Fiber Laser Drilling Machine for Automotive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433982 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Fiber Laser Drilling Machine for Automotive Market Size

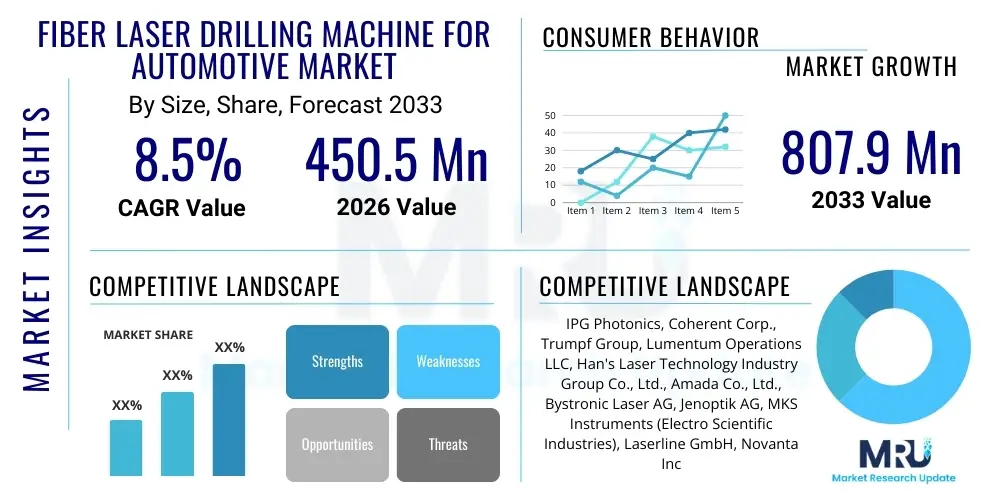

The Fiber Laser Drilling Machine for Automotive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 807.9 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for high-precision, non-contact manufacturing processes necessary for producing complex components in electric vehicles (EVs) and advanced internal combustion engine (ICE) systems. Fiber laser drilling offers superior speed, accuracy, and repeatability compared to traditional mechanical drilling, making it indispensable for critical automotive parts like fuel injector nozzles, transmission components, and specialized sensors.

Market expansion is also heavily supported by continuous technological advancements in laser power sources and beam delivery systems. Modern fiber lasers provide excellent beam quality and efficiency, allowing manufacturers to process hard, abrasive, or highly sensitive materials, such as ceramics, specialized alloys, and carbon composites, which are increasingly utilized in lightweighting initiatives across the automotive sector. Furthermore, the integration of automation and robotics within fiber laser drilling systems enhances throughput and reduces operational costs, offering a compelling return on investment for major Tier 1 suppliers and Original Equipment Manufacturers (OEMs) seeking mass production capabilities that adhere to stringent quality standards.

Fiber Laser Drilling Machine for Automotive Market introduction

The Fiber Laser Drilling Machine for Automotive Market encompasses the sale, installation, and maintenance of specialized laser systems utilized for creating precise holes, often micro-holes, in various automotive components. These machines leverage fiber laser technology, known for its high beam quality, efficiency, and flexibility, to perform non-contact material processing. Major applications include drilling cooling holes in turbine blades, perforating filter screens, fabricating holes in fuel injector nozzles to optimize combustion efficiency, and creating ventilation apertures in EV battery casings and thermal management systems. The primary benefit of employing fiber laser technology is the ability to achieve micron-level accuracy, minimize heat-affected zones (HAZ), and process materials that are difficult or impossible to machine mechanically. Driving factors include the global shift towards electric and hybrid vehicles, demanding new manufacturing techniques for complex battery and power electronics components, coupled with ongoing efforts to reduce vehicle weight and improve engine efficiency in traditional powertrains.

Fiber Laser Drilling Machine for Automotive Market Executive Summary

The Fiber Laser Drilling Machine for Automotive Market is characterized by intense technological competition and rapid adoption driven by the automotive industry's transformation towards electrification and autonomous driving. Business trends indicate a strong move toward integrated, multi-axis laser processing centers capable of handling diverse materials and complex geometries, with key players focusing on offering full automation packages, including robotic loading and sophisticated machine vision systems for quality control. Regional trends show Asia Pacific, particularly China and South Korea, dominating market growth due owing to massive investments in EV manufacturing infrastructure and supporting supply chains. North America and Europe follow closely, driven by stringent emission standards necessitating precision components and the reshoring of critical manufacturing capabilities. Segment trends highlight that ultra-fast pulsed fiber lasers (pico- and femtosecond) are gaining significant traction, particularly for processing heat-sensitive materials and achieving superior surface finish required for critical safety components and power electronics, overshadowing continuous wave (CW) lasers in high-precision applications.

AI Impact Analysis on Fiber Laser Drilling Machine for Automotive Market

User inquiries regarding AI's impact on fiber laser drilling center around several key themes: the potential for autonomous quality control, predictive maintenance of expensive laser sources, and optimization of drilling parameters (power, pulse duration, repetition rate) to maximize throughput and minimize material waste, especially when processing complex or variable material batches. Users are keen to understand how AI-driven machine vision systems can achieve real-time defect detection superior to traditional methods and how machine learning algorithms can dynamically adjust settings to maintain consistent hole geometry and diameter throughout extended production runs. There is also significant interest in AI's role in simulating new processing techniques and materials before physical prototyping, thereby accelerating R&D cycles in precision automotive component manufacturing.

AI's integration fundamentally transforms the operational efficiency and quality assurance capabilities within the fiber laser drilling sector. Machine learning models analyze vast datasets generated during the drilling process—including beam characteristics, material feedback, and environmental factors—to predict component failure or quality deviations before they occur. This transition from reactive maintenance to predictive scheduling significantly increases machine uptime and reduces overall cost of ownership. Furthermore, AI-enhanced process control systems allow for instantaneous, micro-level adjustments to laser parameters, ensuring optimal energy delivery and minimized thermal stress, which is critical for drilling components used in high-stress environments such as engine blocks or high-voltage battery modules.

The utilization of deep learning in vision systems ensures highly accurate and automated inspection of drilled features, particularly micro-holes where manual or simple automated inspection often fails to detect subtle imperfections like spatter or recast layer thickness. By creating digital twins of ideal manufacturing processes, AI facilitates rapid calibration and fault diagnosis, streamlining the commissioning of new machines and ensuring global consistency across multiple manufacturing sites. This strategic adoption of AI underscores the shift towards smart manufacturing (Industry 4.0), positioning fiber laser drilling technology as a highly intelligent and resilient component of the automotive supply chain.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting component failure in high-cost laser sources and optics.

- Real-time Quality Control: Utilizes machine vision and deep learning for automated, high-speed inspection of micro-hole geometry and integrity.

- Parameter Optimization: Machine learning algorithms dynamically adjust laser power, pulse frequency, and focus based on material feedback to maximize yield and precision.

- Process Simulation and Digital Twinning: Accelerates R&D by simulating drilling outcomes on new materials and component designs before physical testing.

- Energy Efficiency Management: Optimizes system power consumption based on real-time production requirements, supporting sustainability goals.

DRO & Impact Forces Of Fiber Laser Drilling Machine for Automotive Market

The market dynamics are governed by powerful driving forces rooted in automotive innovation, balanced by high capital expenditures and strict regulatory constraints. Key drivers include the exponential growth in electric vehicle production, which requires thousands of precise holes in battery components, cooling plates, and power electronics, and the persistent industry focus on lightweighting vehicles through the use of advanced, often difficult-to-machine, materials. Restraints largely center on the significant initial investment required for sophisticated fiber laser systems and the necessity for highly specialized technical expertise for operation and maintenance. Opportunities lie in developing ultra-fast pulsed lasers tailored for high-volume micro-drilling applications and expanding into new applications like drilling cooling channels in 3D-printed metal components used in high-performance vehicles. Impact forces demonstrate that the demand for efficiency and precision in new energy vehicles (NEVs) is the dominant influence, pushing manufacturers to invest in these advanced laser systems to meet critical performance and safety standards.

The necessity for extreme precision in components such as fuel injectors (where hole diameter directly impacts emission performance) and cooling passages in EV battery packs (where hole quality affects thermal management and lifespan) acts as a powerful catalyst for market growth. Traditional mechanical methods often fail to meet the required tolerances or introduce unacceptable material stress and burrs. Fiber laser drilling, particularly using short-pulse and ultra-short-pulse technology, overcomes these limitations by offering clean, consistent drilling results across complex metal and ceramic substrates. This technological superiority ensures fiber lasers remain a strategic investment for automotive manufacturers globally.

However, the market faces headwinds from the high total cost of ownership (TCO) associated with sophisticated laser processing centers. While operating costs related to consumables are relatively low, the acquisition cost, coupled with the reliance on specialized global suppliers for high-power laser sources and precision optics, can limit adoption among smaller Tier 2 and Tier 3 suppliers. Overcoming this constraint requires vendors to offer flexible financing models, modular systems, and robust training programs. The opportunity landscape is continuously expanding, particularly with the rise of additive manufacturing in automotive, where laser systems are needed for post-processing and creating intricate internal features, ensuring long-term market vitality.

Segmentation Analysis

The Fiber Laser Drilling Machine for Automotive Market is comprehensively segmented based on the type of laser employed, the application within the vehicle, and the end-user profile. Analyzing the market by laser type reveals a significant shift toward pulsed fiber lasers due to their ability to provide high peak power with minimal thermal interaction, essential for drilling sensitive materials used in power electronics and safety systems. Segmentation by application highlights the growing dominance of EV components, particularly battery modules and thermal management systems, overtaking traditional powertrain applications in terms of future growth potential. Geographic segmentation confirms the Asia Pacific region as the largest and fastest-growing segment, reflecting the massive scale of automotive manufacturing, particularly EV production, headquartered there.

Further granularity in segmentation allows both market players and investors to pinpoint niche areas of high growth. For instance, classifying the market by component thickness (thin vs. thick sections) provides insights into the required laser power ranges and machine architecture. Thin material processing often utilizes high-speed scanning systems (galvanometer-based), while thick material drilling requires high-power, multi-pass processing strategies. Understanding these distinctions is crucial for suppliers developing targeted product portfolios that maximize performance for specific automotive manufacturing demands, such as micro-drilling for sensor covers versus macro-drilling for structural chassis components.

The complexity of automotive components necessitates specialized drilling methods, leading to secondary segmentation based on drilling mode—trepanning (circular path), percussion (straight-on drilling), and helical drilling. Helical drilling, favored for creating deep holes with excellent aspect ratios and smooth sidewalls, is increasingly used in fuel injector manufacturing and transmission parts, commanding a premium segment within the market. This detailed segmentation ensures that market forecasting accurately reflects the evolving technological demands of the advanced automotive sector.

- By Laser Type:

- Continuous Wave (CW) Fiber Lasers

- Pulsed Fiber Lasers (Nanosecond)

- Ultra-fast Pulsed Fiber Lasers (Pico/Femtosecond)

- By Application:

- Powertrain Components (Fuel Injectors, Turbine Blades)

- Electric Vehicle (EV) Components (Battery Modules, Cooling Plates, Power Electronics)

- Chassis and Structural Components

- Sensors and Electronics

- By Drilling Mode:

- Percussion Drilling

- Trepanning

- Helical Drilling

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Tier 1 & Tier 2 Suppliers

- Specialized Job Shops

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fiber Laser Drilling Machine for Automotive Market

The value chain for the Fiber Laser Drilling Machine for Automotive Market begins with upstream suppliers, primarily manufacturers of fundamental laser components, including specialized optical fibers, pump diodes, and high-precision optics (mirrors, lenses, beam expanders). These suppliers provide the core technology that dictates the ultimate performance and efficiency of the drilling system. Midstream activities involve the machine builders (OEMs), who integrate these components, along with sophisticated motion control systems, high-speed scanners, control software, and safety enclosures, to create the final fiber laser drilling machine. This integration phase is where significant value is added through engineering expertise, system calibration, and software customization tailored for automotive manufacturing environments.

Downstream activities involve the distribution channel, which is typically a mix of direct sales teams for large, complex installations involving major automotive OEMs, and indirect distribution through specialized local distributors or system integrators for Tier 2 suppliers and smaller job shops. Direct sales ensure that customization requirements and complex service agreements are handled efficiently, maintaining a close relationship between the laser machine builder and the end-user. Indirect channels, conversely, provide localized technical support and rapid deployment capabilities across diverse geographical markets, ensuring broader penetration of the technology.

The market's structure emphasizes a tight coupling between the machine builder and the end-user due to the highly specialized nature of the applications (e.g., fuel injector hole geometry requires bespoke laser parameters). Post-sale services, including maintenance, spare parts supply, and process optimization consulting, form a critical part of the downstream value chain. Success in this market depends heavily on maintaining strong relationships with specialized component suppliers to ensure optical quality and integrating advanced software solutions for optimal performance and connectivity (Industry 4.0 readiness).

Fiber Laser Drilling Machine for Automotive Market Potential Customers

Potential customers for Fiber Laser Drilling Machines are predominantly within the automotive manufacturing ecosystem, driven by the need for high-volume, high-precision component production. The primary buyers are large Original Equipment Manufacturers (OEMs) who are setting up or expanding in-house manufacturing lines for critical components, particularly those related to electric vehicle platforms such as battery cooling systems, electronic control units (ECUs), and specialized lightweight structural elements. These customers demand robust, automated, 24/7 operational systems capable of micron-level accuracy and seamless integration with existing robotic lines. Their purchasing decisions are often based on total cost of ownership (TCO), long-term reliability, and global service support.

The second major customer segment consists of Tier 1 and Tier 2 automotive component suppliers, such as those specializing in fuel delivery systems (e.g., Bosch, Denso), transmission assemblies, or advanced sensor manufacturing. These suppliers need laser drilling capabilities to meet the demanding specifications handed down by the OEMs. For instance, a supplier manufacturing high-pressure common rail fuel injectors requires ultra-fast pulsed fiber lasers to create precise, burr-free metering holes, which are crucial for achieving stringent Euro 7 or equivalent emission standards. Their purchasing behavior is often project-specific, focused on machines that offer flexibility and quick changeover capabilities for different component batches.

Finally, specialized metal and materials job shops represent a crucial segment, particularly those focusing on prototyping, small-batch production of luxury or high-performance automotive parts, or processing highly specialized materials (e.g., ceramics, superalloys). These customers prioritize versatility and the ability of the machine to handle diverse materials and complex geometries with minimal setup time. The market is also seeing emerging demand from battery recycling and repurposing facilities that require precise, non-destructive drilling capabilities for disassembling battery modules safely.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 807.9 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Coherent Corp., Trumpf Group, Lumentum Operations LLC, Han's Laser Technology Industry Group Co., Ltd., Amada Co., Ltd., Bystronic Laser AG, Jenoptik AG, MKS Instruments (Electro Scientific Industries), Laserline GmbH, Novanta Inc., DMG MORI, Prima Industrie S.p.A., GF Machining Solutions, Hypertherm Associates, Laser Systems srl, SPI Lasers (Amada), Shenzhen DNE Laser, Wuhan Huagong Laser, Universal Laser Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Laser Drilling Machine for Automotive Market Key Technology Landscape

The core technology driving innovation in the Fiber Laser Drilling Machine for Automotive Market is the continuous evolution of ultra-fast pulsed fiber lasers, specifically pico- and femtosecond laser systems. These systems deliver extremely high peak power in very short durations, allowing for "cold ablation," a process that removes material with minimal heat transfer to the surrounding area. This is critical for processing sensitive materials like thin films, specialized alloys, and certain composites without inducing micro-cracks or heat-affected zones (HAZ). The integration of these ultra-fast lasers ensures superior hole quality, reduced post-processing requirements, and greater overall component integrity, which is essential for safety-critical automotive applications.

Beyond the laser source itself, significant technological advancements focus on the beam delivery and motion control systems. High-speed galvanometer scanners (Galvo systems) are becoming standard, enabling extremely rapid positioning of the laser beam and facilitating high-throughput processing, particularly for applications requiring thousands of micro-holes per component, such as perforated air intake screens or battery ventilation foils. Furthermore, advanced software platforms incorporating real-time monitoring and feedback control loops (often AI-enhanced) ensure precise focal length adjustment, power stability, and drift correction, maintaining consistent quality across long production cycles. This reliance on integrated hardware and sophisticated control software represents the state-of-the-art technological offering in this market.

Another crucial technological development is the shift towards modular and customizable machine architectures. Leading manufacturers are offering flexible platforms that can integrate multiple processing heads (e.g., combining drilling with cutting or welding) and accommodate various degrees of automation, from manual loading to fully roboticized cells. This modularity allows automotive manufacturers to scale their production capacity efficiently and adapt the same base machinery for different component geometries or material changes. The adoption of advanced diagnostics, including in-situ sensor monitoring for beam quality and component alignment, further enhances the reliability and precision of these highly sophisticated fiber laser drilling systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, primarily driven by China's colossal investment in electric vehicle manufacturing and battery production. South Korea and Japan also contribute significantly through their advanced automotive technology and stringent quality standards, driving demand for high-precision laser systems for component fabrication, particularly in power electronics and advanced internal combustion engine (ICE) components tailored for regional markets.

- Europe: Europe represents a mature market, characterized by strong demand driven by strict environmental regulations (Euro 7 standards) that necessitate highly efficient engine components (requiring precision laser-drilled fuel injectors) and substantial investment in local EV supply chains. Germany, with its robust machine tools and automotive manufacturing base, is the primary regional powerhouse for advanced fiber laser adoption, focusing heavily on automation and Industry 4.0 integration.

- North America: The market is rapidly accelerating, spurred by governmental incentives and investments (such as the Inflation Reduction Act in the US) promoting domestic EV and battery manufacturing. This expansion creates significant demand for high-power fiber laser drilling machines for battery module processing, lightweighting structural components, and advanced sensor manufacturing, focusing on minimizing supply chain risk through localized production.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show steady, albeit slower, adoption rates. Growth is concentrated in countries like Mexico and Brazil (as part of North American and European supply chains, respectively) and in Middle Eastern nations investing in diversified manufacturing capabilities. Adoption is initially focused on servicing existing ICE vehicle production and gradually expanding into localized EV component assembly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Laser Drilling Machine for Automotive Market.- IPG Photonics

- Coherent Corp.

- Trumpf Group

- Lumentum Operations LLC

- Han's Laser Technology Industry Group Co., Ltd.

- Amada Co., Ltd.

- Bystronic Laser AG

- Jenoptik AG

- MKS Instruments (Electro Scientific Industries)

- Laserline GmbH

- Novanta Inc.

- DMG MORI

- Prima Industrie S.p.A.

- GF Machining Solutions

- Hypertherm Associates

- Laser Systems srl

- SPI Lasers (Amada)

- Shenzhen DNE Laser

- Wuhan Huagong Laser

- Universal Laser Systems

Frequently Asked Questions

Analyze common user questions about the Fiber Laser Drilling Machine for Automotive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of fiber laser drilling in the automotive industry?

Primary applications include drilling precise micro-holes in fuel injector nozzles for combustion optimization, creating cooling channels in EV battery plates and power electronics, and manufacturing intricate apertures in sensors and lightweight structural components utilizing advanced alloys or composite materials.

How does ultra-fast fiber laser drilling benefit EV component manufacturing?

Ultra-fast lasers (pico/femtosecond) are essential for EV components as they enable "cold ablation," which minimizes the heat-affected zone (HAZ) when processing heat-sensitive materials like thin metallic foils, copper, and specialized polymers used in battery cells and thermal management systems, ensuring component longevity and performance.

What major factor restrains the growth of the Fiber Laser Drilling Machine market?

The primary restraint is the high initial capital expenditure (CAPEX) required to acquire advanced fiber laser drilling systems and integrated automation, which can present a barrier to entry for smaller Tier 2 and Tier 3 component suppliers, despite the long-term operational benefits.

Which geographical region leads the global market for these machines?

The Asia Pacific (APAC) region, driven primarily by extensive manufacturing capacity in China, South Korea, and Japan related to the rapid expansion of electric vehicle and battery production, currently holds the largest market share and is expected to exhibit the highest CAGR.

What is the role of AI in optimizing fiber laser drilling processes?

AI integrates machine learning with vision systems to achieve real-time quality inspection, predict potential machine failures for proactive maintenance scheduling, and dynamically optimize drilling parameters (power, pulse rate) based on material feedback, maximizing precision and throughput.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager