Fiber Optic Spectrometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438451 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Optic Spectrometer Market Size

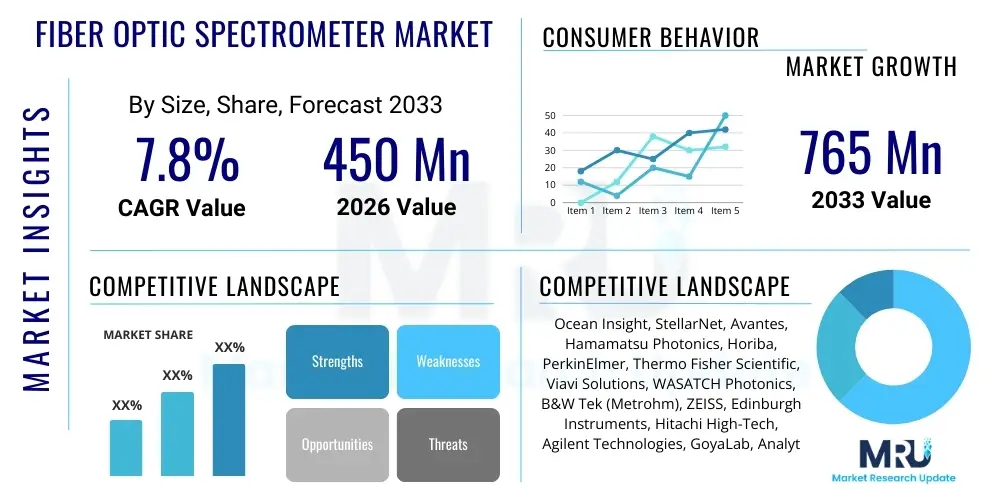

The Fiber Optic Spectrometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Fiber Optic Spectrometer Market introduction

The Fiber Optic Spectrometer Market encompasses high-precision analytical instruments utilizing optical fibers to efficiently guide and capture light from a sample to a dispersive element, such as a grating, and subsequently to a detector array. These devices are crucial for measuring light intensity as a function of wavelength across the ultraviolet (UV), visible (Vis), and near-infrared (NIR) spectra. The fundamental product offers enhanced versatility, portability, and modularity compared to traditional benchtop laboratory spectrometers, enabling seamless integration into complex industrial and medical monitoring systems. Their small footprint, speed, and durability make them indispensable across various scientific and commercial fields requiring fast, non-destructive chemical analysis and quality control.

Major applications of fiber optic spectrometers span environmental monitoring, where they analyze pollutants in water and air; pharmaceutical manufacturing, crucial for quality assurance and process analytical technology (PAT); and biomedical diagnostics, involving tissue analysis and blood oxygen saturation measurements. Furthermore, they are extensively used in materials science for thin-film thickness measurements and semiconductor manufacturing for process optimization. The inherent benefits of these systems include high throughput, low light loss due to efficient fiber coupling, real-time measurement capabilities, and the ability to measure samples remotely without requiring physical contact with the instrument itself, significantly improving operational safety and efficiency in hazardous environments.

The growth of this market is primarily driven by the increasing demand for real-time, non-invasive analytical techniques across industrial production lines and research laboratories. Technological advancements, particularly in miniaturization and detector efficiency (e.g., cooled CCDs and InGaAs arrays), have significantly lowered the cost of ownership while enhancing performance specifications such as resolution and signal-to-noise ratio. The burgeoning adoption of smart sensors and integration into the Internet of Things (IoT) infrastructure further propels market expansion, as fiber optic spectrometers become pivotal components in decentralized, continuous monitoring networks, providing actionable data instantly to operators and analytical systems.

Fiber Optic Spectrometer Market Executive Summary

The Fiber Optic Spectrometer Market is characterized by robust growth, fueled by strong business trends centered on miniaturization, modularity, and integration into automated industrial processes. Key manufacturers are focusing on developing high-resolution, handheld devices and highly customized spectral engines that can be embedded directly into manufacturing equipment, thereby transitioning spectroscopy from a laboratory tool to a field-deployable and in-line process control instrument. Business strategies increasingly revolve around software integration, offering advanced chemometric algorithms and user-friendly interfaces to simplify complex data analysis for non-expert users, widening the market accessibility across diverse industrial sectors such as agriculture and food processing. Strategic partnerships between hardware manufacturers and software developers are critical for maintaining competitive advantage and addressing the increasing industry requirement for comprehensive analytical solutions.

Regional trends indicate that North America and Europe currently dominate the market share, primarily due to the high concentration of advanced research institutions, pharmaceutical companies, and stringent environmental regulations demanding sophisticated monitoring technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, driven by rapid industrialization, expansion of semiconductor fabrication facilities, and substantial government investment in R&D, particularly in China, Japan, and South Korea. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising growth potential, supported by infrastructural development in oil and gas and quality control demands in chemical production, necessitating robust and reliable analytical equipment.

Segment trends highlight the dominance of the UV-Vis segment by wavelength range, owing to its widespread applicability in color measurement, chemical concentration determination, and fundamental academic research. However, the NIR and MIR (Mid-Infrared) segments are experiencing accelerated adoption, driven by their critical role in non-destructive analysis for moisture content, polymer identification, and pharmaceutical polymorph screening, aligning perfectly with Process Analytical Technology (PAT) initiatives. Furthermore, the segmentation based on application shows that industrial process control and quality assurance hold the largest market share, while the biomedical and life sciences segment is expected to show the highest CAGR, propelled by innovations in point-of-care diagnostics and surgical guidance systems that utilize fiber optic spectroscopy for immediate results.

AI Impact Analysis on Fiber Optic Spectrometer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fiber Optic Spectrometer market typically revolve around performance enhancement, data processing speed, and the democratization of complex spectral analysis. Users frequently inquire about how AI can automate calibration processes, correct for environmental noise and baseline drift in real-time, and whether machine learning algorithms can accurately predict sample properties (e.g., concentration, purity, component ratios) without traditional, time-consuming chemometric model building. There is significant interest in AI's role in handling the massive datasets generated by high-speed in-line spectrometers, improving spectral library matching accuracy, and detecting subtle anomalies indicative of manufacturing flaws or disease states that are invisible to human inspection or basic statistical methods. The key themes summarized from user inquiries emphasize the expectation that AI will transform raw spectral data into actionable insights instantaneously, making sophisticated analytical techniques accessible for non-experts in dynamic industrial settings.

The integration of AI, specifically machine learning and deep learning models, is revolutionizing the data analysis pipeline for fiber optic spectrometers. Traditionally, spectral data analysis required highly trained chemometricians to develop complex multivariate calibration models. AI now automates this process, enabling spectrometers to learn from vast datasets, rapidly build predictive models, and perform classification tasks with superior accuracy and robustness. This capability is particularly critical in high-throughput industrial environments, such as pharmaceutical tablet testing or food safety inspection, where minimal latency and maximum reliability are essential for ensuring product consistency and immediate process adjustment. AI algorithms can identify spectral fingerprints unique to contaminants or specific chemical compounds far more efficiently than standard linear regression methods.

Furthermore, AI significantly enhances the performance of the instruments themselves through advanced predictive maintenance and automated system diagnostics. Machine learning models monitor internal spectrometer parameters, such as light source stability, detector temperature fluctuations, and fiber integrity, predicting potential hardware failures before they occur and triggering necessary recalibrations. This proactive approach minimizes downtime and ensures the long-term accuracy and reliability of measurements, a crucial factor for regulatory compliance in regulated industries. The application of deep learning in signal processing also allows for significant reduction in data noise, effectively boosting the signal-to-noise ratio in low-light conditions or rapid measurements, thereby extending the utility of portable and field-based spectroscopic solutions into previously challenging applications.

- AI enables automated, real-time spectral interpretation and chemometric modeling.

- Deep learning enhances signal-to-noise ratio (SNR) and spectral resolution in complex matrices.

- Machine learning algorithms facilitate predictive maintenance and system self-calibration, reducing operational costs.

- AI accelerates anomaly detection for quality control and identifies novel spectral signatures rapidly.

- Integration with cloud-based AI services allows for decentralized data processing and vast spectral library comparison.

DRO & Impact Forces Of Fiber Optic Spectrometer Market

The dynamics of the Fiber Optic Spectrometer Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and overarching Impact Forces that shape technological development and commercial adoption. A primary driver is the pervasive need for rapid, non-destructive, and highly accurate quantitative analysis across multiple industries, including pharmaceuticals, petrochemicals, and agriculture, demanding instantaneous results for optimizing production cycles. Coupled with this is the continuous miniaturization trend in analytical instrumentation, allowing for the creation of compact, portable, and handheld devices that facilitate on-site analysis, eliminating the delays and costs associated with centralized laboratory testing. Restraints include the high initial capital investment required for high-end, research-grade systems and the inherent complexity associated with spectral data interpretation, often requiring specialized training or the deployment of advanced, integrated AI solutions to overcome this knowledge gap. The variability of spectral measurements influenced by environmental factors, such as temperature and humidity, also presents a technical challenge requiring sophisticated compensation techniques.

Significant opportunities are emerging from the burgeoning applications in advanced manufacturing and personalized medicine. The rise of Industry 4.0 and the increasing deployment of Process Analytical Technology (PAT) standards in regulated manufacturing environments create a vast and growing demand for in-line, fiber-coupled spectroscopic sensors capable of continuous monitoring and feedback control. Furthermore, the integration of fiber optic spectrometers into biomedical devices, such as endoscopes and surgical probes, for real-time tissue diagnosis and margin assessment during surgery, represents a high-growth opportunity. The development of specialized, affordable NIR and Raman fiber optic systems targeted at emerging economies for basic quality assurance in food safety and agricultural product assessment also opens untapped markets, leveraging their robustness and ease of use in challenging field conditions.

The overall impact forces driving the market expansion are technology convergence and regulatory pressure. The convergence of optical components, high-speed electronics, and sophisticated computational algorithms (AI/ML) results in increasingly powerful and accessible instruments. Simultaneously, escalating global regulatory scrutiny concerning product quality, environmental emissions, and pharmaceutical integrity (e.g., counterfeit drug detection) mandates the adoption of advanced, traceable analytical methods like fiber optic spectroscopy. These instruments provide the necessary precision and documentation required for compliance, making their implementation a necessity rather than a preference for modern industrial operations. The economic force of reducing production waste and optimizing energy consumption through precise process control also strongly favors the adoption of these real-time analytical tools across the global manufacturing landscape.

Segmentation Analysis

The Fiber Optic Spectrometer Market is extensively segmented based on key criteria including the type of component, the operational wavelength range, the target application, and the end-user industry, providing a granular view of market dynamics and specialized demand pockets. The component segmentation differentiates between the core hardware elements—detectors, gratings, light sources, and fiber optics cables—reflecting specific technological advancements in sensitivity and durability. The differentiation by wavelength (UV-Vis, NIR, MIR) is critical as it dictates the range of chemical analyses possible, addressing requirements from molecular concentration in the UV range to vibrational and overtone analysis in the NIR/MIR regions. Application segmentation, covering areas like metrology, color measurement, and environmental monitoring, allows manufacturers to tailor solutions to specific functional requirements, optimizing instrument design and software support for specialized tasks. The overall market is characterized by a shift towards modular and customizable segmentation strategies, allowing users to select and integrate specific components to build bespoke analytical systems perfectly suited to their unique scientific or industrial needs, emphasizing flexibility and cost-effectiveness in solution deployment.

- Component Type:

- Detectors (CCD, CMOS, InGaAs, Photodiode Arrays)

- Gratings (Holographic, Ruled)

- Light Sources (Deuterium, Halogen, LEDs, Lasers)

- Fiber Optic Probes and Assemblies

- Wavelength Range:

- UV-Visible (200 nm to 800 nm)

- Near-Infrared (NIR) (800 nm to 2500 nm)

- Mid-Infrared (MIR) (2500 nm to 10000 nm)

- Application:

- Process Analytical Technology (PAT)

- Research & Development and Academia

- Environmental Monitoring and Remote Sensing

- Quality Control and Metrology

- Color Measurement and Characterization

- Biomedical Diagnostics and Imaging

- End-User Industry:

- Pharmaceutical and Biotechnology

- Chemical and Petrochemical

- Food and Agriculture

- Semiconductors and Electronics

- Textiles and Polymers

- Oil and Gas

Value Chain Analysis For Fiber Optic Spectrometer Market

The value chain for the Fiber Optic Spectrometer Market begins with the upstream suppliers responsible for high-precision component manufacturing, including optical grade materials for gratings, sophisticated sensor chips (like InGaAs arrays), and specialized optical fibers and connectors. These upstream activities are highly capital-intensive and require stringent quality control, as the performance specifications of the final spectrometer are critically dependent on the quality and stability of these foundational components. Key strategic imperatives at this stage involve securing reliable sources for rare earth elements used in certain detectors and ensuring compliance with miniaturization and low-power consumption requirements, driving innovation in detector cooling technologies and high-efficiency light sources. Suppliers who can offer modular and readily integrable components gain a competitive edge by reducing manufacturing complexity for downstream original equipment manufacturers (OEMs).

The mid-stream segment involves the core manufacturing, assembly, and integration of the spectrometer system by the primary market players. This stage encompasses the complex calibration procedures, integration of proprietary software, and final testing of the assembled instrument. The downstream activities focus heavily on distribution, marketing, and post-sales support. Distribution channels are typically segmented into direct sales teams, especially for large industrial clients requiring complex integration and custom solutions, and indirect channels relying on specialized distributors and scientific equipment resellers who possess localized expertise and access to smaller academic or clinical laboratories. The effectiveness of the downstream segment is highly dependent on providing robust application-specific support, training, and prompt calibration services, which are critical for maintaining customer loyalty and ensuring accurate long-term operation of the analytical instruments.

The transition from direct to indirect channels often reflects the complexity of the sale; high-value, bespoke PAT solutions are predominantly handled directly, while standardized, high-volume portable units are efficiently moved through technical distribution partners. The shift toward subscription-based software services (Software-as-a-Service, or SaaS) for data processing and chemometric model management is increasingly influencing the downstream revenue stream, moving beyond simple hardware sales. Effective value creation throughout the chain is achieved by minimizing production tolerances upstream and maximizing application support and data utility downstream, ensuring that the final customer receives an instrument that is not only highly accurate but also highly usable and maintainable within their operational framework.

Fiber Optic Spectrometer Market Potential Customers

The potential customer base for Fiber Optic Spectrometers is inherently diverse, ranging from advanced research institutions and governmental bodies to highly regulated commercial entities, united by the common requirement for precise, rapid chemical or physical analysis. End-users fall primarily into two broad categories: academic and governmental research (basic and applied science), and commercial industries (quality control and process optimization). In the commercial sector, the pharmaceutical industry represents a crucial buying segment, utilizing these instruments extensively for raw material identification, in-line blend uniformity testing, and final product quality release, driven by rigorous FDA and EMA regulations requiring 100% inspection capabilities. The semiconductor industry, another major end-user, employs fiber optic systems for precise thin-film thickness measurement and plasma monitoring during etching processes, where nanometer-level accuracy is mandatory for yield optimization.

Beyond highly technical manufacturing, a significant and rapidly expanding customer segment includes the food and beverage industry and the agricultural sector. Here, fiber optic spectrometers are used for non-destructive inspection of quality parameters such as sugar content, moisture level, ripeness, and contaminant detection (e.g., adulteration in olive oil or milk). These applications often favor rugged, portable NIR systems that can be operated by field technicians without extensive spectroscopic expertise, demanding highly intuitive interfaces and battery-operated designs. The oil and gas sector also constitutes a key customer group, deploying robust fiber optic sensors for downhole monitoring, compositional analysis of crude oil and natural gas, and detection of potentially corrosive contaminants under harsh environmental conditions, valuing durability and stability over extreme measurement speed.

Furthermore, emerging potential customers include clinical settings and specialized environmental consulting firms. In the clinical domain, fiber optic systems are being adopted for non-invasive blood analysis, tissue spectroscopy for cancer detection, and real-time monitoring during medical procedures. Environmental agencies and consultants rely on these portable systems for rapid field assessments of water quality, atmospheric gas composition, and soil contamination, where fast turnaround time is critical for effective regulatory enforcement and hazard response. The purchasing decision across all segments is increasingly influenced by the total cost of ownership, ease of system integration (especially into existing automation frameworks), and the availability of sophisticated, yet user-friendly, data analysis software compliant with industry standards like CFR 21 Part 11 for regulated environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ocean Insight, StellarNet, Avantes, Hamamatsu Photonics, Horiba, PerkinElmer, Thermo Fisher Scientific, Viavi Solutions, WASATCH Photonics, B&W Tek (Metrohm), ZEISS, Edinburgh Instruments, Hitachi High-Tech, Agilent Technologies, GoyaLab, Analytik Jena, Tec5, Shimadzu Corporation, Renishaw, Bruker Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Optic Spectrometer Market Key Technology Landscape

The technological landscape of the Fiber Optic Spectrometer Market is rapidly evolving, driven primarily by advancements in detector technology, dispersive elements, and signal processing capabilities designed to enhance resolution, sensitivity, and speed while minimizing size and power consumption. A critical advancement involves the shift towards highly integrated micro-electromechanical systems (MEMS) technology for creating miniaturized components, particularly MEMS-based Fabry-Pérot filters and micro-grating arrays, which allow for the reduction of spectrometer size down to chip-level dimensions without substantial compromise on optical performance. Furthermore, the development of high-efficiency, low-noise detectors, such as cooled InGaAs arrays for the NIR region and back-thinned CCDs for enhanced UV sensitivity, is crucial for improving the detection limits and enabling measurements in low-light environments, which is essential for applications like Raman spectroscopy and remote sensing. These hardware innovations are foundational to meeting the stringent requirements of portable and handheld analytical devices, making high-performance spectroscopy accessible outside traditional laboratory settings.

Another major technological trend is the sophistication of the fiber optic components themselves. Specialized optical fibers, including large-core silica fibers for high light throughput and chemically resistant sapphire fibers for high-temperature and harsh chemical environments (common in petrochemical processing), are expanding the operational boundaries of these instruments. Coupled with this is the development of innovative fiber optic probes, such as immersion probes for liquid analysis and contact probes utilizing attenuated total reflection (ATR) for surface analysis, which greatly simplify sample handling and preparation, enhancing the instruments' practical utility. The integration of advanced multiplexing techniques and fiber Bragg grating (FBG) sensors within the optical path also allows a single spectrometer to monitor multiple points or different chemical parameters simultaneously, dramatically improving throughput and cost-efficiency in large-scale industrial monitoring systems.

Crucially, the market's competitive edge is increasingly determined by software and data processing innovations rather than just hardware specifications. The deployment of advanced algorithms, including sophisticated chemometric techniques (e.g., Partial Least Squares Regression, Principal Component Analysis) and the aforementioned AI/ML models, is mandatory for extracting meaningful, quantitative information from complex, overlapping spectral data. The standardization of communications protocols and the incorporation of wireless connectivity (Wi-Fi, Bluetooth) and edge computing capabilities are key for seamless integration into IoT and cloud-based analytical platforms. These computational advancements enable real-time spectral correction, automated system diagnostics, and instant data sharing, positioning the modern fiber optic spectrometer as an intelligent sensor node within broader analytical networks.

Regional Highlights

- North America: This region maintains the largest market share, driven by extensive research and development funding, particularly from government agencies and large biotechnology firms. The United States is the primary consumer, characterized by the early adoption of Process Analytical Technology (PAT) in the highly regulated pharmaceutical sector and significant deployment of environmental monitoring systems. The presence of major market leaders and a mature technological infrastructure ensure continued innovation and high demand for advanced, high-resolution spectroscopy systems.

- Europe: Europe represents a mature market with high demand stemming from strict environmental regulations and substantial industrial activity in Germany (automotive/chemical) and Switzerland (pharmaceuticals). The emphasis here is on integrating fiber optic spectrometers into automated industrial systems for quality control and process optimization, aligning with the EU's push toward smart factories and sustainable manufacturing practices. Funding from the European Union for photonics research further stimulates technological advancements.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the accelerating industrialization, particularly in China and India, and massive investments in semiconductor fabrication and electronics manufacturing across South Korea and Taiwan. The region exhibits high demand for cost-effective, high-throughput systems for quality assurance in food, agriculture, and textiles. Government initiatives supporting local technological development and manufacturing capacity are major growth catalysts.

- Latin America (LATAM): This region is experiencing steady growth, largely focused on the application of fiber optic spectroscopy in the mining, petrochemical, and expanding agricultural sectors (e.g., Brazil, Mexico). The demand centers on robust, field-deployable instruments suitable for harsh operating conditions, primarily utilized for quality control of natural resources and export commodities.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, primarily driven by the oil and gas industry requiring reliable, real-time compositional analysis under high pressure and high-temperature conditions. Additionally, rising investments in educational and research infrastructure are beginning to create a nascent, but growing, demand for analytical instruments in academia and environmental monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Optic Spectrometer Market.- Ocean Insight (Halma Company)

- StellarNet

- Avantes

- Hamamatsu Photonics

- Horiba

- PerkinElmer

- Thermo Fisher Scientific

- Viavi Solutions

- WASATCH Photonics

- B&W Tek (Metrohm)

- ZEISS

- Edinburgh Instruments

- Hitachi High-Tech

- Agilent Technologies

- GoyaLab

- Analytik Jena

- Tec5

- Shimadzu Corporation

- Renishaw

- Bruker Corporation

Frequently Asked Questions

Analyze common user questions about the Fiber Optic Spectrometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a fiber optic spectrometer over a traditional benchtop unit?

The primary advantage is modularity and remote sensing capability. Fiber optic systems utilize flexible optical fibers to separate the sensing point from the bulky spectrometer hardware, allowing for real-time measurements in harsh, inaccessible, or remote locations, significantly improving portability and integration into complex industrial processes (in-line measurement).

Which end-user industry is driving the highest growth rate for Fiber Optic Spectrometers?

The biomedical and life sciences segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the increasing need for non-invasive diagnostics, surgical guidance, and the integration of spectroscopy into point-of-care devices for rapid clinical analysis and personalized medicine applications.

How is Artificial Intelligence (AI) fundamentally changing the utility of these spectrometers?

AI, specifically machine learning, streamlines complex spectral data analysis by automating chemometric model building, correcting for noise and drift, and enabling real-time anomaly detection. This transition makes sophisticated quantitative analysis accessible to operators without advanced spectroscopic expertise, accelerating decision-making in manufacturing and quality control.

What are the key restraint factors limiting the widespread adoption of high-end fiber optic spectroscopy?

Key restraint factors include the high initial capital expenditure required for research-grade and specialized NIR/MIR systems, and the technical challenge associated with interpreting complex multivariate spectral data, which often necessitates specialized software and skilled personnel for accurate implementation and maintenance.

What is Process Analytical Technology (PAT) and how does it relate to the Fiber Optic Spectrometer Market?

PAT is a framework, particularly critical in pharmaceutical and chemical manufacturing, designed to monitor and control processes in real-time to ensure consistent final product quality. Fiber optic spectrometers are essential PAT tools because they offer non-destructive, continuous, in-line or at-line measurement of key critical quality attributes (CQAs), enabling instantaneous feedback and process adjustments, thereby reducing waste and improving efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager