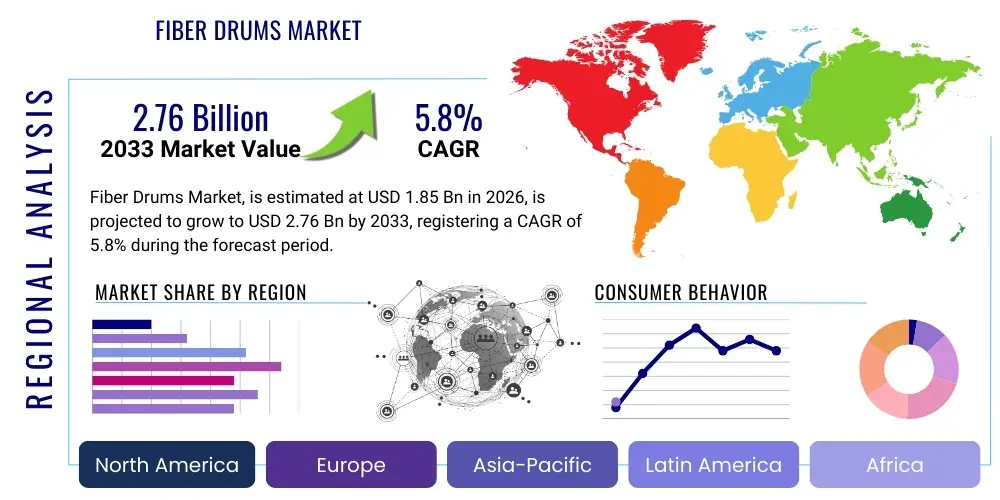

Fiber Drums Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437130 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fiber Drums Market Size

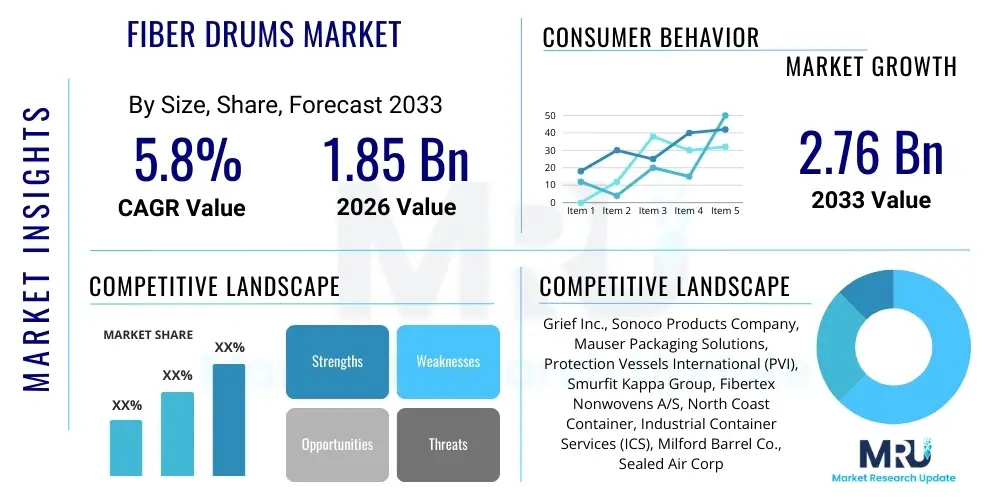

The Fiber Drums Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033.

Fiber Drums Market introduction

The Fiber Drums Market encompasses the global production, distribution, and consumption of cylindrical packaging containers constructed primarily from layers of recycled paperboard or virgin kraft paper, often reinforced with metal, plastic, or fiber closures. These drums serve as durable, cost-effective, and environmentally preferred alternatives to traditional steel or plastic drums for storing and transporting various bulk solid and semi-liquid materials. Designed for medium-duty to heavy-duty applications, fiber drums are distinguished by their versatility in handling products across sensitive sectors like pharmaceuticals, chemicals, food ingredients, and construction materials, where specific barrier properties or contamination risks must be mitigated through tailored internal linings and external coatings. The inherent lightweight nature of these containers significantly contributes to reduced transportation costs and carbon footprints, positioning them favorably in logistics supply chains globally.

Fiber drums are generally categorized by their structural configuration, predominantly featuring open-top removable lids or tight-head fixed tops, addressing the specific requirements of the product being packaged. Open-top drums, which include lever-lock or bolt-ring closures, are widely utilized for powders, granular substances, and solid materials that require easy filling and dispensing, such as resins, adhesives, or pharmaceutical bulk drugs. Tight-head drums, while less common in the fiber segment compared to steel drums, are sometimes adapted for specific semi-liquid or viscous materials where enhanced sealing integrity is paramount. The internal structure often incorporates specialized liners—ranging from polyethylene (PE) to aluminum foil—to provide moisture, vapor, or chemical resistance, thereby ensuring product integrity and regulatory compliance, particularly in the handling of hazardous or high-value materials.

The driving factors propelling the growth of this market are intrinsically linked to global regulatory shifts favoring sustainable packaging solutions and the robust growth observed in end-user industries like specialty chemicals and food additives, particularly across emerging economies. Benefits such as superior stacking strength, low tare weight, and the ability to customize drum dimensions and internal barrier treatments make them highly adaptable for diverse operational environments. Furthermore, the increasing pressure on global corporations to meet ambitious Environmental, Social, and Governance (ESG) targets is accelerating the displacement of non-recyclable or heavier traditional packaging formats by recyclable fiber-based alternatives. This sustained demand from environmentally conscious buyers ensures a predictable trajectory for market expansion over the forecast period, emphasizing innovation in barrier technologies and manufacturing efficiency.

Fiber Drums Market Executive Summary

The global Fiber Drums Market is characterized by a strategic focus on sustainable material integration and optimization of barrier functionality to meet stringent industry standards, particularly in the pharmaceutical and specialty chemicals sectors. Business trends indicate a strong move toward vertical integration among key players, securing a stable supply of high-quality recycled pulp and paperboard, which is essential for maintaining production efficiency and cost competitiveness. The emergence of lightweighting technologies, coupled with advanced sealing mechanisms, is critical for differentiating products in a competitive landscape. Furthermore, digital transformation is impacting the sector through smart packaging initiatives, focusing on tracking and tracing bulk goods, although adoption remains nascent compared to other packaging markets. These macro business shifts emphasize resilience, sustainable sourcing, and enhanced supply chain visibility as central competitive pillars.

Geographically, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapid industrialization, particularly in chemical processing and active pharmaceutical ingredient (API) manufacturing in countries like China and India. This regional expansion is supported by growing domestic consumption and increased export activities requiring compliant and reliable bulk packaging. North America and Europe, while mature markets, are leading in the adoption of premium, high-barrier fiber drums, driven primarily by strict regulatory frameworks governing the transport of hazardous materials and a pervasive corporate commitment to achieving circular economy targets. Regulatory divergence across regions, however, poses a complex challenge for multinational manufacturers, necessitating localized product specifications and certifications to ensure compliance with varying safety and sustainability mandates.

Segmentation trends highlight the dominance of the Open Top drum segment due to its widespread applicability and ease of use for solid materials, representing the largest market share by volume. In terms of capacity, drums ranging from 51 to 150 liters are preferred for logistics optimization, balancing volume and handling efficiency, especially within chemical processing and food ingredient distribution. The end-use segment is increasingly concentrating on the pharmaceutical industry, where fiber drums offer validated, low-contamination packaging solutions for bulk powders, minimizing the risk associated with moisture ingress and protecting the integrity of sensitive components. Successful market players are therefore prioritizing capacity expansion and technological investment specifically focused on high-cleanliness manufacturing standards and sophisticated barrier laminations to capture these high-value applications.

AI Impact Analysis on Fiber Drums Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Fiber Drums Market primarily revolve around operational efficiency, material optimization, and enhanced supply chain predictability. Common questions focus on how machine learning can be leveraged to predict raw material pricing volatility (pulp and paperboard), optimize the structural design of drums for maximum strength-to-weight ratio, and automate complex quality control processes related to barrier lining integrity and sealing efficacy. Users are keenly interested in understanding if AI-driven routing and logistics management can further reduce the overall cost profile of fiber drums, thereby enhancing their competitive edge against plastic and steel alternatives. The consensus concern centers on the capital expenditure required for AI integration within traditional, heavy-machinery manufacturing environments.

AI is beginning to integrate into the fiber drum manufacturing process by offering advanced solutions for predictive maintenance, thereby reducing unexpected downtime and maximizing machine lifespan in high-volume production facilities. Furthermore, algorithms can analyze vast datasets concerning raw material input properties (e.g., moisture content, fiber length) and correlate them with the final drum performance metrics (e.g., drop test results, stacking capacity). This enables manufacturers to dynamically adjust the fiber layering and adhesive application processes, resulting in consistent product quality and optimized material usage. Although the product itself remains low-tech, the processes surrounding its creation and distribution are ripe for AI-driven transformation, emphasizing efficiency and customization capabilities.

- AI-driven optimization of fiber utilization and material waste reduction in the winding and forming process.

- Predictive maintenance schedules for high-speed drum manufacturing machinery, reducing operational downtime.

- Enhanced quality control using computer vision systems to detect minute defects in barrier linings or seam welds.

- Supply chain risk modeling and forecasting for volatile raw material prices (kraft paper and adhesives).

- Logistics optimization, including automated load planning and route efficiency based on drum dimension variations.

- Development of smart fiber drums equipped with AI-analyzed tracking sensors for real-time condition monitoring during transit.

DRO & Impact Forces Of Fiber Drums Market

The Fiber Drums Market is significantly influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory and competitiveness relative to alternative packaging formats. Key drivers include the overwhelming global demand for sustainable and recyclable packaging, heavily influenced by corporate ESG mandates and tightening municipal waste regulations across developed economies. The expansion of industries requiring bulk solid transport, such as specialty chemicals, construction materials, and pharmaceutical excipients, provides a foundational market requirement. However, the market faces strong restraints, primarily derived from the inherent material sensitivity of fiber drums to moisture and humidity, which limits their application in certain harsh environments or for long-term outdoor storage without extensive, and costly, barrier modifications. Additionally, persistent price competition from reconditioned steel drums and high-volume molded plastic drums continues to pressure fiber drum manufacturers on margins and application scope.

Opportunities for growth are concentrated in technological advancements focused on enhancing product attributes and expanding application versatility. Innovation in high-performance barrier coatings and internal laminations—such as those utilizing multi-layer foil or advanced polymer films—allows fiber drums to safely handle hygroscopic and highly sensitive materials, penetrating market segments previously exclusive to metal or heavy-duty plastic containers. Furthermore, customized manufacturing, utilizing variable capacity and printing capabilities to meet specific branding or logistical requirements, offers a pathway for manufacturers to secure premium pricing and specialized contracts. The expanding use of Intermediate Bulk Containers (IBCs) and bulk liquid packaging in conjunction with fiber drums presents collaborative market opportunities rather than direct competition in specialized transport chains.

The primary impact forces governing this market are stringent regulatory requirements concerning packaging safety (e.g., UN certification for hazardous goods transport) and the pervasive influence of public and corporate sustainability metrics. Compliance with UN packaging standards is critical for market access, necessitating rigorous testing and certification processes that act as a barrier to entry for smaller manufacturers. Moreover, the shifting dynamics in the global recycled fiber market—driven by changes in international trade policies regarding waste paper—directly impacts the cost structure and sustainability credentials of fiber drum producers. Successful market navigation requires a proactive approach to material science innovation, consistent compliance assurance, and strategic positioning based on the superior recyclability profile offered by fiber-based packaging solutions.

Segmentation Analysis

The Fiber Drums Market is comprehensively segmented based on Type, Capacity, and End-Use Industry, allowing for a granular analysis of demand patterns and strategic market positioning. The segmentation highlights the critical differences in design requirements across various bulk materials, ranging from dry, inert powders to viscous, semi-liquid substances. Understanding these sub-markets is essential for manufacturers to tailor their product offerings, particularly in barrier technology and closure systems, to maximize performance and compliance within specific industry verticals. The market structure reflects the core packaging requirements dictated by logistics efficiency, product sensitivity, and safety regulations.

By Type, the market is differentiated primarily by the lid mechanism, with Open Top drums dominating the landscape due to their ease of access, while Tight Head drums cater to smaller, more specialized applications. Capacity segmentation is vital for logistical planning, influencing freight costs and warehousing density, with mid-range capacities (51 to 150 Liters) representing the sweet spot for many industrial bulk handlers. The diversity in end-use applications, spanning pharmaceuticals, chemicals, food ingredients, and construction materials, underscores the versatile nature of fiber drums as a universal bulk containment solution. This layered segmentation provides actionable intelligence for investment in production line capabilities and targeted geographic market penetration.

- By Type:

- Open Top Fiber Drums (Removable Lid)

- Tight Head Fiber Drums (Fixed Lid)

- Specialty Fiber Drums (e.g., Salvage Drums)

- By Capacity:

- Up to 50 Liters

- 51 to 150 Liters

- 151 to 250 Liters

- Above 250 Liters

- By End-Use Industry:

- Chemicals (Dyes, Resins, Adhesives, Polymers)

- Pharmaceuticals (APIs, Excipients, Bulk Drugs)

- Food & Beverages (Food Additives, Flavorings, Ingredients)

- Building & Construction (Cements, Powders)

- Others (Metals, Textiles, Waste Management)

Value Chain Analysis For Fiber Drums Market

The value chain for the Fiber Drums Market begins intensely at the upstream level, focused on the sourcing and preparation of raw materials, predominantly high-quality recycled paperboard, virgin kraft paper, and specific adhesive agents necessary for drum formation. Sourcing stability is crucial, as fluctuations in global pulp and recovered paper markets directly impact manufacturing costs and sustainability claims. Key activities in the upstream phase involve managing relationships with paper mills and recyclers, ensuring the consistent supply of appropriate grammage and strength characteristics required for structural integrity, alongside the procurement of specialized lining materials such as polyethylene films or metal bands for reinforcement.

The midstream segment involves the core manufacturing process, where paperboard is spirally wound, laminated with adhesives, and cured into the cylindrical drum body. This stage demands precision engineering, efficient machinery (such as winding and scoring machines), and stringent quality control, especially concerning the application of internal barrier linings which determine the drum's suitability for sensitive materials. Manufacturers are strategically focused on process optimization to reduce energy consumption and improve material yield. Distribution channels play a critical role downstream; the nature of fiber drums—being bulky but relatively lightweight—favors localized or regional distribution to minimize freight expenses, often leveraging a mix of direct sales to large chemical producers and indirect distribution through industrial packaging distributors.

The downstream analysis centers on direct sales to major end-users, especially large-scale pharmaceutical and specialty chemical companies that require standardized, high-volume supply contracts, often involving highly customized specifications regarding capacity and barrier types. Indirect channels, which utilize third-party logistics (3PL) providers and packaging wholesalers, cater more effectively to smaller enterprises or geographically dispersed customers who require integrated packaging solutions and inventory management support. The effectiveness of the distribution channel is highly reliant on efficient warehousing and delivery of bulky items, making regionalized manufacturing footprints a significant competitive advantage for reducing lead times and overall logistics costs to the final buyers of bulk packaging.

Fiber Drums Market Potential Customers

Potential customers for the Fiber Drums Market span a wide array of industrial sectors that require reliable, large-volume, yet eco-friendly containers for the storage and transportation of dry, granular, or viscous materials. The largest buyer base resides within the chemical processing industry, encompassing manufacturers of polymers, resins, specialty additives, dyes, and coatings, which frequently utilize fiber drums for transporting hazardous and non-hazardous bulk powders that benefit from moisture protection and ease of handling. These customers value the drums' stackability and their compliance with UN certification requirements for international logistics, making them an indispensable component of the chemical supply chain infrastructure, particularly for medium-hazard substances.

The pharmaceutical sector represents another high-value customer segment, focusing on the bulk transport of Active Pharmaceutical Ingredients (APIs), excipients, and intermediate drug compounds. Pharmaceutical companies prioritize packaging solutions that guarantee cleanliness, minimal leaching, and validated barrier performance to protect product purity and integrity throughout the supply chain. Fiber drums, particularly those with specialized pharmaceutical-grade liners (e.g., FDA-compliant PE linings), are preferred over reusable containers to mitigate cross-contamination risks and simplify disposal protocols upon drug manufacture. This segment drives demand for premium, high-quality manufacturing and rigorous quality assurance documentation.

Furthermore, the food ingredients and flavoring industry constitutes a significant and growing customer base, utilizing fiber drums for bulk transport of food additives, stabilizers, spices, and dried dairy powders. Here, the focus is strictly on food safety, requiring non-toxic, contaminant-free packaging materials (often necessitating HACCP compliance). Other key buyers include construction material manufacturers (e.g., dry mortar mixes, adhesives), waste management companies requiring certified salvage packaging, and agricultural processors dealing with seeds and feed supplements. The increasing regulatory pressure across all these sectors to adopt fully recyclable or sustainable packaging continually reinforces the commercial appeal of fiber drums as the preferred bulk solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grief Inc., Sonoco Products Company, Mauser Packaging Solutions, Protection Vessels International (PVI), Smurfit Kappa Group, Fibertex Nonwovens A/S, North Coast Container, Industrial Container Services (ICS), Milford Barrel Co., Sealed Air Corporation, CDF Corporation, Novatech Group, TPL Plastech Limited, Container Products Corporation, Encore Container, General Steel Drum LLC, CurTec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Drums Market Key Technology Landscape

The technology landscape in the Fiber Drums Market is primarily focused on three critical areas: enhancing material strength through advanced winding and lamination processes, developing superior moisture and chemical barrier systems, and implementing high levels of automation in the manufacturing line to improve efficiency and consistency. Modern winding technology utilizes precision-controlled tension and alignment systems to ensure optimal density and uniform wall thickness, directly translating into higher stacking strength and UN certification compliance. Furthermore, the use of advanced polymer-based adhesives and bonding agents has allowed manufacturers to improve the structural integrity of the drum body, making it more resilient to impact and vibrations during transit, a crucial technological advancement over earlier generation products.

Significant innovation is concentrated in barrier technology, which is paramount for protecting sensitive contents such as pharmaceutical powders or hygroscopic chemicals. Manufacturers are increasingly adopting multi-layer composite liners, which often combine high-density polyethylene (HDPE), aluminum foil, and specialized EVOH (ethylene vinyl alcohol) films. These composites provide an exceptional barrier against oxygen, moisture vapor, and light, allowing fiber drums to compete effectively in sectors where product degradation is a major concern. The application process for these barrier systems, including hermetic heat sealing and inert gas flushing before closure, utilizes highly specialized machinery to guarantee the container's integrity and extend the shelf life of the packaged material.

Automation and digitalization are steadily transforming production floors. High-speed, computer numerical control (CNC) machinery is used for cutting, scoring, and fitting closures (lever-locks, bolt rings), ensuring tight tolerances and reliable sealing mechanisms. Beyond production, the deployment of industrial IoT sensors monitors operational parameters such as adhesive curing temperatures and winding pressure, enabling real-time adjustments and minimizing defects. This technological shift not only boosts production throughput but also provides the detailed process validation data often required by highly regulated end-use industries like pharmaceuticals, reinforcing the fiber drum's position as a reliable, technically advanced bulk packaging solution suitable for demanding applications worldwide.

Regional Highlights

The Fiber Drums Market exhibits distinct growth and maturity profiles across major global regions, influenced by localized industrial capacity, regulatory environments, and prevailing sustainability norms.

- Asia Pacific (APAC): APAC is positioned as the fastest-growing region, driven by unparalleled expansion in chemical manufacturing, bulk drug production (especially India and China), and increasing domestic demand for packaged food ingredients. The regulatory environment is gradually tightening, encouraging the adoption of certified industrial packaging. However, growth is often volume-driven, focusing on cost-effective, standard fiber drum designs, though demand for high-barrier drums for pharmaceutical exports is escalating rapidly. Regional manufacturers are investing heavily in capacity expansion and modernizing machinery to meet escalating export requirements and improve local supply chain reliability.

- North America: This region represents a mature market characterized by high regulatory compliance, particularly regarding DOT (Department of Transportation) regulations and UN standards for hazardous materials. Demand is strong in the specialty chemicals, resins, and adhesives sectors. Manufacturers here prioritize premium features such as advanced security closures and integrated liners that provide superior product protection. The regional market is highly sensitive to sustainability credentials, with strong preference shown for products utilizing high percentages of certified recycled content and achieving favorable life cycle assessment (LCA) outcomes.

- Europe: Europe is characterized by the most stringent sustainability mandates, significantly impacting purchasing decisions. The circular economy initiatives and extended producer responsibility (EPR) schemes strongly favor the high recyclability of fiber drums over many plastic alternatives. Demand is robust across the chemical and high-value pharmaceutical sectors. The market is competitive, focusing on customized solutions, smaller batch sizes, and innovations in biodegradable or compostable coatings to achieve true end-of-life environmental closure. European adoption is closely tied to compliance with REACH regulations and packaging waste directives.

- Latin America (LATAM): Growth in LATAM is linked to expanding agricultural chemical production, mining operations, and burgeoning food processing industries. The market often favors cost-efficiency, but increasing international trade requires greater adherence to UN standards, driving adoption of certified fiber drums. Market penetration is variable, often influenced by political and economic stability, yet offering significant long-term potential for manufacturers focusing on localized production and optimized logistics.

- Middle East and Africa (MEA): The MEA market is largely driven by petrochemical industries, construction projects, and increasing investment in localized food production. Demand for fiber drums supports the transport of construction chemicals, bulk lubricants, and raw materials. Growth is currently moderate but is expected to accelerate with further infrastructure development and diversification away from oil dependence, creating steady requirements for industrial bulk packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Drums Market.- Grief Inc.

- Sonoco Products Company

- Mauser Packaging Solutions

- Protection Vessels International (PVI)

- Smurfit Kappa Group

- Fibertex Nonwovens A/S

- North Coast Container

- Industrial Container Services (ICS)

- Milford Barrel Co.

- Sealed Air Corporation

- CDF Corporation

- Novatech Group

- TPL Plastech Limited

- Container Products Corporation

- Encore Container

- General Steel Drum LLC

- CurTec

- Myers Container

- C.L. Smith Company

- Fib-Pak Containers

Frequently Asked Questions

Analyze common user questions about the Fiber Drums market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of fiber drums over steel or plastic drums?

The primary advantage of fiber drums is their high sustainability profile, as they are typically made from recycled paperboard and are fully recyclable, offering a lower environmental impact and reduced tare weight, which lowers shipping costs compared to heavier alternatives.

Are fiber drums suitable for hazardous material transportation, and how is compliance achieved?

Yes, fiber drums are widely used for bulk hazardous solids and semi-liquids. Compliance is achieved through rigorous testing and certification according to UN packaging standards (UN 1G/X, UN 1G/Y), which ensures structural integrity for specific material types and packing groups.

Which end-use industry contributes most significantly to the demand for high-barrier fiber drums?

The pharmaceutical industry is the most significant contributor to demand for high-barrier fiber drums. These specialized drums prevent moisture ingress and contamination, essential for protecting sensitive Active Pharmaceutical Ingredients (APIs) and excipients.

How do technological advancements influence the growth of the Fiber Drums Market?

Technological advancements focus on improving barrier linings (e.g., multi-layer films) and precision manufacturing (automation), enabling fiber drums to handle more sensitive and hygroscopic materials, thus expanding their application scope into high-value markets previously dominated by rigid plastics.

What are the key capacity ranges driving the volume demand in the global market?

The key capacity range driving global volume demand is typically between 51 liters and 150 liters. This size segment balances logistical efficiency, ease of manual handling, and sufficient bulk volume required by the chemical and food ingredient sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager