Fiber Laser Cutter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439875 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Fiber Laser Cutter Market Size

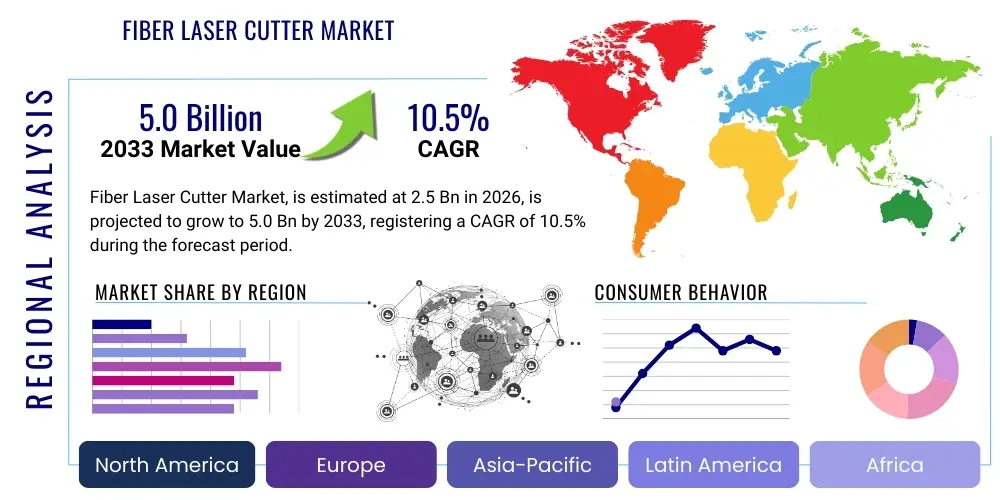

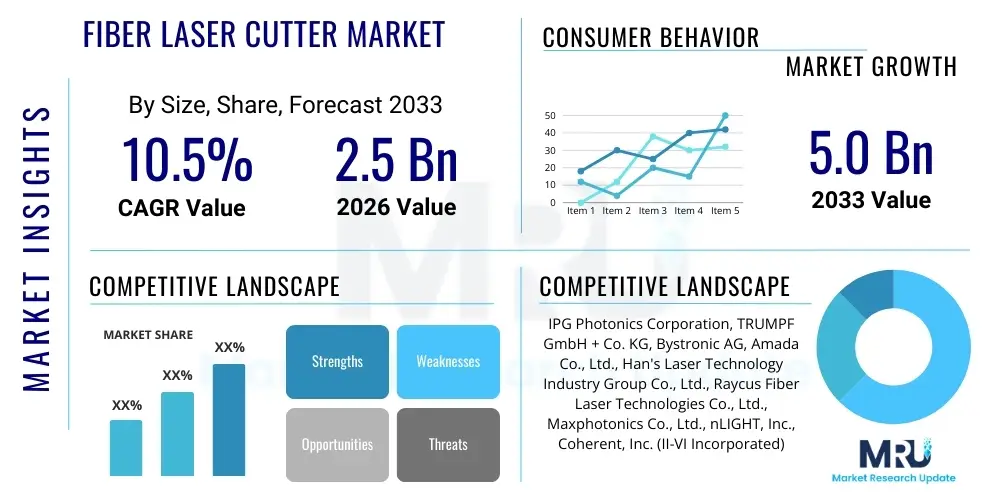

The Fiber Laser Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Fiber Laser Cutter Market introduction

The Fiber Laser Cutter Market encompasses the global industry dedicated to the manufacturing, sales, and service of advanced cutting systems utilizing fiber laser technology. Fiber laser cutters are sophisticated tools that employ a solid-state laser, where the active gain medium is an optical fiber doped with rare-earth elements like ytterbium, erbium, or neodymium. This technology offers superior beam quality, high energy efficiency, and low maintenance, making it an increasingly preferred choice across various industrial applications. These systems are adept at processing a wide array of materials, including metals such as stainless steel, carbon steel, aluminum, copper, and brass, as well as certain non-metals, with exceptional precision and speed.

The primary applications of fiber laser cutters span across diverse sectors, including automotive manufacturing for chassis and component fabrication, aerospace for precise component cutting, electronics for intricate circuit board and casing production, and general manufacturing for custom parts and prototypes. Their ability to deliver fine cuts, narrow kerf widths, and minimal heat-affected zones enhances material utilization and reduces post-processing requirements, thereby streamlining production workflows. Furthermore, the inherent benefits of fiber laser technology, such as increased operational uptime, reduced energy consumption compared to traditional CO2 lasers, and enhanced safety features, contribute significantly to their growing adoption across industrialized nations and emerging economies alike.

Key driving factors for the Fiber Laser Cutter Market include the escalating demand for high-precision and high-speed material processing in modern manufacturing environments, the global push towards automation and Industry 4.0 integration, and the continuous technological advancements leading to more powerful and versatile laser systems. The shift from traditional cutting methods, which often involve more material waste and slower processing times, to efficient laser solutions is a significant accelerator. Additionally, the increasing cost-effectiveness over the operational lifespan of fiber laser cutters, despite higher initial investment, further bolsters their market penetration.

Fiber Laser Cutter Market Executive Summary

The Fiber Laser Cutter Market is characterized by robust growth driven by escalating industrial automation trends and the demand for high-precision material processing across manufacturing sectors. Business trends indicate a strong focus on research and development by key players, aiming to enhance laser power, improve beam quality, and integrate advanced software solutions for intelligent manufacturing. There is a noticeable shift towards customized solutions, offering modular designs and tailored cutting parameters to meet specific industry needs, from heavy machinery to intricate electronics. Furthermore, strategic alliances, mergers, and acquisitions are common as companies seek to consolidate market share, leverage complementary technologies, and expand their geographical reach. The competitive landscape is intensifying, with both established giants and agile innovators vying for market leadership by offering differentiated products and superior after-sales services.

Regionally, the Asia Pacific continues to dominate the market, primarily propelled by rapid industrialization, burgeoning manufacturing hubs, and significant investments in advanced machinery, particularly in China, Japan, South Korea, and India. Europe and North America represent mature markets, demonstrating consistent demand driven by automotive, aerospace, and medical device manufacturing, with a strong emphasis on integrating fiber laser cutters into smart factory ecosystems. These regions are also at the forefront of adopting automation and AI-driven solutions to optimize cutting processes. Emerging markets in Latin America and the Middle East & Africa are showing promising growth, fueled by infrastructure development projects and diversification of their industrial bases, leading to increased adoption of modern fabrication technologies.

From a segmentation perspective, high-power fiber laser cutters (above 3kW) are experiencing rapid adoption due to their ability to process thicker materials at higher speeds, catering to heavy industries. The automotive, aerospace, and general manufacturing sectors remain the largest end-users, demanding precision and efficiency in their production lines. Meanwhile, the market is also witnessing innovation in pulsed fiber lasers for micro-processing and delicate material applications, expanding the market into electronics and medical device manufacturing. Software integration for process optimization, predictive maintenance, and real-time monitoring is becoming a critical differentiator across all segments, pushing the market towards more intelligent and autonomous cutting solutions.

AI Impact Analysis on Fiber Laser Cutter Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the Fiber Laser Cutter Market by addressing fundamental user questions related to operational efficiency, precision, maintenance, and process optimization. Users are increasingly seeking answers on how AI can enhance the accuracy of cuts, reduce material waste, predict equipment failures before they occur, and streamline complex design-to-production workflows. Common concerns revolve around the practical implementation of AI in existing systems, the learning curve for operators, and the cybersecurity implications of connected machinery. Expectations are high for AI to autonomously adjust cutting parameters, diagnose issues, and provide intelligent recommendations for improved performance, ultimately leading to significant cost savings and increased productivity in manufacturing operations. The market is looking for tangible proof of AI's ability to deliver measurable improvements in throughput and quality, while simultaneously simplifying machine management.

Moreover, end-users are keen to understand how AI algorithms can contribute to generative design processes, allowing for the optimization of part geometries that are highly efficient for fiber laser cutting, minimizing material usage, and maximizing structural integrity. The concept of "lights-out" manufacturing, where machines operate with minimal human intervention, is a key driver for AI adoption in this sector. This ambition raises questions about the robustness of AI systems in handling unexpected variations in materials or environmental conditions, and the extent to which human oversight will still be necessary. The industry is also exploring AI's role in supply chain optimization for raw materials and finished goods, further enhancing the overall efficiency of the manufacturing ecosystem associated with fiber laser cutting.

- Enhanced cutting precision and quality through real-time parameter adjustments.

- Predictive maintenance algorithms reducing downtime and extending machine lifespan.

- Automated defect detection and correction, minimizing scrap and rework.

- Optimized nesting and material utilization for reduced waste.

- Intelligent process control adapting to material variations.

- Autonomous operation capabilities for "lights-out" manufacturing.

- Streamlined design-to-production workflows through generative design integration.

- Energy consumption optimization based on operational patterns.

DRO & Impact Forces Of Fiber Laser Cutter Market

The Fiber Laser Cutter Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively influenced by various Impact Forces. Key drivers include the relentless global demand for high-precision and high-speed material processing across diverse industrial sectors, such as automotive, aerospace, and electronics, which are continually seeking more efficient and accurate manufacturing solutions. The pervasive trend of industrial automation and the push towards Industry 4.0 paradigms are also propelling the adoption of advanced fiber laser cutting systems, as they offer seamless integration into smart factory environments. Furthermore, the inherent advantages of fiber lasers, such as lower operating costs, higher energy efficiency compared to traditional CO2 lasers, and superior beam quality, make them a compelling investment for manufacturers aiming to reduce their carbon footprint and improve profitability.

Despite these strong drivers, the market faces several restraints. The high initial capital investment required for purchasing fiber laser cutting machines presents a significant barrier, particularly for small and medium-sized enterprises (SMEs) with limited budgets. The technical complexity associated with operating and maintaining these advanced systems necessitates a highly skilled workforce, and a shortage of such trained professionals can hinder market growth, especially in developing regions. Additionally, intense competition from established traditional cutting methods and other laser technologies, albeit less efficient, continues to pose a challenge. Economic downturns or geopolitical instabilities can also impact manufacturing investments, leading to a temporary slowdown in market expansion.

However, substantial opportunities exist for market players. The expansion into emerging economies with rapidly developing manufacturing bases, particularly in Southeast Asia, Latin America, and Africa, offers untapped potential for growth. The increasing demand for customized manufacturing solutions and the rise of additive manufacturing present avenues for fiber laser cutters to be integrated into hybrid production systems. Continuous advancements in laser technology, leading to higher power outputs, greater versatility in material processing, and more compact designs, will open new application areas. Strategic collaborations between laser manufacturers, software developers, and industrial automation providers can unlock innovative solutions and accelerate market penetration. These forces collectively define the market landscape, pushing companies to innovate and adapt to evolving industrial needs.

Segmentation Analysis

The Fiber Laser Cutter Market is comprehensively segmented across various dimensions to provide granular insights into its structure and dynamics, enabling precise market analysis and strategic planning. These segments categorize the market based on specific characteristics of the fiber laser technology, its power output, the materials it processes, and the end-user industries it serves. Understanding these segmentations is crucial for identifying growth hotspots, assessing competitive landscapes, and tailoring product development and marketing strategies to specific market niches. The primary goal of this segmentation is to break down the complex global market into manageable, understandable components, highlighting the diverse needs and preferences of different customer groups.

The market’s segmentation by type delineates the different configurations and functionalities of fiber lasers, reflecting advancements in beam delivery and pulse characteristics. Power segmentation is critical as it directly correlates with the machine's ability to process various material thicknesses and types, impacting throughput and application suitability. Application segmentation showcases the versatile utility of fiber laser cutters across a multitude of tasks, from precise cutting to intricate engraving. Finally, end-user industry segmentation identifies the major industrial consumers of this technology, underscoring their unique requirements and the specific benefits fiber laser cutters bring to their respective manufacturing processes. This multi-faceted approach allows for a holistic understanding of market demand patterns and technological adoption trends.

- By Type

- Solid-State Fiber Lasers

- Q-Switched Fiber Lasers

- Continuous Wave (CW) Fiber Lasers

- Pulsed Fiber Lasers

- By Power

- Low Power (Below 1kW)

- Medium Power (1kW - 3kW)

- High Power (Above 3kW)

- By Application

- Metal Cutting

- Welding

- Drilling

- Marking and Engraving

- Cladding

- Surface Treatment

- By End-User Industry

- Automotive

- Aerospace & Defense

- Electronics & Semiconductor

- Medical Devices

- Heavy Machinery

- Jewelry & Decorative

- General Manufacturing & Job Shops

Value Chain Analysis For Fiber Laser Cutter Market

The value chain for the Fiber Laser Cutter Market is a complex ecosystem involving multiple stages, starting from the sourcing of raw materials to the final delivery and after-sales support of the cutting systems. Upstream analysis reveals a critical dependency on specialized component manufacturers, including suppliers of rare-earth doped optical fibers, high-power diodes, optical components (lenses, mirrors), control systems, and cooling units. These suppliers are pivotal in determining the quality, performance, and cost-effectiveness of the final fiber laser cutter. Innovation and quality control at this stage are paramount, as the integrity of these foundational components directly impacts the efficiency and longevity of the laser system. Strong relationships with these upstream suppliers, often involving long-term contracts and collaborative R&D, are essential for manufacturers to maintain a competitive edge and ensure a consistent supply of high-grade materials.

Midstream activities involve the core manufacturing and assembly of the fiber laser cutting machines. This includes the integration of the laser source, beam delivery system, motion control systems, and cutting tables, along with sophisticated software for design, programming, and operation. This stage demands high-precision engineering, advanced manufacturing processes, and rigorous quality assurance protocols to produce reliable and high-performance machines. Manufacturers often invest heavily in automation and robotics within their own production facilities to optimize assembly efficiency and maintain consistent product quality. The integration of advanced diagnostics and remote monitoring capabilities during manufacturing further enhances the value proposition, preparing the product for efficient downstream deployment.

Downstream analysis focuses on the distribution channels and end-user engagement. Fiber laser cutters typically reach their potential customers through a combination of direct sales and indirect channels, including specialized distributors, regional agents, and system integrators. Direct sales are often preferred for large industrial clients requiring custom solutions and extensive technical support, allowing manufacturers to maintain direct relationships and gather valuable feedback. Indirect channels, on the other hand, provide broader market reach, particularly in regions where manufacturers do not have a strong direct presence. These distributors and agents often provide localized sales, installation, training, and critical after-sales services, including maintenance and spare parts supply. The effectiveness of the distribution network is crucial for market penetration, customer satisfaction, and building long-term brand loyalty in a highly competitive market.

Fiber Laser Cutter Market Potential Customers

The potential customers for the Fiber Laser Cutter Market encompass a broad spectrum of industries that require high-precision, efficient, and versatile material processing capabilities. At the forefront are manufacturers in the automotive sector, where fiber laser cutters are indispensable for fabricating lightweight chassis components, interior parts, and exhaust systems with exceptional speed and accuracy, often working with diverse metals. Similarly, the aerospace and defense industry relies heavily on these systems for cutting intricate components from specialized alloys, ensuring stringent quality standards and structural integrity for aircraft and military equipment. The demand for precise, repeatable cuts in high-performance materials makes fiber laser technology a critical asset for these demanding applications.

Beyond heavy industries, the electronics and semiconductor sector represents a significant customer base, utilizing fiber laser cutters for micro-cutting, engraving, and drilling sensitive components like circuit boards, sensors, and protective casings. The ability to achieve fine features and minimal heat input is crucial here to prevent damage to delicate materials. Medical device manufacturers also constitute a vital segment, employing fiber lasers for producing precision instruments, implants, and surgical tools from biocompatible materials, where hygiene and accuracy are paramount. These industries frequently require custom solutions and the ability to process a wide variety of materials, making the flexibility of fiber laser systems highly attractive.

Furthermore, general manufacturing and job shops form a large and diverse customer segment, ranging from small workshops to large-scale fabrication facilities. These entities leverage fiber laser cutters for producing custom parts, prototypes, and short-run productions for various industries, benefiting from the machines' flexibility, speed, and cost-effectiveness for diverse job requirements. The heavy machinery industry, including construction and agricultural equipment manufacturers, also utilize fiber lasers for cutting thick metal plates with high efficiency. The jewelry and decorative arts sector employs these lasers for intricate designs and engraving on precious metals. Essentially, any enterprise seeking to enhance productivity, reduce material waste, and achieve superior precision in material cutting and shaping stands as a potential customer for fiber laser technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics Corporation, TRUMPF GmbH + Co. KG, Bystronic AG, Amada Co., Ltd., Han's Laser Technology Industry Group Co., Ltd., Raycus Fiber Laser Technologies Co., Ltd., Maxphotonics Co., Ltd., nLIGHT, Inc., Coherent, Inc. (II-VI Incorporated), LVD Company N.V., Mazak Optonics Corporation, Prima Power S.p.A., Mitsubishi Electric Corporation, Salvagnini Italia S.p.A., Cincinnati Incorporated, Eagle Group, DNE Laser Co., Ltd., Tianqi Laser Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Laser Cutter Market Key Technology Landscape

The Fiber Laser Cutter Market is characterized by a rapidly evolving technological landscape, driven by continuous innovation in laser source design, beam delivery systems, and integrated software solutions. At the core, the development of higher power fiber laser sources, reaching well over 20kW, enables faster cutting speeds and the processing of thicker materials with enhanced efficiency. These advancements focus on improving the electrical-to-optical conversion efficiency, minimizing power consumption, and extending the lifespan of the laser diodes, which are the fundamental building blocks of fiber lasers. The ongoing refinement of beam quality, often quantified by the beam parameter product (BPP), allows for tighter focusing and finer cutting details, crucial for intricate applications in electronics and medical device manufacturing. Furthermore, the development of single-mode and multi-mode fiber lasers provides flexibility to optimize for either precision or power, catering to a diverse range of industrial needs.

Beyond the laser source itself, significant technological strides are being made in the ancillary systems that constitute a complete fiber laser cutter. Advanced cutting heads now incorporate features like auto-focusing capabilities, real-time piercing detection, and active anti-collision systems, greatly enhancing operational safety and precision. The integration of sophisticated motion control systems, often leveraging linear motor drives, ensures exceptionally high acceleration, deceleration, and positioning accuracy, which are vital for maintaining throughput and cut quality at high speeds. Furthermore, the development of intelligent gas control systems for assist gases (e.g., oxygen, nitrogen, air) optimizes gas consumption and improves cutting performance across different material types and thicknesses, thereby reducing operational costs for end-users.

A critical aspect of the modern fiber laser cutter technology landscape is the pervasive integration of advanced software and automation. CAD/CAM software solutions are becoming increasingly intelligent, offering features like automatic nesting for optimal material utilization, collision avoidance algorithms, and production scheduling tools. The incorporation of real-time monitoring and diagnostic systems, often cloud-connected, allows for predictive maintenance, remote troubleshooting, and performance analytics, significantly boosting machine uptime and overall equipment effectiveness (OEE). The emerging trend of AI and machine learning integration further enhances these capabilities, enabling adaptive process control, autonomous parameter adjustments, and even generative design for parts optimized for laser cutting. These software-driven innovations are transforming fiber laser cutters from mere cutting tools into intelligent manufacturing hubs, facilitating Industry 4.0 adoption and smart factory initiatives.

Regional Highlights

- North America: The United States and Canada are major contributors, driven by a strong presence of automotive, aerospace, and general manufacturing industries. High adoption rates of advanced manufacturing technologies, significant R&D investments, and a focus on automation and smart factories contribute to steady market growth.

- Europe: Dominated by countries like Germany, Italy, and the United Kingdom, Europe exhibits a mature market characterized by stringent quality standards, innovation in specialized manufacturing sectors, and a strong emphasis on industrial automation and digitalization. The automotive and machinery manufacturing sectors are key demand drivers.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily led by China, Japan, South Korea, and India. Rapid industrialization, substantial government support for manufacturing, increasing foreign direct investment, and a burgeoning electronics and automotive industry fuel explosive growth in the region.

- Latin America: Countries like Brazil and Mexico are emerging as significant markets due to growing industrialization, increasing foreign investments in manufacturing, and a rising demand for efficient material processing solutions in automotive and general fabrication sectors.

- Middle East and Africa (MEA): This region is experiencing nascent but promising growth, driven by infrastructure development projects, diversification of economies away from oil, and increasing adoption of modern manufacturing technologies in countries like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Laser Cutter Market.- IPG Photonics Corporation

- TRUMPF GmbH + Co. KG

- Bystronic AG

- Amada Co., Ltd.

- Han's Laser Technology Industry Group Co., Ltd.

- Raycus Fiber Laser Technologies Co., Ltd.

- Maxphotonics Co., Ltd.

- nLIGHT, Inc.

- Coherent, Inc. (II-VI Incorporated)

- LVD Company N.V.

- Mazak Optonics Corporation

- Prima Power S.p.A.

- Mitsubishi Electric Corporation

- Salvagnini Italia S.p.A.

- Cincinnati Incorporated

- Eagle Group

- DNE Laser Co., Ltd.

- Tianqi Laser Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fiber Laser Cutter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a fiber laser cutter and how does it work?

A fiber laser cutter is an advanced machine that uses a laser beam generated by an optical fiber doped with rare-earth elements to precisely cut materials. The laser light is guided through the fiber, amplified, and then focused onto the workpiece, melting and vaporizing the material to create intricate cuts with high accuracy and speed.

What are the primary benefits of using a fiber laser cutter over traditional methods?

Fiber laser cutters offer numerous advantages, including significantly higher cutting speeds, superior precision and edge quality, lower operating costs due to high energy efficiency, reduced maintenance requirements, and the ability to process a wider range of materials, especially highly reflective metals, with minimal material distortion.

Which industries are the main adopters of fiber laser cutting technology?

The automotive, aerospace and defense, electronics, medical device manufacturing, and general fabrication industries are the primary adopters. These sectors demand high-precision, high-speed, and efficient material processing for components ranging from car parts and aircraft frames to circuit boards and surgical instruments.

How does AI impact the performance and future of fiber laser cutters?

AI significantly enhances fiber laser cutters by enabling features like predictive maintenance, real-time cutting parameter optimization, automated defect detection, and intelligent nesting for material efficiency. It contributes to greater automation, precision, reduced downtime, and supports the transition towards smart factory operations and generative design.

What are the key factors driving the growth of the Fiber Laser Cutter Market?

The market's growth is primarily driven by the increasing demand for high-precision manufacturing, the global push towards industrial automation and Industry 4.0 initiatives, continuous advancements in laser technology leading to more powerful and efficient systems, and the shift from conventional cutting methods to more cost-effective and environmentally friendly laser solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager