Fiber Optic Spectroscopy Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435210 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fiber Optic Spectroscopy Instruments Market Size

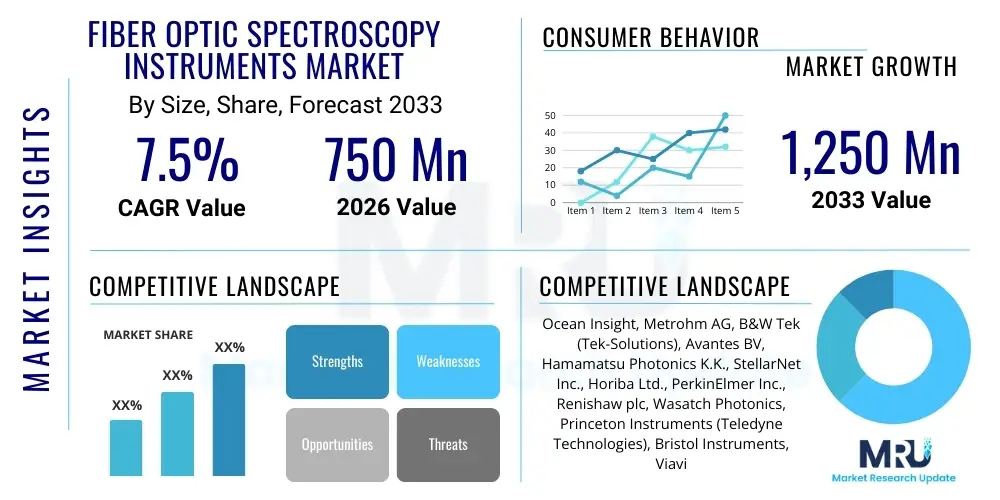

The Fiber Optic Spectroscopy Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Fiber Optic Spectroscopy Instruments Market introduction

Fiber optic spectroscopy instruments represent a critical technological convergence, integrating optical fibers with sophisticated spectrometers and detection systems to enable precise analysis of light-matter interaction across various spectral ranges, including UV, Visible, and Near-Infrared (NIR). These systems leverage the flexibility and low signal loss of optical fibers to transmit light from a remote sample to a stationary spectrograph, offering superior versatility and enabling measurements in challenging, hazardous, or high-throughput environments where traditional benchtop instruments are impractical. Key instruments within this market include specialized Raman spectrometers, fluorescence measurement systems, absorption spectroscopes, and reflective probes, all utilizing fiber bundles or single fibers for efficient light coupling and delivery. This market is defined by continuous miniaturization and enhanced portability, meeting the growing demand for real-time, on-site analytical capabilities across diverse industries.

The core product description centers on highly modular systems comprising light sources (such as LEDs, lasers, or broadband lamps), fiber optic cables and probes (designed for specific geometries like reflection, transmission, or immersion), and the spectrometer itself, which disperses the collected light onto a highly sensitive detector (e.g., CCD, CMOS, or InGaAs arrays). Major applications span quality control in pharmaceuticals and food processing, environmental monitoring (water quality and pollution detection), fundamental research in chemistry and physics, and increasingly, medical diagnostics (non-invasive tissue analysis). The inherent benefits of these instruments—including rapid measurement speed, non-destructive testing capabilities, high sensitivity, and the ability to perform measurements remotely—make them indispensable tools in modern analytical science, driving widespread adoption across industrial and academic sectors seeking operational efficiency and enhanced data acquisition.

Driving factors supporting the robust growth of the Fiber Optic Spectroscopy Instruments Market include the escalating global focus on industrial automation and process analytical technology (PAT), particularly within the chemical and petrochemical sectors, which necessitates continuous, in-line monitoring for quality assurance. Furthermore, the rising investment in advanced materials research, coupled with expanding applications in biotechnology and clinical point-of-care testing, mandates flexible and accurate analytical devices. The technological advances leading to lower-cost, high-performance miniature spectrometers, coupled with the development of specialized fiber probes capable of surviving harsh chemical environments or providing highly localized measurements, further propel market expansion by lowering the barrier to entry and enhancing the utility of these instruments across new and challenging analytical tasks.

Fiber Optic Spectroscopy Instruments Market Executive Summary

The Fiber Optic Spectroscopy Instruments Market is experiencing dynamic business trends characterized by a strong shift toward digitalization, integration with Internet of Things (IoT) platforms, and the increasing incorporation of advanced algorithms for automated data processing and calibration. Key market players are prioritizing strategic partnerships with software providers and systems integrators to deliver comprehensive, end-to-end analytical solutions rather than standalone hardware components, driving value proposition improvements in sectors like pharmaceutical manufacturing (for regulatory compliance) and large-scale industrial quality assurance. Furthermore, there is a pronounced consolidation trend aimed at acquiring specialized sensor technology or enhancing proprietary data analysis capabilities, positioning companies to capitalize on the demand for high-throughput, real-time measurement systems that reduce reliance on centralized laboratory infrastructure, thereby optimizing overall operational expenditure for end-users across various manufacturing domains.

Regionally, North America and Europe currently dominate the market, primarily due to substantial existing research infrastructure, high adoption rates of PAT in regulated industries, and significant government funding directed towards advanced scientific instrumentation and biomedical research. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory over the forecast period, fueled by rapid industrialization, burgeoning investments in food safety and quality control (particularly in China and India), and the increasing establishment of advanced manufacturing hubs seeking to implement continuous process monitoring techniques to maintain global competitive standards. Specific regional trends include increased localized manufacturing efforts in APAC to circumvent complex supply chain logistics and tariffs, simultaneously catering to the unique spectral analytical needs prevalent in regional agricultural and environmental monitoring applications.

Segment trends indicate that the Raman spectroscopy segment, utilizing specialized fiber probes, is witnessing accelerated growth owing to its unique capability for molecular fingerprinting and non-destructive material identification, finding strong traction in chemical detection and forensic applications. Moreover, the component segment, specifically related to miniaturized detectors and high-grade optical fibers optimized for low noise and superior spectral range transmission, is expanding rapidly, supported by the ongoing trend of creating handheld and portable analytical devices for field use. In terms of application, the environmental and agricultural segment is demonstrating robust compound growth, driven by global pressures to monitor soil composition, water contamination, and crop health using rapid, accessible fiber optic sensing technologies, displacing slower, more resource-intensive traditional laboratory methodologies.

AI Impact Analysis on Fiber Optic Spectroscopy Instruments Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fiber Optic Spectroscopy Instruments Market frequently revolve around three core themes: the potential for AI-driven spectral interpretation and quantification, the automation of complex calibration and drift correction processes, and the integration of machine learning for real-time anomaly detection in high-throughput industrial settings. Users express high expectations that AI will solve challenges related to overlapping spectral features and noise reduction, which traditionally require specialized expertise and time-consuming multivariate analysis. The key concern, however, often centers on data governance, model validation, and the need for standardized AI-ready spectral databases to ensure the reliability and transparency of autonomous analytical decisions, particularly in heavily regulated sectors like pharmaceuticals and medical diagnostics where verifiable results are mandatory for compliance.

The consensus emerging from user interest is that AI will fundamentally transform fiber optic spectroscopy from a measurement tool into an intelligent analytical system. Current systems generate large volumes of raw spectral data, which often requires significant post-processing. AI, specifically deep learning models, promises to analyze these complex, multi-dimensional datasets instantaneously, allowing operators with minimal spectroscopic training to achieve expert-level diagnostic results directly in the field or on the production line. This shift enhances the accessibility of advanced spectroscopy, expanding its deployment beyond specialized laboratories into diverse industrial and clinical environments, thereby multiplying the market reach and utilization frequency of fiber optic instruments.

Furthermore, AI is pivotal in optimizing the performance and longevity of the hardware itself. Machine learning algorithms can be trained on vast amounts of historical data related to instrument degradation, temperature fluctuations, and source variability to predict maintenance needs and perform proactive, automated recalibration of the spectrometer components and fiber optics. This predictive maintenance capability minimizes downtime and ensures measurement accuracy over prolonged operational periods, which is critical for continuous monitoring applications. The expectation is that AI integration will become a fundamental competitive differentiator, determining which instruments are favored for large-scale industrial deployment requiring maximum uptime and minimal human intervention.

- AI enhances spectral deconvolution, improving accuracy in complex mixtures.

- Machine learning enables real-time quantitative analysis and predictive calibration drift correction.

- Deep learning models automate quality control by detecting subtle spectral anomalies in high-speed processes.

- AI facilitates the creation of robust, portable analytical instruments requiring less specialized user input.

- Integration with cloud-based AI services optimizes data storage, processing, and collaborative analysis.

- AI algorithms assist in optimizing fiber probe design and light coupling efficiency for specific applications.

DRO & Impact Forces Of Fiber Optic Spectroscopy Instruments Market

The dynamics of the Fiber Optic Spectroscopy Instruments Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces that dictate strategic direction and market permeability. The primary drivers include the escalating global demand for rapid, non-destructive, and real-time analytical techniques, coupled with the increasing necessity for process optimization across manufacturing sectors, especially pharmaceuticals, food and beverage, and chemicals. These drivers are intrinsically linked to the inherent mobility and flexibility offered by fiber-based systems, enabling deployment in harsh or inaccessible environments where conventional benchtop systems cannot function effectively. Simultaneously, market growth is fueled by continuous technological innovations that result in smaller, lighter, and more cost-effective spectral engines, broadening the potential customer base to include smaller research facilities and specialized field operations.

Restraints, however, pose significant challenges to widespread adoption, notably the relatively high initial capital expenditure associated with high-resolution spectrometer systems and specialized fiber optic probes, particularly for entry-level users or smaller enterprises in developing economies. Technical complexities related to precise light coupling, signal attenuation over very long fiber runs, and the difficulty in generating robust calibration models for complex matrices also limit immediate plug-and-play usability. Furthermore, the market faces constraints related to the need for highly skilled personnel capable of operating, maintaining, and accurately interpreting the multivariate spectral data generated, although AI integration is beginning to mitigate this skill gap challenge over time by automating key analytical functions.

Opportunities for exponential growth are concentrated in emerging applications, particularly in personalized medicine, where fiber optic probes facilitate minimally invasive diagnostic procedures, and in the burgeoning market for advanced semiconductor and display manufacturing, requiring ultra-precise material characterization. The massive push toward sustainable practices also creates demand for fiber optic sensors used in continuous environmental monitoring of pollutants and greenhouse gases. The primary Impact Force is the velocity of technology convergence, specifically the merging of micro-electro-mechanical systems (MEMS) technology with high-performance optical sensors, accelerating miniaturization and integration capabilities. This convergence, coupled with the rising regulatory pressures emphasizing quality assurance and traceability across global supply chains, creates a compelling environment that favors the adoption of robust, data-rich analytical solutions like fiber optic spectroscopy systems, strongly influencing purchasing decisions across all major industrial verticals.

Segmentation Analysis

The Fiber Optic Spectroscopy Instruments Market is comprehensively segmented based on key parameters including component type, application, end-user industry, and spectral range, providing a detailed framework for understanding market dynamics and specific growth pockets. Segmentation by component type reflects the technological architecture, differentiating between the core spectrometer unit, the light source module, the specific fiber optic probes and sensors used for sampling, and the requisite software platform for data acquisition and analysis. This segmentation is crucial as the performance and cost of a system are heavily dependent on the choice and quality of each individual component, particularly the detector arrays and the specialized fiber material chosen for specific spectral transmission characteristics and environmental robustness.

Segmentation by application reveals the diversity of uses, ranging from quantitative analysis (concentration measurement) and qualitative analysis (material identification) to in-line process monitoring and specialized biomedical imaging, demonstrating the versatility of the underlying technology. This analysis highlights segments like Raman spectroscopy for chemical identification versus general UV-Vis spectroscopy for concentration measurements, allowing market participants to target specific high-value analytical problems. Furthermore, the end-user industry segmentation—spanning pharmaceuticals, food and beverage, environmental monitoring, research and academia, and life sciences—provides insight into procurement cycles, regulatory requirements, and the scale of deployment, with pharmaceutical companies typically requiring higher regulatory compliance and validation documentation than academic research facilities.

Finally, segmentation by spectral range (UV-Vis, NIR, Mid-IR) reflects the analytical function performed, as different molecules absorb or emit light at distinct wavelengths. Near-Infrared (NIR) fiber optic systems are particularly relevant for analyzing materials with hydrogen bonds, such as moisture, protein, and fat content in food or polymers in plastics, driving strong growth in industrial process control. Conversely, UV-Vis systems remain crucial for high-precision liquid analysis in chemical and biochemical laboratories. Detailed analysis across these axes helps manufacturers optimize product portfolios, align technological development with end-user needs, and accurately forecast demand across various geographical and industrial landscapes, ensuring market strategy remains agile and responsive to evolving technical requirements.

- By Component:

- Spectrometer Units (Benchtop, Portable, Miniature)

- Light Sources (Halogen, Deuterium, LED, Laser)

- Fiber Optic Probes and Sensors (Reflection, Transmission, Immersion, Remote Sensing)

- Software and Data Analysis Tools

- By Spectral Range:

- Ultraviolet-Visible (UV-Vis) Spectroscopy

- Near-Infrared (NIR) Spectroscopy

- Raman Spectroscopy

- Other Advanced Techniques (e.g., Fluorescence)

- By Application:

- Process Analytical Technology (PAT) and Quality Control

- Research and Development

- Environmental Monitoring

- Life Sciences and Medical Diagnostics

- Semiconductor and Material Characterization

- By End-User:

- Pharmaceutical and Biotechnology Industries

- Chemical and Petrochemical Industries

- Food and Agriculture

- Academic and Government Research

- Environmental and Clinical Laboratories

Value Chain Analysis For Fiber Optic Spectroscopy Instruments Market

The Value Chain for the Fiber Optic Spectroscopy Instruments Market is characterized by highly specialized stages, beginning with upstream raw material suppliers and culminating in complex downstream integration and end-user application support. Upstream analysis focuses on the sourcing of critical components: high-purity glass, specialty polymers for fiber jacketing, sophisticated sensor materials for detector arrays (e.g., InGaAs, silicon CCDs), and precision optical elements like diffraction gratings and mirrors. Key upstream activities involve advanced manufacturing techniques for optical fibers capable of maintaining high transmission fidelity over wide spectral ranges, often requiring strict quality control to minimize signal noise and attenuation. Strategic partnerships with highly specialized component manufacturers are crucial in this phase, as performance differentiation often hinges on the quality of these foundational elements, directly impacting the final instrument's sensitivity and resolution capabilities.

The manufacturing and assembly stage involves integrating these high-precision components into functional spectrometer units and robust fiber optic probes. This midstream activity includes complex tasks such as grating alignment, detector cooling integration, and securing the fiber-to-spectrometer coupling for optimal light throughput—processes that require high levels of engineering expertise and proprietary calibration methodologies. Distribution channels are varied, encompassing direct sales for large, complex industrial PAT installations where bespoke integration is required, and indirect channels relying on specialized distributors and scientific equipment suppliers who offer localized support, application expertise, and technical calibration services. The choice of channel is often dictated by the complexity of the sale; standardized, portable systems frequently move through indirect channels, while highly customized systems for biomedical or semiconductor use are often handled directly by the manufacturer’s technical sales teams.

Downstream analysis is dominated by the system integration, application engineering, and post-sales support necessary to ensure successful end-user adoption. In industries like pharma, downstream activities involve stringent system validation and regulatory compliance assistance. Potential customers often require extensive training on data interpretation and maintenance protocols. The value chain emphasizes service and integration, recognizing that the hardware is only one part of the solution; successful deployment relies heavily on robust software, custom calibration models (especially important for NIR and Raman applications), and responsive technical support. This focus on long-term service adds significant value downstream, creating opportunities for recurring revenue streams through maintenance contracts and software updates, cementing customer loyalty and driving differentiation among competitors based on overall solution efficacy rather than just hardware specifications.

Fiber Optic Spectroscopy Instruments Market Potential Customers

Potential customers for Fiber Optic Spectroscopy Instruments are broadly categorized into three major groups: research and development institutions, heavily regulated industrial manufacturing sectors, and emerging non-traditional field analysis users. Research institutions, including universities and government laboratories, represent a foundational customer base driven by the need for high-precision, flexible analytical tools to support fundamental research in material science, chemistry, and physics. These customers prioritize instrument resolution, broad spectral range coverage, and compatibility with diverse experimental setups, often requiring modular systems that can be easily customized with various light sources and detectors to adapt to evolving research requirements. Their purchasing decisions are frequently influenced by grant availability and the need for cutting-edge technology that can facilitate publishable results and advanced scientific discovery.

The industrial sector constitutes the largest and most rapidly growing customer segment, encompassing pharmaceutical manufacturers, petrochemical refineries, food and beverage processing plants, and semiconductor fabrication facilities. These users are primarily concerned with implementing Process Analytical Technology (PAT) for continuous quality control, real-time process monitoring, and reducing waste. For pharmaceutical companies, the instruments are essential for verifying raw materials, monitoring reaction kinetics, and ensuring final product uniformity, driven by strict regulatory mandates (e.g., FDA). Industrial buyers prioritize robustness, long-term stability, ease of integration into automated manufacturing lines, and the ability of the system to withstand harsh operational environments, emphasizing total cost of ownership (TCO) and return on investment (ROI) derived from enhanced efficiency and reduced batch failure rates.

Emerging and specialized customers include environmental protection agencies, agricultural technicians, and clinical point-of-care providers. Environmental customers utilize portable fiber optic systems for rapid field screening of water and soil contamination, valuing portability, battery life, and durability in non-laboratory settings. Agricultural users apply NIR fiber probes for immediate assessment of crop health, soil nutrients, and food quality characteristics at harvest time, prioritizing rapid, actionable data. Clinical customers leverage highly specialized fiber optic probes for non-invasive diagnostics (ee.g., spectroscopic analysis of skin or tissue), demanding miniaturization, sterilization compatibility, and integration with existing medical device platforms. This diverse base highlights the market’s expansive reach, extending far beyond the traditional centralized laboratory environment towards decentralized, application-specific analytical solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ocean Insight, Metrohm AG, B&W Tek (Tek-Solutions), Avantes BV, Hamamatsu Photonics K.K., StellarNet Inc., Horiba Ltd., PerkinElmer Inc., Renishaw plc, Wasatch Photonics, Princeton Instruments (Teledyne Technologies), Bristol Instruments, Viavi Solutions, Analytik Jena, Thermo Fisher Scientific, Agilent Technologies, Kaiser Optical Systems (Endress+Hauser), FOSS A/S, Sciencetech Inc., Edinburgh Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Optic Spectroscopy Instruments Market Key Technology Landscape

The technological landscape of the Fiber Optic Spectroscopy Instruments Market is defined by continuous innovation across three main pillars: enhanced detector technology, specialized fiber and probe engineering, and sophisticated signal processing and software integration. Detector advancements, particularly the transition from traditional CCD to high-sensitivity CMOS and specialized InGaAs arrays for NIR, are critical in improving spectral resolution and signal-to-noise ratios, especially important for detecting trace components or performing rapid measurements under low light conditions. Furthermore, the development of miniaturized and thermally stabilized detectors (often utilizing Peltier cooling) is enabling the creation of robust, high-performance handheld devices suitable for field deployment, thereby broadening the application scope and reducing the physical footprint required for complex analytical tasks in industrial settings.

Fiber and probe engineering represents another crucial area of innovation. Manufacturers are developing specialty fibers, such as those made from chalcogenide glass for mid-infrared transmission or high-OH silica fibers optimized for deep UV transmission, which overcome the spectral limitations of standard silica fibers. Probes are increasingly designed for specific harsh or complex sampling scenarios, including immersion probes for corrosive liquids, robust reflection probes for high-temperature surfaces, and specialized needle probes for biomedical tissue analysis. The integration of proprietary light coupling techniques and anti-reflective coatings on probe surfaces minimizes light loss and maximizes signal delivery to the spectrometer, ensuring reliable, reproducible data acquisition even in challenging process environments where optical alignment stability is often compromised by vibration or temperature shifts.

Software and data processing advancements are transforming raw measurement into actionable insights. Modern fiber optic spectroscopy systems heavily rely on multivariate analysis (MVA) techniques, chemometrics, and, increasingly, machine learning algorithms embedded within the instrument software to automatically interpret complex spectra, separate overlapping signals, and quantify multiple components simultaneously without extensive user intervention. Key technology trends include seamless software integration with laboratory information management systems (LIMS) and industrial control systems (PLCs), enabling automated feedback loops for real-time process control. Furthermore, cloud computing infrastructure is facilitating remote diagnostics, collaborative data sharing, and centralized calibration management across distributed networks of instruments, positioning the technology as a key enabler for Industry 4.0 initiatives requiring decentralized analytical monitoring capabilities.

Regional Highlights

- North America: This region maintains market leadership due to substantial R&D expenditure, particularly within the life sciences, defense, and pharmaceutical sectors. The stringent regulatory environment in the U.S. and Canada drives the adoption of PAT tools for quality assurance. Major technology hubs and the presence of leading spectrometer manufacturers and specialized fiber optic component suppliers create a mature and highly innovative market. High integration rates of spectroscopy instruments into clinical diagnostic tools and advanced research infrastructure ensure sustained demand and continuous upgrading of existing analytical platforms.

- Europe: Characterized by strong governmental support for industrial automation (e.g., Germany's Industry 4.0 initiative) and a highly active environmental monitoring sector. Countries like Germany, the UK, and France are major adopters of fiber optic spectroscopy in the chemical, food safety, and automotive industries. Regulatory compliance requirements, such as those governing chemical registration (REACH), necessitate precise material identification and quantification, bolstering the market for Raman and NIR systems. Emphasis on sustainability and circular economy practices further promotes the use of these instruments for recycling and waste material characterization.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily driven by rapid industrial expansion, increasing investment in domestic scientific research, and heightened consumer awareness regarding food safety and quality in major economies like China, India, Japan, and South Korea. Government initiatives focusing on building advanced manufacturing capabilities and establishing world-class testing laboratories fuel significant infrastructure investment. The shift of pharmaceutical manufacturing and semiconductor production to this region necessitates high-throughput, automated analytical tools, accelerating the adoption of fiber optic PAT solutions across the industrial base.

- Latin America: This region exhibits moderate but accelerating growth, primarily centered on key economic sectors such as agriculture (soil and crop analysis), mining (material grading and process control), and the nascent pharmaceutical manufacturing sector in countries like Brazil and Mexico. Market penetration is often focused on portable and ruggedized systems suitable for challenging field environments, driven by the need for localized quality control checks in remote areas, although adoption rates are heavily influenced by currency stability and foreign investment in local industries.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the petrochemical and oil and gas industries, where fiber optic sensors are crucial for remote monitoring of pipelines, process streams, and refinery operations under extreme temperature and pressure conditions. Additionally, increasing investments in water desalination and quality control infrastructure in the Gulf Cooperation Council (GCC) countries are driving demand for specialized analytical instrumentation, though the market remains highly dependent on capital projects and foreign technology imports for high-end systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Optic Spectroscopy Instruments Market.- Ocean Insight

- Metrohm AG

- B&W Tek (Tek-Solutions)

- Avantes BV

- Hamamatsu Photonics K.K.

- StellarNet Inc.

- Horiba Ltd.

- PerkinElmer Inc.

- Renishaw plc

- Wasatch Photonics

- Princeton Instruments (Teledyne Technologies)

- Bristol Instruments

- Viavi Solutions

- Analytik Jena

- Thermo Fisher Scientific

- Agilent Technologies

- Kaiser Optical Systems (Endress+Hauser)

- FOSS A/S

- Sciencetech Inc.

- Edinburgh Instruments

Frequently Asked Questions

Analyze common user questions about the Fiber Optic Spectroscopy Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of fiber optic spectroscopy over traditional benchtop systems?

The primary advantage is the capacity for remote and non-destructive measurement. Fiber optic systems allow the core spectrometer unit to remain stable in a laboratory or control room while the fiber probe can be deployed directly into harsh environments, manufacturing lines, or sensitive samples, enabling real-time analysis without physically moving the sample or requiring complex sample preparation.

Which spectral range segment is experiencing the fastest growth rate?

The Near-Infrared (NIR) spectroscopy segment is experiencing the fastest growth, primarily driven by its indispensable role in Process Analytical Technology (PAT) across the food, pharmaceutical, and chemical industries. NIR is ideal for non-destructive analysis of organic compounds, moisture content, and polymer composition, supporting continuous, high-speed quality control applications.

How does AI integrate with fiber optic spectroscopy instruments?

AI integrates by providing sophisticated data analysis and interpretation capabilities. Machine learning algorithms are used for chemometric modeling, automated identification of complex mixtures (spectral deconvolution), reducing noise, and enabling real-time quantitative analysis and predictive calibration, thereby lowering the need for specialized human spectroscopic expertise.

What major restraints hinder the broader adoption of this technology?

Major restraints include the high initial capital investment required for high-resolution systems and specialized fiber probes, which can be prohibitive for small laboratories. Additionally, ensuring system stability and accuracy in highly variable industrial environments, alongside the need for specialized training to interpret complex multivariate spectral data, acts as a barrier to entry for generalized users.

Which end-user industry is the largest consumer of fiber optic spectroscopy systems?

The Pharmaceutical and Biotechnology industry is the largest consumer, driven by mandatory regulatory requirements for continuous quality control (PAT), rapid raw material verification, and process monitoring during drug manufacturing. The non-destructive nature and speed of fiber optic spectroscopy are crucial for maintaining compliance and optimizing batch throughput in this highly regulated sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager