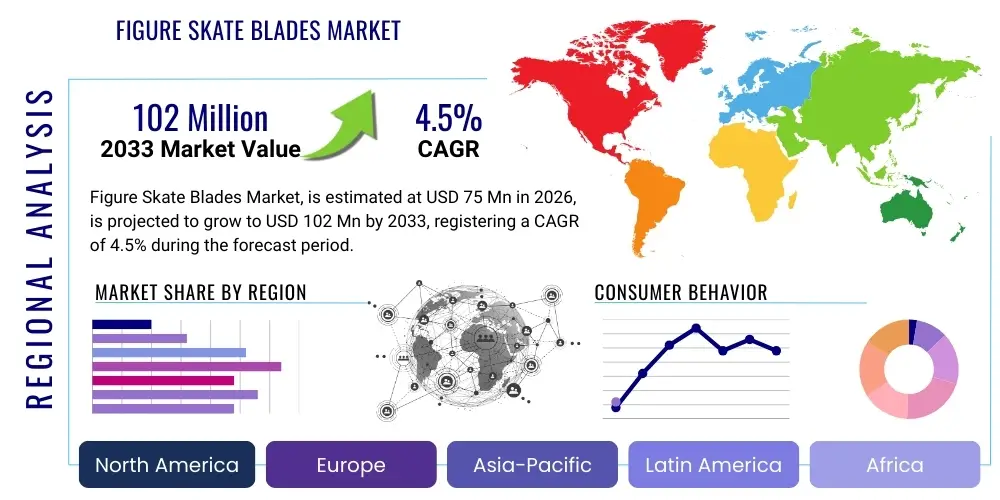

Figure Skate Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435452 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Figure Skate Blades Market Size

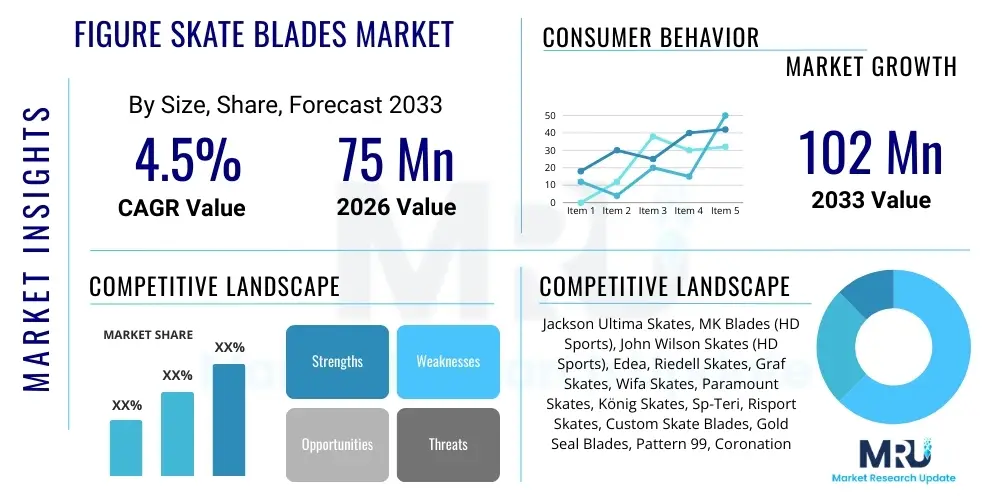

The Figure Skate Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $75 Million USD in 2026 and is projected to reach $102 Million USD by the end of the forecast period in 2033.

Figure Skate Blades Market introduction

The Figure Skate Blades Market encompasses the manufacturing, distribution, and sale of specialized metal runners designed for attachment to figure skating boots. These blades are precision-engineered tools crucial for executing complex maneuvers such as jumps, spins, and intricate footwork on ice. The design complexity includes features like the toe pick, which is essential for initiating jumps, and the rocker radius, which influences glide and turning capabilities. The market primarily serves professional figure skaters, amateur competitors, and recreational users, ranging from basic models made of standard carbon steel to high-performance blades utilizing aerospace-grade stainless steel, titanium, or advanced alloys.

Product descriptions vary significantly across segments, dictated by performance needs and skater level. Entry-level blades prioritize durability and ease of maintenance, whereas professional competition blades focus on weight reduction, precise edge geometry, and specialized heat treatment processes like cryogenic tempering to maintain sharpness longer. Major applications include competitive figure skating (singles, pairs, ice dance), synchronized skating, and theatrical ice shows. The inherent benefits derived from high-quality blades include improved stability, enhanced speed generation, superior edge control, and reduced vibration, all of which directly contribute to performance metrics and safety.

The market is currently being driven by several macro-level factors, notably the increasing global participation in ice sports, heightened visibility of figure skating through major international events like the Winter Olympics, and rising consumer demand for personalized and technologically advanced sporting equipment. Furthermore, advancements in materials science, leading to lighter yet stronger blades, are compelling professional athletes to frequently upgrade their equipment, sustaining growth in the high-end segments. The expanding infrastructure of ice rinks and skating academies globally further solidifies the foundational demand structure for figure skate blades.

Figure Skate Blades Market Executive Summary

The Figure Skate Blades Market is poised for stable expansion, characterized by a fundamental shift toward premium, performance-oriented products and increasing geographic penetration in emerging Asian markets. Key business trends include consolidation among traditional manufacturers and a strong emphasis on direct-to-consumer (DTC) sales channels, allowing specialty brands to better control branding and pricing strategies. Manufacturing efficiency, particularly the utilization of Computer Numerical Control (CNC) machining for meticulous blade profiles, is a core competitive differentiator, ensuring consistency and precision required by elite athletes. Sustainability concerns are also beginning to influence material sourcing and packaging within the major market players, though high-performance requirements often dictate material choices.

Regionally, North America and Europe remain the dominant revenue generators, underpinned by deep-rooted skating cultures, high disposable incomes, and well-established amateur and professional training circuits. However, the Asia Pacific (APAC) region, driven primarily by China, Japan, and South Korea, is exhibiting the fastest growth rates. This acceleration is linked to significant governmental investment in winter sports infrastructure following major international sporting events hosted in the region, leading to a surge in both recreational and competitive skating participation. Latin America and the Middle East and Africa (MEA) currently represent niche markets, but localized infrastructure development presents future opportunities.

Segmentation trends highlight the Material Type segment, where stainless steel remains dominant due to cost-effectiveness, but high-end segments are rapidly adopting lightweight titanium and specialized alloys for competition use. Application-wise, the Competitive Skating segment holds the highest value share due to the specialized nature and frequent replacement cycles of elite blades, while the Distribution Channel segment sees strong growth in online retail platforms, complementing the expertise provided by specialized physical pro shops. The competitive landscape is characterized by a few global established leaders maintaining market share through brand recognition and strategic partnerships with professional skaters and skating organizations.

AI Impact Analysis on Figure Skate Blades Market

User inquiries regarding AI in the Figure Skate Blades Market commonly center on how machine learning can optimize performance characteristics, automate manufacturing processes, and personalize product recommendations. Users frequently ask if AI can design a "perfect" blade profile tailored to an individual skater's biomechanics or if AI-driven quality control can eliminate manufacturing defects. The prevailing themes are precision engineering, customization, and predictive maintenance. Users expect AI to streamline the R&D cycle, potentially leading to blades that offer superior aerodynamics and friction reduction, moving away from traditional trial-and-error design methods toward data-validated performance improvements, thereby influencing future high-end product development.

- AI-Driven Design Optimization: Machine learning algorithms analyze vast datasets of skater biomechanics, ice temperature, and performance metrics (speed, spin rate) to recommend optimal blade radii, rocker profiles, and side-honing angles, minimizing drag and maximizing energy transfer.

- Predictive Quality Control (PQC): AI vision systems monitor the CNC machining process in real-time, detecting micro-defects or inconsistencies in edge hardening and profile shape far more accurately than human inspectors, thereby ensuring zero-defect production batches for elite equipment.

- Personalized Equipment Matching: AI tools assist pro shop fitters and online retailers by matching specific blade models and sizes to a skater's skill level, weight, height, and style (e.g., jump-heavy vs. dance-focused), significantly enhancing the purchasing experience.

- Supply Chain Forecasting: Machine learning models improve inventory management and demand forecasting for seasonal peaks, optimizing raw material procurement (e.g., high-carbon steel alloys) and reducing stockouts in specialized regional markets.

- Smart Sharpening Recommendations: AI integration into smart sharpening devices or apps could analyze blade wear patterns and usage data to recommend the precise frequency and angle needed for maintenance, prolonging blade life and maintaining peak performance.

DRO & Impact Forces Of Figure Skate Blades Market

The dynamics of the Figure Skate Blades Market are shaped by a balanced set of market drivers that incentivize innovation and expansion, coupled with specific restraints that necessitate strategic management, while emerging opportunities provide pathways for sustained long-term growth. Driving factors primarily revolve around the enhanced globalization of winter sports and technological advancements in manufacturing, particularly the push for lighter, more resilient materials. Restraints include the high initial investment required for quality blades, the specialized nature of the sport leading to a limited consumer base compared to mass-market sports, and the intense seasonality of demand in certain geographies. Opportunities lie in capitalizing on customization services and penetrating developing markets where infrastructure investment is increasing.

Impact forces acting on this market are categorized into Drivers (D), Restraints (R), and Opportunities (O). Key drivers include the robust increase in professional skating circuits and the associated need for frequent high-quality blade replacement, coupled with consumer willingness to invest in performance-enhancing sports equipment. Restraints are predominantly the stringent and highly technical requirements for product certification and safety standards, which increase R&D costs, alongside the challenge of counterfeiting impacting brand integrity in fast-growing, price-sensitive regions. Market opportunities focus heavily on leveraging e-commerce and digitalization for direct sales and specialized fitting services, reducing reliance solely on traditional brick-and-mortar pro shops.

The interaction between these forces determines the market trajectory. For example, while the high cost (R) might limit market access for some amateurs, the technological advancements (D) leading to better performance justify the premium pricing for competitive athletes. Furthermore, manufacturers are actively pursuing opportunities (O) by developing modular or adjustable blade systems, which could mitigate the high replacement costs (R) by allowing components to be replaced individually, thereby catering to a broader range of price points while maintaining technological superiority.

Segmentation Analysis

The Figure Skate Blades Market is segmented based on critical factors including the material used for construction, the application for which the blade is designed, the level of the skater, and the distribution channel through which the product is purchased. This segmentation is essential for manufacturers to tailor product lines and marketing strategies, particularly distinguishing between the high volume, moderate value recreational segment and the low volume, high value professional segment. The most significant segmentation influence lies in Material Type, which dictates performance characteristics like weight, edge retention, and resistance to corrosion, directly correlating with the overall cost structure and target end-user.

- By Material Type:

- Carbon Steel Blades

- Stainless Steel Blades (Standard and High-Grade)

- Titanium Blades

- Advanced Alloy Composites

- By Application:

- Competitive Figure Skating (Singles, Pairs, Dance)

- Recreational Skating

- Ice Shows and Exhibitions

- Synchronized Skating

- By Skater Level:

- Beginner/Entry-Level

- Intermediate

- Advanced/Professional

- By Distribution Channel:

- Specialized Sports Stores/Pro Shops

- Online Retail & E-commerce

- Department Stores & General Retailers

Value Chain Analysis For Figure Skate Blades Market

The value chain for the Figure Skate Blades Market begins with upstream activities focused on raw material sourcing, predominantly high-grade carbon steel, specialized stainless steel, and, increasingly, lighter materials like titanium and specific alloy blends. Quality control at this initial stage is paramount, as the steel’s chemical composition directly impacts the final blade’s hardness and edge retention capabilities after heat treatment. Upstream suppliers are often specialized metal fabricators capable of providing materials with extremely low impurity levels and precise mechanical properties, necessitating strict supplier relationship management and quality assurance protocols to maintain product integrity.

Midstream activities involve core manufacturing, including forging, precise CNC machining, grinding, polishing, heat treatment (including tempering or cryogenic processing), and chroming or coating for corrosion resistance. Given the need for micron-level precision in rocker radius and edge profile, manufacturing requires significant capital investment in highly specialized machinery and skilled labor. Assembly processes integrate the blade with the mounting plate (often copper-plated) and packaging. Efficiency in the midstream segment is vital for cost optimization and maintaining competitive pricing while adhering to the rigorous performance standards demanded by elite skaters.

Downstream analysis covers distribution channels. Direct distribution (sales directly to professional teams, sponsored athletes, or through manufacturer-owned online portals) allows for maximum control over customer experience and customization. Indirect distribution involves specialized ice sports pro shops—which provide crucial fitting and sharpening services—and, increasingly, large third-party e-commerce platforms. The pro shops remain critical because figure skate blades require expert selection and precision mounting onto boots. The movement of products through these channels necessitates robust logistics capable of handling high-value, fragile goods, ensuring prompt delivery to meet the demanding schedules of competitive skaters worldwide.

Figure Skate Blades Market Potential Customers

Potential customers for the Figure Skate Blades Market are highly diverse, spanning from young children taking their first recreational lessons to world-class Olympic contenders. The end-user spectrum can be broadly segmented into performance-driven athletes and recreational users, each possessing distinct purchasing behaviors, willingness to pay, and product requirements. Performance athletes, including professional and advanced amateur figure skaters, represent the core value segment, demanding the highest technological specifications such as titanium lightweight blades and specialized profile geometries, often replacing their blades several times per season due to wear and competitive necessity.

The secondary, yet high-volume, customer base comprises intermediate and beginner skaters who prioritize durability, affordability, and ease of learning. These buyers typically opt for mid-range stainless steel or standard carbon steel blades that offer a good balance of performance and maintenance requirements. Institutional buyers also form a critical customer group, encompassing skating clubs, ice rinks, rental facilities, and specialized academies that purchase durable, entry-level blades in bulk for rental fleets or student programs, focusing heavily on robust construction and longevity.

Moreover, the growing segment of adult skaters returning to the sport, often driven by fitness and social motivations, represents an untapped demographic for mid-to-high quality recreational blades. Understanding the nuanced needs—such as the preference for parabolic blades or specialized features for ice dance versus free skating—is essential for manufacturers targeting these specific end-user profiles. Marketing efforts must therefore be highly tailored, emphasizing performance metrics for professionals and durability/safety features for recreational and institutional buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $75 Million USD |

| Market Forecast in 2033 | $102 Million USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jackson Ultima Skates, MK Blades (HD Sports), John Wilson Skates (HD Sports), Edea, Riedell Skates, Graf Skates, Wifa Skates, Paramount Skates, König Skates, Sp-Teri, Risport Skates, Custom Skate Blades, Gold Seal Blades, Pattern 99, Coronation Ace, Eclipse Blades, Legacy Blades, Tapered Blades, Matrix Blades, P99 Ice. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Figure Skate Blades Market Key Technology Landscape

The technological landscape of the Figure Skate Blades Market is heavily focused on materials science, precision engineering, and specialized surface treatments aimed at enhancing glide, edge control, and durability. Computer Numerical Control (CNC) machining represents a cornerstone technology, enabling manufacturers to achieve extremely tight tolerances on parameters such as the rocker radius, profile shape, and toe pick position. This precision is essential for professional blades, where micron differences can significantly affect performance during complex maneuvers. Advanced manufacturers leverage multi-axis CNC machines to replicate patented geometries consistently across entire product lines, ensuring that every blade meets stringent performance specifications.

Beyond shaping, material enhancement technologies are driving innovation. Cryogenic treatment, a process involving deep cooling of the steel after heat treatment, is increasingly utilized to rearrange the steel’s molecular structure, resulting in dramatically improved hardness, wear resistance, and edge retention. This process significantly extends the period between sharpening, which is a major performance benefit for high-level skaters. Furthermore, the application of specialized coatings, such as chrome plating or Physical Vapor Deposition (PVD) coatings, is employed to minimize friction and protect the high-carbon steel core from corrosion and rusting, extending the functional lifespan of the blade.

The growing trend of incorporating lightweight materials, such as aerospace-grade titanium and specialized aluminum alloys, in the stanchions (the vertical supports connecting the blade runner to the boot plate) is a key technological area. While the runner itself typically requires high-carbon steel for edge integrity, using lighter materials for the non-cutting components significantly reduces the overall weight of the blade, decreasing the rotational inertia during jumps and enhancing maneuverability. Manufacturers are also developing modular blade systems, such as the Jackson Matrix line, which use separate stanchions and runners, allowing skaters to customize their setup or replace only the worn runner component, representing an advancement in product lifecycle management and serviceability.

Regional Highlights

- North America (United States and Canada): This region dominates the Figure Skate Blades Market in terms of market size and technological adoption. The U.S. and Canada possess highly developed winter sports infrastructure, including numerous Olympic-level training facilities and robust amateur competitive circuits. High disposable income levels support the consumption of premium, performance-oriented blades (Titanium and advanced alloy models). The market here is characterized by fierce competition among global leaders and a strong preference for brands with established histories in professional sports endorsement. The emphasis on high-quality specialized fitting services provided by local pro shops sustains demand for mid-to-high-end inventory.

- Europe (Western and Nordic Countries): Europe represents the second-largest market, built upon a strong historical foundation in ice sports. Countries like the United Kingdom, Germany, Russia, and the Nordic nations exhibit stable, mature demand. Demand is high for both traditional, time-tested blade designs (often from legacy European brands) and cutting-edge performance models. Eastern European countries, especially Russia, have historically been crucial hubs for competitive skating, driving strong demand for elite-level equipment. The market dynamics are slightly fragmented, with specialized local distributors playing a pivotal role in market penetration.

- Asia Pacific (APAC) (China, Japan, South Korea): APAC is the fastest-growing region, driven by substantial government investment in winter sports infrastructure, particularly in countries that have hosted or are preparing for major events. Japan and South Korea have long maintained strong figure skating cultures, resulting in mature markets for high-quality, professional equipment. China’s rising middle class and increasing participation in ice sports represent a massive, relatively untapped potential market, primarily driving demand for beginner and intermediate-level blades. The key challenge in APAC is establishing robust, specialized distribution and service networks necessary for proper blade fitting and maintenance.

- Latin America and Middle East & Africa (MEA): These regions constitute emerging markets characterized by localized pockets of demand linked to indoor, artificial ice rink facilities. Market growth is highly dependent on infrastructure expansion and the initiation of formal skating programs. Demand is predominantly focused on recreational and entry-level blades, with minimal presence in the high-performance competitive segment. Opportunities exist for manufacturers willing to partner with local governments or private investors to supply rental fleets and basic training equipment, prioritizing durability and cost-effectiveness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Figure Skate Blades Market.- Jackson Ultima Skates (including Ultima Blades)

- MK Blades (HD Sports)

- John Wilson Skates (HD Sports)

- Edea (Though primarily boots, strongly influences blade mounting and sales)

- Riedell Skates (Including Eclipse Blades)

- Graf Skates

- Wifa Skates

- Paramount Skates

- König Skates

- Sp-Teri

- Risport Skates

- Custom Skate Blades

- Gold Seal Blades

- Pattern 99

- Coronation Ace

- Legacy Blades

- Matrix Blades

- P99 Ice

- Blades USA

- Skatemaster

Frequently Asked Questions

Analyze common user questions about the Figure Skate Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between carbon steel and stainless steel figure skate blades?

Carbon steel blades generally offer superior edge retention and can achieve a sharper edge due to higher hardness but are highly susceptible to rust and require diligent maintenance. Stainless steel blades, while often slightly softer, provide exceptional corrosion resistance, making them more durable and easier to maintain for recreational users.

How frequently should a professional figure skater replace their blades?

Professional figure skaters typically replace their blades annually or even biannually, depending on the intensity of training and the frequency of sharpening. High-level competitive blades, due to the critical nature of their precision profile and the stresses of jumps, are often replaced once their complex rocker profile begins to wear down, usually within 100 to 200 hours of aggressive use.

What role does the toe pick play in figure skating and how does it affect blade design?

The toe pick, the serrated edge at the front of the blade, is essential for initiating all jumps (e.g., toe loop, flip, lutz) and is critical for specific spins and pivots. Blade design varies significantly; dance blades have smaller toe picks for less interference during footwork, while freestyle blades feature larger, more aggressive picks positioned higher for powerful jumping takeoffs.

Are titanium figure skate blades truly better than high-grade steel models?

Titanium blades, specifically those using titanium for the stanchions/mount, are significantly lighter than steel alternatives, reducing inertia and perceived weight during complex rotations and jumps. While they offer a performance advantage in weight reduction, the actual runner edge is still typically steel or specialized alloys for optimal hardness and edge retention, meaning 'better' depends on the skater prioritizing lightness over traditional steel feel.

What impact does the rocker radius have on a figure skate blade’s performance?

The rocker radius defines the curve of the blade contacting the ice and is measured in feet. A smaller radius (tighter curve) provides greater maneuverability, speed in spins, and quick turns (favored by ice dancers). A larger radius (flatter curve) increases stability, improves glide, and provides a broader sweet spot for landing jumps (favored by singles freestyle skaters). Selecting the appropriate rocker radius is crucial for matching the blade to the skater’s discipline and style.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager