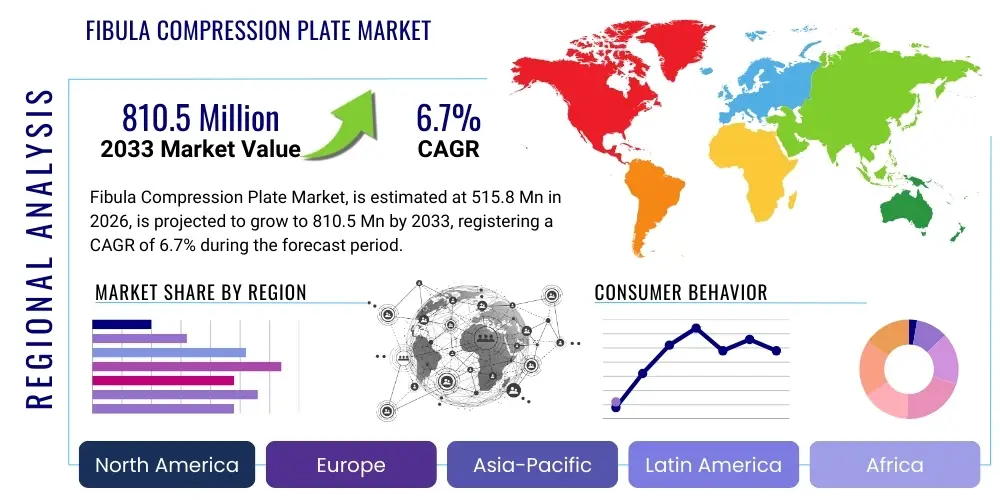

Fibula Compression Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439895 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fibula Compression Plate Market Size

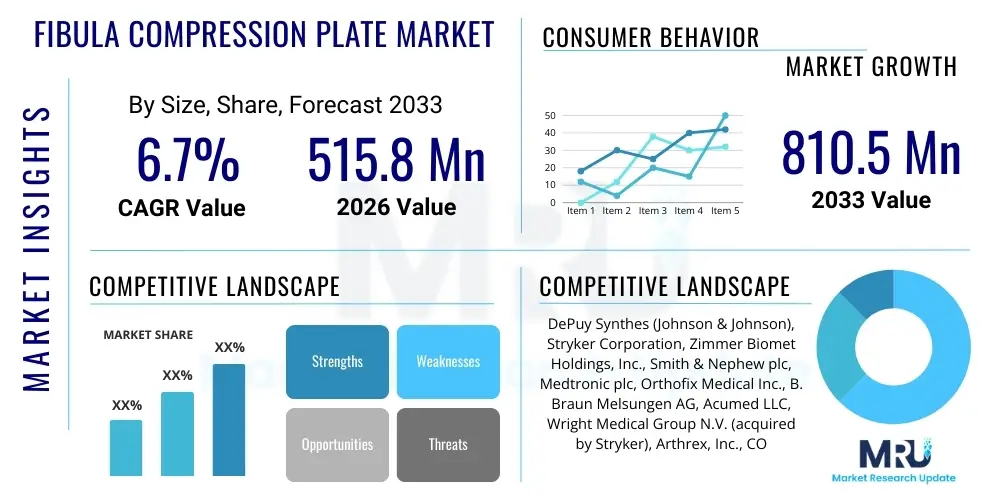

The Fibula Compression Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 515.8 Million in 2026 and is projected to reach USD 810.5 Million by the end of the forecast period in 2033.

Fibula Compression Plate Market introduction

The fibula compression plate market encompasses medical devices designed for internal fixation of fibula fractures and other lower leg bone trauma. These specialized orthopedic implants provide crucial stability and support, facilitating the healing process by holding bone fragments in anatomical alignment. Fibula compression plates are typically made from biocompatible materials such as surgical-grade stainless steel or titanium alloys, engineered for strength, corrosion resistance, and compatibility with the human body. Their design often incorporates features like pre-contoured shapes to match the natural anatomy of the fibula, offering optimal fit and reducing the need for intraoperative bending. The market is characterized by continuous innovation aimed at improving plate design, material properties, and surgical techniques to enhance patient outcomes.

The primary applications of fibula compression plates include the fixation of various types of fibula fractures, ranging from simple stable fractures to complex comminuted fractures, often associated with ankle injuries or tibia fractures. They are also utilized in osteotomy procedures to correct deformities, in the treatment of non-unions or malunions, and in revision surgeries. The effectiveness of these plates lies in their ability to provide rigid fixation, which is paramount for early mobilization, pain reduction, and the prevention of long-term complications such as malunion or non-union. This broad range of applications underscores their indispensable role in trauma and reconstructive orthopedic surgery, directly impacting patient recovery and functional restoration.

The key benefits driving the adoption of fibula compression plates include enhanced biomechanical stability, which is critical for successful bone healing, and the ability to enable early weight-bearing and rehabilitation. This early mobilization significantly reduces the risk of complications associated with prolonged immobilization, such as muscle atrophy, joint stiffness, and deep vein thrombosis. Furthermore, modern plate designs are increasingly low-profile, minimizing soft tissue irritation, and often feature locking screw technology that provides angular stability, particularly beneficial in osteoporotic bone. The continuous advancements in materials and design contribute to improved surgical outcomes, shorter hospital stays, and a faster return to daily activities for patients, making them a preferred choice for orthopedic surgeons worldwide.

Several significant driving factors are propelling the growth of the fibula compression plate market. Firstly, the global demographic shift towards an aging population inherently increases the incidence of osteoporosis-related fractures, including those involving the fibula, thereby augmenting demand for fixation devices. Secondly, the rising participation in sports and recreational activities contributes to a higher prevalence of sports-related injuries, many of which involve lower limb trauma requiring surgical intervention. Thirdly, ongoing technological advancements in implant design, such as anatomically contoured plates, variable angle locking screws, and minimally invasive surgical techniques, are improving surgical efficiency and patient outcomes, fostering greater adoption. Lastly, the expansion of healthcare infrastructure in emerging economies and increasing awareness regarding advanced orthopedic treatments are also critical drivers stimulating market growth.

Fibula Compression Plate Market Executive Summary

The Fibula Compression Plate Market is experiencing dynamic shifts driven by evolving healthcare landscapes and technological innovation. Business trends indicate a strong focus on strategic mergers and acquisitions among leading orthopedic companies to consolidate market share and expand product portfolios, especially towards comprehensive trauma solutions. There is also a discernible trend towards partnerships with healthcare providers and research institutions to accelerate product development and clinical validation. Companies are increasingly investing in research and development to introduce next-generation materials, such as bioabsorbable polymers and advanced titanium alloys, and to refine plate designs for improved anatomical fit and enhanced biomechanical performance. Furthermore, the emphasis on cost-effectiveness and value-based healthcare models is pushing manufacturers to optimize production processes and offer competitive pricing, while maintaining high-quality standards. The market is also witnessing a surge in direct-to-hospital sales models and specialized distribution networks to ensure efficient product delivery and support to surgical teams.

From a regional perspective, the market exhibits varied growth trajectories. North America and Europe currently represent mature markets, characterized by established healthcare infrastructure, high adoption rates of advanced surgical techniques, and significant expenditure on orthopedic care. Growth in these regions is primarily driven by an aging population, prevalence of sports injuries, and continuous product innovation. Conversely, the Asia Pacific region is emerging as the fastest-growing market, propelled by rapidly expanding healthcare access, increasing disposable incomes, a large patient pool, and growing awareness of advanced medical treatments. Countries like China and India are particularly attractive due to their massive populations and governmental initiatives to modernize healthcare facilities. Latin America, the Middle East, and Africa are also demonstrating steady growth, albeit from a lower base, as healthcare systems develop and access to specialized orthopedic surgery improves, making these regions critical targets for future market expansion.

Segmentation trends within the Fibula Compression Plate Market highlight significant preferences and technological advancements across various categories. By material, titanium alloys continue to dominate due to their superior biocompatibility, strength-to-weight ratio, and MRI compatibility, though stainless steel remains a cost-effective alternative. The rise of bioabsorbable materials presents an intriguing long-term growth segment, aiming to eliminate the need for secondary removal surgeries. In terms of plate type, locking plates are gaining significant traction over conventional non-locking plates, especially for complex fractures and osteoporotic bone, due to their enhanced angular stability. Anatomically contoured plates, designed to closely match the fibula's natural curvature, are also seeing increased adoption, as they improve surgical efficiency and reduce irritation. End-user segments show hospitals as the largest consumers, but ambulatory surgical centers (ASCs) are projected to exhibit robust growth, driven by a shift towards outpatient surgical procedures for cost-efficiency and patient convenience.

AI Impact Analysis on Fibula Compression Plate Market

User questions regarding AI's influence on the Fibula Compression Plate market frequently revolve around its potential to enhance surgical precision, improve diagnostic accuracy, personalize treatment plans, and streamline the entire patient care pathway. Common inquiries include how AI can aid in pre-operative planning, whether AI-powered robotics will perform fibula fracture surgeries, the role of AI in material science for next-generation implants, and its impact on post-operative recovery monitoring. There is a strong interest in understanding if AI can predict fracture healing outcomes more accurately or identify patients at higher risk of complications. Users also express concerns about data privacy, the cost implications of integrating AI into orthopedic practices, and the need for rigorous validation of AI algorithms to ensure patient safety and efficacy. The prevailing sentiment indicates an optimistic outlook on AI's transformative potential, coupled with a cautious approach to its practical implementation and ethical considerations.

- Enhanced Pre-operative Planning: AI algorithms can analyze vast amounts of medical imaging data (X-rays, CT scans) to create highly detailed 3D models of fibula fractures, helping surgeons precisely plan plate size, contour, and screw placement, thereby optimizing anatomical reduction and minimizing intraoperative adjustments.

- Robotic-Assisted Surgery: While direct robotic bone manipulation for fibula plates is nascent, AI-driven robotics can assist in navigating instruments, maintaining stability during drilling, and ensuring precise screw insertion angles, potentially reducing human error and improving procedural accuracy.

- Personalized Implant Design: AI can leverage patient-specific anatomical data and biomechanical analyses to develop custom or semi-custom fibula compression plates that offer a superior fit and potentially better long-term outcomes, moving beyond standard off-the-shelf solutions.

- Predictive Analytics for Healing: Machine learning models, trained on large datasets of patient demographics, fracture characteristics, and treatment protocols, can predict fracture healing times, risk of non-union, or potential complications, allowing for proactive intervention and tailored post-operative care.

- Optimized Material Development: AI can accelerate the discovery and optimization of new biomaterials for fibula plates by simulating material properties, testing performance under various physiological stresses, and identifying novel compositions that offer enhanced biocompatibility, strength, or bioabsorbability.

- Post-operative Monitoring and Rehabilitation: AI-powered wearable sensors and remote monitoring systems can track patient activity, weight-bearing progression, and wound healing, providing real-time data to clinicians and enabling personalized feedback for more effective rehabilitation.

- Supply Chain and Inventory Management: AI can optimize the inventory of fibula compression plates and associated surgical instruments within hospitals and distribution centers by predicting demand based on historical data, surgical schedules, and regional epidemiological trends, ensuring product availability and reducing waste.

DRO & Impact Forces Of Fibula Compression Plate Market

The Fibula Compression Plate Market is significantly influenced by a multitude of interconnected drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory. Key drivers include the escalating global incidence of fibula fractures, which is a direct consequence of an aging population more prone to fragility fractures and a younger demographic engaged in high-impact sports and recreational activities. Moreover, continuous advancements in orthopedic surgical techniques, such as minimally invasive approaches and improved understanding of fracture mechanics, are enhancing the efficacy and safety of fibula plating, leading to wider adoption. The increasing prevalence of musculoskeletal disorders, coupled with growing healthcare expenditure in developing economies and a rising demand for advanced fracture fixation solutions, further propels market expansion by making these sophisticated devices more accessible to a larger patient base. These factors collectively create a robust environment for sustained market growth.

Despite the strong growth drivers, several significant restraints challenge the market's full potential. The high cost associated with advanced fibula compression plates, particularly those made from premium materials like titanium and featuring complex designs, can be a major barrier, especially in cost-sensitive healthcare systems or regions with limited reimbursement policies. Stringent regulatory approval processes, particularly in developed markets, pose significant hurdles for manufacturers, leading to prolonged development cycles and increased costs of bringing new products to market. Furthermore, the inherent risks associated with surgical procedures, such as infection, nerve damage, or implant failure, coupled with the potential need for revision surgeries, can deter some patients and clinicians, influencing the choice of treatment. Issues surrounding inadequate reimbursement policies in certain regions for specific types of plates or procedures also limit market penetration and adoption, creating financial constraints for both providers and patients.

Opportunities for growth in the fibula compression plate market are substantial and diverse. The burgeoning demand for personalized medicine and patient-specific implants presents a significant avenue for innovation, where plates can be customized based on individual patient anatomy and fracture patterns using advanced imaging and 3D printing technologies. The development of next-generation materials, including bioabsorbable polymers that degrade over time, eliminating the need for removal surgery, and enhanced biocompatible alloys, offers considerable potential to improve patient outcomes and reduce healthcare burdens. Emerging markets in Asia Pacific, Latin America, and Africa represent untapped growth potential due to their large patient populations, improving healthcare infrastructure, and increasing disposable incomes, making them attractive targets for market expansion. Moreover, the integration of smart technologies, such as sensors embedded in plates for monitoring healing or providing feedback, could revolutionize post-operative care and rehabilitation, opening new product categories and service offerings.

The impact forces influencing the fibula compression plate market extend beyond immediate drivers and restraints, shaping its long-term dynamics. The bargaining power of buyers, primarily hospitals and group purchasing organizations, is considerable, driven by their need for cost-effective solutions and bulk procurement capabilities, which can exert downward pressure on prices. The bargaining power of suppliers, particularly those providing specialized raw materials like medical-grade titanium or advanced polymers, can impact production costs and lead times. The threat of new entrants, while relatively low due to high R&D costs, stringent regulatory hurdles, and established brand loyalty, remains a factor for innovative startups with disruptive technologies. The threat of substitute products, such as external fixation devices or alternative conservative treatments, is moderate but could increase with advancements in non-surgical interventions. Finally, the intense competitive rivalry among established players, characterized by continuous product innovation, aggressive marketing, and strategic collaborations, drives market efficiency and propels technological advancements, but also puts pressure on profit margins. These forces collectively dictate the market structure and competitive landscape.

Segmentation Analysis

The Fibula Compression Plate Market is meticulously segmented across various dimensions to provide a granular understanding of its complex landscape, including material type, plate design, fracture type, and end-user facilities. Each segment reveals distinct market dynamics, growth drivers, and competitive strategies. This comprehensive segmentation allows stakeholders to identify niche opportunities, understand specific product demands, and tailor their market approaches effectively. Analyzing these segments is critical for manufacturers to align their research and development efforts with market needs and for healthcare providers to optimize their procurement and patient care strategies. The interplay between these segments often dictates the overall market trajectory, reflecting shifts in clinical practice, technological advancements, and economic factors, thereby providing a holistic view of the market's structure and potential for growth.

- By Material Type

- Stainless Steel: Historically a dominant material, offering good strength and cost-effectiveness.

- Titanium Alloy: Increasingly preferred due to superior biocompatibility, MRI compatibility, and corrosion resistance, despite higher cost.

- PEEK (Polyether Ether Ketone): Offers radiolucency and flexibility closer to bone, suitable for specific applications where imaging artifacts are a concern.

- Bioabsorbable/Biodegradable Materials: Emerging segment offering plates that resorb over time, eliminating the need for removal surgery, though with limitations in load-bearing capacity for some applications.

- By Plate Type

- Locking Plates: Feature threaded screw holes that lock the screw head to the plate, providing angular stability, especially beneficial in osteoporotic bone or comminuted fractures.

- Non-Locking/Conventional Plates: Rely on compression between the plate and bone for stability, suitable for simpler fractures with good bone quality.

- Anatomical/Contoured Plates: Pre-shaped to match the natural curvature of the fibula, reducing intraoperative bending and improving fit.

- Straight/Standard Plates: Versatile for various applications but may require intraoperative bending to match anatomy.

- By Fracture Type

- Distal Fibula Fractures: Most common type, often associated with ankle injuries (e.g., Weber A, B, C classifications).

- Proximal Fibula Fractures: Less common, often associated with knee injuries or syndesmotic disruptions.

- Fibula Shaft Fractures: Fractures along the length of the fibula, sometimes occurring in isolation or as part of a tibia-fibula fracture.

- By End-User

- Hospitals: Major end-users due to the volume of trauma cases, comprehensive surgical facilities, and emergency services.

- Ambulatory Surgical Centers (ASCs): Growing segment for less complex cases, driven by cost-efficiency and patient convenience.

- Specialty Orthopedic Clinics: Cater to specific orthopedic needs, performing a range of procedures including fibula fracture fixation.

- By Region

- North America: Mature market with high adoption of advanced technologies.

- Europe: Established healthcare systems, steady innovation and market growth.

- Asia Pacific (APAC): Fastest-growing region due to increasing healthcare expenditure and large patient pool.

- Latin America: Emerging market with developing healthcare infrastructure.

- Middle East & Africa (MEA): Nascent market showing potential due to improving healthcare access.

Value Chain Analysis For Fibula Compression Plate Market

The value chain for the Fibula Compression Plate Market is intricate, beginning with upstream raw material suppliers and extending through manufacturing, distribution, and ultimately to the end-users. The upstream segment involves the sourcing and processing of specialized medical-grade materials such as titanium alloys (e.g., Ti-6Al-4V), surgical stainless steel (e.g., 316L), and advanced polymers like PEEK. Key suppliers in this stage are specialized metal refineries and chemical manufacturers that provide high-purity, biocompatible materials meeting strict industry standards (e.g., ISO 5832). Component manufacturers then transform these raw materials into semi-finished products or specific plate components through processes like forging, machining, and surface treatment. The quality and consistency of these upstream inputs are paramount as they directly influence the biocompatibility, mechanical strength, and overall performance of the final fibula compression plates, making robust supplier relationships and quality control critical at this initial stage. Innovation in material science at this level directly impacts the capabilities of downstream product development, offering plates with improved properties like enhanced fatigue life or reduced susceptibility to infection.

The core manufacturing stage involves the design, development, and production of fibula compression plates. This includes intricate processes like precision machining, laser cutting, bending, and polishing to create anatomically contoured plates with precise screw holes. Advanced manufacturing techniques, such as additive manufacturing (3D printing), are increasingly being explored for creating custom implants or plates with optimized internal structures. Post-processing steps include sterilization, packaging, and strict quality assurance checks to ensure compliance with regulatory standards (e.g., FDA, CE Mark). Research and development activities, often involving collaborations with orthopedic surgeons and biomechanical engineers, are crucial here for innovating plate designs (e.g., variable angle locking plates, low-profile designs) and incorporating new technologies. Manufacturers often invest heavily in clinical trials and regulatory affairs to ensure their products are safe, effective, and gain market approval, forming the central nexus of value creation in the market, where raw materials are transformed into life-changing medical devices.

The downstream segment primarily focuses on the distribution and sales of fibula compression plates to end-users, mainly hospitals, ambulatory surgical centers, and specialty orthopedic clinics. Distribution channels are typically categorized into direct and indirect methods. Direct distribution involves manufacturers selling directly to hospitals or healthcare systems, often employing a specialized sales force that provides product education, technical support, and inventory management. This approach allows for closer relationships with key opinion leaders and surgeons, offering a higher degree of control over product placement and branding. Indirect distribution involves leveraging third-party distributors, wholesalers, or medical device purchasing organizations. These intermediaries often have established networks and logistics capabilities, allowing manufacturers to reach a broader geographical market, particularly in regions where direct sales infrastructure is not feasible or cost-effective. The choice of distribution channel often depends on the manufacturer's market penetration strategy, product portfolio, and regional regulatory environment. Effective logistics and inventory management are essential to ensure timely delivery of sterile implants for planned and emergency surgical procedures, ultimately impacting patient access and care quality.

Fibula Compression Plate Market Potential Customers

The primary potential customers and end-users of fibula compression plates are medical institutions and healthcare professionals involved in the treatment of orthopedic trauma and reconstructive surgery. Hospitals, particularly those with robust trauma centers, emergency departments, and orthopedic surgery departments, represent the largest segment of end-users. These facilities handle a high volume of fracture cases, ranging from acute traumatic injuries to complex reconstructive surgeries, requiring a constant supply of various types of fibula plates. Orthopedic surgeons, especially those specializing in trauma, foot and ankle surgery, and sports medicine, are the direct prescribers and users of these devices. Their purchasing decisions are often influenced by plate design, material innovation, ease of use, clinical outcomes, and the overall support provided by the manufacturer. They seek plates that offer superior biomechanical stability, reduced soft tissue irritation, and enable early patient mobilization and rehabilitation. Factors such as reputation for quality, clinical evidence, and comprehensive product portfolios from manufacturers significantly sway their choices. The shift towards value-based care also means that surgeons and hospitals are increasingly looking for devices that not only provide excellent outcomes but also demonstrate cost-effectiveness over the entire patient care pathway, including potential for reducing re-operations or complications, thereby minimizing total healthcare costs.

Ambulatory Surgical Centers (ASCs) are emerging as a rapidly growing customer segment. These facilities specialize in outpatient surgical procedures, offering a cost-effective alternative to traditional hospital settings for less complex fibula fractures or elective orthopedic procedures. As healthcare systems globally seek to reduce costs and enhance patient convenience, a growing number of fibula fracture fixations are being performed in ASCs. These centers prioritize efficiency, streamlined inventory management, and ease of access to high-quality, reliable implants. Their purchasing decisions are often driven by competitive pricing, favorable contractual agreements, and the availability of instrument sets that facilitate quick turnover between cases. Furthermore, specialty orthopedic clinics, which often house outpatient surgical suites or serve as referral centers for trauma cases, also represent a significant customer base. These clinics frequently cater to sports injuries and provide follow-up care, maintaining a close relationship with device manufacturers to ensure they have access to the latest and most appropriate fibula compression plates for their patient population. The increasing demand from these diverse end-user segments underscores the critical role fibula compression plates play across the entire spectrum of orthopedic care, from acute trauma to rehabilitative stages, necessitating a multifaceted approach to customer engagement and product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 515.8 Million |

| Market Forecast in 2033 | USD 810.5 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Medtronic plc, Orthofix Medical Inc., B. Braun Melsungen AG, Acumed LLC, Wright Medical Group N.V. (acquired by Stryker), Arthrex, Inc., CONMED Corporation, Integra LifeSciences Holdings Corporation, Össur hf., DJO Global (Colfax Corporation), Paragon 28, Inc., Amplitude Surgical, Xtant Medical Holdings, Inc., Bioventus LLC, Globus Medical, Inc., Enovis Corporation (formerly Colfax Corporation) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fibula Compression Plate Market Key Technology Landscape

The technology landscape for the Fibula Compression Plate Market is rapidly evolving, driven by continuous innovation in materials science, biomechanical engineering, and surgical methodologies. A significant technological advancement lies in the development of sophisticated plate designs, specifically anatomical contouring. Modern fibula plates are pre-bent and shaped to closely match the natural three-dimensional curvature of the fibula bone, significantly reducing the need for intraoperative bending by the surgeon. This not only streamlines the surgical procedure and reduces operative time but also minimizes the risk of implant fatigue and soft tissue irritation, leading to better patient comfort and functional outcomes. Furthermore, low-profile plate designs are increasingly prevalent, featuring thinner cross-sections that reduce palpability and further decrease soft tissue impingement, which is a common complaint with traditional plates. These design innovations are crucial for enhancing surgical efficiency and improving the overall patient experience.

Material science remains a cornerstone of innovation within the fibula compression plate market. While traditional materials like surgical-grade stainless steel continue to be used, there is a growing preference for advanced titanium alloys, such as Ti-6Al-4V, due to their superior biocompatibility, high strength-to-weight ratio, excellent corrosion resistance, and magnetic resonance imaging (MRI) compatibility. These properties are critical for patient safety and for allowing post-operative diagnostic imaging without significant artifact interference. Beyond metals, there is increasing research and development in biodegradable or bioabsorbable polymers (e.g., polylactic acid (PLA), polyglycolic acid (PGA), polycaprolactone (PCL)). These materials offer the potential for implants to gradually degrade and be absorbed by the body after bone healing, thereby eliminating the need for a secondary removal surgery. While still facing challenges in terms of load-bearing capacity and degradation rates for weight-bearing bones, their long-term promise for reducing patient morbidity and healthcare costs is substantial, driving significant investment in this area.

Advancements in screw technology, particularly the widespread adoption of locking screw systems, represent another critical technological shift. Locking screws provide angular stability by rigidly fixing the screw head to the plate, creating a "fixed-angle construct." This feature is particularly advantageous in osteoporotic bone, comminuted fractures where conventional compression alone is insufficient, and in situations requiring bridge plating where the plate acts as an internal splint. Variable angle locking screws further enhance this capability, allowing surgeons to choose the optimal screw trajectory within a specific range, providing greater flexibility to capture bone fragments effectively and avoid critical anatomical structures. Furthermore, the integration of surgical navigation systems and robotic assistance, though still nascent for fibula plating specifically, is beginning to influence orthopedic trauma. These technologies use advanced imaging and real-time tracking to provide surgeons with precise guidance for plate and screw placement, minimizing invasiveness, improving accuracy, and potentially reducing radiation exposure. While not yet routine for all fibula fractures, these technologies signify a future trend towards enhanced surgical precision and predictable outcomes.

Regional Highlights

- North America: This region holds a significant share of the Fibula Compression Plate Market, driven by a well-established healthcare infrastructure, high healthcare expenditure, and a strong emphasis on advanced medical technologies. The presence of leading market players, high adoption rates of sophisticated surgical techniques, and a relatively high incidence of sports-related injuries and age-related fractures contribute to its dominance. Furthermore, robust research and development activities and favorable reimbursement policies for orthopedic procedures further bolster market growth. The region's mature market status means growth is often fueled by innovation and the replacement of older generation implants, with a strong focus on clinical outcomes and patient satisfaction.

- Europe: Europe represents another substantial market for fibula compression plates, characterized by a high standard of healthcare, widespread access to advanced orthopedic treatments, and an aging population contributing to a steady demand for fracture fixation devices. Countries such as Germany, the UK, France, and Italy are key contributors due to their well-developed healthcare systems, significant investments in medical technology, and a proactive approach to adopting innovative surgical solutions. Strict regulatory frameworks ensure high-quality product standards, while ongoing research collaborations between academic institutions and industry players foster continuous product development and clinical advancements. The market growth in Europe is also influenced by increasing awareness about advanced orthopedic care and a growing number of orthopedic surgical procedures.

- Asia Pacific (APAC): The Asia Pacific region is anticipated to be the fastest-growing market for fibula compression plates during the forecast period. This accelerated growth is attributed to several factors including rapidly improving healthcare infrastructure, increasing healthcare expenditure, a vast and growing patient population, and rising awareness about advanced orthopedic treatments. Countries like China, India, Japan, and South Korea are at the forefront of this expansion, driven by economic development, urbanization, and a burgeoning middle class with greater access to medical services. Furthermore, the increasing prevalence of road traffic accidents and sports injuries, coupled with the establishment of modern trauma care facilities, fuels the demand for effective fracture fixation solutions. Local manufacturing capabilities are also developing, aiming to cater to regional demands and potentially reduce costs.

- Latin America: The Latin American market for fibula compression plates is in a growth phase, characterized by developing healthcare systems and increasing investment in medical infrastructure. Countries such as Brazil, Mexico, and Argentina are leading the regional market, driven by a rising number of orthopedic procedures, a growing awareness of modern surgical techniques, and an increasing penetration of international medical device manufacturers. Economic improvements and government initiatives to enhance public health services are contributing to better access to advanced orthopedic care. While still facing challenges related to healthcare disparities and reimbursement issues, the region presents significant opportunities for market expansion as healthcare access continues to improve and demand for specialized implants rises.

- Middle East and Africa (MEA): The MEA region is an emerging market for fibula compression plates, showing promising growth potential. The market expansion is largely driven by increasing investments in healthcare infrastructure, particularly in countries like Saudi Arabia, UAE, and South Africa, coupled with a rising prevalence of trauma cases and a growing expatriate population with access to private healthcare. Governments in these regions are focusing on diversifying their economies and improving healthcare services, which includes modernizing hospitals and adopting advanced medical technologies. While the market is relatively nascent compared to North America and Europe, increasing disposable incomes, medical tourism, and a greater emphasis on localizing healthcare solutions are expected to fuel substantial growth in the coming years, attracting international players to establish a stronger presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fibula Compression Plate Market.- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Medtronic plc

- Orthofix Medical Inc.

- B. Braun Melsungen AG

- Acumed LLC

- Arthrex, Inc.

- CONMED Corporation

- Integra LifeSciences Holdings Corporation

- Össur hf.

- DJO Global (Colfax Corporation)

- Paragon 28, Inc.

- Amplitude Surgical

- Xtant Medical Holdings, Inc.

- Bioventus LLC

- Globus Medical, Inc.

- Enovis Corporation (formerly Colfax Corporation)

- Merete Medical GmbH

Frequently Asked Questions

What is a fibula compression plate and what is its primary use?

A fibula compression plate is a medical implant, typically made of titanium or stainless steel, designed to internally stabilize fractures of the fibula bone. Its primary use is to hold bone fragments in correct anatomical alignment, providing rigid fixation to promote healing and enable early patient mobilization.

What are the key benefits of using fibula compression plates for fracture fixation?

The main benefits include providing strong biomechanical stability for bone healing, allowing for earlier weight-bearing and rehabilitation, reducing the risk of non-union or malunion, and improving patient comfort and functional outcomes. Modern designs also minimize soft tissue irritation.

Which materials are commonly used for fibula compression plates?

Common materials include surgical-grade stainless steel for its strength and cost-effectiveness, and titanium alloys for their superior biocompatibility, corrosion resistance, and MRI compatibility. Bioabsorbable polymers are an emerging option for implants that dissolve over time.

Are there different types of fibula compression plates available?

Yes, types include locking plates, which provide angular stability; non-locking plates, which rely on compression; and anatomically contoured plates, which are pre-shaped to match the fibula's natural curve, improving fit and reducing surgical time.

What factors are driving the growth of the Fibula Compression Plate Market?

Key drivers include an increasing incidence of fibula fractures due to an aging population and sports injuries, continuous technological advancements in plate design and materials, and the expansion of healthcare infrastructure and awareness in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager