Fiber Optic Cable Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432722 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Optic Cable Assembly Market Size

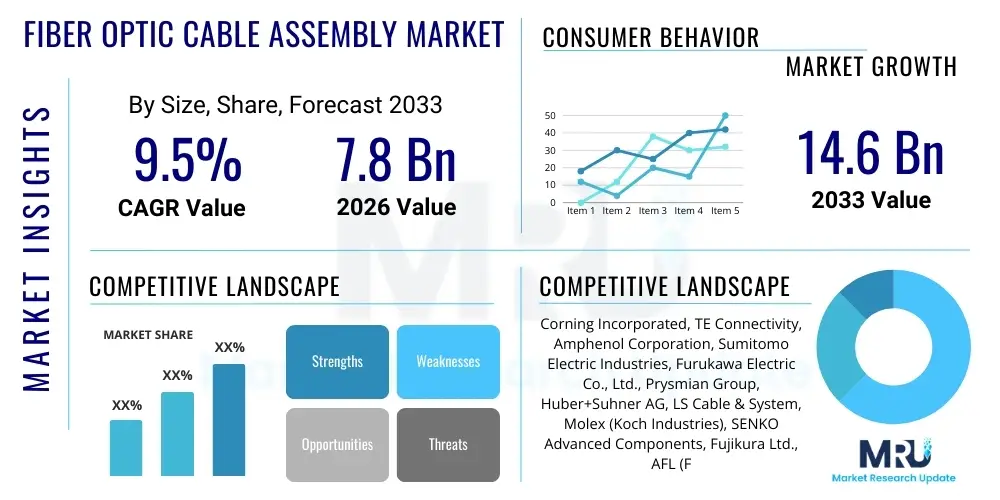

The Fiber Optic Cable Assembly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $7.8 Billion in 2026 and is projected to reach $14.6 Billion by the end of the forecast period in 2033.

Fiber Optic Cable Assembly Market introduction

The Fiber Optic Cable Assembly Market encompasses the specialized manufacturing and deployment of pre-terminated optical cable solutions designed to facilitate reliable and high-speed data transmission across various network infrastructures. These assemblies are critical components bridging active networking equipment and passive infrastructure, ensuring minimal signal loss and maximum throughput. Key products include patch cords, pigtails, multi-fiber assemblies like MTP/MPO, and specialized harsh environment assemblies. The fundamental product description involves an optical fiber cable terminated with connectors (such as SC, LC, FC, or ST) on one or both ends, precision-polished to meet demanding specifications for insertion loss and return loss. The meticulous quality control during assembly is paramount, driving performance in sophisticated telecommunication and data center environments.

Major applications of these assemblies span across several high-growth sectors, primarily driven by the exponential demand for bandwidth. Telecommunications utilizes these assemblies extensively for Fiber-to-the-Home (FTTH) deployments, backbone networks, and the burgeoning build-out of 5G infrastructure, which requires dense fiber connectivity to cell sites. Data centers, particularly hyper-scale and co-location facilities, represent another core application, where assemblies are vital for high-density interconnects, server racks, and Storage Area Networks (SANs). Furthermore, enterprise networks, campus connectivity, industrial automation, military, and broadcast sectors rely on the superior EMI immunity and bandwidth capabilities offered by fiber optic assemblies compared to traditional copper solutions.

The primary benefits fueling market growth include significantly higher bandwidth capacity, reduced latency, greater transmission distances, and complete immunity to electromagnetic interference (EMI). These attributes position fiber optics as the indispensable medium for modern digital transformation initiatives globally. Driving factors for the market expansion are manifold, including massive investments in cloud computing infrastructure, the accelerating global deployment of 5G networks, increasing penetration of FTTH services in developing regions, and the continuous need for upgrading legacy data transmission networks to support IoT, AI, and Big Data processing. Standardization efforts by organizations like the Telecommunications Industry Association (TIA) and International Electrotechnical Commission (IEC) also ensure interoperability and drive adoption.

Fiber Optic Cable Assembly Market Executive Summary

The Fiber Optic Cable Assembly Market is characterized by robust growth, primarily propelled by aggressive global digital infrastructure investments. Business trends indicate a strong shift towards high-density, factory-terminated assemblies (like MPO/MTP) due to their time-saving installation benefits and superior performance repeatability in hyperscale data centers. Key players are increasingly focusing on vertical integration, enhancing their capabilities in fiber manufacturing, connector technology, and automated assembly processes to maintain competitive edge and control supply chains. Furthermore, there is a rising demand for specialized ruggedized assemblies capable of performing reliably in challenging outdoor, industrial, and military environments, reflecting diversification beyond conventional telecom applications. Mergers and acquisitions remain a consistent strategy for market expansion and technology acquisition, especially in niche areas such as photonics and advanced splicing technologies.

Regional trends highlight Asia Pacific (APAC) as the epicenter of market activity and growth. This dominance is driven by massive government-led initiatives in China and India focused on expanding broadband access (FTTH) and leading the world in 5G rollout speed and scale. North America and Europe, while mature, exhibit high growth rates focused primarily on upgrading existing infrastructure to 400G and 800G speeds within data center environments, demanding the latest generation of ultra-low loss assemblies. Latin America and the Middle East & Africa (MEA) are emerging as significant opportunity areas, fueled by substantial investments in undersea cables, smart city projects, and the liberalization of the telecommunications sectors, creating latent demand for core network components like fiber assemblies.

Segmentation trends reveal that the Multi-Mode fiber segment is witnessing renewed interest, particularly in shorter reach data center interconnects (up to 300 meters) utilizing Vertical-Cavity Surface-Emitting Lasers (VCSELs) for cost-effective, high-speed connectivity (e.g., OM5). Conversely, the Single Mode fiber segment continues its unchallenged dominance in long-haul, metropolitan, and FTTH applications due to its superior transmission distance capabilities. By product type, MTP/MPO assemblies are experiencing the fastest uptake due to their ability to condense 12, 24, or even 72 fibers into a single connector footprint, crucial for managing cable congestion and maximizing port density in modern equipment. The application segment remains heavily skewed towards Telecommunication and Data Centers, though Industrial and Military applications are adopting specialized assemblies requiring stringent environmental resilience.

AI Impact Analysis on Fiber Optic Cable Assembly Market

Common user questions regarding AI's impact on the Fiber Optic Cable Assembly Market revolve around how the increasing computational demands of AI and Machine Learning (ML) will translate into physical network infrastructure needs. Users frequently inquire about the correlation between AI cluster growth and the requirement for ultra-high-density interconnects, especially within the context of next-generation AI data centers utilizing specialized GPU farms. Key themes center on bandwidth acceleration, low-latency requirements (crucial for real-time ML model training), and the subsequent need for specialized fiber assemblies (e.g., those supporting 800G and future 1.6T speeds). Concerns often include supply chain stability given the potential exponential demand surge driven by large language models (LLMs) and generative AI, and how AI-driven optimization might enhance the manufacturing and quality control processes of the assemblies themselves.

The primary influence of Artificial Intelligence on the fiber optic assembly market is the massive, non-linear growth in demand for specialized, high-performance fiber infrastructure required to support AI training and inference. AI models, particularly large language models (LLMs), require immense parallel processing power housed in interconnected GPU clusters, which necessitates fiber assemblies capable of handling extreme data rates with minimal cross-talk and delay. This translates directly into a surge in demand for sophisticated MTP/MPO assemblies and custom-length, high-quality patch cords for interconnecting switches, servers, and accelerators within the tight confines of AI compute racks. The stringent performance metrics demanded by AI applications push manufacturers to innovate in areas like ultra-low loss (ULL) connectors and next-generation fiber types to minimize power consumption and maximize efficiency.

Furthermore, AI is not only a demand driver but also a tool for optimization within the manufacturing process. Deploying AI and ML algorithms in factory settings allows manufacturers to predict and prevent defects in the highly sensitive polishing and termination phases of assembly production. AI can analyze sensor data from polishing machines to ensure perfect end-face geometry, reducing yield loss and guaranteeing the stringent performance specifications required for advanced networking standards. This operational efficiency driven by AI integration helps meet the scaling demands of the market while maintaining the high quality necessary for mission-critical applications in hyperscale cloud environments.

- AI drives massive bandwidth demand in GPU/TPU clusters, necessitating ULL fiber assemblies.

- Increased adoption of Generative AI accelerates data center upgrades to 400G/800G speeds.

- AI systems require ultra-low latency interconnects, favoring high-precision, factory-terminated MTP/MPO assemblies.

- AI is utilized in manufacturing to optimize fiber polishing and assembly termination, improving yield and quality control.

- The growth of AI edge computing increases demand for ruggedized, distributed fiber connectivity assemblies.

DRO & Impact Forces Of Fiber Optic Cable Assembly Market

The dynamics of the Fiber Optic Cable Assembly Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Key drivers include the overwhelming global need for enhanced bandwidth fueled by cloud computing, Big Data, and video streaming, alongside mandatory infrastructure rollouts such as 5G mobile networks and government-backed FTTH initiatives. These factors mandate the continuous deployment and density increase of fiber optics. Restraints often manifest as high initial deployment costs, particularly for trenching and duct installation in established urban areas, coupled with a persistent shortage of skilled labor required for specialized fiber splicing and termination. Opportunities arise from technological advancements such as Polymer Optical Fiber (POF) adoption in automotive applications, the shift towards co-packaged optics (CPO) in data centers, and the untapped potential of smart city projects requiring vast interconnected sensor networks.

The primary driving force remains the digital transformation across all industry verticals. As enterprises migrate applications to the cloud and consumers demand seamless high-definition content, the infrastructure capacity must perpetually expand. This sustained growth directly translates into the consistent demand for high-quality, reliable cable assemblies. The shift from 10G and 40G networks to 100G, 400G, and planning for 800G in data center architectures necessitates not only more fiber but also assemblies with increasingly complex fiber counts and stringent performance requirements (e.g., specific polarity and low insertion loss). This technological pressure ensures constant market churn and investment in next-generation products, maintaining a positive growth trajectory despite global economic fluctuations.

However, the market is constrained by significant geopolitical tensions affecting the global supply chain, leading to volatility in the prices of raw materials, particularly glass fiber preforms and specialized plastics. Furthermore, the specialized nature of fiber optic termination demands precision machinery and highly controlled environments, which adds to the manufacturing complexity and limits the number of qualified suppliers capable of meeting hyperscale quality standards. The Impact Forces ultimately favor resilience; companies that can manage the supply chain risk, invest in highly automated assembly lines, and offer comprehensive, integrated solutions (from cable to connector) are best positioned to capitalize on the overarching opportunity presented by the global, unabated appetite for high-speed data connectivity.

Segmentation Analysis

The Fiber Optic Cable Assembly Market is comprehensively segmented based on Type, Product, Application, and End-Use, allowing for granular analysis of demand patterns and technological trends across different operational environments. The fundamental distinction lies between Single Mode (SM) and Multi-Mode (MM) fibers, which dictates the transmission distance and core technology (long-distance transmission vs. cost-effective short-reach interconnects). Product segmentation differentiates between basic components like patch cords and pigtails, and complex multi-fiber systems such as MTP/MPO assemblies, reflecting the increasing need for density in network planning. Application segments delineate the primary use environments—Telecommunication, Data Center, and Enterprise—each with unique physical and performance requirements for their deployed assemblies. This multi-faceted segmentation provides stakeholders with clarity on where specific product innovations are most relevant and impactful.

- By Type:

- Single Mode (SM)

- Multi-Mode (MM)

- By Product:

- Patch Cords

- Pigtails

- MTP/MPO Assemblies

- Connectors and Adapters (As parts of assemblies)

- Hybrid Assemblies

- By Application:

- Data Centers (Hyperscale, Enterprise)

- Telecommunication (FTTH, 5G Backhaul, Core Network)

- Enterprise Networks (LAN, Campus)

- CATV (Cable Television)

- Military and Aerospace

- Industrial and Factory Automation

- By End-Use:

- IT & Telecom

- Industrial

- Healthcare

- Energy & Utilities

- Government & Defense

Value Chain Analysis For Fiber Optic Cable Assembly Market

The value chain for the Fiber Optic Cable Assembly Market is characterized by highly specialized stages, beginning with the complex manufacturing of raw fiber and culminating in the final deployment and service provision. Upstream analysis focuses on the manufacturing of core raw materials: high-purity silica glass preforms, followed by the fiber drawing process, and the production of optical connectors and cable jackets (polymers/plastics). This upstream segment is highly consolidated, dominated by a few global players who possess the technological expertise and capital to control quality and supply of the base components. The middle stage involves the actual cable assembly: cutting, termination, polishing, and rigorous testing, which is often semi-automated and requires stringent cleanroom conditions to ensure optimal performance. Precision engineering in this stage is critical for achieving low insertion loss and high return loss characteristics.

Downstream analysis covers the distribution, integration, and final installation of the assemblies. The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Direct sales are prevalent for hyperscale data center operators or large-scale telecom infrastructure projects where customization and volume are key. Indirect sales utilize a network of specialized distributors, value-added resellers (VARs), and system integrators who provide localized inventory, technical support, and installation services to smaller enterprises or regional networks. The increasing complexity of network topologies, especially with the introduction of parallel optics like MPO, means that system integration and on-site technical support are increasingly valuable components of the downstream market.

The overall flow is governed by the demand signals from large Tier 1 telecom operators and cloud service providers (CSPs). Suppliers who can offer end-to-end solutions, from raw fiber to pre-engineered cassette systems, benefit from streamlined procurement and reduced logistics complexity for the end-user. The highly quality-sensitive nature of the product means that supply chain stability and quality traceability are premium requirements. This structural rigidity favors vertically integrated companies that maintain tight control over the entire process, minimizing the risk of performance degradation introduced by external component sourcing.

Fiber Optic Cable Assembly Market Potential Customers

Potential customers for the Fiber Optic Cable Assembly Market represent any entity or organization reliant on high-speed, high-capacity digital communication infrastructure. The primary end-users or buyers are major telecommunication service providers (Telcos) involved in building and maintaining mobile backhaul (5G), long-haul submarine cables, and Fiber-to-the-Home (FTTH) networks. These customers prioritize robustness, extreme length capacity, and standardization for seamless network expansion. Another crucial segment comprises Cloud Service Providers (CSPs) and enterprises managing hyperscale and co-location data centers. For these buyers, the focus is intensely placed on density (MPO/MTP utilization), ultra-low latency, and fast deployment times (favoring pre-terminated assemblies over field termination).

Beyond the core telecom and data center sectors, significant customer potential exists in industrial and specialized sectors. Industrial automation customers, including manufacturers utilizing high-speed robotics and IoT devices, require ruggedized, industrial-grade assemblies designed to withstand vibration, temperature extremes, and chemical exposure, often incorporating specialized connectors. Government and Defense entities are major buyers, utilizing fiber optics for secure, high-bandwidth command and control systems, demanding assemblies that meet stringent military specifications (Mil-Spec). Healthcare facilities (hospitals and medical research labs) also constitute an important segment, requiring robust fiber connectivity for medical imaging and large data transmission within campus environments, emphasizing reliability and EMI shielding.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.8 Billion |

| Market Forecast in 2033 | $14.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, TE Connectivity, Amphenol Corporation, Sumitomo Electric Industries, Furukawa Electric Co., Ltd., Prysmian Group, Huber+Suhner AG, LS Cable & System, Molex (Koch Industries), SENKO Advanced Components, Fujikura Ltd., AFL (Fujikura), CommScope, Inc., OFS (Furukawa), Jiangsu Hongguang Optical Communication Technology Co., Ltd., GoFoton, Panduit Corp., Phoenix Contact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Optic Cable Assembly Market Key Technology Landscape

The technological landscape of the Fiber Optic Cable Assembly Market is rapidly evolving, driven by the persistent need for increased bandwidth, higher density, and improved efficiency, particularly within data center ecosystems. A foundational technology remains precision termination and polishing, where advanced automated machinery achieves nanometer-level tolerances on fiber end-faces to minimize insertion loss (IL) and maximize return loss (RL). Innovations in this area include specialized polishing films and interferometric testing equipment that ensure compliance with increasingly stringent low-loss specifications required for 400G and 800G transmission speeds. The materials science aspect is also critical, focusing on developing new polymer compositions for cable jacketing that offer better flexibility, flame retardancy (low smoke zero halogen - LSZH), and chemical resistance, enhancing the applicability of assemblies in diverse environments.

A major technological advancement driving current market growth is the widespread adoption of Multi-Fiber Push On (MPO) and Multi-fiber Termination Push-on (MTP) technology. These connectors allow for the simultaneous termination of 12, 24, 48, or even 72 fibers, dramatically increasing port density and reducing the physical space required for connectivity. The evolution here focuses on reducing the pitch and size of these connectors while maintaining or improving performance, crucial for fitting into the front panels of next-generation high-port-count switches. Furthermore, polarization maintaining (PM) fiber assemblies are gaining prominence in specialized applications such as coherent optical communications and high-precision sensing, requiring specific alignment technologies during the assembly process to maintain the light's polarization state.

Looking ahead, the market is preparing for the transition to Co-Packaged Optics (CPO) and Near-Packaged Optics (NPO), where optical interfaces are brought closer to the processing chips. While CPO will partially disrupt traditional pluggable transceiver modules, it simultaneously increases the demand for very short-reach, high-precision fiber ribbon assemblies (often utilizing MPO) to connect the co-packaged components to the rack-level infrastructure. This shift necessitates new design considerations for thermal management and miniature assembly techniques. Additionally, the industrial segment is seeing greater incorporation of Expanded Beam Connectors (EBCs), which use lenses to expand and collimate the light beam, making them highly resistant to dust and vibration, a significant technical advantage in harsh industrial and military settings.

Regional Highlights

- Asia Pacific (APAC): This region is the powerhouse of the Fiber Optic Cable Assembly Market, characterized by the world’s most extensive FTTH deployments (driven heavily by China and India) and rapid 5G infrastructure build-out. Government policies promoting digital inclusion and massive investments by telecom operators contribute to consistently high demand for both standard patch cords and complex backbone assemblies. Japan and South Korea lead in adopting advanced, ultra-high-speed network technologies, setting regional benchmarks for quality and innovation.

- North America: North America is defined by technological leadership, particularly in the hyperscale data center segment. Demand here is focused on supporting 400G and 800G high-speed Ethernet upgrades, driving the adoption of high-fiber count MPO/MTP assemblies and ultra-low loss components. The US continues significant investment in rural broadband expansion (FTTX), ensuring sustained demand for outside plant (OSP) ruggedized cable assemblies.

- Europe: Growth in Europe is steady, supported by the mandatory push for widespread 5G coverage and national fiber rollouts in countries like Germany, the UK, and France. The region emphasizes standardized, compliant products, with a growing focus on sustainable manufacturing practices (e.g., green cables and recyclable assembly materials). Data center growth, while robust, is constrained by land availability, leading to demand for dense, space-saving assembly solutions.

- Latin America (LATAM): The LATAM region represents a significant growth opportunity as connectivity penetration increases dramatically. Investments in new submarine cables connecting the continent and government initiatives to improve national broadband infrastructure are primary drivers. The market favors competitive pricing and reliable, robust solutions suitable for challenging regional environmental conditions and often relying on international financing for large-scale projects.

- Middle East and Africa (MEA): MEA is experiencing high growth spurred by smart city developments (like NEOM in Saudi Arabia) and massive investments in cloud infrastructure and 5G deployment. The Middle East, with significant capital, demands cutting-edge technology and high-quality infrastructure, while Africa presents immense potential for initial FTTH deployment and mobile connectivity expansion, favoring cost-effective and ruggedized solutions for remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Optic Cable Assembly Market.- Corning Incorporated

- TE Connectivity

- Amphenol Corporation

- Sumitomo Electric Industries

- Furukawa Electric Co., Ltd.

- Prysmian Group

- Huber+Suhner AG

- LS Cable & System

- Molex (Koch Industries)

- SENKO Advanced Components

- Fujikura Ltd.

- AFL (Fujikura)

- CommScope, Inc.

- OFS (Furukawa)

- Jiangsu Hongguang Optical Communication Technology Co., Ltd.

- GoFoton

- Panduit Corp.

- Phoenix Contact

Frequently Asked Questions

Analyze common user questions about the Fiber Optic Cable Assembly market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-density fiber optic cable assemblies?

The predominant driver is the exponential growth of hyperscale and co-location data centers, specifically the need for high-speed, parallel interconnectivity (400G and 800G Ethernet) within racks and rows, which mandates the use of high-density MTP/MPO assemblies to manage cable congestion efficiently.

How does the rollout of 5G networks influence the fiber optic assembly market?

5G necessitates extensive fiberization of the mid-haul and fronthaul segments, requiring numerous ruggedized, outdoor-rated fiber optic assemblies to connect remote radio heads (RRH) and base stations to the central network infrastructure, thereby significantly boosting demand for specialized outdoor assemblies.

What is the key technological challenge currently facing fiber optic cable assembly manufacturers?

The main challenge is consistently achieving ultra-low insertion loss (ULL) performance across mass-produced multi-fiber assemblies (MPO/MTP) while meeting the accelerating demands for higher fiber counts and maintaining cost-efficiency, essential for supporting next-generation transceiver technologies.

Which geographical region exhibits the fastest growth potential for this market?

The Asia Pacific (APAC) region, led by China and India, maintains the fastest growth potential due to expansive government-supported FTTH programs, rapid urbanization, and accelerated deployment of 5G networks and supporting digital infrastructure upgrades across the continent.

What is the difference between Single Mode (SM) and Multi-Mode (MM) assemblies in terms of application?

Single Mode assemblies are used for long-distance transmission (telecom, FTTH, long-haul data center links) due to their minimal attenuation, while Multi-Mode assemblies are used for short-reach, high-bandwidth interconnects (typically under 300 meters) within data centers and enterprise LANs, offering a lower cost solution via LED or VCSEL light sources.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager