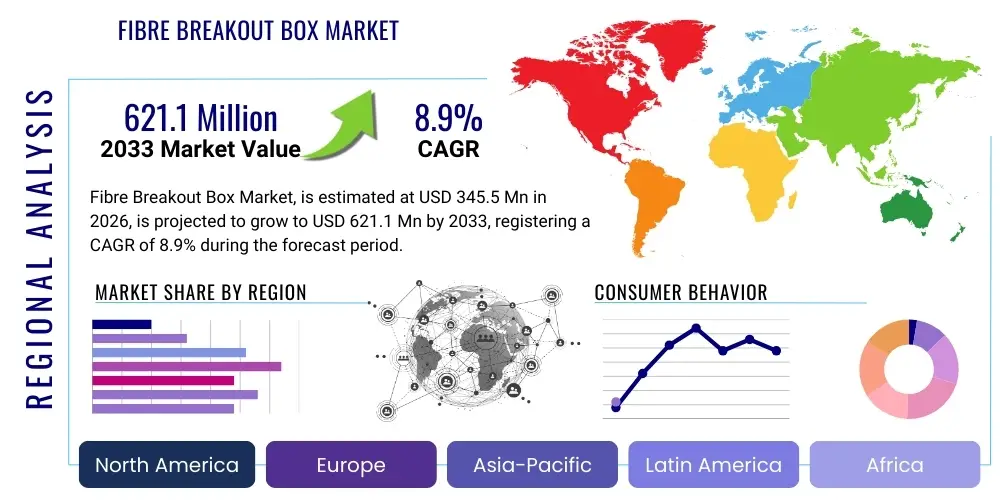

Fibre Breakout Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438603 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fibre Breakout Box Market Size

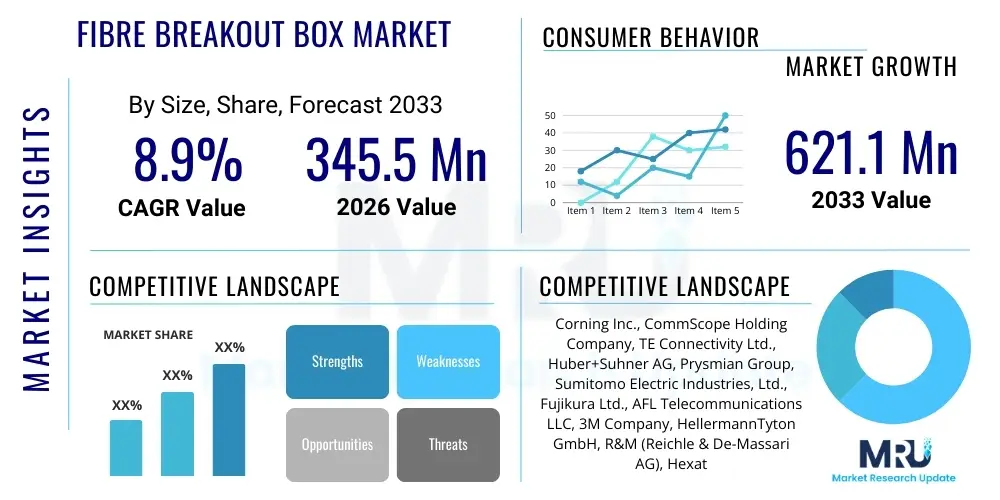

The Fibre Breakout Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 345.5 Million in 2026 and is projected to reach USD 621.1 Million by the end of the forecast period in 2033.

Fibre Breakout Box Market introduction

The Fibre Breakout Box (FBB) Market encompasses specialized passive optical components designed to facilitate the distribution, organization, and protection of individual optical fibres derived from a multi-fibre cable, typically in FTTx (Fibre-to-the-x) networks. These boxes serve as crucial points in the last-mile infrastructure, enabling the conversion of high-capacity feeder cables into manageable drop cables for premises connectivity. Major applications include residential broadband deployment, commercial building installations, and enterprise data center connectivity where secure and flexible fibre management is paramount. Key benefits driving adoption include enhanced network scalability, superior physical protection of delicate optical splices, and simplified maintenance and troubleshooting procedures, directly addressing the growing global demand for high-speed, reliable bandwidth.

Fibre Breakout Boxes are essential elements in the expanding architecture of next-generation telecommunication networks, particularly as global internet usage demands higher bandwidth capacity and lower latency. The primary function of these components is to ensure the integrity of the optical path from the central office or local exchange point directly to the end-user’s location. They provide a ruggedized enclosure capable of withstanding various environmental conditions, whether installed outdoors on poles, mounted on building façades, or deployed within indoor riser environments. The evolving design focuses on optimizing density, improving ease of installation through modular components, and maintaining compatibility with various fibre types and connector standards, such as SC, LC, and MPO, critical for diverse deployment scenarios.

The market growth is substantially driven by massive governmental and private sector investments in ubiquitous fibre optic infrastructure across developing and developed nations. Initiatives focused on smart cities, rural broadband deployment, and the rollout of 5G networks necessitate denser and more reliable fibre termination points, directly increasing the demand for robust Fibre Breakout Boxes. Furthermore, the migration of businesses to cloud computing and the proliferation of IoT devices amplify the need for reliable fibre backhaul, making FBBs indispensable for efficient network provisioning. Technological advancements focusing on miniaturization, enhanced ingress protection ratings (IP ratings), and tool-less installation mechanisms are further accelerating market penetration across diverse geographical and structural landscapes.

Fibre Breakout Box Market Executive Summary

The Fibre Breakout Box Market exhibits robust growth propelled by accelerated global FTTx deployments and the persistent demand for reliable high-speed broadband infrastructure, particularly in emerging markets. Business trends highlight a strong emphasis on automation-ready designs, modularity for scalable deployment, and increased integration of hardened optical connectors to minimize installation time and environmental susceptibility. Regionally, the Asia Pacific remains the dominant market due to expansive governmental fibre optic network projects in China and India, while North America and Europe focus on upgrading existing infrastructure to gigabit speeds. Segmentation trends show a distinct preference shift towards smaller, higher-density wall-mounted boxes for urban deployments, alongside a growing adoption of splice/connector hybrid models offering flexible connectivity options suitable for varied end-user requirements.

Current market dynamics are characterized by intensifying competition among component manufacturers, leading to continuous innovation in material science and design engineering aimed at reducing overall component size while increasing fibre count capacity. Strategic mergers, acquisitions, and partnerships are increasingly common as market players seek to expand their geographical footprint and bolster their product portfolios with specialized, environmentally hardened solutions. The focus on lowering the Total Cost of Ownership (TCO) for network operators is influencing product development, encouraging the creation of products that require minimal skilled labor for installation and possess extended operational lifecycles. This emphasis on operational efficiency is a core trend shaping vendor strategies across the value chain, from raw material procurement to final network deployment.

Moreover, the adoption of specialized boxes designed for harsh environments, such as those exposed to extreme temperatures or high moisture levels, is expanding, driven by the need for network resilience in diverse global climates. The enterprise segment, specifically data center interconnect and campus networks, is showing elevated demand for high-performance, high-density breakout boxes compliant with stringent fire and safety standards. This segment demands flexibility to accommodate ribbon fiber and high-channel count MPO/MTP connectors. Looking ahead, the synergy between Fibre Breakout Box deployment and 5G backhaul infrastructure deployment represents a significant opportunity, as cell densification requires robust, localized fibre termination points, ensuring sustained market expansion throughout the forecast period and cementing the FBB’s role as a critical enabler of digital transformation.

AI Impact Analysis on Fibre Breakout Box Market

User queries regarding the impact of Artificial Intelligence on the Fibre Breakout Box Market primarily focus on how AI can optimize network deployment and maintenance, rather than directly affecting the physical manufacturing of the boxes themselves. Key themes include AI-driven predictive maintenance scheduling for passive infrastructure, automated fault localization within FTTx networks, and the use of AI algorithms to optimize cable routing and box placement during network planning to minimize material usage and maximize signal quality. Users are particularly concerned about how AI can integrate with existing Optical Network Terminals (ONTs) and management systems to monitor the health and performance of the passive optical network (PON) containing the FBBs, ensuring seamless operation and reducing Mean Time To Repair (MTTR).

While the Fibre Breakout Box remains a passive hardware component, its deployment and subsequent operational efficiency are significantly benefiting from AI and machine learning integration within the wider network ecosystem. AI tools are increasingly being used in the pre-deployment phase to analyze geospatial data, subscriber density, and topographical constraints, allowing network planners to determine the optimal location and configuration (e.g., required port density, ruggedization level) for each FBB. This intelligent planning reduces over-engineering and capital expenditure (CAPEX). Post-deployment, AI-powered diagnostic systems analyze telemetry data from active network components to infer potential degradation or fault locations within the passive fibre infrastructure, potentially indicating stress on the breakout box or associated splice points, thus streamlining proactive maintenance efforts.

- AI optimizes FBB placement and cable routing during network planning, reducing installation costs.

- Machine Learning algorithms enhance predictive maintenance, anticipating splice degradation within the box enclosures.

- AI-driven network monitoring quickly pinpoints fibre breaks or signal loss potentially localized at the breakout box level.

- Automated inventory management systems leverage AI to forecast specific FBB requirements based on regional expansion plans.

- Increased network density driven by AI applications (like autonomous vehicles and dense IoT) necessitates higher port count FBB designs.

- AI assists in analyzing performance data from installed FBBs to inform future design improvements regarding heat dissipation and material resilience.

DRO & Impact Forces Of Fibre Breakout Box Market

The Fibre Breakout Box Market is powerfully driven by the global imperative for high-speed connectivity (Driver), yet constrained by the complexity and high initial investment required for fibre deployment, particularly in sparsely populated areas (Restraint). Significant opportunities arise from the convergence of FTTx, 5G backhaul requirements, and smart city infrastructure development, which necessitate dense fibre connectivity (Opportunity). These factors exert a combined influence, where the escalating demand for bandwidth (Impact Force) compels network operators to overcome cost barriers by investing in standardized, easily deployable FBB solutions, thereby stabilizing the market trajectory towards consistent expansion.

The primary driving force is the massive global shift toward high-data consumption activities, including 4K/8K streaming, cloud gaming, and widespread remote working, which necessitate the superior capacity and reliability offered only by fibre optic networks. Governments worldwide are prioritizing universal broadband access, often mandating specific rollout targets, which directly translates into high-volume demand for reliable passive components like FBBs. Furthermore, the relentless expansion of hyper-scale and edge data centers requires high-density breakout solutions for internal cabling and external connectivity, ensuring the market benefits from both access network growth and core network infrastructure upgrades. The transition away from legacy copper infrastructure, accelerated by its inherent bandwidth limitations, further underpins the sustained demand for fibre termination points.

However, the market faces significant restraints, chiefly related to the civil engineering challenges and the high initial capital expenditure (CAPEX) associated with laying fibre cables and deploying the associated passive equipment. Regulatory hurdles and the complexity of securing permits for trenching or aerial installations can severely delay FTTx projects, impacting FBB sales cycles. Additionally, the shortage of highly skilled technical personnel proficient in precise fibre handling, splicing, and termination poses an operational constraint, increasing the risk of installation errors at the breakout box level, which in turn necessitates component designs focused on minimizing complexity and requiring less specialized tools. Addressing these installation constraints through simplified, plug-and-play FBB designs is critical for overcoming market friction.

Segmentation Analysis

The Fibre Breakout Box Market is extensively segmented based on criteria such as the type of fibre count capacity, installation environment, and specific application usage (e.g., FTTB, FTTH). The critical segmentation by type often includes models based on the number of fibre ports (e.g., 2-4 ports, 6-12 ports, 24+ ports), which dictates their suitability for either single-dwelling units (SDUs) or multi-dwelling units (MDUs). Analysis of these segments indicates that the 6-12 port segment is currently experiencing the highest growth, driven by rapid deployment in suburban and dense residential areas requiring moderate capacity distribution points.

Further segmentation is applied based on the box structure and functionality, differentiating between splicing-only boxes, pre-terminated (connectorized) boxes, and hybrid units that combine splicing and connectivity options. The pre-terminated segment is gaining traction due to the demand for faster installation times and reduced labor costs, although splicing boxes remain popular for trunk line termination where long-term durability and customization are prioritized. Environmental segmentation (indoor vs. outdoor) is also crucial, with outdoor boxes requiring highly durable, UV-resistant, and water-resistant materials, contrasting with indoor boxes that prioritize aesthetic appeal and fire resistance, particularly for deployment within building risers and demarcation points.

Geographically, market segmentation reveals distinct technology preferences; for instance, European operators often favor aesthetically subtle, highly integrated boxes for apartment buildings, while Asian markets frequently utilize larger, higher-capacity boxes for community-wide distribution. Understanding these regional product preferences is vital for manufacturers. The comprehensive segmentation analysis provides a detailed framework for market players to tailor product development, pricing strategies, and distribution channels to target specific end-user needs effectively, ensuring optimized market penetration across the diverse application landscape.

- By Type/Fibre Count Capacity:

- Low Density (2-4 Ports)

- Medium Density (6-12 Ports)

- High Density (24 Ports and above)

- By Installation Environment:

- Outdoor (Pole/Wall Mounted, Pedestal)

- Indoor (Wall/Rack Mounted, Riser)

- By Structure/Functionality:

- Splice Only Boxes (for fusion splicing)

- Pre-terminated/Connectorized Boxes (Plug-and-Play)

- Hybrid Breakout Boxes (Splice and Connector combination)

- By Application/End-User:

- Fibre to the Home (FTTH)

- Fibre to the Building (FTTB)

- Fibre to the Curb (FTTC)

- Data Center Interconnect (DCI)

- 5G Backhaul Networks

- By Material:

- Polycarbonate/Plastic (PC/ABS Blend)

- Metal (Aluminum/Steel)

Value Chain Analysis For Fibre Breakout Box Market

The Value Chain for the Fibre Breakout Box Market begins with the sourcing of specialized raw materials, primarily high-grade plastics (like UV-stabilized PC/ABS) and robust metals, followed by the manufacturing of passive components such as plastic casings, specialized trays, and connectors (Upstream Analysis). These components are then assembled into the final FBB product, undergoing rigorous testing for environmental resilience and optical performance. Distribution occurs through both direct channels, where manufacturers supply large telecom operators, and indirect channels, involving specialized optical distributors and system integrators who add value through customized kitting and logistics. Downstream activities focus on the installation, network integration, and long-term maintenance carried out by telecom operators and specialized engineering firms, providing the final essential link to the end-users.

Upstream operations are highly sensitive to global commodity prices for polymers and specialized metals, which directly influence manufacturing costs. Key strategic focus areas for upstream players include standardization of internal component interfaces, such as splice tray designs, and incorporating advanced material science to ensure durability against harsh outdoor elements like extreme temperature fluctuations and ingress of moisture or dust. Component suppliers must adhere to strict international standards regarding flame retardancy and mechanical robustness, particularly for high-density components utilized in data center applications, maintaining stringent quality controls throughout the material processing phase to minimize production defects.

Downstream market activities are characterized by the interplay between large Tier 1 telecom operators and smaller local network providers. Direct distribution channels allow major manufacturers to leverage economies of scale and offer bespoke solutions tailored to specific network architectures, fostering long-term relationships. Conversely, indirect distribution through specialized value-added resellers (VARs) and system integrators is crucial for reaching smaller operators and navigating complex localized installation requirements. The success of the downstream phase relies heavily on simplified product design (AEO principle), reducing the complexity of field installation, and offering comprehensive training and documentation to technicians to ensure rapid and error-free network activation for the ultimate benefit of residential and commercial end-users.

Fibre Breakout Box Market Potential Customers

The primary customers and end-users of Fibre Breakout Boxes are overwhelmingly the telecommunication service providers (Telcos) and Internet Service Providers (ISPs) engaged in deploying and maintaining high-speed fibre optic access networks. This segment includes massive multinational carriers (Tier 1 operators) involved in large-scale national fibre rollouts, regional fixed-line operators, and emerging competitive local exchange carriers (CLECs). Beyond traditional telecom, key potential customers also include data center operators requiring robust termination solutions for high-density fibre interconnection, utility companies implementing smart grid infrastructure, and large commercial property developers focusing on pre-wiring buildings with fibre optic capabilities to meet future tenant demands for ultra-fast connectivity.

A significant growth vector for potential customers is the emerging segment of private network operators and municipal broadband initiatives. Municipalities and local governments in both North America and Europe are increasingly investing in their own fibre infrastructures to ensure equitable access to high-speed internet, bypassing traditional carriers. These entities often prioritize FBB solutions that offer longevity, easy maintenance access, and compatibility with open-access network standards. The demand from the utility sector is driven by the necessity for fibre backbones supporting smart metering and remote monitoring systems, requiring specialized outdoor-rated FBBs capable of reliable operation in harsh environmental conditions and secure physical enclosures to prevent tampering.

Furthermore, the hyperscale data center industry represents a lucrative customer base. These operators continuously demand cutting-edge FBBs that offer extremely high fibre density within minimal physical footprints, supporting technologies like parallel optics and high-channel-count MPO/MTP interfaces. For these specialized applications, performance characteristics such as low insertion loss and high mechanical stability are non-negotiable requirements, positioning them as high-value, quality-sensitive buyers. As 5G network densification continues, Mobile Network Operators (MNOs) also become critical customers, utilizing FBBs for Fibre-to-the-Antenna (FTTA) and mid-haul/fronthaul network connections to base stations and remote radio units (RRUs), cementing the diversity of the customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Million |

| Market Forecast in 2033 | USD 621.1 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., CommScope Holding Company, TE Connectivity Ltd., Huber+Suhner AG, Prysmian Group, Sumitomo Electric Industries, Ltd., Fujikura Ltd., AFL Telecommunications LLC, 3M Company, HellermannTyton GmbH, R&M (Reichle & De-Massari AG), Hexatronic Group AB, Sterlite Technologies Limited (STL), Fiberhome Telecom Technologies Co., Ltd., YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company), Optiarc Ltd., EXFO Inc., Diamond SA, LEGRAND SA, Huawei Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fibre Breakout Box Market Key Technology Landscape

The technological landscape of the Fibre Breakout Box market is defined by advancements in component modularity, material science, and pre-termination techniques aimed at improving network reliability and reducing field installation time. Key technologies utilized include robust ingress protection (IP) rated enclosures, specialized fibre management techniques such as bend-insensitive fibre (ITU G.657 standard) handling trays, and the use of hardened or protected connectors (e.g., OptiTap, H-Connector) that allow for quick, tool-less connections in outdoor environments. Furthermore, passive optical components within the boxes, such as integrated splitters, are becoming smaller and more efficient, allowing for higher port density and scalability without increasing the overall footprint of the box, essential for high-density urban FTTB deployments.

A major technological focus is on enhancing the ease of installation to address the skilled labor constraint. This involves the widespread adoption of factory-terminated and tested FBBs, where the fibre cable tails are pre-installed and protected with hardened connectors. This approach significantly minimizes the requirement for on-site fusion splicing, which is time-consuming and prone to environmental variability. Manufacturers are also integrating features like swivel splice trays and organized cable routing paths that utilize color-coded tubing and holders, simplifying the identification and management of individual fibres. These design innovations are directly aimed at reducing installation errors and achieving consistent performance across large-scale deployments, adhering to the principle of "install and forget" reliability.

Another pivotal technological development involves the materials used for the box enclosures. The transition towards advanced engineering plastics that offer superior UV stability, flame retardancy (crucial for indoor use), and impact resistance is accelerating. These materials must maintain their structural integrity across an expansive temperature range (-40°C to +70°C) common in global outdoor deployments. Moreover, the integration of intelligent features, although the box itself is passive, such as incorporating small RFID or NFC tags into the FBB for automated inventory tracking and digital location mapping, represents an emerging technological shift that supports smart network management and maintenance efficiency, enhancing the overall functionality within the wider digital infrastructure ecosystem.

Regional Highlights

The Fibre Breakout Box Market demonstrates significant regional variation in demand and technological preferences, primarily driven by the maturity of broadband infrastructure and governmental investment priorities. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share of global revenue and volume. This dominance is attributed to massive, centralized government-led fibre rollout programs in China, high subscriber density in India, and continuous investment in 5G and FTTH across Southeast Asia. The APAC region typically demands high-volume, cost-effective solutions with a focus on durability for both aerial and densely populated urban deployments, driving innovation in efficient manufacturing processes and standardized products.

North America and Europe represent mature markets undergoing intensive infrastructure upgrades focused on migrating customers to higher gigabit speeds and expanding coverage to rural areas. In North America, the market is characterized by a strong demand for hardened, pre-terminated outdoor boxes suitable for rapid aerial and underground deployments, driven by large carriers like AT&T and Verizon. The introduction of government subsidy programs, such as the BEAD program in the US, is expected to accelerate FBB adoption significantly over the forecast period. European demand, particularly in Western Europe, emphasizes aesthetic and compact indoor FTTB solutions, reflecting the high percentage of multi-dwelling unit (MDU) living and stringent fire safety regulations, prioritizing small, non-obtrusive distribution points.

The Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging as high-growth markets, albeit starting from a smaller base. In LATAM, competitive local fiber providers are rapidly expanding networks, creating a surge in demand for flexible, cost-efficient FBB solutions, particularly in Brazil and Mexico. The MEA region is benefiting from national digital transformation agendas, especially in the Gulf Cooperation Council (GCC) countries, where smart city projects and new business district developments necessitate robust, high-performance fibre infrastructure. These regions frequently require specialized FBBs designed to withstand extreme desert temperatures and dust ingress, making material resilience a key purchasing criterion and showcasing the global diversity in product requirements.

- Asia Pacific (APAC): Dominant market share fueled by national broadband plans (China, India), high urbanization, and 5G deployment density. Strong focus on cost-efficient, high-volume outdoor FBBs.

- North America: High demand for advanced, pre-terminated, and hardened connectors in FBBs to facilitate rapid deployment and reduce installation labor costs in FTTx and greenfield projects.

- Europe: Emphasis on compact, aesthetically pleasing, and highly integrated indoor FBBs for MDU environments, adhering to strict CPR (Construction Products Regulation) and fire safety standards.

- Latin America (LATAM): High growth potential driven by competitive regional ISPs and expansion into previously underserved urban and rural areas, preferring robust and scalable solutions.

- Middle East & Africa (MEA): Growth tied to smart city developments (e.g., Saudi Arabia, UAE) and the need for climate-resilient FBBs capable of operating reliably in extreme heat and dusty conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fibre Breakout Box Market.- Corning Inc.

- CommScope Holding Company

- TE Connectivity Ltd.

- Huber+Suhner AG

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Fujikura Ltd.

- AFL Telecommunications LLC

- 3M Company

- HellermannTyton GmbH

- R&M (Reichle & De-Massari AG)

- Hexatronic Group AB

- Sterlite Technologies Limited (STL)

- Fiberhome Telecom Technologies Co., Ltd.

- YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company)

- Optiarc Ltd.

- EXFO Inc.

- Diamond SA

- LEGRAND SA

- Huawei Technologies Co., Ltd.

- Clearfield, Inc.

- SENKO Advanced Components, Inc.

Frequently Asked Questions

Analyze common user questions about the Fibre Breakout Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Fibre Breakout Box in an FTTx network?

The primary function of a Fibre Breakout Box (FBB) is to act as a crucial fibre distribution point in the last mile of a Fibre-to-the-x network. It provides a secure, organized enclosure for splicing, terminating, and managing individual optical fibres derived from a multi-fibre feeder cable, enabling connectivity to end-user drop cables.

What are the key technical differences between an indoor and outdoor Fibre Breakout Box?

Outdoor FBBs require superior material construction, typically high IP ratings (IP65 or higher) and UV-stabilized enclosures, to withstand environmental exposure, moisture, and extreme temperatures. Indoor FBBs prioritize compactness, fire resistance (CPR compliance), and aesthetic integration within building riser systems or equipment rooms.

How is the growth of 5G infrastructure affecting the demand for Fibre Breakout Boxes?

5G infrastructure necessitates high-density fibre connectivity, particularly for mid-haul and fronthaul networks connecting distributed small cells and remote radio units. This dense deployment strategy significantly increases the demand for robust, small-footprint Fibre Breakout Boxes used as critical demarcation and termination points near cell sites.

What is the significance of pre-terminated FBBs in reducing network deployment costs?

Pre-terminated Fibre Breakout Boxes arrive factory-equipped with connectors, eliminating the need for time-consuming and labor-intensive field splicing. This dramatically reduces installation complexity, minimizes labor costs, shortens deployment timelines, and ensures consistent optical performance across large-scale rollouts, optimizing operational expenditure.

Which geographical region exhibits the strongest current market growth for Fibre Breakout Boxes?

The Asia Pacific (APAC) region currently demonstrates the strongest market growth for Fibre Breakout Boxes, driven by extensive governmental initiatives in China and India focused on rapidly expanding FTTx coverage and accelerating 5G infrastructure deployment throughout the dense urban and increasingly covered rural areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager