Fiber Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433928 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fiber Converter Market Size

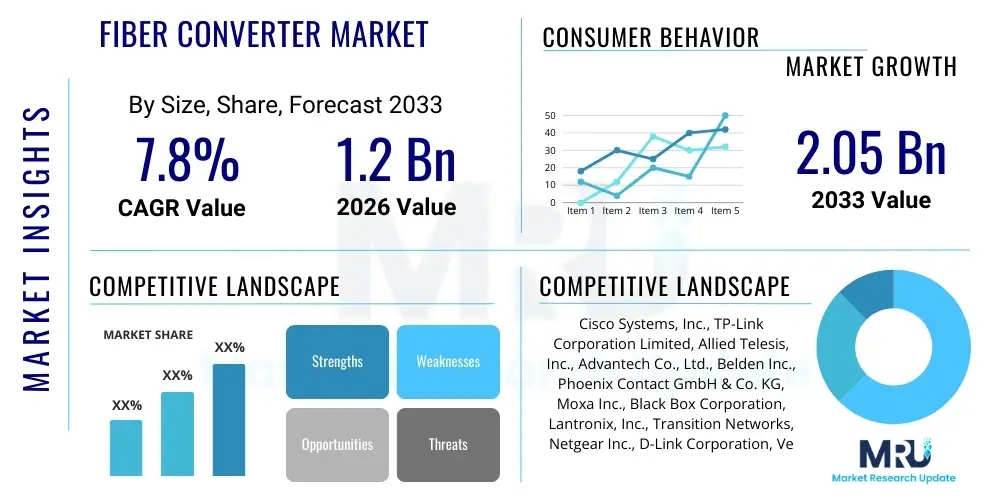

The Fiber Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

Fiber Converter Market introduction

The Fiber Converter Market encompasses devices engineered to translate signals between different transmission media, primarily converting electrical signals (typically transmitted over copper cabling like twisted pair) into optical signals for fiber optic cables, and vice-versa. These converters are essential components in modern networking infrastructure, enabling seamless integration between legacy copper-based equipment and high-speed, long-distance fiber optic networks. The primary function is to extend network distances, enhance immunity to electromagnetic interference (EMI), and increase bandwidth capacity, which is critical for demanding applications across enterprise, telecommunications, and industrial sectors. The market growth is inherently tied to the global expansion of high-bandwidth services such as 5G, cloud computing, and high-definition video streaming, all of which necessitate robust, reliable fiber backbone networks.

Fiber converters, often referred to as media converters, facilitate critical network transitions, allowing organizations to maximize the lifespan of existing copper infrastructure while benefiting from the superior performance of fiber optics. Products range from simple, unmanaged plug-and-play devices to complex, managed chassis-based systems that offer features like network management, redundancy, and diagnostic capabilities. Key applications include connecting remote workstations, establishing metropolitan area networks (MANs), linking diverse local area networks (LANs), and ensuring compatibility in industrial settings where environmental robustness is paramount. The fundamental benefits driving adoption are extended transmission range, significantly higher data security due to the nature of optical transmission, and improved system reliability in electrically noisy environments.

Driving factors for this market include the pervasive need for data center interconnectivity (DCI), rapid urbanization leading to increased deployment of Fiber to the Home/Building (FTTH/FTTB) infrastructure, and stringent regulatory demands for high-speed network availability in critical infrastructure like smart grids and transportation systems. Furthermore, the continuous decline in the cost of fiber optic components, coupled with the rising performance demands from technologies such as Industrial IoT (IIoT) and advanced surveillance systems, ensures sustained investment in fiber conversion technologies. The capability of fiber converters to bridge disparate network standards, such as Ethernet, T1/E1, and Serial interfaces, further solidifies their crucial role in heterogenous networking environments globally.

Fiber Converter Market Executive Summary

The Fiber Converter Market is characterized by robust growth, propelled primarily by the exponential increase in global data traffic and the concurrent necessity for long-distance, high-speed data transmission capabilities. Business trends highlight a significant shift towards managed fiber converters, offering advanced diagnostics, remote monitoring, and enhanced security features demanded by modern data centers and industrial automation environments. Consolidation among key vendors focusing on integrated solutions that combine switching and conversion functionalities is also a notable trend. Furthermore, supply chain resilience remains a key focus for manufacturers, particularly in the wake of recent global disruptions, driving investments in regional manufacturing hubs to mitigate lead times and ensure product availability across diverse geographical markets.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing region, driven by massive governmental investments in broadband expansion projects (such as China’s ‘Broadband China’ and India’s ‘Digital India’) and the rapid proliferation of mobile broadband infrastructure, particularly 5G networks, which require extensive fiber backhaul. North America and Europe maintain strong market positions due to the early adoption of advanced data center technologies and the continuous upgrade cycles within established enterprise and telecom sectors, focusing heavily on transitioning from 1G/10G to 25G/100G fiber connectivity standards. Regulatory frameworks promoting network neutrality and high-speed access also provide a stable investment environment in these mature markets.

In terms of segmentation trends, the multimode segment, while mature, sees sustained demand in campus networks and short-reach data center applications. However, the single-mode fiber converter segment is experiencing superior growth, attributed to its ability to support much longer transmission distances, making it indispensable for inter-city telecom backbones and large metropolitan area networks. Application-wise, the telecommunication and networking segment holds the largest market share, but the industrial automation and transportation sectors are projected to exhibit the highest CAGRs, driven by the rollout of Industry 4.0 initiatives and the need for hardened, reliable networking components in harsh operational settings. The increasing complexity of network topologies necessitates sophisticated, protocol-agnostic conversion solutions.

AI Impact Analysis on Fiber Converter Market

User queries regarding AI's influence on the Fiber Converter Market commonly revolve around themes such as predictive maintenance integration, automated network optimization, and how AI-driven data demands affect physical layer infrastructure. Users are concerned about whether existing fiber conversion equipment can handle the massive, unpredictable data surges generated by high-performance AI clusters and machine learning operations. Key expectations include the use of AI for real-time monitoring of converter performance, identification of potential failures (like optical power degradation or overheating) before they occur, and automated adjustment of transmission parameters to maintain optimal network throughput and energy efficiency. There is also significant interest in AI supporting the planning and deployment of new fiber routes by optimizing converter placement and configuration.

While fiber converters are essentially passive or Layer 1 devices, the infrastructure supporting high-speed AI and ML applications is entirely dependent on their reliability and high throughput capabilities. AI algorithms deployed in network management systems (NMS) leverage data collected from managed converters regarding link status, error rates, and power consumption. This real-time telemetry allows NMS to dynamically allocate bandwidth, predict component lifecycle, and execute automated troubleshooting procedures, significantly reducing mean time to repair (MTTR). Consequently, manufacturers are developing smarter fiber converters with enhanced embedded processing power specifically designed to communicate detailed diagnostic information relevant to AI-powered network observability platforms.

The deployment of large AI models, particularly in edge computing environments, mandates ultra-low latency and consistent connectivity. Fiber converters facilitate this by ensuring that the high-speed optical links connecting edge data centers or distributed processing units operate flawlessly. AI's core demand for massive, low-latency bandwidth acts as a fundamental driver for increasing the density and quality of fiber infrastructure, thereby boosting the demand for high-performance, multi-gigabit fiber conversion solutions capable of 25G, 40G, and 100G transmission rates. The overall impact of AI is indirect but profoundly accelerative, prioritizing smart, manageable conversion systems over basic, unmanaged units.

- AI enhances network observability by demanding higher telemetry output from managed converters.

- Predictive maintenance algorithms utilize converter diagnostic data to anticipate optical component degradation.

- High-density AI clusters drive the critical requirement for ultra-low latency, pushing adoption of high-speed (100G+) fiber converters.

- Machine learning models optimize fiber converter placement and configuration during network planning phases.

- Automated network optimization platforms use converter data to dynamically manage traffic and load balancing across mixed copper-fiber segments.

- AI in smart grids and industrial IoT increases the reliance on robust, environmentally hardened fiber converters for stable data aggregation.

DRO & Impact Forces Of Fiber Converter Market

The Fiber Converter Market is shaped by a powerful synergy of drivers, balanced by inherent restraints, leading to considerable opportunities that define future strategic direction. Major drivers include the global rollout of 5G infrastructure, demanding extensive fiber backhaul and fronthaul networks; the sustained expansion of hyperscale and edge data centers requiring high-density DCI solutions; and the burgeoning adoption of Industrial Ethernet (IE) and IIoT technologies, which necessitate reliable, environmentally hardened media conversion in factory environments. These forces collectively create a strong foundation for sustained market expansion, driven by the foundational need for speed, distance, and reliability in data transmission.

Restraints, however, temper this growth. These include the high initial capital expenditure associated with deploying comprehensive fiber optic infrastructure compared to existing copper systems, which can be a barrier for smaller enterprises or emerging economies. Furthermore, the increasing trend toward all-fiber networks (like Passive Optical Networks or PON), where devices are designed natively to accept fiber inputs, could eventually reduce the necessity for discrete conversion devices over the long term, particularly in greenfield installations. Technical challenges such as complexity in network management for highly heterogeneous networks utilizing numerous converter types and susceptibility to physical damage during installation also pose restraints.

Opportunities in the market center on developing next-generation managed and smart converters that integrate advanced security features, Layer 2 functions, and protocol compatibility (e.g., Profinet, EtherNet/IP) specifically tailored for Industry 4.0 applications. The rise of smart cities and smart transportation systems presents a lucrative niche for specialized, ruggedized fiber converters that can withstand extreme temperatures and electrical surges. Moreover, the shift towards modular, chassis-based converter solutions offers vendors opportunities to provide flexible, scalable, and cost-effective solutions for large corporate and telecom deployments, positioning the market for growth through product sophistication and targeted application development.

Segmentation Analysis

The Fiber Converter Market is primarily segmented based on product type, fiber type, data rate, power supply method, and end-user application, offering a comprehensive view of adoption patterns across various industries. Understanding these segments is crucial for manufacturers to tailor their product development strategies and for service providers to optimize network deployment. Key differentiators within the market include the ability of converters to handle different wavelengths, support various power sources (AC/DC or PoE), and provide compliance with specific industrial or military standards. The convergence of IT and Operational Technology (OT) networks heavily influences segmentation, particularly the demand for ruggedized converters versus enterprise-grade solutions.

Fiber converters are broadly categorized into standalone converters, which are ideal for point-to-point connections, and chassis-based systems, designed for high-density centralized deployments typical in data centers and central offices. The distinction between single-mode and multimode fiber converters drives fundamental market allocation; single-mode dominates telecommunications due to its distance capabilities, while multimode remains prevalent in shorter, cost-sensitive enterprise environments. The move towards higher data rates (10G, 25G, 40G, and 100G) is the most significant technological segmentation driver, reflecting the relentless global pursuit of increased network performance and bandwidth.

- Product Type: Standalone Converters, Chassis-based Converters, Managed Converters, Unmanaged Converters.

- Fiber Type: Single-mode Fiber Converters, Multimode Fiber Converters.

- Data Rate: 10/100 Mbps, 1000 Mbps (Gigabit Ethernet), 10 Gbps, Above 10 Gbps (25G/40G/100G).

- End-User Application: Telecommunications, Data Centers & Enterprise Networking, Industrial Automation (IIoT), Transportation Systems, Government & Defense, Oil & Gas.

- Power Supply: External Power Supply, Power over Ethernet (PoE) Converters.

Value Chain Analysis For Fiber Converter Market

The value chain for the Fiber Converter Market begins with upstream activities involving the sourcing of core components, primarily specialized semiconductors, optical transceivers (like Small Form-factor Pluggables or SFPs), integrated circuits, power supply units, and metal/plastic enclosures. Key players in this stage are semiconductor foundries and component manufacturers specializing in high-speed optical components. Efficiency in this stage is critical, as the cost and performance of the final converter are heavily dependent on the quality and availability of the optical transceivers, particularly those meeting stringent standards for environmental hardening or high-speed transmission.

Midstream activities involve the design, manufacturing, assembly, testing, and quality assurance of the fiber converter units. Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) play a central role here, leveraging sophisticated automated assembly lines to ensure precision in circuit board placement and connector alignment. Rigorous testing for electromagnetic compatibility (EMC), temperature tolerance, and adherence to specific IEEE standards (such as 802.3) is crucial. Manufacturers often differentiate themselves through proprietary firmware, specialized management software, and unique industrial-grade ruggedization processes, adding value through reliability and advanced functionality rather than merely basic signal conversion.

Downstream activities focus on market penetration, distribution, and post-sales support. The distribution channel is multifaceted, comprising direct sales to large telecommunication providers and hyperscale data centers, indirect sales through a vast network of authorized distributors, system integrators, and value-added resellers (VARs). VARs often bundle fiber converters with complete networking solutions, particularly for enterprise and industrial customers. Post-sales service, including long-term warranties, technical support, and rapid replacement services, forms a vital part of the value proposition, ensuring maximum uptime for mission-critical applications across the various end-user segments. Effective inventory management within the distribution network is essential to meet fluctuating global demand.

Fiber Converter Market Potential Customers

Potential customers for fiber converters span a vast array of industries where data transmission speed, distance, and reliability are paramount. The largest segment remains telecommunications providers (Telcos) and Internet Service Providers (ISPs). These entities utilize fiber converters extensively in central offices, remote terminals, and cellular backhaul networks to connect legacy equipment with modern fiber optic infrastructure, facilitating services like FTTH and 5G deployment. Telcos require high-density, managed chassis-based solutions that offer carrier-grade reliability and sophisticated network management capabilities necessary to handle massive subscriber traffic and ensure service continuity.

Another major customer segment includes large enterprises and data centers. Hyperscale data centers require fiber converters to bridge connectivity between distinct network zones utilizing different media types, primarily focusing on 10G and 100G rates for efficient data center interconnect (DCI) and storage area networks (SANs). Enterprise customers, including universities, large corporate campuses, and financial institutions, employ converters to extend their existing LAN infrastructure beyond the 100-meter limitation of copper cable, linking geographically dispersed buildings or remote office environments effectively and securely. For these customers, cost-effectiveness, ease of deployment, and manageability are key purchasing criteria.

The fastest-growing customer base resides in the Industrial and critical infrastructure sectors, including manufacturing (IIoT), transportation (railways, smart traffic), energy utilities (smart grids), and defense. These environments demand specialized industrial-grade fiber converters characterized by extended temperature ranges, robust electromagnetic shielding, DIN rail mounting, and compliance with industry-specific protocols. These end-users prioritize ruggedization, long Mean Time Between Failures (MTBF), and adherence to safety standards, recognizing fiber conversion as a critical enabling technology for real-time monitoring and control systems operating in harsh operational conditions far from climate-controlled IT closets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | CAGR 7.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Inc., TP-Link Corporation Limited, Allied Telesis, Inc., Advantech Co., Ltd., Belden Inc., Phoenix Contact GmbH & Co. KG, Moxa Inc., Black Box Corporation, Lantronix, Inc., Transition Networks, Netgear Inc., D-Link Corporation, Versa Technology, Inc., Media Converter Store, Inc., Siemens AG, Hirschmann Automation and Control, ComNet, LLC, MikroTik, Shenzhen GSD Tech Co., Ltd., Planet Technology Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Converter Market Key Technology Landscape

The technological landscape of the Fiber Converter Market is evolving rapidly, driven by the demand for higher bandwidth and greater network intelligence. A primary technological focus is the transition towards higher-speed optical interfaces, moving beyond standard Gigabit Ethernet converters to support 10 Gigabit, 25 Gigabit, and 40 Gigabit Ethernet standards. This shift requires more sophisticated chipsets capable of handling higher throughput while maintaining low power consumption and thermal efficiency. Furthermore, the adoption of specialized wavelength division multiplexing (WDM) technologies, specifically Coarse Wavelength Division Multiplexing (CWDM) and Dense Wavelength Division Multiplexing (DWDM), is critical. WDM fiber converters allow multiple data channels to be transmitted simultaneously over a single optical fiber strand using different wavelengths, significantly enhancing fiber utilization in metropolitan and long-haul networks.

Another significant technological advancement is the integration of Layer 2 switching capabilities and advanced management protocols, transforming simple media converters into smart, manageable network components. Managed fiber converters often support Simple Network Management Protocol (SNMP) and provide features like Link Fault Pass-Through (LFP), remote configuration, and network diagnostics. This intelligence is crucial for complex deployments where remote monitoring and rapid fault isolation are non-negotiable requirements. The implementation of Power over Ethernet (PoE) technology in fiber converters is also expanding rapidly, enabling the conversion device to supply power to connected end devices, such as IP cameras or wireless access points, simplifying deployment in locations where traditional power sources are difficult to access, particularly in surveillance and smart building applications.

The industrial and military segments are driving innovation in ruggedization technology. This includes designing converters with IP ratings (Ingress Protection) for dust and water resistance, utilizing extended temperature-range components (e.g., -40°C to +85°C), and implementing specialized anti-vibration features suitable for deployment in factory floors, roadside cabinets, and railway signaling systems. The convergence of Ethernet standards with legacy industrial protocols (e.g., RS-232/485 serial data) requires specialized protocol converters, which are increasingly integrated into fiber converter platforms. Future technology evolution is expected to focus on miniaturization, enhanced power efficiency, and seamless integration of cybersecurity features at the physical layer to protect critical infrastructure from growing cyber threats.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for fiber converters globally. This explosive growth is largely fueled by massive government initiatives aimed at universal broadband coverage and the rapid expansion of 4G and 5G cellular networks, particularly in countries like China, India, and Southeast Asian nations. The region is characterized by high population density, driving the need for sophisticated metropolitan area network (MAN) solutions. Furthermore, APAC is a global hub for electronics manufacturing and industrial automation (Industry 4.0), leading to substantial demand for high-speed, ruggedized converters in factory environments. Investment in new hyperscale data centers in emerging economies like Indonesia and Vietnam further solidifies the region's dominance.

- North America: North America is a highly mature market, characterized by early adoption of high-speed data center technologies and continuous infrastructure upgrades. The demand here is centered on replacing older 1G/10G infrastructure with 25G and 100G fiber converter solutions to support cloud computing, AI operations, and enterprise modernization efforts. Key drivers include significant capital expenditure by leading telecom operators and the relentless need to expand fiber networks into underserved rural areas, often leveraging federal subsidies. The market strongly favors high-quality, managed, and highly reliable converter systems offering advanced diagnostics and cybersecurity compliance necessary for critical infrastructure protection (CIP).

- Europe: The European market demonstrates steady growth, propelled by the European Union’s Digital Agenda, which mandates high-speed broadband penetration across member states. Demand is robust across the enterprise, utility (smart grid), and transportation sectors (e.g., European Railway Traffic Management System - ERTMS). Germany, the UK, and France are key contributors, driven by extensive industrial automation adoption and sophisticated telecom infrastructure. The region shows a strong preference for converters adhering to stringent environmental and quality standards (e.g., RoHS, REACH), reflecting a broader commitment to sustainable and reliable networking components.

- Latin America (LATAM): LATAM is an emerging market with significant untapped potential. Growth is accelerating due to increased private investment in fiber optics infrastructure across Brazil, Mexico, and Colombia, aiming to bridge the digital divide. The primary demand is for cost-effective, reliable fiber converters to facilitate FTTx deployment and upgrade existing municipal networks. While still reliant on external manufacturers, local assembly and partnerships are growing to meet specific regional requirements regarding regulatory compliance and power stability issues. Telecom deployment represents the single largest application segment in this region.

- Middle East and Africa (MEA): The MEA market is exhibiting strong growth, particularly in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to ambitious smart city projects (e.g., NEOM) and massive oil and gas industrial investments. These projects require highly sophisticated, mission-critical industrial fiber converters capable of operating reliably in harsh desert climates and hazardous environments. Africa’s growth is driven by submarine cable landing points and increasing bandwidth demand from rapidly urbanizing nations, leading to widespread deployment of affordable, reliable converters for backhaul and access networks, often utilizing solar-powered remote terminal units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Converter Market.- Cisco Systems, Inc.

- TP-Link Corporation Limited

- Allied Telesis, Inc.

- Advantech Co., Ltd.

- Belden Inc.

- Phoenix Contact GmbH & Co. KG

- Moxa Inc.

- Black Box Corporation

- Lantronix, Inc.

- Transition Networks

- Netgear Inc.

- D-Link Corporation

- Versa Technology, Inc.

- Media Converter Store, Inc.

- Siemens AG

- Hirschmann Automation and Control

- ComNet, LLC

- MikroTik

- Shenzhen GSD Tech Co., Ltd.

- Planet Technology Corporation

Frequently Asked Questions

Analyze common user questions about the Fiber Converter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a managed and an unmanaged fiber converter?

AEO Optimized Answer: Managed fiber converters offer advanced features such as SNMP support, remote configuration, network diagnostics, and security controls, allowing network administrators to monitor and control the device remotely. Unmanaged converters are plug-and-play devices that simply translate media signals without providing any management interface or advanced network features, making them suitable for simple, non-critical point-to-point connections where cost is a major factor.

Why are industrial fiber converters essential in environments like manufacturing or utilities?

AEO Optimized Answer: Industrial fiber converters are essential because they are engineered to withstand extreme operating conditions, including wide temperature variations (-40°C to +85°C), high levels of electromagnetic interference (EMI), and excessive vibration or humidity. They feature robust housings (high IP ratings) and specialized power supplies, ensuring network stability and reliability in harsh operational technology (OT) environments like factory floors, roadside cabinets, and substations, which standard commercial converters cannot tolerate.

How does the choice between single-mode and multimode fiber affect converter selection?

AEO Optimized Answer: Converter selection is determined by the fiber type used. Single-mode (SM) fiber converters are necessary for long-distance transmissions (up to 100 km or more) typical in telecom backbones and metropolitan networks, using a single light path. Multimode (MM) fiber converters are designed for shorter distances (usually under 2 km) prevalent in local area networks (LANs) and data centers, utilizing multiple light paths. SM converters generally use laser light sources and offer higher bandwidth capacity over distance.

What role do fiber converters play in the current 5G network expansion?

AEO Optimized Answer: Fiber converters are critical in 5G expansion by facilitating the necessary high-speed backhaul and fronthaul infrastructure. They connect existing copper-based network segments or remote radio units (RRUs) to the central fiber optic backbone, ensuring the low latency and massive bandwidth required by 5G technology. They often use specialized CWDM/DWDM technology to maximize fiber utilization from the cell site to the central processing unit.

Are Power over Ethernet (PoE) fiber converters gaining market traction?

AEO Optimized Answer: Yes, PoE fiber converters are rapidly gaining traction, particularly in applications like smart security systems, surveillance, and smart buildings. These devices convert fiber signals and simultaneously inject power into the copper output cable (e.g., Cat5/6), allowing end devices such as IP cameras or VoIP phones to be powered directly from the converter, significantly simplifying installation and reducing cabling complexity in remote or hard-to-reach locations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager