Fiber Sintered Felt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433173 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fiber Sintered Felt Market Size

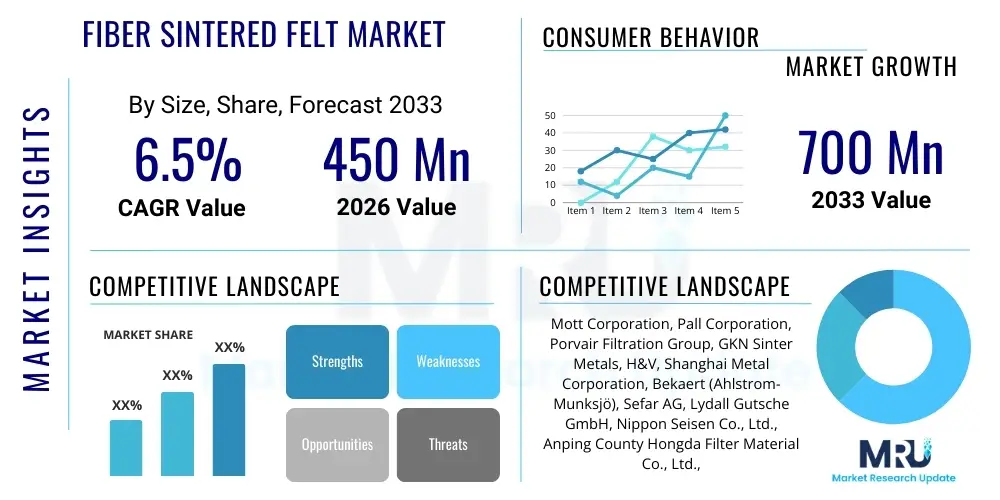

The Fiber Sintered Felt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-efficiency filtration media, particularly in rigorous industrial environments such as high-temperature gas filtration and aggressive chemical processing. The inherent structural integrity, exceptional corrosion resistance, and precise pore size distribution offered by fiber sintered felt materials position them as indispensable components where conventional filtration materials fail to meet stringent performance and longevity requirements. Furthermore, advancements in metal fiber technology and sintering processes are continually expanding the applicability of these specialized materials across emerging sectors, including advanced battery technology and hydrogen fuel cells, thereby solidifying the market’s positive revenue forecast through the coming decade.

Fiber Sintered Felt Market introduction

Fiber Sintered Felt, often referred to as metal fiber felt, is a high-performance porous material manufactured by laying ultra-fine metal fibers (such as stainless steel, nickel, or titanium) into a web, followed by high-temperature vacuum sintering. This sintering process bonds the contact points of the fibers, resulting in a highly stable, three-dimensional, interconnected porous structure with exceptional strength and uniform permeability. Unlike woven mesh or powder sintered materials, the felt structure provides higher porosity (up to 90%) and lower flow resistance, making it superior for applications requiring high flow rates and precise separation efficiencies. The resultant material exhibits outstanding heat resistance, chemical inertness, and mechanical stability, rendering it suitable for extreme operating conditions prevalent in critical industrial processes.

Major applications of fiber sintered felt span across highly demanding industries, primarily focusing on filtration, diffusion, and catalyst support. In filtration, they are crucial for hot gas filtration, polymer filtration in the petrochemical sector, and hydraulic oil filtration in aerospace systems. As catalyst supports, they provide a robust, high-surface-area substrate for chemical reactions, particularly in automotive emission control and industrial chemical synthesis. Key benefits driving adoption include their regenerability (allowing for easy backwashing and reuse), long service life, ability to maintain structural integrity under differential pressure, and precise control over micron ratings, ensuring optimal process purity and system protection. These technical advantages reinforce their preference over disposable or less durable media in high-value manufacturing and environmental protection technologies.

The market growth is substantially driven by the rigorous implementation of environmental regulations globally, particularly concerning industrial emissions and wastewater treatment, which necessitates advanced separation technologies. Simultaneously, the sustained expansion of the chemical and petrochemical industries, coupled with significant investments in aerospace and defense technologies—where reliability is non-negotiable—provides a robust demand foundation. Furthermore, the burgeoning green energy sector, specifically the development of proton exchange membrane (PEM) fuel cells and high-temperature solid oxide fuel cells (SOFCs) utilizing fiber sintered components for gas diffusion layers and flow field plates, acts as a pivotal factor accelerating market expansion and technological innovation across various geographical regions.

Fiber Sintered Felt Market Executive Summary

The Fiber Sintered Felt market is undergoing significant expansion, driven by crucial business trends centered on material innovation and strategic industry penetration. Companies are heavily investing in developing new alloy compositions, such as those incorporating titanium and specialized nickel alloys, to enhance performance in ultra-corrosive or extremely high-temperature environments, specifically targeting nuclear and specialized chemical processing sectors. Furthermore, there is a distinct trend towards automation and process optimization in manufacturing to reduce the historically high production costs associated with fiber drawing and sintering, thereby improving scalability and overall market competitiveness. Strategic partnerships between felt manufacturers and major Original Equipment Manufacturers (OEMs) in the filtration and aerospace domains are accelerating product standardization and market accessibility, positioning fiber sintered felt as a foundational material for next-generation industrial equipment globally.

Regionally, Asia Pacific (APAC) dominates the consumption and production landscape, fueled by rapid industrialization, especially in China and India, focusing on expanding their chemical, polymer, and automotive manufacturing capacities. North America and Europe maintain strong market positions characterized by stringent regulatory frameworks mandating the use of high-efficiency pollution control devices, driving demand for advanced hot gas filtration elements. Europe, in particular, showcases robust growth spurred by intense focus on sustainable energy solutions and hydrogen technology development, where metal fiber felt components are essential for efficiency improvement and longevity. The Middle East and Africa (MEA) are emerging areas, primarily driven by substantial investments in petrochemical refining and power generation infrastructure projects requiring high-quality separation technologies.

Segmentation trends highlight the Material segment, with stainless steel (specifically 316L) remaining the dominant material due to its balance of cost, corrosion resistance, and mechanical properties. However, demand for nickel-based felts is accelerating rapidly in the chemical and aerospace sectors where extreme chemical resistance is paramount. The Application segment is heavily skewed toward high-end industrial filtration, but the fastest growing application is catalyst support, driven by global efforts to improve catalytic efficiency and reduce harmful emissions. The End-Use Industry analysis reveals that Chemical and Petrochemical sectors are the largest consumers, while the Energy (particularly fuel cells and nuclear) and Aerospace sectors represent the highest growth potential, characterized by high-value, low-volume consumption of specialized felt products requiring stringent certification and quality control.

AI Impact Analysis on Fiber Sintered Felt Market

Common user questions regarding AI's impact on the Fiber Sintered Felt market often revolve around optimizing the complex manufacturing process, predicting material performance under varying stress conditions, and enhancing quality control. Users are concerned about how AI can mitigate the high variance often seen in specialized sintering processes and whether predictive analytics can minimize material wastage, which is significant given the cost of metal fibers. Key themes emerging include utilizing machine learning (ML) for real-time monitoring of sintering furnace parameters (temperature, vacuum level, holding time) to achieve superior uniformity in pore structure and permeability. Expectations are high that AI will revolutionize quality assurance by analyzing vast image datasets derived from microscopic examination, identifying defects far faster and more accurately than human operators, and ultimately reducing the cost and time associated with rigorous qualification processes required by high-reliability end-users like aerospace and medical device manufacturers.

- AI-driven optimization of sintering furnace parameters for enhanced structural uniformity.

- Predictive maintenance analytics applied to production machinery, minimizing downtime and optimizing throughput.

- Machine learning algorithms utilized for advanced quality inspection and defect detection in felt microstructures.

- Simulation and modeling using AI to predict the long-term filtration efficiency and mechanical degradation under specific industrial stresses.

- Automated supply chain management optimizing inventory levels of high-cost metal fibers (e.g., titanium, specialized nickel alloys).

- Development of AI-assisted design tools to rapidly prototype felt structures with customized porosity and permeability characteristics for niche applications.

- Enhanced energy efficiency in high-temperature processing stages through smart control systems informed by real-time data analysis.

DRO & Impact Forces Of Fiber Sintered Felt Market

The dynamics of the Fiber Sintered Felt market are dictated by a sophisticated interplay of factors that both accelerate and constrain growth. The primary driving force centers on the global shift towards high-performance industrial standards, particularly in demanding sectors such as high-temperature gas treatment, polymer filtration, and fuel cell technology, which require materials capable of surviving harsh chemical and thermal stress while maintaining superior efficiency. This demand is reinforced by increasingly strict governmental environmental mandates across industrialized and developing nations, compelling industries to adopt superior separation technologies to reduce atmospheric emissions and ensure product purity. These drivers ensure sustained investment in research and development aimed at improving material specifications and manufacturing efficiencies, thereby expanding the potential application envelope of the felt materials. The impact of these drivers is substantial, leading to steady annual growth rates and technological maturation within the supply chain.

However, the market faces significant restraints, most notably the inherently high manufacturing cost associated with producing fiber sintered felt. The process requires specialized equipment for ultra-fine metal fiber drawing, high-temperature vacuum sintering, and stringent quality control, leading to high capital expenditure and operational costs. Furthermore, the cost of raw materials, particularly high-purity nickel and exotic alloys, can be volatile, introducing pricing instability for end-users. Another restraint is the limited awareness and technical understanding among potential users in less specialized industrial fields, who often default to less expensive, albeit less performant, conventional media. These restraints necessitate strategic pricing models and increased market education efforts by major manufacturers to justify the superior total cost of ownership (TCO) offered by sintered felt over its extended service life, which is a critical point for overcoming initial price sensitivity in diverse industrial segments.

Opportunities for exponential growth are concentrated in the rapidly expanding clean energy sectors, particularly hydrogen production and storage technologies, where fiber sintered materials are essential for gas diffusion layers in PEM fuel cells and filters in hydrogen compressors. The growing adoption of advanced manufacturing techniques, such as additive manufacturing (AM) used in conjunction with metal powders to create hybrid structures, presents an avenue for optimizing material usage and customizing intricate geometries previously unattainable. Impact forces on the market are high, driven by technological obsolescence pressure from alternative advanced filtration media and the intense scrutiny on material performance in critical aerospace and medical applications. The necessity for zero-defect materials in these high-stakes environments places significant pressure on manufacturers to maintain unparalleled quality control, thereby influencing market competition and technological investment priorities across the key manufacturing regions.

Segmentation Analysis

The Fiber Sintered Felt Market is comprehensively segmented based on Material Type, Application, and End-Use Industry, providing a nuanced view of consumption patterns and future growth areas. Analysis reveals that segmentation is crucial for understanding the market's trajectory, as performance characteristics are inextricably linked to the base material utilized and the specific demands of the intended application. For instance, the choice between stainless steel and nickel felt is entirely dictated by the required chemical resistance and operating temperature of the filtration system. The market’s complexity is a reflection of the specialized nature of its end-use environments, where a one-size-fits-all approach is impractical, necessitating a deep segmentation approach to effectively capture value and address diverse technical specifications demanded by global industries.

- Material Type

- Stainless Steel (316L, 304L, 347)

- Nickel and Nickel Alloys (Inconel, Monel, Hastelloy)

- Titanium and Titanium Alloys

- Iron-Chrome-Aluminum (FeCrAl)

- Other Exotic Alloys (e.g., Cobalt-based)

- Application

- High-Temperature Gas Filtration

- Polymer Filtration

- Catalyst Support and Diffusion

- Hydraulic and Lubricating Oil Filtration

- Acoustic Damping and Sound Absorption

- Fluidizing Media

- End-Use Industry

- Chemical and Petrochemical

- Aerospace and Defense

- Automotive (Emission Control)

- Pharmaceutical and Biotechnology

- Energy and Power Generation (Including Fuel Cells)

- Semiconductor and Electronics

Value Chain Analysis For Fiber Sintered Felt Market

The value chain for the Fiber Sintered Felt Market is intricate, commencing with the highly specialized upstream production of ultra-fine metal fibers and concluding with downstream integration into complex filtration systems or catalytic reactors. Upstream activities involve specialized metallurgy and fiber drawing, where highly pure metal ingots are processed into fibers typically ranging from 2 to 50 microns in diameter. These fibers are then processed into felt via non-woven web laying and subsequent high-temperature vacuum sintering—a critical step that requires immense precision and capital investment. Raw material quality, particularly the purity of stainless steel and nickel alloys, significantly influences the final product’s porosity and mechanical strength, making supplier partnerships in this stage essential for maintaining a competitive edge in performance and cost.

The core manufacturing stage involves converting the sintered felt into final products, which often requires complex cutting, pleating, welding, and casing processes to create cartridges, discs, or custom-shaped elements. Distribution channels are varied, involving direct sales to large Original Equipment Manufacturers (OEMs) in aerospace and specialized chemical processing, providing materials used in the manufacture of their finished systems. Indirect distribution typically involves specialized industrial distributors and filtration system integrators who purchase standard felt sheets or components and incorporate them into bespoke filtration units for smaller or regional end-users. The reliance on highly technical knowledge necessitates that both direct and indirect channels provide extensive technical support and application expertise to ensure correct material selection and implementation.

Downstream analysis focuses on the integration and utilization of the felt in end-user systems. For instance, in petrochemicals, the felt element is integrated into large-scale polymer melt filtration systems, while in aerospace, it forms part of high-pressure hydraulic filters. The efficiency and longevity of the sintered felt directly impact the operational costs and reliability of these high-value industrial assets. Feedback loops from these downstream users are crucial for manufacturers, driving improvements in pore size distribution consistency and resistance to chemical fouling. The structure of the value chain, with high barriers to entry in both the upstream fiber production and the core sintering process, emphasizes the importance of vertical integration or robust, long-term strategic supplier agreements for market leaders seeking sustainable growth and supply security, especially for high-demand, specialized materials.

Fiber Sintered Felt Market Potential Customers

Potential customers for Fiber Sintered Felt are predominantly large industrial enterprises and specialized manufacturers operating in environments requiring superior material durability, high-efficiency separation, or precise fluid dynamics control. Key end-users/buyers include major chemical companies (e.g., Dow Chemical, BASF) requiring stringent polymer melt filtration to ensure product quality and eliminate contaminants, and petrochemical refiners utilizing hot gas filters for catalyst protection and emission control. Aerospace and defense contractors (such as Boeing, Lockheed Martin) are critical buyers for hydraulic system filters, pneumatic breathers, and acoustic damping elements where failure is not permissible, prioritizing material reliability and certification above all else.

Furthermore, the rapidly evolving energy sector represents a growing customer base, including manufacturers of advanced energy storage systems and fuel cells (e.g., Ballard Power Systems, Plug Power). These companies purchase metal fiber felt for use as gas diffusion layers (GDLs) in proton exchange membrane fuel cells or filters within complex hydrogen processing chains. Pharmaceutical and Biotechnology firms, where sterile processing and precise particle removal are paramount, represent another high-value segment, utilizing these materials for sterile vent filtration and high-purity fluid processing. The diversity in end-user requirements mandates that felt manufacturers maintain highly adaptable production capabilities capable of meeting diverse material specifications, regulatory compliance (e.g., FDA, REACH, AS9100), and custom geometry demands across the specialized customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mott Corporation, Pall Corporation, Porvair Filtration Group, GKN Sinter Metals, H&V, Shanghai Metal Corporation, Bekaert (Ahlstrom-Munksjö), Sefar AG, Lydall Gutsche GmbH, Nippon Seisen Co., Ltd., Anping County Hongda Filter Material Co., Ltd., Surefil Technologies, Hebei Huade Filter Co., Ltd., TISAN Materials Co., Ltd., Micro-Tech Filtration Pvt. Ltd., Taizhou City Dongfang Filter Material Co., Ltd., Wuxi T-King Filtration Machinery Co., Ltd., BOE Technology Group Co., Ltd., JFE Steel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Sintered Felt Market Key Technology Landscape

The technological landscape of the Fiber Sintered Felt Market is characterized by continuous refinement in fiber metallurgy, web formation, and sintering science, aimed at achieving ultra-uniformity and tailored porosity profiles. A critical technology is the precision drawing of ultra-fine metal fibers, which are typically less than 10 microns in diameter, demanding specialized equipment and highly controlled environments to prevent oxidation and ensure dimensional consistency. Advances in fiber coating technologies, sometimes incorporating ceramic or metallic nano-coatings before sintering, are emerging to enhance surface area and catalytic activity, moving the material beyond simple filtration and into high-performance chemical reaction systems. The ability to manage the delicate fiber structure throughout the process—from forming the web using air laying or wet laying techniques to the final sintering—is the fundamental competitive differentiator among leading manufacturers.

Sintering technology itself is paramount; modern manufacturers utilize high-vacuum, controlled-atmosphere furnaces operating at precise temperature regimes to achieve optimal metallurgical bonding without melting the individual fibers. Key innovations include advanced thermal mapping and simulation techniques used to ensure consistent temperature distribution throughout large furnace loads, which is essential for uniform pore size distribution across the finished felt sheet. Furthermore, the integration of advanced laser cutting and welding technologies allows for the fabrication of complex geometric shapes with minimal thermal distortion, which is critical for producing specialized filter cartridges used in high-pressure and high-flow environments like aerospace hydraulic systems. These advanced fabrication methods improve yield rates and reduce material waste, directly addressing the restraint of high production costs.

In terms of quality assurance, non-destructive testing (NDT) and advanced microscopic analysis techniques, often augmented by AI for rapid image processing, are defining the technological edge. Permeability testing apparatus capable of measuring gas or liquid flow rates with extremely high precision are standard, ensuring that every batch meets rigorous specifications, particularly the Bubble Point Test which determines the largest pore size. The emerging use of additive manufacturing, specifically laser powder bed fusion, in combination with sintered felt allows for the creation of hybrid filter elements where the felt provides fine filtration and the additive manufactured frame provides structural support and integrated flow channels. This technological convergence promises highly optimized components for next-generation filtration systems in extreme operational conditions.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of production capacity and consumption volume, driven primarily by the colossal manufacturing bases in China, Japan, and South Korea. The demand is robust across polymer manufacturing (petrochemicals), automotive emission control, and rapid expansion in semiconductor fabrication requiring ultra-pure fluid handling. Government policies supporting electric vehicles and hydrogen energy in regions like Japan and South Korea further accelerate the adoption of fiber sintered felt components for advanced battery and fuel cell technology.

- North America: Characterized by high-value, high-reliability applications, especially in the Aerospace and Defense industries, which demand materials conforming to the most rigorous quality and certification standards (e.g., AS9100). The region shows steady growth fueled by the robust pharmaceutical and biotechnology sectors, which require specialized sterile filtration media, alongside significant investment in advanced oil and gas refining operations utilizing high-performance filtration elements to manage process integrity and regulatory compliance.

- Europe: Exhibits strong growth driven by sustainability mandates and leadership in green technology innovation. The European market focuses heavily on advanced environmental applications, including hot gas particulate filtration (especially under stringent EU emission standards) and is a global leader in the development and commercialization of hydrogen fuel cell technologies, driving significant demand for high-quality metallic porous media components essential for these systems.

- Latin America (LATAM): Represents an emerging market with growth concentrated in industrial expansion related to mining, petrochemical extraction, and refining. Market adoption is slower but accelerating as local industries modernize and integrate high-performance filtration solutions to comply with increasing regional environmental controls and improve operational efficiency across capital-intensive facilities.

- Middle East and Africa (MEA): Growth is primarily tethered to massive capital projects in the oil and gas, petrochemical, and power generation sectors. The region demands robust, high-temperature, corrosion-resistant filtration media necessary for the harsh operational climates and the large-scale refinery expansion initiatives currently underway, making it a critical consumer of specialized stainless steel and nickel alloy sintered felts for reliable process filtration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Sintered Felt Market.- Mott Corporation

- Pall Corporation

- Porvair Filtration Group

- GKN Sinter Metals

- Bekaert (Ahlstrom-Munksjö)

- H&V (Hollingsworth & Vose)

- Shanghai Metal Corporation

- Sefar AG

- Lydall Gutsche GmbH

- Nippon Seisen Co., Ltd.

- Anping County Hongda Filter Material Co., Ltd.

- Surefil Technologies

- Hebei Huade Filter Co., Ltd.

- TISAN Materials Co., Ltd.

- Micro-Tech Filtration Pvt. Ltd.

- Taizhou City Dongfang Filter Material Co., Ltd.

- Wuxi T-King Filtration Machinery Co., Ltd.

- BOE Technology Group Co., Ltd.

- JFE Steel Corporation

- Donaldson Company, Inc.

Frequently Asked Questions

Analyze common user questions about the Fiber Sintered Felt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Fiber Sintered Felt over traditional sintered powder media?

Fiber Sintered Felt offers significantly higher porosity (up to 90%) and lower flow resistance compared to traditional sintered powder media. This allows for superior dirt holding capacity, higher throughput, and reduced pressure drop, making it ideal for high-viscosity fluid and high-flow gas applications in critical industrial sectors.

Which end-use industry is expected to drive the fastest growth in the Fiber Sintered Felt Market?

The Energy sector, specifically the hydrogen and fuel cell segment, is projected to experience the fastest growth. Fiber sintered felt is critical for gas diffusion layers (GDLs) in PEM fuel cells, enabling high efficiency, stability, and long-term durability necessary for commercial viability and global adoption of hydrogen technology.

What are the main material types used in the production of Fiber Sintered Felt and their typical uses?

The main materials are Stainless Steel (316L for general corrosion resistance and cost-effectiveness), Nickel Alloys (Inconel/Hastelloy for extreme chemical and high-temperature environments in aerospace and chemical processing), and Titanium (for bio-compatibility and exceptional corrosion resistance in medical and aggressive chemical applications).

How do stringent environmental regulations influence the demand for Fiber Sintered Felt?

Stringent regulations, particularly concerning industrial air emissions (hot gas filtration) and wastewater standards, necessitate the use of highly reliable and regenerable filtration media. Fiber sintered felt meets these demands by offering consistent, high-efficiency separation capabilities required to protect catalysts and comply with environmental mandates, thus accelerating market demand.

What is the key limiting factor impacting the widespread adoption and pricing of Fiber Sintered Felt products?

The primary limiting factor is the high initial manufacturing cost, driven by the specialized process required for drawing ultra-fine metal fibers and the capital-intensive, high-vacuum sintering process. This necessitates that end-users focus on the superior total cost of ownership (TCO) due to the felt’s extended service life and regenerability, rather than the initial purchase price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager