File Sharing Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433979 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

File Sharing Software Market Size

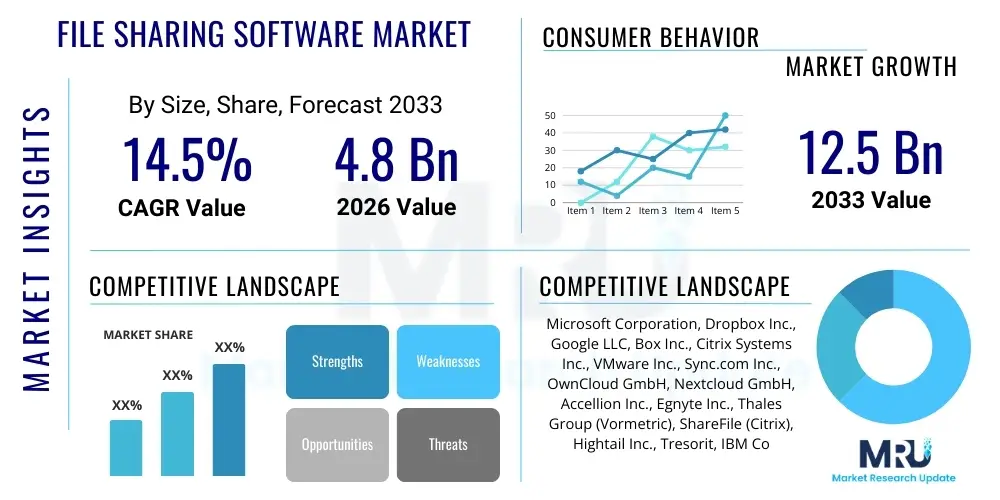

The File Sharing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

File Sharing Software Market introduction

File sharing software serves as a critical digital utility, enabling the secure and efficient transmission, synchronization, and collaborative management of digital files across diverse networks and devices. Its functionality extends far beyond simple data transfer, encompassing sophisticated features such as version control, granular user access permissions, and robust integration capabilities with expansive enterprise productivity suites (e.g., ERP and CRM). The foundational product is crucial for maintaining business continuity and supporting organizational flexibility, especially in the context of globally distributed and hybrid workforces.

The market offers diverse deployment models, predominantly Software-as-a-Service (SaaS) cloud platforms, alongside traditional on-premise installations and hybrid configurations, addressing specific organizational requirements for data sovereignty and security compliance. Major applications span high-data-volume sectors, including media and entertainment, where large file handling is critical, and highly regulated domains like healthcare and financial services, which demand secure, auditable data exchange mechanisms. This technology is universally adopted across industry verticals due to the inherent need for centralized, immediate access to corporate data repositories.

The primary benefits driving the market include substantial improvements in operational workflows, leading to heightened efficiency in team collaboration, significantly reinforced data security through end-to-end encryption and strong authentication protocols, and overall cost reduction compared to managing complex physical or legacy digital storage solutions. Market expansion is fundamentally propelled by the exponential growth in digital content generation, the global tightening of data governance standards, and the pervasive digital transformation initiatives occurring across both large multinational corporations and rapidly expanding Small and Medium Enterprises (SMEs).

File Sharing Software Market Executive Summary

The File Sharing Software Market is experiencing accelerated growth driven by the sustained evolution of remote and hybrid operational models, positioning secure, scalable, and integrated cloud solutions as non-negotiable business infrastructure. Current business trends emphasize enhanced security features, including zero-trust frameworks, and superior compliance capabilities tailored to global regulations such as GDPR and HIPAA. The competitive environment requires vendors to differentiate through specialization, offering targeted functionality like co-authoring tools, advanced workflow automation, and sector-specific data governance controls.

From a regional perspective, North America retains its dominant market share, benefiting from high early cloud adoption, the presence of major technology headquarters, and rigorous regulatory requirements that mandate documented, secure data handling processes. However, the Asia Pacific (APAC) region is projected to demonstrate the fastest Compound Annual Growth Rate (CAGR), driven by significant infrastructural investment, rapidly increasing internet penetration, and strong uptake among its vast and growing ecosystem of SMEs undergoing digital modernization. Europe maintains steady growth, largely catalyzed by stringent data localization and privacy laws that necessitate regionally compliant file sharing architectures.

Analysis of market segmentation indicates that the Cloud-Based deployment model decisively leads the market due to its inherent flexibility, operational scalability, and the advantageous shift from capital expenditure (CAPEX) to operational expenditure (OPEX). While Large Enterprises currently generate the bulk of the market revenue, the SME segment is anticipated to display the highest growth velocity, facilitated by increasingly affordable and user-friendly SaaS subscriptions. Furthermore, application demand is shifting strongly towards real-time collaborative platforms and integrated data governance tools, reflecting the market’s pivot towards active data utility rather than passive storage.

AI Impact Analysis on File Sharing Software Market

User inquiries frequently center on Artificial Intelligence (AI) and its potential to introduce unprecedented automation, security, and intelligence into file sharing platforms. Key themes include AI's role in proactive security monitoring, automatic classification and indexing of vast unstructured data sets, and optimizing storage and bandwidth usage based on predicted user behavior. The consensus is that AI is fundamentally expected to address the massive challenges associated with managing the volume and complexity of enterprise data by delivering hyper-efficient content discovery through semantic search capabilities and establishing a new generation of reinforced, adaptive security. AI integration is transforming these platforms from static repositories into intelligent, self-managing data ecosystems capable of real-time risk assessment and automated governance application.

- AI algorithms automatically detect and tag sensitive data (e.g., financial records, PII) upon upload, ensuring immediate compliance application.

- Machine learning optimizes network traffic and resource allocation, predicting peak usage times for synchronization and reducing operational costs.

- AI-powered semantic search drastically improves content retrieval accuracy, understanding context rather than just keywords.

- Behavioral AI enhances security by establishing baselines of normal user behavior and immediately flagging anomalous or suspicious file access attempts.

- Intelligent assistants and chatbots utilize NLP to simplify complex file management tasks and retrieval commands via conversational interfaces.

- AI facilitates automated data migration and cleanup processes, identifying obsolete or redundant files for archiving or deletion, optimizing storage tiers.

DRO & Impact Forces Of File Sharing Software Market

Market expansion is powerfully driven by the accelerating global adoption of hybrid work environments, which critically necessitate seamless, secure access to centralized data stores. Coupled with this is the unrelenting exponential growth in organizational data volume and the associated need for efficient data management tools. However, this momentum is counterbalanced by significant constraints, primarily stemming from heightened organizational anxiety regarding data sovereignty, the regulatory complexity imposed by varied global laws, and the persistent, evolving threat landscape of sophisticated cyberattacks targeting cloud services. The opportunity lies in providing advanced, AI-enabled, zero-trust solutions that meet stringent, sector-specific compliance mandates, particularly appealing to high-value, regulated industries.

Drivers emphasize operational globalization and efficiency. The demand for instant data synchronization across diverse geographical boundaries accelerates the adoption of robust cloud-based SaaS solutions. Furthermore, increasing regulatory pressure in sectors like finance (SOX) and healthcare (HIPAA) mandates secure, auditable, and compliant file management systems, making professional software a necessity. The continuous advancements in mobile technology and ubiquitous high-speed internet further facilitate remote access and collaboration, broadening the market appeal beyond traditional office settings.

Restraints center on inherent security risks and technical hurdles. User reluctance persists due to recent high-profile cloud data breaches, creating demand for guaranteed client-side encryption and strict key management control. Integrating modern file sharing platforms with outdated, disparate legacy IT systems remains a significant technical challenge for established large enterprises, often requiring extensive customization and high migration costs. Opportunities address these gaps by focusing on secure hybrid solutions, guaranteed data localization options, and delivering seamless integration tools that minimize operational disruption during the transition from legacy systems.

Segmentation Analysis

The File Sharing Software market is structurally segmented to reflect the diverse needs of modern businesses, varying across technical implementation (deployment), organizational scale (enterprise size), functionality (application), and commercial user base (end-use industry). This granular classification allows vendors to develop highly targeted products, ranging from large-scale data backup solutions to specialized, compliance-driven collaborative platforms. The ongoing technological migration favors cloud-based architectures, while the functional demand is shifting rapidly towards integrated collaboration and robust data security functionalities, signaling a mature market increasingly focused on data utility and governance.

- Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- Hybrid

- Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Application Type:

- Data Backup and Synchronization

- Collaboration and Project Management

- Data Security and Governance (DLP, IAM)

- Workflow Automation

- End-Use Industry:

- IT and Telecommunication

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Media and Entertainment

- Retail and E-commerce

- Government and Defense

- Education

Value Chain Analysis For File Sharing Software Market

The value chain initiates with the upstream segment, which involves fundamental infrastructure provision and core technology development. This stage encompasses the hardware (servers, networking equipment) and the underlying platform software, crucially provided by hyperscale cloud providers (e.g., AWS, Microsoft Azure). Upstream activities focus on maximizing global availability, data redundancy, and optimizing low-latency data transfer protocols. Software developers then leverage this infrastructure to build the proprietary file sharing applications, prioritizing critical user-facing elements like user interface design, cross-platform compatibility, and the integration of advanced security features such as end-to-end encryption and robust authentication mechanisms.

The downstream activities involve market access, distribution, and customer support. Distribution channels are bifurcated into direct sales—handling large, customized enterprise contracts requiring extensive consultation—and indirect channels, utilizing Value-Added Resellers (VARs), managed service providers (MSPs), and online marketplaces, which are essential for reaching the high-growth SME market efficiently. Effective channel management requires training partners extensively on compliance requirements and integration capabilities to ensure seamless deployment across diverse client environments.

The success of the distribution strategy relies heavily on optimized market positioning. Direct channels ensure high-touch, customized security configuration for complex regulatory environments, often associated with higher profit margins per deal. Indirect channels offer scale and speed, crucial for achieving widespread market penetration via standardized, subscription-based packages. Post-sale activities, including continuous software updates, data migration support, and 24/7 technical assistance, are vital for customer retention and establishing long-term enterprise relationships, reinforcing vendor trust and perceived value.

File Sharing Software Market Potential Customers

The potential customer base for file sharing software is extremely broad, spanning virtually every sector and organization size that utilizes digital data. Primary End-Users include large enterprises that require sophisticated, integrated platforms to manage massive data volumes, complex security protocols, and global collaboration across thousands of employees. These customers seek solutions with advanced Data Loss Prevention (DLP) and eDiscovery tools, necessitating compliance with stringent regional and international regulations like ISO 27001 and FedRAMP certification.

A high-growth segment comprises Small and Medium Enterprises (SMEs), which increasingly rely on file sharing software to bypass the need for significant internal IT infrastructure investment. SMEs prioritize affordable, scalable, and highly usable cloud-based solutions that facilitate rapid team communication and secure client data exchange. Furthermore, highly regulated sectors—specifically BFSI (Banks, Financial Services, and Insurance) and Healthcare—are crucial buyers, driven by their mandatory need for auditable, confidential, and highly secure virtual data rooms and patient record management systems.

Beyond commercial entities, government agencies and educational institutions represent significant consumption potential. Government departments require secure, highly localized file sharing for sensitive documents, often favoring on-premise or sovereign cloud deployments for national security concerns. Academic bodies, particularly universities, utilize these platforms for research collaboration, large lecture file distribution, and secure student record management, prioritizing systems that offer high bandwidth and integration with learning management systems (LMS).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft Corporation, Dropbox Inc., Google LLC, Box Inc., Citrix Systems Inc., VMware Inc., Sync.com Inc., OwnCloud GmbH, Nextcloud GmbH, Accellion Inc., Egnyte Inc., Thales Group (Vormetric), ShareFile (Citrix), Hightail Inc., Tresorit, IBM Corporation, MediaFire, SugarSync, SecureDocs Inc., pCloud AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

File Sharing Software Market Key Technology Landscape

The technological evolution of the File Sharing Software market is dominated by advancements in cryptographic security, rapid synchronization mechanisms, and integration capabilities designed for complex enterprise ecosystems. Core security relies heavily on AES-256 encryption for data at rest and robust TLS/SSL protocols for data in transit, coupled with mandatory Multi-Factor Authentication (MFA) and seamless Single Sign-On (SSO) integration. The strategic industry shift toward Zero-Trust Architecture (ZTA) dictates that all access attempts, internal or external, are continuously authenticated and authorized, enhancing platform resilience against sophisticated threats.

Crucial to collaborative functionality is the implementation of advanced synchronization technologies, often employing block-level sync to minimize data transfer by updating only the changed parts of files, thereby significantly reducing bandwidth consumption and latency for globally distributed teams. Robust Application Programming Interfaces (APIs) are essential, ensuring seamless interoperability with third-party productivity tools (e.g., communication platforms, CRM systems). The ability of a file sharing platform to integrate deep within the existing enterprise technology stack is a primary competitive advantage and a critical factor for large enterprise adoption.

Emerging technologies like Distributed Ledger Technology (DLT) or blockchain are starting to be explored for creating tamper-proof, immutable audit trails for file access and modification history, offering unprecedented transparency crucial for regulated sectors. Furthermore, client-side encryption—where the user retains control of the encryption keys before data leaves their device—is gaining prominence for users requiring maximum privacy and control. Edge computing is also influencing deployment, allowing data processing and storage closer to the physical location of heavy data usage, thereby optimizing performance for organizations operating large hybrid IT infrastructures.

Regional Highlights

- North America: The market powerhouse, characterized by the highest market penetration and technological maturity, driven by major cloud providers and stringent regulatory demands (HIPAA, CCPA). Focus is on enterprise-grade security, robust ZTA deployment, and deep integration with existing IT stacks.

- Europe: Growth is primarily guided by the necessity to comply with GDPR and demands for data localization (Sovereign Cloud). The region favors hybrid and secure cloud solutions that guarantee data residency, making compliance automation a leading driver across all major economies (Germany, UK, France).

- Asia Pacific (APAC): Expected to lead in CAGR, fueled by rapid digital transformation and massive expansion in the SME segment. Adoption centers around flexible, scalable, and affordable SaaS solutions suitable for the massive, mobile-centric workforce in countries like China and India.

- Latin America (LATAM): An emerging market with growing cloud dependency. Demand is focused on solutions that balance cost-effectiveness with foundational security features, particularly in the banking and telecom sectors as digital infrastructure matures.

- Middle East and Africa (MEA): Growth is tied to government-led smart initiatives and economic diversification, particularly in the GCC states. Security and governance are critical, with strong preference for solutions offering robust data residency compliant with regional laws.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the File Sharing Software Market.- Microsoft Corporation (OneDrive, SharePoint)

- Dropbox Inc.

- Google LLC (Google Drive)

- Box Inc.

- Citrix Systems Inc. (ShareFile)

- VMware Inc. (Workspace ONE)

- Sync.com Inc.

- OwnCloud GmbH

- Nextcloud GmbH

- Accellion Inc. (Kiteworks)

- Egnyte Inc.

- Thales Group (Vormetric Data Security)

- Hightail Inc.

- Tresorit

- IBM Corporation

- MediaFire

- SugarSync

- SecureDocs Inc.

- pCloud AG

- Intralinks (SS&C Technologies)

- OpenText Corporation

- Canto Inc.

- Zendesk Inc.

Frequently Asked Questions

Analyze common user questions about the File Sharing Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the File Sharing Software market?

The primary driver is the pervasive global shift towards remote and hybrid working models, requiring centralized, secure, and easily accessible cloud-based platforms for real-time collaboration and synchronization across geographically dispersed teams.

How does AI currently impact file sharing platforms?

AI primarily enhances security through anomaly detection in access patterns and improves content management by automating file classification, tagging, and metadata generation, drastically increasing search efficiency and data governance compliance.

Is cloud-based file sharing secure enough for highly regulated industries like Healthcare and Finance?

Yes, modern cloud-based solutions catering to regulated sectors offer advanced client-side encryption, granular access controls, immutable audit trails, and certification for compliance standards such as HIPAA, GDPR, and FINRA, making them suitable and often mandatory for secure operations.

Which deployment model holds the largest market share?

The Cloud-Based (SaaS) deployment model holds the largest and fastest-growing market share due to its superior scalability, cost-effectiveness (reduced CAPEX), easy implementation, and robust features supporting cross-organizational collaboration.

What major challenges restrict the market growth?

Market growth is primarily restricted by persistent concerns over data sovereignty and potential security breaches in third-party cloud environments, alongside the inherent technical complexity and cost involved in migrating large volumes of data from legacy on-premise systems.

Market Dynamics and Competitive Landscape Analysis

The competitive landscape of the File Sharing Software market is intensely dynamic, defined by strategic competition between established cloud ecosystem providers and specialized security innovators. Major players like Microsoft and Google leverage their massive user bases and seamless integration across their productivity suites, creating substantial switching costs for enterprises. This strategy focuses on providing file sharing not as a standalone product but as an essential, deeply embedded feature within a unified enterprise platform. Conversely, focused players such as Box and Egnyte compete by offering unparalleled expertise in enterprise content governance, industry-specific compliance features, and superior open API connectivity, enabling greater customization for bespoke IT environments.

Market segmentation based on vertical specialization is becoming a key differentiator. Vendors are increasingly developing features specifically for sectors requiring high security and auditability, such as Virtual Data Room (VDR) functionalities tailored for financial services (M&A) and legal document management. In contrast, the media sector demands high-speed large file transfer protocols and robust digital rights management (DRM). This trend indicates that competitive success will increasingly rely on a vendor’s ability to move beyond general cloud storage provision and deliver specialized, highly compliant functional packages that address unique industry pain points. Consolidation via strategic M&A activities is frequent, aimed at rapidly acquiring advanced encryption technologies or expanding geographic reach to meet local data residency mandates.

Pricing strategies reflect the competitive environment: large enterprises engage in complex volume licensing negotiations requiring extensive SLAs, while SMEs are targeted with aggressive, scalable subscription tiers focused on rapid onboarding and predictable operational costs. Future competitiveness will be dominated by vendors who successfully integrate next-generation security paradigms, particularly Zero-Trust frameworks, and intelligently automate compliance processes using AI, ensuring both functional superiority and regulatory adherence in a rapidly evolving threat landscape.

- Competitive Strategies:

- Leveraging Ecosystem Integration (Microsoft 365, Google Workspace) for user lock-in.

- Focusing on advanced enterprise-grade security and governance specialization (Box, Egnyte).

- Targeting high-value niche verticals (e.g., M&A VDR, Healthcare compliance).

- Utilizing tiered, scalable SaaS subscription models to capture the SME market.

- Key Market Challenges for Competitors:

- Addressing fragmentation in global data residency and sovereignty laws.

- Ensuring platform compatibility across legacy IT infrastructure and modern cloud environments.

- Mitigating evolving threats, including ransomware and insider data leakage.

SME vs. Large Enterprise Adoption Trends

Adoption behavior in the File Sharing Software market shows a distinct contrast between Large Enterprises (LEs) and Small and Medium Enterprises (SMEs). LEs, defined by their extensive budgets, complex global operations, and stringent security requirements, typically gravitate towards hybrid or custom on-premise solutions. Their focus is on high-level integration with existing mission-critical systems, requiring vendors who can deliver comprehensive Data Loss Prevention (DLP), detailed forensic logging, and global scalability while meeting industry-specific regulatory burdens. Trust and proven track records drive their decisions, leading to strong reliance on major vendors like IBM, Microsoft, and Box Enterprise, often secured through multi-year, bespoke contracts and substantial professional service agreements.

SMEs demonstrate a rapid, agility-focused adoption pattern, overwhelmingly favoring pure Software-as-a-Service (SaaS) cloud solutions. The motivation for SMEs is centered on minimizing IT complexity, avoiding large capital investments, and achieving fast time-to-value. They prioritize ease of use, instant deployment, and accessible subscription pricing based on storage requirements and user count, making platforms like Dropbox and Google Drive highly attractive. For this segment, basic security features like MFA and reliable data synchronization are sufficient, provided they are packaged affordably and require minimal management oversight.

A crucial convergence trend is the trickle-down of advanced security features. As competition intensifies, security capabilities previously exclusive to LEs (such as advanced encryption and comprehensive auditing) are increasingly integrated into even basic SME SaaS tiers. For LEs, the ongoing challenge is to perfect the hybrid model—securely and efficiently connecting sensitive data held on proprietary internal servers with the flexibility and collaborative features of the public cloud. This balancing act fuels demand for robust governance connectors and intelligent data classification tools that automate policy enforcement across both environments, ensuring compliance without sacrificing collaboration efficiency.

- SME Adoption Characteristics:

- High preference for OPEX-friendly, standardized SaaS models.

- Drivers: Cost efficiency, immediate access, and integration with productivity apps.

- Growth segment focuses on high-volume, low-cost synchronization and teamwork tools.

- Large Enterprise Adoption Characteristics:

- Demand for hybrid deployment for localized data sovereignty and control.

- Prioritization of complex governance, regulatory reporting, and forensic auditing capabilities.

- Investment directed towards Zero-Trust security models and seamless integration with bespoke ERP/CRM systems.

Security, Compliance, and Governance Trends

The contemporary File Sharing Software market is intrinsically linked to sophisticated security, necessitating a proactive, rather than reactive, approach to data governance. The most significant architectural shift is the migration toward Zero-Trust Architecture (ZTA), which fundamentally eliminates implicit trust, requiring continuous verification of every user, device, and application attempting to access shared files. This paradigm is crucial for mitigating risks associated with remote work and complex supply chains. Paired with ZTA, the adoption of robust client-side encryption and End-to-End Encryption (E2EE) is growing, giving organizations absolute control over their cryptographic keys, thereby neutralizing the risk of data exposure even in the event of a cloud provider compromise.

Compliance complexity, driven by global regulations like GDPR, CCPA, and sector-specific rules (e.g., PCI DSS), fuels demand for automated governance features. Modern file sharing solutions must integrate intelligent tools capable of automatic file classification, policy tagging, and applying jurisdictional-based data retention policies. The ability to generate immutable and easily searchable audit trails is non-negotiable for proving regulatory adherence during official audits. These integrated compliance mechanisms reduce human error and minimize the legal and financial exposure associated with unauthorized data movement or retention violations.

Furthermore, Data Loss Prevention (DLP) has evolved into an essential, integrated governance tool, monitoring file activity in real-time to detect anomalous behavior that may signal data exfiltration or insider threats. Solutions are also increasingly integrating with external threat intelligence feeds to scan for and quarantine files containing known malware signatures before they can be shared internally. This convergence of advanced encryption, regulatory automation, and real-time threat detection is defining the competitive edge, transforming file sharing platforms into indispensable pillars of enterprise data security architecture.

- Key Security Implementations:

- Mandatory deployment of Zero-Trust Architecture (ZTA) for access control.

- Increased demand for client-side encryption and hardware security module (HSM) integration for key management.

- Advanced Identity and Access Management (IAM) supporting adaptive authentication based on context.

- Compliance Focus Areas:

- Automated data residency and jurisdictional policy enforcement.

- Granular retention and defensible disposition policies meeting GDPR/CCPA.

- Blockchain or DLT for immutable audit logging and non-repudiation.

Future Outlook and Emerging Business Models

The future of the File Sharing Software market is characterized by pervasive integration and intelligent automation. File sharing capabilities are projected to dissolve into the background of core business processes, becoming seamlessly embedded within ERP, CRM, and communication platforms via sophisticated open APIs. This transition minimizes friction and context switching for end-users, transforming the file sharing service into an invisible data utility supporting complex organizational workflows. The focus will move entirely to value creation derived from the data itself, facilitated by intelligent platforms that automate classification, summarization, and compliance activities.

New business models are diversifying beyond the traditional per-user, per-storage license. Emerging strategies include usage-based pricing, charging based on bandwidth consumption, data transfer volume, or the specific use of premium governance features (e.g., eDiscovery searches or VDR setup). Furthermore, the high-demand segment for data sovereignty is spurring the growth of ‘Sovereign Cloud’ models, where vendors collaborate with regional telecommunication providers or certified local data centers to guarantee that data remains physically within specific national borders, satisfying stringent government and financial sector regulations prevalent in Europe and APAC.

Technological advancement will concentrate on decentralization and ultra-low latency. Decentralized file sharing, potentially utilizing Distributed Ledger Technology (DLT) for file indexing and metadata, offers increased resilience, transparency, and resistance to single points of failure, a significant advantage for highly sensitive data. AI will drive specialized premium tiers, offering automated data clean-up, proactive risk assessment, and intelligent content prioritization, ensuring the file sharing system evolves into a self-optimizing, strategic asset for data governance and operational efficiency.

- Future Technology Integrations:

- Deep, API-driven integration into enterprise productivity and workflow applications.

- Development of decentralized storage protocols for enhanced data resilience and auditability.

- Widespread utilization of AI for intelligent content automation (summaries, risk flagging).

- Evolving Business Models:

- Adoption of usage-based and feature-specific pricing structures.

- Expansion of "Sovereign Cloud" offerings tailored for national data residency laws.

- Shift towards Platform-as-a-Service (PaaS) models enabling custom application development on the sharing infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager