Film Faced Plywood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437202 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Film Faced Plywood Market Size

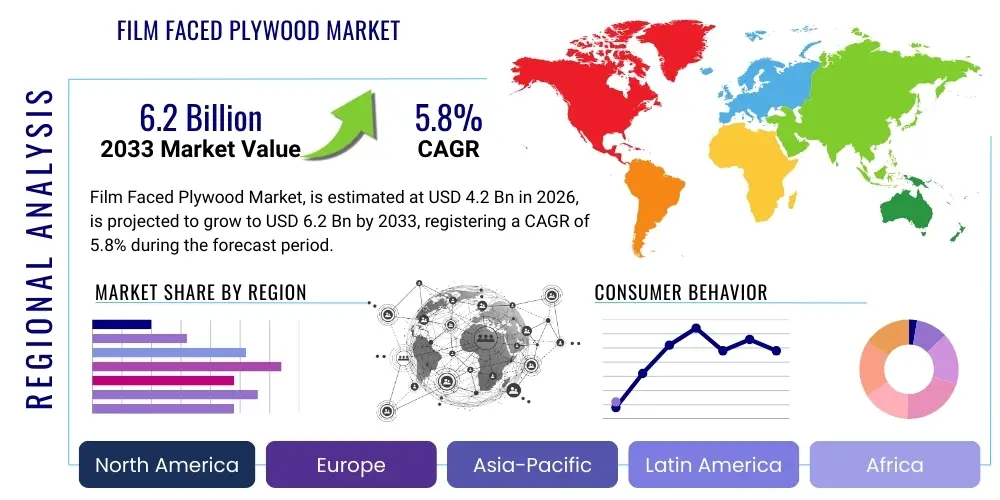

The Film Faced Plywood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Film Faced Plywood Market introduction

Film Faced Plywood (FFP) is a highly durable wood panel overlaid with phenolic resin film, primarily utilized in concrete formwork applications due to its smooth surface, high resistance to abrasion, moisture penetration, and chemical damage. This specialized plywood is constructed by bonding multiple veneers under high pressure, followed by the application of a thermosetting resin film on both faces, often finished with sealed edges to maximize lifespan and reusability. The primary function of FFP is to create seamless, high-quality concrete surfaces, thereby minimizing the need for extensive post-pouring finishing work, offering significant time and cost efficiencies in large-scale construction projects.

Major applications of FFP span across the construction industry, including infrastructure development (bridges, tunnels, highways), residential and commercial building construction (high-rises, basements), and specialized industrial installations. The inherent strength, rigidity, and the ability of FFP to withstand multiple cycles of use make it an indispensable material for temporary structures requiring high load-bearing capacity and a flawless finish. The product is categorized based on its core material, such as birch, poplar, or mixed hardwood, with birch generally commanding a premium due to its superior density and mechanical properties, offering maximum lifespan and dimensional stability for demanding applications.

The market growth is fundamentally driven by the accelerated pace of urbanization, particularly in emerging economies of the Asia Pacific, necessitating extensive investment in residential and commercial infrastructure. Furthermore, stringent quality standards in modern engineering and architectural design demand materials that ensure concrete surface quality and longevity, directly benefiting the FFP market. The increasing global emphasis on resilient and efficient construction methodologies, coupled with the rising adoption of standardized construction forms, further solidifies the market trajectory, making FFP a crucial component in contemporary building practices worldwide.

Film Faced Plywood Market Executive Summary

The Film Faced Plywood market is characterized by robust growth, primarily propelled by the burgeoning construction and infrastructure sectors globally, particularly focusing on vertical development and heavy civil engineering projects. Business trends indicate a strong shift toward sustainable sourcing and the integration of advanced coating technologies to enhance panel durability and reduce formaldehyde emissions, aligning with stricter international environmental regulations. Key manufacturers are focusing on establishing localized production facilities closer to major consumption hubs in Asia and the Middle East to mitigate logistical challenges and high transportation costs. Strategic partnerships between plywood manufacturers and large-scale formwork system providers are becoming increasingly prevalent, aiming to offer integrated solutions to major construction conglomerates, ensuring consistent quality and supply chain optimization across geographically dispersed projects.

Regionally, Asia Pacific maintains its dominance, driven by massive government investments in smart city projects, urbanization initiatives, and the sustained growth of the housing sector in countries like China, India, and Indonesia. Europe exhibits mature market characteristics, with growth driven by maintenance, repair, and overhaul (MRO) activities, and a high demand for premium birch-based FFP known for its exceptional reusability and compliance with rigorous European standards. North America shows stable growth, fueled by commercial construction and the energy sector's infrastructure needs, including large industrial foundations and specialized structures. The Middle East and Africa (MEA) region is emerging as a high-potential market due to large-scale infrastructure mega-projects associated with vision programs and preparations for global events, creating substantial, though often cyclical, demand for specialized formwork materials.

Segment trends reveal that the use of High-Density Polyethylene (HDPE) film and specialized anti-slip coatings is gaining traction, especially in applications requiring worker safety enhancements, such as scaffolding and temporary platforms. The Birch core segment is expected to witness the highest revenue growth, reflecting the industry's preference for superior quality and maximum return on investment through increased panel lifespan. In terms of application, infrastructure and heavy civil construction remains the largest segment, but residential building construction is projected to grow rapidly, driven by prefabricated housing techniques that rely on consistent, reusable formwork materials. Furthermore, the standardization of formwork systems across the industry is driving the demand for panels with highly precise dimensional tolerances, influencing manufacturing quality control protocols significantly.

AI Impact Analysis on Film Faced Plywood Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Film Faced Plywood market predominantly revolve around supply chain efficiencies, predictive maintenance for manufacturing equipment, and AI’s role in optimizing wood resource utilization and quality control. Users frequently question how AI algorithms can predict fluctuations in raw material pricing (lumber, resins) and subsequent finished product demand, allowing for better inventory management. There is significant interest in using machine vision systems integrated with AI for automated grading of veneer sheets and detecting microscopic defects in the phenolic film application process, thereby ensuring adherence to rigorous quality standards and minimizing material wastage. Furthermore, construction firms are investigating how AI-driven project management tools can optimize formwork scheduling and reuse cycles on-site, indirectly influencing the purchasing volumes and specifications of FFP required per project.

- AI-Enhanced Quality Control: Deployment of machine vision and deep learning models for real-time defect detection in veneer sorting and resin film lamination, improving panel consistency and reducing manual inspection time.

- Predictive Supply Chain Optimization: Utilizing AI to forecast global timber price volatility and logistics bottlenecks, enabling manufacturers to optimize raw material procurement strategies and inventory levels.

- Manufacturing Process Optimization: Application of machine learning algorithms to fine-tune press temperatures, cycle times, and resin quantity, leading to reduced energy consumption and improved panel bonding strength.

- Formwork Management Integration: AI integration into construction management software to optimize the utilization rate of FFP on construction sites, predicting the remaining lifecycle of panels and informing replacement schedules.

- Demand Forecasting Accuracy: Advanced analytics and AI predicting regional construction booms and material requirements, allowing manufacturers to scale production dynamically and efficiently allocate inventory.

DRO & Impact Forces Of Film Faced Plywood Market

The Film Faced Plywood market is shaped by a critical balance of intrinsic growth drivers, specific market restraints, and significant opportunities, all subjected to overarching impact forces influencing strategic decision-making. The primary driver is the accelerating global investment in infrastructure, particularly in developing nations, coupled with the inherent advantages of FFP over traditional steel or plastic formwork in terms of cost-effectiveness, ease of handling, and superior surface finish. Simultaneously, the market faces significant restraint from the volatile pricing of raw timber veneers and petrochemical-derived resins, which introduces instability into production costs and pricing strategies, often compounded by stringent environmental regulations concerning sustainable forestry and formaldehyde emission limits. However, the opportunity landscape is vast, centered on the development of ultra-durable, environmentally friendly variants (e.g., using bio-based resins) and the expansion into niche applications such as transport flooring and specialized storage solutions, allowing for market diversification beyond core construction formwork.

Impact forces govern how swiftly and decisively these internal factors manifest in market outcomes. The high competitive intensity, driven by low barriers to entry for standard-grade FFP producers, particularly in Asia, keeps profit margins under constant pressure, forcing established players to differentiate through quality, specialized coatings, and certified sustainability. Technological advancements, acting as a secondary force, influence both manufacturing efficiency (e.g., faster pressing cycles, automated edge sealing) and product differentiation (e.g., anti-slip films, specialized color coding). Economic cycles, specifically construction downturns or interest rate hikes affecting large projects, serve as powerful external forces capable of swiftly decelerating demand across multiple regions. Furthermore, trade protectionist policies, such as anti-dumping duties targeting certain exporting nations, significantly restructure supply chains and regional pricing dynamics, forcing manufacturers to rethink their global distribution models and sourcing footprints.

The market’s overall trajectory is thus defined by the imperative to manage raw material volatility while capitalizing on persistent global infrastructure growth. Success relies heavily on leveraging superior product quality—often achieved through technological investment—to justify a premium price point, thereby insulating key players from the severe price competition observed in the commodity-grade segment. The sustained focus on certified quality (e.g., conformity to European EN standards or specific national codes) and guaranteed reusability is increasingly becoming a non-negotiable factor for large construction procurement entities, dictating purchasing power and supplier selection processes, making reliability a core competitive advantage.

Segmentation Analysis

The Film Faced Plywood market is meticulously segmented across core material type, film overlay specifications, thickness variations, and end-use application, providing a granular view of market dynamics and consumer preferences. This segmentation is crucial for manufacturers to tailor production strategies and optimize product portfolios to meet specialized demands across different construction methodologies and geographies. The performance characteristics of FFP—including reusability, water resistance, and strength—are fundamentally tied to the specifications within these segments, particularly the quality of the core and the density of the phenolic resin film. Understanding these sub-markets allows for targeted marketing and strategic allocation of resources toward the fastest-growing and highest-margin segments, such as premium birch FFP utilized in high-frequency concrete pouring operations requiring dozens of reuse cycles.

- By Core Material:

- Birch

- Poplar

- Combi (Mixed Hardwood and Softwood)

- Others (Eucalyptus, Tropical Hardwood)

- By Film Overlay Type:

- Phenolic Resin Film

- Melamine Film

- Polypropylene (PP) Film

- High-Density Polyethylene (HDPE) Film

- By Thickness:

- 6mm - 12mm

- 15mm - 18mm

- 21mm and Above

- By Application:

- Construction and Infrastructure Formwork

- Residential and Commercial Building

- Transport and Logistics (Vehicle Flooring)

- Furniture and Interior Design

- Others (Storage Systems, Scaffolding Platforms)

Value Chain Analysis For Film Faced Plywood Market

The value chain for Film Faced Plywood starts with intensive upstream activities focused on sustainable timber harvesting and veneer production, moving through highly specialized manufacturing processes, and concluding with a complex, often fragmented, downstream distribution system serving diverse end-user segments. Upstream analysis highlights the sourcing of quality timber, which is heavily influenced by forest certification schemes (e.g., FSC, PEFC) and global commodity markets. Veneer preparation, including rotary cutting, drying, and grading, is a critical initial stage, setting the foundation for the final product's strength and dimensional stability. The procurement of thermosetting resins (typically phenol-formaldehyde or melamine-urea-formaldehyde) is another key upstream activity, influenced by petrochemical pricing and environmental regulations regarding volatile organic compound (VOC) emissions, driving material cost volatility in the subsequent manufacturing stage.

The central manufacturing stage involves high-precision assembly where graded veneers are cross-layered, glued, and pressed under heat and pressure to form the plywood core, followed by the crucial step of overlaying the core with the resin-impregnated film. Quality control at this stage is paramount, focusing on bonding integrity, film weight uniformity, and the precise sealing of panel edges to maximize moisture resistance and service life. The manufacturing process itself requires significant capital investment in large hot presses and sophisticated gluing machinery. Post-production, the downstream structure manages the connection to the end user. Distribution channels are bifurcated into direct sales to large construction firms (often for bespoke or high-volume orders) and indirect sales through specialized distributors, trading houses, and construction material retailers, catering to smaller contractors and regional projects.

Direct distribution often includes value-added services such as technical consultation on formwork design and material optimization, ensuring the correct grade and thickness are supplied for specific engineering requirements. Indirect channels, while providing broad market access, introduce multiple layers of handling, potentially impacting the final product cost and delivery speed. Specialized trading houses play a vital role in international logistics, managing customs, large-scale warehousing, and localized inventory management, particularly in regions where manufacturing capacity is low relative to construction demand. The efficiency of the distribution network, especially the availability of standard sizes and rapid turnaround times, significantly influences customer satisfaction and market penetration, making logistics optimization a key competitive battleground.

Film Faced Plywood Market Potential Customers

The primary customers for Film Faced Plywood are construction contractors and specialized formwork companies engaged in medium-to-large scale infrastructure and building projects, demanding materials that offer high reusability and consistent surface quality for concrete pouring. These buyers prioritize product specifications such as the number of guaranteed pouring cycles, resistance to alkali attack from wet concrete, and dimensional stability, seeking to minimize total project costs through durable formwork rather than initial material purchase price savings. Civil engineering firms focusing on complex structures like bridges, dams, and metro systems represent a high-value customer segment, requiring premium, highly durable birch or high-specification hardwood FFP that can endure harsh conditions and precise architectural specifications.

A secondary, rapidly growing customer base includes manufacturers of prefabricated concrete elements (precast segment), where FFP is used as the mold surface to achieve the smooth finish required for factory-controlled production environments. These customers demand highly uniform quality and surfaces free of imperfections, contributing to low rejection rates in their manufacturing lines. Furthermore, customers in the transport sector, specifically manufacturers and repair shops for trucks, trailers, and railway carriages, purchase FFP (often specialized anti-slip variants) for durable, waterproof flooring applications. This diversified demand base ensures that manufacturers must maintain a flexible product line catering not only to the cyclical construction industry but also to more stable industrial and specialized transport sectors, managing varying needs for strength, surface finish, and weather resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sveza, UPM-Kymmene, Riga Plywood, Paged Group, Greenply Industries, Luli Group, Samling Global, Maderas Abreu, Georgia-Pacific, Weyerhaeuser Company, Starplywood, China Foma Group, Fantoni Group, Metsä Wood, Wanhua Plywood, Century Plyboards (I) Ltd., Al-Khorayef Group, Unilin Group, Huber Engineered Woods, and Timber Products Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Film Faced Plywood Market Key Technology Landscape

The technological landscape of the Film Faced Plywood market is primarily defined by advancements in adhesive chemistry, specialized surface coating applications, and high-precision manufacturing techniques aimed at maximizing product longevity and reducing environmental impact. A significant technological focus is placed on the development of low-VOC and zero-formaldehyde emission resins, responding directly to stringent global health and safety standards, particularly in Europe and North America. Manufacturers are investing heavily in innovative resin formulations, such as those derived from bio-based sources or specialized methylene diphenyl diisocyanate (MDI) adhesives, which offer superior bonding strength and water resistance while adhering to E0 or CARB-compliant emission limits. This shift not only improves product compliance but also enhances the durability of the final product, extending the number of reuse cycles, which is a critical performance metric for large construction customers and provides a strong competitive advantage in the premium segment.

Furthermore, significant technological progress is evident in the film overlay manufacturing process. This includes the application of specialized film types beyond standard phenolic paper, such as High-Density Polyethylene (HDPE) films, which offer exceptional abrasion resistance and chemical inertness, making them ideal for high-alkali concrete applications or areas exposed to harsh weather. Advanced manufacturing lines now incorporate automated film laying systems and synchronized press cycles that ensure uniform film weight and perfect adhesion across the entire panel surface, mitigating common issues such as bubbling or peeling. Edge sealing technology is also undergoing continuous refinement, moving from simple paint application to sophisticated, highly water-resistant polyurethane or specialized rubber-based sealants. Effective edge sealing is paramount as it prevents moisture ingress into the vulnerable core, which is the primary cause of panel delamination and premature failure, thereby directly influencing the commercial viability and operational cost-effectiveness of the panel.

The integration of Industry 4.0 principles, including sensor technology and automated quality control, represents another crucial technological area. Modern plywood mills utilize sophisticated non-destructive testing (NDT) techniques, such as ultrasonic or near-infrared spectroscopy, to continuously monitor the internal bonding strength and moisture content of the panels during production. This real-time data acquisition allows for instantaneous adjustments to pressing parameters, optimizing efficiency and ensuring every panel meets the required structural and durability standards. The adoption of advanced veneer drying technology, including veneer scanning and moisture sorting equipment, ensures that only optimally conditioned veneers are used, minimizing internal stresses and warpage in the final FFP product. These manufacturing precision improvements are critical for meeting the demanding dimensional tolerances required by modern modular and prefabricated construction systems, solidifying the market's trajectory towards high-quality, high-tech engineered wood products.

Regional Highlights

- Asia Pacific (APAC)

- Europe

- North America

- Middle East and Africa (MEA)

- Latin America (LATAM)

The APAC region constitutes the largest and fastest-growing market for Film Faced Plywood globally, driven by unprecedented levels of infrastructure development and urbanization across emerging economies. Countries such as China, India, and Indonesia are undertaking massive government and private sector investments in residential housing, commercial complexes, transportation networks (rail, road, port expansion), and energy projects. This relentless construction activity creates an enormous, sustained demand for FFP, positioning the region as the central hub for both production and consumption. While local production capacity is vast, encompassing a wide range of grades from commodity to high-quality, the competitive landscape is intense, favoring manufacturers who can manage complex supply chains and offer cost-effective solutions tailored to high-volume project specifications.

The primary trend in APAC involves the increasing adoption of higher-grade FFP, moving away from cheaper, less durable alternatives, as project managers recognize the long-term cost savings associated with extended panel reusability. Furthermore, the region is witnessing a rapid expansion in precast concrete manufacturing, which necessitates highly uniform and durable formwork materials to maintain product quality and production efficiency. Despite strong growth, the region faces challenges related to inconsistent wood sourcing quality and environmental compliance enforcement, prompting international buyers to prefer products sourced from certified European or North American producers for high-specification projects, though local leaders are increasingly investing in proprietary technology and sustainable forestry certifications.

Europe is a mature market characterized by a strong emphasis on premium quality, sustainability, and high technical specifications, particularly within the Scandinavian and Eastern European countries which are major producers of high-quality birch FFP. Demand is driven by complex civil engineering projects, a robust MRO sector, and specialized formwork applications that require exceptional durability and guaranteed dimensional tolerance, often exceeding 50 reuse cycles. The market adheres strictly to European Norms (EN) regarding performance, safety, and environmental standards (such as E1 and E0 emission levels), dictating procurement policies for both manufacturers and end-users. The highly structured nature of European construction markets, coupled with long-term contracts for large-scale construction system providers, ensures stable, though slower, growth compared to APAC.

Key trends include the growing prominence of sustainable and certified wood products (FSC/PEFC) and the increasing adoption of specialized, non-slip FFP for temporary structures and transport vehicle applications, reflecting a focus on worker safety and specialized niche markets. Production within Europe, particularly centered around the birch resources of Russia, Finland, and the Baltics, benefits from established technological expertise and efficient logistics networks. However, the market remains vulnerable to geopolitical instability affecting timber supply chains and faces persistent pressure from lower-cost imports, forcing domestic producers to continually innovate through specialized coatings, customized panel sizing, and enhanced technical support to maintain their premium market positioning.

The North American FFP market exhibits stable growth, highly reliant on large-scale commercial, industrial, and infrastructure projects, particularly in the energy and transportation sectors. The market is defined by a strong preference for domestically manufactured or high-quality imported products, often favoring thicker panels (e.g., 18mm or 19mm) that meet specific regional building codes and construction practices, which frequently use standardized modular formwork systems. While hardwood and fir plywood form the local core base, premium birch FFP is imported primarily for projects requiring maximum reusability and superior concrete finishes, especially in architectural concrete applications.

Regulatory landscapes, particularly those enforced by organizations like the APA (The Engineered Wood Association) and specific regional building departments, play a significant role in material specification and acceptance. A growing trend involves the integration of FFP within proprietary formwork rental systems offered by large equipment providers, bundling the material with the overall formwork solution, which standardizes demand and ensures quality control. The US market, being highly consumer-conscious regarding environmental issues, also sees rising demand for products complying with stringent emissions standards and originating from sustainably managed forests, influencing purchasing decisions across residential and commercial development segments significantly.

The MEA market is highly dynamic and characterized by large, cyclical fluctuations driven by massive government-backed infrastructure and urbanization mega-projects, particularly in the GCC nations (Saudi Arabia, UAE, Qatar). The region relies heavily on imports, primarily sourcing standard and high-grade FFP from Europe and Asia, dictated by the immediate scale and complexity of ongoing projects such as new cities, major transport links, and preparatory construction for international events. Extreme climate conditions in the region necessitate FFP with enhanced water and heat resistance, leading to demand for specialized, high-quality phenolic resin films and robust edge sealants to prevent panel degradation under high temperatures and prolonged sun exposure.

Growth is fueled by diversification initiatives away from oil dependency, leading to sustained investment in non-oil sectors like tourism, real estate, and manufacturing zones. However, the market faces challenges related to volatile import duties, complex logistics, and fluctuating project timelines. Key opportunities lie in localized manufacturing partnerships and the provision of FFP bundled with comprehensive formwork design and technical consultation services, addressing the rapid requirement for reliable, high-volume material supply for large, time-sensitive construction contracts. South Africa also serves as a key regional hub, showing consistent demand for construction materials driven by industrial and mining infrastructure needs.

The LATAM market is characterized by heterogeneity in demand and sourcing, with local manufacturing capacity existing alongside significant imports, particularly for high-grade FFP required for major civil works. Brazil, Mexico, and Chile represent the largest consumption centers, driven by sustained, though often economically unstable, residential construction and public works projects. The region typically utilizes softwood cores (like pine) and combi cores for standard applications due to local resource availability, with imported birch FFP reserved for high-precision, architectural applications where surface quality is non-negotiable.

Market growth is highly sensitive to macroeconomic factors, including currency exchange rates, interest rates, and political stability, which directly impact the financing and execution of large construction projects. Key trends include the formalization of construction practices and increasing demand for certified products, moving away from non-standardized materials. Opportunities exist in optimizing supply chains to reduce import costs and developing FFP variants specifically tailored to withstand the varying humidity and tropical conditions prevalent across the continent, focusing on superior adhesion technologies and antifungal treatments to prolong panel life in challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Film Faced Plywood Market.- Sveza

- UPM-Kymmene

- Riga Plywood

- Paged Group

- Greenply Industries

- Luli Group

- Samling Global

- Maderas Abreu

- Georgia-Pacific

- Weyerhaeuser Company

- Starplywood

- China Foma Group

- Fantoni Group

- Metsä Wood

- Wanhua Plywood

- Century Plyboards (I) Ltd.

- Al-Khorayef Group

- Unilin Group

- Huber Engineered Woods

- Timber Products Company

Frequently Asked Questions

Analyze common user questions about the Film Faced Plywood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Film Faced Plywood?

The primary driver is the rapid increase in global infrastructure development, particularly large-scale civil engineering projects and high-rise commercial construction, where FFP's high reusability and ability to produce smooth, superior concrete finishes offer significant cost and time efficiencies over conventional formwork materials.

How does the core material impact the performance and cost of FFP?

The core material dictates strength, weight, and lifespan. Birch core FFP offers maximum density, dimensional stability, and reusability (up to 50+ cycles), positioning it in the premium, higher-cost segment. Poplar or mixed hardwood cores are generally lighter, suitable for standard applications, and offer fewer reuse cycles, catering to the mid-range market.

What are the key technological advancements influencing FFP quality?

Key advancements include the development of low-formaldehyde and bio-based phenolic resins for superior bonding and environmental compliance, and the utilization of specialized film overlays like HDPE and anti-slip coatings that enhance abrasion resistance and panel longevity, alongside automated edge sealing for critical moisture protection.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC) holds the largest market share due to unparalleled growth in construction and urbanization projects across major economies such as China, India, and Southeast Asian nations. This massive scale of infrastructure investment translates directly into the highest volume demand for formwork materials, including FFP.

What is the significance of edge sealing in the extended life of Film Faced Plywood?

Edge sealing is crucial as it protects the vulnerable plywood core from moisture penetration and chemical attack from concrete and weather. High-quality polyurethane or specialized rubber-based sealants prevent water ingress, which is the leading cause of panel delamination and premature failure, thereby maximizing the FFP's reuse cycles and overall return on investment.

Are sustainability certifications important in the FFP market?

Yes, sustainability certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) are critically important, especially in regulated markets like Europe and North America. These certifications guarantee that the wood source is legally and sustainably managed, increasingly becoming a mandatory procurement requirement for large contractors and public works projects.

How does the thickness of the plywood panel affect its application?

Thicker panels (18mm and above) provide greater strength and rigidity, making them essential for high-load formwork systems, deep pours, or large-span construction where deflection must be minimized. Thinner panels (6mm to 12mm) are typically used for specific curved formwork, non-structural temporary applications, or as specialized facing material for existing structures, requiring less load-bearing capacity.

What role do anti-slip FFP variants play in the construction industry?

Anti-slip FFP, featuring structured wire-mesh or specialized embossed films, plays a vital role in enhancing worker safety. These variants are primarily used for scaffolding platforms, temporary pedestrian walkways, ramp surfaces, and transport vehicle flooring where reliable grip, even when wet, is essential to prevent accidents and comply with safety regulations.

What is the difference between Phenolic Film and Melamine Film overlays?

Phenolic resin film is superior in durability and moisture resistance, offering a higher number of reuses and better protection against alkali in concrete, commonly used for high-end structural formwork. Melamine film is less durable, offers fewer reuse cycles, and is often used for less demanding, general-purpose applications where cost sensitivity is higher, or for furniture manufacturing.

How is the volatility of raw material prices restrained by manufacturers?

Manufacturers attempt to mitigate raw material volatility (lumber and resin) through strategies such as forward contracts for large volume procurement, establishing diversified sourcing channels across different geographies, and investing in advanced inventory management systems, often utilizing AI-driven forecasting to predict price spikes and optimize purchasing timings.

What is the outlook for FFP usage in prefabricated (precast) concrete construction?

The outlook is highly positive. Precast concrete requires molds that deliver precise dimensions and flawless surface finishes consistently. FFP, particularly high-grade birch variants, is the preferred material for these molds due to its dimensional stability and guaranteed smooth surface, making it crucial for the efficiency and quality control in factory-based element production.

Why are logistics and distribution challenges significant in the FFP market?

Logistics challenges arise from the bulkiness and weight of plywood panels, leading to high transportation costs, especially across continents or to remote project sites. Manufacturers must manage complex import/export regulations, specialized container loading, and localized warehousing to ensure materials reach construction sites on time, making supply chain efficiency a key determinant of competitive success.

How do competitive dynamics affect pricing strategies for FFP?

High competitive intensity, especially in the commodity-grade segment dominated by Asian manufacturers, puts downward pressure on pricing and profit margins. Established players counter this by emphasizing product differentiation, certifying high reusability guarantees, and offering technical support services, allowing them to maintain premium pricing in specialized and high-quality segments.

What specific challenges does the Film Faced Plywood market face in the Middle East and Africa (MEA)?

The MEA region faces challenges related to extreme climatic conditions (high heat and sun exposure), reliance on imports leading to high logistical costs, and cyclical demand tied to government mega-projects. Materials supplied must demonstrate superior resistance to heat and moisture degradation to maintain performance standards on site.

Is there a trend toward replacing FFP with plastic or metal formwork?

While plastic and metal formwork systems exist, FFP maintains a significant market share due to its superior versatility, lower initial cost, ease of cutting and modification on-site, and ability to deliver extremely smooth concrete surfaces quickly. The trend is toward using FFP within integrated modular systems, rather than total replacement, leveraging the strengths of each material.

What are the environmental concerns related to FFP manufacturing?

Primary environmental concerns revolve around sustainable timber sourcing (deforestation risk) and the use of formaldehyde-based resins. The industry is mitigating these concerns by adopting certified forestry practices (FSC/PEFC) and transitioning to low-emission (E0/CARB compliant) and alternative bio-based adhesives, enhancing the product's ecological footprint.

Which application segment provides the greatest revenue for FFP manufacturers?

The infrastructure and heavy civil construction segment, covering projects like bridges, tunnels, large foundations, and public utilities, provides the greatest revenue due to the large volumes of FFP required for extensive, complex formwork setups that often mandate high-strength and highly durable panels.

How do quality standards (e.g., European EN) influence procurement decisions?

Adherence to recognized quality standards like European EN or national standards ensures product performance consistency, especially regarding dimensional stability, bonding strength, and reusability guarantees. Large-scale construction procurement is often mandated to source FFP meeting these specific codes to minimize project risk and ensure structural integrity.

What is Combi core plywood and where is it typically used?

Combi core plywood utilizes a combination of hardwood and softwood veneers, blending the strength and density of hardwood in external layers with the lighter weight or lower cost of softwood in the inner layers. It is widely used for general construction formwork applications where a balance between strength, cost, and moderate reusability is required.

How does AI technology benefit FFP manufacturers in terms of material utilization?

AI, particularly through machine vision systems, enables automated inspection and grading of raw veneers, detecting flaws and optimizing the cutting pattern to maximize usable material from each log. This minimizes waste and ensures that only the appropriate quality veneers are used for specific FFP grades, enhancing resource efficiency substantially.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager