Fiber Internet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434132 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fiber Internet Market Size

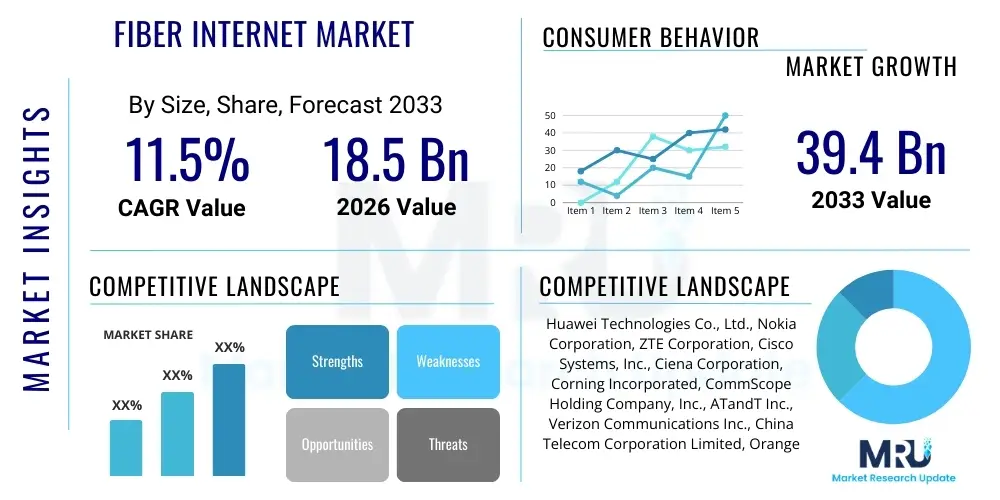

The Fiber Internet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 39.4 Billion by the end of the forecast period in 2033.

Fiber Internet Market introduction

Fiber Internet, utilizing Fiber-to-the-Home (FTTH) or Fiber-to-the-Curb (FTTC) architectures, represents the technological apex of broadband connectivity, delivering unparalleled speed, bandwidth, and reliability compared to traditional copper-based infrastructures like DSL or cable modem services. This technology transmits data using light signals through thin strands of glass or plastic fiber, eliminating electromagnetic interference and significantly extending transmission distances. The fundamental shift towards fiber deployment is driven by escalating consumer and enterprise demand for high-definition video streaming, cloud computing services, massive online gaming, and the proliferation of IoT devices that require consistent, symmetrical high-speed connections. Products within this market encompass the entire fiber optic network ecosystem, including passive optical networks (PONs) such as GPON and XGS-PON systems, optical network terminals (ONTs), optical line terminals (OLTs), and various types of fiber optic cables and connectors optimized for last-mile delivery. The ongoing global infrastructure investments, often backed by governmental subsidies aimed at bridging the digital divide, are the primary propellant ensuring sustained market expansion throughout the forecast period.

Major applications of fiber internet span residential, commercial, and governmental sectors. In the residential segment, fiber enables true Gigabit and multi-Gigabit services, essential for supporting remote work, distance learning, and concurrent high-bandwidth activities within a single household. For commercial enterprises, especially those reliant on data centers, financial trading platforms, and large-scale cloud synchronization, fiber provides the necessary low latency and symmetrical upload/download speeds critical for operational efficiency and disaster recovery planning. Furthermore, emerging applications such as Smart Cities initiatives and enhanced 5G backhaul infrastructure heavily rely on the scalability and capacity provided exclusively by dense fiber optic networks. The robustness of fiber internet ensures minimal degradation of service quality during peak usage times, a key differentiator supporting its widespread adoption across densely populated urban centers and increasingly, in suburban and rural areas receiving subsidized rollout programs.

The core benefits driving market penetration are undeniable speed advantages, enhanced reliability, and future-proofing capability. Fiber infrastructure is inherently more reliable than copper, offering superior resistance to environmental factors and less susceptibility to signal loss over distance, leading to fewer service interruptions and reduced maintenance costs for providers. Crucially, the capacity of installed fiber is virtually limitless regarding current consumer needs, meaning that future upgrades often only require replacing the terminal electronics (GPON to 10G PON, for example) rather than digging up and replacing the physical cable infrastructure. This scalability provides a significant long-term economic advantage for Internet Service Providers (ISPs). Driving factors include the continuous rise in average household data consumption, the necessity for high-quality symmetrical bandwidth to support video conferencing platforms, and strong governmental policies promoting national broadband infrastructure deployment as a critical economic competitiveness pillar.

Fiber Internet Market Executive Summary

The Fiber Internet Market is experiencing robust acceleration fueled by a confluence of favorable business trends, intensified regional deployment strategies, and critical technological segmentation shifts towards next-generation passive optical network architectures. Key business trends indicate a strong move towards infrastructure sharing models, where multiple operators utilize the same fiber conduits and trenches to minimize capital expenditure and accelerate time-to-market, particularly in competitive urban environments. Furthermore, large telecommunication companies are increasingly divesting or spinning off their infrastructure assets into dedicated FiberCo entities to unlock trapped capital and finance further ambitious build-outs, attracting significant investment from private equity and infrastructure funds viewing fiber as a low-risk, essential utility asset. These financial and operational restructuring activities underscore the confidence in the long-term revenue stability and essential nature of high-speed fiber connectivity, facilitating market expansion even during periods of broader economic uncertainty. The competitive landscape is characterized by aggressive deployment targets set by established incumbents seeking to defend market share against agile, fiber-focused challengers who prioritize greenfield installations using advanced XGS-PON technologies.

Regional trends reveal significant disparities in market maturity and penetration rates. North America and parts of Western Europe are transitioning from early-stage deployment to mass market saturation, characterized by intense competition and migration strategies targeting cable modem subscribers. Conversely, the Asia Pacific region, led by China, South Korea, and Japan, demonstrates the highest global penetration rates, leveraging extensive governmental backing and early adoption of FTTH, setting the benchmark for speed and coverage worldwide. Emerging markets, particularly in Southeast Asia, Latin America, and certain Middle Eastern nations, represent the next major growth frontier, driven by rapidly increasing mobile penetration necessitating robust fiber backhaul and urbanization requiring scalable fixed broadband solutions. Regulatory frameworks promoting open access and easing permitting processes are crucial drivers determining the pace of rollout across these diverse geographies, resulting in varying market velocities and technology adoption cycles globally. Governments increasingly recognize fiber deployment as a national priority, often stimulating growth through tax incentives and co-funding programs specifically targeting underserved rural communities, thereby boosting market visibility and project feasibility for ISPs.

Segment trends highlight the dominance of the Fiber-to-the-Home (FTTH) architecture as the preferred model for new builds due to its superior performance capabilities and minimal maintenance needs, contrasting sharply with the slower adoption of Fiber-to-the-Building (FTTB) in certain multi-dwelling unit (MDU) scenarios where existing copper wiring is leveraged for the final few meters. Technologically, the shift from traditional GPON (Gigabit Passive Optical Network) to higher-capacity XGS-PON (10 Gigabit Symmetrical Passive Optical Network) is the most critical segment trend, enabling providers to offer symmetrical 10 Gbps services to individual subscribers and future-proofing their networks for the expected demands of the late 2020s and early 2030s. Moreover, the segmentation based on end-user application shows continuous disproportionate growth in the enterprise segment, particularly among small and medium enterprises (SMEs) that require reliable cloud connectivity and robust security features, driving demand for dedicated, higher service level agreement (SLA) fiber connections. This segmentation based on technology readiness and customer vertical dictates capital allocation strategies and influences vendor selection in the competitive marketplace.

AI Impact Analysis on Fiber Internet Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Fiber Internet Market primarily revolve around three core themes: operational efficiency, capacity planning, and the demand elasticity created by AI applications. Users frequently ask how AI can optimize network performance, specifically focusing on predictive maintenance capabilities to reduce outages and truck rolls, which are significant operational expenditures for network operators. There is high interest in using machine learning algorithms to analyze massive amounts of network telemetry data to detect anomalies, forecast traffic spikes with greater accuracy, and dynamically allocate bandwidth resources, thereby improving Quality of Experience (QoE) without requiring extensive human intervention. A second major theme addresses the increased data demand generated by widespread AI adoption, specifically generative AI models, large language models (LLMs), and high-resolution computational clusters, querying whether existing fiber infrastructure is sufficient or if the rapid adoption of AI will necessitate an immediate acceleration towards XGS-PON and 25G PON deployments. Users are highly focused on the role of AI in streamlining construction and deployment processes, inquiring about how AI-driven analysis of geographical data, terrain mapping, and existing utility infrastructure can lead to optimized trenching routes and faster build times, directly impacting capital efficiency and reducing the time-to-market for new fiber rollouts globally.

The integration of AI tools provides significant advancements in network management, transitioning traditional, reactive maintenance models into sophisticated, proactive operational frameworks. AI-powered network monitoring systems utilize complex machine learning models to analyze patterns in error logs, traffic fluctuations, and equipment performance data, identifying precursors to potential faults before they escalate into service-disrupting failures. This capability drastically reduces the mean time to repair (MTTR) and minimizes costly unscheduled downtimes, leading to substantial savings in operational expenditure (OPEX) for ISPs. Furthermore, AI contributes significantly to cybersecurity within the fiber infrastructure by analyzing network traffic in real-time to detect sophisticated denial-of-service (DDoS) attacks and other malicious anomalies that standard rule-based systems might miss, thereby protecting the integrity and security of the high-speed data transmission channels inherent in fiber networks. The optimization extends into the customer service domain, where AI-powered chatbots and predictive tools can triage customer complaints based on real-time network status, often resolving issues without the need for agent intervention or unnecessary technician dispatches, enhancing overall customer satisfaction and operational throughput.

From a strategic planning perspective, AI plays a crucial role in managing the massive data growth expected from widespread AI adoption itself. LLMs, AI training models, and edge computing demand high-capacity, low-latency backhaul, putting significant pressure on existing fiber capacity. AI analysis helps network planners project future bandwidth needs with greater accuracy by correlating demographic growth, enterprise cloud migration rates, and the expected adoption curves of advanced consumer technologies, enabling more targeted and cost-effective upgrades from GPON to 10G PON or even 25G/50G PON architectures. This predictive capability ensures that capital investments are strategically aligned with future demand hotspots, minimizing stranded assets and maximizing network efficiency. Ultimately, AI transforms the operation of fiber networks from static infrastructure management into a dynamic, adaptive system capable of self-optimizing and scaling intelligently to meet the unprecedented demands of the interconnected digital economy, serving both as a consumer of high bandwidth and a powerful tool for infrastructure optimization.

- AI-driven Predictive Maintenance: Reduces network downtime by forecasting equipment failures (e.g., OLT/ONT issues) based on real-time data analysis.

- Automated Network Optimization: Utilizes machine learning to dynamically manage bandwidth allocation and traffic routing, ensuring optimal Quality of Service (QoS).

- Enhanced Security Monitoring: AI algorithms detect and mitigate sophisticated cyber threats, including DDoS attacks, protecting critical fiber network nodes.

- Accelerated Fiber Deployment Planning: AI uses geospatial and demographic data to optimize trenching routes, reducing construction costs and time-to-market.

- Demand Forecasting for XGS-PON: Predicts future capacity requirements stemming from increased AI applications (LLMs, cloud computing), guiding strategic upgrade cycles.

- Automated Fault Isolation: Speeds up diagnosis and localization of fiber cuts or technical faults through intelligent correlation of sensor data.

DRO & Impact Forces Of Fiber Internet Market

The market for Fiber Internet is subject to significant dynamic forces encompassing robust drivers, structural restraints, and transformative opportunities that collectively shape its growth trajectory and competitive intensity. The primary drivers revolve around the insatiable demand for bandwidth driven by high-definition content consumption, the proliferation of cloud services, and the shift towards remote work models that necessitate symmetrical, reliable connectivity. Governmental initiatives globally, providing subsidies and establishing aggressive broadband targets (e.g., the FCC's push in the US, or the European Commission's Digital Agenda), act as powerful exogenous drivers stimulating massive capital investment into fiber infrastructure, particularly in historically underserved rural areas, thereby expanding the market's total addressable reach. These drivers are fundamentally economic and social, cementing fiber internet as an indispensable 21st-century utility, rather than a luxury service, reinforcing consistent investment from both public and private sectors, accelerating the pace of technology adoption and geographic coverage expansion.

Despite strong drivers, several critical restraints impede uniform market acceleration. The foremost restraint is the extremely high upfront Capital Expenditure (CAPEX) required for large-scale fiber deployment, involving significant civil engineering works (trenching, duct installation, pole access), which poses substantial barriers to entry for new competitors and strains the balance sheets of existing operators, often requiring long payback periods. Furthermore, regulatory hurdles related to permitting, rights-of-way access, and pole attachment agreements often lead to protracted delays in deployment schedules, particularly in densely populated urban environments where infrastructure congestion is high and municipal bureaucracy is complex. A persistent constraint is the shortage of skilled labor—specifically fiber splicers, installation technicians, and network engineers—needed to execute the massive volume of parallel fiber construction projects simultaneously worldwide. This labor scarcity not only increases project costs but also limits the maximum speed at which rollouts can occur, potentially slowing the forecasted CAGR despite the strong underlying demand.

Opportunities for market players are abundant and primarily concentrated in technological advancements and strategic collaborations. The shift to advanced PON standards like XGS-PON and the emerging 25G PON presents a lucrative opportunity for vendors to supply next-generation equipment and for operators to monetize premium multi-Gigabit services, boosting Average Revenue Per User (ARPU). Strategic opportunities also lie in targeting the enterprise segment with high-SLA services and providing fiber backhaul solutions for 5G wireless networks, which require dense, high-capacity fiber connectivity to support massive MIMO and low latency applications. The impact forces are overwhelmingly positive; the irreversible trend of digitalization, coupled with technological progress that continuously lowers the cost of optical components, ensures that fiber remains the foundational technology for future communications. The competitive impact force is high, pushing innovation and reducing pricing pressure for consumers, while the regulatory impact force is evolving, moving towards supporting infrastructure development through streamlined processes and financial incentives, leading to a consistently growing and technologically advancing market structure.

Segmentation Analysis

The Fiber Internet Market is meticulously segmented based on key criteria including the Network Architecture deployed, the Technology used for transmission, the Application across end-user verticals, and the geographical region. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where capital investment is concentrated and which technological standards are gaining dominance. The network architecture segmentation, primarily differentiating between FTTH, FTTB, and FTTC, is crucial as it dictates the level of fiber penetration into the end-user premise and subsequently, the quality and speed of service delivered. This segmentation highlights the industry's strategic preference for FTTH in greenfield deployments due to its superior future-proofing capabilities and lower long-term maintenance costs, driving the highest growth within this specific segment globally, particularly in areas receiving new infrastructure upgrades.

The technological segmentation is perhaps the most dynamic area, dominated by Passive Optical Network (PON) standards, specifically distinguishing between the legacy GPON and the advanced XGS-PON. The growing need for symmetrical speeds beyond 1 Gbps to support intensive corporate applications and high-resolution video streams is rapidly shifting investment towards XGS-PON, which offers 10 Gbps symmetrical capacity. This transition ensures operators can remain competitive and satisfy the exponentially increasing bandwidth demands originating from cloud computing, remote desktop infrastructure, and the expansion of smart home ecosystems. Furthermore, the segmentation by application identifies the most profitable end-user segments, showing that while residential users account for the largest volume of connections, the commercial and enterprise segments often generate higher ARPU due to specialized requirements like dedicated internet access, service level agreements (SLAs), and advanced security protocols tailored for business continuity and mission-critical operations.

Geographically, the market segmentation illustrates the maturity curve of fiber deployment. Asia Pacific leads in terms of penetration, having established ubiquitous fiber connectivity early on, while North America and Europe are currently undergoing aggressive, multi-billion-dollar build-out phases aimed at nationwide coverage parity. These regional variances are critical for vendors supplying network equipment, as demand profiles differ—Asia Pacific focuses on upgrades and high-density deployments, whereas North America and Europe emphasize extensive rural coverage and competitive overbuilding in metropolitan areas. Understanding these interconnected segmentations allows businesses to tailor their product offerings, marketing strategies, and investment portfolios to maximize returns based on the distinct technology requirements and regional growth patterns evident across the global fiber internet ecosystem.

- By Technology:

- GPON (Gigabit Passive Optical Network)

- XGS-PON (10 Gigabit Symmetrical Passive Optical Network)

- NG-PON2 (Next-Generation Passive Optical Network 2)

- Ethernet Passive Optical Network (EPON)

- By Network Architecture:

- FTTH (Fiber-to-the-Home)

- FTTB (Fiber-to-the-Building)

- FTTC (Fiber-to-the-Curb)

- FTTN (Fiber-to-the-Node)

- By Application/End-User:

- Residential

- Commercial/Enterprise (Small, Medium, Large Enterprises)

- Governmental/Public Sector

- 5G Backhaul & Telecommunication Infrastructure

Value Chain Analysis For Fiber Internet Market

The Value Chain for the Fiber Internet Market is complex and involves several distinct stages, commencing with the raw material and component manufacturers and culminating in the delivery of high-speed connectivity services to the end consumer. The upstream analysis focuses heavily on the procurement and processing of fundamental materials necessary for fiber optic cables, including high-purity silica glass, specialized plastics for jacketing, and connectivity hardware like optical transceivers and semiconductor chips essential for OLTs (Optical Line Terminals) and ONTs (Optical Network Terminals). Key players at this stage include specialized chemical companies and highly sophisticated electronics manufacturers who dictate the baseline costs and technical specifications of the core infrastructure. Managing the supply chain stability of high-quality silica preforms and advanced laser components is crucial, as any disruption at this upstream level can severely impact the massive global fiber deployment efforts currently underway, making reliable sourcing a top strategic priority for major network operators.

The midstream portion of the value chain is dominated by equipment manufacturing and network deployment. This stage involves the production of bulk fiber optic cables by major manufacturers, the assembly of sophisticated network equipment (OLTs, network switches, routers) by telecommunication equipment vendors (e.g., Huawei, Nokia, Ericsson, Ciena), and, critically, the services provided by construction and installation contractors. Direct fiber deployment—including planning, trenching, duct laying, and fiber splicing—is highly labor-intensive and forms a major cost center in the value chain. Successful players in this midstream segment must possess strong logistical capabilities and project management expertise to handle large-scale, multi-year infrastructure projects across diverse geographical terrains, effectively bridging the gap between component supply and functional network infrastructure. Efficiency in this segment directly translates into competitive advantage, influencing the speed and cost-effectiveness of market penetration for ISPs.

The downstream analysis focuses on the final delivery and monetization of the fiber connectivity service. This involves the Internet Service Providers (ISPs) or telecom operators (e.g., AT&T, Vodafone, China Telecom) who own and operate the network infrastructure, manage customer relationships, provide technical support, and bundle value-added services such as television, VoIP telephony, and smart home solutions. Distribution channels are predominantly direct, utilizing the ISP's own sales force, online platforms, and physical retail stores to acquire residential and enterprise customers, ensuring direct control over branding and service quality. However, indirect channels are growing, especially in the wholesale market where fiber infrastructure owners (FiberCos) lease capacity or dark fiber to other retail ISPs, creating a crucial open-access ecosystem that maximizes network utilization and facilitates competitive service offerings. The profitability in the downstream is determined by effective service differentiation, high subscription rates, and the ability to maintain a high Average Revenue Per User (ARPU) through premium service tiers leveraging the high-speed capability of fiber.

Fiber Internet Market Potential Customers

The potential customer base for the Fiber Internet Market is exceptionally broad, spanning nearly every segment of the modern economy and society, categorized primarily into residential, commercial/enterprise, and governmental segments. Residential users constitute the largest volume of potential connections, driven fundamentally by the increasing reliance on bandwidth-intensive activities such as 4K/8K streaming, competitive online gaming, and the proliferation of connected devices in smart homes, which necessitates symmetrical multi-gigabit speeds. The shift towards remote work and distance learning, accelerated significantly by global health events, has permanently elevated the importance of high-reliability, low-latency connectivity, transforming fiber from a desirable upgrade into a mandatory utility for modern households seeking to maintain productivity and social connectivity, making every non-fiber household a conversion target.

The commercial and enterprise segments represent high-value potential customers, ranging from Small and Medium Enterprises (SMEs) requiring reliable cloud access and unified communications platforms to large multinational corporations requiring dedicated dark fiber capacity for global data center interconnectivity and mission-critical operations. Key industry verticals that are heavy users of fiber include finance (requiring extremely low latency for algorithmic trading), healthcare (for telemedicine and massive electronic health record transfers), and technology companies (for software development, testing environments, and global collaboration). These customers prioritize stringent Service Level Agreements (SLAs), dedicated account management, and scalable bandwidth options that can handle rapid organizational growth and sophisticated security demands, offering ISPs opportunities to secure long-term, high-margin contracts for specialized fiber solutions.

Government and public sector entities are also significant potential customers, utilizing fiber internet for smart city infrastructure, public safety networks, municipal operations, and educational institutions. Smart cities rely on ubiquitous, high-speed fiber backhaul to support connected sensors, traffic management systems, public Wi-Fi hotspots, and advanced surveillance technologies, enhancing urban management efficiency and citizen services. Furthermore, educational institutions leverage fiber for high-capacity digital learning environments, facilitating access to large data repositories and global research networks. The overall market strategy must therefore be multifaceted, addressing the high-volume needs of the residential sector through mass deployment and targeted marketing, while securing the high-ARPU, low-churn enterprise customers through customized, high-reliability fiber solutions, and supporting the large-scale infrastructure requirements of the governmental sector through competitive bidding and strategic public-private partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 39.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huawei Technologies Co., Ltd., Nokia Corporation, ZTE Corporation, Cisco Systems, Inc., Ciena Corporation, Corning Incorporated, CommScope Holding Company, Inc., ATandT Inc., Verizon Communications Inc., China Telecom Corporation Limited, Orange S.A., Vodafone Group Plc, Bharat Sanchar Nigam Ltd. (BSNL), Fujikura Ltd., Prysmian Group, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., Juniper Networks, Inc., Adtran, Inc., Calix, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Internet Market Key Technology Landscape

The technological landscape of the Fiber Internet Market is primarily defined by the evolution and deployment of Passive Optical Network (PON) standards, which enable high-speed broadband transmission over a shared fiber infrastructure efficiently and cost-effectively. Current market dominance rests with GPON (Gigabit Passive Optical Network), which offers asymmetrical speeds typically up to 2.5 Gbps downstream and 1.25 Gbps upstream, sufficient for current residential Gigabit service tiers. However, the technology architecture is rapidly transitioning towards next-generation solutions to meet escalating symmetrical bandwidth requirements. XGS-PON (10 Gigabit Symmetrical Passive Optical Network) is the leading successor, providing 10 Gbps symmetrical capacity, allowing operators to offer 2 Gbps, 5 Gbps, and even 10 Gbps services to both residential power users and high-demand enterprise customers. This migration is crucial as it leverages the existing installed fiber base, minimizing civil work costs while maximizing bandwidth provisioning capability, representing a strategic investment focus for major ISPs globally seeking future-proof scalability.

Beyond XGS-PON, the technological horizon includes NG-PON2 (Next-Generation Passive Optical Network 2), which utilizes Time-Wavelength Division Multiplexing (TWDM) to offer even greater capacities, potentially supporting multiple 10 Gbps channels simultaneously over a single fiber, thereby aggregating up to 40 Gbps of capacity. While NG-PON2 provides superior robustness and flexibility, its complexity and higher deployment cost compared to XGS-PON mean its adoption is currently focused on specific high-density or enterprise applications requiring extreme scalability and network virtualization capabilities. Moreover, the deployment of 25G and 50G PON standards is beginning to emerge from research labs into field trials, indicating the long-term technological roadmap for the industry. These ultra-high-speed standards are being driven by the need for low-latency, massive bandwidth connectivity to support new 6G wireless infrastructure, advanced edge computing paradigms, and metropolitan-scale data synchronization requiring virtually unlimited capacity from the fixed fiber network.

Furthermore, the physical technology landscape encompasses advancements in fiber optic cable manufacturing and deployment methodologies. Innovations like bend-insensitive fiber (BIF) have significantly eased installation processes, particularly in complex in-home wiring scenarios and multi-dwelling units (MDUs), reducing signal loss associated with tight bends and simplifying technician training requirements. The integration of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) is transforming how fiber networks are managed, moving away from rigid, hardware-based controls to flexible, software-driven architectures that enhance service provisioning speed, automate network slices for different service tiers (residential vs. enterprise), and improve fault isolation. This technological convergence of advanced optics (XGS-PON) and intelligent software management (SDN/NFV) is optimizing the operational efficiency and increasing the revenue potential of the deployed fiber infrastructure, securing the market's long-term competitive advantage against all other fixed broadband access technologies worldwide.

Regional Highlights

- Asia Pacific (APAC): APAC represents the most mature and dominant fiber internet market globally, driven by early and aggressive governmental investment, particularly in South Korea, Japan, and China. These nations boast some of the highest FTTH penetration rates worldwide, often exceeding 90% in urban areas. The regional focus has shifted from initial rollout to capacity upgrades, with major operators rapidly migrating existing GPON networks to XGS-PON to accommodate massive residential data consumption, particularly mobile backhaul requirements for dense 5G networks. India and Southeast Asian countries like Indonesia and Vietnam are emerging as high-growth markets, characterized by rapid urbanization and significant infrastructure deficits being addressed by large-scale, often government-backed, fiber deployment initiatives, driving substantial demand for cable and access equipment.

- North America: North America is currently undergoing a massive, multi-year fiber build-out phase, characterized by intense competitive overbuilding between traditional telecommunication incumbents (e.g., AT&T, Verizon) and aggressive cable operators who are defensively deploying fiber to counter the technological superiority of FTTH. This region benefits significantly from regulatory incentives and substantial federal funding programs (like the BEAD program in the US) aimed at closing the digital divide, accelerating rural and underserved area deployment. The market is highly focused on promoting multi-Gigabit symmetrical services (2 Gbps and 5 Gbps), making it a high-value market for XGS-PON equipment and sophisticated network management software, driving strong CAGR throughout the forecast period due to the vast remaining market potential.

- Europe: The European market demonstrates significant variability, with Western and Northern Europe (e.g., France, Spain, Sweden) showing high penetration rates due to government mandates and supportive competitive regulatory frameworks favoring open access models. Conversely, nations like Germany and the UK are playing catch-up, rapidly transitioning away from legacy copper networks (VDSL/ADSL) towards nationwide FTTH coverage, often utilizing wholesale FiberCo models to spread the capital risk. The European market is heavily influenced by the European Commission’s connectivity targets, prioritizing Gigabit connectivity for all households and the deployment of 5G corridors, maintaining a strong, steady demand for fiber infrastructure, components, and specialized civil engineering services across the continent.

- Latin America (LATAM): LATAM is characterized by fragmented but accelerating growth, led by countries such as Brazil and Mexico. The region is seeing significant activity from smaller, agile regional ISPs utilizing financing from infrastructure funds to deploy fiber in historically underserved cities and towns, bypassing the aging infrastructure of incumbents. Mobile operators are heavily reliant on fixed fiber backhaul to support the rapid expansion of 4G and 5G networks, creating a dual-driver market dynamic. Regulatory simplification and increased foreign direct investment are key factors enabling the continued expansion, though logistical challenges and varying local regulatory environments present unique deployment hurdles compared to more established global regions.

- Middle East and Africa (MEA): The MEA region presents contrasting market dynamics. The Gulf Cooperation Council (GCC) states in the Middle East possess some of the highest fiber penetration rates globally, driven by centralized infrastructure planning and high consumer wealth, prioritizing advanced 10G PON services. In Africa, fiber deployment is concentrated in urban centers and critical undersea cable landing points, primarily focused on providing backhaul for mobile networks and connecting large enterprises. Major opportunities exist in extending national fiber backbone networks across vast geographical areas and increasing last-mile connectivity in high-growth African economies, heavily dependent on international development bank funding and focused public-private partnerships to overcome high deployment costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Internet Market.- Huawei Technologies Co., Ltd.

- Nokia Corporation

- ZTE Corporation

- Cisco Systems, Inc.

- Ciena Corporation

- Corning Incorporated

- CommScope Holding Company, Inc.

- ATandT Inc.

- Verizon Communications Inc.

- China Telecom Corporation Limited

- Orange S.A.

- Vodafone Group Plc

- Bharat Sanchar Nigam Ltd. (BSNL)

- Fujikura Ltd.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- Juniper Networks, Inc.

- Adtran, Inc.

- Calix, Inc.

Frequently Asked Questions

Analyze common user questions about the Fiber Internet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current primary technological standard for new fiber optic deployments?

The current primary technological standard is XGS-PON (10 Gigabit Symmetrical Passive Optical Network). XGS-PON is rapidly replacing legacy GPON in new FTTH build-outs and network upgrades globally because it provides symmetrical 10 Gbps capacity, essential for delivering multi-gigabit services (2 Gbps to 10 Gbps) required by modern consumers and enterprises.

How do governmental subsidies affect the growth of the Fiber Internet Market?

Governmental subsidies and funding programs (such as the BEAD program in the U.S. or national broadband plans in Europe) significantly accelerate market growth by mitigating the high initial capital expenditure (CAPEX) risk associated with deployment in low-density, rural areas, thereby expanding the market's addressable opportunity and ensuring faster nationwide coverage.

What are the main advantages of Fiber-to-the-Home (FTTH) over traditional cable broadband?

FTTH offers three main advantages: vastly superior speed (multi-gigabit capabilities), symmetrical bandwidth (equal upload and download speeds, crucial for remote work and cloud services), and significantly higher reliability and lower latency due to the elimination of copper components prone to interference and signal degradation.

Which geographical region leads the global market in terms of fiber penetration?

The Asia Pacific (APAC) region, specifically countries like China, South Korea, and Japan, leads the global market in terms of fiber penetration, having achieved near-ubiquitous coverage early through concerted government efforts and intense investment, setting global benchmarks for service speed and accessibility.

What role does 5G infrastructure play in driving Fiber Internet demand?

5G infrastructure is a major driver of fixed fiber demand because 5G requires dense, high-capacity fiber backhaul to connect its numerous small cell towers and distributed radio access points. The performance of 5G services is directly dependent on the scalability, low latency, and bandwidth provided by underlying fiber optic networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager