Filament Winding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433902 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Filament Winding Machine Market Size

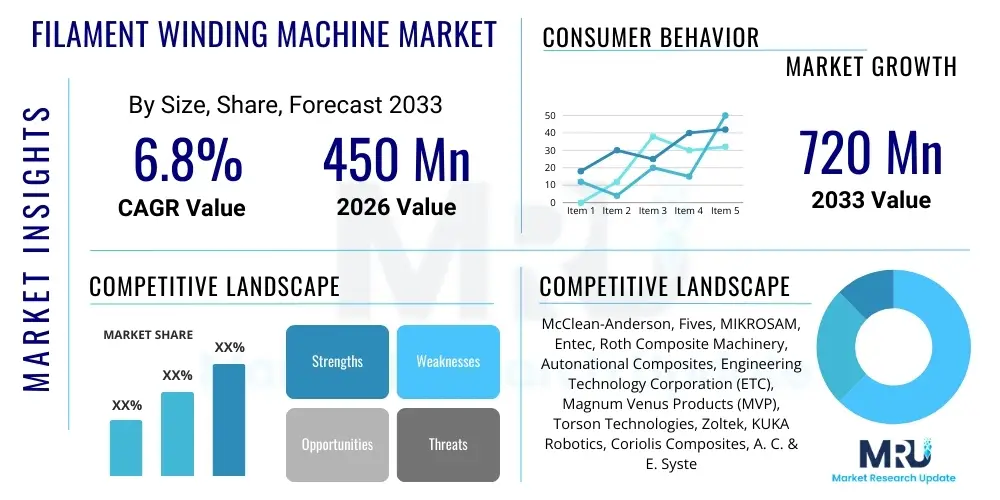

The Filament Winding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Filament Winding Machine Market introduction

The Filament Winding Machine Market centers on specialized equipment used for manufacturing high-strength, lightweight composite structures. Filament winding is a fabrication technique that involves winding continuous rovings or filaments, pre-impregnated with a thermoset or thermoplastic resin, onto a rotating mandrel surface in a precise pattern. This technology is critical for producing structures that require high tensile strength and superior stiffness-to-weight ratios, suchcoming indispensable across various high-performance industries. The fundamental product is the winding machine itself, which ranges from simple two-axis models to complex multi-axis CNC machines capable of handling intricate geometric shapes and providing real-time data feedback for quality assurance and process control. The precision and automation offered by modern filament winding machines are key to achieving the tight tolerances required in demanding applications like aerospace components and high-pressure storage vessels.

Major applications for filament winding technology include the production of pipes and conduits, pressure vessels (especially for hydrogen and natural gas storage), rocket motor casings, and specialized aerospace components. The primary benefit of using this method is the ability to strategically orient reinforcing fibers to bear specific loads, resulting in components that are exceptionally strong, lightweight, and corrosion-resistant, often surpassing the performance characteristics of traditional metallic structures. This enhanced material performance drives demand, particularly in sectors prioritizing energy efficiency and reduced operational weight. The core driving factor is the escalating global necessity for advanced composite materials across critical infrastructure and mobility solutions, coupled with continuous innovation in automated winding patterns and resin systems that improve production speed and component reliability.

Furthermore, the market's growth is heavily influenced by the adoption of Type IV composite pressure vessels (CPVs) for compressed natural gas (CNG) and hydrogen storage in the automotive and energy sectors. These vessels, constructed almost exclusively using filament winding, offer superior safety and weight advantages over steel or aluminum tanks. Simultaneously, the aerospace and defense industries are integrating these machines to manufacture lighter fuselage components, missile bodies, and rotor blades, aiming to enhance fuel efficiency and operational range. The continuous evolution of fiber types, including carbon, glass, and aramid, alongside advancements in control software and robotics, ensures that filament winding remains the preferred method for manufacturing structurally critical cylindrical and spherical geometries, solidifying its pivotal role in the future of composite manufacturing.

Filament Winding Machine Market Executive Summary

The Filament Winding Machine Market is characterized by robust business trends centered on automation, digitization, and the integration of advanced material handling systems. A significant trend involves the transition from conventional mechanical control systems to sophisticated Computer Numerical Control (CNC) architectures, enabling greater flexibility in winding patterns and enhancing repeatability crucial for quality certification, especially in aerospace applications. Regional trends indicate that Asia Pacific, spearheaded by China and India, is experiencing the highest growth rate, driven by massive infrastructure projects, burgeoning composite pipe manufacturing, and rapid growth in the hydrogen mobility ecosystem. North America and Europe maintain dominance in technology adoption and high-end aerospace and defense applications, focusing on highly automated, six-axis winding systems for complex geometries. Segment trends highlight that the market for machines dedicated to producing large-diameter pipes and high-pressure composite storage tanks is seeing the most substantial revenue increase, underpinned by global investments in sustainable energy infrastructure and the increasing demand for high-performance, lightweight transportation solutions. The preference for carbon fiber winding is growing faster than glass fiber due to the increasing adoption of Type IV hydrogen tanks, mandating higher strength and lighter weight components.

AI Impact Analysis on Filament Winding Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Filament Winding Machine Market predominantly focus on how AI can optimize complex winding parameters, predict material failures, and automate quality control processes to reduce scrap rates. Users are keenly interested in predictive maintenance models that minimize unscheduled downtime, a major cost factor in continuous manufacturing operations. Furthermore, there is strong demand for AI-driven simulation tools that can instantly validate new winding patterns for structural integrity, potentially cutting down months of physical prototyping required for certification, particularly in the highly regulated aerospace and pressure vessel sectors. The consensus expectation is that AI integration will transform filament winding from a craft-based skill into a highly automated, data-driven manufacturing process, leading to unprecedented precision, resource efficiency, and enhanced component reliability that meets the stringent requirements of new energy and high-performance applications.

- AI-Powered Predictive Maintenance: Utilizing sensor data (temperature, tension, vibration) to forecast equipment failures, minimizing downtime and increasing operational uptime.

- Optimized Winding Pattern Generation: AI algorithms simulate and select the most efficient fiber orientation to maximize strength-to-weight ratio while minimizing material usage.

- Real-Time Quality Control (QC): Implementing machine vision and deep learning to instantly detect material defects, fiber slippage, or resin inconsistencies during the winding process.

- Automated Process Parameter Adjustment: AI dynamically adjusts winding speed, tension, and resin curing profiles based on ambient conditions and material batch variations for consistent output.

- Enhanced Design Simulation: Integrating AI models with Finite Element Analysis (FEA) to accelerate the design iteration process for complex pressure vessel geometries.

DRO & Impact Forces Of Filament Winding Machine Market

The dynamics of the Filament Winding Machine Market are shaped by a potent combination of driving forces related to material demand and technological innovation, constrained by significant financial and technical hurdles, yet offering expansive growth opportunities fueled by global shifts toward sustainable energy. Key drivers include the overwhelming global demand for lightweight materials in the automotive and aerospace industries aimed at improving fuel efficiency and reducing carbon footprint, alongside massive governmental and private investments in infrastructure, particularly for water/wastewater systems requiring durable composite pipes. These factors create sustained demand for high-throughput, reliable winding machinery. However, the market faces strong restraints, primarily the very high initial capital investment required for sophisticated CNC multi-axis winding systems, making entry difficult for smaller manufacturers. Furthermore, the complexity of developing and integrating sophisticated process control software and the necessity for highly skilled labor to operate and maintain these precision machines present ongoing technical challenges that must be mitigated for widespread adoption.

Opportunities for expansion are largely concentrated in the burgeoning hydrogen economy, which necessitates the mass production of Type IV composite hydrogen storage tanks capable of handling extreme pressures (700 bar). This application demands the most advanced, precise, and high-speed filament winding technology, creating a high-value niche market. Similarly, the deep-sea and offshore oil and gas sectors present opportunities for specialized, large-scale winding machines capable of producing robust, corrosion-resistant composite risers and flowlines. Impact forces currently favor market expansion; the bargaining power of buyers is moderate due to product differentiation (precision and complexity), but the bargaining power of suppliers (especially of advanced CNC components and composite fibers) is high, pushing up manufacturing costs. The threat of new entrants is low due to high barriers to entry (capital and expertise), while the threat of substitutes is also moderate, as alternative processes like resin infusion or pultrusion serve different, less structurally demanding applications, leaving filament winding dominant for pressure vessels and high-strength pipes.

The synergistic effect of global environmental regulations mandating reduced emissions and the concurrent push for lighter electric vehicles (EVs) and fuel cell electric vehicles (FCEVs) acts as a powerful, sustained market driver. This environmental pressure is translating directly into increased orders for winding machines designed for composite battery enclosures and hydrogen tanks. Successful market players are those that can effectively manage the restraint of technical complexity by offering integrated, user-friendly software solutions that automate much of the winding pattern generation and quality assurance, thereby broadening the potential customer base beyond traditional composite specialists. Strategic focus on large-scale infrastructure projects, such as those involving composite pipe rehabilitation and expansion in developing regions, represents a critical area for leveraging market opportunities and achieving economies of scale in machine manufacturing and deployment.

Segmentation Analysis

The Filament Winding Machine Market is extensively segmented based on machine type, fiber material utilized, application, and level of automation, allowing manufacturers to cater to the highly specialized demands of various end-user industries. The segmentation by machine type distinguishes between helical, circumferential, and polar winding capabilities, reflecting the geometrical requirements of the final product. Segmentation by fiber material, primarily Glass Fiber, Carbon Fiber, and Aramid Fiber, is critical as it dictates the strength, weight, and cost profile of the finished composite part. The Application segment is the most crucial, reflecting the end market demand, with pressure vessels and piping dominating the volume and value. The trend toward high-speed, multi-axis, and fully automated CNC machines is driving the automation segment, ensuring consistent, high-volume production necessary for automotive and standardized industrial products.

- By Type:

- Helical Winding Machine

- Circumferential Winding Machine

- Polar Winding Machine

- Multi-Axis Winding Machine (4-Axis, 6-Axis, and above)

- By Fiber Type:

- Carbon Fiber

- Glass Fiber (E-glass, S-glass)

- Aramid Fiber

- Other Fibers (e.g., Basalt, Hybrid Composites)

- By Application:

- Pipes and Conduits (Oil and Gas, Water/Wastewater)

- Pressure Vessels (CNG, Hydrogen, Storage Tanks)

- Aerospace and Defense Components (Rocket Motor Casings, Missile Bodies)

- Sports Equipment

- Others (Insulators, Drive Shafts)

- By End-User Industry:

- Chemical and Petrochemical

- Aerospace and Defense

- Automotive and Transportation

- Water and Wastewater Management

- Construction and Infrastructure

Value Chain Analysis For Filament Winding Machine Market

The Value Chain for the Filament Winding Machine Market commences with upstream activities focused on the procurement and processing of foundational materials, primarily high-performance composite fibers (carbon, glass, aramid) and specialty resin systems (epoxy, polyester, vinyl ester). Suppliers of these raw materials exert considerable influence on the final component cost and machine design parameters, especially fiber tensioning systems. The core manufacturing stage involves specialized machinery manufacturers who design, assemble, and integrate complex mechanical components (mandrels, carriages, spindles) with sophisticated electronic control systems (CNC units, HMI software). Direct and indirect distribution channels are critical; direct sales are preferred for complex, customized, multi-million dollar machinery, allowing for intimate customer consultations and tailored installation, while indirect channels utilizing system integrators and distributors are common for standardized, lower-axis machines targeting regional composite shops.

Downstream analysis focuses on the end-user composite component manufacturers, which utilize the machines to produce finished goods like pipes, tanks, and aerospace parts. This stage includes critical post-processing steps such as curing, demolding, and non-destructive testing (NDT), where the quality of the winding process directly impacts the final product integrity. The ultimate value delivery occurs when these composite products are integrated into major systems, such as municipal water networks, hydrogen fueling stations, or aircraft structures. The service segment, covering installation, commissioning, maintenance, and software updates provided by the machine manufacturers, is an increasingly high-margin aspect of the value chain, ensuring long-term operational efficiency and customer loyalty. The entire chain is currently moving towards digitalization, with connectivity (IoT) enabling remote diagnostics and enhanced service delivery.

Effective management of the distribution channel is paramount for capturing regional market share. In established markets like North America and Western Europe, direct sales teams manage key aerospace and defense accounts, ensuring compliance with strict quality standards and customized machine specifications. In contrast, high-growth APAC markets often rely on experienced local agents or joint ventures (indirect channel) who possess deeper regional knowledge and can handle localized service and maintenance requirements for large-volume pipe manufacturers. The integration between the machine manufacturer and the software provider (often third-party CNC specialists) is also a critical junction in the value chain, determining the machine's overall intelligence and ease of use, which significantly influences the purchasing decision of the end-user component producer.

Filament Winding Machine Market Potential Customers

Potential customers and end-users of Filament Winding Machines span diverse industrial sectors, united by the common need for high-strength, lightweight, and often pressure-resistant composite structures. Key buyers include large-scale composite pipe manufacturers specializing in Glass Fiber Reinforced Plastic (GFRP) and Carbon Fiber Reinforced Plastic (CFRP) pipes for water, sewer, and high-pressure chemical transfer systems, driven by infrastructure development and the need for corrosion-resistant alternatives to metal piping. Another significant customer base consists of manufacturers of high-pressure storage vessels, particularly those catering to the rapidly expanding hydrogen and natural gas vehicle markets, demanding sophisticated multi-axis machinery for Type IV tank production. Furthermore, defense contractors and aerospace original equipment manufacturers (OEMs) purchase these machines for fabricating mission-critical components such as rocket motor casings, missile bodies, and specialized structural parts where weight reduction is paramount.

Beyond these primary high-volume and high-value segments, smaller composite fabrication shops specializing in niche products also constitute a steady stream of buyers, requiring smaller, more flexible three- or four-axis machines for items like sports equipment (bicycle frames, fishing rods) and various industrial drive shafts and rollers. The automotive industry represents a growing segment, with the demand for lighter chassis components and composite battery enclosures for electric vehicles driving the need for automated winding systems that can integrate seamlessly into high-speed production lines. These buyers prioritize machine speed, precision, and the ability to manage complex programming effortlessly, underscoring a shift towards fully automated, software-driven solutions that minimize human error and maximize throughput across all end-user categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McClean-Anderson, Fives, MIKROSAM, Entec, Roth Composite Machinery, Autonational Composites, Engineering Technology Corporation (ETC), Magnum Venus Products (MVP), Torson Technologies, Zoltek, KUKA Robotics, Coriolis Composites, A. C. & E. Systems, Inc., Pultrex, Dalian Innovation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filament Winding Machine Market Key Technology Landscape

The technological landscape of the Filament Winding Machine Market is characterized by continuous advancements in motion control, material delivery precision, and digitalization, moving beyond basic mechanical operation toward fully integrated cyber-physical systems. Core technologies revolve around high-performance CNC systems, which provide precise, simultaneous control over four to six axes, enabling the creation of complex, non-geodesic winding paths essential for advanced pressure vessel design. Modern machines incorporate sophisticated tensioning and impregnation systems that ensure uniform resin saturation and maintain consistent fiber alignment throughout the winding process, which is critical for maximizing the composite’s structural integrity and preventing voids. Furthermore, the integration of advanced sensors (e.g., laser guidance, vision systems) is becoming standard to monitor fiber placement accuracy and ensure real-time quality assurance, contributing to higher yield rates and reduced waste.

A significant technological shift involves the transition toward robotic and gantry-style winding setups, offering greater flexibility and scalability, especially for very large or uniquely shaped components that traditional lathe-style winders cannot accommodate. These robotic systems, often six-axis articulated arms, allow for greater degrees of freedom in applying fiber, facilitating highly specialized repairs or prototyping activities, alongside volume manufacturing. Another crucial area is software innovation: sophisticated CAD/CAM packages are now integral to the machine’s operation, translating complex component geometry directly into optimized winding programs, minimizing the need for manual parameter adjustments and accelerating the design-to-production cycle, a key requirement in rapidly evolving industries like hydrogen storage.

Moreover, the integration of Industry 4.0 principles, including the Industrial Internet of Things (IIoT), is pivotal. Connectivity allows machines to communicate process data, enabling remote monitoring, diagnostics, and over-the-air software updates, which enhances operational efficiency and predictive maintenance capabilities. Advanced curing technologies, such as microwave or induction curing systems, are also gaining traction, particularly for thermoplastic filament winding, offering faster cycle times and reduced energy consumption compared to traditional oven curing. The ability to switch seamlessly between different fiber types (e.g., carbon to glass) and resin systems further defines the technological superiority of leading machine manufacturers, positioning their equipment as versatile tools capable of addressing a broad spectrum of high-performance composite manufacturing requirements efficiently and accurately.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to extensive government investments in infrastructure, particularly in China and India, fueling the demand for composite pipes for water and sanitation. Furthermore, the region's rapidly expanding automotive sector and increasing domestic manufacturing capacity for composite parts drive the adoption of new filament winding machinery, focusing heavily on high-volume, cost-efficient production models. Japan and South Korea are key technology hubs leading in advanced materials and hydrogen tank production, demanding sophisticated, multi-axis winding systems.

- North America: North America holds a commanding share in terms of value, largely driven by the stringent quality requirements and significant procurement budgets of the aerospace, defense, and oil and gas industries. The region focuses heavily on highly automated, precision-based 6-axis machines for complex geometry parts, missile components, and advanced pressure vessels for niche applications, prioritizing technological superiority and operational reliability over sheer cost reduction. Investments in space exploration and hydrogen refueling infrastructure are key growth catalysts.

- Europe: Europe is characterized by strong regional expertise in advanced composite materials and robust environmental regulations favoring lightweighting in transportation. Germany, the UK, and France are crucial markets, specializing in high-performance pressure vessel production for automotive (CNG/H2) and industrial gas storage. European manufacturers lead in integrating advanced control software and sustainable manufacturing practices, often favoring thermoplastic filament winding for its recyclability potential.

- Latin America: This region is an emerging market, primarily driven by investments in the oil and gas sector (particularly Brazil) and localized infrastructure projects demanding composite piping. Market growth here is slower and more dependent on economic stability and foreign direct investment, with demand typically focusing on standardized, reliable 4-axis circumferential winders for large-diameter pipe production.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in GCC countries, fueled by large-scale petrochemical projects and desalination plants requiring corrosion-resistant composite piping and tanks. The region is seeing increasing imports of high-end machinery to establish local manufacturing capabilities, driven by national visions aimed at diversifying economies away from raw commodity exports and establishing local value-added industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filament Winding Machine Market.- McClean-Anderson

- Fives

- MIKROSAM

- Entec

- Roth Composite Machinery

- Autonational Composites

- Engineering Technology Corporation (ETC)

- Magnum Venus Products (MVP)

- Torson Technologies

- Zoltek (a subsidiary of Teijin)

- KUKA Robotics (supplier of robotic winding solutions)

- Coriolis Composites

- A. C. & E. Systems, Inc.

- Pultrex

- Dalian Innovation

- Aumann AG

- Schlösser Kunststofftechnik GmbH

- Steelhead Composites, Inc.

- Schmidt & Heinzmann GmbH & Co. KG

- D&W Industrial Composites

Frequently Asked Questions

Analyze common user questions about the Filament Winding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Filament Winding Machines?

The paramount driver is the exponential increase in demand for lightweight, high-strength composite materials, particularly in the production of Type IV composite pressure vessels (CPVs) used for hydrogen and CNG storage, alongside continuous infrastructure investment requiring corrosion-resistant piping.

How does multi-axis CNC technology improve the filament winding process?

Multi-axis CNC technology significantly improves precision and flexibility by enabling complex, non-geodesic fiber path placement. This optimizes structural performance, allows for the manufacture of complex shapes (e.g., elliptical domes), and ensures highly repeatable quality critical for aerospace certification.

Which fiber type dominates the high-pressure vessel segment of the market?

Carbon fiber dominates the high-pressure vessel segment, especially for Type IV hydrogen tanks, due to its exceptional strength-to-weight ratio and fatigue resistance, which is necessary to meet the demanding safety and performance standards of high-pressure storage applications.

What are the key technical challenges restraining market growth?

Key challenges include the high initial capital investment required for automated multi-axis machinery, the complexity of developing and integrating sophisticated winding software, and the critical need for highly specialized personnel trained in advanced composite material processing and machine maintenance.

How is Industry 4.0 impacting modern filament winding machinery?

Industry 4.0, facilitated by IIoT and AI integration, enables remote diagnostics, real-time process monitoring, automated quality control via sensor feedback, and predictive maintenance scheduling, transitioning manufacturing toward highly efficient, data-driven, and autonomous operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager