Ficus Foveolata Extract Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431454 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ficus Foveolata Extract Market Size

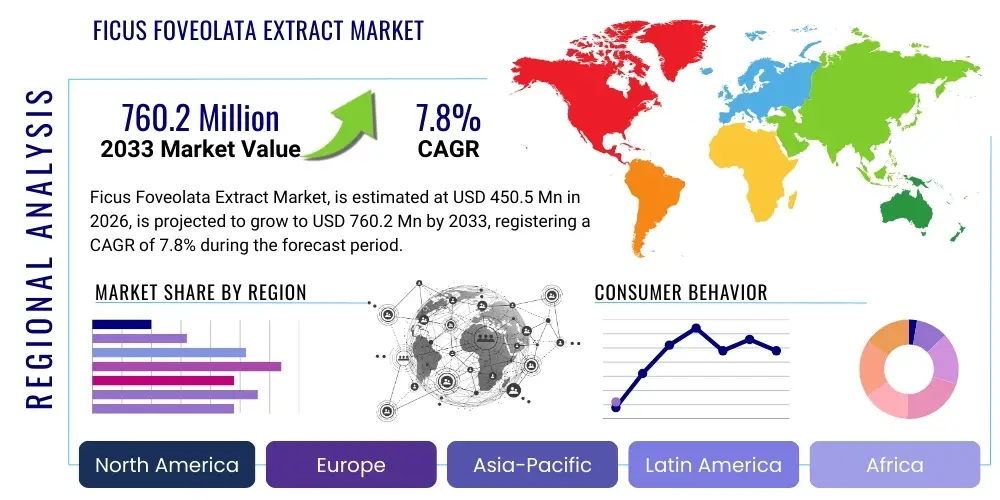

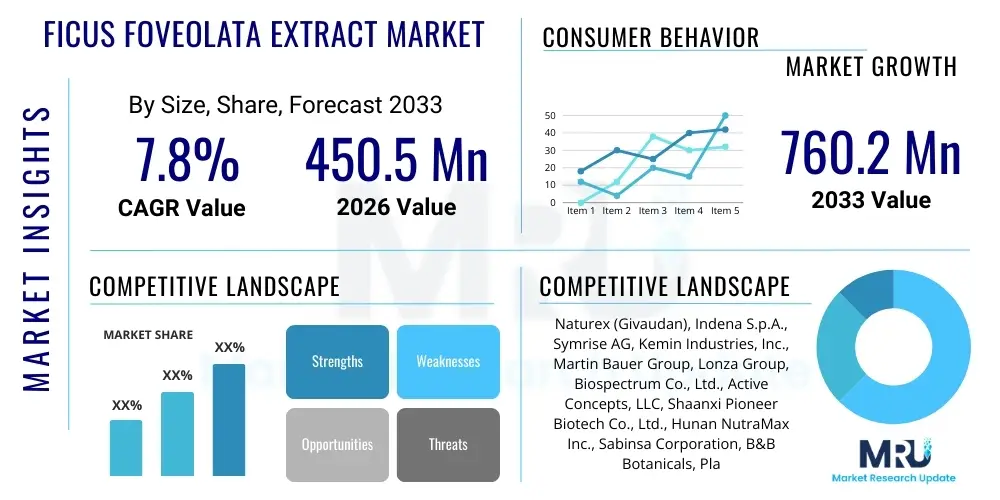

The Ficus Foveolata Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033. The robust growth trajectory is primarily driven by the increasing consumer preference for natural, plant-derived ingredients across the cosmetic, pharmaceutical, and nutraceutical industries, leveraging the extract's scientifically validated anti-inflammatory and antioxidant properties. This significant expansion is also attributed to continuous advancements in extraction and purification technologies, which ensure high yield, standardized product quality, and the isolation of specific high-value bioactive marker compounds critical for clinical applications.

Ficus Foveolata Extract Market introduction

The Ficus Foveolata Extract Market encompasses the comprehensive commercial ecosystem involved in the cultivation, processing, distribution, and utilization of bioactive substances derived from the leaves and branches of the Ficus Foveolata plant, a botanical species indigenous to specific regions in Asia and historically integral to traditional herbal medicine practices. The extract is highly valued for its complex phytochemical profile, which includes a synergistic blend of flavonoids (such as rutin and quercetin derivatives), phenolic acids, triterpenoids (like lupeol), and lignans. These components bestow the extract with pronounced functional properties, notably potent antioxidant activity, significant anti-inflammatory capabilities, and demonstrated efficacy in dermal hydration and barrier function enhancement, thereby establishing its status as a premium functional ingredient in contemporary health and wellness products.

Major applications of Ficus Foveolata Extract span three primary high-growth sectors. In the cosmetics and personal care industry, the extract is extensively incorporated into anti-aging serums, high-performance moisturizers, and sun protection formulations, capitalizing on its ability to mitigate oxidative stress and reduce inflammation linked to environmental aggressors and intrinsic aging processes. Within the nutraceutical segment, it is utilized in dietary supplements aimed at supporting liver function, bolstering immune response, and managing systemic inflammation, aligning perfectly with the global trend toward proactive health maintenance and the consumption of science-backed botanical supplements. The third, rapidly emerging application is in pharmaceuticals, where specialized isolates are undergoing preclinical and clinical trials to evaluate their potential as therapeutic agents for conditions ranging from chronic dermatitis to metabolic disorders, demanding the highest grade of purity and standardization.

The market expansion is fundamentally driven by several intertwined factors, including a pervasive global consumer shift away from synthetic additives towards natural, sustainable, and ethically sourced ingredients (the 'clean beauty' and 'green chemistry' movements). Concurrently, significant investment in R&D has successfully validated the traditional uses of Ficus Foveolata through modern analytical and biological testing methods, providing the clinical data necessary for robust marketing claims and securing regulatory approvals in stringent Western markets. Furthermore, the accessibility of sophisticated extraction techniques, such as pressurized liquid extraction and supercritical fluid extraction, has allowed commercial producers to manufacture standardized, highly concentrated extracts that meet the specific formulation requirements of pharmaceutical and advanced cosmetic manufacturers, thereby guaranteeing predictable therapeutic outcomes.

Ficus Foveolata Extract Market Executive Summary

The Ficus Foveolata Extract Market is positioned for robust acceleration, driven by the convergence of increasing consumer demand for high-efficacy botanical extracts and continuous innovations in ingredient delivery systems. Key business trends underscore a competitive focus on traceability, sustainability, and the establishment of vertically integrated supply chains, particularly among leading European and North American suppliers aiming to secure consistent, ethically sourced raw materials from Asia Pacific origins. Strategic partnerships between botanical suppliers and major consumer goods manufacturers are becoming increasingly common, serving to co-develop novel formulations that leverage the unique anti-inflammatory properties of the extract and secure early market advantage in rapidly expanding segments like functional dermatological health.

Regionally, Asia Pacific maintains its pivotal role as the primary source of raw material and a dominant consumer market, propelled by deep cultural integration of traditional herbal remedies and a dynamic, innovation-led cosmetic sector, particularly in Northeast Asia. However, the highest incremental growth rate is projected for North America and Europe, where sophisticated regulatory environments encourage the use of novel, clinically supported natural ingredients. Demand in these regions is heavily influenced by clean-label mandates and consumer awareness regarding the health benefits of phytochemicals, necessitating rigorous third-party testing and certifications that attest to the extract's purity and potency, forcing suppliers to invest heavily in advanced analytical infrastructure.

Segmentation analysis reveals that the Powdered Extract form currently holds a significant market share, favored for its stability, ease of incorporation into solid dosage nutraceuticals (capsules and tablets), and cost-effective transportation. Nevertheless, the Liquid Extract/Oil segment, preferred for premium cosmetic serums and topical formulations requiring enhanced skin penetration, is forecast to exhibit the fastest growth, underpinned by innovations in natural solubilization and carrier oil matrices. Across all segments, the trend is toward higher standardization, with a growing preference for extracts guaranteed to contain specific minimum concentrations of key bioactive markers, moving the market away from generic botanical powders toward specialized, functional ingredient systems tailored for specific biological targets.

AI Impact Analysis on Ficus Foveolata Extract Market

Analysis of industry queries highlights substantial interest in leveraging Artificial Intelligence (AI) and Machine Learning (ML) to overcome inherent challenges in botanical sourcing, quality control, and R&D efficiency within the Ficus Foveolata Extract market. Users are keenly focused on how AI can be deployed to predict optimal harvest times and geographical locations based on climatic data, thereby maximizing the concentration of desired active compounds and ensuring sustainable sourcing practices. Furthermore, a core theme involves utilizing ML algorithms for rapid screening of vast compound libraries derived from the extract, accelerating the process of identifying lead compounds with specific therapeutic potential in drug discovery and novel functional food development, which dramatically reduces the traditionally lengthy R&D cycles.

In the cultivation and sourcing phase, AI is revolutionizing resource management. Satellite imagery and environmental sensor data are processed by predictive algorithms to monitor plant health, detect stress factors, and forecast yield and quality variation across different sourcing regions. This precision farming approach allows suppliers to maintain strict quality control standards, ensuring that raw material inputs consistently meet the high specifications demanded by pharmaceutical-grade applications. By optimizing irrigation, fertilization, and pest management based on AI insights, the environmental footprint associated with Ficus Foveolata sourcing is significantly minimized, addressing a critical concern of ethical consumers and sustainable supply chain initiatives.

The integration of AI into quality assurance (QA) and standardization processes represents a major advancement. Sophisticated spectroscopic techniques (like Near-Infrared or Raman Spectroscopy) coupled with ML models can instantly analyze the chemical fingerprint of incoming raw materials and outgoing finished extracts, detecting adulteration or deviations from the standardized profile far more rapidly and accurately than traditional laboratory methods. This level of automated, real-time QA ensures unparalleled batch consistency, which is non-negotiable for manufacturers using the extract in regulated products, bolstering consumer safety and compliance confidence across international borders.

- AI-driven metabolomic analysis to rapidly map and quantify the full spectrum of bioactive compounds in the extract.

- Predictive modeling using deep learning to optimize cultivation conditions (soil, climate) for peak active compound concentration.

- Enhanced high-throughput screening utilizing ML to identify novel anti-inflammatory or anti-cancer activities of isolated Ficus compounds.

- Automated spectroscopic quality control for real-time authentication and detection of contaminants or inconsistent batch profiles.

- AI integration into ERP systems for optimizing supply chain forecasting, minimizing inventory holding costs, and mitigating sourcing risks.

- Development of personalized cosmetic formulations based on consumer genomic and environmental data analyzed by AI, suggesting optimal extract concentration.

DRO & Impact Forces Of Ficus Foveolata Extract Market

The market trajectory for Ficus Foveolata Extract is dynamically shaped by potent Drivers rooted in scientific validation, persistent Restraints concerning supply logistics and cost, and significant Opportunities in advanced therapeutic development, all mediated by external Impact Forces such as regulatory shifts and global climate change. The primary driver is the accelerating trend of consumer distrust in synthetic chemicals, which is simultaneously met by compelling scientific evidence demonstrating the efficacy of Ficus Foveolata in treating common dermatological issues and supporting systemic health through its potent anti-inflammatory pathway modulation. This synergy between consumer demand and scientific proof creates a powerful impetus for market growth, especially in premium product categories.

Restraints are prominently logistical and economic. Ficus Foveolata is not widely cultivated globally; sourcing often relies on wild harvesting or specific regional plantations, making the supply vulnerable to geopolitical instability, seasonal variations, and climate-related disruptions. The necessity for advanced, high-cost extraction technologies (such as SFE) to achieve pharmaceutical-grade purity further restricts market entry and maintains a high cost base for premium finished products. Moreover, while its traditional use is acknowledged, securing comprehensive, harmonized Novel Food or GRAS (Generally Recognized As Safe) status in all major Western markets for specific high-concentration isolates requires substantial, multi-year investment in toxicology and clinical studies, presenting a significant regulatory restraint.

Opportunities for market stakeholders are focused on diversification and technological enhancement. The most lucrative opportunity lies in isolating novel, patentable compounds from the extract for use as Active Pharmaceutical Ingredients (APIs) in the treatment of chronic autoimmune or inflammatory conditions, leveraging the growing global investment in botanical drug development. Furthermore, strategic opportunities exist in forging exclusive sourcing agreements and investing in large-scale, sustainable cultivation projects outside the traditional endemic regions, potentially utilizing controlled environment agriculture (CEA) to ensure year-round supply consistency and mitigate climate risk. Impact forces, particularly the Nagoya Protocol concerning access and benefit-sharing of genetic resources, mandate transparent and equitable dealings with source countries, profoundly influencing ethical sourcing strategies and competitive advantage.

Key Market Dynamics:

- Drivers (D): Increased clinical validation supporting the extract's anti-inflammatory and cellular repair capabilities. Strong global consumer demand for natural, functional ingredients in high-end cosmetic and wellness products. Favorable regulatory recognition of traditional medicine ingredients in APAC and emerging markets.

- Restraints (R): Significant volatility and fragility in the raw material supply chain due to geographical restrictions and susceptibility to adverse climatic events. High capital expenditure required for advanced, standardized extraction and purification technologies. Complexity and time required for gaining full regulatory approval (e.g., Novel Food status) for concentrated isolates.

- Opportunities (O): Development of proprietary, stabilized extract formulations specifically designed for high-bioavailability delivery systems (e.g., nano-emulsions). Expansion into specialized veterinary medicine and pet health nutraceuticals. Strategic vertical integration to control sourcing costs and quality from farm to finished ingredient.

- Impact Forces: Growing regulatory pressure for complete supply chain transparency and adherence to international sustainability standards, like fair trade practices (positive force on compliance). Climate change intensifying raw material volatility and requiring investment in resilient sourcing solutions (negative force on stable supply).

Segmentation Analysis

The Ficus Foveolata Extract market segmentation provides a granular view essential for strategic planning, dissecting the total market based on the physical form of the extract, its primary end-use application, and the required purity grade. The segmentation by Form—Powdered versus Liquid/Oil—reflects distinct industrial requirements; powdered extracts offer excellent shelf stability, reduced transportation weight, and ease of inclusion in dry blends like tablet pre-mixes and encapsulated dietary supplements. The liquid form, often dissolved in natural carrier oils or glycerin, offers superior dermal compatibility and ease of incorporation into water-based cosmetic serums, demanding different preservation and homogenization techniques.

The segmentation by Application—Cosmetics and Personal Care, Nutraceuticals, and Pharmaceuticals—is pivotal for understanding market revenue distribution. The Cosmetics segment, focused on anti-aging, hydration, and soothing properties, generates the highest current revenue due to shorter product development cycles and lower regulatory hurdles compared to health claims. However, the Nutraceutical segment is witnessing rapid uptake, driven by growing scientific literacy among consumers seeking preventative health solutions. The Pharmaceutical segment, while currently small, promises the highest long-term growth and margin, contingent on successful clinical validation and the isolation of high-purity, drug-candidate molecules, thereby driving the demand for specialized, expensive, pharmaceutical-grade material.

The distinction by Grade/Purity—Standard Grade versus High Purity/Pharmaceutical Grade—is crucial for defining pricing and market access. Standard Grade extracts are acceptable for general cosmetic and non-specific nutraceutical use, prioritizing cost-effectiveness and standardized color/odor. Conversely, Pharmaceutical Grade demands certification of non-detectable levels of heavy metals and solvents, a precise fingerprint of active compounds verified by advanced chromatography, and often requires compliance with Good Manufacturing Practices (GMP) protocols specific to API production. This high-grade segment is insulated from price competition and is primarily governed by quality assurance and regulatory clearance capacity, reflecting a sophisticated manufacturing commitment.

- By Form:

- Powdered Extract: Preferred for capsules, tablets, functional food blending, and dry cosmetic formulation bases (e.g., clay masks).

- Liquid Extract/Oil: Preferred for topical solutions, serums, tinctures, and specialized cosmetic emulsions requiring enhanced skin absorption.

- By Application:

- Cosmetics and Personal Care (Anti-aging serums, sun care repair products, sensitive skin treatments, shampoos).

- Nutraceuticals (Immune support supplements, antioxidant capsules, liver detoxification formulas, functional beverages).

- Pharmaceuticals (R&D into therapeutic compounds for chronic inflammatory diseases, botanical drug formulations, topical prescriptions).

- By Grade/Purity:

- Standard Grade (Food/Cosmetic): Typically 1-5% standardized marker compounds; focus on cost and color/odor profile.

- High Purity/Pharmaceutical Grade: Often >50% isolated compound or highly standardized; adheres to cGMP, requiring extensive analytical testing (HPLC, Mass Spec).

- By Extraction Method:

- Supercritical Fluid Extraction (SFE)

- Ethanol/Hydro-alcoholic Extraction

- Pressurized Liquid Extraction (PLE)

Value Chain Analysis For Ficus Foveolata Extract Market

The value chain commences with the critical upstream activities of raw material procurement, encompassing the careful cultivation and sustainable wild harvesting of Ficus Foveolata leaves and stems. Given the extract's high value, suppliers are increasingly implementing advanced agricultural practices, including ethnobotanical studies and germplasm preservation, to optimize the plant's phytochemical production. The primary challenge upstream is compliance with international treaties like the Convention on Biological Diversity (CBD) and the Nagoya Protocol, which necessitate establishing clear access and benefit-sharing mechanisms with the countries of origin. Robust traceability systems, often utilizing blockchain technology, are essential at this stage to prove ethical and sustainable sourcing claims, which directly influence the marketing appeal of the final ingredient.

The midstream phase involves the sophisticated transformation of raw botanicals into standardized commercial extracts. This stage is capital-intensive, requiring specialized facilities equipped with advanced machinery for various extraction techniques, including SFE and countercurrent chromatography, designed to maximize the yield of specific bioactive markers while eliminating heavy metals and solvent residues. Quality control (QC) at the midstream level is rigorous, involving chemical fingerprinting and potency testing to ensure that the extract meets the guaranteed percentage concentration specified for flavonoids or triterpenoids. Producers who achieve higher standardization and can offer customized purity profiles hold a significant competitive edge, allowing them to serve premium pharmaceutical and cosmeceutical manufacturers.

The downstream flow focuses on the formulation, marketing, and distribution of finished products. Distribution channels are highly specialized: large-volume buyers (Tier 1 cosmetic multinational corporations, Big Pharma) typically engage in direct, long-term supply agreements with extract manufacturers to ensure consistency and proprietary blend protection. Smaller formulation houses and regional nutraceutical producers often rely on specialized ingredient distributors, who provide localized technical support, smaller batch sizes, and handle complex import/export documentation. Marketing efforts downstream are increasingly reliant on digital content and clinical white papers, emphasizing the scientific validation of the extract's health benefits (AEO strategy), translating complex biological efficacy data into clear, consumer-facing value propositions.

Ficus Foveolata Extract Market Potential Customers

The target demographic for Ficus Foveolata Extract includes organizations highly committed to producing premium, functional, and scientifically supported consumer health and beauty products. Cosmetic manufacturers specializing in "active ingredient" or "doctor-formulated" skincare are principal buyers. These clients require water-soluble or oil-miscible liquid extracts with high antioxidant scores, focused on claims related to reducing inflammation, protecting against blue light or UV damage, and promoting collagen synthesis. Their procurement specifications often demand evidence of efficacy through in-vitro and human clinical data, prioritizing ingredient suppliers who offer proprietary stability enhancements or patented delivery systems.

Another crucial customer segment consists of global nutraceutical and dietary supplement producers. These firms integrate Ficus Foveolata Extract into complex formulations targeting specific health outcomes such as joint mobility, gut health, or cellular protection. For these buyers, the extract must be supplied in standardized powdered form, compatible with encapsulation machinery, and possess excellent long-term stability without requiring refrigeration. Regulatory compliance is paramount; nutraceutical companies require suppliers to provide exhaustive documentation verifying the ingredient's safety profile (e.g., non-GMO, allergen-free status) and to support compliance with regional dietary supplement regulations (e.g., FDA or EFSA guidelines).

The third, strategically important customer group comprises pharmaceutical companies and contract research organizations (CROs) engaged in early-stage drug discovery. These entities are not focused on bulk purchasing but require extremely small quantities of ultra-high-purity, isolated compounds (e.g., 99% pure lupeol) for assay development and preclinical testing. These customers necessitate specialized, small-batch production, extremely tight chemical specification tolerances, and comprehensive impurity profiling. Suppliers capable of offering these specialized services often form long-term research partnerships, benefiting from intellectual property co-development and securing a strong position in future high-margin API supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Naturex (Givaudan), Indena S.p.A., Symrise AG, Kemin Industries, Inc., Martin Bauer Group, Lonza Group, Biospectrum Co., Ltd., Active Concepts, LLC, Shaanxi Pioneer Biotech Co., Ltd., Hunan NutraMax Inc., Sabinsa Corporation, B&B Botanicals, Plant Extract Corp., Herbochem, Euromed S.A., Bio-Botanica, Inc., Döhler GmbH, Lipoid Kosmetik AG, IFF (International Flavors & Fragrances), BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ficus Foveolata Extract Market Key Technology Landscape

The technological sophistication inherent in producing Ficus Foveolata Extract is a primary determinant of market differentiation, moving beyond rudimentary methods to achieve ultra-high purity and functional specificity. Supercritical Fluid Extraction (SFE), particularly using non-toxic CO2, stands as a cornerstone technology. SFE is favored because it operates at low temperatures, minimizing the degradation of heat-sensitive flavonoids and producing extracts free of residual toxic solvents, which is a key requirement for clean-label and pharmaceutical formulations. The ability of SFE to fractionate the extract by adjusting pressure and temperature allows manufacturers to selectively concentrate specific non-polar compounds, providing highly customized ingredients tailored to distinct end-user needs, such as high triterpenoid content for topical pain relief applications.

Advanced analytical technologies are indispensable for ensuring standardization and regulatory compliance. High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS) is routinely employed for meticulous phytochemical fingerprinting, establishing identity, purity, and quantifying marker compounds with exceptional accuracy. This analytical rigor is vital for suppliers operating in the European Union and the U.S., where regulatory bodies demand unequivocal proof of botanical identity and concentration consistency, necessitating dedicated Quality Assurance laboratories and continuous investment in certified reference standards. Standardization efforts are increasingly focusing on a panel of 5-10 key bioactive compounds rather than relying solely on total polyphenol content, reflecting the shift toward targeted functionality.

Furthermore, innovation in delivery and stabilization technologies is crucial for maximizing the efficacy of Ficus Foveolata Extract in finished products. Nanotechnology applications, including the formation of liposomes and nano-emulsions, are being widely adopted to encapsulate the hydrophobic active components. Encapsulation serves dual purposes: protecting the extract from degradation caused by light, oxygen, or temperature fluctuations during storage and enhancing its transdermal absorption or systemic bioavailability post-ingestion. These stabilized and highly bioavailable forms command a premium price and are essential for maintaining the integrity of the extract's delicate bioactive profile throughout the product's shelf life, thereby driving market value creation.

Key Technologies Utilized:

- Supercritical Fluid Extraction (SFE) employing CO2 for high-purity, solvent-free extraction, crucial for pharmaceutical grading.

- High-Performance Liquid Chromatography-Mass Spectrometry (HPLC-MS) used for advanced phytochemical profiling, identification, and quantitative standardization of marker compounds.

- Microencapsulation and liposomal delivery systems to protect active ingredients (flavonoids, triterpenoids) and enhance their bioavailability and targeted release.

- Continuous Chromatography techniques (like Simulated Moving Bed Chromatography) for cost-effective, large-scale isolation of specific high-purity components.

- Green Chemistry solvent technologies, such as deep eutectic solvents (DES), being explored as environmentally friendly alternatives to traditional organic solvents.

Regional Highlights

The regional market landscape for Ficus Foveolata Extract is characterized by a high concentration of sourcing and traditional utilization in Asia Pacific, contrasted by escalating adoption rates driven by high consumer spending and sophisticated regulatory acceptance in North America and Europe. Asia Pacific (APAC) stands as the undisputed market leader, responsible for the vast majority of raw material supply, processing, and domestic consumption. Nations such as China, Vietnam, and Indonesia serve as the epicenter for cultivation and initial extraction, bolstered by centuries of incorporation into Traditional Chinese Medicine (TCM) and the current massive market size of regional cosmetic powerhouses like South Korea (K-Beauty), which consistently demand novel, naturally derived efficacy ingredients.

North America is demonstrating the highest growth velocity, propelled by an aggressive marketing push toward clean-label and functional wellness supplements. U.S. and Canadian consumers are increasingly educated about botanical health benefits and willing to invest significantly in products containing clinically substantiated, traceable ingredients. This market segment places a premium on high-grade, standardized extracts with clear scientific data supporting anti-inflammatory and gut health claims. Consequently, regulatory guidance from the FDA regarding New Dietary Ingredients (NDIs) dictates that suppliers focus heavily on robust toxicological dossiers and purity certifications to ensure market access and avoid protracted regulatory challenges.

Europe constitutes a mature, high-value market driven by the rigorous cosmetic regulation framework, which mandates exceptional standards for ingredient safety, traceability, and sustainability. Countries like Germany and France are key consumers, integrating the extract into sophisticated dermo-cosmetic lines targeting chronic skin sensitivity and barrier function repair. European demand is heavily skewed towards organic-certified extracts and those produced via sustainable extraction methods (e.g., SFE), reflecting the strong ethical purchasing habits prevalent across the continent. The Latin American (LATAM) and Middle East & Africa (MEA) regions are showing early signs of accelerated adoption, primarily driven by investments in localized cosmetic manufacturing capabilities and the rising consumer interest in preventative health, facilitating growth in imported premium supplements and specialized skincare products.

- Asia Pacific (APAC): Dominates market volume; high integration into TCM and modern cosmetics; strong government support for botanical research and domestic manufacturing (China, Japan, South Korea).

- North America: Leading growth market by value; driven by high consumer premiumization, demand for evidence-based nutraceuticals, and significant R&D in botanical drug discovery.

- Europe: High-value market focused on safety, purity, and sustainability (COSMOS certification); strict regulatory environment ensures only high-grade extracts are imported for dermo-cosmetic use (Germany, UK).

- Latin America (LATAM): Emerging cosmetic manufacturing hubs are increasing demand for local and imported natural ingredients for market differentiation (Brazil, Mexico).

- Middle East & Africa (MEA): Growth attributed to expanding modern retail infrastructure and greater access to imported high-end dietary supplements and luxury personal care items, driven by economic diversification in GCC nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ficus Foveolata Extract Market.- Naturex (Givaudan)

- Indena S.p.A.

- Symrise AG

- Kemin Industries, Inc.

- Martin Bauer Group

- Lonza Group

- Biospectrum Co., Ltd.

- Active Concepts, LLC

- Shaanxi Pioneer Biotech Co., Ltd.

- Hunan NutraMax Inc.

- Sabinsa Corporation

- B&B Botanicals

- Plant Extract Corp.

- Herbochem

- Euromed S.A.

- Bio-Botanica, Inc.

- Döhler GmbH

- Lipoid Kosmetik AG

- IFF (International Flavors & Fragrances)

- BASF SE

- DSM Nutritional Products

- Aromtech Oy

- Naturalin Bio-Resources Co., Ltd.

- Guangzhou Phytochem Sciences Inc.

Frequently Asked Questions

Analyze common user questions about the Ficus Foveolata Extract market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Ficus Foveolata Extract?

The primary applications are in Cosmetics and Personal Care (for anti-aging and antioxidant properties), Nutraceuticals (in dietary supplements for systemic wellness), and Pharmaceuticals (in specialized research for anti-inflammatory compounds).

Which geographical region leads the Ficus Foveolata Extract market?

Asia Pacific (APAC) currently dominates the market share due to the plant's native availability, established traditional usage in medicine, and robust cosmetic and nutraceutical manufacturing capabilities in countries like China and South Korea.

What key bioactive compounds are responsible for the extract's efficacy?

The efficacy of Ficus Foveolata Extract is primarily attributed to a rich composition of polyphenols, flavonoids (such as quercetin derivatives), and unique triterpenoids, which collectively provide potent antioxidant and anti-inflammatory benefits.

How is technological advancement influencing the market growth?

Advanced extraction technologies like Supercritical Fluid Extraction (SFE) and microencapsulation are enhancing the purity, standardization, and bioavailability of the extract, making it suitable for high-value pharmaceutical and premium cosmetic formulations.

What are the main market restraints affecting the supply of Ficus Foveolata Extract?

The main restraints include the geographical restrictions on cultivation, leading to supply chain volatility, and the necessity for costly, sustainable harvesting and high-purity processing required to meet global quality standards.

What distinguishes pharmaceutical-grade Ficus Foveolata Extract?

Pharmaceutical-grade extract requires ultra-high purity (>98% specified compound), adherence to stringent cGMP (Current Good Manufacturing Practices), and exhaustive analytical validation (HPLC-MS) to ensure safety and consistent dosage for clinical applications.

How is sustainability addressed in the Ficus Foveolata Extract value chain?

Sustainability is addressed through precision agriculture, ethical sourcing practices compliant with the Nagoya Protocol, and the adoption of green chemistry extraction methods (like CO2 SFE) to minimize environmental impact and ensure traceability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager