Fiber Channel Networking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436613 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fiber Channel Networking Market Size

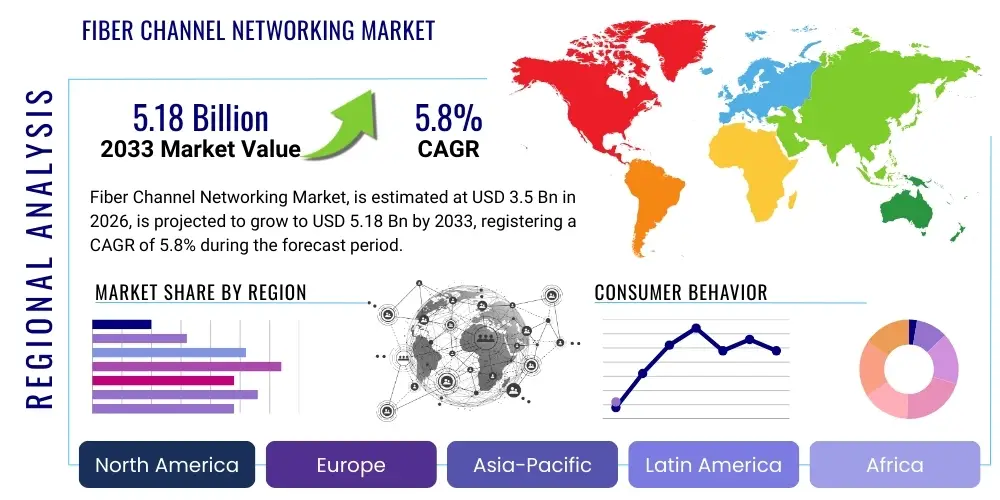

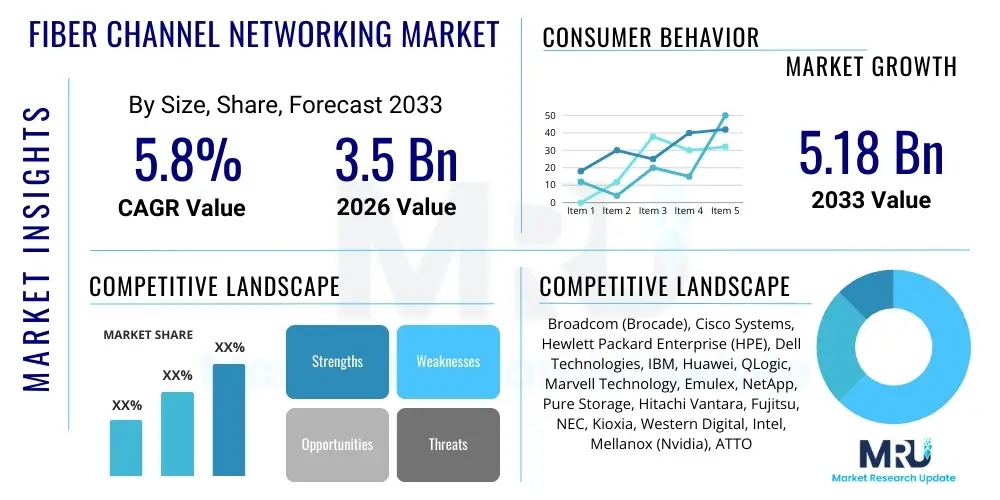

The Fiber Channel Networking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.18 Billion by the end of the forecast period in 2033.

Fiber Channel Networking Market introduction

Fiber Channel Networking (FCN) constitutes a high-speed networking technology primarily designed for connecting computer storage to servers. It is the backbone of Storage Area Networks (SANs), offering lossless, ordered, and highly reliable data delivery crucial for enterprise-grade applications such as virtualization, database management, and cloud infrastructure. Unlike traditional Ethernet, Fiber Channel (FC) utilizes specialized protocols optimized for storage traffic, ensuring low latency and high throughput necessary for mission-critical operations where data integrity and accessibility are paramount. The sustained demand for faster storage access and the proliferation of large-scale data centers continue to solidify FC's role, despite competition from newer storage technologies.

The core products within the FCN market include FC switches, host bus adapters (HBAs), cables, and specialized routing equipment capable of handling speeds up to 64Gbps and beyond. Major applications span across banking, financial services, and insurance (BFSI), healthcare, telecommunications, and high-performance computing (HPC). The inherent benefits of Fiber Channel, such as superior reliability, deterministic performance, and robust security features—including hardware-enforced zoning—drive its continuous adoption in environments requiring guaranteed quality of service (QoS) for data transfer. Furthermore, its ability to integrate seamlessly with older storage infrastructure provides a compelling value proposition for organizations undertaking gradual digital transformation.

Driving factors for this market include the escalating global data volume, necessitating highly efficient and scalable storage solutions, and the critical need for continuous data availability mandated by modern compliance regulations. The increasing adoption of flash storage technologies (NVMe over FC) leverages the low-latency capabilities of Fiber Channel to maximize the performance benefits of solid-state drives. Continuous innovation in standards, particularly the introduction of Gen 7 and Gen 8 FC technologies offering increased bandwidth and backward compatibility, sustains the market's relevance in the face of evolving IT landscapes. These technological advancements ensure that Fiber Channel remains a foundational element for sophisticated enterprise data management.

Fiber Channel Networking Market Executive Summary

The Fiber Channel Networking market demonstrates resilient growth driven by sustained enterprise investment in Storage Area Networks (SANs) and the critical need for deterministic, high-throughput storage connectivity. Business trends indicate a strong migration towards NVMe over Fiber Channel (NVMe-oF), which significantly boosts application performance by reducing latency inherent in traditional SCSI protocols. Market consolidation among key technology providers is observed, focusing on integrating advanced security features and AI-driven network management tools into FC fabrics. Furthermore, the convergence of traditional FC with Ethernet-based connectivity solutions (FCoE) continues to shape hybrid data center architectures, although pure FC solutions maintain dominance in high-performance, critical environments.

Regionally, North America maintains the largest market share, fueled by the early adoption of advanced data center technologies and the presence of numerous hyperscale cloud providers and large financial institutions demanding stringent data management standards. Asia Pacific (APAC) is emerging as the fastest-growing region, driven by rapid digitalization, massive infrastructure investments in countries like China and India, and the burgeoning establishment of new data centers catering to explosive population data growth. European market growth is steady, emphasizing regulatory compliance (such as GDPR) and vertical-specific applications in healthcare and manufacturing, where data reliability is paramount.

Segmentation trends highlight the increasing preference for 64 Gbps and 128 Gbps solutions in core data centers, necessitating upgrades of existing infrastructure to accommodate increased bandwidth demands from virtualized and cloud environments. Component-wise, the demand for high-density, modular FC switches capable of non-disruptive scaling is prominent. Vertical segmentation underscores the robust adoption in the BFSI sector, which requires guaranteed transaction integrity, and the telecommunications sector, which relies on high-speed, reliable storage for network function virtualization (NFV) and edge computing deployments. These targeted investments across components and verticals are essential drivers of market value and technological evolution.

AI Impact Analysis on Fiber Channel Networking Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Fiber Channel Networking primarily revolve around two themes: the necessity of FC to support high-performance AI workloads and how AI can optimize the management of the FC infrastructure itself. Users are concerned about whether existing FC fabrics are fast enough to handle the massive, parallel I/O demands generated by AI/ML training models, particularly regarding the movement of large datasets between storage and GPU clusters. There is significant interest in how NVMe-oF leverages FC's speed to minimize bottlenecks in AI processing pipelines, ensuring that the storage fabric does not become the limiting factor in computational throughput.

Furthermore, a major theme focuses on the integration of AI operations (AIOps) within SAN management. Users seek solutions that employ machine learning algorithms for predictive maintenance, automated troubleshooting, and proactive capacity planning within complex FC environments. The expectation is that AI tools will move beyond simple monitoring to analyze historical performance data, detect anomalies, predict potential failures—such as switch port congestion or HBA latency spikes—before they affect service delivery, and automatically reconfigure fabric paths to optimize workload distribution. This shift towards intelligent, self-healing SANs represents a key area of investment for both vendors and end-users seeking operational efficiency.

The convergence of increasing AI-driven data demands and the need for optimized infrastructure management strongly positions advanced Fiber Channel technologies, such as Gen 7 and future iterations, as essential components for the AI data center. These high-speed, ultra-low latency networks are critical for maximizing the utilization of expensive AI compute resources, ensuring that multi-petabyte datasets required for model training are accessible instantaneously. Consequently, the development of FC fabrics explicitly optimized for AI traffic patterns, incorporating features like adaptive routing and enhanced flow control mechanisms, is rapidly becoming a significant market differentiator.

- AI drives demand for ultra-high-speed (64G/128G) FC to support GPU-intensive storage I/O.

- NVMe over FC is critical for low-latency data transfer necessary for real-time AI inference and model training.

- AIOps integration into SAN management provides predictive analytics for proactive maintenance and performance optimization of FC fabrics.

- AI algorithms are used for automated zoning and path optimization within complex, large-scale Fiber Channel deployments.

- Increased data movement requirements from AI workloads necessitate larger, denser FC switch deployments and higher port utilization rates.

DRO & Impact Forces Of Fiber Channel Networking Market

The Fiber Channel Networking market is significantly influenced by a blend of powerful drivers, key restraints, and promising opportunities, collectively shaping the competitive landscape. A primary driver is the pervasive need for guaranteed Quality of Service (QoS) and the superior reliability FC offers, which remains unmatched by competing technologies in mission-critical environments like financial trading and healthcare records management. Additionally, the constant exponential growth in unstructured and structured data generated globally necessitates scalable, high-speed storage infrastructure, pushing enterprises to upgrade or expand their existing FC SANs. The innovation cycle, particularly the introduction of NVMe-oF support over FC, is revitalizing the technology by dramatically reducing storage latency and maximizing the performance of flash arrays, thereby acting as a critical growth catalyst.

However, the market faces significant restraints, chiefly the higher initial cost of deployment and the perceived complexity of managing Fiber Channel fabrics compared to commodity Ethernet-based solutions. The specialized nature of FC often requires dedicated technical expertise and specific hardware (HBAs, switches), which can deter smaller enterprises or those preferring converged infrastructure models utilizing standard Ethernet for both storage and network traffic. Furthermore, the persistent rise of Ethernet-based storage protocols, such as iSCSI and emerging RDMA over Converged Ethernet (RoCE), presents a viable alternative, particularly in less performance-sensitive environments, creating competitive pressure that limits FC adoption outside traditional enterprise SANs.

Opportunities for market growth are strongly focused on leveraging the superior attributes of FC for specialized, demanding workloads. The rapid expansion of edge computing, which requires robust and reliable localized storage solutions with minimal latency, opens new deployment vectors for compact FC solutions. Moreover, the shift towards multi-cloud and hybrid cloud architectures necessitates high-speed, secure connectivity between on-premises SANs and cloud infrastructure; FC is well-positioned to serve as the high-integrity bridge through technologies like Fibre Channel over IP (FCIP). Future growth will also be heavily reliant on continued standardization efforts (Gen 8 and beyond) that ensure FC remains performance-competitive against future iterations of Ethernet-based storage.

- Drivers:

- Escalating demand for high-speed, reliable data storage access in enterprise data centers.

- Critical adoption of NVMe over Fiber Channel (NVMe-oF) for maximizing flash storage performance.

- Stringent regulatory requirements demanding guaranteed data availability and integrity (e.g., in BFSI and Healthcare).

- Increasing virtualization and server consolidation leading to high I/O density requirements.

- Restraints:

- Higher capital expenditure and operational complexity compared to standard Ethernet solutions.

- Growing adoption of competitive storage networking technologies like iSCSI and RoCE.

- Requirement for specialized technical expertise for deployment and maintenance of FC fabrics.

- Opportunities:

- Deployment of FC in high-performance computing (HPC) and AI/ML data environments.

- Expansion into edge data centers requiring deterministic, localized storage connectivity.

- Development of unified, software-defined SAN management tools simplifying FC fabric operation.

- Impact Forces:

- The transition from 16Gbps and 32Gbps to 64Gbps technology rapidly depreciates older infrastructure.

- Convergence trends necessitate interoperability between FC, FCoE, and IP networks.

- Security requirements drive the demand for advanced hardware-level encryption and fabric isolation features.

Segmentation Analysis

The Fiber Channel Networking market is extensively segmented based on key parameters including Component, Data Rate, Protocol, Application, and End-Use Industry, reflecting the diverse requirements of enterprise data centers globally. Analyzing these segments provides critical insight into where capital investments are concentrated and which technological advancements are gaining traction. The segmentation by Data Rate is particularly pivotal, showing a clear migration from legacy 8Gbps/16Gbps systems towards 32Gbps and 64Gbps infrastructure, driven by the intense bandwidth requirements of modern flash arrays and highly virtualized environments. This sustained upgrade cycle ensures the market's technological relevance and revenue generation capacity over the forecast period.

From a Component perspective, the switch segment holds the largest market share due to the centralized and indispensable role of FC switches in forming scalable SAN fabrics. The increasing sophistication of these switches, incorporating features like advanced flow control, fabric management software, and security zoning, drives premium pricing and replacement cycles. Meanwhile, the Host Bus Adapters (HBAs) segment is witnessing significant innovation, particularly with the integration of NVMe-oF capabilities, allowing servers to fully exploit the performance benefits of NVMe-based storage arrays. The ongoing need for high-density, high-performance cabling (primarily optical fiber) also contributes substantially to the overall market value.

In terms of End-Use Industry, the BFSI sector remains the most robust consumer of Fiber Channel networking, relying on its guaranteed performance for real-time transaction processing, auditing, and regulatory compliance. However, rapid growth is projected in the Telecommunications and IT & Data Center segments, fueled by the massive deployment of carrier-grade infrastructure and cloud services that demand superior storage access reliability and throughput. The healthcare sector is also an increasingly important segment, driven by the proliferation of large medical imaging files (PACS) and electronic health records (EHR) that require immediate, secure, and reliable storage access, making Fiber Channel the preferred networking medium.

- By Component:

- Fiber Channel Switches (Core, Edge, and Director-class)

- Host Bus Adapters (HBAs) and Controllers

- Cabling (Copper and Optical Fiber)

- Software and Services (Fabric Management, Monitoring, and Professional Services)

- By Data Rate:

- 8 Gbps

- 16 Gbps

- 32 Gbps

- 64 Gbps and Above (e.g., 128G, 256G)

- By Protocol:

- Fibre Channel Protocol (FCP)

- NVMe over Fibre Channel (NVMe-oF)

- Fibre Channel over Ethernet (FCoE)

- By Application:

- Data Backup and Recovery

- Storage Area Networks (SANs)

- Data Center Interconnect (DCI)

- Virtual Desktop Infrastructure (VDI)

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunication

- Healthcare and Life Sciences

- Government and Defense

- Retail and E-commerce

- Manufacturing

Value Chain Analysis For Fiber Channel Networking Market

The value chain for the Fiber Channel Networking market is characterized by a specialized, multi-tiered structure, starting from the core semiconductor manufacturers and culminating in complex system integration at the end-user data center. The upstream segment involves the production of specialized ASICs, transceivers (SFP+ and QSFP), and complex firmware essential for high-speed FC switches and HBAs. This segment is highly concentrated, relying on a few specialized semiconductor vendors capable of delivering high-performance, low-latency components compliant with FC standards (e.g., T11). Innovation at this stage, particularly around enhancing data rates (64G and 128G components), dictates the performance ceiling of the entire market.

Midstream activities involve the design, manufacturing, and assembly of finished products, primarily FC switches (Director and Modular), HBAs, and storage arrays that incorporate FC connectivity. Key vendors in this stage focus heavily on R&D to introduce fabric management software, advanced diagnostic tools, and proprietary operating systems that enhance reliability and ease of use. Distribution channels are predominantly indirect, relying on a robust network of value-added resellers (VARs), system integrators (SIs), and specialized IT solution providers. These intermediaries offer critical services, including consultation, installation, configuration (zoning), and post-sales support, bridging the gap between sophisticated technology and complex customer requirements.

The downstream flow involves the final deployment and utilization of the Fiber Channel infrastructure by the end-user organizations. Direct distribution often occurs for very large enterprises or hyperscale cloud providers who purchase directly from manufacturers, utilizing internal IT teams for implementation. However, the indirect channel is essential for the vast majority of mid-to-large enterprises, providing necessary integration expertise to incorporate new FC fabrics into existing IT ecosystems. The long lifecycle and high switching costs associated with FC SANs ensure strong recurring revenue opportunities for professional services and maintenance contracts within the downstream segment.

Fiber Channel Networking Market Potential Customers

Potential customers for Fiber Channel Networking products are primarily large enterprises and organizations that manage massive volumes of mission-critical data requiring non-negotiable performance and reliability standards. The key buyers are Chief Information Officers (CIOs), Data Center Managers, and Storage Architects within sectors where downtime translates directly into significant financial or regulatory penalties. These end-users are characterized by their reliance on Tier 1 storage systems, high levels of server virtualization, and the continuous operation of large-scale databases or high-transaction applications that are extremely sensitive to I/O latency.

Major end-user demographics include multinational banks, insurance companies, and trading houses (BFSI) that mandate the deterministic nature of FC for transaction integrity and auditing. Large hospitals, research institutions, and pharmaceutical companies in the Healthcare sector represent a rapidly growing customer base due as they handle exponentially growing patient data and high-resolution medical images. Furthermore, hyperscale cloud providers, although often implementing bespoke solutions, rely on FC or FC-integrated solutions for their high-performance internal storage pools and persistent block storage services offered to tenants, demanding the density and reliability inherent in Director-class switches.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.18 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom (Brocade), Cisco Systems, Hewlett Packard Enterprise (HPE), Dell Technologies, IBM, Huawei, QLogic, Marvell Technology, Emulex, NetApp, Pure Storage, Hitachi Vantara, Fujitsu, NEC, Kioxia, Western Digital, Intel, Mellanox (Nvidia), ATTO Technology, and DataDirect Networks (DDN) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Channel Networking Market Key Technology Landscape

The technology landscape of the Fiber Channel Networking market is currently defined by a rapid evolution toward higher speeds and integration of NVMe technology. The transition from 16Gbps and 32Gbps to the mainstream adoption of 64Gbps (Gen 7) FC represents the most critical technological shift, doubling the bandwidth available per port while maintaining full backward compatibility with previous generations. This speed enhancement is crucial for satisfying the increasing density of virtualized environments and supporting the performance characteristics of all-flash storage arrays. Furthermore, the development of FC switches with built-in telemetry and enhanced diagnostic capabilities is transforming fabric management, providing deep visibility into I/O flows and latency metrics that were previously difficult to capture.

The single most impactful technological advancement is the widespread deployment of NVMe over Fiber Channel (NVMe-oF). NVMe-oF replaces the legacy SCSI command set with a highly efficient, parallel protocol optimized for flash storage, significantly reducing software overhead and latency. By tunneling NVMe commands through the lossless FC fabric, enterprises can realize end-to-end latency reductions, maximizing the ROI on high-performance storage hardware. This protocol evolution ensures that FC remains the premium storage connectivity solution, offering far lower latency than traditional iSCSI or FCoE deployments that still rely on older SCSI encapsulation methods.

Beyond speed and protocol, advancements in security and virtualization are paramount. Modern FC technologies incorporate advanced hardware-enforced security features such as mandatory access control, enhanced zoning capabilities, and encryption directly within the switch hardware, providing a secure foundation for highly sensitive data. Additionally, the increasing convergence of networking and storage management, driven by Software-Defined Storage (SDS) principles, is leading to intelligent FC fabrics that can dynamically allocate resources and automatically adapt to workload changes. This focus on intelligent automation and security future-proofs the Fiber Channel infrastructure against evolving threats and operational complexity.

Regional Highlights

- North America: This region holds the largest market share, driven by the strong presence of major technology innovators, early adoption of high-speed storage technologies (NVMe-oF), and massive investment in data center infrastructure by hyperscale cloud providers and large financial institutions. The regulatory environment, particularly in sectors like finance and government, mandates the high availability and security inherent in Fiber Channel, ensuring sustained demand for upgrades to 64Gbps and Director-class switches. The US dominates regional consumption due to significant R&D spending on AI and HPC, requiring top-tier storage networking performance.

- Europe: The European market demonstrates steady, mature growth, particularly in Germany, the UK, and France. Growth is strongly influenced by data privacy regulations (GDPR), which mandate secure and auditable data storage practices, favoring FC’s robust security features. The adoption rate is high in manufacturing (Industry 4.0) and healthcare, where reliable, low-latency data access is vital for automation and patient care systems. Eastern Europe is emerging as a growing market due to increasing foreign investment in localized data centers and IT modernization projects.

- Asia Pacific (APAC): APAC is the fastest-growing region, characterized by explosive data growth, aggressive digital transformation initiatives, and substantial government investments in smart cities and digital infrastructure, particularly in China, Japan, India, and South Korea. The rapid expansion of local and regional cloud services drives the demand for scalable SAN solutions. While cost sensitivity remains a factor, the shift towards mission-critical applications in finance and telecom ensures that high-performance Fiber Channel deployments are prioritized in Tier 1 data centers across the region.

- Latin America (LATAM): The LATAM market is growing moderately, focusing primarily on modernization projects within the financial and telecommunications sectors in Brazil and Mexico. Economic volatility can sometimes slow down large-scale infrastructure investments, leading to phased upgrades. However, the foundational need for reliable storage connectivity for banking systems and mobile network infrastructure provides a stable baseline demand for Fiber Channel components.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, driven by governmental digitalization efforts (e.g., Vision 2030 initiatives) and heavy investment in sovereign data centers and oil and gas sector IT. Reliability and disaster recovery capabilities are key purchasing criteria, favoring the robust architecture of Fiber Channel SANs over alternatives in environments sensitive to infrastructure failure. Africa’s market remains nascent, focused mainly on South Africa and key financial hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Channel Networking Market.- Broadcom (Brocade)

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- IBM

- Huawei

- QLogic (now part of Marvell)

- Marvell Technology

- Emulex (now part of Broadcom)

- NetApp

- Pure Storage

- Hitachi Vantara

- Fujitsu

- NEC

- Kioxia

- Western Digital

- Intel

- Mellanox (Nvidia)

- ATTO Technology

- DataDirect Networks (DDN)

- Juniper Networks

- Microchip Technology

- Infinidat

- Tintri

Frequently Asked Questions

Analyze common user questions about the Fiber Channel Networking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Fiber Channel over standard Ethernet for storage?

Fiber Channel offers a highly reliable, deterministic, and lossless data delivery protocol specifically optimized for storage traffic, ensuring superior Quality of Service (QoS) and significantly lower, consistent latency compared to best-effort standard Ethernet protocols.

How is NVMe over Fiber Channel (NVMe-oF) impacting the future growth of the market?

NVMe-oF is a critical growth driver as it leverages FC’s low-latency architecture to unlock the full performance of modern flash storage arrays, replacing the legacy SCSI protocol with one optimized for parallel I/O, thereby sustaining FC's relevance in high-performance computing.

Which data rate is currently seeing the highest adoption in new enterprise SAN deployments?

While 32 Gbps remains widely deployed, 64 Gbps (Gen 7) Fiber Channel is experiencing the highest growth in new enterprise and hyperscale data center deployments due to the increasing density of virtualized workloads and the need to support extremely fast all-flash storage arrays.

What are the main alternatives to Fiber Channel Networking and how do they compare in performance?

The main alternatives are iSCSI and Fibre Channel over Ethernet (FCoE), and increasingly RoCE (RDMA over Converged Ethernet). While iSCSI is lower cost and simpler to implement, pure FC typically offers better reliability, lower latency, and more guaranteed performance for mission-critical Tier 1 storage.

Which geographic region dominates the Fiber Channel Networking market share?

North America currently dominates the Fiber Channel Networking market share, attributed to its early and substantial adoption of advanced data center technologies, the high density of enterprise-level data centers, and strong regulatory requirements in key industry verticals like BFSI.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager