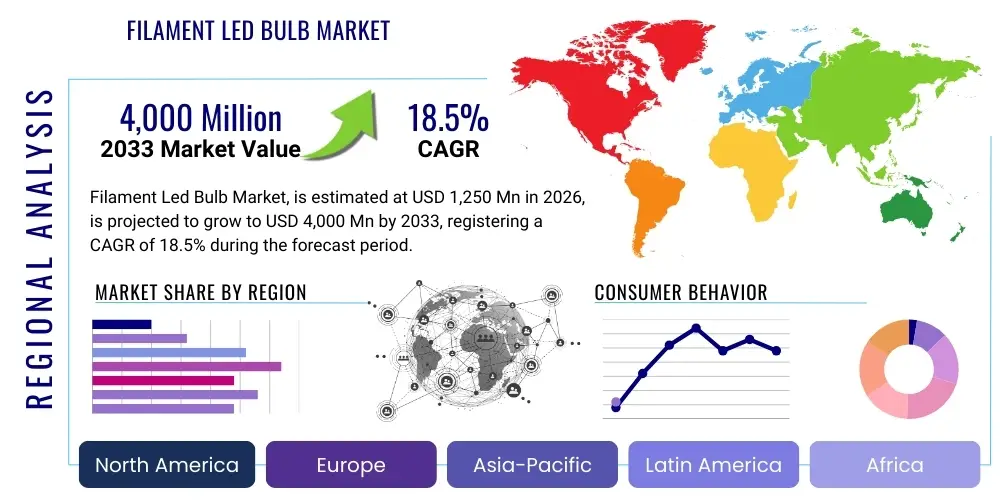

Filament Led Bulb Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437606 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Filament Led Bulb Market Size

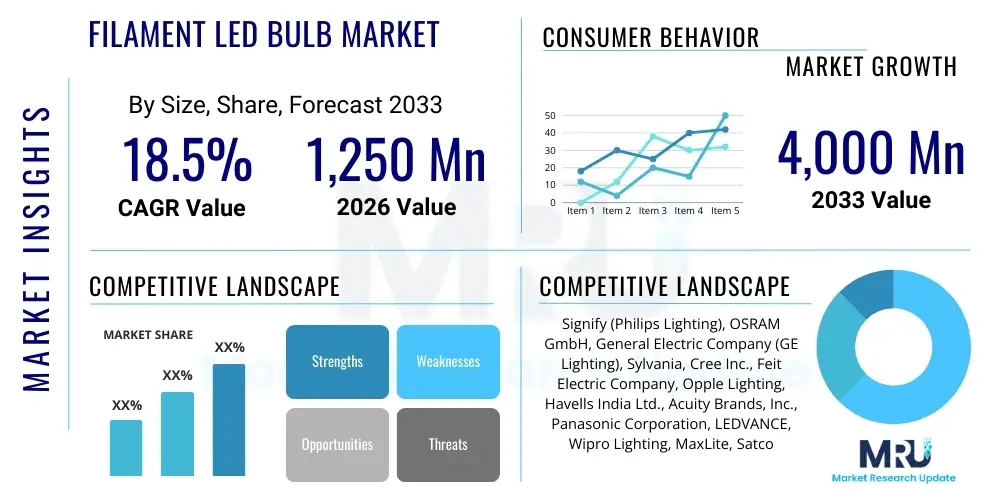

The Filament Led Bulb Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1,250 Million in 2026 and is projected to reach $4,000 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global legislative shift away from inefficient incandescent lighting technologies, coupled with increasing consumer preference for retro-styled, energy-efficient lighting solutions. The blend of high energy savings typical of LED technology with the classic aesthetic appeal of traditional filament bulbs positions this segment for accelerated uptake across both residential and commercial sectors, particularly in hospitality and retail environments seeking warm, inviting ambiance.

Market valuation reflects sustained demand for high-quality, long-lasting decorative illumination. While initial prices for filament LED bulbs are higher than standard LEDs, their extended lifespan (often exceeding 15,000 hours) and minimal maintenance requirements justify the investment, providing significant total cost of ownership (TCO) benefits over the operational life. Furthermore, continuous innovation in chip-on-glass (COG) technology and improved thermal management solutions are enhancing light output and color rendering index (CRI), making these products viable replacements for traditional bulbs in primary lighting applications, not just decorative use. The decorative appeal, particularly the availability of various glass shapes (Edison, globe, candelabra) and color temperatures (warm white to ultra-warm), is a crucial differentiator driving premium pricing and market size increase.

Filament Led Bulb Market introduction

The Filament LED Bulb Market encompasses lighting products that emulate the appearance and light quality of traditional incandescent bulbs using modern Light Emitting Diode (LED) technology. These bulbs utilize multiple small LED chips assembled onto thin, linear structures, often coated with phosphors, arranged to mimic the glowing filaments of old bulbs. This unique design provides the wide beam angle and omnidirectional light distribution characteristic of classic bulbs, solving a primary aesthetic limitation of early standard LED technology. Major applications span residential décor, historical fixture replacement, specialty retail displays, and high-end hospitality venues where ambiance is paramount.

Product descriptions emphasize two core advantages: aesthetic warmth and superior energy efficiency. Unlike early generation LEDs that often produced cold, directional light, filament LEDs offer color temperatures typically ranging from 2200K (ultra-warm) to 2700K (warm white), closely matching the comfort level provided by incandescent lamps. Simultaneously, these bulbs consume drastically less power, often replacing a 60W incandescent bulb with a 6W or 8W LED equivalent, resulting in energy savings exceeding 85%. This combination of functional performance and visual appeal makes them highly desirable for retrofitting existing lighting infrastructure.

Driving factors propelling market growth include stringent government regulations mandating the phase-out of inefficient lighting sources across major economies, particularly in North America and Europe. Consumer awareness regarding the environmental benefits and cost savings associated with LED technology is also rapidly increasing. Furthermore, the advent of smart lighting systems often incorporates filament LED designs to combine aesthetic quality with connectivity features, allowing for remote control, dimming capabilities, and color adjustments, further integrating these products into modern smart home ecosystems.

Filament Led Bulb Market Executive Summary

The Filament LED Bulb Market is characterized by robust growth, primarily fueled by the convergence of sustainability mandates and sophisticated interior design preferences. Business trends indicate a strong focus on product diversification, particularly in specialty shapes, dimmable functionalities, and smart connectivity (Wi-Fi/Bluetooth enabled bulbs). Manufacturers are increasingly investing in proprietary Chip-on-Glass (COG) packaging methods and advanced driver electronics to improve efficiency and reduce flicker, solidifying the product's position in the premium lighting segment. Strategic partnerships between lighting companies and interior designers or smart home platforms are becoming vital to expand market reach and integrate products seamlessly into complex residential and commercial projects.

Regional trends highlight that Europe and North America currently dominate the market share due to early and strict energy efficiency regulations, high disposable incomes, and a cultural appreciation for decorative and historical lighting fixtures. However, the Asia Pacific region is demonstrating the highest growth trajectory, driven by rapid urbanization, significant infrastructure development, and increasing adoption of energy-saving technologies across countries like China and India. Government initiatives supporting LED adoption and large-scale residential and commercial building projects are catalyzing demand in these emerging economies, shifting the center of manufacturing and consumption eastward over the forecast period.

Segment trends underscore the dominance of the 4W–6W wattage segment, striking an optimal balance between light output (equivalent to 40W–60W incandescent) and energy consumption. Application-wise, the hospitality sector (hotels, restaurants, heritage sites) represents a critical growth segment, valuing the warmth and vintage appeal of filament bulbs to enhance customer experience. Technologically, the shift is towards high CRI (Color Rendering Index >90) bulbs and improved compatibility with existing dimming systems, addressing early user complaints regarding performance inconsistencies. The Bayonet Cap (BC) type remains crucial in markets influenced by UK standards, while the Edison Screw (ES) dominates North America and mainland Europe, requiring manufacturers to maintain diverse product inventories tailored to regional standards.

AI Impact Analysis on Filament Led Bulb Market

Common user questions regarding AI's impact on the Filament LED Bulb Market frequently revolve around how artificial intelligence can enhance personalization, optimize manufacturing costs, and integrate lighting control into broader smart environments. Users are primarily concerned with whether AI can enable predictive maintenance for high-volume installations (like in hotels), automate dynamic color temperature adjustment based on occupant activity or external stimuli (like time of day or weather), and drive efficiency improvements in the complex supply chain of specialized components. The analysis of these queries reveals a collective expectation for AI to transform filament bulbs from static light sources into integral, responsive components of the built environment, particularly emphasizing cost reduction in complex thermal and optical design stages and maximizing the bulb's lifespan through predictive analytics applied to driver components.

The integration of AI fundamentally alters the product lifecycle, moving beyond simple automation. In design and engineering, AI algorithms are being deployed to simulate complex heat dissipation models for the LED filaments within their glass envelopes, optimizing material selection and internal structure to maximize longevity, which is a key selling point. Furthermore, AI-driven demand forecasting and inventory management ensure that manufacturers can quickly respond to aesthetic trend changes (e.g., shifts in glass tint or filament shape popularity), minimizing waste and shortening lead times for specialized orders typical in the hospitality market. This predictive capability reduces capital risk associated with high-mix, low-volume product lines.

From a user perspective, AI primarily influences the Filament LED bulb market through advanced control systems. Smart filament bulbs, when connected to an AI-enabled hub, can learn user preferences and automatically adjust brightness and warmth (tunable white) throughout the day to support circadian rhythms or create specific moods optimized for activities like dining or relaxation. This integration transforms the bulb from a simple utility item into a sophisticated well-being tool. While AI does not directly affect the core aesthetic of the filament structure itself, it dramatically enhances the functionality and value proposition of the surrounding control ecosystem, driving consumer adoption of premium, connectivity-enabled filament products.

- AI optimizes LED driver design and thermal management simulation, extending bulb lifespan.

- AI enables predictive maintenance systems for large-scale commercial and hospitality installations.

- Automated manufacturing processes leverage AI for quality control and defect detection specific to delicate filament structures.

- Machine learning algorithms personalize lighting scenes based on user behavior and ambient conditions.

- AI enhances supply chain efficiency, forecasting demand for specific aesthetic variants and materials.

DRO & Impact Forces Of Filament Led Bulb Market

The Filament LED Bulb Market is driven by strong regulatory push towards energy efficiency and increasing consumer demand for aesthetically pleasing, environmentally friendly lighting solutions. The primary driver remains the global phase-out of traditional incandescent and halogen bulbs, creating a mandatory replacement market where filament LEDs offer the closest aesthetic match. Conversely, the market faces restraints such as the relatively higher initial purchasing cost compared to standard encapsulated LED bulbs and technical challenges related to effective heat dissipation within the sealed, traditional glass bulb envelope, which can affect long-term reliability. Opportunities emerge from the rapid expansion of the smart home and IoT lighting sectors, where the vintage look can be combined with modern connectivity and dimming capabilities. These forces are significantly impacting the adoption curve, pushing manufacturers to continuously innovate in cost reduction and thermal engineering to remain competitive and meet regulatory compliance.

Key drivers include the dramatic reduction in operational costs, as these bulbs consume only about 10–20% of the energy used by equivalent incandescent versions, appealing directly to cost-conscious businesses and consumers. Additionally, the superior quality of light, characterized by high CRI and warm color temperatures, is highly valued in decorative and architectural lighting, distinguishing filament LEDs from their conventional LED counterparts. Regulatory support, including subsidies and energy efficiency targets set by governments globally, accelerates the market conversion process. The longevity of these bulbs also reduces waste and maintenance frequency, aligning with broader sustainability goals adopted by corporations and municipalities.

Restraints are centered on pricing and technical hurdles. Despite declining production costs, the specialized manufacturing required for COG (Chip-on-Glass) technology and the intricate assembly necessary to create the filament aesthetic maintain a price premium. Furthermore, ensuring seamless compatibility with legacy dimmer switches poses a continuous technical challenge, leading to potential flicker or operational failure if the integrated driver is not precisely engineered. Impact forces are predominantly shaped by competitive dynamics and regulatory pressures. The competitive landscape necessitates constant innovation in thermal design and light quality, while the impact of environmental regulations means that any future legislative changes on materials (e.g., restrictions on certain metals or plastics) could significantly reshape supply chain logistics and manufacturing methodologies across the industry.

Segmentation Analysis

The Filament LED Bulb Market is broadly segmented based on key criteria including Wattage Equivalent, Cap Type, Color Temperature, and End-Use Application, allowing manufacturers and analysts to precisely target specialized consumer needs. Wattage segmentation reflects the historical incandescent replacement demand, ranging from lower 2W–4W decorative bulbs to higher 8W–10W general illumination equivalents. Cap type segmentation is crucial for regional market penetration, dividing products into Edison Screw (E26/E27) and Bayonet Cap (B22/B15) categories. Color temperature dictates the ambiance, with ultra-warm (below 2500K) being highly favored for decorative purposes, and warmer (2700K–3000K) being standard for residential and commercial general lighting.

Application-based segmentation provides insight into where the highest value demand lies. While residential use remains the largest volume segment, driven by household retrofits and décor upgrades, the hospitality sector (hotels, cafes, restaurants) represents the highest growth segment due to its reliance on aesthetic quality and the ability of filament LEDs to create sophisticated, warm atmospheres that enhance customer experience. Commercial and retail sectors use these bulbs heavily in display lighting to showcase products effectively, leveraging the high CRI and visual appeal of the filament structure to attract attention and improve product perception.

The strategic importance of these segmentations lies in customizing product offerings. For instance, manufacturers targeting the North American residential market must focus on E26 base types, dimmable functions, and 4W–6W equivalents, often prioritizing ENERGY STAR certification. Conversely, targeting European hospitality requires a focus on E27 or B22 bases, high durability, and sophisticated ultra-warm color temperatures (2200K) to meet specific architectural requirements, driving the complexity and diversity of product development within the market.

- By Wattage Equivalent:

- 2W – 4W (Decorative/Accent Lighting)

- 4W – 6W (Standard Replacement)

- 6W – 8W (High-Lumen Output)

- Above 8W (Specialty Applications)

- By Cap Type:

- Edison Screw (E26, E27)

- Bayonet Cap (B22, B15)

- Candelabra (E12, E14)

- By Color Temperature (CCT):

- Ultra Warm White (< 2500K)

- Warm White (2500K – 3000K)

- Neutral White (3000K – 4000K)

- By Application:

- Residential

- Commercial (Office Spaces, Retail Stores)

- Hospitality (Hotels, Restaurants, Cafes)

- Industrial/Architectural

Value Chain Analysis For Filament Led Bulb Market

The value chain for the Filament LED Bulb market is complex and highly specialized, beginning with the sourcing of critical semiconductor components and concluding with final installation by end-users or contractors. Upstream analysis focuses on the supply of core materials: LED chips (primarily based on sapphire or silicon carbide substrates), high-purity glass enclosures (often specialty tinted or coated), and advanced phosphor materials necessary for achieving the desired warm light color temperatures. The unique requirement for Chip-on-Glass (COG) packaging, where LED chips are directly mounted onto a glass substrate that mimics the filament, necessitates precise, micro-scale manufacturing capabilities, heavily relying on suppliers specializing in optical-grade materials and semiconductor packaging.

The midstream involves the core manufacturing process, encompassing the assembly of the LED filament structure, the integration of specialized driver electronics (which must often include sophisticated circuitry for dimming compatibility), and the vacuum sealing of the glass envelope. This stage is crucial for quality control, especially thermal management, as excess heat within the sealed glass reduces the bulb's lifespan. Downstream activities involve distribution channels. Due to the bulb's aesthetic nature, marketing and distribution rely heavily on both direct channels (large commercial contracts with hospitality chains) and indirect channels, particularly specialized lighting showrooms, DIY/Home Improvement retail stores, and increasingly, targeted e-commerce platforms that cater to design-conscious consumers.

Direct sales are prevalent for high-volume commercial retrofits where lighting consultants or energy service companies (ESCOs) interface directly with facility managers to ensure product compatibility and energy savings guarantees. Indirect distribution through traditional retail provides widespread consumer access. The rising importance of e-commerce allows specialized, smaller brands to penetrate niche markets focusing on unique shapes and specialized color temperatures (e.g., amber glass), bypassing traditional retail barriers. Effective inventory management and robust logistics are essential downstream elements, ensuring that delicate glass products are delivered efficiently and intact to diverse global markets, often requiring regional warehousing strategically positioned near high-demand areas like major metropolitan centers.

Filament Led Bulb Market Potential Customers

The primary end-users and buyers of Filament LED bulbs fall into distinct categories, all united by a requirement for both high energy efficiency and superior aesthetic quality. The Hospitality sector stands out as a crucial customer segment, encompassing hotels, upscale restaurants, cafes, and bars. These businesses prioritize ambiance and décor, relying on the warm, inviting glow of filament LEDs to create sophisticated customer environments. For these clients, the long lifespan and reduced maintenance costs of LEDs are significant factors, minimizing disruption associated with frequent bulb changes in high-ceiling or hard-to-reach fixtures.

The Residential segment constitutes the largest volume of potential customers. This group includes homeowners undertaking renovation projects, those seeking to upgrade existing decorative fixtures (chandeliers, wall sconces), and consumers interested in integrating smart lighting solutions that retain a classic look. Within the residential market, design-focused consumers who value vintage or industrial aesthetics are highly receptive to the product. They seek specific glass types, such as clear, smoked, or amber, to match their interior design themes, viewing the bulb itself as an exposed design element rather than just a functional light source.

Additionally, Commercial and Specialty Retail customers are significant purchasers. Art galleries, fashion boutiques, and specialized retail stores utilize filament LEDs to enhance the visual appeal of merchandise displays, benefitting from the high Color Rendering Index (CRI) that accurately displays colors while providing a welcoming atmosphere. Government and heritage preservation agencies also constitute a specialized customer base, needing filament LEDs to retrofit historical buildings where modern light sources might violate aesthetic or architectural integrity, making the visual fidelity of the filament structure essential for regulatory compliance and historical accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 Million |

| Market Forecast in 2033 | $4,000 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), OSRAM GmbH, General Electric Company (GE Lighting), Sylvania, Cree Inc., Feit Electric Company, Opple Lighting, Havells India Ltd., Acuity Brands, Inc., Panasonic Corporation, LEDVANCE, Wipro Lighting, MaxLite, Satco Products, Inc., TCP International Holdings Ltd., LOHUIS, Midea Group, Technical Consumer Products, Inc., Seoul Semiconductor Co., Ltd., Z-Lite. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filament Led Bulb Market Key Technology Landscape

The technological evolution of the Filament LED Bulb market is centered around enhancing efficiency, improving light quality, and managing thermal load within the restrictive geometry of traditional glass bulbs. The most pivotal technology is the utilization of Chip-on-Glass (COG) packaging, where multiple micro-LED chips are mounted directly onto a slender, transparent glass or sapphire substrate, which is then coated with specialized phosphors. This method successfully mimics the linear glow of a traditional incandescent filament while providing 360-degree light distribution. Continuous advancements in COG technology focus on optimizing the density and placement of micro-LEDs to achieve higher lumens per watt without generating excessive heat, a critical balance given the minimal internal cooling mechanisms available in these sealed enclosures.

Thermal management is a critical technical challenge driving innovation. Since filament LEDs lack the large heat sinks common in standard LED bulbs, passive cooling must be highly effective. Manufacturers are researching and implementing novel inert gas fills (e.g., helium or specialized blends) within the glass envelope to improve convective heat transfer away from the filament substrate and driver circuitry located in the base. Furthermore, improvements in driver electronics are essential, particularly the implementation of sophisticated Constant Current (CC) drivers that maintain stable output and minimize ripple, ensuring compatibility with a broader range of existing Triac (leading/trailing edge) dimmers without causing visible flicker—a common complaint in earlier generation products. The development of driverless or integrated circuit (IC) solutions is also being explored to further reduce component count and manufacturing costs.

Aesthetic technology is equally vital. This includes the development of high Color Rendering Index (CRI >90) phosphors to produce light that accurately reflects natural colors, crucial for retail and hospitality applications. Specialized glass coatings, such as amber or smoked finishes, are applied to further enhance the vintage look, controlling both the visual appearance of the bulb when off and the warmth of the light output. Furthermore, tunable white technology, although more complex to integrate into the compact filament form factor, represents the next frontier, allowing consumers to dynamically shift the Correlated Color Temperature (CCT) from ultra-warm (2200K) to standard warm white (3000K) using smart controls, providing flexibility without sacrificing the classic filament design aesthetic.

Regional Highlights

North America represents a mature and technologically sophisticated market for Filament LED bulbs, driven primarily by high residential retrofit rates and the robust hospitality sector in the US and Canada. Stringent energy efficiency mandates, such as those governed by the Department of Energy (DOE) and state-level standards (e.g., California’s Title 24), necessitate the adoption of high-efficiency lighting. Consumers here often prioritize smart capabilities and ENERGY STAR certification, making products that combine aesthetic appeal with advanced IoT functionality highly successful. The market is characterized by strong competition among major global players and established domestic lighting brands, with a focus on E26 base types and high-lumen, dimmable solutions. Growth in this region is steady, supported by continuous commercial modernization projects and a cultural appreciation for industrial and vintage interior design styles.

Europe is a dominant market, largely due to the early and comprehensive phase-out of incandescent lighting across the EU, coupled with a deep-rooted focus on architectural preservation and design excellence, particularly in countries like Germany, France, and the UK. European consumers exhibit a high preference for quality, durability, and specific aesthetic characteristics, often favoring ultra-warm color temperatures (2200K) to complement historic interiors and classic fixture designs. The market is fragmented by differing socket standards (E27, B22, E14), requiring a broad product portfolio from manufacturers. Regulatory compliance with directives related to energy labeling and eco-design is mandatory, ensuring that all products meet high standards of efficiency and performance. The strong emphasis on sustainability across the continent further cements the filament LED bulb's position as the preferred aesthetic replacement option.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure development, and increasing governmental support for energy conservation initiatives, especially in China, India, and Southeast Asian nations. While the initial adoption rate was slower than in Western markets, rising disposable incomes and growing awareness of LED benefits are accelerating penetration. China, being the world’s leading manufacturing hub for LED components, benefits from lower production costs and serves as both a massive domestic consumer and a major exporter. The market structure here is highly price-sensitive, demanding cost-effective filament solutions, although premium brands are finding traction in high-end commercial properties and new smart city developments that prioritize energy efficiency and modern aesthetics. Regulatory environments are quickly evolving, mirroring Western efficiency standards, thereby boosting long-term market potential.

Latin America and Middle East & Africa (MEA) represent emerging markets with significant untapped potential. In Latin America, economic fluctuations and varying regulatory frameworks pose challenges, but demand is growing steadily, particularly in urban centers like Brazil and Mexico, driven by commercial and residential construction booms. In the MEA region, large-scale luxury hospitality projects (hotels, resorts) and retail developments, particularly in the Gulf Cooperation Council (GCC) countries, are key consumers of premium, decorative filament LED bulbs to achieve high-end, contemporary interior lighting effects. Government investment in energy efficiency and smart city projects in the UAE and Saudi Arabia provides a strong foundation for future growth, albeit focused primarily on high-value commercial applications where aesthetic quality overrides initial cost concerns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filament Led Bulb Market.- Signify N.V. (Philips Lighting)

- OSRAM GmbH

- General Electric Company (GE Lighting)

- Sylvania

- Cree Inc.

- Feit Electric Company

- Opple Lighting

- Havells India Ltd.

- Acuity Brands, Inc.

- Panasonic Corporation

- LEDVANCE

- Wipro Lighting

- MaxLite

- Satco Products, Inc.

- TCP International Holdings Ltd.

- LOHUIS

- Midea Group

- Technical Consumer Products, Inc.

- Seoul Semiconductor Co., Ltd.

- Z-Lite

Frequently Asked Questions

Analyze common user questions about the Filament Led Bulb market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Filament LED bulb and a standard LED bulb?

The primary difference is aesthetic and light distribution. Standard LEDs often use a plastic diffuser and provide directional light, whereas Filament LED bulbs use multiple small LED chips mounted on thin, transparent substrates (Chip-on-Glass or COG) housed in a glass envelope. This design mimics the appearance of a glowing incandescent filament and provides superior omnidirectional (360-degree) light output, crucial for decorative and vintage fixtures.

Are Filament LED bulbs truly energy efficient, and what is their average lifespan?

Yes, Filament LED bulbs are highly energy efficient, typically consuming 80% to 90% less electricity than the incandescent bulbs they replace. Their average operational lifespan is significantly long, often rated between 15,000 to 25,000 hours, drastically reducing replacement frequency and long-term operating costs in residential and commercial settings.

What factors affect the dimmability of Filament LED bulbs, and how can compatibility issues be minimized?

Dimmability is primarily affected by the quality of the internal driver electronics and the compatibility with the existing dimmer switch (usually Triac type). To minimize issues, consumers should purchase bulbs explicitly rated as "dimmable" and ensure their dimmer is rated for low-wattage LED loads. High-quality filament bulbs often integrate specialized circuitry to prevent flicker and buzzing at low dimming levels.

Which market segment drives the highest demand for aesthetic Filament LED bulbs?

The Hospitality sector (hotels, restaurants, cafes) represents the segment driving the highest-value demand for aesthetic Filament LED bulbs. These businesses prioritize the warm color temperature and vintage appearance to create specific atmospheres, viewing the bulbs as essential design elements that enhance customer experience and operational efficiency through longevity.

How does the Chip-on-Glass (COG) technology contribute to the performance of Filament LED bulbs?

COG technology is essential because it allows the construction of slender, linear light sources that visually resemble traditional filaments. By mounting LED chips directly onto a transparent substrate, COG maximizes light dispersion, achieves the omnidirectional light output required for decorative applications, and aids in passive thermal management, contributing significantly to the bulb's lifespan and overall aesthetic authenticity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager