Fiber Glass Mesh Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437853 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Glass Mesh Market Size

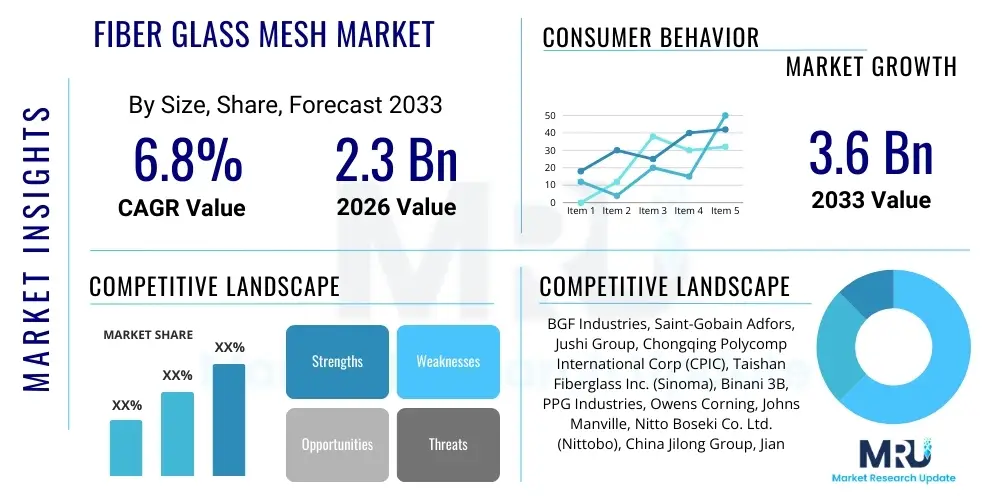

The Fiber Glass Mesh Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.3 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

Fiber Glass Mesh Market introduction

Fiber glass mesh is a high-performance material widely used in the construction and industrial sectors for reinforcement, stabilization, and crack prevention. This material is manufactured by weaving fiber glass yarns into a grid structure, subsequently coating it with alkali-resistant (AR) polymers or other protective resins to enhance durability, tensile strength, and resistance to environmental degradation, particularly from alkaline substances found in cement and plaster. Its exceptional strength-to-weight ratio makes it an indispensable component in modern building envelopes and structural applications, providing necessary tensile support where traditional materials might fail under stress or movement. The product is integral to achieving structural longevity and adherence to stringent building codes globally.

The primary applications of fiber glass mesh are concentrated in External Thermal Insulation Composite Systems (ETICS) or Exterior Insulation and Finish Systems (EIFS), where it acts as a stress-relieving layer embedded within the base coat, preventing cracks caused by temperature fluctuations or substrate movement. Beyond thermal insulation systems, fiber glass mesh is extensively utilized in the reinforcement of cement boards, concrete structures, stucco, waterproofing membranes, and marble or mosaic tiling installations. Its versatility stems from the availability of various mesh sizes, coating types (e.g., polymer-modified, acrylic), and glass compositions (C-Glass, E-Glass, AR-Glass), allowing manufacturers and builders to select specific products tailored to moisture resistance, fire rating, and mechanical load requirements of distinct projects. The core benefit of using fiber glass mesh lies in its ability to significantly extend the lifespan of construction materials and enhance the energy efficiency of buildings.

The market growth is fundamentally driven by the escalating focus on energy-efficient construction practices, particularly in developed economies, necessitating the widespread adoption of robust thermal insulation systems. Furthermore, increasing infrastructure development and renovation activities across Asia Pacific and Latin America, coupled with stricter governmental regulations mandating the use of fire-resistant and durable building materials, significantly propel market expansion. Continuous innovation in coating technologies, leading to enhanced alkali resistance and ease of application, further solidifies fiber glass mesh’s position as a crucial material in the global construction industry. These technological advancements ensure that the mesh remains compatible with newer, sustainable building compounds.

Fiber Glass Mesh Market Executive Summary

The Fiber Glass Mesh Market is characterized by robust growth, primarily fueled by the accelerating global demand for sustainable and energy-efficient building materials, particularly within the residential and commercial construction sectors. Key business trends indicate a strong move toward high-performance, Alkali-Resistant (AR) glass mesh varieties, which offer superior longevity and compatibility with alkaline construction substrates, driven by increasingly stringent European and North American building standards emphasizing durability and reduced maintenance. Manufacturers are focusing on process optimization to reduce production costs and achieve greater uniformity in coating application, critical factors in maintaining competitive pricing while adhering to quality mandates. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach and securing raw material supply chains (such as fiberglass yarns) define the competitive landscape, ensuring resilience against fluctuating commodity prices and logistic challenges.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market due to massive urbanization, significant public and private investment in infrastructure, and the subsequent high volume of new construction projects, particularly in China and India. Europe maintains a dominant position in terms of value, driven by aggressive governmental policies like the European Green Deal, which mandates deep energy renovations requiring high-quality ETICS reinforced with fiber glass mesh. North America is witnessing steady demand, primarily focused on restoration and repair projects, alongside the growing adoption of fiber glass mesh in prefabrication construction and modular housing components. The Middle East and Africa (MEA) are emerging regions, propelled by large-scale commercial and residential complex development that requires advanced thermal management solutions to cope with extreme climate conditions.

Segmentation analysis reveals that the ETICS/EIFS application segment holds the largest market share globally, reflecting the global commitment to thermal insulation and energy efficiency. Within the product type segmentation, E-Glass mesh remains prevalent due to its cost-effectiveness, though AR-Glass mesh is rapidly gaining traction, especially in applications requiring long-term chemical stability in high-alkaline environments, such as cement board reinforcement. The demand trend shows a clear shift towards heavier weight mesh specifications (above 145 g/m²) in regions with seismic activity or severe weather patterns, reflecting the need for enhanced structural integrity. The market’s future trajectory is intrinsically linked to governmental support for green building initiatives and the speed of technological adoption in textile manufacturing processes aimed at improved fiber strength and coating technology.

AI Impact Analysis on Fiber Glass Mesh Market

User queries regarding AI’s impact on the Fiber Glass Mesh Market commonly center on how Artificial Intelligence and Machine Learning (ML) can optimize complex manufacturing processes, enhance quality control, and streamline supply chain logistics. Specific concerns often relate to predictive maintenance of weaving and coating machinery, the use of computer vision for defect detection in mesh textiles, and how AI might aid in developing new, performance-enhanced alkali-resistant coatings by simulating chemical reactions and material stresses. Users are keen to understand if AI can reduce the variability in the fiber alignment and coating thickness, which directly impacts the product’s tensile strength and longevity. Furthermore, there is significant interest in using predictive analytics to forecast demand fluctuations in the volatile construction sector, allowing manufacturers to optimize inventory and production schedules, mitigating risks associated with overproduction or material shortages.

- AI-driven optimization of weaving loom parameters for increased throughput and reduced material waste.

- Implementation of machine vision systems for real-time, high-precision defect detection (e.g., coating gaps, misalignments) on the mesh surface, ensuring superior quality control.

- Predictive maintenance analytics using sensor data from production lines to anticipate equipment failure, minimizing costly downtime and maximizing operational efficiency.

- Supply chain management enhanced by ML algorithms to forecast fluctuations in raw material (fiber glass yarn, polymer resins) pricing and availability.

- AI-assisted material science research to simulate and optimize new formulations for alkali-resistant coatings, accelerating the development of next-generation fiber glass mesh products.

- Use of generative AI tools in design and engineering for customizing mesh specifications (weight, weave pattern) based on specific regional environmental and structural requirements.

DRO & Impact Forces Of Fiber Glass Mesh Market

The dynamics of the Fiber Glass Mesh Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. The primary Driver is the worldwide imperative to enhance building energy efficiency and structural longevity, leading to widespread adoption of ETICS, which inherently requires high-quality fiber glass mesh for reinforcement. Restraints predominantly involve the significant price volatility of key raw materials, particularly glass fiber rovings and petrochemical-derived polymer coatings, coupled with intense regulatory scrutiny in certain markets regarding material sourcing and adherence to fire safety standards, which can increase compliance costs. However, substantial Opportunities lie in the increasing demand from emerging economies for modern construction techniques, the expansion of the repair and renovation sector, and technological advancements focusing on developing sustainable, bio-based coating resins that align with global green building mandates. These combined forces mandate that market players prioritize efficiency, innovation, and adherence to quality standards to maintain competitiveness and capitalize on long-term growth trends.

Segmentation Analysis

The Fiber Glass Mesh Market is highly segmented based on crucial parameters including product type, application, mesh size/weight, and geographical region. Understanding these segments is vital for analyzing market structure and identifying niche growth areas. The segmentation based on product type delineates the performance characteristics and cost structure, with E-Glass being the traditional, cost-effective option, while AR-Glass commands a premium due to its superior chemical resistance, essential for applications in direct contact with cementitious materials. Application segmentation clearly highlights the dominance of the residential and commercial construction sectors, where thermal insulation systems drive volume. Furthermore, the segmentation by mesh weight reflects regional building code requirements, with heavier mesh typically specified for areas prone to severe weather or higher structural loads, influencing purchasing decisions and material specifications across different geographies.

The detailed analysis within each segment reveals distinct growth patterns. For instance, the growing preference for high-strength cement boards in modular and prefabrication construction is boosting the demand for specialized, high-density AR-Glass mesh products. Conversely, in renovation markets focused on simple plaster reinforcement, standard, lighter-weight E-Glass mesh still maintains a significant share. The strategic focus for market players involves developing product lines that cater specifically to the performance metrics required by the top application segments, such as highly flexible mesh for complex architectural facades or fire-rated mesh for high-rise commercial structures. The intersection of these segments—for example, AR-Glass mesh used in ETICS in the European market—represents the highest value and fastest-growing sub-markets, requiring specific certifications and regulatory compliance.

- By Type:

- C-Glass Mesh

- E-Glass Mesh

- AR-Glass Mesh (Alkali-Resistant)

- By Application:

- External Thermal Insulation Composite Systems (ETICS) / Exterior Insulation and Finish Systems (EIFS)

- Reinforcement of Plaster and Stucco

- Waterproofing and Roofing Membranes

- Reinforcement of Cement Boards and Concrete Products

- Stone and Marble Reinforcement

- Grinding Wheels and Abrasives

- By Mesh Weight (Density):

- Under 100 g/m² (Lightweight)

- 100 g/m² to 145 g/m² (Standard)

- Above 145 g/m² (Heavy-duty)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Fiber Glass Mesh Market

The value chain for the Fiber Glass Mesh Market begins with the upstream procurement of raw materials, primarily silica sand, limestone, and other minerals used to produce molten glass, which is subsequently drawn into high-strength fiber glass filaments. Key upstream players include specialized glass fiber manufacturers (such as Jushi Group, CPIC, and Owens Corning) who produce C-Glass, E-Glass, or specialized AR-Glass rovings. This stage is capital-intensive and highly dependent on energy costs and regulatory compliance related to emissions. The quality and type of glass fiber produced directly influence the final mesh product's performance characteristics, making the integration of high-quality raw material suppliers crucial for the competitive positioning of mesh manufacturers.

The midstream phase involves the core manufacturing processes: weaving the glass fibers into a mesh structure using advanced textile machinery and, critically, applying alkali-resistant polymer coatings (typically acrylic emulsions or styrene-butadiene latex) onto the woven material. Mesh manufacturers often specialize in optimizing weave patterns and coating compositions to meet application-specific standards, such as tensile strength, fire resistance, and alkali exposure durability. Efficiency in this stage, particularly minimizing coating waste and ensuring uniform tension during weaving, is key to maintaining profitable margins. Major mesh producers often manage both weaving and coating processes internally to control quality and intellectual property surrounding specialized chemical treatments.

The downstream component involves distribution and end-use application. Fiber glass mesh products are distributed through a mixture of direct sales to large construction companies and indirect channels utilizing specialized building material distributors, wholesalers, and retail outlets. Direct channels are common for large infrastructural projects and relationships with major EIFS/ETICS system providers, ensuring just-in-time delivery and technical support. Indirect channels dominate sales to smaller contractors and the renovation market. End-users are primarily construction companies, insulation specialists, contractors, and cement board manufacturers, where the mesh is integrated into final products or site applications. The proximity of distributors to construction hubs significantly impacts logistics efficiency and final product cost for the end-user.

Fiber Glass Mesh Market Potential Customers

The primary customers for fiber glass mesh are entities engaged in construction, infrastructure development, and manufacturing of specialized building components that require tensile reinforcement, stabilization, and crack prevention. The largest segment comprises insulation contractors and construction firms specializing in External Thermal Insulation Composite Systems (ETICS) or EIFS installation for both new construction and retrofitting of existing commercial and residential buildings. These customers consume high volumes of standard and heavy-duty coated mesh, standardized to European (ETAG/EAD) or North American (ASTM) specifications, making performance verification a critical purchasing criterion. Demand is strongly correlated with government incentives for energy efficiency improvements.

Another significant customer base includes manufacturers of prefabrication and composite building materials, notably producers of cement boards, gypsum panels, and specialized concrete elements. These manufacturers integrate alkali-resistant (AR) mesh directly into their production lines to enhance the dimensional stability, impact resistance, and long-term durability of their products before they are shipped to construction sites. For these high-volume industrial customers, consistent supply, customization options regarding mesh aperture and weight, and favorable long-term supply agreements are major factors influencing vendor selection. The increasing adoption of modular construction techniques globally further solidifies this customer segment's importance, requiring reliable, certified reinforcement materials.

Furthermore, specialty contractors focused on roofing, waterproofing, stucco, and stone/marble reinforcement constitute a substantial, albeit geographically dispersed, customer segment. These users require specialized, sometimes lighter-weight or more flexible, mesh products designed for challenging applications such as complex curves, horizontal surfaces, and applications involving aggressive chemical environments (e.g., highly alkaline mortars). Finally, major wholesalers and large retail chains that supply construction materials serve as crucial intermediaries, acting as procurement points for smaller independent contractors and renovation projects, requiring a diverse and readily available inventory of various mesh specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BGF Industries, Saint-Gobain Adfors, Jushi Group, Chongqing Polycomp International Corp (CPIC), Taishan Fiberglass Inc. (Sinoma), Binani 3B, PPG Industries, Owens Corning, Johns Manville, Nitto Boseki Co. Ltd. (Nittobo), China Jilong Group, Jiangsu Jiuding New Material Co., Ltd., Sureflex, Fibertex Nonwovens, Ten Cate Advanced Composites, Sidero S.p.A., Haining Century Material Co., Ltd., P-D Group, TWP Inc., and Luyang Energy-Saving Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Glass Mesh Market Key Technology Landscape

The manufacturing of high-quality fiber glass mesh relies heavily on advanced textile and chemical engineering technologies, categorized primarily into glass fiber production, weaving processes, and chemical coating application. In the glass fiber production stage, the trend is toward refining formulations to increase alkali resistance without compromising tensile strength. Specialized AR-Glass (Zirconia-containing) formulations are critical for cementitious applications, requiring precise control over melting and drawing processes. Technological innovation focuses on achieving thinner, yet stronger, fibers that allow for lighter overall mesh products while maintaining or exceeding required structural performance. Automation and digitalization of these drawing lines are essential for maintaining consistency and optimizing energy use in the upstream segment of the value chain.

In the midstream processing, weaving technology is increasingly moving towards high-speed, shuttleless looms capable of handling the delicate yet rigid glass yarns efficiently. Key technological developments include advanced tension control systems to ensure uniform aperture size and alignment, which is crucial for the mesh’s mechanical performance when embedded in matrices like stucco or base coats. Furthermore, the integration of continuous monitoring sensors and sophisticated machine learning algorithms allows for real-time adjustments to weaving parameters, reducing defects such as slack threads or irregularities that could compromise the mesh’s integrity. This focus on precision weaving is directly linked to enhanced product quality and reduced waste in high-volume production environments, addressing the stringent quality requirements set by major certification bodies.

The chemical coating technology represents the most significant area of differentiation and innovation in the current market landscape. The alkali-resistant coating is vital for protecting the E-glass or standard C-glass fibers from chemical attack by alkaline compounds in cement, lime, and plaster, thereby ensuring long-term reinforcement effectiveness. Current trends include the development of polymer dispersions (like modified acrylics or SBR latex) that offer superior adhesion, flexibility, and hydrolysis resistance. Moreover, there is an increasing push towards environmentally friendly, low-VOC (Volatile Organic Compound) and formaldehyde-free coating systems, driven by sustainability mandates, particularly in Europe. Research into nanotechnology and specialty additives, such as hydrophobic agents, aims to further enhance the mesh's durability against moisture and extreme weather conditions, creating highly functional, third-generation mesh products that command higher margins.

Regional Highlights

- Europe: Market Leader Driven by Efficiency Mandates

Europe holds a dominant position in terms of market value, largely due to the early and widespread adoption of stringent energy performance directives, necessitating the deployment of External Thermal Insulation Composite Systems (ETICS) in both new construction and massive renovation waves. Countries like Germany, France, and the UK have implemented aggressive decarbonization and energy efficiency targets, making the use of reinforced ETICS mandatory for compliance, thereby ensuring consistent, high-volume demand for fiber glass mesh. The European market is characterized by a high preference for certified, heavy-duty mesh (typically 160 g/m² and above) adhering to ETAG 004 or European Assessment Document (EAD) standards, demanding superior quality AR-Glass or highly coated E-Glass products to withstand long-term exposure in harsh climates.

Furthermore, the repair and maintenance sector in established European urban centers contributes significantly to consumption, as aging building stock requires continuous renovation and structural reinforcement using reliable, certified materials. The mature supply chain and the presence of leading global manufacturers, such as Saint-Gobain Adfors, facilitate efficient distribution and technical support across the continent. Future growth will be strongly influenced by the implementation pace of the Renovation Wave strategy under the European Green Deal, which is expected to further intensify demand for insulation materials and their reinforcement components through 2030.

- Asia Pacific (APAC): Fastest Growing Market Fueled by Urbanization

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven primarily by exponential urbanization, rapid industrialization, and massive investment in public infrastructure, particularly in emerging economies like China, India, and Southeast Asian nations. While the initial market segment often prioritizes cost-effectiveness (leading to higher adoption of standard E-Glass mesh), the increasing awareness of building quality and implementation of localized energy conservation codes are gradually shifting demand towards higher-quality, coated products.

China, being the world’s largest producer and consumer of construction materials, dictates much of the region's market dynamics. Although local production is high, there is a growing segment of high-end commercial projects in major metropolitan areas that prefer internationally certified, premium fiber glass mesh for critical applications like fire-rated construction and high-performance cement boards. India’s burgeoning real estate sector and government initiatives aimed at affordable housing and smart cities are creating immense potential, demanding reinforcement materials that can handle diverse climatic conditions and structural loads, ensuring long-term durability in high-density construction environments. The focus is shifting from simply mass production to balancing cost and certified performance.

- North America: Steady Demand in Residential and Commercial Restoration

The North American market, comprising the U.S. and Canada, represents a substantial segment driven by consistent demand for EIFS applications in commercial and institutional construction, as well as extensive residential remodeling and repair activities. The market adheres to rigorous local standards (ASTM and ICC codes), particularly concerning seismic resistance and performance in severe weather regions (e.g., high-wind zones), favoring robust, heavy-duty mesh specifications. The U.S. market sees strong consumption in external wall systems and cementitious backer units (CBU), where fiber glass mesh prevents cracking and ensures the structural integrity of tiled surfaces.

Technological adoption, particularly in prefabrication and off-site construction methods, is accelerating the use of fiber glass mesh in modular components, providing consistent quality and speed of construction. The demand growth, though mature compared to APAC, is stable, supported by infrastructure modernization projects and continuous regulatory pressure to enhance building envelope thermal performance. Canada, in particular, drives significant demand for thermal insulation systems due to extreme seasonal temperature variations, ensuring steady requirement for high-quality reinforcing mesh.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging High-Growth Pockets

LATAM and MEA represent emerging markets with high-growth potential, albeit starting from a lower base. In the Middle East, substantial investment in large-scale residential, commercial, and hospitality projects—especially in the UAE and Saudi Arabia—drives demand for mesh used in exterior insulation systems, crucial for managing intense solar heat gain and reducing air conditioning loads. The focus here is on mesh that can withstand high temperatures and salinity exposure.

In Latin America, rapid urbanization in Brazil and Mexico, coupled with increasing awareness of energy conservation, is boosting the adoption of modern construction chemicals and insulation methods, including ETICS. Local regulations are gradually tightening building standards, creating opportunities for international suppliers offering cost-effective and certified reinforcement solutions. These regions primarily rely on imported specialized mesh products, making supply chain efficiency and localized technical support vital competitive differentiators for market players targeting these geographies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Glass Mesh Market.- BGF Industries

- Saint-Gobain Adfors

- Jushi Group

- Chongqing Polycomp International Corp (CPIC)

- Taishan Fiberglass Inc. (Sinoma)

- Binani 3B

- PPG Industries

- Owens Corning

- Johns Manville

- Nitto Boseki Co. Ltd. (Nittobo)

- China Jilong Group

- Jiangsu Jiuding New Material Co., Ltd.

- Adfors Saint-Gobain

- Sureflex

- Fibertex Nonwovens

- Ten Cate Advanced Composites

- Sidero S.p.A.

- Haining Century Material Co., Ltd.

- P-D Group

- TWP Inc.

Frequently Asked Questions

Analyze common user questions about the Fiber Glass Mesh market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of fiber glass mesh in construction?

Fiber glass mesh primarily functions as a reinforcement material, offering tensile strength and impact resistance to prevent cracking and ensure the structural stability of cementitious layers, plaster, stucco, and external insulation systems (ETICS/EIFS).

What is the difference between E-Glass Mesh and AR-Glass Mesh?

E-Glass mesh is the standard, cost-effective option, suitable for general applications. AR-Glass (Alkali-Resistant) mesh contains Zirconia, providing superior chemical resistance required when the mesh is embedded directly into highly alkaline cement, ensuring longevity and performance.

Which application segment drives the highest demand for the mesh?

The External Thermal Insulation Composite Systems (ETICS) or EIFS application segment is the largest driver of demand globally, propelled by stringent energy efficiency regulations in Europe and North America and rapid adoption in Asia Pacific.

What factors restrain the growth of the Fiber Glass Mesh Market?

The main restraints are the significant volatility in the prices of raw materials, specifically fiberglass rovings and polymer resins, and the complexity associated with meeting diverse and stringent regional building and fire safety codes.

Which geographical region is anticipated to show the fastest market growth?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial infrastructure investments, accelerated urbanization, and increasing regulatory focus on improving construction quality and energy efficiency in countries like China and India.

*** End of Report ***

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fiber Glass Mesh Market Statistics 2025 Analysis By Application (External Wall Insulation, Building Waterproofing, Others), By Type (C-Glass, E-Glass, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fiber Glass Mesh Market Statistics 2025 Analysis By Application (External Wall Insulation, Building Waterproofing), By Type (C-Glass, E-Glass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager