Film and Video Production Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433224 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Film and Video Production Market Size

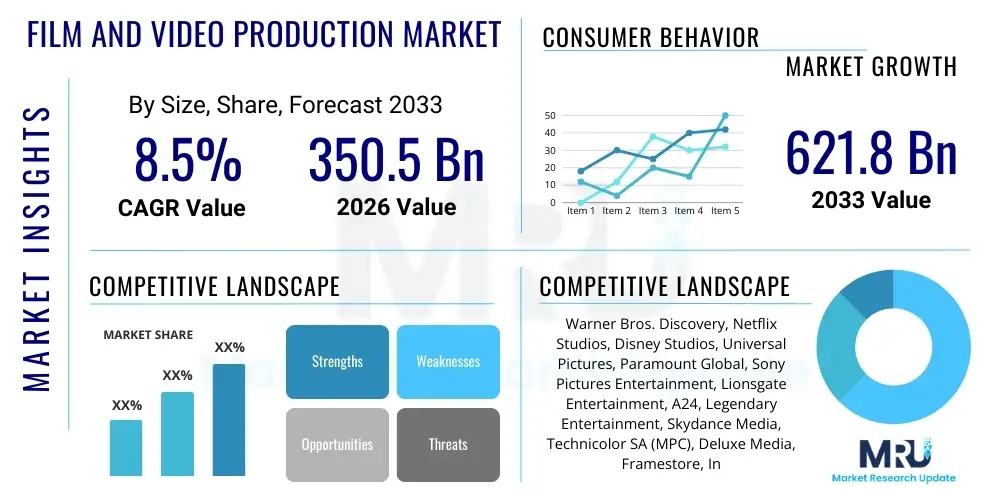

The Film and Video Production Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 621.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the exponential expansion of digital media consumption globally, coupled with the relentless demand for high-quality, original content across streaming platforms, traditional broadcasters, and corporate sectors. The shift toward direct-to-consumer models necessitates continuous, aggressive investment in production capabilities, particularly in high-end episodic content and large-scale virtual production environments, significantly boosting the overall market valuation and operational throughput across all geographical segments. The increasing sophistication of audience expectations regarding visual fidelity and narrative depth mandates higher budgets for specialized services, ensuring sustained financial influx into the production ecosystem.

The valuation reflects substantial investment across the entire production lifecycle, including comprehensive pre-production (extensive script development, detailed budgeting, logistical planning), resource-intensive principal photography (advanced cinematography, lighting, sound capture), and complex post-production workflows (editing, sophisticated visual effects, immersive sound design, color grading). Furthermore, the emergence of advanced production technologies, such as virtual production (VP) environments utilizing massive interconnected LED volumes, sophisticated 8K camera systems, and proprietary real-time rendering engines (often derived from the gaming industry), contributes significantly to the total market capitalization. These technological shifts are not merely incremental improvements but foundational changes that reshape labor requirements and capital expenditure profiles within the film and video production industries, enabling scale previously considered unattainable.

The projected expansion rate is further supported by the increasing fragmentation of viewing platforms, which generates demand for content specifically tailored for various devices and consumer consumption habits, including short-form vertical video, interactive narratives, and specialized content for augmented and virtual reality experiences. The global content arms race among major streaming service providers ensures that competition remains fierce, compelling studios to finance larger slates of diverse, high-value projects year-over-year. Moreover, governmental incentives and attractive tax relief programs offered by numerous nations to encourage localized filming contribute materially to the sustained high investment levels observed throughout the forecast period, cementing the market’s trajectory toward reaching the projected USD 621.8 Billion valuation by 2033. This continuous cycle of investment and technological integration underscores the fundamental stability and long-term potential of the global film and video production market, despite periodic economic volatility.

Film and Video Production Market introduction

The Film and Video Production Market encapsulates the complete spectrum of activities involved in the creation of motion pictures and video content for various distribution platforms. This industrial ecosystem spans from conceptualization and financing to the final delivery of the content product, encompassing highly specialized creative and technical disciplines. The industry's primary output includes high-budget motion pictures for theatrical release, serialized television content (both traditional broadcast and streaming originals), commercials, corporate communication videos, and digital-native content. The fundamental goal of this market is to effectively translate narrative concepts into engaging visual media that resonates with target audiences globally, requiring coordination among specialized personnel, advanced equipment, and complex scheduling logistics. The market’s operational model is highly project-based, demanding flexible resource scaling and specialized vendor relationships for successful execution of diverse production requirements across multiple formats and platforms.

A detailed product description necessitates segmenting the output into distinct format categories, including long-form narrative features designed for cinematic exhibition, high-episode-count television series optimized for binge-watching on streaming platforms, educational modules developed for continuous learning environments, and short-form branded content designed for rapid digital impact across social media channels. Major applications of professional film and video production are extensive; while entertainment remains the largest segment, critical secondary applications include sophisticated corporate branding, complex internal training modules, government public service messaging, and archival documentation. The intrinsic benefits derived from leveraging professional video production services are profound: they enable unparalleled levels of emotional engagement, facilitate complex information transfer through visual storytelling, ensure brand consistency across international markets, and drive essential subscription or advertising revenue for media platforms, making it indispensable in the modern communication landscape.

Key driving factors underpinning the market expansion are multi-faceted. Firstly, the fierce competition for consumer attention within the digital sphere continually raises the bar for production quality, demanding investment in premium cinematography and sophisticated post-production effects. Secondly, the globalization of content licensing and distribution means that a single production can generate revenue across dozens of territories simultaneously, encouraging larger initial financial commitments from studios. Finally, the confluence of technical breakthroughs—such as more accessible 4K/HDR technology, efficient cloud-based editing solutions, and real-time visualization tools—reduces certain production bottlenecks, enabling faster project turnover and maximizing the production cycle efficiency, thereby supporting the overall market growth trajectory. The commitment of major technology companies to developing proprietary content libraries also provides substantial, reliable funding streams into the production services sector, guaranteeing sustained activity and innovation.

Film and Video Production Market Executive Summary

The Film and Video Production Market is currently undergoing a transformative phase marked by accelerated vertical integration and a global pivot towards serialized episodic content that fuels subscription economies. Business trends are dominated by strategic mergers and acquisitions aimed at consolidating content libraries and production capacity, alongside a heavy emphasis on proprietary technology development for distribution and workflow optimization. This consolidation trend enables major players to exert greater control over the entire value chain, from content creation to direct consumer interface, reducing reliance on third-party licensing and enhancing profit margins. Furthermore, the reliance on data analytics to inform creative decisions, particularly in predicting audience acceptance and optimizing marketing spend, has become a standard operational practice among leading production houses.

Regional trends highlight a pronounced shift in production focus; while North America remains the primary financial hub due to established infrastructure and access to global capital markets, the Asia Pacific region is rapidly dominating volume growth and creative output diversity, driven by massive investments in local language content that caters specifically to regional demographics. This geographical diversification introduces both challenges related to logistical coordination and opportunities for cross-cultural storytelling and international co-financing structures, forcing studios to develop complex, multi-territory production strategies. Europe continues to excel in leveraging co-production treaties and government incentives to maintain a competitive edge, focusing on creative excellence alongside commercial viability, balancing public funding with private investment.

Key segment trends reveal the sustained dominance of Post-Production Services, especially in advanced Visual Effects (VFX) and sound design, as the final quality differentiator for high-budget streaming and theatrical releases. Within Content Type segmentation, scripted television and streaming series are unequivocally outpacing traditional feature film production volume, primarily due to the subscription models prioritizing consistent content refresh cycles and serialized narratives that encourage viewer retention. The market is also witnessing a conscious commitment to sustainability (Green Production initiatives), driven by corporate social responsibility and regulatory pressures in certain regions, which impacts material sourcing, power consumption on set, and overall logistical planning. Successful market participation mandates flexibility, technological literacy, and a robust global network capable of handling complex international co-production financing and distribution obligations simultaneously.

AI Impact Analysis on Film and Video Production Market

Industry stakeholders and end-users frequently pose critical questions concerning the long-term impact of Artificial Intelligence (AI) on the creative integrity, employment landscape, and operational scalability within the Film and Video Production Market. The primary thematic focus revolves around the balance between automation efficiency and artistic control. Users inquire about the efficacy of AI in generating synthetic scripts, performing realistic voice synthesis, and automating complex post-production tasks such as rotoscoping, content logging, and initial edit assembly. A significant concern is the ethical implementation of generative AI, particularly regarding intellectual property rights, creator attribution, and the potential erosion of established craft skills due to reliance on automated tools. Expectations are high for AI’s role in logistical optimization, utilizing machine learning to predict audience taste, optimize distribution strategies, and precisely manage vast digital asset libraries, allowing production companies to allocate human capital towards higher-value creative endeavors.

The integration of AI extends deeply into the pre-production phase, where analytical tools assess millions of data points related to historical viewing patterns and genre success rates to inform greenlighting decisions, thereby minimizing speculative investment risks. During the physical production phase, AI assists in optimizing camera movements, managing complex virtual set environments in real-time, and ensuring continuity checks across multiple takes. However, the most visible impact is concentrated in post-production, where AI algorithms drastically reduce the manual labor required for tasks like motion tracking, object removal, and scene segmentation, offering a pathway to significantly reduced post-production timelines and associated costs. This shift necessitates retraining existing workforce members to manage and refine AI outputs rather than performing the underlying repetitive tasks themselves, creating new specialized roles in prompt engineering, algorithmic oversight, and ethical AI deployment within creative teams.

Furthermore, AI is poised to revolutionize content personalization and accessibility. Machine learning models can dynamically adjust content elements—such as subtitles, audio mixing, or even specific visual details—to optimize engagement for individual viewers based on their psychological profile or consumption context, moving beyond static, one-size-fits-all broadcasts. While the promise of efficiency is vast, the industry continues to grapple with the legal and creative implications, including securing robust licensing for AI training data and establishing clear guidelines on when synthetic media constitutes an infringement on human creative authorship. The successful deployment of AI hinges on regulatory clarity and industry consensus on ethical use, ensuring that the technology serves to augment human creativity rather than diminish its value, fostering a future where AI becomes an indispensable collaborative partner in content creation and optimization.

- Automated Script Analysis: AI assists in assessing genre classification, audience appeal, and commercial viability of scripts, significantly accelerating the greenlight process for studios by providing quantifiable risk assessments and identifying potential market saturation risks.

- Deepfake and Synthesis Technology: Use of AI for hyper-realistic digital doubles, voice replication, and seamless scene extension, minimizing the need for expensive location shoots, intricate scheduling around key talent, and costly re-shoots.

- Intelligent Post-Production: Automation of repetitive editing tasks, detailed sound equalization, initial color grading passes, and dynamic noise reduction, substantially improving speed, consistency, and fidelity in large-scale content pipelines.

- Personalized Content Delivery: Algorithms recommend tailored viewing sequences or dynamically adjust subtle narrative elements and marketing materials based on individual viewer engagement data, crucial for enhancing subscriber retention and maximizing viewing time across OTT platforms.

- Efficient Resource Management: AI optimizes complex production schedules, monitors equipment performance and allocation in real-time, and identifies optimal shooting windows and location availability by simulating millions of logistical scenarios, thereby minimizing potential delays and cost overruns.

- Predictive Analytics for Financing: Machine learning models forecast expected return on investment (ROI) for specific projects based on comprehensive analysis of historical performance data, cast appeal metrics, genre market health, and emerging audience trend identification, supporting strategic investment decisions.

- Enhanced Visual Effects (VFX) Workflows: AI accelerates high-fidelity rendering times, automates labor-intensive rotoscoping and keying processes, and generates complex environmental elements and particle simulations, dramatically accelerating the often-bottlenecked VFX pipeline and reducing reliance on manual frame-by-frame effort.

- Digital Asset Management (DAM): Automated tagging, categorization, and searchable indexing of massive libraries of raw footage and archived content using advanced computer vision and natural language processing, ensuring that assets are readily accessible and efficiently managed throughout their lifecycle.

- Localized Dubbing and Subtitling: AI rapidly translates, synthesizes, and accurately lip-syncs dubbed audio tracks across multiple languages using neural networks, dramatically reducing the time and cost associated with global content distribution and comprehensive localization efforts while improving viewer experience quality.

DRO & Impact Forces Of Film and Video Production Market

The Film and Video Production Market is fundamentally shaped by powerful growth drivers such as the relentless expansion of global streaming platforms and the associated demand for exclusive, high-budget original programming. Drivers are intrinsically linked to consumer behavior, notably the shift away from linear television toward on-demand digital consumption, necessitating a continuous supply chain of premium video content across all genres, supported by global internet penetration growth which expands the addressable market dramatically. Furthermore, the democratization of high-quality filmmaking equipment lowers entry barriers, fostering a vibrant ecosystem of independent creators and production studios capable of generating high-caliber content efficiently. Restraints primarily involve escalating production costs, the persistent challenge of content piracy, and significant skill shortages in highly technical domains like advanced VFX and virtual production management, all of which threaten project profitability and sustainable growth, necessitating strategic mitigation efforts.

However, the industry faces severe restraints, particularly in the form of talent scarcity for highly specialized roles and the highly volatile nature of content success, making large upfront investments inherently risky. Securing adequate financing for projects remains complex, often requiring intricate co-production agreements or substantial studio backing with demanding contractual terms. The constant need for rapid technological upgrades (e.g., transitioning to HDR, 4K, or 8K workflows) represents a high capital expenditure constraint, particularly for smaller independent production entities struggling to keep pace with industry standards set by the major studios. These high operating costs, coupled with the systemic threat of intellectual property theft and illegal distribution, exert downward pressure on potential revenue generation, demanding sophisticated security solutions.

Opportunities abound in the burgeoning fields of localized content production tailored for specific regional demographics and the massive, untapped potential of Extended Reality (XR) content (VR/AR/Metaverse experiences). Opportunities lie significantly in leveraging decentralized, cloud-based production models, exploiting niche market demands for specialized content (e.g., educational, sustainability-focused), and integrating blockchain technology for improved content rights management and transparent royalty payments, which could mitigate some piracy concerns and enhance creator trust. These dynamics collectively create strong impact forces, pushing the industry toward greater technological adoption and necessitating new, sophisticated financing and distribution models to sustain high growth levels while strategically mitigating financial and operational risks associated with large-scale, high-value projects in a globally competitive marketplace.

Segmentation Analysis

The Film and Video Production Market is segmented based on Content Type, End-User, Revenue Source, and Production Stage, providing a comprehensive framework for market analysis and strategic planning. Content Type segmentation is crucial, differentiating between Feature Films, which typically seek high upfront theatrical revenue, and Episodic Content (TV series), which prioritizes sustained long-term licensing revenue and subscriber engagement for streaming platforms. Episodic content currently dominates market share growth due to the recurring nature of subscription service models. End-user categorization distinguishes between the massive expenditures of Media and Entertainment companies (studios, broadcasters, OTT platforms) and the rapidly expanding commercial enterprises (marketing agencies, corporations) that utilize video as a core element of their operational and outreach strategies, each segment possessing distinct requirements regarding budget, speed, and creative scope.

Further delineation is provided by segmenting based on Production Stage, recognizing the specialized nature and distinct cost centers associated with Pre-Production (development, rights acquisition, and planning), Principal Photography (physical shooting and technical execution), and Post-Production (editing, VFX, sound design). Post-Production services, particularly those involving complex computer-generated imagery (CGI), color science, and digital restoration, represent a consistently high-growth sub-segment due to the ever-increasing visual demands placed upon modern cinema and television, requiring continuous investment in specialized hardware and highly skilled technical personnel. The efficiency of transitions between these stages, often facilitated by cloud collaboration tools, is a key determinant of overall project success and cost efficiency across the market.

Revenue Source segmentation reveals the critical dependence on licensing fees from Subscription Video on Demand (SVOD) providers, which have largely supplanted traditional Box Office performance as the primary indicator of financial success for many studio projects, alongside significant, but inherently volatile, advertising revenue generated by AVOD platforms and linear broadcasters. Understanding these revenue streams is essential for strategic planning, as investment priorities differ significantly: feature film investment targets peak global theatrical success followed by windows licensing, whereas episodic content investment prioritizes long-term subscriber retention metrics. The continuous evolution of these segments necessitates that production companies remain agile, capable of scaling technical infrastructure and specialized talent pools to meet diverse, fluctuating demands from various end-users and adapt to rapidly changing distribution monetization models globally.

- By Content Type:

- Feature Films (Theatrical, Direct-to-Video releases, focusing on global marketing potential and high per-unit cost)

- Episodic Content (TV Series, Web Series, including high-budget limited series and lower-cost factual or reality formats)

- Commercials and Advertisements (High-frequency, short-form content targeting brand visibility and direct digital marketing impact)

- Documentaries and Non-Fiction (Focusing on factual content, often supported by specialized distribution platforms and educational licensing)

- Corporate and Educational Videos (Internal communications, e-learning modules, product demonstration videos, prioritizing clarity and professional presentation)

- Music Videos and Short Form Content (Essential for driving engagement on social media and specialized music platforms, often characterized by high visual creativity and rapid delivery schedules)

- By End-User:

- Media and Entertainment (Major Studios, Traditional Broadcasters, Pure-play OTT Platforms, specialized content aggregators)

- Corporate Sector (Fortune 500 Companies, Marketing Agencies, B2B and B2C enterprises utilizing video for sales, training, and crisis management)

- Government and Public Sector (Public service announcements, legislative documentation, cultural preservation projects, often adhering to strict compliance requirements)

- Non-Profit Organizations (Fundraising campaigns, awareness videos, mission statements, often highly sensitive to budget constraints)

- By Revenue Source:

- Box Office Revenue and Theatrical Rights (Traditional exhibition model, highly affected by global events and local regulations)

- Subscription Video on Demand (SVOD) Licensing Fees (Dominant, stable revenue stream from recurring platform licenses based on volume and exclusivity)

- Advertising Video on Demand (AVOD) Revenue (Ad-supported models, reliant on high viewership numbers, regional ad rates, and sophisticated programmatic advertising technologies)

- Direct Production Service Fees (Income from commissioning entities like corporate clients or specific governmental grants, highly customized per project)

- Broadcast and Cable Licensing (Traditional television rights sales, a gradually diminishing but still significant source, particularly in regions with limited high-speed internet penetration)

- By Production Stage:

- Pre-Production Services (Script development, detailed budgeting, storyboarding, casting, location scouting, essential for early risk management and creative alignment)

- Production Services (Principal photography, sophisticated sound recording, set construction, on-location crew hire, specialized equipment rental, physical execution)

- Post-Production Services (Editing, Advanced Visual Effects (VFX), Immersive Sound Design and Mixing, Precision Color Correction, Localization and Mastering, high-tech infrastructure dependency and creative finishing)

- By Format Technology:

- Traditional 2D Production (Standard cinema and broadcast quality content, still the largest segment by volume)

- 3D and Stereoscopic Production (Specialized format for certain theatrical releases and themed ride experiences, niche market)

- Virtual and Augmented Reality (VR/AR) Content (Immersive experiences requiring specialized capture, processing, and delivery methods, rapidly growing segment)

- High Frame Rate (HFR) and Large Format Production (Used for specific cinematic effects and premium exhibition formats)

Value Chain Analysis For Film and Video Production Market

The Film and Video Production value chain is an intricate sequence of interconnected, high-value activities that transforms an initial creative concept into a monetized media asset distributed globally. Upstream analysis begins with Intellectual Property (IP) origination, involving writers, conceptual artists, and development executives who secure financing and initial rights. This critical stage determines the creative and financial scope, heavily involving specialized legal counsel and financial intermediaries such as studio development funds or private equity groups. Suppliers at this stage include literary agents, specialized legal firms, and early-stage investors. Efficiency in the upstream is paramount as flawed concepts or inadequate financing at this level can lead to significant cost overruns or project abandonment further down the line, emphasizing robust risk assessment and detailed script analysis before committing substantial resources to physical production.

The core of the value chain is the Physical Production and Post-Production phase. Physical production relies heavily on suppliers such as high-end equipment rental companies (specialized cameras, lighting rigs, grips), specialized crew providers (cinematographers, sound mixers, specialized technicians), and facilities management (sound stages, studio complexes, backlots). This stage is exceptionally capital and labor-intensive, often geographically dispersed, and subject to complex logistical and regulatory hurdles. Post-production, which immediately follows, is increasingly technology-driven, utilizing specialized post-houses for advanced services like Visual Effects (VFX), which require massive, scalable computing power, specialized software licenses, and highly skilled digital artists. The seamless efficiency of data transfer, collaborative editing platforms (often cloud-based), and sufficient rendering farm capacity are crucial factors determining the speed and cost control in this central, high-tech segment of the value chain.

Downstream analysis focuses explicitly on content Distribution and Exhibition, where the final monetization of the media asset occurs. Distribution channels are rapidly bifurcating into Direct and Indirect models. Direct distribution involves content owners leveraging their own digital platforms (OTT) to reach consumers instantly, maintaining maximum control over audience data and recurring revenue streams, maximizing the lifetime value of the content. Indirect distribution includes licensing content to third-party broadcast networks, cinema operators (theatrical exhibition), or international content distributors who handle complex foreign rights sales across non-owned platforms. The effectiveness of the downstream strategy, informed by sophisticated predictive analytics regarding audience preference and windowing optimization, directly dictates the final revenue yield. The strategic evolution favoring digital distribution has fundamentally altered the power dynamics, increasingly favoring entities that own both content IP and the necessary distribution infrastructure.

Film and Video Production Market Potential Customers

The Film and Video Production Market serves a highly concentrated yet diverse clientele, where demand volume is heavily influenced by the competitive dynamics of the content landscape and the need for continuous, engaging programming. The paramount customers (End-Users/Buyers) are major global Media and Entertainment conglomerates, encompassing the six major Hollywood studios and their extensive network of subsidiaries, alongside the largest global Over-The-Top (OTT) streaming providers like Netflix, Amazon Prime Video, Disney+, and HBO Max. These entities represent the largest source of demand for high-volume, premium content—ranging from animated features to high-stakes drama series—required to drive subscription figures, reduce churn, and maintain global market penetration, making them the primary clients for major production studios and independent houses globally. Their buying patterns are characterized by long-term strategic investments in intellectual property and high-risk, high-reward projects designed for mass global appeal and critical recognition.

The second substantial customer segment is the Corporate and Commercial sector, spanning multinational enterprises, dedicated advertising and public relations agencies, and internal marketing departments across nearly every major industry vertical. These customers commission production services for mission-critical objectives such as consumer marketing campaigns, advanced virtual reality training simulations, executive communications, and detailed product tutorials. This segment highly values partners capable of delivering rapid, high-quality output compliant with strict brand guidelines and often involves sophisticated technical requirements related to complex 3D animation, motion graphics integration, and integrated digital marketing strategies. They favor specialized production houses focusing on commercial agility, measurable impact, and rapid deployment across various digital ad networks, often operating on fixed deadlines rather than multi-year schedules.

Furthermore, government and public sector organizations represent reliable buyers, commissioning production for public education campaigns, tourism promotion videos, cultural heritage documentaries, and critical crisis communication announcements, often requiring compliance with accessibility standards and complex bureaucratic oversight. Educational institutions globally utilize specialized production houses to create comprehensive e-learning content and high-quality course modules, a market segment that grew significantly post-pandemic, focusing on pedagogical effectiveness and robust online delivery platforms. This broad spectrum of buyers underscores the market's resilience, demonstrating that professional video production is an essential service utilized not only for pure entertainment but also as a core driver for corporate engagement, educational dissemination, and governmental transparency, ensuring a steady, diversified, and growing revenue stream for the production service providers across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 621.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Warner Bros. Discovery, Netflix Studios, Disney Studios, Universal Pictures, Paramount Global, Sony Pictures Entertainment, Lionsgate Entertainment, A24, Legendary Entertainment, Skydance Media, Technicolor SA (MPC), Deluxe Media, Framestore, Industrial Light & Magic (ILM), Weta Digital, BBC Studios, Endemol Shine Group, Fremantle, ViacomCBS, The Weinstein Company (Legacy Assets), MediaPro, Pinewood Group, EUE/Screen Gems, Shepperton Studios, DNEG, Cinesite, Prime Focus World, Beijing Enlight Media, Toho Co. Ltd., CJ Entertainment, Bani-J Productions, Reliance Entertainment, Tencent Pictures, Alibaba Pictures, Studio Ghibli, Working Title Films, Focus Features, Miramax |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Film and Video Production Market Key Technology Landscape

The technological evolution within the Film and Video Production Market is centered on achieving photorealistic fidelity, streamlining complex workflows, and facilitating hyper-efficient remote collaboration necessary for global projects. A foundational shift is the pervasive adoption of Virtual Production (VP), which utilizes enormous, interconnected LED walls driven by real-time gaming engines such as Unreal Engine and Unity. This technology enables filmmakers to instantly render and photograph complex digital environments and lighting setups directly on set, minimizing the need for extensive post-production compositing and reducing environmental impact associated with distant location shooting. Concurrently, the proliferation of high-resolution image capture (4K, 6K, and 8K) combined with High Dynamic Range (HDR) standards mandates continuous upgrades in camera sensor technology, data storage capacity, and the entire post-production infrastructure, demanding specialized grading suites and color science expertise to manage the enhanced data loads effectively and maintain color accuracy across diverse viewing platforms.

Cloud-based solutions and Software as a Service (SaaS) platforms represent another critical technological pillar, enabling secure, real-time collaboration across editing, visual effects, and sound mixing teams located in different continents. Cloud rendering farms offer scalable computing power on demand, crucial for handling the immense processing requirements of modern VFX sequences and high-resolution mastering, transitioning CapEx to OpEx models for computing resources. Specialized proprietary software, often incorporating sophisticated machine learning algorithms, automates labor-intensive tasks within the VFX pipeline—such as rotoscoping, camera tracking, and cloth simulation—thereby improving output consistency and accelerating project timelines significantly. This robust digital infrastructure underpins the industry's shift toward remote-first operational models, ensuring business continuity and reliable access to global talent pools irrespective of geographical constraints, making production logistics far more flexible and less dependent on physical location.

Furthermore, Artificial Intelligence (AI) is transforming content intelligence, moving beyond simple automation to sophisticated prediction. AI tools are increasingly employed for predictive content valuation, optimized advertising placement within AVOD streams, and hyper-efficient digital asset management, where computer vision automatically catalogs, tags, and indexes every frame of raw footage, making large archives instantly searchable and reusable. Security technology, including advanced Digital Rights Management (DRM) and blockchain applications, is also rapidly maturing to protect valuable Intellectual Property from piracy during distribution and to ensure transparent, automated royalty payments across complex international licensing agreements. These interconnected technologies collectively drive the market towards higher capital intensity but offer proportional gains in creative flexibility, workflow efficiency, superior image quality, and potential return on investment (ROI) through sophisticated, data-driven decision-making processes, marking a new era of technologically enhanced filmmaking.

Regional Highlights

North America, particularly the United States, maintains its established leadership in the Film and Video Production Market, characterized by the presence of all major global studios, immense capital investment in high-budget content (tent-pole features and flagship streaming series), and superior technological infrastructure, including extensive sound stage capacity and advanced post-production facilities. The region is the primary driver of technological adoption, notably in areas like Virtual Production and high-end VFX, and dictates global trends in licensing and distribution agreements, leveraging its massive domestic market and powerful cultural influence globally. The density of specialized creative and technical talent, coupled with sophisticated financing mechanisms (including dedicated film funds and tax equity structures), reinforces North America's status as the core financial and creative hub of the global market, setting the benchmark for production quality, scale, and innovative business model implementation.

The Asia Pacific (APAC) region is indisputably the engine of future market growth, recording the highest expected Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributable to explosive increases in internet accessibility and smartphone penetration, converting millions of new consumers into digital content viewers across populous nations like India, China, and Indonesia. South Korea's massive cultural export success (K-Content) demonstrates the global appeal of high-quality, regionally produced content, encouraging massive domestic investment across the region. Governmental initiatives often support local production quotas and infrastructure development, minimizing reliance on Western production imports and fostering unique, localized content ecosystems that cater directly to regional cultural nuances and linguistic preferences, creating highly competitive local OTT markets and significant opportunity for content localization services.

Europe, leveraging its long cinematic history and strong cultural emphasis on film, remains a robust market segment, characterized by high production values and diverse content offerings. Countries such as the UK, Germany, and France utilize comprehensive tax incentives, beneficial co-production treaties, and strong public funding bodies (like the BBC or Arte) to maintain high levels of production activity, attracting both internal European projects and major international studio shoots seeking favorable financial conditions and access to highly skilled crews and world-class technical facilities. Latin America and the Middle East & Africa (MEA) represent important emerging markets with rapidly scaling capabilities. Latam focuses on developing Spanish- and Portuguese-language originals for global streaming platforms, benefiting from shared language markets, while MEA is investing heavily in centralized media zones (e.g., Dubai Media City, Neom) to rapidly build infrastructure, specialized talent pools, and technical capacity, transitioning these regions from content importers to significant domestic and regional content creators, thereby contributing materially to the global diversity of film and video production volume and cultural exchange.

- North America: Dominant market size, characterized by high capital expenditure, leader in technological implementation (VP, 8K, HDR), stable and sophisticated financial structures, and the headquarters for most global content distributors and major studios.

- Asia Pacific (APAC): Highest CAGR growth driven by explosive increases in digital access, massive domestic content demand (India, China, South Korea), global success of localized content, and significant government investment in media infrastructure development and talent nurturing.

- Europe: Strong regulatory support, effective tax incentive schemes, established co-production frameworks, high quality of specialized technical labor, and resilient public broadcasting production segments balancing artistic merit with commercial viability.

- Latin America: Rapidly increasing demand for regional Spanish and Portuguese content acquisition by global streamers, emerging hub status for production services in Mexico and Brazil, and rising consumer spending on digital entertainment subscriptions, driving demand for telenovelas and local dramas.

- Middle East and Africa (MEA): Significant infrastructure investment in specialized media cities, government-backed cultural industry development, and emerging local talent driving domestic film and series production aimed at regional audience consumption patterns, often supported by sovereign wealth funds focused on diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Film and Video Production Market.- Warner Bros. Discovery

- Netflix Studios

- Disney Studios

- Universal Pictures

- Paramount Global

- Sony Pictures Entertainment

- Lionsgate Entertainment

- A24

- Legendary Entertainment

- Skydance Media

- Technicolor SA (MPC)

- Deluxe Media

- Framestore

- Industrial Light & Magic (ILM)

- Weta Digital

- BBC Studios

- Endemol Shine Group

- Fremantle

- ViacomCBS

- The Weinstein Company (Legacy Assets)

- MediaPro

- Pinewood Group

- EUE/Screen Gems

- Shepperton Studios

- DNEG

- Cinesite

- Prime Focus World

- Beijing Enlight Media

- Toho Co. Ltd.

- CJ Entertainment

- Bani-J Productions

- Reliance Entertainment

- Tencent Pictures

- Alibaba Pictures

- Studio Ghibli

- Working Title Films

- Focus Features

- Miramax

Frequently Asked Questions

Analyze common user questions about the Film and Video Production market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the Film and Video Production Market growth?

The primary factor driving market growth is the exponential expansion and intense competition among Over-The-Top (OTT) streaming platforms, which requires a constant, high-volume supply of premium, original episodic and feature film content to attract and retain global subscribers, necessitating aggressive investment in production capabilities worldwide.

How is Artificial Intelligence (AI) currently affecting film production workflows?

AI is primarily used to optimize technical and logistical workflows, automating tasks like script analysis, sophisticated metadata tagging, efficient scheduling, and enhancing labor-intensive visual effects processing. This allows production teams to achieve faster turnaround times and allocate human capital towards higher-level creative decision-making and execution.

Which technology is revolutionizing set design and location shooting?

Virtual Production (VP) utilizing large LED volume stages and real-time rendering engines (like Unreal Engine) is revolutionizing set design, enabling filmmakers to capture complex digital environments and realistic lighting conditions in-camera on set, drastically reducing the need for costly green screens, remote location travel, and lengthy post-production compositing processes.

Which geographical region holds the highest growth potential for the film market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapidly increasing digital consumption, vast domestic markets in countries like India and China, and surging global demand for high-quality localized content (such as K-Content and Bollywood productions).

What are the main restraints impacting the profitability of production companies?

The main restraints include rapidly escalating production budgets, driven by high demand for A-list talent and the constant requirement for expensive technology upgrades (e.g., 8K, HDR), alongside the persistent and damaging financial impact of digital content piracy and fragmented global regulatory landscapes, increasing financial risk.

How significant is the Corporate Video segment within the overall market structure?

The Corporate Video segment is increasingly significant, driven by the need for businesses to utilize broadcast-quality content for digital marketing, internal communications, training, and brand storytelling. This segment provides stable, high-frequency revenue for agile production agencies specializing in commercial efficiency and rapid digital deployment.

What is vertical integration and why is it a key business trend in this market?

Vertical integration refers to major studios controlling both the production facilities and the final distribution channels (i.e., owning the studio and the streaming platform). This is a key trend as it allows companies to secure exclusive content supply, optimize production-to-market timelines, and maximize revenue capture by bypassing third-party licensing costs and ensuring content exclusivity.

What role does cloud computing play in modern film production?

Cloud computing is essential for enabling secure, large-scale remote collaboration, particularly in post-production workflows (editing, VFX rendering, color grading). It provides on-demand scalable storage, secure asset management, and crucial processing power necessary to handle the immense data volumes generated by high-resolution capture formats across global teams, enhancing workflow flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager