Fiberglass and Glass Fiber Reinforcements Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433406 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fiberglass and Glass Fiber Reinforcements Market Size

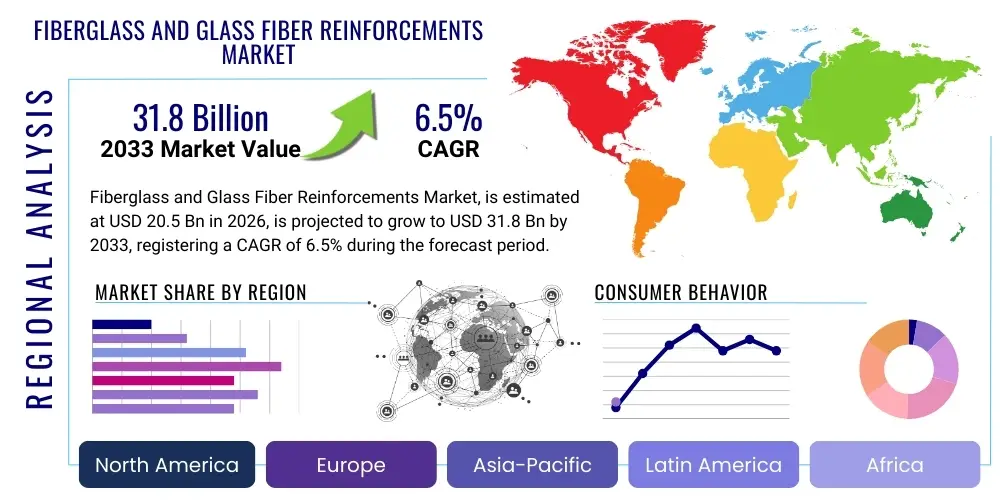

The Fiberglass and Glass Fiber Reinforcements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Fiberglass and Glass Fiber Reinforcements Market introduction

The Fiberglass and Glass Fiber Reinforcements Market encompasses materials derived from fine fibers of glass, which are utilized to strengthen and enhance the mechanical properties of composite structures, primarily through incorporation into polymer matrices. These reinforcements, which include various forms such as chopped strands, woven fabrics, and rovings, are critical components in the production of composites known for their superior strength-to-weight ratio, chemical resistance, and dimensional stability. The primary function is to transfer loads within the composite structure, ensuring integrity and performance across demanding applications. E-glass, R-glass, and S-glass are common types, each tailored for specific performance requirements regarding tensile strength and dielectric properties.

The product is essential across several high-growth industries due to its versatility and cost-effectiveness compared to carbon fiber or aramid fiber. Major applications span structural components in construction, lightweight parts in the automotive and aerospace sectors, high-efficiency blades in wind energy generation, and specialized materials in the electronics industry. The ability of fiberglass to conform to complex shapes during molding processes makes it indispensable for manufacturing intricate components used in infrastructure development and consumer goods. Furthermore, its excellent resistance to corrosion makes it highly suitable for marine and chemical processing environments, further driving consistent demand globally.

The market is predominantly driven by the global push toward lightweighting in transportation to improve fuel efficiency and reduce emissions, alongside massive investments in renewable energy infrastructure, particularly offshore and onshore wind farms where large composite blades are utilized. Key benefits include high tensile strength, non-conductivity, low thermal expansion, and durability, offering a compelling material solution for replacing traditional metals and plastics. Continuous innovation in sizing chemistry and fiber manufacturing processes is aimed at enhancing fiber-matrix adhesion and improving overall composite performance, thereby sustaining the market’s robust growth trajectory over the forecast period.

Fiberglass and Glass Fiber Reinforcements Market Executive Summary

The Fiberglass and Glass Fiber Reinforcements market is characterized by robust business trends driven primarily by the escalating demand for high-performance composite materials across crucial industrial sectors. Key business developments involve vertical integration among major players to secure raw material supply (silica, boron) and strategic investments in advanced manufacturing technologies, such as pultrusion and filament winding, to produce complex composite shapes efficiently. Furthermore, there is a pronounced shift toward developing specialized glass fibers (e.g., high-modulus or alkali-resistant fibers) tailored for specific high-stress applications in aerospace and advanced construction. Sustainability initiatives, focusing on reducing the energy intensity of glass melting and exploring potential end-of-life recycling solutions for glass fiber composites, are increasingly influencing corporate strategies and market competitiveness.

Regionally, the Asia Pacific (APAC) continues to dominate the market, largely propelled by exponential growth in infrastructure projects, rapid expansion of manufacturing capabilities, particularly in China and India, and significant government support for renewable energy installations. North America and Europe demonstrate mature market growth, focusing less on volume and more on high-value applications, such as sophisticated composites for electric vehicles (EVs) and advanced aerospace components. Regulatory environments in these Western regions often favor materials that contribute to energy efficiency and structural longevity, ensuring steady demand for premium reinforcement products. Latin America and the Middle East and Africa (MEA) are emerging growth hubs, with increasing utilization in pipeline infrastructure and construction driven by urbanization.

Segmentation trends highlight the Chopped Strands segment maintaining a significant market share due to its ease of processing and widespread use in compounding and injection molding for automotive parts and consumer goods. However, the Rovings and Woven Fabrics segments are projected to exhibit the highest CAGR, spurred by their critical role in large-scale structural applications like wind turbine blades and large piping systems where continuous, high-strength reinforcement is essential. In terms of application, the Wind Energy sector is exhibiting exceptional growth due to the global energy transition, while the Automotive sector remains a foundational driver, increasingly demanding fiberglass reinforcements for battery casings and structural body components in next-generation electric vehicle platforms.

AI Impact Analysis on Fiberglass and Glass Fiber Reinforcements Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fiberglass and Glass Fiber Reinforcements Market revolve primarily around optimizing manufacturing consistency, reducing energy consumption in the glass melting process, and enhancing quality control throughout the production chain. Users are keen to understand how predictive analytics can forecast equipment failure (especially in high-wear environments like bushings and furnaces), optimize raw material mixing ratios, and automate the intricate process of fiber drawing to maintain consistent diameter and strength. The key expectations center on AI's potential to dramatically improve operational efficiency, minimize waste through tighter process control, and accelerate the development of novel fiber chemistries through simulation and material informatics, ultimately leading to lower manufacturing costs and higher product performance consistency, which are critical competitive factors in this commodity-intensive industry.

- AI-driven Predictive Maintenance: Utilizing sensor data from melting furnaces and drawing lines to predict component failure, reducing unplanned downtime by up to 30%.

- Quality Control Automation: Employing machine vision systems and deep learning algorithms to instantaneously detect surface defects, fiber inconsistencies, and sizing errors, ensuring material conformity.

- Energy Consumption Optimization: Implementing AI models to manage the complex heat profiles and energy input required for glass melting, resulting in significant energy cost savings and reduced carbon footprint.

- Supply Chain and Logistics Forecasting: Using advanced algorithms to predict demand fluctuations and optimize inventory levels for silica, kaolin, and boron, stabilizing production schedules.

- Accelerated R&D: Applying material informatics and generative AI to simulate and test new glass compositions (e.g., high-strength S-glass alternatives) and sizing formulations, drastically cutting development cycles.

DRO & Impact Forces Of Fiberglass and Glass Fiber Reinforcements Market

The Fiberglass and Glass Fiber Reinforcements market operates under a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces that shape investment and strategic decision-making. The primary drivers include the mandatory global shift toward lighter vehicles for improved fuel economy and reduced carbon emissions, alongside aggressive expansion in wind energy infrastructure, particularly in offshore capacity requiring robust, extra-large rotor blades. These large-scale infrastructure projects necessitate materials that offer longevity, corrosion resistance, and high structural integrity, making fiberglass the material of choice over traditional metals. Furthermore, increasing urbanization and subsequent demand for non-corrosive, durable construction materials, such as fiberglass-reinforced concrete (FRC) and composite rebar, provide a stable foundation for market expansion.

Despite strong underlying demand, the market faces significant restraints, chiefly the inherent volatility and high energy intensity associated with the manufacturing process. The production of glass fibers requires extremely high temperatures (over 1,500°C), making energy costs a critical variable expense highly sensitive to geopolitical energy price fluctuations. Additionally, the fluctuating costs of key raw materials like silica sand, alumina, and boron compounds directly impact the profitability margins of manufacturers. Another structural challenge lies in the complex and expensive nature of recycling thermoset composite materials at the end of their lifecycle, leading to environmental concerns and potential regulatory pressures that could restrict broader adoption in some sensitive applications.

Opportunities for growth are concentrated in the development of next-generation fiberglass products and novel application methods. This includes the proliferation of thermoplastic fiberglass composites, which are easier to recycle and process, making them highly attractive for high-volume automotive production. The emergence of specialized high-performance fibers (e.g., H-glass or M-glass) tailored for harsh environments and extremely high stress levels—such as those found in deep-sea applications or advanced ballistic protection—opens premium market avenues. The collective impact forces favor sustainable and high-performance solutions; companies investing in energy-efficient production and developing recyclable, advanced fiber chemistries are best positioned to capture market share and mitigate risks associated with raw material price spikes and environmental scrutiny.

Segmentation Analysis

The Fiberglass and Glass Fiber Reinforcements market is extensively segmented based on the fiber type, product form, glass type, application, and geographical region, reflecting the diverse industrial requirements for composite materials. Segmentation is critical as it dictates the required manufacturing technology, the target end-user industry, and the final material properties, such as stiffness, tensile strength, and heat resistance. Understanding these segments allows manufacturers to tailor their production lines, optimize distribution channels, and focus R&D efforts on specific market needs, such as developing specialized fibers for high-voltage applications in the electrical grid or high-impact resistance in structural components for demanding environments.

- Fiber Type:

- E-Glass

- E-CR Glass

- S-Glass

- C-Glass

- Other (A-Glass, D-Glass, R-Glass)

- Product Form:

- Rovings (Direct, Assembled)

- Chopped Strands

- Woven Fabrics

- Mats (Chopped Strand Mat, Continuous Filament Mat, Composite Mat)

- Resin Type:

- Thermoset Composites (Epoxy, Unsaturated Polyester, Vinyl Ester, Phenolic)

- Thermoplastic Composites (PP, PA, PBT, PEEK)

- Application/End-Use Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Wind Energy

- Marine

- Electrical and Electronics

- Aerospace and Defense

- Pipes and Tanks

Value Chain Analysis For Fiberglass and Glass Fiber Reinforcements Market

The value chain for the Fiberglass and Glass Fiber Reinforcements market initiates with the upstream analysis, focusing intensely on the sourcing and preparation of essential raw materials, primarily high-purity silica sand, kaolin clay, limestone, and borax. Suppliers of these minerals hold significant leverage, especially for specialized grades required for high-performance glass types like S-glass or E-CR glass. The primary manufacturing stage involves the capital-intensive process of melting these materials in large furnaces, followed by the fiber drawing process through platinum or rhodium bushings, application of specialized chemical sizing agents to enhance resin compatibility, and finally, the cooling and forming of the fibers into various reinforcement product forms (rovings, mats, or chopped strands). Efficiency and energy management at this stage are paramount, as they directly determine the final cost structure and environmental footprint of the product.

The middle segment of the chain involves the conversion and distribution channels. Finished fiberglass reinforcements are sold either directly to large composite manufacturers (Tier 1 suppliers, wind turbine fabricators, pipe producers) or through specialized distributors and compounders who further process the fibers, often by integrating them into specific resin systems (e.g., preparing long fiber thermoplastic pellets). Direct sales are common for high-volume, standardized products, while distribution networks are crucial for serving smaller custom molders and specialized niche applications that require varying volumes and technical support. The choice of channel depends heavily on the volume, technical requirements, and geographic reach of the end-user.

Downstream analysis centers on the fabrication and end-use application of the composite material. Fabricators use processes like pultrusion, filament winding, hand lay-up, or injection molding to produce final components such as circuit boards, automobile panels, pressure vessels, or massive wind blades. The performance of the fiberglass reinforcement is intrinsically linked to the resin matrix and the manufacturing process employed by the fabricator. Key downstream trends include the increasing automation of composite fabrication and the demand for pre-impregnated (prepreg) materials to simplify processing. The ultimate success in the market is determined by the functional performance of the final component in demanding end-user sectors like aerospace, automotive, and large-scale renewable energy projects.

Fiberglass and Glass Fiber Reinforcements Market Potential Customers

The potential customers and end-users of fiberglass and glass fiber reinforcements are highly diversified, encompassing sectors that require materials offering exceptional strength-to-weight ratios, durability, and resistance to environmental stress. The largest customer base resides within the construction and infrastructure sectors, which utilize these materials for composite rebar, façade panels, bridge decks, and specialized concrete reinforcement, prioritizing resistance to alkali attack and long-term durability. Automotive and transportation manufacturers constitute another critical group, increasingly demanding fiberglass composites for structural components, body panels, and battery enclosures, particularly driven by the electrification trend which necessitates lighter materials to offset battery weight and extend driving range.

A rapidly expanding customer segment includes the renewable energy industries, specifically manufacturers of wind turbine blades. These companies are high-volume, highly technical buyers requiring continuous filament rovings and specialty high-modulus glass fibers to construct blades that can withstand extreme fatigue and environmental conditions over decades of operation. Furthermore, customers in the oil and gas, and chemical processing industries purchase fiberglass reinforcements for corrosion-resistant pipes, storage tanks, and industrial grating, valuing the material's inertness and longevity in harsh chemical environments. Aerospace and defense entities also represent a premium customer base, though smaller in volume, demanding the highest quality S-glass or R-glass fibers for critical, high-performance applications where failure is not permissible.

The purchasing decisions of these diverse customers are influenced by several factors: the cost-performance balance of the reinforcement, the technical support provided by the supplier regarding optimal sizing and resin compatibility, consistency of supply, and adherence to stringent industry certifications (e.g., ISO standards, specific automotive OEM requirements, or DNV certifications for marine/wind applications). As the market matures, the ability of fiberglass suppliers to provide customized solutions that facilitate faster processing (e.g., high-flow chopped strands or specialized weaving patterns) becomes a crucial determinant in securing long-term contracts with key Tier 1 fabricators and major industrial end-users globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jushi Group Co. Ltd., Owens Corning, China Fiberglass Co. Ltd. (CPIC), Nippon Electric Glass Co. Ltd. (NEG), Taishan Fiberglass Inc., Johns Manville (Berkshire Hathaway), Saint-Gobain Vetrotex, Chongqing Polycomp International Corp. (CPIC), PPG Industries Inc., AGY Holding Corp., KCC Corporation, P-D Fibre Glass Group, Ahlstrom-Munksjö Oyj, BGF Industries, 3B-the fiberglass company, Gurit Holding AG, Binani 3B Fiberglass, Taiwan Glass Industry Corporation, Tianma Group, and Shaanxi Huafei Glass Fiber Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberglass and Glass Fiber Reinforcements Market Key Technology Landscape

The technology landscape for the Fiberglass and Glass Fiber Reinforcements market is continuously evolving, driven by the need to enhance fiber performance, reduce manufacturing costs, and improve sustainability. The core technology remains the continuous melting of glass batch materials in high-temperature furnaces, utilizing direct-melt or marble-melt processes, with advanced furnaces now integrating oxy-fuel combustion systems to significantly reduce natural gas consumption and NOx emissions, addressing the industry's high energy footprint. The most critical technological advancements are occurring in the bushing design and fiber drawing process, employing sophisticated platinum/rhodium alloys and highly precise mechanical drawing mechanisms to ensure uniform fiber diameter, which is crucial for achieving optimal mechanical properties in the final composite.

Beyond the primary fiber manufacturing, substantial technological progress is evident in the development and application of chemical sizing agents. These proprietary sizing chemistries are applied to the fibers immediately after drawing and are pivotal as they define the compatibility and adhesion between the glass fiber and the specific polymer matrix (e.g., epoxy, vinyl ester, or polypropylene). Modern sizing technology focuses on developing multi-functional coupling agents and binders that are specialized for high-temperature resistance, wet-out speed, and compatibility with increasingly complex thermoplastic resins, enabling rapid processing methods like high-speed injection molding and stamping for automotive applications.

Furthermore, fabrication technologies that utilize these reinforcements are advancing rapidly. Automated fiber placement (AFP) and automated tape laying (ATL) systems are becoming more prevalent, particularly in aerospace and high-end automotive manufacturing, enabling precise orientation of rovings and fabrics for maximum structural efficiency. Innovations in pultrusion—including high-speed pultrusion processes—are enhancing the cost-effectiveness of producing large volumes of constant-cross-section composite profiles, while specialized weaving technologies are creating multiaxial fabrics and non-crimp fabrics (NCFs) that offer superior mechanical performance and simplified handling compared to traditional woven structures, catering directly to the large-scale wind energy and marine construction sectors.

Regional Highlights

Geographical dynamics are fundamental to the global Fiberglass and Glass Fiber Reinforcements market, with specific regions exhibiting unique demand characteristics and growth trajectories driven by distinct industrial focuses and regulatory frameworks. The market is broadly categorized into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA), each contributing uniquely to the overall global landscape. Global supply chain strategies, logistical costs associated with bulky materials, and regional environmental standards significantly influence the competitiveness and market access for manufacturers operating across these territories.

Asia Pacific (APAC) stands out as the predominant market region, both in terms of production capacity and consumption volume. This dominance is primarily fueled by extensive infrastructure development in countries like China, which is the world's largest producer and consumer of glass fiber, and rapid industrialization across Southeast Asia and India. Government policies supporting large-scale wind farm deployment and ambitious targets for electric vehicle manufacturing have created sustained, robust demand for all forms of fiberglass reinforcement, making APAC the engine of global volume growth, though profitability margins can be highly competitive due to the sheer number of domestic players.

North America and Europe represent mature markets characterized by technological sophistication and a strong focus on high-performance and specialty glass fibers. Demand in these regions is heavily weighted toward the automotive sector (especially lightweight components for electric vehicles), high-end aerospace applications, and advanced construction materials that meet stringent fire resistance and environmental standards. While volume growth is steady, the emphasis here is on premium products, sustainable manufacturing practices, and circular economy initiatives, driving investment toward thermoplastic composites and innovative fiber chemistry. The Middle East and Africa (MEA), alongside Latin America, offer high growth potential, primarily driven by massive investments in chemical processing, oil and gas infrastructure (requiring corrosion-resistant pipes and tanks), and nascent renewable energy projects, indicating future opportunities for fiberglass reinforcement suppliers.

- China: Dominates global production and consumption; massive demand from infrastructure and wind energy.

- North America (USA, Canada): High-value market focused on automotive lightweighting (EVs) and aerospace S-glass usage.

- Europe (Germany, Spain, UK): Strong emphasis on high-performance composite parts and stringent environmental regulations driving material innovation.

- India: Rapidly growing consumer base driven by construction, automotive, and emerging domestic wind energy capacity.

- Middle East: Growing demand for corrosion-resistant materials (pipes, tanks) in oil, gas, and water desalination infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberglass and Glass Fiber Reinforcements Market.- Jushi Group Co. Ltd.

- Owens Corning

- China Fiberglass Co. Ltd. (CPIC)

- Nippon Electric Glass Co. Ltd. (NEG)

- Taishan Fiberglass Inc.

- Johns Manville (A Berkshire Hathaway Company)

- Saint-Gobain Vetrotex

- PPG Industries Inc.

- AGY Holding Corp.

- KCC Corporation

- P-D Fibre Glass Group

- Ahlstrom-Munksjö Oyj

- BGF Industries Inc.

- 3B-the fiberglass company

- Gurit Holding AG

- Binani 3B Fiberglass

- Taiwan Glass Industry Corporation

- Tianma Group

- Shaanxi Huafei Glass Fiber Co., Ltd.

- Jiangsu Changhai Composite Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fiberglass and Glass Fiber Reinforcements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers propelling the growth of the Fiberglass and Glass Fiber Reinforcements Market?

The market growth is primarily driven by the increasing global demand for lightweight materials in the automotive sector (especially for electric vehicles), the substantial expansion of wind energy capacity requiring large composite turbine blades, and significant worldwide investment in infrastructure projects demanding durable, corrosion-resistant building materials.

Which type of fiberglass reinforcement product dominates the market share?

Chopped strands and rovings are generally the dominant product forms. Chopped strands are widely used in thermoplastic compounding and injection molding due to their excellent processability, while rovings are essential for high-strength, continuous applications such as filament winding for pipes and pultrusion for structural profiles, especially in the booming wind energy sector.

What major challenges impact the profitability and expansion of the fiberglass industry?

Major challenges include the high volatility and energy intensity of the glass melting process, leading to fluctuating operational costs sensitive to global energy prices. Additionally, the complexity and associated costs of recycling large-scale thermoset fiberglass composite waste present environmental and logistical constraints for the industry.

How is technological innovation affecting the performance of fiberglass reinforcements?

Technological innovation is focused heavily on developing specialized chemical sizing agents to improve fiber-matrix adhesion and compatibility with advanced resins. Furthermore, advancements in furnace design (oxy-fuel combustion) reduce energy consumption, and AI integration is enhancing quality control and predictive maintenance across manufacturing lines, resulting in higher consistency and performance.

Which application segment is expected to exhibit the fastest growth rate?

The Wind Energy application segment is anticipated to register the highest Compound Annual Growth Rate (CAGR). This acceleration is due to unprecedented global governmental and private sector investment in renewable energy targets, particularly the construction of larger, more powerful onshore and offshore wind farms which rely entirely on advanced fiberglass composites for their rotor blades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager