Fiberglass Step Ladder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431589 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fiberglass Step Ladder Market Size

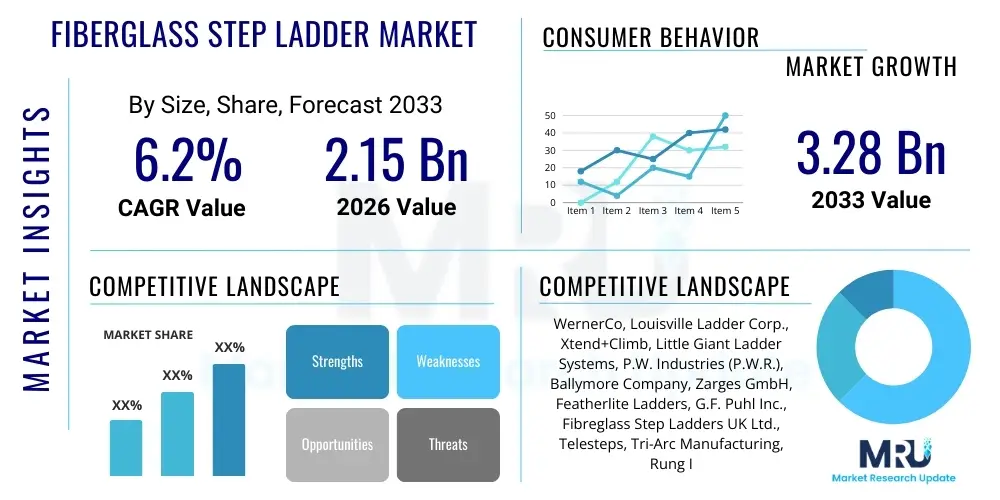

The Fiberglass Step Ladder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.28 Billion by the end of the forecast period in 2033.

Fiberglass Step Ladder Market introduction

The Fiberglass Step Ladder Market encompasses the manufacturing, distribution, and sale of ladders primarily constructed from fiberglass-reinforced polymer (FRP) composites. These ladders are distinguished by their inherent non-conductive properties, making them essential safety equipment for tasks involving proximity to electricity, such as electrical installation, utility work, and telecommunications maintenance. The fiberglass structure provides superior strength and rigidity while maintaining a relatively lightweight profile compared to traditional wooden ladders. The product line typically includes various configurations, sizes, and duty ratings (e.g., Type I, IA, and IAA) tailored to specific commercial, industrial, and heavy-duty applications, prioritizing user safety and operational longevity. The market growth is fundamentally driven by increasingly stringent occupational safety regulations globally and the expanding infrastructure development requiring maintenance in electrified environments.

Fiberglass step ladders offer significant advantages over their metal counterparts, particularly aluminum, because they do not conduct electricity. This critical safety feature has solidified their adoption across diverse professional sectors where electrical hazards are common, including construction, industrial maintenance, and utility services. Major applications include internal and external maintenance work, painting, elevated repairs, HVAC system installation, and general facility upkeep in environments such as factories, power plants, and commercial buildings. The durability and resistance of fiberglass to weather, moisture, and corrosion further extend the product lifespan, contributing to a reduced total cost of ownership over time. The primary driving factors include heightened awareness of workplace safety standards and the necessity for durable, non-conductive access solutions in complex industrial settings.

The core benefits associated with fiberglass step ladders include improved worker safety due to electrical isolation, resistance to warping or degradation from external elements, and compliance with American National Standards Institute (ANSI) and Occupational Safety and Health Administration (OSHA) standards regarding load capacity and stability. These benefits position fiberglass step ladders as the preferred choice for professionals. Continuous innovation in composite materials and ladder design, focusing on enhanced stability features like non-slip feet and improved platform security, further accelerates market penetration. Furthermore, the residential segment, while smaller, is growing as DIY enthusiasts and homeowners increasingly recognize the long-term value and safety advantages of non-conductive materials for household electrical repairs and high-reach cleaning tasks.

Fiberglass Step Ladder Market Executive Summary

The Fiberglass Step Ladder Market is experiencing robust expansion driven primarily by escalating demand from the utility and industrial maintenance sectors, particularly in regions undergoing rapid infrastructure modernization. Key business trends indicate a strong shift towards higher duty ratings (Type IA and IAA) as commercial and industrial users require equipment capable of handling heavier loads and more rigorous operational environments. Manufacturers are strategically focusing on integrating enhanced safety features, such as advanced stability systems, tool trays, and tethering points, to comply with evolving global safety mandates. Furthermore, competitive pricing strategies in emerging economies and the expansion of digital distribution channels, including specialized industrial e-commerce platforms, are defining the current market dynamics, enabling broader access to specialized ladder products across diverse geographical areas.

Regional trends reveal that North America maintains market dominance due to mature regulatory frameworks, mandatory safety standards (OSHA/ANSI), and substantial ongoing investment in electrical grid maintenance and commercial construction projects. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by fast-paced industrialization, extensive public infrastructure development (e.g., power distribution and telecommunications), and increasing foreign investment in manufacturing facilities. Europe demonstrates steady growth, largely spurred by modernization of industrial plants and stringent adherence to European safety directives. These regional variations necessitate tailored market strategies concerning product specifications (e.g., height, maximum load) and compliance certifications.

Segment trends underscore the criticality of the Heavy-Duty (Type IA and IAA) segment by duty rating, dominating revenue share due to their extensive use in construction sites, petrochemical facilities, and utility work where load-bearing capacity is paramount. In terms of end-use, the Industrial and Commercial sectors collectively account for the majority of the market, driven by recurring maintenance requirements and large-scale project execution. The twin-step ladder segment is gaining traction, particularly in applications requiring two workers or dual access points simultaneously, enhancing operational efficiency and safety in specific work scenarios. Manufacturers are also exploring opportunities in the specialized segment, offering highly tailored designs for unique industry requirements, such as platform step ladders designed for prolonged standing tasks.

AI Impact Analysis on Fiberglass Step Ladder Market

User inquiries regarding AI's impact on the Fiberglass Step Ladder Market frequently center on themes of manufacturing efficiency, predictive safety maintenance, and supply chain optimization. Common questions include how AI can improve the quality control of fiberglass composites, whether smart ladders integrating sensors will become standard, and how AI-driven demand forecasting can stabilize volatile raw material costs. Users are concerned about whether AI-optimized production will lower the product's premium cost relative to aluminum and expect AI to contribute to a drastic reduction in workplace fall incidents through proactive monitoring and user feedback systems. The key expectation is that AI will transform the manufacturing process, making fiberglass production more resource-efficient and enhancing the ladder's functional safety aspects through integrated intelligence.

- AI-driven optimization of composite layup processes, ensuring superior material integrity and reducing structural defects in fiberglass components.

- Predictive maintenance analytics applied to manufacturing equipment, minimizing downtime and increasing production throughput efficiency.

- Integration of machine learning algorithms for real-time demand forecasting, optimizing inventory levels and mitigating supply chain disruptions for raw materials (resins, glass fibers).

- Development of smart ladder systems featuring embedded sensors and AI capabilities to monitor load capacity, stability angle, ground conditions, and user activity, issuing proactive safety alerts.

- Enhanced quality control using computer vision systems to inspect finished ladder components for structural compliance and cosmetic defects at high speeds.

- AI utilization in logistics and routing optimization for distribution networks, leading to reduced delivery costs and shorter lead times for specialized orders.

DRO & Impact Forces Of Fiberglass Step Ladder Market

The dynamics of the Fiberglass Step Ladder Market are defined by a strong set of Drivers, which primarily revolve around non-conductive safety mandates, counterbalanced by Restraints such as the premium cost and logistical challenges. Opportunities are emerging through material innovation and expansion into underserved maintenance markets. These elements collectively generate significant Impact Forces that shape strategic decision-making and investment priorities within the industry. The intrinsic requirement for non-conductivity in electrical work mandates the use of fiberglass, establishing a powerful baseline demand that is resistant to substitution. However, manufacturers must constantly mitigate the higher raw material and production costs associated with fiberglass composites compared to readily available metals, posing a continuous challenge to market price stability and penetration in cost-sensitive segments.

Key drivers include the proliferation of national and international safety standards (such as OSHA, ANSI, EN 131) that specifically recommend or require non-conductive ladders near power sources, thereby creating a captive market in utility and telecommunications sectors. Moreover, increasing investments in renewable energy infrastructure (solar farms, wind turbines), which require frequent, non-conductive maintenance access, further amplify demand. Conversely, primary restraints include the relatively higher purchase price of fiberglass ladders compared to aluminum alternatives, potentially deterring price-sensitive small-scale contractors or residential buyers. Additionally, fiberglass ladders are generally heavier and bulkier than aluminum models of comparable height, presenting logistical challenges concerning transport and storage, particularly for frequent, mobile applications.

Significant opportunities lie in the development of next-generation fiberglass composites that offer lighter weight without compromising strength or electrical insulation properties, addressing the bulkiness restraint. Furthermore, market expansion into high-growth developing economies, particularly in Southeast Asia and Latin America, presents untapped commercial potential as these regions formalize their safety regulations and upgrade aging electrical infrastructure. The main impact force is the regulatory compliance pressure, which fundamentally mandates product characteristics and quality, ensuring high barriers to entry for non-compliant manufacturers and constantly pushing established players toward innovation in safety features and durability testing to maintain competitive advantage.

Segmentation Analysis

The Fiberglass Step Ladder market is systematically segmented based on product type, duty rating, and end-use application, enabling manufacturers and analysts to accurately gauge demand patterns across various professional and non-professional user groups. Segmentation by Type differentiates between single-sided and twin-step access solutions, catering to varying needs for stability and multiple-user operation. The crucial segmentation by Duty Rating (e.g., Type I, IA, IAA) reflects the load-bearing capacity and structural integrity of the ladder, directly correlating with the rigor of the application, from light commercial use up to heavy industrial environments. End-use segmentation clearly divides the market into industrial, commercial, and residential applications, each exhibiting distinct purchasing behaviors and product preference requirements, with industrial users typically demanding the highest safety specifications and durability.

The segmentation structure is pivotal for strategic planning. For instance, the market for Type IAA (Extra Heavy Duty) step ladders, favored in petrochemical and aerospace maintenance, commands higher average selling prices and requires specialized manufacturing certifications. In contrast, the residential segment typically focuses on lower-rated, more affordable models for general household tasks. Understanding these nuances allows key players to tailor their product mix and distribution strategies. The Type segment also addresses functional needs; single-sided ladders are common for general utility access, whereas twin-step designs are increasingly adopted in environments where dual-sided access is necessary for efficiency, such as warehouse shelving or specific construction tasks requiring shared access to the work area.

Overall, the market remains heavily weighted toward industrial and commercial applications globally, driven by stringent regulatory enforcement and the high frequency of use. However, the twin-step segment is showing accelerated growth due to its enhanced safety profile and utility in specific professional settings. Geographic segmentation further overlays these factors, with high-compliance regions like North America demanding advanced features and certifications, while emerging markets often prioritize balance between basic compliance and cost efficiency. This multi-dimensional segmentation provides a robust framework for assessing market dynamics, competitive intensity, and future growth opportunities across specific niche requirements.

- By Type:

- Single-Sided Step Ladders

- Twin-Step (Double-Sided) Ladders

- Platform Step Ladders

- By Duty Rating (Load Capacity):

- Type III (Light Duty, 200 lbs)

- Type II (Medium Duty, 225 lbs)

- Type I (Heavy Duty, 250 lbs)

- Type IA (Extra Heavy Duty, 300 lbs)

- Type IAA (Special Duty, 375 lbs)

- By End-Use Application:

- Industrial (e.g., Manufacturing, Utilities, Oil & Gas)

- Commercial (e.g., Retail, Office Maintenance, HVAC)

- Residential (e.g., Household Use, DIY Projects)

Value Chain Analysis For Fiberglass Step Ladder Market

The Value Chain of the Fiberglass Step Ladder Market begins with the Upstream activities, focused on the procurement and processing of fundamental raw materials, primarily fiberglass rovings (strands), polymer resins (e.g., polyester or vinyl ester), and various chemical additives for fire resistance and UV protection. Critical upstream suppliers include chemical companies and composite material producers whose performance directly impacts the quality and cost structure of the final product. Midstream activities involve the specialized manufacturing process, including pultrusion (a continuous process for creating constant cross-sections like rails and steps), assembly, integration of hardware (hinges, braces), and rigorous quality testing to ensure compliance with load-bearing standards. Efficiency in pultrusion technology is a key competitive differentiator in this stage, determining structural quality and production speed.

The distribution phase is characterized by a mix of direct and indirect channels. Direct channels involve large manufacturers supplying directly to major industrial contractors, utility companies, or government agencies through high-volume, often customized, tenders. Indirect distribution relies heavily on an intricate network comprising wholesalers, specialized industrial supply distributors (e.g., Grainger, Fastenal), large format home improvement retailers (e.g., Home Depot, Lowe’s), and increasingly, third-party logistics (3PL) providers supporting burgeoning e-commerce platforms. This multi-channel approach is necessary to reach the highly fragmented customer base, ranging from specialized professionals to general consumers. Retailers and industrial distributors play a crucial role in providing local stock, immediate availability, and after-sales support, bridging the gap between manufacturer and end-user.

Downstream analysis focuses on the end-use market and post-sale activities. End-users derive value from the ladder's performance, durability, and safety certifications over its operational lifespan. Post-sale services, though minimal for step ladders, typically involve warranty provisions, repair services (primarily for replacement parts like feet or braces), and recycling programs for end-of-life products. The efficiency of the value chain is significantly influenced by global logistics costs and the adherence of all stages, particularly manufacturing, to stringent international safety and environmental regulations. Optimizing raw material input and streamlining pultrusion technology are continuous efforts aimed at improving gross margins and sustaining competitive pricing strategies against aluminum alternatives.

Fiberglass Step Ladder Market Potential Customers

The potential customers for the Fiberglass Step Ladder Market span a wide spectrum of sectors united by the common need for safe, non-conductive, elevated access. The primary segment consists of utility and electrical service providers, including power generation companies, telecommunications carriers, and municipal electrical maintenance crews, where the non-conductive nature of fiberglass is not optional but a mandatory safety requirement for working on or near live circuits. This group often requires specialized, high-duty rating ladders (Type IA and IAA) and constitutes the highest-value customer base due to frequent replacement cycles and stringent quality demands. Infrastructure maintenance and upgrade projects, particularly those related to 5G deployment and smart grid development, further solidify this sector's importance.

The second major group includes commercial construction companies and general contractors involved in both new build and renovation projects. While these entities use various types of access equipment, fiberglass step ladders are indispensable for tasks like installing lighting fixtures, running wiring, setting up HVAC units, and general internal finishing work in commercial buildings. Facility management companies and institutional clients (hospitals, schools, government buildings) also represent significant potential customers, requiring continuous supply for routine maintenance tasks. These customers prioritize durability, compliance with regional building codes, and standardized ladder dimensions that fit within various commercial environments.

Finally, the growing residential and light commercial segment, encompassing DIY homeowners, small local repair services, and painters, forms the broader base of potential customers. Although these buyers often opt for lower duty ratings (Type I or Type II), their sheer volume contributes significantly to the overall market size. Purchasing decisions in this segment are highly influenced by retail accessibility, brand trust, perceived safety value, and competitive pricing relative to aluminum ladders. The rising adoption of e-commerce channels has made it easier for manufacturers to directly target this consumer segment with educational content emphasizing the safety benefits of fiberglass over metal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.28 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WernerCo, Louisville Ladder Corp., Xtend+Climb, Little Giant Ladder Systems, P.W. Industries (P.W.R.), Ballymore Company, Zarges GmbH, Featherlite Ladders, G.F. Puhl Inc., Fibreglass Step Ladders UK Ltd., Telesteps, Tri-Arc Manufacturing, Rung Industries, Alaco Ladder Company, Michigan Ladder Co., Hailo, Bauer Corporation, Gorilla Ladders, Zhejiang Yamei, and Hebei Sinostar Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberglass Step Ladder Market Key Technology Landscape

The technological landscape of the Fiberglass Step Ladder Market is primarily defined by advancements in materials science, focusing on pultrusion process optimization, and the incorporation of ergonomic and integrated safety features. The core technology remains pultrusion, which efficiently produces the high-strength, constant-cross-section rails and steps necessary for structural integrity. Recent innovations in this area focus on using advanced resin matrix formulations (e.g., specialized vinyl esters) combined with proprietary glass fiber arrangements to increase the stiffness-to-weight ratio. This reduces the overall weight of the ladder without compromising the required load-bearing capacity (duty rating), directly addressing the traditional restraint of fiberglass ladders being heavier than aluminum alternatives. Furthermore, UV-resistant coatings and fire-retardant additives are standard technological enhancements ensuring long-term outdoor durability and compliance with strict industrial safety standards, particularly in utility and petrochemical environments.

Ergonomics and integrated safety features represent a critical area of technological differentiation. This includes the development of proprietary non-slip tread designs for steps and platforms, as well as highly engineered non-marring foot pads that offer increased surface grip and stability on various substrates. Platform step ladders, a growing segment, often incorporate larger, more secure working surfaces and integrated tool trays or magnetic components to improve user efficiency and reduce the risk of dropping tools from height. Another important technological trend is the use of color-coding systems (often temperature or UV sensitive) to indicate potential damage or excessive heat exposure, providing a visual cue to users regarding the ladder's structural integrity or safe operational limits, significantly enhancing preventative maintenance protocols.

In the near future, the technological landscape will be shaped by the nascent adoption of Internet of Things (IoT) and sensor technologies, leading to the emergence of "smart ladders." These systems utilize low-power embedded sensors to monitor real-time data such as verticality, maximum applied load, and usage frequency. This data can be transmitted wirelessly to safety officers or fleet management systems, allowing companies to track asset utilization, ensure correct usage, and predict maintenance needs before failure occurs. This blend of advanced composite engineering and digital integration is expected to revolutionize workplace safety standards associated with elevated access equipment, pushing the market towards premium, technology-enabled products that offer data-backed assurance of compliance and safety performance.

Regional Highlights

- North America (United States and Canada): This region is the largest and most mature market for fiberglass step ladders, characterized by exceptionally high safety standards mandated by agencies like OSHA and ANSI. The dominant consumption is driven by the vast utility sector (power lines, telecommunications) and continuous, large-scale commercial and industrial construction projects. Demand is concentrated on high-duty rated ladders (Type IA and IAA). The presence of major domestic manufacturers and a robust distribution network ensures high product availability and consumer awareness regarding the superior safety of fiberglass over metallic options.

- Europe (Germany, UK, France, Italy, and Nordic Countries): Europe represents a stable market where strict adherence to EN 131 safety norms drives consistent demand. The market is propelled by industrial modernization, factory maintenance, and a strong focus on renewable energy infrastructure. Germany and the UK are key demand centers, with consumers prioritizing durability and certifications. Market growth is steady, emphasizing specialized solutions like insulated platform ladders for complex machinery maintenance.

- Asia Pacific (APAC) (China, India, Japan, South Korea, and Southeast Asia): APAC is forecast to be the fastest-growing region, fueled by rapid urbanization, significant government investment in infrastructure (roads, railways, power grids), and burgeoning manufacturing activity. While price sensitivity remains high, increasing regulatory focus on workplace safety in countries like China and India is accelerating the transition from traditional materials (wood, aluminum) to safer fiberglass alternatives, particularly in high-risk utility sectors. Local manufacturing expansion is also impacting competitive pricing.

- Latin America (LATAM) (Brazil, Mexico, Argentina): This region shows moderate growth potential, tied closely to economic stability and investment cycles in construction and resource extraction (mining, oil & gas). Demand often focuses on Type I and IA ladders, balancing cost efficiency with basic safety requirements. Market maturity varies significantly by country, with Brazil and Mexico leading consumption due to larger industrial bases.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa): Growth in MEA is largely dependent on mega-infrastructure projects, particularly in the Gulf Cooperation Council (GCC) states. High temperatures and corrosive environments common in the region necessitate durable, weather-resistant fiberglass composites, boosting demand, especially in the oil and gas and large-scale commercial real estate sectors. South Africa acts as a key industrial hub, driving regional consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberglass Step Ladder Market.- WernerCo

- Louisville Ladder Corp.

- Little Giant Ladder Systems

- Xtend+Climb

- P.W. Industries (P.W.R.)

- Ballymore Company

- Zarges GmbH

- Featherlite Ladders

- G.F. Puhl Inc.

- Fibreglass Step Ladders UK Ltd.

- Telesteps

- Tri-Arc Manufacturing

- Rung Industries

- Alaco Ladder Company

- Michigan Ladder Co.

- Hailo

- Bauer Corporation

- Gorilla Ladders

- Zhejiang Yamei

- Hebei Sinostar Group

Frequently Asked Questions

Analyze common user questions about the Fiberglass Step Ladder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fiberglass step ladders?

The primary driver is the mandatory safety requirement for non-conductive access equipment, especially in professional environments near electrical hazards, enforced by strict occupational safety regulations such as OSHA and ANSI standards globally.

How do duty ratings (e.g., Type IA, IAA) affect fiberglass step ladder selection?

Duty ratings define the maximum safe working load (e.g., Type IAA rated for 375 lbs) and are critical for industrial and commercial users to ensure the ladder meets the structural requirements for heavy-duty tasks involving workers and equipment.

Why are fiberglass ladders typically more expensive than aluminum ladders?

Fiberglass ladders are generally more costly due to the higher raw material price of resins and glass fibers, and the specialized, energy-intensive pultrusion manufacturing process required to create structurally sound, non-conductive composite rails.

Which geographical region is expected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to show the highest CAGR, fueled by rapid industrialization, massive infrastructure investment (power grids, telecom), and increasing adoption of stringent workplace safety compliance measures.

What role will smart technology play in the future development of fiberglass ladders?

Future development will involve integrating IoT sensors and AI into "smart ladders" to monitor real-time load, angle, and stability. This technology will enhance user safety by providing proactive alerts and enabling remote asset management for improved fleet compliance and maintenance prediction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager