Fiberoptic laryngoscopy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433419 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fiberoptic laryngoscopy Market Size

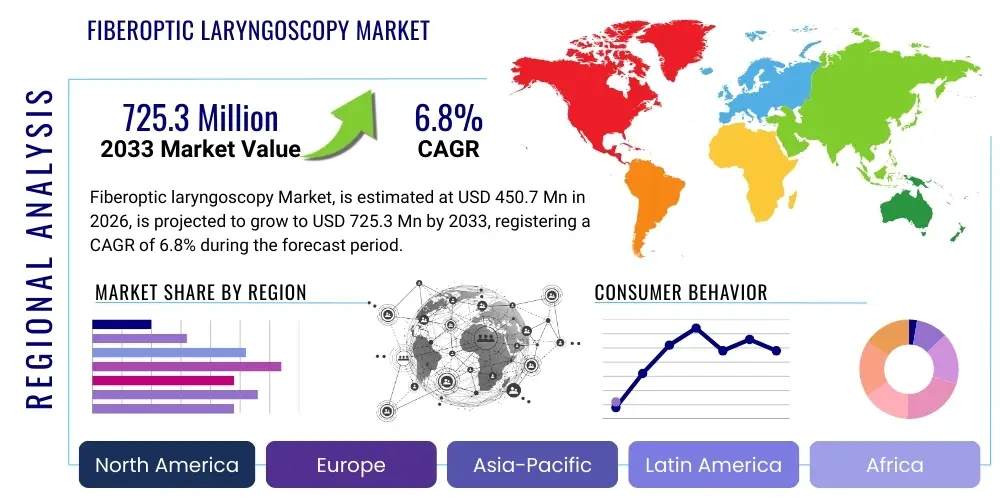

The Fiberoptic laryngoscopy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 725.3 Million by the end of the forecast period in 2033.

Fiberoptic laryngoscopy Market introduction

Fiberoptic laryngoscopy is a foundational diagnostic and therapeutic procedure utilizing a flexible endoscope, known as a fiberscope, to visualize the vocal cords, pharynx, and larynx. This minimally invasive technique is paramount in otolaryngology, anesthesiology, and emergency medicine for complex airway management, including difficult intubations, and the precise diagnosis of conditions such as vocal cord lesions, chronic cough, dysphonia, and laryngeal tumors. The ability of the fiberscope to navigate the complex anatomical structure of the upper airway with minimal patient discomfort, often under topical anesthesia, positions it as a preferred alternative to traditional rigid laryngoscopy in numerous clinical settings, driving its adoption across global healthcare systems.

The core product in this market encompasses reusable and disposable fiberscopes, complemented by associated ancillary equipment such as light sources, video processors, and documentation systems. Major applications extend beyond routine diagnostics to include therapeutic interventions like foreign body removal, targeted drug delivery, and minimally invasive biopsies. The rising global prevalence of chronic respiratory illnesses, coupled with an increasing number of surgical procedures requiring advanced intubation techniques, serves as a significant impetus for market expansion. Furthermore, the inherent benefits, including enhanced patient safety, reduced procedure time, and superior visualization compared to conventional methods, solidify its indispensable role in modern medical practice.

Key benefits derived from fiberoptic laryngoscopy include improved visualization of subglottic structures, crucial for managing challenging airways; enhanced capacity for early stage disease detection; and the provision of real-time imaging for educational and documentation purposes. The primary driving factors for market growth involve continuous technological advancements, particularly the integration of high-definition imaging and narrow-band imaging (NBI) capabilities, which improve mucosal contrast and lesion demarcation. Additionally, the growing focus on patient comfort and the global shift towards ambulatory surgical centers (ASCs) favor the adoption of flexible, reliable endoscopic tools.

Fiberoptic laryngoscopy Market Executive Summary

The global Fiberoptic Laryngoscopy Market is characterized by robust growth, primarily fueled by the accelerating demand for minimally invasive diagnostic tools and the expansion of advanced airway management protocols in critical care and surgical settings. The market exhibits a definitive business trend toward product miniaturization, enabling enhanced patient tolerance, and the rapid shift towards disposable scope technology. Disposable fiberoptic laryngoscopes are gaining traction due to concerns regarding cross-contamination, particularly in high-volume settings, despite the higher per-unit cost compared to their reusable counterparts. Major market players are strategically investing in developing integrated visualization systems that combine high-resolution fiber optics with portable, user-friendly monitors, thereby expanding accessibility in emergency departments and smaller clinical facilities.

Regional trends indicate North America currently holds a dominant market share, attributed to high healthcare expenditure, sophisticated infrastructure, and rapid adoption of cutting-edge medical devices. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth in APAC is driven by the vast patient pool, improving healthcare access in developing economies like China and India, and increasing government investment in upgrading surgical and diagnostic capabilities. Europe maintains a steady growth trajectory, supported by established reimbursement policies and a strong emphasis on early detection of laryngeal pathologies, underpinned by rigorous regulatory standards.

In terms of segmentation trends, the product segment dominated by flexible fiberscopes remains the largest revenue contributor, owing to their versatility in both diagnostic and therapeutic applications. Within end-user segments, Hospitals and Ambulatory Surgical Centers (ASCs) are the primary consumers, although specialty clinics are showing promising growth as they expand their scope of complex diagnostic procedures. Furthermore, there is a pronounced segment trend favoring devices optimized for pediatric use, addressing the critical need for specialized, small-diameter scopes that ensure safety and efficacy in treating neonatal and pediatric airway conditions.

AI Impact Analysis on Fiberoptic laryngoscopy Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fiberoptic Laryngoscopy Market typically revolve around whether AI can automate diagnostic interpretations, enhance procedural safety, and reduce the learning curve for new practitioners. Users are particularly concerned about the reliability of real-time AI guidance during intubation in complex or emergency scenarios and how AI integration will influence the necessity of specialized training. There is significant anticipation regarding AI's potential to standardize image analysis, ensuring consistent lesion detection regardless of the operator's experience level, thereby mitigating diagnostic variability. Conversely, concerns include data privacy related to image capture, regulatory approval pathways for AI-assisted devices, and the initial costs associated with integrating deep learning algorithms into existing endoscopy systems.

AI is set to revolutionize the field by enhancing diagnostic precision and optimizing procedural workflows. Deep learning algorithms are being trained on vast datasets of laryngeal images to automatically identify suspicious mucosal changes, such as early-stage squamous cell carcinoma, often subtle and easily missed by the human eye. This AI-powered assisted diagnosis provides instant second opinions, significantly improving the sensitivity and specificity of laryngeal examinations. Furthermore, AI systems can monitor the physiological parameters of the patient in real-time during intubation, offering predictive alerts regarding potential complications like oxygen desaturation or esophageal intubation, thus acting as an essential layer of procedural safety assurance, particularly in rapid sequence induction environments.

Beyond diagnostics, AI applications are extending into training and quality control. Virtual reality (VR) and augmented reality (AR) platforms, powered by AI, offer highly realistic simulations for training anesthesiologists and otolaryngologists, allowing them to practice difficult airway management scenarios without patient risk. For quality control, AI can assess the completeness of the laryngeal examination by ensuring that all anatomical landmarks have been adequately visualized and documented, leading to standardized reporting and improved patient outcomes. This move towards intelligent systems validates the investment in smart fiberoptic laryngoscopes that inherently integrate sophisticated computational capabilities at the point of care.

- Enhanced diagnostic accuracy through automated lesion detection and classification.

- Real-time procedural guidance for difficult or rapid sequence intubations (RSI).

- Improved quality assurance by standardizing examination completeness and documentation.

- Development of sophisticated AI-powered simulation platforms for practitioner training.

- Reduction in inter-observer variability in the interpretation of laryngeal images.

- Predictive analytics for estimating intubation difficulty based on airway visualization scoring (e.g., Cormack-Lehane grading).

DRO & Impact Forces Of Fiberoptic laryngoscopy Market

The Fiberoptic Laryngoscopy Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating aging population globally, which inherently increases the incidence of age-related laryngeal and pharyngeal diseases, including malignancy and voice disorders, thereby necessitating frequent diagnostic procedures. Concurrently, the increasing clinical acceptance and adoption of advanced video laryngoscopy techniques, which often utilize flexible fiber optics or comparable CMOS technology, push traditional rigid scopes out of favor, promoting the flexible fiberscope segment. Furthermore, mandated infection control standards across regulated markets are driving the critical shift toward single-use (disposable) devices, addressing patient safety concerns related to reprocessing and sterilization failures.

Restraints to market growth primarily include the high initial capital expenditure associated with purchasing high-definition reusable fiberoptic systems and their complex associated video towers. Additionally, the stringent regulatory landscape in highly developed regions, such as the FDA's 510(k) clearance process in the US and the MDR compliance in Europe, introduces delays and significant costs for manufacturers, potentially slowing the launch of innovative products. Moreover, in low- and middle-income countries, inadequate reimbursement policies and the lack of specialized trained professionals limit the widespread adoption of these sophisticated, yet costly, diagnostic tools, restricting market penetration in these potentially high-growth regions.

Opportunities for expansion lie prominently in the development of cost-effective, portable, and durable battery-operated fiberoptic systems, increasing their utility in emergency pre-hospital care and remote settings. The burgeoning trend of miniaturization and the integration of 'chip-on-the-tip' technology, which offers superior image quality to traditional fiber bundles, presents a lucrative pathway for technological differentiation. Impact forces, such as global pandemics (like COVID-19) that necessitate stringent infection control and prompt, safe airway management, have dramatically increased the demand for disposable scopes. Economic impact forces, particularly fluctuations in global healthcare spending and budget allocations towards surgical equipment procurement, directly influence market uptake. Technological impact forces, driven by competitors in the rigid and video laryngoscopy markets, compel fiberoptic providers to continuously innovate in areas such as illumination, field of view, and durability to maintain a competitive edge.

Segmentation Analysis

The Fiberoptic Laryngoscopy Market is intricately segmented based on product type, usability, application, and end-user, providing a granular view of market dynamics and potential growth pockets. The segmentation highlights the underlying technological preferences and the diverse clinical needs dictating purchasing decisions across different healthcare environments. Analyzing these segments is critical for manufacturers to tailor their marketing and product development strategies, ensuring devices meet specific requirements, whether it be the high durability needed for hospital operating rooms or the portability required for emergency settings. The prevailing trend toward single-use devices, while challenging reusable scope market share, underscores the growing priority of infection control in clinical practice.

The product type segmentation differentiates between flexible fiberoptic laryngoscopes, which utilize optical fibers to transmit the image, and the associated video/imaging systems necessary for display and documentation. The application segment reveals the breadth of the scope's utility, ranging from general examination and diagnosis of laryngeal diseases to critical interventions like complex endotracheal intubation, particularly in neonates or patients with anatomical anomalies. Usability segmentation—reusable versus disposable—is currently the most dynamic area, with disposable scopes experiencing the highest growth trajectory due to their inherent advantages in minimizing cross-contamination risks and eliminating expensive, time-consuming reprocessing protocols, aligning with modern infection prevention guidelines.

End-user analysis demonstrates that large multispecialty hospitals remain the dominant consumer segment due to the high volume of surgeries, emergency cases, and specialized otolaryngology departments. However, the rise of Ambulatory Surgical Centers (ASCs) is significant, as these facilities increasingly manage complex outpatient procedures that require precise airway management tools like flexible laryngoscopes. Understanding these segment behaviors allows stakeholders to predict future investment flows, recognizing that ASCs prioritize compact, reliable, and often disposable devices, whereas major academic hospitals may invest in the most technologically advanced, reusable systems with integrated digital documentation capabilities.

- By Product Type:

- Flexible Fiberoptic Laryngoscopes

- Video/Imaging Systems and Accessories

- Portable Scopes

- By Usability:

- Reusable Scopes

- Disposable (Single-Use) Scopes

- By Application:

- Endotracheal Intubation

- Laryngeal Examination and Diagnosis (e.g., Biopsy, Stroboscopy)

- Therapeutic Procedures (e.g., Foreign Body Removal)

- By End User:

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (e.g., Otolaryngology Clinics)

- Emergency Medical Services (EMS)

Value Chain Analysis For Fiberoptic laryngoscopy Market

The value chain for the Fiberoptic Laryngoscopy Market begins with the highly specialized upstream component manufacturing, primarily involving the sourcing of high-purity glass fiber bundles, CMOS sensors (for video models), complex lens systems, and durable biocompatible polymer materials. This initial stage is characterized by significant investment in R&D to enhance image resolution and reduce scope diameter. Key raw material suppliers, often concentrated in specific high-technology hubs, provide these components to Original Equipment Manufacturers (OEMs). Manufacturing complexity is high, demanding precision engineering, cleanroom environments, and rigorous quality control, especially concerning the flexibility and longevity of the fiber bundle, which dictates the scope's performance and lifespan. Successful OEMs leverage proprietary knowledge in optics and miniaturization to establish a competitive advantage in the market.

The midstream involves the core manufacturing, assembly, and rigorous testing phases, culminating in the creation of the final fiberoptic laryngoscope product, along with its corresponding light source and video processor unit. Following manufacturing, the distribution channel plays a pivotal role in market penetration. Distribution is broadly segmented into direct sales and indirect channels. Direct sales are typically employed for major hospital systems and academic centers, where specialized sales representatives manage large contracts, provide technical training, and offer direct maintenance services, fostering strong client relationships. This direct approach ensures precise handling of complex, high-value reusable equipment and facilitates faster feedback loops for product improvement.

Indirect distribution relies heavily on established networks of regional distributors, medical device wholesalers, and third-party logistics providers, particularly crucial for reaching smaller clinics, ASCs, and international markets where manufacturers lack direct physical presence. Downstream activities involve the crucial steps of clinical utilization, ongoing device maintenance, and sterilization protocols for reusable scopes. The growing segment of disposable scopes simplifies the downstream, eliminating reprocessing costs and risks but shifting the operational focus toward efficient inventory management and waste disposal. Ultimate end-users, including anesthesiologists, surgeons, and emergency physicians, rely on continuous technical support and accredited training programs to maximize device efficacy and patient safety.

Fiberoptic laryngoscopy Market Potential Customers

The primary purchasers and end-users of fiberoptic laryngoscopy equipment span a wide array of healthcare institutions and specialized medical practitioners who require precision visualization for airway management and laryngeal diagnostics. Hospitals, particularly large multi-specialty and academic medical centers, represent the largest and most frequent buyers. Within these institutions, the key departments driving procurement include Anesthesiology, Otolaryngology (ENT), Critical Care Units (ICUs), Emergency Departments (EDs), and Pulmonary Medicine. These departments mandate continuous access to both standard and specialized fiberoptic scopes to manage routine intubations, difficult airways, and complex diagnostic examinations of the throat and voice box.

Another rapidly expanding customer segment includes Ambulatory Surgical Centers (ASCs) and dedicated specialty clinics, particularly those focusing on voice disorders (laryngology clinics) and outpatient endoscopic procedures. ASCs prioritize flexible, portable, and often disposable systems that minimize turnaround time and reprocessing requirements, catering to the increasing volume of same-day surgeries. Furthermore, military medical units and Emergency Medical Services (EMS) providers constitute a crucial market, demanding robust, battery-operated, portable scopes suitable for field use and challenging pre-hospital environments where standard equipment access is limited and reliable visualization is paramount for trauma patient stabilization.

Educational institutions and simulation centers also function as significant potential customers, requiring simulation-grade fiberoptic systems for the training of medical residents, nurses, and paramedical staff. These buyers focus on durability and compatibility with advanced simulation mannequins and virtual training platforms. The procurement decision-making process within large hospitals typically involves a multidisciplinary committee comprising anesthesiology chiefs, infection control specialists, and purchasing managers, highlighting the need for products that offer both clinical superiority and cost-effectiveness over the device lifecycle, particularly for reusable models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 725.3 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ambu A/S, Karl Storz SE & Co. KG, Olympus Corporation, PENTAX Medical (HOYA Group), Medtronic Plc, Teleflex Incorporated, Verathon Inc., ProSurg Inc., XION GmbH, SonoScape Medical Corp., Zhejiang Supereyes Medical Apparatus Co. Ltd., Ackermann Instrumente GmbH, Richard Wolf GmbH, OptiXend, Inc., Clarus Medical, Rudolf Riester GmbH, Venner Medical GmbH, Adroit Surgical Inc., Fujifilm Holdings Corporation, Intersurgical Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiberoptic laryngoscopy Market Key Technology Landscape

The technology landscape of the Fiberoptic Laryngoscopy Market is currently defined by a duality: the mature, yet continuously refined, traditional fiber bundle technology and the rapidly emerging digital video technologies. Traditional fiberoptic scopes utilize coherent glass fiber bundles to transmit the image from the distal tip to the eyepiece or camera. Advancements in this domain focus primarily on increasing the numerical aperture of the fiber bundles to gather more light, thus improving brightness and resolution, while simultaneously reducing the scope diameter to enhance patient comfort and access to difficult airways. Materials science innovations also contribute to the durability and flexibility of the insertion tube, extending the life cycle of reusable scopes.

The most transformative trend in the landscape is the migration toward high-definition video technology, often referred to as 'chip-on-the-tip' technology. Although technically distinct from pure fiberoptic scopes, many modern flexible video laryngoscopes incorporate fiber bundles for illumination alongside a CMOS or CCD sensor located at the distal end. This technological integration eliminates the pixelation inherent in traditional fiber bundles, delivering superior, full-screen digital image quality crucial for accurate diagnosis and teaching purposes. For disposable scopes, manufacturing processes are increasingly reliant on highly optimized, cost-effective CMOS sensors and integrated LED illumination, ensuring high performance while adhering to strict per-unit cost constraints necessary for single-use economics.

Furthermore, connectivity and integration with hospital digital ecosystems are becoming mandatory. Modern fiberoptic and video laryngoscopy systems incorporate features such as Wi-Fi connectivity, integration with PACS (Picture Archiving and Communication Systems), and electronic health record (EHR) compatibility. This allows for seamless documentation, remote consultation, and simplified archiving of high-quality images and video recordings of the procedure. The development of Narrow Band Imaging (NBI) and other specialized light filtering techniques further elevates the technological standard, allowing clinicians to visualize subtle changes in mucosal blood vessel patterns, aiding in the early identification and staging of laryngeal malignancies, making these advanced visualization modes a key competitive differentiator.

Regional Highlights

The global Fiberoptic Laryngoscopy Market exhibits significant regional variation in terms of market maturity, regulatory environment, healthcare expenditure, and adoption rates of advanced technology. North America, encompassing the United States and Canada, currently maintains the dominant market share. This dominance is driven by several critical factors: exceptionally high per capita healthcare spending, the presence of numerous specialized surgical and academic institutions, and a sophisticated infrastructure that readily adopts high-cost, technologically advanced medical devices. The region also benefits from well-established reimbursement policies for endoscopic procedures, alongside a heightened awareness and aggressive management of difficult airways in critical care settings, propelling the demand for state-of-the-art fiberoptic and video laryngoscopes.

Europe represents the second-largest market, characterized by mature healthcare systems in Western European countries (Germany, UK, France). Market growth here is steady, supported by robust regulatory standards, particularly the Medical Device Regulation (MDR), which, while challenging for manufacturers, ensures high product quality and safety. The European market shows a strong preference for reusable, high-end optical devices manufactured by established regional players, although the push for infection control is gradually increasing the uptake of disposable alternatives. Eastern Europe, while smaller, is demonstrating rapid growth as healthcare infrastructure modernization initiatives receive substantial governmental and private investment, focusing on upgrading surgical and diagnostic equipment inventories.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to the massive population base, increasing incidence of respiratory and laryngeal diseases, and substantial improvements in healthcare access and infrastructure across highly populated nations like China, India, and Japan. While price sensitivity remains a factor in many APAC countries, the rising middle class and increasing medical tourism drive demand for advanced diagnostic tools. Government initiatives aimed at expanding universal health coverage and medical equipment procurement also contribute significantly. Latin America and the Middle East & Africa (MEA) represent emerging markets, where growth is currently constrained by lower healthcare budgets and fragmented distribution networks, but offer substantial long-term potential driven by urbanization and expanding private healthcare sectors.

- North America: Market leadership driven by high adoption of advanced video technology, strong regulatory framework (FDA), and extensive presence of specialized critical care facilities. Focus on high-definition visualization and disposable options.

- Europe: Stable market growth, underpinned by robust national health services (NHS, GKV), stringent quality standards (MDR compliance), and high clinical demand for early cancer detection. Germany and the UK are key revenue contributors.

- Asia Pacific (APAC): Highest CAGR forecast due to rapid healthcare modernization, expanding clinical capacity, and large patient pool in China and India. Growing emphasis on cost-effective, high-quality manufacturing locally.

- Latin America (LATAM): Growth driven by increased private investment in hospitals and improving surgical capacity, though hindered by economic volatility and reliance on imported equipment.

- Middle East & Africa (MEA): Emerging market concentrated in the Gulf Cooperation Council (GCC) countries, focusing on establishing world-class medical facilities and attracting high-end medical device manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiberoptic laryngoscopy Market.- Ambu A/S

- Karl Storz SE & Co. KG

- Olympus Corporation

- PENTAX Medical (HOYA Group)

- Medtronic Plc

- Teleflex Incorporated

- Verathon Inc.

- ProSurg Inc.

- XION GmbH

- SonoScape Medical Corp.

- Zhejiang Supereyes Medical Apparatus Co. Ltd.

- Ackermann Instrumente GmbH

- Richard Wolf GmbH

- OptiXend, Inc.

- Clarus Medical

- Rudolf Riester GmbH

- Venner Medical GmbH

- Adroit Surgical Inc.

- Fujifilm Holdings Corporation

- Intersurgical Ltd.

Frequently Asked Questions

Analyze common user questions about the Fiberoptic laryngoscopy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference driving growth between reusable and disposable fiberoptic laryngoscopes?

The crucial difference driving the growth of disposable fiberoptic laryngoscopes is the elimination of cross-contamination risk and the reduction of high reprocessing costs associated with reusable devices. While reusable scopes offer superior optical quality and a lower cost per use over their lifespan, increasing regulatory pressure and clinical focus on patient safety, especially concerning high-risk infections, are accelerating the adoption of single-use disposable models, particularly in emergency and high-volume surgery settings.

How is the integration of video technology affecting traditional fiberoptic laryngoscopy procedures?

The integration of digital video (chip-on-the-tip) technology is transforming traditional fiberoptic laryngoscopy by offering superior, high-definition, non-pixilated images, enhancing both diagnostic accuracy and teaching capabilities. While traditional fiber optics remain valuable for extremely thin scopes or specific environments, video integration provides critical advantages such as real-time documentation, easier group viewing, and improved contrast capabilities (like NBI), making video-assisted scopes the gold standard for many complex diagnostic and therapeutic procedures.

Which application segment holds the largest market share and why is it so critical?

The Endotracheal Intubation segment, encompassing both routine and difficult airway management, currently holds the largest market share. This criticality stems from the indispensable role fiberoptic laryngoscopes play in assuring patient safety during anesthesia and critical care interventions. Their ability to visualize and secure difficult airways where conventional methods fail significantly reduces morbidity and mortality, making them an essential, high-utilization tool in operating rooms and intensive care units globally.

What are the major technological limitations manufacturers are striving to overcome in this market?

Manufacturers are primarily focusing on overcoming two major technological limitations: improving the durability and rigidity-to-flexibility ratio of reusable scopes to extend their service life, and, more critically, achieving high-definition image quality in disposable scopes at a significantly reduced manufacturing cost. The goal is to produce disposable units that match the performance of high-end reusable systems while maintaining the economic viability required for single-use clinical practice, balancing optical performance with cost management.

How do regulatory changes, such as the EU MDR, influence the Fiberoptic Laryngoscopy Market?

Regulatory changes like the European Union Medical Device Regulation (MDR) significantly influence the market by increasing the compliance burden on manufacturers, demanding more extensive clinical evidence, and ensuring rigorous post-market surveillance. While these regulations promote higher standards of device safety and quality, they also increase R&D costs and time-to-market, potentially favoring larger, established companies with resources to navigate the complex certification processes, thus impacting smaller manufacturers and market innovation speed within regulated regions.

This report has been generated in accordance with the specified technical and content requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager