Fiberglass Pools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431924 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Fiberglass Pools Market Size

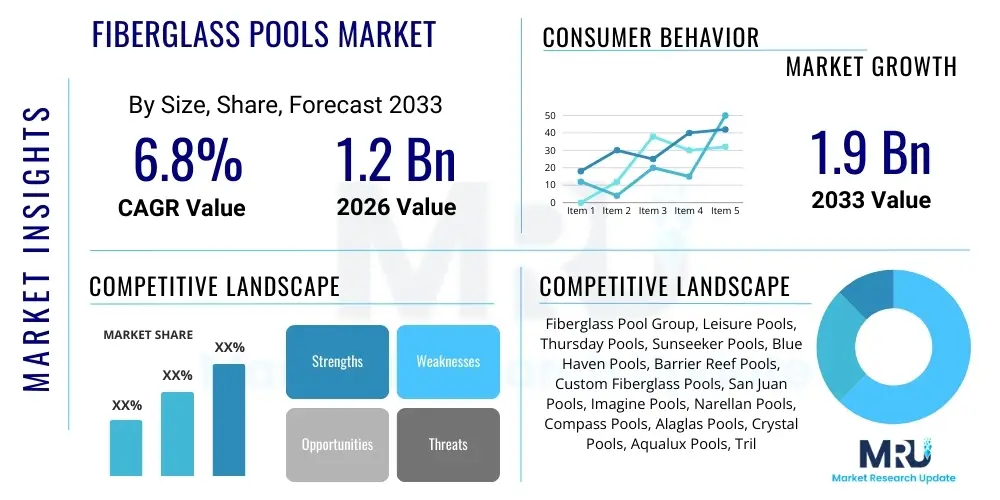

The Fiberglass Pools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Fiberglass Pools Market introduction

The Fiberglass Pools Market encompasses the manufacturing, distribution, and installation of prefabricated swimming pools constructed using fiberglass reinforced plastic (FRP). These pools are distinct from traditional concrete (gunite) or vinyl liner pools due to their monolithic shell structure, which offers superior durability, faster installation times, and reduced maintenance requirements. Fiberglass pools are popular in residential and light commercial settings where longevity, aesthetic appeal, and lower lifetime cost of ownership are primary considerations for consumers and developers. The inherent resistance of fiberglass to algae growth and staining, coupled with a smooth, non-abrasive surface, further contributes to their rising adoption across diverse geographical regions, especially those with moderate to high residential wealth.

The primary applications for fiberglass pools include backyard installations in single-family homes, luxury residential developments, community centers, small resorts, and boutique hotels. Product descriptions typically highlight features such as built-in steps, seating areas, various sizes, and customizable colors and finishes, allowing for high degrees of personalization. A significant benefit of fiberglass pools is their structural integrity and flexibility, which makes them highly suitable for regions prone to ground shifting or adverse weather conditions. Their non-porous surface minimizes the need for harsh chemicals and frequent cleaning, presenting a substantial advantage over concrete alternatives, thereby reducing environmental impact and ongoing operational costs for the owner.

Driving factors propelling market growth include increasing global disposable income, a sustained trend toward home improvement and outdoor living spaces, and technological advancements in manufacturing processes leading to larger, more aesthetically pleasing pool designs. Furthermore, the perceived value proposition—balancing initial cost with long-term durability and low maintenance—is strongly encouraging consumers to choose fiberglass over competing pool construction methods. The ease of transportation and installation, typically completed within days rather rather than weeks or months, is a critical time-saving benefit that appeals particularly to modern consumers seeking rapid project completion without sacrificing quality or longevity in their high-value investments.

Fiberglass Pools Market Executive Summary

The Fiberglass Pools Market is characterized by robust expansion driven primarily by favorable economic indicators across North America and Europe, coupled with increasing infrastructure development in emerging Asia Pacific markets. Current business trends indicate a strong move towards customization and integration of smart pool technologies, focusing on energy efficiency and automated maintenance systems. Regional trends show North America maintaining market dominance, benefiting from high housing starts and established consumer preference for rapid, durable installation solutions, while Europe exhibits steady growth underpinned by renovation projects and a focus on sustainable pool ownership. Segment trends point to residential usage dominating the market share, with rectangular and freeform shapes being the most sought-after designs, supported by innovations in composite material technology that allow for greater design freedom and increased shell strength.

Key strategic shifts among market participants include investments in advanced robotic manufacturing to ensure precise shell molding and reduce production lead times, and the establishment of wider distribution networks to penetrate previously untapped mid-tier residential markets. Competitive dynamics are influenced by material costs, particularly resin and fiberglass, necessitating efficient supply chain management to maintain profitability and price competitiveness. Furthermore, environmental, social, and governance (ESG) considerations are increasingly influencing consumer choice, favoring manufacturers who demonstrate sustainable material sourcing and reduced waste in their manufacturing processes. The market structure, while mature in established economies, still offers substantial growth opportunities through geographic expansion into developing regions where awareness of fiberglass pool benefits is just beginning to accelerate and replace traditional construction methods.

The overall market trajectory remains highly positive, supported by the durability of the product and its competitive edge in installation speed. As consumers prioritize lifetime value over initial investment, the shift away from high-maintenance alternatives continues to favor the monolithic fiberglass shell structure. Manufacturers are also focusing on diversification, offering ancillary products such as pool covers, heating systems, and integrated landscaping packages, thereby increasing the average transaction value and solidifying their position as holistic outdoor living solution providers rather than simply pool manufacturers. This holistic approach ensures resilience against minor economic downturns and sustains a strong growth forecast throughout the projected period.

AI Impact Analysis on Fiberglass Pools Market

User inquiries regarding the impact of Artificial Intelligence on the Fiberglass Pools Market frequently center on automation in manufacturing, predictive maintenance capabilities, and enhanced customer engagement tools. Key themes reveal user expectations for AI to streamline the design process, enabling highly accurate 3D modeling and structural integrity analysis before physical production begins. Concerns often revolve around the initial investment costs associated with integrating sophisticated robotic systems and the necessity for specialized training for installation crews utilizing AI-guided equipment. Furthermore, users are keen to understand how AI-driven analytics can optimize pool chemical balancing and energy consumption post-installation, thereby extending the lifespan of the pool and reducing the required daily operational input from the homeowner, shifting the focus towards intelligent, autonomous pool care systems that minimize manual intervention.

The integration of AI is primarily transforming two critical areas: the manufacturing floor and the post-sale customer experience. In production, AI-powered robotics ensures unprecedented precision in spraying fiberglass layers and trimming the shells, drastically reducing material waste and structural inconsistencies that can lead to warranty claims later on. This automated precision enhances the overall quality and uniformity of the final product, addressing a common consumer concern regarding pre-fabricated quality control. On the service side, AI algorithms are processing data from integrated pool sensors—monitoring temperature, pH levels, and filtration performance—to anticipate equipment failures, schedule maintenance automatically, and proactively adjust chemical dosages, providing a level of care that significantly surpasses traditional, reactive maintenance models, leading to higher customer satisfaction rates.

Moreover, AI is revolutionizing the customer journey from initial inquiry to final installation. Virtual reality (VR) and augmented reality (AR) tools, often powered by underlying AI frameworks, allow potential buyers to visualize pool designs accurately placed within their specific backyard dimensions, mitigating design errors and ensuring alignment between expectation and reality. For logistics and scheduling, machine learning models optimize transportation routes and installation crew deployment based on real-time weather data and site accessibility, ensuring timely project completion. This blend of precise manufacturing, proactive maintenance, and highly personalized customer visualization tools establishes AI as a pivotal force driving efficiency, quality, and consumer confidence within the modern Fiberglass Pools Market ecosystem.

- AI-driven robotic manufacturing enhancing shell precision and minimizing material waste.

- Predictive maintenance analytics for early detection of pump or filtration system failures.

- Optimized supply chain logistics and installation scheduling via machine learning algorithms.

- Enhanced customer visualization using AI-powered AR/VR design tools for precise placement.

- Automated chemical monitoring and dosing systems ensuring optimal water quality and reduced manual labor.

- Data analytics identifying regional design preferences to inform product development strategies.

DRO & Impact Forces Of Fiberglass Pools Market

The Fiberglass Pools Market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory, constituting the primary impact forces. Key drivers include the inherent benefits of fiberglass—rapid installation, superior durability, and low long-term maintenance costs—which increasingly appeal to time-conscious and value-seeking consumers globally. Coupled with rising affluence in key international markets and the consistent trend of homeowners investing in sophisticated outdoor living spaces, these factors provide a strong foundation for sustained market expansion. However, the market faces significant restraints, notably the relatively higher initial purchasing cost compared to vinyl liner alternatives, and limitations in customization, as the pools must be transported as monolithic structures, restricting the sheer size and shape flexibility possible with concrete construction, creating a structural ceiling on certain types of large, custom commercial projects. The impact forces are thus dominated by the balance between installation efficiency gains and the constraint of size and initial capital outlay.

Opportunities for growth are concentrated in material science innovation, focusing on developing lighter, stronger, and more eco-friendly resin and composite materials that enhance durability and reduce the environmental footprint associated with manufacturing. Furthermore, penetrating commercial segments, such as small hotels, health spas, and rehabilitation centers, presents a significant avenue for diversification beyond the saturated residential sector. Strategic opportunities also exist in geographic expansion, targeting developing economies in Southeast Asia and Latin America where traditional pool construction methods are inefficient and where the value proposition of rapid fiberglass installation offers a compelling alternative to incumbent technologies. Successful market players are leveraging these opportunities by expanding their standard model lineups to include more specialized designs suitable for smaller urban backyards, thus overcoming the traditional size limitation restraint through strategic design choices that cater to high-density living environments.

The dominant impact forces on the market include fluctuating raw material prices, primarily petroleum-derived resins and fiberglass reinforcement materials, which directly influence production costs and final consumer pricing volatility. Regulatory environments pertaining to construction, water usage, and chemical standards also exert significant influence, necessitating continuous adaptation in product design and installation procedures. Ultimately, the long-term competitive advantage is secured by manufacturers who can consistently mitigate the volatility of input costs while simultaneously maximizing the aesthetic appeal and long-term performance benefits inherent to fiberglass technology. The push-pull between operational efficiency (Driver) and raw material cost volatility (Impact Force) defines the profitability margin for most market participants, urging innovation in material substitutes and efficient supply chain management to maintain stable growth.

Segmentation Analysis

The Fiberglass Pools Market is broadly segmented based on product type (shapes), end-use application, and distribution channel, providing a comprehensive framework for market assessment and strategic planning. Segmentation by shape is critical as it reflects current aesthetic trends and functional preferences, distinguishing between classic geometrical forms like rectangular and more stylized options such as kidney, oval, and freeform pools. The end-use application segment clearly delineates the market penetration across residential and commercial sectors, with residential installations maintaining the dominant share due to global trends in home improvement and investment in private leisure facilities. Analyzing these segments helps manufacturers tailor their production volumes and marketing strategies to match specific consumer demands and regional architectural styles, ensuring product relevance in diverse socio-economic landscapes.

Further granular analysis within these segments reveals specific consumer behavior patterns. For instance, in the residential segment, there is a growing demand for integrated features such as tanning ledges, built-in spas, and shallow splash zones, driving innovation in mold design and composite integration. Commercial applications, although smaller in volume, demand higher structural specifications and greater compliance with public safety standards, influencing material composition and shell thickness. Understanding the distribution channel segmentation—which includes direct sales by manufacturers, authorized dealers/installers, and large retail outlets—is vital for optimizing supply chain efficiency and managing installation quality control, as fiberglass pools typically require specialized handling and expertise during delivery and setting, making the relationship with the installer network paramount to brand reputation and final product satisfaction.

The strategic differentiation based on product type allows companies to target distinct market niches; for example, rectangular pools often appeal to customers seeking maximum swimming space and formal landscaping integration, while freeform pools cater to those desiring a more natural, lagoon-like aesthetic, typically integrated into elaborate outdoor living designs. Detailed segmentation analysis not only forecasts growth in specific product lines but also informs regional market entry strategies, considering that regulatory requirements, such as depth restrictions or fence mandates, vary widely by geography, necessitating region-specific product adjustments. This intricate segmentation confirms the market's maturity while highlighting focused avenues for specialized product line investment and targeted geographical expansion across both developed and rapidly urbanizing regions seeking durable, low-maintenance leisure solutions.

- By Shape:

- Rectangular Pools

- Freeform Pools

- Kidney Pools

- Oval/Round Pools

- Custom/Specialty Shapes

- By Application:

- Residential

- Commercial (Hotels, Resorts, Community Centers, Health Clubs)

- By Distribution Channel:

- Direct Sales (Manufacturer to Consumer)

- Authorized Dealers/Independent Installers

- Retail and E-commerce Platforms

Value Chain Analysis For Fiberglass Pools Market

The value chain for the Fiberglass Pools Market begins with upstream activities focused on securing high-quality raw materials, primarily polyester resins, vinyl ester resins, fiberglass strands/mats, gel coats, and structural core materials. This phase involves negotiations with specialized chemical and composite suppliers, where cost management and quality assurance of the chemical components are critical determinants of the final pool shell's integrity and aesthetic finish. Upstream efficiency is fundamentally linked to global petrochemical prices, making hedging strategies and long-term supply contracts vital for manufacturers to stabilize production costs. Following procurement, the manufacturing process involves precision molding, layering, curing, and finishing of the monolithic pool shells, a capital-intensive process that relies heavily on automated or semi-automated spraying and rolling techniques to ensure structural homogeneity and consistent thickness across the pool structure.

Midstream activities encompass the core production and logistics. After manufacturing, the substantial size and weight of the completed pool shells present unique distribution challenges, requiring specialized oversized transportation permits and equipment for long-haul shipping. The distribution channel is bifurcated into direct sales and indirect sales through authorized dealer networks. Direct sales offer higher margin control and direct interaction with the end-user, facilitating customized service but requiring substantial investment in regional storage and dedicated installation crews. Conversely, the indirect channel, relying on authorized independent installers and dealers, provides broader geographical reach and leverages local expertise, though manufacturers must maintain rigorous quality control standards over installation practices to protect brand reputation, as improper setting can lead to structural failure.

Downstream activities focus entirely on installation, after-market services, and maintenance. Installation is the most critical juncture in the value chain, heavily influencing customer satisfaction, as the shell must be set, backfilled, plumbed, and finished precisely within the excavation site. This phase necessitates skilled local contractors capable of handling complex excavation and technical plumbing. Post-installation, the value chain extends to warranty services, the supply of ancillary equipment (pumps, filters, heaters, covers), and ongoing maintenance products. The profitability of the downstream segment is increasingly derived from providing comprehensive, integrated packages that include automation and energy-efficient systems, fostering long-term relationships with customers and securing recurring revenue streams beyond the initial pool sale.

Fiberglass Pools Market Potential Customers

The primary end-users and buyers of fiberglass pools are diverse but generally fall into two distinct categories: affluent homeowners and specific segments of the commercial hospitality and wellness sectors. Residential customers represent the largest segment, driven by middle-to-upper-income families seeking a durable, low-maintenance leisure amenity that adds value to their property without the protracted construction timeline associated with concrete pools. These homeowners prioritize longevity, aesthetic appeal, and minimal upkeep effort, making the non-porous surface and rapid installation of fiberglass pools highly attractive. Residential purchasing decisions are often influenced by local dealer reputation, warranty offerings, and the ability to integrate smart pool technology for automated operation, particularly within suburban and vacation home markets where outdoor leisure space is highly valued and regularly utilized for family recreation.

The commercial segment includes operators of small boutique hotels, mid-sized resorts, local community centers, and specialized wellness facilities, such as physiotherapy or rehabilitation clinics that require reliable, clean, and durable water features. For commercial buyers, the speed of installation is often paramount, minimizing disruption to operations or accelerating project completion for new developments. Furthermore, the low long-term operational costs—due to reduced chemical needs and ease of cleaning—make fiberglass an economical choice over the lifecycle of the pool, despite potentially higher upfront costs compared to some basic alternatives. These commercial customers prioritize ease of regulatory compliance, structural warranty strength, and features supporting high-traffic usage, requiring robust materials and reliable, centralized automation systems for management.

Additionally, a significant niche segment consists of replacement buyers, specifically owners of aging vinyl liner or concrete pools who are seeking an upgrade solution that remedies historical maintenance issues such as liner replacement or surface deterioration. These customers are well-informed about the shortcomings of previous pool types and are proactively seeking a superior, permanent solution. They represent a high-value customer base receptive to premium fiberglass products and comprehensive installation services. Targeting this replacement market with clear comparisons of lifetime ownership costs and material benefits is a key strategic opportunity for market growth, leveraging the known pain points associated with high-maintenance alternatives to drive conversion to the more resilient fiberglass standard.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiberglass Pool Group, Leisure Pools, Thursday Pools, Sunseeker Pools, Blue Haven Pools, Barrier Reef Pools, Custom Fiberglass Pools, San Juan Pools, Imagine Pools, Narellan Pools, Compass Pools, Alaglas Pools, Crystal Pools, Aqualux Pools, Trilogy Pools, Viking Pools, Imperial Pools, River Pools, Eco-Pools, Aquatech Pools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberglass Pools Market Key Technology Landscape

The technological landscape of the Fiberglass Pools Market is defined by innovations aimed at improving shell manufacturing precision, enhancing material composition, and integrating advanced automation systems. Core manufacturing technologies involve sophisticated computerized numerical control (CNC) routing machines used in mold preparation to ensure flawless symmetry and structural accuracy, alongside advanced resin infusion and spray-up techniques designed to create dense, void-free laminates. A significant focus is placed on proprietary gel coat formulations that offer superior UV resistance, color retention, and chemical stain resistance, thereby maximizing the pool's aesthetic lifespan. Manufacturers are adopting multi-layer construction processes, often incorporating ceramic or carbon fiber cores to increase tensile strength and rigidity, particularly important for handling the stresses of transportation and ground movement post-installation, substantially elevating the pools’ structural warranty period.

Beyond the shell itself, the market is undergoing a profound transformation driven by smart pool technology. This includes the proliferation of Internet of Things (IoT) sensors embedded within the filtration and plumbing systems to continuously monitor water chemistry (pH, chlorine, alkalinity) and operational parameters (flow rate, temperature, pressure). These sensors transmit data to cloud-based platforms, allowing homeowners and maintenance providers to remotely manage pool operations via mobile applications. The integration of variable-speed pumps (VSPs) and energy-efficient LED lighting systems, often controlled through smart home ecosystems, contributes significantly to reducing the overall energy footprint of the installation, addressing consumer demand for more sustainable and cost-effective pool operation.

Furthermore, technology is playing a pivotal role in the pre-sale phase through digital visualization tools. Utilizing augmented reality (AR) and sophisticated 3D modeling software, prospective buyers can accurately overlay the chosen pool design onto their real-world backyard environment using a smartphone or tablet. This technology greatly enhances the consumer buying experience by reducing ambiguity regarding size, placement, and surrounding aesthetics, minimizing the risk of post-sale dissatisfaction. Additionally, advancements in excavation and setting technology, including specialized vacuum lifts and precision laser leveling equipment, ensure faster, more accurate installation processes, cementing fiberglass pools' advantage in speed and efficiency over traditional construction methods that require extensive on-site fabrication and prolonged curing times.

Regional Highlights

The global Fiberglass Pools Market exhibits distinct characteristics and growth rates across major geographic regions, primarily influenced by climatic factors, housing market health, disposable income levels, and cultural preferences for outdoor leisure activities. North America, encompassing the United States and Canada, remains the largest and most mature market, characterized by high penetration rates, well-established distribution networks, and strong consumer acceptance due to the prevalence of large single-family homes and robust outdoor living cultures. Growth here is sustained by replacement demand and the continual expansion of residential development in Sun Belt states and other areas experiencing favorable population shifts, where rapid construction is prioritized. The high awareness of fiberglass benefits, such as durability and low maintenance in extreme weather conditions, ensures continued market dominance for this region.

Europe represents a steady growth market, particularly in countries like France, Spain, Germany, and the UK, where fiberglass pools are gaining traction against traditional liner and concrete options due to improved aesthetics and structural warranties. European consumers often prioritize sustainable solutions; thus, the energy efficiency inherent in the smooth fiberglass surface (requiring less heating and chemical use) strongly appeals to this market. Regulatory environments regarding construction and environmental impact are often stricter here, pushing manufacturers to continuously innovate their materials and installation practices to meet stringent local standards. The focus in Europe is often on smaller, personalized pools suited for compact urban and suburban gardens, driving demand for specialized, smaller pool models and integrated spa features that maximize limited space.

Asia Pacific (APAC) is projected to be the fastest-growing region, albeit starting from a lower base. Market expansion is fueled by rapid urbanization, rising middle-class disposable incomes, and the growth of the hospitality and resort sectors in economies like Australia, China, and India. Australia, in particular, demonstrates extremely high adoption rates, mirroring North American trends due to similar climatic and cultural factors, serving as a regional hub for manufacturing and innovation. In emerging Asian markets, the fiberglass pool's ability to be installed quickly and reliably in diverse climatic zones—from tropical humidity to monsoon-prone areas—offers a significant competitive edge over lengthy concrete construction, despite ongoing challenges related to supply chain complexity and localized construction regulations that vary widely across individual nations in the region.

- North America: Dominant market share driven by robust residential construction, strong DIY culture, and high consumer awareness of low-maintenance benefits.

- Europe: Steady growth, characterized by strong demand for sustainable, energy-efficient pools and high adoption rates in France and Spain.

- Asia Pacific (APAC): Highest projected CAGR, fueled by urbanization, rising affluence in China and India, and high market maturity in Australia.

- Latin America (LATAM): Emerging market potential, focused on luxury residential developments and resort construction, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by high temperatures necessitating pool ownership and investment in large-scale luxury tourism infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberglass Pools Market.- Fiberglass Pool Group

- Leisure Pools

- Thursday Pools

- Sunseeker Pools

- Blue Haven Pools

- Barrier Reef Pools

- Custom Fiberglass Pools

- San Juan Pools

- Imagine Pools

- Narellan Pools

- Compass Pools

- Alaglas Pools

- Trilogy Pools

- Viking Pools

- Imperial Pools

- River Pools

- Eco-Pools

- Aquatech Pools

- Piscines Magiline

- Latham Group Inc.

Frequently Asked Questions

Analyze common user questions about the Fiberglass Pools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the average lifespan of a fiberglass pool compared to concrete or vinyl pools?

Fiberglass pools typically have a much longer structural lifespan, often exceeding 30 to 50 years, primarily due to their solid, non-porous shell structure. Unlike concrete pools which require re-plastering every 10–15 years, or vinyl liners needing replacement every 7–10 years, fiberglass surfaces are highly durable and generally require minimal structural maintenance throughout their lifespan.

How much time does the installation of a fiberglass pool generally take?

Fiberglass pools are renowned for rapid installation, which typically takes between three to seven days from excavation to filling. This efficiency is achieved because the pool shell is delivered fully formed, minimizing on-site construction time, a significant advantage over concrete pools which require several weeks or months for curing and finishing.

Are fiberglass pools more environmentally friendly than other pool types?

Yes, fiberglass pools generally possess a smaller environmental footprint. Their non-porous surface is highly resistant to algae growth, reducing the need for harsh chemicals and requiring less frequent filtration cycling, thereby lowering overall energy consumption and chemical usage compared to porous concrete pool surfaces.

What are the primary aesthetic limitations regarding fiberglass pool design?

The main aesthetic limitation is size and shape customization, as fiberglass pools must be molded in a factory and transported as a single unit, restricting the maximum dimensions and requiring reliance on pre-designed molds. While manufacturers offer numerous shapes, highly bespoke, massive, or unusually complex designs remain best suited for concrete construction methods.

What is the key factor driving residential adoption of fiberglass pools?

The key driving factor for residential adoption is the superior combination of low lifetime ownership costs and minimal maintenance requirements. Homeowners are attracted by the smooth, durable surface, which prevents snags and is easy to clean, coupled with the benefit of fast installation and long-term structural integrity warranties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager