Filling Station and Gas Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432417 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Filling Station and Gas Station Market Size

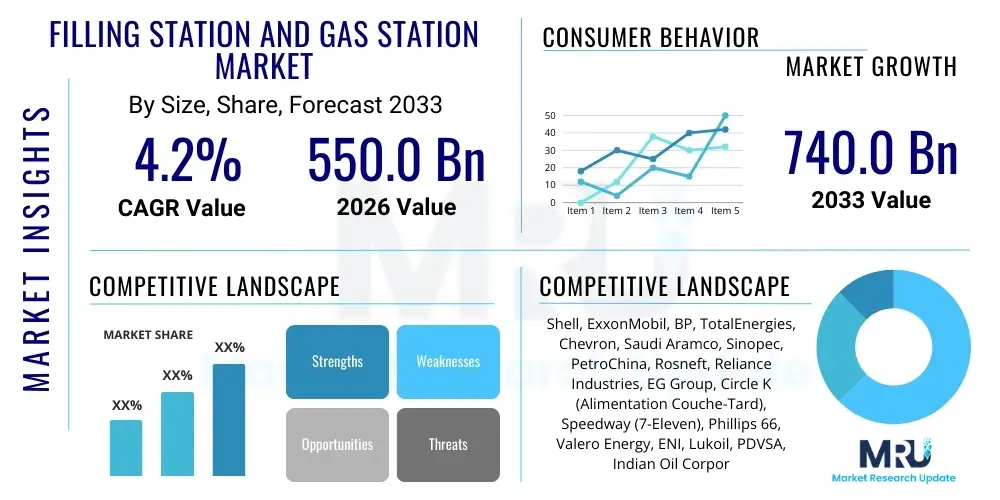

The Filling Station and Gas Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2026 and 2033. The market is estimated at USD 550.0 Billion in 2026 and is projected to reach USD 740.0 Billion by the end of the forecast period in 2033.

Filling Station and Gas Station Market introduction

The Filling Station and Gas Station Market encompasses the global infrastructure dedicated to dispensing motor fuels, including traditional gasoline, diesel, and rapidly expanding alternative fuels like electricity (EV charging), compressed natural gas (CNG), and hydrogen. These establishments serve as critical nodes in the transportation ecosystem, primarily providing energy for vehicles but increasingly evolving into comprehensive convenience hubs offering ancillary services such as retail convenience stores, quick-service restaurants, and car washes. Major applications span personal vehicular travel, commercial logistics (trucking fleets), and public transport networks. The core benefits delivered include uninterrupted mobility, accessible convenience retail, and increasingly, standardized charging solutions for electric vehicles, supporting the global energy transition. Key driving factors include sustained growth in vehicle parc globally, especially in emerging economies, the necessity for robust infrastructure to support long-haul logistics, and significant technological investments focused on modernization, payment security, and the integration of next-generation fuel dispensing systems to accommodate diverse energy sources.

Filling Station and Gas Station Market Executive Summary

Market dynamics are currently dominated by a crucial transition phase, characterized by significant investment in non-fuel revenue streams and digitalization initiatives across the sector. Business trends indicate a shift towards experiential retail, where gas stations are rebranded as mobility and convenience centers, mitigating risks associated with plateauing traditional fuel demand due to increasing EV adoption. Regional trends show stark differences: North America and Europe are focusing heavily on EV charger rollouts and advanced loyalty programs, while the Asia Pacific region, driven by countries like China and India, exhibits robust expansion in traditional fuel infrastructure coupled with rapid development of urban charging networks to meet escalating transportation demands. Segment trends highlight the increasing importance of the 'Convenience Store Retail' segment, which now often generates higher profit margins than fuel sales. Furthermore, the 'Electric Vehicle Charging' segment is witnessing exponential growth, demanding sophisticated grid management and dynamic pricing models. Overall, the market is navigating complex regulatory landscapes focused on emissions reduction while simultaneously optimizing operational efficiency through automation and data analytics to maintain profitability during the energy transition.

AI Impact Analysis on Filling Station and Gas Station Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Filling Station and Gas Station Market predominantly revolve around operational efficiency, customer personalization, and risk management. Common questions focus on how AI can optimize inventory management (predicting fuel demand spikes), enhance security (AI-powered surveillance for anomaly detection), and personalize the consumer experience through tailored digital signage and loyalty program recommendations. Users are keenly interested in the application of AI for predictive maintenance of pumps and charging infrastructure to minimize downtime, and the use of machine learning algorithms to optimize energy consumption and pricing strategies for both fuel and EV charging services. The synthesis of these concerns suggests that the primary expectation is for AI to drive significant cost reductions, improve site safety, and transform the static experience of refueling into a dynamic, data-driven retail interaction, thereby future-proofing operations against changing energy consumption patterns.

- AI-driven Predictive Maintenance: Reduces equipment downtime and operational costs by forecasting failures in pumps, compressors, and charging units.

- Dynamic Pricing Optimization: Utilizes machine learning to adjust fuel and retail pricing based on real-time demand, competitor data, and inventory levels.

- Personalized Customer Experience: Implements AI to analyze purchase history and vehicle data (where permissible) to offer customized promotions and loyalty rewards, enhancing convenience store profitability.

- Automated Inventory Management: Optimizes fuel ordering and stock levels by predicting consumer demand fluctuations and supply chain variability.

- Enhanced Security and Surveillance: Uses computer vision for real-time threat detection, monitoring forecourt activity, and preventing retail loss.

DRO & Impact Forces Of Filling Station and Gas Station Market

The market is predominantly driven by sustained global growth in the vehicle population, particularly commercial fleets requiring reliable refueling infrastructure, and the continuous necessity for convenient retail services integrated with mobility solutions. Concurrently, technological advancements in payment systems, automation, and telematics are streamlining operations and improving customer throughput. However, the market faces significant restraints, primarily the aggressive global push towards electric vehicles (EVs), which inherently challenges the long-term demand for traditional liquid fuels, coupled with stringent environmental regulations imposing higher compliance costs and limitations on new site development. The major opportunity lies in transforming existing sites into integrated 'Mobility Hubs,' offering ultra-fast EV charging, last-mile delivery services, and diversified convenience options (e.g., ghost kitchens, parcel lockers), effectively diversifying revenue away from purely fuel sales. The primary impact force shaping the future is regulatory change and technological disruption; governments mandate lower-emission fuels and infrastructure development, while decentralized energy generation and smart grid integration fundamentally redefine how energy is delivered and consumed at the point of sale, forcing rapid capital investment in non-traditional assets.

Segmentation Analysis

The Filling Station and Gas Station Market is extensively segmented across several dimensions crucial for market analysis, including the type of fuel offered, the operational model employed, the services provided, and the geographical region of operation. Understanding these segments is vital for stakeholders to allocate capital efficiently, recognize areas of high growth, such as the rapid deployment of charging infrastructure, and address specific consumer needs, such as the preference for large, integrated travel centers versus smaller, unmanned urban refueling points. Segmentation allows for targeted marketing strategies and operational adjustments tailored to varying local regulatory environments and consumer behavior patterns globally.

- By Fuel Type:

- Gasoline/Petrol

- Diesel

- Alternative Fuels (CNG, LPG, Hydrogen)

- Electric Vehicle (EV) Charging

- By Operation Type:

- Company-Owned, Company-Operated (COCO)

- Dealer-Owned, Dealer-Operated (DODO)

- Company-Owned, Dealer-Operated (CODO)

- By Service Type:

- Refueling Services Only

- Refueling and Retail Convenience (C-Stores)

- Refueling, Retail, and Ancillary Services (Car Wash, Repair)

- By Location:

- Urban Areas

- Highways/Travel Centers

- Rural Areas

Value Chain Analysis For Filling Station and Gas Station Market

The value chain of the Filling Station and Gas Station Market begins with the upstream segment, primarily involving the exploration, extraction, refining, and initial bulk transportation of crude oil and natural gas feedstock, or the generation and transmission of electricity in the case of EV charging. Key upstream players include major integrated oil companies and utilities responsible for securing and processing the energy sources. The efficiency and cost-effectiveness of this initial stage significantly dictate the final price of fuel or energy delivered to the consumer, making secure, long-term supply contracts and efficient refining processes crucial components of profitability. For electricity, the upstream involves power generation—whether from fossil fuels, nuclear, or renewables—and the stability of the grid infrastructure supporting high-demand charging points.

The midstream elements focus on storage, large-scale transportation, and wholesale distribution. This phase includes pipeline networks, bulk storage terminals, and specialized tanker fleets required to move refined products or high-capacity power lines for electricity transmission. Midstream operations require substantial capital investment in infrastructure and strict adherence to safety and environmental standards. The ability of distribution channel operators to manage logistics efficiently, minimize transit losses, and optimize routing directly impacts the operational viability of downstream filling stations. Consolidation among midstream players is a continuous trend aimed at achieving economies of scale and improving network robustness, particularly in volatile regulatory environments.

The downstream component is the most visible to the consumer and encompasses the actual retail operation: the filling station itself. Distribution channels here involve both direct sales (company-owned stations) and indirect sales (franchised or dealer-owned stations). Direct channels offer greater control over branding, pricing, and operational standards, vital for maintaining corporate image and implementing new technologies swiftly. Indirect channels, through independent dealers, allow for rapid market penetration with lower initial capital outlay, although maintaining brand consistency can be more challenging. The trend toward digital integration means both direct and indirect channels are increasingly relying on centralized IT systems for inventory, pricing, and customer relationship management to enhance overall forecourt profitability.

Filling Station and Gas Station Market Potential Customers

The primary customer base for the Filling Station and Gas Station Market is remarkably broad, spanning both individual consumers and large commercial entities, making market segmentation based on consumption patterns critical. Individual vehicle owners constitute the largest volume of transactions, utilizing stations for personal mobility needs, focusing heavily on convenience, speed of service, and access to integrated retail options such as convenience stores and coffee services. These individual customers are highly sensitive to loyalty programs, mobile payment technologies, and location accessibility, driving the need for sophisticated digital marketing and customer retention strategies by station operators. Operators must cater to varied needs, from quick fill-ups to longer stops involving vehicle cleaning or food purchases, positioning the station as a necessary stop within the daily commute or long-distance journey.

Another crucial customer segment involves commercial fleets and logistics companies. These businesses—including long-haul trucking, last-mile delivery services, public transport authorities, and construction firms—are characterized by high-volume, regular fuel consumption and prioritize reliability, consistent supply quality, and specialized refueling capabilities (e.g., high-speed diesel pumps, bulk purchasing discounts, and fleet management payment systems). Serving this segment requires stations strategically located near major transport corridors and logistics hubs, offering infrastructure designed for heavy vehicles. The rising adoption of alternative energy sources, such as CNG/LNG and battery electric heavy vehicles, necessitates that station operators invest in dedicated infrastructure to retain these lucrative commercial contracts, thereby becoming integral partners in logistics supply chains.

Finally, the rapidly growing electric vehicle (EV) owner population represents a distinctly important customer group. EV drivers, while currently a smaller segment of overall energy buyers, require specialized infrastructure: fast, reliable charging stations often positioned in convenient locations that allow for 20-40 minute dwell times, encouraging integrated retail consumption. These customers prioritize charger availability, ease of payment via app or card, and competitive pricing for kilowatt-hours (kWh). Successfully serving EV drivers requires gas stations to transform their business model from transactional fueling to destination-based charging hubs, necessitating significant site modification and integration with smart grid technologies to manage peak load demands effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Billion |

| Market Forecast in 2033 | USD 740.0 Billion |

| Growth Rate | 4.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell, ExxonMobil, BP, TotalEnergies, Chevron, Saudi Aramco, Sinopec, PetroChina, Rosneft, Reliance Industries, EG Group, Circle K (Alimentation Couche-Tard), Speedway (7-Eleven), Phillips 66, Valero Energy, ENI, Lukoil, PDVSA, Indian Oil Corporation (IOC), Marathon Petroleum. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filling Station and Gas Station Market Key Technology Landscape

The modernization of the Filling Station and Gas Station Market is fundamentally driven by the integration of digital and energy-related technologies designed to enhance operational efficiency, security, and customer experience. Forecourt technology has advanced significantly beyond basic dispensers to include sophisticated Point-of-Sale (POS) systems capable of handling multiple fuel types, loyalty programs, and mobile payments seamlessly. Crucially, the deployment of Internet of Things (IoT) sensors is transforming operations, enabling real-time monitoring of fuel inventory levels in underground tanks, tracking dispenser performance for predictive maintenance, and optimizing temperature control within convenience stores, ensuring compliance and minimizing energy waste. Secure payment processing, including EMV chip technology and tokenization, remains paramount to mitigate fraud risks inherent in high-volume, self-service environments, forming a critical technological backbone for reliable service delivery.

The rapid shift towards electric mobility necessitates the integration of high-powered, DC fast-charging technology (Level 3 charging) capable of delivering 150kW to 350kW, requiring substantial upgrades to site power infrastructure. This includes smart load management systems that communicate with the utility grid to optimize charging schedules and mitigate peak demand charges, which can drastically impact profitability. Furthermore, stations are increasingly adopting advanced software platforms that integrate fuel management, EV charger network management, and retail inventory systems into a single cloud-based interface. This centralized management facilitates dynamic pricing adjustments, supports robust customer relationship management (CRM) via mobile apps, and ensures regulatory reporting compliance across diverse energy assets.

Automation and self-service solutions represent another major technological trend. Automated payment verification, license plate recognition (LPR) for personalized greetings and loyalty linkage, and robotic or automated car wash systems reduce the reliance on manual labor, optimizing staffing levels and reducing operational costs. For the commercial sector, telematics integration allows fleet managers to monitor fuel consumption and charging status remotely, linking station transactions directly to corporate expense reporting systems. The future landscape will be heavily defined by the widespread implementation of AI for demand forecasting and supply chain optimization, ultimately creating highly efficient, data-rich mobility hubs capable of servicing both fossil fuel and electric vehicles with minimal human intervention.

Regional Highlights

Regional dynamics within the Filling Station and Gas Station Market are highly heterogeneous, primarily dictated by regional variations in regulatory frameworks concerning environmental standards, the pace of electric vehicle adoption, and the maturity of existing infrastructure networks. North America (NA), particularly the United States, is characterized by large, often franchise-owned, travel centers focused heavily on non-fuel retail revenue (convenience stores and quick-service food). The investment focus in NA is twofold: modernizing existing liquid fuel infrastructure for efficiency, and aggressively deploying high-speed EV charging along major interstate highways and urban corridors, often subsidized by federal and state initiatives to meet ambitious decarbonization targets.

Europe stands out due to its stringent environmental regulations and high rate of EV penetration, particularly in Scandinavian countries, Germany, and the UK. European operators are leaders in transforming traditional sites into multi-energy hubs, integrating premium EV charging, hydrogen refueling capabilities, and comprehensive mobility services like bike-sharing or car rental pods. Regulatory pressures necessitate higher margins on liquid fuels to fund the transition to alternative energies, forcing operators to innovate quickly in retail offerings and operational efficiency. Furthermore, public-private partnerships are crucial in Europe for overcoming high infrastructure costs associated with urban charging deployment.

The Asia Pacific (APAC) region represents the fastest-growing market in terms of sheer volume, driven by explosive vehicle parc growth in emerging economies like India, Indonesia, and China. While traditional fuel demand remains robust, China is simultaneously the global leader in EV production and infrastructure deployment, creating a dual-market environment. Investment in APAC is focused on establishing new filling stations to meet escalating demand, particularly in previously underserved rural and suburban areas, alongside massive urban rollouts of dedicated EV charging parks. Operational models are often optimized for high-density, rapid turnover, leveraging mobile technology for payment and loyalty programs to manage immense customer traffic effectively.

- North America: Focus on large, profitable convenience retail integration; rapid EV charging deployment on interstate corridors; reliance on franchise models.

- Europe: Driven by strong regulatory mandates and high EV uptake; focus on multi-energy hubs (Hydrogen, EV, Biofuels); emphasis on sustainable operations and premium non-fuel offerings.

- Asia Pacific (APAC): Largest volume growth driven by emerging markets; dual focus on expanding traditional fuel infrastructure and leading global EV charging deployment (especially China); high adoption of digital payment solutions.

- Latin America (LATAM): High reliance on traditional fuels; market growth tied to economic stability; challenges include infrastructure investment gaps and potential regulatory unpredictability regarding fuel subsidies.

- Middle East and Africa (MEA): Dominated by national oil companies; focus shifting towards diversification and modernization; significant opportunities in developing integrated fuel/retail offerings as part of urbanization projects, particularly in the GCC states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filling Station and Gas Station Market.- Shell

- ExxonMobil

- BP

- TotalEnergies

- Chevron

- Saudi Aramco

- Sinopec

- PetroChina

- Rosneft

- Reliance Industries

- EG Group

- Circle K (Alimentation Couche-Tard)

- Speedway (7-Eleven)

- Phillips 66

- Valero Energy

- ENI

- Lukoil

- PDVSA

- Indian Oil Corporation (IOC)

- Marathon Petroleum

Frequently Asked Questions

Analyze common user questions about the Filling Station and Gas Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is the growth of electric vehicles (EVs) impacting traditional gas station profitability?

EV growth primarily restrains future volume demand for liquid fuels, forcing gas stations to diversify revenue streams. Profitability is increasingly maintained through high-margin non-fuel retail (convenience stores and food services) and the installation of fast-charging infrastructure, transitioning the station model from a quick fuel stop to a mobility and retail destination.

What is the primary revenue driver for modern filling stations?

While liquid fuel sales still account for the majority of sales volume, the primary driver for profit margins in mature markets is increasingly the convenience store retail segment (C-stores), including prepared food, beverages, and general merchandise. This non-fuel revenue provides higher margins necessary to offset static or declining fuel sales margins.

What are the critical technological investments for gas stations in the next five years?

Critical investments include the deployment of ultra-fast DC EV charging infrastructure, integration of sophisticated AI and IoT systems for dynamic pricing and predictive maintenance, implementation of robust cybersecurity for payment systems, and adoption of unified digital platforms to manage fuel, retail, and charging operations efficiently.

Which geographical region exhibits the fastest market expansion for new filling station sites?

The Asia Pacific (APAC) region, particularly driven by rapid urbanization and economic development in China and India, shows the fastest expansion in the establishment of new physical filling station sites and supporting infrastructure to meet the rising demand from expanding vehicle populations.

What regulatory challenges are most significant in the Filling Station Market?

The most significant regulatory challenges involve increasingly stringent environmental standards related to underground storage tank compliance, vapor recovery systems, and emissions reduction mandates. Additionally, government initiatives promoting mandated blending of biofuels and the regulation of pricing mechanisms for both traditional fuels and EV charging pose complexity for operators.

How does the convenience store segment mitigate market risks?

The convenience store segment mitigates market risks by providing a stable, high-margin counter-balance to the volatility and declining long-term prospects of liquid fuel sales. By transforming the site into a multi-purpose retail outlet, operators can capture revenue during the extended dwell times necessitated by EV charging and secure stable income independent of fluctuating global oil prices.

What role does telematics play in the commercial fleet segment?

Telematics plays a vital role by integrating fuel and charging transactions directly with fleet management systems. This enables automated tracking of fuel consumption, optimization of driver routes to preferred stations, seamless digital payment processing, and comprehensive data analytics for reducing operational costs and improving audit compliance for commercial logistics companies.

What are the operational advantages of Company-Owned, Company-Operated (COCO) stations?

COCO operational models offer companies maximum control over branding, pricing, service quality, and rapid implementation of new technologies (like advanced POS systems or EV chargers). This model ensures operational consistency across the network, which is critical for maintaining strong brand equity and leveraging centralized management efficiencies.

How is the hydrogen fuel market segment developing within the overall filling station landscape?

The hydrogen fuel segment is emerging slowly, primarily focused on supporting heavy-duty transport (trucks and buses) and specific regional initiatives (e.g., California, Germany, Japan). While capital intensive, dedicated hydrogen refueling stations are being strategically developed at major logistics hubs to position operators for the long-term adoption of fuel cell electric vehicles (FCEVs) in commercial applications.

What is Answer Engine Optimization (AEO) in the context of this market?

AEO in this context involves structuring content (like this report and FAQs) using clear headings, concise paragraphs, and direct answers to anticipated user questions. This optimization ensures that generative AI models and search engines can easily extract and present accurate, high-quality snippets about market size, drivers, and key technological shifts directly to the end-user.

Define the concept of a 'Mobility Hub' in the context of gas stations.

A Mobility Hub is the evolution of a traditional gas station, offering a diversified suite of services beyond liquid fuels. This typically includes fast EV charging, convenience retail, integrated food service, parcel pick-up/drop-off, and potentially last-mile transport options (e.g., e-bike rentals), serving as a comprehensive stop for various modern transportation and convenience needs.

How do global oil price fluctuations affect retail gas station operators?

Volatile global oil prices lead to fluctuating wholesale fuel costs, which operators must manage by adjusting retail prices. While operators aim to pass costs through, rapid price changes can squeeze fuel margins, making inventory management (timing purchases) crucial, and further stressing the need for stable, non-fuel revenue streams to cushion financial impacts.

What challenges are unique to rural filling stations compared to urban ones?

Rural stations face unique challenges including lower customer density, higher transportation costs for fuel delivery, greater difficulty in attracting skilled labor, and slower connectivity for implementing advanced digital technologies. However, they often benefit from less direct competition and serve a captive local or long-haul customer base.

What is the significance of the 2026 to 2033 forecast period for the market?

This forecast period is critical as it is expected to encompass the inflection point where the rate of decline in liquid fuel demand accelerates due to widespread EV penetration, especially in developed economies. The market structure will fundamentally shift, requiring major capital allocation toward alternative energy infrastructure and retail diversification to ensure long-term viability.

How is cybersecurity managed within the payment systems of a modern gas station?

Cybersecurity is managed through multi-layered defenses, including adherence to PCI DSS standards, mandatory use of EMV chip and PIN technology, end-to-end encryption of transactional data, robust network segmentation (separating POS systems from corporate networks), and active threat monitoring to protect customer financial information and operational integrity.

What impact does urbanization have on filling station location strategy?

Urbanization increases the demand for highly efficient, compact sites that maximize throughput and leverage high density to support premium convenience retail. Station location strategy shifts toward high-traffic arterial roads and neighborhood centers, often focusing on smaller footprints that can accommodate EV charging without extensive land use, contrasting with large highway travel centers.

Explain the role of sustainability reporting in the context of major oil company owned stations.

Major oil companies are under increasing pressure from stakeholders (investors, consumers, regulators) to demonstrate sustainability. Sustainability reporting covers metrics like site energy consumption, waste management, investments in renewable energy infrastructure (solar panels on canopies), and progress in deploying low-carbon fuels and EV charging, enhancing corporate environmental, social, and governance (ESG) credentials.

What are the key differences between CODO and DODO operational models?

In the CODO (Company-Owned, Dealer-Operated) model, the major oil company owns the physical assets (land and infrastructure) but contracts an independent dealer to run daily operations. In the DODO (Dealer-Owned, Dealer-Operated) model, the dealer owns both the assets and the operation, often franchising the brand name, providing the independent dealer with greater autonomy but also greater financial risk and capital responsibility.

How is personalized marketing being utilized at the pump?

Personalized marketing utilizes data gathered through loyalty programs and mobile apps. AI analyzes purchase history and frequency to deliver customized offers—often displayed via digital signage at the pump or sent via mobile notification—for convenience store items, car washes, or fuel discounts, aimed at increasing the customer’s basket size during their visit.

What is the primary constraint to widespread hydrogen refueling infrastructure development?

The primary constraint is the extremely high capital cost associated with building hydrogen production, transportation, and specialized high-pressure dispensing infrastructure, coupled with the current low volume of hydrogen fuel cell vehicles (FCEVs), creating a significant chicken-and-egg problem concerning investment viability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager