Figure Skates Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433906 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Figure Skates Market Size

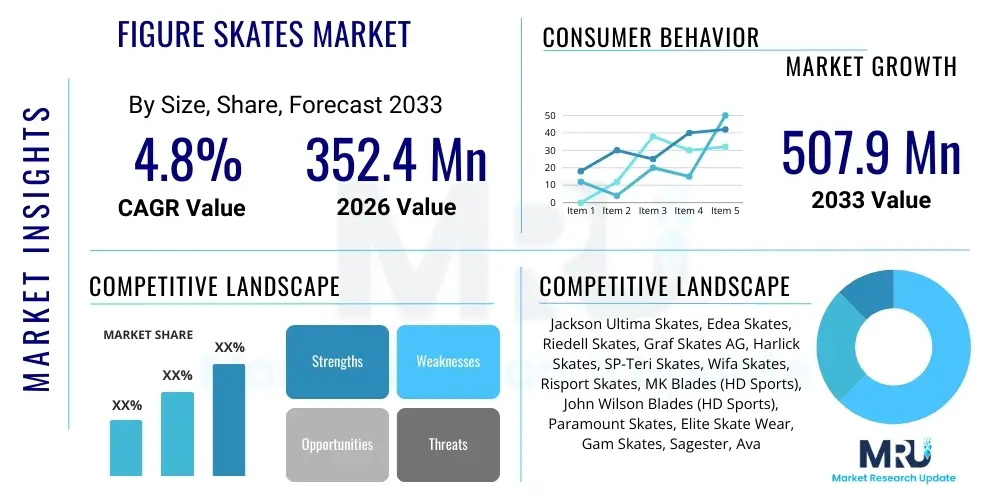

The Figure Skates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 352.4 million in 2026 and is projected to reach USD 507.9 million by the end of the forecast period in 2033.

Figure Skates Market introduction

The Figure Skates Market encompasses the manufacturing, distribution, and sale of specialized footwear and blade systems designed for figure skating disciplines, including singles, pairs, ice dance, and synchronized skating. These products are complex engineering marvels, integrating high-performance materials such as carbon fiber composites, reinforced leather, and precision-machined steel alloys to optimize comfort, structural support, and aerodynamic efficiency. The core product is segmented primarily by skill level, ranging from beginner leisure skates to highly customized, professional-grade boots and blades designed to withstand the immense forces generated by triple and quadruple jumps. Market proliferation is strongly tied to the global popularity of winter sports, the frequency of international skating competitions, and the growing enrollment in amateur skating programs worldwide. Furthermore, advances in boot molding technology and heat-formable materials have significantly improved fit and reduced break-in time, driving consumer satisfaction and professional adoption rates.

Major applications of figure skates extend beyond competitive athletics into recreational skating, theatrical ice shows (such as Ice Capades and Disney on Ice), and general fitness activities on ice surfaces. The primary benefit derived from high-quality figure skates is the precise control and responsiveness they offer, which is critical for executing intricate maneuvers, spins, and jumps safely and effectively. Modern skates feature lightweight designs and superior ankle support, minimizing fatigue and injury risk compared to older, heavier models. Driving factors include increasing disposable income in emerging economies, governmental support for winter sports infrastructure development, and sophisticated marketing campaigns leveraging endorsements from world-renowned athletes. The standardization of safety requirements and the continuous pursuit of lighter, more rigid blade technologies also act as significant market drivers.

The product lifecycle in this market is characterized by incremental innovation, where material science breakthroughs often dictate new product launches. Figure skates are essential equipment, meaning demand is relatively inelastic among dedicated users. The market’s health is closely correlated with the accessibility and affordability of ice rinks and skating lessons. Geographically, regions with strong historical ties to ice sports, particularly North America and Europe, maintain significant market shares, though Asia-Pacific, led by rapidly growing interest in countries like China, Japan, and South Korea, is poised for the most rapid expansion throughout the forecast period. The focus on personalized fit and boot customization, often involving 3D scanning technology, represents a key consumer trend driving premium segment growth.

Figure Skates Market Executive Summary

The Figure Skates Market is experiencing robust growth driven by favorable demographic shifts favoring participation in structured sports activities and significant technological advancements in boot and blade construction. Business trends indicate a strong move toward customization and the adoption of specialized components, pushing the Average Selling Price (ASP) upwards, particularly in the competitive segment. Manufacturers are increasingly focused on vertical integration, controlling material sourcing (especially high-grade steel and composite fabrics) to ensure quality and supply chain resilience. Key vendors are expanding their digital footprint through e-commerce platforms and utilizing advanced data analytics to understand complex consumer needs, particularly regarding boot stiffness and blade rocker radius preferences. Furthermore, the market has seen a rise in collaborations between skate manufacturers and biomechanical specialists to design products that minimize stress on joints, which is a critical consideration for competitive athletes.

Regionally, North America maintains its dominance due to a highly established skating culture and extensive network of training facilities, particularly in the United States and Canada. However, the Asia Pacific (APAC) region is projected to register the highest CAGR, fueled by the legacy impact of recent Winter Olympics hosted in the region and massive governmental investments in developing ice infrastructure. European markets, particularly Russia, Germany, and the Nordic countries, remain stable and mature, characterized by high demand for mid-to-high-end recreational and professional equipment. Emerging markets in Latin America and the Middle East are showing nascent potential, primarily driven by the introduction of indoor, climate-controlled ice rinks and rising interest among the affluent consumer base. These regional dynamics necessitate tailored marketing and distribution strategies focusing on local climate and competitive structures.

Segment trends highlight the Professional/Competitive segment as the fastest-growing in terms of value, largely due to the mandatory replacement cycles and high cost of specialized equipment required for advanced maneuvers. Material segmentation shows a definitive shift away from traditional leather towards synthetic materials and advanced composites, which offer superior waterproofing, stiffness consistency, and lighter weight. The recreational segment, while representing the largest volume, is increasingly influenced by design aesthetics and ease of maintenance, favoring durable, less expensive vinyl or entry-level leather options. Sustainability is emerging as a critical trend, with consumers showing preference for brands utilizing ethically sourced materials or implementing circular economy practices in manufacturing, though this remains challenging given the highly specialized materials required for performance.

AI Impact Analysis on Figure Skates Market

User queries regarding the impact of Artificial Intelligence (AI) on the Figure Skates Market primarily revolve around three key themes: personalized fitting and product design, optimized manufacturing processes, and enhanced coaching/performance analysis. Consumers and industry professionals frequently question how AI-driven 3D scanning and predictive modeling can solve chronic issues related to boot fit and comfort, a notorious challenge in the sport. There is a strong expectation that AI will move beyond simple measurement to simulating stress points during complex movements, thereby designing boots that dynamically adapt to the skater’s foot shape and movement profile. Furthermore, manufacturers are concerned with integrating AI into quality control to detect micro-flaws in blades and composite boots faster than traditional human inspection, ensuring performance consistency across batches. Users are also interested in how AI analytics, coupled with IoT sensors embedded in skates, can provide real-time biomechanical feedback to coaches and athletes, revolutionizing training methodology and injury prevention.

The application of AI in bespoke boot manufacturing represents the most immediate and valuable shift. Traditional customization is time-intensive and reliant on expert craftsmanship; AI-powered systems can analyze thousands of data points related to foot geometry, previous injury history, and preferred skating style to generate precise CAD models for production. This predictive design capability minimizes trial-and-error, significantly reducing lead times and ensuring optimal force transmission from the foot to the blade. For the consumer, this translates directly into enhanced performance and reduced risk of blisters and alignment issues, justifying the premium price point associated with AI-designed products. This shift will particularly benefit high-level athletes who demand absolute precision from their equipment.

In terms of market operations, AI is optimizing inventory management and forecasting demand based on competition schedules and regional climatic conditions, leading to more efficient supply chains. The use of machine learning algorithms to analyze material stress tests provides manufacturers with crucial insights for formulating next-generation composites and alloys, improving durability without compromising weight. While AI is not directly involved in the physical act of skating equipment manufacturing, its influence on design precision, material selection, quality assurance, and consumer personalization makes it a transformative force, moving the industry toward 'Skating 4.0'—a highly data-driven approach to athletic equipment engineering.

- AI-driven 3D scanning and biomechanical analysis for personalized boot last design.

- Predictive maintenance and quality control systems detecting micro-fractures in blades.

- Optimization of composite layups and material selection using machine learning stress simulations.

- Real-time performance feedback systems integrated with IoT sensors embedded in boots (Smart Skates).

- Enhanced supply chain management and regional demand forecasting based on event calendars.

DRO & Impact Forces Of Figure Skates Market

The market for figure skates is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces that determine its trajectory and profitability. Key drivers predominantly revolve around the escalating global interest in competitive figure skating, often magnified by major international events like the Winter Olympics, which significantly boost participation rates in subsequent years. Technological advancements, particularly in lightweight materials (such as carbon fiber and aerospace-grade aluminum alloys) and heat-moldable liners, enhance product performance and drive replacement demand among serious skaters seeking marginal gains. Furthermore, the increasing affluence in key Asian markets is enabling greater investment in specialized sporting equipment, transforming what was once a niche, geographically concentrated sport into a globally accessible activity. These positive forces collectively contribute to a steady increase in both volume and value sales across all segments.

Conversely, the market faces significant restraints, primarily stemming from the high initial cost barrier associated with quality figure skates, which can deter entry-level participation. Unlike general recreational sports, figure skating requires specialized facilities (ice rinks), which are expensive to maintain and are often geographically sparse, especially in warmer climates, thus limiting the potential consumer base. Furthermore, the long replacement cycles for intermediate and high-end skates (typically 3-5 years) due to their durable construction temper growth, preventing rapid cyclical purchases. Regulatory complexities related to safety standards and the specialized craftsmanship required for boot production also introduce manufacturing restraints, making scaling production challenging and costly, which in turn affects pricing and market accessibility.

Significant opportunities exist in the customization and digital integration space, particularly leveraging 3D printing for highly personalized boot components and developing smart skate technology that monitors performance metrics like edge pressure and jump height. Developing more cost-effective, yet high-performance, synthetic alternatives to traditional leather offers a pathway to expand the mid-range segment and improve sustainability profiles. Impact forces include fluctuating raw material prices, especially for high-grade steel necessary for blades, and the dependence of market stability on global sporting event schedules (which can be disrupted by geopolitical events or pandemics). The strongest impact force is the cultural influence of prominent athletes and media coverage, which instantaneously drives interest and generates new consumer cohorts, creating spikes in localized demand that manufacturers must be prepared to meet rapidly.

Segmentation Analysis

The Figure Skates Market is rigorously segmented across multiple dimensions, including Product Type, Application, Material Type, and Distribution Channel, to accurately reflect the diverse needs of consumers ranging from casual hobbyists to elite athletes. This granularity is essential for manufacturers to tailor their product development and marketing efforts effectively. The primary distinction exists between the competitive equipment, which prioritizes stiffness, weight reduction, and precision engineering, and the recreational equipment, which emphasizes comfort, durability, and affordability. Understanding these segments is key to predicting market shifts, particularly the migration from recreational to intermediate and eventually competitive segments as a skater progresses through skill levels.

- Product Type:

- Boots (Traditional Leather, Synthetic/Composite)

- Blades (Carbon Steel, Stainless Steel, Lightweight Aluminum/Composite Alloys)

- Complete Skates (Boot and Blade Assembly)

- Application:

- Competitive Skating (Singles, Pairs, Ice Dance, Synchronized)

- Recreational Skating

- Theatrical/Show Skating

- Material Type:

- Leather Skates

- Synthetic/Composite Skates (Carbon Fiber Reinforced Polymer, Microfiber)

- Distribution Channel:

- Specialty Sports Stores

- Online Retailers/E-commerce

- Department Stores

- Direct Sales (Manufacturer to Club/Pro Shop)

- End-User:

- Men

- Women

- Children/Juniors

Value Chain Analysis For Figure Skates Market

The value chain for the Figure Skates Market begins with upstream activities focused on sourcing highly specialized raw materials. This includes procuring high-carbon stainless steel and aircraft-grade aluminum for blades, specialized leathers or synthetic microfibers, and high-density foam for boot padding and liners. Upstream suppliers are typically geographically concentrated and operate under stringent quality control standards, as the performance and safety of the final product heavily depend on the consistency of the raw materials. The manufacturing phase involves complex, precision-intensive processes such as heat treatment and polishing for blades, injection molding for composite components, and highly skilled hand assembly for shaping and lasting the boots, particularly for high-end models. Due to the need for specialized equipment and skilled labor, barriers to entry at the manufacturing stage are substantial, leading to consolidation among a few dominant global players.

The distribution segment of the value chain is critical due to the highly technical nature of the product. Figure skates require expert fitting, often involving heat molding and professional mounting and sharpening of blades. Consequently, direct distribution and indirect sales through specialty sports stores staffed by certified fitters dominate the competitive segment. These specialty retailers often function as pro shops located near major ice rinks, providing not only sales but also essential maintenance services. Online retailers, while growing rapidly, primarily serve the recreational and entry-level segments where precise fitting requirements are less critical. The direct sales channel involves manufacturers supplying large volumes directly to skating clubs, national federations, and professional training centers, bypassing traditional retail for efficiency and bulk discounts.

Downstream activities center on the end-user interaction and post-sale services. This includes professional blade sharpening, alignment checks, and specialized boot repairs or modifications, which are recurring revenue streams vital to the overall value chain health. Customer satisfaction is heavily influenced by the expertise of the fitter and the availability of local maintenance services. The increasing integration of digital technologies, such as online fitting consultations and interactive product configurators, is streamlining the downstream process. The efficiency of this value chain hinges on seamless communication between manufacturers (ensuring product quality), specialty retailers (providing expert fitting and service), and professional coaches (influencing purchasing decisions), thereby creating a closed loop that maintains high standards and brand loyalty.

Figure Skates Market Potential Customers

The primary end-users and buyers in the Figure Skates Market can be segmented into three major categories: competitive athletes and their parents/sponsors, recreational skaters, and institutional buyers. Competitive athletes, ranging from regional amateurs to Olympic-level professionals, represent the highest-value segment, characterized by high purchase frequency (due to rapid growth in youth or rigorous training demands) and absolute requirement for premium, customized, high-performance equipment. For these customers, factors like boot stiffness index, material lightweighting, and blade precision are non-negotiable, driving demand for specialized synthetic and carbon composite products with complex pricing structures. Purchase decisions are heavily influenced by coaching recommendations and brand endorsement visibility within the competitive circuit. Parents of junior skaters are also key buyers, frequently needing to replace skates as their children outgrow equipment.

Recreational skaters form the largest volume segment, encompassing general public skating attendees, individuals participating in basic lessons, and seasonal users. These consumers prioritize comfort, durability, and a lower price point. They typically purchase complete, entry-level skates through mass-market channels like department stores or online retailers. Their buying criteria are less focused on technical specifications and more on usability, aesthetic appeal, and perceived value. Marketing efforts targeted at this segment often emphasize the fun and fitness aspects of skating, positioning the product as an accessible leisure activity rather than purely a sports performance tool. The growth of this segment is directly tied to the availability and marketing of local ice rinks and introductory programs.

Institutional buyers include skating clubs, professional ice shows, theatrical companies, and rental facilities managed by ice rinks. Skating clubs purchase skates for their training programs or offer consignment sales to members. Professional ice shows, such as holiday extravaganzas or touring theatrical performances, require durable, customizable skates that often prioritize aesthetic design and cost-effective maintenance for large casts. Rental facilities constitute a niche but consistent market for extremely durable, low-maintenance skates designed to withstand heavy, non-expert use. These bulk purchases are driven by criteria such as longevity, ease of sanitization, and unit cost, providing manufacturers with predictable, high-volume orders, albeit usually for entry-to-mid-range quality products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 352.4 Million |

| Market Forecast in 2033 | USD 507.9 Million |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jackson Ultima Skates, Edea Skates, Riedell Skates, Graf Skates AG, Harlick Skates, SP-Teri Skates, Wifa Skates, Risport Skates, MK Blades (HD Sports), John Wilson Blades (HD Sports), Paramount Skates, Elite Skate Wear, Gam Skates, Sagester, Avanta Skates, Bauer Hockey (recreational line influence), Roces, Botas Skates, Lake Placid Skates. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Figure Skates Market Key Technology Landscape

The technological landscape of the Figure Skates Market is increasingly sophisticated, moving away from reliance on traditional leather and wood construction toward advanced material science and precision engineering. A central technological focus lies in the development of lightweight, stiff, and heat-moldable synthetic composite boots, often utilizing carbon fiber or specialized thermoplastic polymers. These materials offer superior support consistency, especially during high-impact maneuvers like triple and quadruple jumps, where traditional leather can quickly break down or lose stiffness. Heat-moldable technology is crucial, allowing specialty fitters to customize the internal structure of the boot to the skater’s foot contours using specialized ovens, drastically improving comfort and reducing the lengthy and painful "break-in" period historically associated with new skates. This technology is a primary differentiator in the competitive segment and significantly enhances AEO performance by addressing consumer pain points related to fit and comfort.

Blade technology represents another critical area of innovation, primarily driven by metallurgy and manufacturing precision. Modern blades utilize high-grade carbon steel or stainless steel alloys, sometimes coated with titanium or chrome for enhanced durability and corrosion resistance. Key technological advancements include the development of parabolic and tapered blade geometries, which optimize the rocker radius and hollow grind to improve glide speed and maneuverability while maintaining stability. Lightweight blades, often featuring hollow cores or aluminum alloy holders combined with steel running surfaces, are gaining traction. Precision Computer Numerical Control (CNC) machining ensures that the blade profile is manufactured to micron tolerances, vital for professional performance. The ability to swap blades easily using advanced screw or quick-release systems, rather than permanent riveting, is also a modern convenience improving product modularity.

Furthermore, the integration of digital technologies, though nascent, is defining the next phase of market evolution. This includes 3D scanning technology used by pro shops to create a precise digital map of the skater’s foot, which is then used in conjunction with Computer-Aided Design (CAD) to tailor boot specifications. Looking ahead, the embedding of IoT sensors into the skate boot—often referred to as 'smart skates'—is poised to revolutionize coaching. These sensors can track precise metrics such as jump rotation axis, landing force, edge utilization, and center of gravity shifts, providing data previously unavailable. While still in early adoption, these biomechanical data capture capabilities will drive the premium pricing and competitive advantage for manufacturers who successfully monetize the performance data generated by their products.

Regional Highlights

The global Figure Skates Market exhibits significant regional variations in terms of maturity, growth trajectory, and consumption patterns, with North America and Europe historically dominating the competitive landscape. North America, encompassing the United States and Canada, holds the largest market share primarily due to deep cultural engagement with ice sports, high disposable income, and an extensive, established infrastructure of ice rinks and coaching programs. The demand here is highly diversified, spanning from large volumes of recreational skates sold in big-box retail to the intense, specialized demand for high-end professional equipment driven by major skating federations. Market penetration is high, making growth incremental but stable, focused largely on replacement sales and technological upgrades. The high regulatory standards for athletic equipment in this region also mandate continuous quality assurance from manufacturers.

Europe represents a mature and highly competitive market, characterized by strong national skating traditions, particularly in Nordic countries, Russia, Germany, and Italy (which is a major manufacturing hub). Eastern Europe, especially Russia, maintains a formidable presence in both manufacturing capacity and high-level competitive skating, generating consistent demand for premium blades and custom boots. Western European consumers show a stronger preference for specialized, often bespoke, Italian or German brands known for craftsmanship and tradition. Market growth in Europe remains steady, driven by strong local league participation and established pathways for amateur development. The emphasis on high-quality materials and artisanal manufacturing keeps the Average Selling Price high in many European sub-markets.

The Asia Pacific (APAC) region is the primary engine of future market growth, expected to post the highest CAGR during the forecast period. This rapid expansion is catalyzed by rising economic prosperity, massive government investment in sports infrastructure following recent international events (e.g., Winter Olympics in South Korea and China), and the increasing global success of Asian figure skaters. Countries like Japan and South Korea already possess strong skating cultures and advanced training facilities, driving demand for the highest-tier competitive skates. China represents the largest untapped potential, with concerted governmental efforts to increase participation in winter sports. This region demands robust supply chain solutions and culturally adapted marketing strategies to capitalize on the accelerating interest in ice sports among a newly affluent middle class. Latin America and MEA remain relatively niche, dependent primarily on localized development of indoor rinks and high-income consumer segments.

- North America: Dominant market share; High demand for both recreational and professional segments; Stable replacement sales volume.

- Europe: Mature market with strong competitive traditions; Key manufacturing base (Italy, Germany); High valuation of artisanal and high-quality boots.

- Asia Pacific (APAC): Fastest growing region; Driven by government investment and Olympic legacy; China and Japan are key expansion targets.

- Latin America & MEA: Nascent markets; Growth constrained by infrastructure limitations; Focus primarily on indoor rinks in affluent urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Figure Skates Market.- Jackson Ultima Skates

- Edea Skates

- Riedell Skates

- Graf Skates AG

- Harlick Skates

- SP-Teri Skates

- Wifa Skates

- Risport Skates

- MK Blades (HD Sports)

- John Wilson Blades (HD Sports)

- Paramount Skates

- Elite Skate Wear

- Gam Skates

- Sagester

- Avanta Skates

- Bauer Hockey

- Roces

- Botas Skates

- Lake Placid Skates

- Riedell/Legacy Blades

Frequently Asked Questions

Analyze common user questions about the Figure Skates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from leather to synthetic composite materials in figure skates?

The shift is driven by the need for enhanced structural stiffness and lighter weight to support modern jumping techniques. Synthetic composites like carbon fiber offer consistent support, superior water resistance, and are heat-moldable, providing a custom fit unavailable with traditional leather, which is crucial for competitive safety and performance.

How significant is the role of customization and 3D printing in the professional figure skates segment?

Customization, often facilitated by 3D foot scanning and potentially 3D printing of non-structural components like tongue inserts or ankle wraps, is highly significant. It ensures precise boot fit, minimizes injury risk, and optimizes force transfer from the skater to the ice, defining the premium market tier for high-level athletes.

Which regional market is forecast to exhibit the fastest growth rate for figure skates?

The Asia Pacific (APAC) region is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rising affluence, increasing governmental support for winter sports, and heightened consumer interest following the regional hosting of major international ice skating competitions.

What are the primary factors restraining growth in the entry-level figure skates market?

Primary restraints include the high initial cost of quality equipment relative to other sports and the limited global accessibility of specialized infrastructure, specifically well-maintained, climate-controlled ice rinks, which limits the potential consumer base in many regions.

How does smart skate technology utilizing IoT sensors impact figure skating training?

Smart skate technology uses embedded IoT sensors to capture precise biomechanical data on performance, such as edge pressure, landing impact, and rotation velocity. This data provides coaches and athletes with objective, real-time feedback, enabling data-driven adjustments to technique for optimized performance and injury prevention.

What is the typical replacement cycle for competitive figure skate boots?

For competitive athletes, especially those performing advanced jumps, the intense forces exerted require frequent replacement. A typical cycle is usually 12 to 18 months, though junior skaters may require replacement sooner due to growth, while highly customized boots may last up to 2 years with proper maintenance, contrasting sharply with recreational skates which can last 5-7 years.

Who are the leading manufacturers dominating the figure skates market?

Leading manufacturers that dominate the global competitive and recreational market segments include Jackson Ultima Skates, Edea Skates, Riedell Skates, and Graf Skates AG. The blade market is largely dominated by specialized divisions such as MK Blades and John Wilson Blades, both owned by HD Sports.

What role do specialty sports stores play in the Figure Skates Market distribution?

Specialty sports stores, particularly those located near ice rinks, are essential for the market's high-end segment. They provide crucial services like expert fitting, heat molding, and professional blade mounting and sharpening, which are non-negotiable for ensuring the safety and performance of competitive figure skates.

What is the projected growth trajectory for the Figure Skates Market?

The Figure Skates Market is projected to exhibit a stable growth trajectory, forecasted to achieve a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, driven by innovation in materials and increased global interest in winter sports participation.

How is the environmental impact affecting manufacturing decisions in figure skating equipment?

Sustainability concerns are increasing, leading manufacturers to explore ethically sourced materials, recyclable composites, and more energy-efficient manufacturing processes. Although challenging due to performance requirements, consumer preference is driving a gradual shift towards eco-friendlier production methods and materials in both boots and blades.

What distinguishes competitive blades from recreational blades in terms of technology?

Competitive blades feature precision-machined, high-carbon steel alloys with complex geometries (e.g., highly specific rocker radii and deep, consistent hollow grinds) designed for stability during intricate maneuvers and optimal glide. Recreational blades typically use lower-grade stainless steel with simpler profiles focusing on durability and ease of maintenance rather than fine performance tuning.

What defines the upstream segment of the figure skates value chain?

The upstream segment involves the sourcing of critical raw materials, including specialized steel alloys for blades, high-density foam padding, and advanced thermoplastic composites or high-grade leather for boot construction. This segment is characterized by stringent quality control and reliance on specialized metallurgical suppliers.

How does government investment influence the Figure Skates Market?

Government investment, particularly in Asia Pacific nations, plays a critical role by funding the construction of new ice rinks, establishing national training programs, and supporting athletic federations. This infrastructure development directly increases accessibility, thereby expanding the potential consumer base for figure skates.

What is meant by the "Impact Forces" acting on the market?

Impact Forces are external factors significantly influencing the market dynamics, such as fluctuating raw material prices (especially steel), geopolitical disruptions affecting international competition schedules, and the powerful, instantaneous cultural influence exerted by successful athletes and major media events.

In which application segment is the highest value growth concentrated?

The highest value growth is concentrated in the Competitive Skating application segment. This is due to the mandatory requirement for frequently replaced, highly specialized, and premium-priced composite boots and precision-machined blades necessary for advanced professional maneuvers.

What technical advantages do heat-moldable boots offer figure skaters?

Heat-moldable boots allow specialty retailers to use controlled heating processes to soften internal thermoplastic components, which then contour precisely to the skater's unique foot geometry upon cooling. This dramatically reduces the uncomfortable break-in period and ensures a superior, supportive, and custom fit.

How does the Average Selling Price (ASP) differ between the competitive and recreational segments?

The Average Selling Price (ASP) for competitive skates is significantly higher, often ranging from USD 500 to over USD 1,500 per pair for boots and blades combined, due to specialized materials and customization. Recreational skates, however, typically range from USD 80 to USD 250, focusing on mass production and affordability.

What is the primary role of AI in quality control for figure skate manufacturing?

AI is used primarily to enhance non-destructive testing and quality assurance by analyzing sensor data and high-resolution imaging to detect minute structural flaws or inconsistencies in materials (such as micro-cracks in blades or defects in composite layups) far more reliably and rapidly than human inspection.

What material segmentation trend is most notable in the current market?

The most notable segmentation trend is the definitive shift from traditional bovine leather towards high-performance synthetic microfibers and advanced composite materials (like carbon fiber reinforced polymers), driven by the demand for lighter weight, greater stiffness, and moisture resistance in high-level competitive equipment.

What type of customers constitute the institutional buyer segment in this market?

Institutional buyers include ice skating clubs, national sports federations, professional theatrical ice shows (e.g., touring companies), and rental operations run by public and private ice rinks. Their purchasing decisions prioritize durability, bulk pricing, and specialized functional requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager