Fibre Cleavers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432175 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fibre Cleavers Market Size

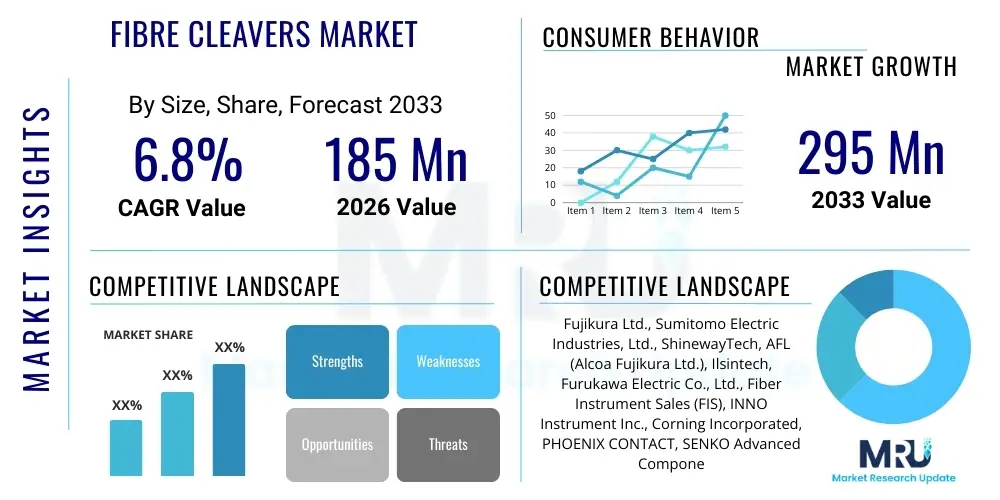

The Fibre Cleavers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185 Million in 2026 and is projected to reach $295 Million by the end of the forecast period in 2033.

Fibre Cleavers Market introduction

The Fibre Cleavers Market encompasses the specialized precision tooling utilized for preparing optical fibers prior to splicing or connectorization. A fibre cleaver is essential for achieving a precise, mirror-quality end-face, which minimizes optical loss and ensures the structural integrity of the resulting fiber joint. This preparation process is non-negotiable in high-bandwidth installations, particularly those involving fusion splicing in telecommunications and data transmission infrastructure. The performance of the cleaver directly impacts the long-term reliability and efficiency of the entire fiber optic network, making it a critical component within the installation and maintenance ecosystem. Key advancements focus on improving portability, enhancing automation, and ensuring highly consistent cleave angles, especially for demanding applications like Polarization Maintaining (PM) fibers.

Major applications driving market growth include the global deployment of Fiber-to-the-Home (FTTx) networks, the relentless expansion of hyper-scale data centers requiring vast amounts of high-density fiber connectivity, and specialized industrial sectors such as aerospace, defense, and medical devices. Fibre cleavers are categorized primarily by the level of automation (manual, semi-automatic, and fully automatic) and the type of fiber they can handle (single-fiber or ribbon fiber). The primary benefit delivered by high-quality fibre cleavers is the assurance of low splice loss, which translates directly into superior network performance and reduced operational expenses related to re-work and maintenance. The market’s trajectory is heavily influenced by infrastructural spending on broadband and 5G rollouts across emerging and developed economies.

Driving factors for the sustained market expansion include the exponential increase in global data traffic, necessitating faster and higher-capacity optical networks. Furthermore, technological shifts towards more complex fiber types, such as specialty fibers used in sensing and harsh environments, require increasingly sophisticated cleaving tools capable of tighter tolerances. Regulatory initiatives promoting universal broadband access also underpin robust demand for cleaving equipment. The competitive landscape is characterized by manufacturers continuously innovating in blade technology (material science, geometry), ergonomic design for field use, and smart integration features that interface directly with fusion splicers to provide quality assurance feedback, optimizing the entire installation workflow.

Fibre Cleavers Market Executive Summary

The Fibre Cleavers Market is poised for substantial growth, driven predominantly by infrastructural investments in high-speed optical networks globally. Business trends indicate a strong shift towards automatic and specialized cleavers, particularly those designed for high-volume splicing in data center environments and dense urban FTTx deployments. Key market players are concentrating on developing intelligent cleavers featuring Bluetooth connectivity, automatic blade rotation, and waste fiber management systems, addressing the critical need for consistency and efficiency among field technicians. The market structure is moderately consolidated, with major players maintaining technological leads through patenting advanced diamond or tungsten carbide blade technologies. Furthermore, supply chain resilience is becoming a critical factor, especially concerning the sourcing of high-precision components and specialized blade materials, which can affect production capacity and pricing stability.

Regionally, the Asia Pacific (APAC) continues to dominate the market share, fueled by massive government-backed FTTx projects in countries like China, India, and Southeast Asia, alongside the region’s status as a major manufacturing hub for fiber optic cables and related components. North America and Europe, while representing mature markets, exhibit strong demand for high-end, automatic cleavers utilized in the deployment of 5G infrastructure and upgrading legacy data networks. The migration from standard single-mode fiber to specialized multi-fiber ribbons in data center interconnects (DCIs) is a notable trend observed in Western markets, necessitating the adoption of specialized ribbon cleaving equipment. The Middle East and Africa (MEA) are emerging as high-growth regions, spurred by significant government investment in smart city initiatives and diversification away from oil economies, leading to rapid expansion of underground fiber optic backbones.

Segmentation trends reveal that the automatic fibre cleavers segment is expected to witness the highest CAGR, primarily due to the need for minimized human error and accelerated deployment schedules in large-scale projects. By application, the telecommunications sector remains the largest consumer, but the medical/sensing segment is growing rapidly, demanding ultra-precise cleavers for minimally invasive surgical instruments and sophisticated sensor arrays. Pricing pressures exist mainly in the manual and low-cost semi-automatic cleaver segments, especially those targeting smaller localized installations. However, the high-precision, automatic cleaver segment maintains strong pricing power, justified by the enhanced reliability and reduced long-term operational costs they offer to large telecommunication service providers and network builders. Strategic partnerships between cleaver manufacturers and fusion splicer companies are increasingly common, aiming to provide integrated, optimized solutions.

AI Impact Analysis on Fibre Cleavers Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Fibre Cleavers Market primarily revolve around how machine learning can enhance cleaving precision, automate quality control, and integrate seamlessly with broader network management systems. Users are concerned about achieving 'perfect' cleaves consistently, especially in complex environments or when handling novel fiber types. Key themes emerging from these questions include the integration of real-time image processing using AI for defect detection, predictive maintenance of cleaver blades, and the optimization of cleaving parameters (like pressure and speed) based on environmental factors and fiber material properties. There is also significant interest in how AI can minimize waste and improve the yield rate in high-volume manufacturing settings.

The adoption of AI and Machine Learning (ML) algorithms is set to revolutionize the precision and consistency offered by automatic fibre cleavers. AI-driven vision systems can analyze the microscopic end-face geometry immediately post-cleaving, comparing it against optimal parameters and identifying subtle defects such as hacks, lips, or protruding points that are often missed by traditional inspection methods or human operators. This real-time, quantitative analysis allows the cleaver to adjust its internal parameters (e.g., scoring force or tension) dynamically for subsequent cleaves, thereby maximizing efficiency and minimizing the need for re-cleaving. For manufacturers, AI-enabled processes contribute significantly to waste reduction and quality assurance, moving towards a zero-defect manufacturing standard for fiber optic components.

Furthermore, AI algorithms are being employed in predictive maintenance for cleaver mechanisms, specifically tracking the degradation of the scoring blade. By analyzing patterns in cleave quality metrics and the total number of cleaves performed, the system can accurately forecast when blade rotation or replacement is necessary, preempting costly failures and ensuring uninterrupted high-quality performance in critical field deployment scenarios. This capability is paramount for large network operators who manage thousands of installations monthly, as it transforms maintenance from a reactive task to a proactive, data-driven process. The future integration of these AI-enhanced cleavers with fusion splicers and cloud-based network diagnostic platforms will create a fully optimized ecosystem for fiber installation and monitoring, marking a significant leap toward autonomous field operations.

- Enhanced Automated Quality Control: AI algorithms analyze cleave angle and end-face geometry in milliseconds, ensuring superior consistency compared to manual inspection.

- Predictive Blade Maintenance: Machine learning models track blade wear based on usage history and environmental variables, optimizing replacement cycles.

- Dynamic Parameter Adjustment: Real-time feedback loops powered by AI allow automatic cleavers to adjust scoring force and tension based on fiber specifications and ambient conditions.

- Integration with Splicing Equipment: AI enables cleavers to communicate quality data directly to fusion splicers, optimizing splicing parameters for reduced splice loss.

- Defect Recognition Automation: High-resolution imaging combined with deep learning identifies microscopic imperfections (chips, residual material) that affect optical performance.

DRO & Impact Forces Of Fibre Cleavers Market

The Fibre Cleavers Market is fundamentally shaped by a robust set of driving factors stemming primarily from global digital transformation and infrastructural necessity. The imperative for higher data throughput, catalyzed by the widespread rollout of 5G networks, the expansion of cloud services, and the pervasive adoption of IoT devices, mandates the continuous expansion and densification of fiber optic networks globally. This massive investment in infrastructure directly drives the demand for high-quality, reliable cleaving tools. Technological advancements in fusion splicing equipment also necessitate corresponding improvements in cleaving precision, as modern splicers can achieve extremely low loss only when the fiber end-face preparation is near-perfect. The transition to specialized fiber types, such as multi-core and polarization-maintaining fibers, particularly in specialized industrial and defense applications, further accelerates the demand for advanced, specialized cleavers capable of handling complex geometries.

However, the market faces inherent restraints, most notably the significant initial capital investment required for high-precision, automatic cleaving units, which can pose a barrier to entry for smaller contractors or installers in developing regions. Furthermore, the inherent technical complexity and sensitivity of these tools necessitate specialized training for technicians, and improper use can rapidly degrade the expensive internal components, such as the precision blade, leading to higher maintenance costs and downtime. The market also contends with the saturation of some developed FTTx markets, meaning growth shifts from initial deployment to ongoing maintenance and replacement cycles. Moreover, the prevalence of low-cost, low-quality manual cleavers, especially from APAC manufacturers, introduces pricing pressure and potential quality risks into the market, challenging the perceived value of high-end automatic solutions.

Opportunities for growth are concentrated around emerging specialized applications and geographic expansion. The proliferation of Fiber-to-the-Antenna (FTTA) and small cell backhaul for 5G, combined with the increasing use of fiber optic sensing systems in civil engineering and environmental monitoring, represents significant untapped demand for ruggedized, highly reliable field cleavers. Geographically, emerging economies in Southeast Asia, Latin America, and Africa, which are embarking on aggressive national broadband plans, present substantial greenfield opportunities. The integration of cleaving technology into unified field kits that include fusion splicers and optical time-domain reflectometers (OTDRs) provides a value-added proposition. Impact forces, therefore, lean heavily towards technological adoption driven by industry standards and global data demands, compelling manufacturers to focus on automation, integration, and miniaturization to meet both high-volume deployment needs and niche application requirements.

Segmentation Analysis

The Fibre Cleavers Market segmentation provides a structural view of the diverse product offerings and their specialized applications across various end-user industries. The market is primarily segmented based on product type (single-fiber cleavers and ribbon fiber cleavers), level of automation (manual, semi-automatic, and automatic), and application (telecommunications, data centers, industrial/military, and medical/sensing). This granularity is essential because the performance specifications, cost structures, and intended environments vary significantly across these categories. For instance, ribbon cleavers, designed for simultaneous preparation of 4 to 12 fibers, are indispensable in hyperscale data centers, whereas highly durable, specialized single-fiber cleavers are preferred in challenging external plant environments for FTTx deployment.

The segmentation by automation level is crucial, reflecting the trade-off between cost and precision. Manual cleavers, while inexpensive, rely heavily on operator skill and offer lower consistency, typically relegated to low-volume or repair applications. Automatic cleavers, conversely, offer unparalleled precision, consistency, and speed, justifying their higher price point through minimized splicing loss and reduced labor time in large-scale installations. The adoption rate of automatic cleavers is directly correlated with the complexity and scale of network projects, particularly in Tier 1 carrier deployments and high-density data center build-outs where minimal signal degradation is paramount.

From an application perspective, the telecommunications segment holds the dominant share, encompassing traditional long-haul, metropolitan, and FTTx networks. However, the data center segment is the fastest-growing application, driven by the massive demand for ribbon fiber cleaving and associated high-speed interconnection. The industrial and military segments demand highly ruggedized, environmentally sealed units capable of operating reliably under extreme temperature variations and physical shock, often requiring specialized coatings and materials. Understanding these varied needs is vital for market players to tailor their product development and marketing strategies, ensuring alignment with specific industry compliance requirements and performance expectations.

- By Type:

- Single-Fiber Cleavers

- Ribbon Fiber Cleavers (4-12 fiber count)

- Specialty Fiber Cleavers (e.g., large diameter, polarization-maintaining)

- By Automation Level:

- Manual Cleavers

- Semi-Automatic Cleavers

- Automatic/Programmable Cleavers

- By Application:

- Telecommunications (FTTx, Long-Haul, Metro)

- Data Centers and Enterprise Networking

- Industrial and Manufacturing

- Military and Aerospace

- Medical and Sensing

- By Cleave Method:

- Score-and-Break

- Laser Cleaving (emerging)

Value Chain Analysis For Fibre Cleavers Market

The value chain for the Fibre Cleavers Market begins with the Upstream Segment, focusing on the procurement of specialized raw materials critical for the precision and longevity of the tool. Key components include ultra-hard materials such as diamond, tungsten carbide, or sapphire used for the scoring blade, high-precision machining components for linear motion and alignment mechanisms, and specialized plastics and alloys for the casing and fixtures. Suppliers in this segment must adhere to extremely tight manufacturing tolerances, as even microscopic imperfections in the blade edge or movement systems can compromise cleaving quality. The procurement process is often global, with specialized material suppliers providing components under stringent quality agreements. Ensuring a stable supply of these high-grade materials is a persistent challenge that dictates manufacturing efficiency and final product cost.

The Midstream Segment involves the core manufacturing, assembly, and quality control processes. This stage is highly proprietary and technologically intensive, encompassing the precise grinding and shaping of the cleaver blade (the most crucial element), the integration of electromechanical components for automatic models, and the calibration of tension and scoring forces. Automated assembly lines, often utilizing advanced robotics and cleanroom environments, are necessary to achieve the micron-level precision required. Extensive quality assurance testing, including thousands of test cleaves, is performed here to guarantee the specified cleave angle and end-face quality are met across the tool’s lifespan. R&D activities, focusing on blade lifespan extension and improved automation, are centralized at this manufacturing stage, establishing competitive differentiation among major players.

The Downstream Segment covers distribution, sales, and aftermarket services. Distribution channels are varied, including direct sales to Tier 1 telecommunication carriers and large system integrators, and indirect channels through specialized fiber optic equipment distributors and resellers. Direct distribution allows manufacturers better control over pricing and customer support, especially for high-end automatic cleavers. Indirect channels, particularly in geographically fragmented markets, provide necessary localized support and inventory management. Crucially, post-sales support, including calibration services, blade replacement programs, and training for field technicians, forms a significant part of the value proposition. The effectiveness of the service network directly influences customer loyalty and the long-term adoption of premium cleaving solutions.

Fibre Cleavers Market Potential Customers

The primary End-Users or Buyers of fibre cleavers span across several critical sectors reliant on robust optical communication infrastructure. Telecommunication Service Providers (TSPs), including national carriers and regional broadband operators, represent the largest customer base. These entities require vast quantities of highly reliable cleavers for the installation and maintenance of FTTx, 4G/5G backhaul, and long-haul transport networks. Their purchasing decisions are driven by factors such as cleaver speed, consistency, durability in harsh outdoor environments, and seamless integration with their existing fleet of fusion splicers. The trend towards automatic cleavers is strongest within this segment due to the economies of scale afforded by reduced labor time and minimized re-work rates across massive deployment projects.

Another rapidly expanding segment consists of Hyperscale Data Center Operators and Enterprise Network Managers. These customers prioritize ribbon fiber cleavers and automated solutions to rapidly interconnect the dense optical fabric within server rooms and between data center campuses. The necessity to minimize optical loss in ultra-high-speed links (100G, 400G, and beyond) makes the precision offered by premium cleavers non-negotiable. For these buyers, product compatibility with specialized high-density connectors and the ability to manage fiber waste efficiently in a controlled indoor environment are crucial purchasing criteria. Furthermore, military and aerospace contractors form a niche, high-value customer group demanding extremely robust cleavers for deployment in harsh environments, often requiring specialized tools for handling radiation-hardened or non-standard jacketed fibers.

The third major customer segment includes Specialized Industrial and Medical Device Manufacturers. In the industrial sector, fibre cleavers are utilized for the manufacturing of fiber optic sensors used in oil and gas monitoring, smart infrastructure, and manufacturing automation. In the medical field, cleavers are essential for the production of specialized optical fibers used in endoscopic imaging and laser delivery systems, requiring the highest possible precision and hygiene standards. These buyers often seek custom or highly specialized cleaving tools, valuing ultra-low angle repeatability over raw speed. System Integrators and specialized contractors, who execute the physical deployment for all the aforementioned end-users, act as important intermediaries, often purchasing cleavers in bulk based on project specifications and recommending specific models to their clients, thereby influencing market demand significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million |

| Market Forecast in 2033 | $295 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fujikura Ltd., Sumitomo Electric Industries, Ltd., ShinewayTech, AFL (Alcoa Fujikura Ltd.), Ilsintech, Furukawa Electric Co., Ltd., Fiber Instrument Sales (FIS), INNO Instrument Inc., Corning Incorporated, PHOENIX CONTACT, SENKO Advanced Components, Inc., JDSU (now Viavi Solutions/Lumentum), Ripley Tools (Miller Brand), Fitel (Furukawa), Techwin (Tianjin) Fiber Optic Equipment Co., Ltd., COMWAY, Beijing Sunma Technologies Co., Ltd., Lightel Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fibre Cleavers Market Key Technology Landscape

The technological landscape of the Fibre Cleavers Market is continuously evolving, driven by the need for higher precision, greater automation, and improved field durability. A foundational technology remains the mechanical Score-and-Break method, where a high-precision blade scores the fiber surface under tension, ensuring a clean fracture perpendicular to the fiber axis. Modern technological advancements focus on refining this mechanical process through automated mechanisms that control the scoring force, angle, and subsequent tension application with computerized precision, thereby minimizing operator variability. The implementation of motors for automatic blade rotation and height adjustment is standard in high-end models, ensuring that a fresh, unused section of the cleaving blade is utilized for every cleave, significantly extending blade life and maintaining quality consistency across thousands of cycles.

A major technological frontier is the development of cleavers specifically designed for Large Diameter Fibers (LDFs), often used in high-power laser applications and specialized medical devices. Cleaving LDFs presents unique challenges due to increased internal stresses and the requirement for much larger, flatter end-faces. Innovations in this area include specialized clamping mechanisms that prevent fiber rotation and sophisticated scoring techniques that use specialized, often proprietary, blade geometries to ensure a consistent fracture plane. Furthermore, integrated fiber optic preparation tools, which combine stripping, cleaning, and cleaving functionalities into a single, cohesive unit, are gaining traction, streamlining the complex process of fiber preparation in the field and reducing the number of individual tools required by technicians.

The emerging technological focus is on the integration of smart features, leveraging the Internet of Things (IoT) and advanced software. Many automatic cleavers now feature wireless connectivity (Bluetooth or Wi-Fi) to communicate real-time quality data directly to fusion splicers or cloud-based reporting systems, optimizing the entire splicing process and providing auditable records of installation quality. Another important, though nascent, technology is Laser Cleaving, which uses a precise, controlled laser beam to create a stress point, resulting in a perfectly planar end-face without mechanical contact. While currently costly and primarily used in controlled laboratory or factory settings for specialty fibers, laser cleaving offers the potential for virtually unlimited blade life and superior end-face quality, positioning it as a significant disruptive technology for ultra-high-precision applications in the long term.

Regional Highlights

Regional dynamics heavily influence the demand and technological adoption rates within the Fibre Cleavers Market. Asia Pacific (APAC) stands out as the undisputed leader in terms of market volume, primarily driven by mass deployment projects in China, India, and Southeast Asia (such as Indonesia and Vietnam). These countries are aggressively investing in national broadband infrastructure (FTTx), necessitating a constant flow of cleaving equipment. While the APAC region consumes a significant volume of both manual and automatic cleavers, the trend is moving towards high-quality automatic units as network complexity increases and labor costs rise, demanding efficiency improvements in large-scale installations. APAC is also a critical manufacturing base, hosting many key global and regional cleaver manufacturers, which influences global pricing and supply chain management.

North America represents a high-value market characterized by early adoption of advanced technology and a strong focus on data center expansion and 5G densification. Demand in this region is concentrated on high-end automatic cleavers, especially ribbon fiber cleavers, due to the prevalence of high-fiber-count cables utilized in inter-data center connections and metro networks. The labor costs necessitate tools that drastically reduce installation time and guarantee consistency, making premium, integrated solutions (cleavers that connect seamlessly with splicers) highly sought after. Regulatory frameworks and stringent quality standards in the U.S. and Canada further drive the demand for certified, high-precision tooling.

Europe exhibits steady growth, fueled by both FTTx rollouts in Southern and Eastern Europe and significant investments in industrial automation and research facilities across Western Europe. The European market shows robust demand for specialized cleavers used in aerospace, medical sensing, and industrial control systems, emphasizing precision and reliability in niche applications. The demand is segmented, with high-volume automatic tools preferred by major telecommunication carriers, while research institutes and specialized manufacturers require custom-engineered cleavers for highly exotic fiber types. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by late-stage infrastructure build-outs. MEA, particularly the Gulf Cooperation Council (GCC) countries, shows strong potential due to significant government spending on modern digital infrastructure and smart city development, creating substantial greenfield opportunities for fibre cleaver suppliers.

- Asia Pacific (APAC): Market Volume Leader; Driven by FTTx expansion in China, India, and Indonesia; Major manufacturing hub; High demand for both cost-effective and premium automatic cleavers.

- North America: High-Value Market; Focus on 5G densification and hyperscale data centers; High adoption rate of automatic and ribbon cleavers; Strong emphasis on integrated and smart tools.

- Europe: Mature Market with Niche Demand; Steady FTTx rollout; Strong demand for cleavers in industrial automation, medical, and specialized sensing applications; Compliance with strict quality standards is paramount.

- Latin America (LATAM): Developing Market; Increasing investment in national fiber backbones; Growing demand for semi-automatic and robust field cleavers.

- Middle East & Africa (MEA): High-Growth Emerging Market; Driven by smart city projects and digital infrastructure investment; Significant opportunities for new market entrants focusing on large-scale governmental projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fibre Cleavers Market.- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- AFL (Alcoa Fujikura Ltd.)

- Furukawa Electric Co., Ltd. (Fitel)

- INNO Instrument Inc.

- ShinewayTech

- Corning Incorporated

- Ilsintech

- PHOENIX CONTACT

- SENKO Advanced Components, Inc.

- Viavi Solutions Inc. (formerly JDSU)

- Ripley Tools (Miller Brand)

- Techwin (Tianjin) Fiber Optic Equipment Co., Ltd.

- COMWAY

- Beijing Sunma Technologies Co., Ltd.

- Lightel Technologies Inc.

- Precision Rated Optics (PRO)

- Fiber Instrument Sales (FIS)

- Greenlee Communications

- HUIHONGA Fiber Optic Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fibre Cleavers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor influencing the quality of a fiber cleave?

The most critical factor is achieving a perfect end-face angle, ideally 90 degrees (or less than 0.5 degrees deviation), which is essential for minimizing optical signal loss when the fiber is subsequently fusion spliced. Consistency and the condition of the cleaver blade are paramount.

How do automatic fibre cleavers differ significantly from manual cleavers in field deployment?

Automatic cleavers provide superior consistency and speed by mechanically controlling the scoring force, blade rotation, and tension application, thereby eliminating human error. This results in significantly lower splice loss and faster installation times, justifying the higher capital cost for high-volume deployments.

What role does the cleaver blade material play in market dynamics?

Blade material, typically ultra-hard substances like diamond or tungsten carbide, dictates the longevity and precision of the cleave. High-quality blade materials increase the tool’s lifespan (up to 60,000 cleaves), reduce maintenance frequency, and are a key differentiator for premium market players.

Which application segment is driving the highest growth rate for ribbon fibre cleavers?

The hyperscale Data Center and Enterprise Networking segment is driving the highest growth for ribbon cleavers. Ribbon fiber cables are essential for high-density interconnections (MPO/MTP systems), requiring specialized cleavers that can simultaneously prepare multiple fibers (up to 12 or 16) efficiently and accurately.

How does 5G infrastructure deployment specifically impact the demand for fibre cleavers?

5G requires massive fiber densification, particularly Fiber-to-the-Antenna (FTTA) links and backhaul networks. This drives the bulk demand for ruggedized, highly consistent automatic cleavers that can handle rapid, reliable installations in diverse and often challenging urban and rural environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager