like ammonia and methanol, effectively de-risking long-term vessel investments. Consolidation among system integrators and increased collaboration between engine manufacturers and module suppliers are prevalent, aiming to provide optimized, highly reliable integrated solutions. Furthermore, digitalization is integrating predictive maintenance and operational monitoring into FGSS control systems, improving uptime and safety management across global fleets.

Regional trends highlight Asia Pacific (APAC) as the dominant manufacturing and demand hub, attributed to leading shipbuilding nations like South Korea, China, and Japan heavily investing in gas-fueled vessel construction. Europe demonstrates significant leadership in technological innovation and operational adoption, particularly in cruise shipping and ferry sectors, driven by stringent regional emissions regulations such as those in the Baltic and North Seas. North America is rapidly developing its LNG bunkering infrastructure, supporting a nascent but fast-growing market for LNG-fueled vessels engaged in intra-regional trade. These regional disparities reflect differences in regulatory implementation timelines and the maturity of LNG infrastructure availability, but overall, global growth remains strongly positive.

Segmentation trends reveal that the LNG segment currently dominates the market by fuel type due to its established infrastructure and technology maturity. However, there is accelerating growth in the demand for ‘Ammonia-ready’ or ‘Methanol FGSS’ modules, reflecting industry foresight regarding next-generation low-carbon fuels. By component, Gas Valve Units (GVUs) and high-pressure cryogenic pumps are critical growth areas due to their essential role in safe fuel delivery. In terms of ship type, large container vessels and new LNG carriers, requiring sophisticated and high-capacity FGSS installations, contribute the largest share of market value, while the growing market for smaller bunkering tankers also represents a significant high-growth opportunity for compact module designs.

AI Impact Analysis on FGSS Module Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can enhance the complex operations and maintenance protocols of high-pressure cryogenic FGSS modules. Key concerns revolve around improving predictive failure detection for critical components like pumps and compressors, optimizing fuel conditioning efficiency in real-time, and integrating AI into safety and risk management systems to prevent gas leaks or catastrophic failures. Users seek clarity on whether AI can genuinely reduce operational expenditure (OPEX) by minimizing unnecessary maintenance downtime and optimizing fuel consumption based on dynamic sailing conditions. The core expectation is that AI will transition FGSS maintenance from a scheduled, calendar-based approach to a condition-based, highly efficient paradigm, thereby improving the overall safety and reliability of gas-fueled propulsion systems.

AI’s influence on the FGSS Module Market is primarily focused on enhancing operational reliability and safety through advanced data analytics. AI algorithms are being deployed to process continuous streams of sensor data—monitoring pressures, temperatures, vibration levels, and flow rates within the cryogenic system. This allows for the identification of subtle anomalies that precede equipment failure, offering highly accurate predictive maintenance alerts well before traditional monitoring systems would flag an issue. This capability is particularly valuable for complex and expensive components such as cryogenic pumps and gas valve units, where unexpected failure can lead to significant operational disruptions and high repair costs. By minimizing unexpected downtime, AI directly contributes to the economic attractiveness of LNG as a marine fuel.

Furthermore, AI is instrumental in optimizing the performance of the FGSS during dynamic operating conditions, such as varying engine loads or changes in fuel composition (e.g., boil-off gas characteristics). ML models can adjust vaporization rates, heating protocols, and pressure regulation in real-time to ensure the fuel delivered to the engine meets precise calorific and physical specifications for optimal combustion efficiency. This algorithmic optimization reduces energy consumption within the FGSS itself (e.g., optimizing vaporizer power draw) and minimizes emissions variability. As the industry moves toward multi-fuel platforms (handling LNG, methanol, ammonia), AI will become essential for managing the distinct and complex conditioning requirements of each fuel type seamlessly.

- AI enhances Predictive Maintenance (PdM) for cryogenic pumps and compressors, reducing unexpected failures.

- Machine learning optimizes real-time fuel conditioning parameters (pressure and temperature) for peak engine performance.

- AI-driven risk assessment improves gas leak detection and safety shutdown procedures.

- Operational analytics derived from AI minimizes auxiliary power consumption within the FGSS components.

- AI supports the seamless integration and switching of multi-fuel FGSS modules (LNG, Ammonia, Methanol).

- Optimized fuel delivery sequencing reduces fuel costs and maximizes energy efficiency during transit.

DRO & Impact Forces Of FGSS Module Market

The FGSS Module Market is shaped by a powerful confluence of drivers, constraints, opportunities, and consequential impact forces. The primary driver remains the stringent global environmental regulations, particularly the IMO’s decarbonization targets (Drivers). However, high upfront capital expenditure for complex cryogenic systems and inherent safety concerns regarding handling low-flashpoint fuels act as significant Restraints. The Opportunity lies in the emergence of next-generation, non-carbon fuels such as ammonia and methanol, pushing demand for highly adaptive FGSS designs (Ammonia-ready/Methanol FGSS). These elements together create persistent Impact Forces, notably increasing the total cost of ownership (TCO) for vessels while simultaneously driving rapid technological innovation and system integration across the shipbuilding supply chain.

Key drivers include the compelling regulatory landscape, specifically the mandate for reducing CO2 emissions by 40% by 2030 and 70% by 2050 compared to 2008 levels, alongside near-zero emissions targets for SOx and particulate matter, which LNG substantially addresses. The economic advantage of LNG, often priced lower than equivalent compliant conventional fuels, provides a strong operational incentive. Furthermore, continuous advancements in dual-fuel engine technology, offering increased power density and reliability, require corresponding sophisticated FGSS installations. This synergy between engine manufacturers and FGSS suppliers accelerates market penetration across various maritime segments, including the burgeoning LNG bunkering vessel segment, which itself requires highly efficient FGSS for its operations.

Constraints primarily involve the substantial investment costs associated with FGSS modules, which can significantly inflate the price of a newbuild vessel compared to conventional engine installations. The technical complexity related to managing cryogenic temperatures and high pressures demands highly skilled crew and sophisticated maintenance procedures, adding to operational complexity. Public perception and inherent safety risks associated with flammable gases require rigorous certification and specialized vessel design, which can slow down adoption rates in risk-averse segments. Opportunities are centered on the vast potential of retrofitting older vessels to meet environmental standards, providing a long-term revenue stream for module manufacturers. Moreover, the focus on compact, standardized, and easily scalable FGSS modules for smaller vessels and standardized short-sea shipping fleets represents an untapped growth vector, leveraging standardization to mitigate complexity and cost barriers.

Segmentation Analysis

The FGSS Module Market is comprehensively segmented based on three critical parameters: the type of fuel handled, the specific components incorporated within the system, and the primary application determined by ship type. Analysis reveals that segmentation by Fuel Type, currently dominated by LNG, is evolving rapidly to incorporate newer segments like Methanol and Ammonia due to global regulatory pressures favoring carbon-neutral solutions. Component segmentation highlights the technical depth of the market, focusing on high-value, high-precision elements such as Gas Valve Units (GVUs) and specialized cryogenic pumps essential for maintaining system integrity and safety. Ship type segmentation demonstrates the breadth of applications, with demand concentrated in capital-intensive, large vessels that require substantial fuel capacity and high redundancy in their supply systems.

The segmentation structure provides crucial insights into technological investment trends. For instance, the transition from traditional LNG FGSS to Ammonia FGSS requires significant redesigns in materials and safety features due to the toxicity and corrosive nature of ammonia, driving specific component development. Similarly, the difference in vessel size directly impacts the module design, ranging from large, custom-engineered systems for Ultra Large Container Vessels (ULCVs) to standardized, compact skid-mounted units for regional ferries or smaller bunkering vessels. This detailed categorization helps stakeholders, including manufacturers and shipyards, align their product development and market strategies with projected demand shifts across various technological maturity levels and end-user requirements, ensuring market resilience and targeted innovation.

- By Fuel Type:

- Liquefied Natural Gas (LNG) FGSS

- Methanol FGSS

- Ammonia FGSS (Ammonia-ready designs)

- LPG FGSS

- By Component:

- Gas Valve Units (GVUs)

- Cryogenic Pumps and Compressors

- Vaporizers (Shell-and-tube, Ambient air)

- Storage Tanks (Type C, Membrane)

- Control and Monitoring Systems (FGS Control Unit)

- Fuel Preparation Systems

- By Ship Type:

- Container Ships (Large and Mid-sized)

- Tankers (Crude Oil, Product, Chemical)

- Bulk Carriers

- Cruise Ships and Ferries

- LNG Carriers (Excluding boil-off gas handling)

- Specialized Vessels (Tugs, Offshore Supply Vessels)

Value Chain Analysis For FGSS Module Market

The FGSS Module value chain begins with specialized upstream activities focused on the procurement and fabrication of highly resilient, cryogenic-compatible materials, including high-grade stainless steel and specialized insulation components, followed by the manufacturing of high-precision components like cryogenic pumps and flow control valves. These complex components are supplied by specialized vendors who often operate in niche segments, requiring high levels of certification and quality assurance (Upstream Analysis). This phase is capital-intensive and characterized by strict adherence to international maritime classification society standards (e.g., DNV, Lloyd’s Register). System integrators and major shipbuilding groups then take these components and assemble them into integrated, skid-mounted FGSS modules, customizing the arrangement based on specific vessel requirements and engine configurations, representing the core manufacturing stage.

Downstream analysis focuses on the distribution and implementation of these integrated modules. The primary distribution channel involves direct sales from the FGSS manufacturer/integrator to large shipbuilding yards (Newbuilds) or directly to ship owners/operators (Retrofits). Due to the complexity and custom nature of the product, the distribution is overwhelmingly direct, involving extensive engineering collaboration. Installation, commissioning, and subsequent aftermarket services (maintenance, spare parts, and crew training) form the critical downstream activities. Aftermarket support is a significant revenue generator, requiring global service networks to ensure quick response times for highly technical issues. Indirect distribution, involving engineering consultants or brokers, is minimal, reserved mostly for initial project specification and feasibility studies rather than product delivery.

The value generated is highest in the manufacturing and system integration phase, where proprietary control systems and module layout optimization add significant intellectual property value. However, the long-term sustainability is reinforced by the aftermarket segment, characterized by high margins on specialized spare parts and mandatory annual servicing. Direct distribution ensures tight control over quality and installation, mitigating risks associated with handling pressurized cryogenic fuels. Strategic partnerships within the value chain, particularly between component suppliers and module integrators, are vital for maintaining competitiveness and technological lead, especially as the market shifts towards multi-fuel flexibility and greater digitalization in system management.

FGSS Module Market Potential Customers

The primary end-users and potential buyers of FGSS modules are global ship owners and maritime operators who are actively engaged in fleet renewal or modification programs aimed at complying with current and anticipated environmental regulations. These customers include major international shipping lines specializing in container transport (e.g., Maersk, CMA CGM), large commodity bulk carriers, and global energy companies operating extensive tanker fleets (e.g., Shell, BP). A second significant segment comprises the operators of passenger vessels, such as major cruise lines and ferry operators in environmentally sensitive areas like the Baltic Sea and North American Emission Control Areas (ECAs), who require robust, quiet, and highly reliable gas propulsion systems to meet strict port entry rules.

Shipbuilding yards, particularly those in South Korea (DSME, HHI, SHI) and China (CSSC), act as immediate purchasers, acquiring FGSS modules as part of the total engine package or the vessel’s technical specification package during the construction phase. These yards often influence the choice of FGSS supplier based on integration expertise and established partnerships. Furthermore, companies specializing in marine retrofitting and engineering consulting firms that manage extensive vessel upgrade projects are crucial indirect customers, influencing purchasing decisions for existing vessels seeking compliance upgrades. The evolving regulatory landscape means that traditionally diesel-focused operators, such as coastal shipping and towage companies, are increasingly entering the potential customer base as LNG bunkering infrastructure expands to smaller ports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, MAN Energy Solutions, TGE Marine Gas Engineering, Cryostar, Emerson, TechnipFMC, Gasum, Kongsberg Maritime, HD Hyundai Global Service, Chart Industries, Kawasaki Heavy Industries, Mitsui E&S, Sumitomo Heavy Industries, Daewoo Shipbuilding & Marine Engineering (Hanwha Ocean), Samsung Heavy Industries, CSSC, CRYOSTAR, DNV, ABS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FGSS Module Market Key Technology Landscape

The technological landscape of the FGSS Module market is highly specialized, centered around safely and efficiently managing cryogenic and low-flashpoint fuels. A key area is the development of ultra-reliable cryogenic pumping technology, which must operate under extreme temperature differentials and high pressures necessary for high-pressure two-stroke engines (e.g., MAN ME-GI). Advancements in materials science are crucial for ensuring the integrity of storage tanks (Type C tanks being common for FGSS) and piping systems against cold embrittlement and fatigue. Furthermore, vaporizer technology is evolving, with ambient air and seawater-heated vaporizers being optimized for efficiency and minimal footprint, though electric or engine waste heat-powered solutions are gaining traction to improve energy independence and reliability, especially in varying climates.

Another crucial technological area is the integration of highly sophisticated Gas Valve Units (GVUs). The GVU acts as the final safety barrier and pressure control system, requiring redundancy and rapid shutdown capabilities to comply with the International Gas Fuel (IGF) Code. Modern FGSS solutions are characterized by highly integrated, skid-mounted designs that minimize the physical footprint onboard and simplify installation complexity during shipbuilding, crucial for optimizing vessel cargo space. Furthermore, the convergence of operational technology (OT) and information technology (IT) is driving the adoption of centralized control and monitoring systems that offer real-time diagnostics, performance optimization, and seamless integration with the vessel’s broader ship management system (SMS), often incorporating AI for predictive maintenance.

Looking forward, the technological focus is shifting toward multi-fuel flexibility. Manufacturers are investing heavily in 'Ammonia-ready' or 'Methanol FGSS' designs, anticipating the need for easy conversion or dual operation capabilities. This involves developing corrosion-resistant components for methanol, specialized ventilation, and enhanced monitoring for toxic fuels like ammonia. The utilization of smart sensor technology (IoT) throughout the FGSS piping and components is essential for maintaining advanced safety integrity levels (SIL) required for toxic and highly flammable substances. The goal is to produce modular, adaptable, and future-proof fuel supply systems that can handle the full spectrum of low-carbon marine fuels expected to dominate the market post-2030, ensuring long-term vessel operational viability.

Regional Highlights

Regional dynamics heavily influence the FGSS Module market, driven by localized shipbuilding activity, bunkering infrastructure readiness, and specific regional emission regulations. Asia Pacific (APAC) dominates global market share, largely due to South Korea, China, and Japan maintaining their status as the world’s leading shipbuilding nations. These countries possess the industrial capacity and technical expertise to integrate complex FGSS modules into massive commercial vessels like ULCVs and large LNG carriers. APAC also benefits from a rapidly expanding LNG bunkering network across major hubs like Singapore and Shanghai, supporting regional demand and making gas-fueled vessels a practical choice for intra-Asia trade routes.

Europe represents the second-largest market, distinguished by its early adoption of LNG propulsion, especially in cruise, ferry, and short-sea shipping sectors, driven by stringent EU regulations and the presence of ECAs (Emission Control Areas) in the Baltic and North Seas. European demand is characterized by a focus on technological innovation, reliability, and increasingly, multi-fuel readiness, pushing manufacturers to develop advanced FGSS modules compatible with methanol and, potentially, e-fuels. Key countries like Norway, Germany, and the Netherlands lead in innovation and infrastructure development, setting a high standard for technological requirements and system integration.

North America is emerging as a strong growth market, primarily due to the availability of inexpensive domestic natural gas (LNG) and expanding infrastructure along the Gulf Coast and East Coast, supporting domestic shipping and international trade. While currently smaller than APAC or Europe, regulatory mandates governing vessel operations in sensitive areas, coupled with significant investment in LNG-fueled dredging and specialized offshore fleets, promise accelerated growth throughout the forecast period. The Middle East and Africa (MEA) and Latin America currently hold smaller shares but are expected to see increasing adoption, particularly in specialized LNG bunkering vessel fleets and regional energy transport fleets, aligning with global energy transitions and increased intra-regional trade complexity.

- Asia Pacific (APAC): Dominates due to world-leading shipbuilding capabilities (South Korea, China); strong demand for large gas-fueled container vessels and tankers; rapidly expanding LNG bunkering infrastructure (e.g., Singapore).

- Europe: High technological adoption rate driven by strict regional ECAs (Baltic, North Sea); strong focus on cruise and ferry sectors; pioneers in methanol and multi-fuel FGSS module integration; centralized innovation hub.

- North America: Accelerating market growth driven by cheap domestic LNG supply; increasing use in regional trade and specialized fleets (offshore, dredging); infrastructure expansion along key coastal trade routes.

- Middle East & Africa (MEA): Growth centered on localized energy transport, emerging LNG bunkering hubs (e.g., UAE); potential for increased adoption in regional tanker and bulk fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FGSS Module Market.- Wärtsilä Corporation

- MAN Energy Solutions

- TGE Marine Gas Engineering GmbH (CIMC ENRIC)

- Cryostar SAS

- Chart Industries Inc.

- Kongsberg Maritime AS

- Emerson Electric Co.

- TechnipFMC plc

- HD Hyundai Global Service Co. Ltd.

- Kawasaki Heavy Industries, Ltd.

- Mitsui E&S Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- Daewoo Shipbuilding & Marine Engineering Co., Ltd. (Hanwha Ocean)

- Samsung Heavy Industries Co., Ltd.

- Hudong-Zhonghua Shipbuilding (CSSC Group)

- Gasum Ltd.

- DNV GL AS

- ABS Group

- GTT (Gaztransport & Technigaz)

- Baker Hughes Company

Frequently Asked Questions

Analyze common user questions about the FGSS Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an FGSS Module in maritime applications?

The primary function of an FGSS (Fuel Gas Supply System) module is to safely store, condition (vaporize, heat, and regulate pressure), and deliver low-flashpoint fuels, such as LNG, to the ship's dual-fuel or pure gas engine, ensuring compliance with strict safety and emission standards like the IMO IGF Code.

How does the shift to ammonia and methanol impact FGSS module design?

The shift necessitates significant design modifications focused on handling toxicity and corrosion. Ammonia FGSS requires specialized ventilation, enhanced sealing, robust materials, and increased safety redundancy, while Methanol FGSS demands corrosion-resistant materials and specific pumping/dosing units.

Which regulatory framework primarily governs the design and operation of FGSS?

The design and operation of FGSS are primarily governed by the International Code of Safety for Ships using Gases or other Low-flashpoint Fuels (IGF Code), established by the International Maritime Organization (IMO). Classification societies ensure compliance through mandatory certification and surveys.

What are the key components of a typical LNG FGSS module?

Key components typically include cryogenic storage tanks, high-pressure cryogenic pumps and compressors, specialized vaporizers (ambient or thermal), the Gas Valve Unit (GVU) for safety isolation and pressure control, and a centralized integrated control system (FGS Control Unit).

Is the FGSS Module market primarily focused on new builds or retrofitting existing vessels?

While the majority of high-capacity FGSS installations are currently concentrated in newbuild vessels (especially large container ships and tankers), the retrofit market for smaller and existing compliant fleets is projected to grow substantially, driven by looming long-term decarbonization deadlines and stricter operational mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager