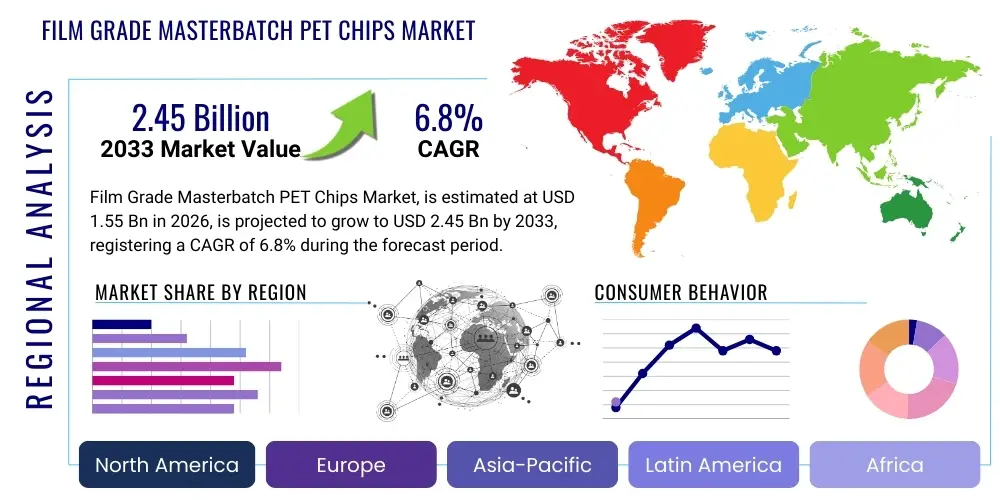

Film Grade Masterbatch PET Chips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436368 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Film Grade Masterbatch PET Chips Market Size

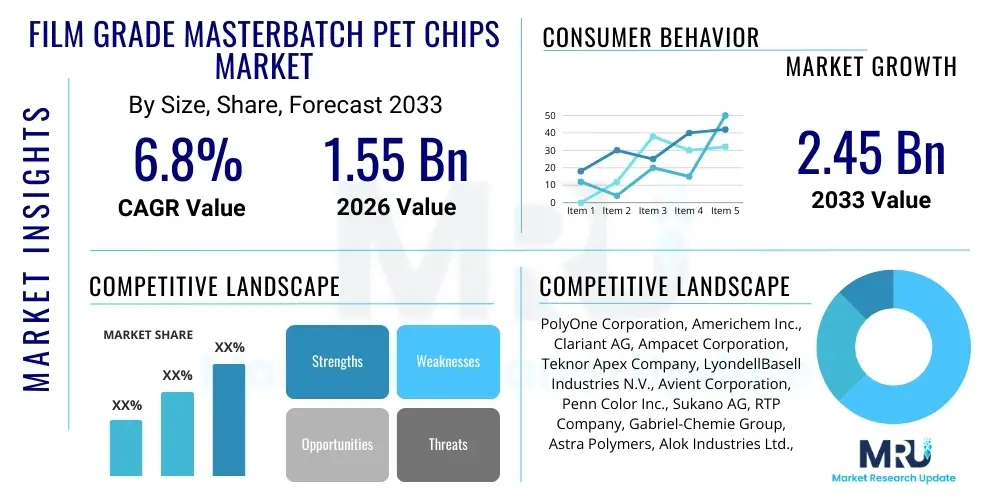

The Film Grade Masterbatch PET Chips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Film Grade Masterbatch PET Chips Market introduction

The Film Grade Masterbatch PET Chips market encompasses specialized polyethylene terephthalate (PET) granules that have been compounded with high concentrations of additives, colorants, or functional agents (the masterbatch). These compounded chips are specifically engineered for use in film extrusion processes, offering enhanced mechanical, optical, or barrier properties to the final film product. Unlike standard PET chips used for injection molding or bottle blowing, film grade chips are optimized for high clarity, uniform thickness, and excellent processability under demanding film production conditions, making them essential components in multilayer packaging, agricultural films, and protective barrier applications. The inherent advantages of PET, such as superior barrier properties against moisture and gases, combined with the customization offered by masterbatches, positions this segment for robust expansion driven by stringent packaging requirements in the food and pharmaceutical industries.

Product differentiation in this market relies heavily on the quality and functionality of the masterbatch integrated into the PET matrix. Key products include white masterbatches for opacity in dairy packaging, black masterbatches for UV protection in agricultural films, and additive masterbatches designed to improve slip, anti-static characteristics, or flame retardancy. The primary applications for these high-performance films include flexible packaging for processed foods, shrink films, specialized industrial strapping films, and medical-grade blister packaging. The versatility of Film Grade Masterbatch PET Chips allows manufacturers to precisely tailor the final film product to meet specific regulatory compliance and consumer aesthetic demands, directly contributing to product longevity and shelf appeal.

Major market growth is fundamentally driven by the escalating global demand for convenient, lightweight, and durable packaging solutions, particularly in rapidly developing economies across Asia Pacific. Furthermore, the increasing focus on material sustainability has pushed manufacturers toward developing recyclable and bio-based PET chip alternatives, often compounded with functional masterbatches to maintain performance while reducing environmental impact. The robust physical properties of PET films, including their high tensile strength and chemical resistance, further secure their position as preferred materials over conventional polymers in numerous high-specification applications. These driving factors, coupled with continuous innovation in compounding technology, ensure sustained market trajectory throughout the forecast period.

Film Grade Masterbatch PET Chips Market Executive Summary

The Film Grade Masterbatch PET Chips Market is characterized by dynamic business trends centered on sustainability integration, technological advancements in barrier films, and intensive regional shifts toward Asia Pacific manufacturing dominance. Business trends are significantly shaped by regulatory pressures in North America and Europe mandating increased recyclability and reduced plastic usage, prompting manufacturers to invest heavily in mono-material solutions utilizing specialized PET chips that maintain film integrity without complex multi-polymer layers. Regional trends indicate that while consumption remains high in established Western markets, the exponential growth in flexible packaging and fast-moving consumer goods (FMCG) sectors in China, India, and Southeast Asia is catapulting the APAC region into the leading position for both production and consumption, necessitating capacity expansion and localized supply chain establishment by global players. Segmentation trends reveal a pronounced shift toward functional masterbatches, particularly those imparting oxygen scavenging or antimicrobial properties, alongside a stable, yet critical, demand for high-quality white and color masterbatches used for branding and aesthetic purposes in high-volume consumer goods packaging.

Strategic movements within the market involve key mergers and acquisitions aimed at vertically integrating the supply chain, securing consistent access to purified terephthalic acid (PTA) and monoethylene glycol (MEG), and acquiring niche expertise in specialized additive formulation. Companies are increasingly collaborating with recycling organizations to close the loop, developing chips compatible with chemical or mechanical recycling processes, thus positioning themselves favorably in an environment where circular economy principles are paramount. Furthermore, the competitive landscape is intensifying with regional producers offering cost-effective solutions, compelling major international firms to emphasize premium, high-performance products and technical support to maintain market share. This strategic focus on performance and sustainability is redefining investment priorities across the industry, favoring innovation that reduces material usage while enhancing protective capabilities.

In essence, the market outlook remains strongly positive, anchored by the indispensable role of PET in flexible packaging and supported by continuous technological breakthroughs addressing the material science challenges of film thinness, strength, and barrier performance. The executive summary highlights a resilient market adapting swiftly to environmental demands, leveraging geographical manufacturing advantages, and investing strategically in masterbatch functionality to meet the evolving needs of end-users ranging from sensitive medical devices to high-speed food processing lines. Success in this evolving landscape is predicated on agility in raw material procurement and a commitment to providing advanced, regulatory-compliant film solutions.

AI Impact Analysis on Film Grade Masterbatch PET Chips Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Film Grade Masterbatch PET Chips Market typically revolve around operational efficiency, product quality consistency, and the acceleration of material innovation. Users frequently ask how AI can predict raw material price volatility (PTA/MEG) to optimize procurement, how machine learning (ML) algorithms improve the consistency of masterbatch dispersion during compounding (a critical quality parameter for film optics), and whether AI-driven simulation tools can rapidly develop novel PET formulations with enhanced barrier properties. Concerns often focus on the required investment in smart manufacturing infrastructure and the integration challenges between legacy compounding equipment and sophisticated AI monitoring systems. These thematic inquiries indicate a strong expectation that AI will primarily serve as a powerful tool for predictive maintenance, hyper-optimization of extrusion parameters, and accelerating the research and development pipeline for high-performance, sustainable film solutions, thereby reducing waste and time-to-market.

The application of AI in the manufacturing phase is particularly transformative, moving traditional compounding processes from reactive quality control to predictive optimization. AI algorithms analyze vast datasets encompassing extruder torque, temperature profiles, flow rates, and material input characteristics in real-time. This analysis allows the system to instantaneously adjust process variables to ensure uniform masterbatch dispersion, which is crucial for achieving consistent color saturation, opacity, and mechanical properties across large batches of film-grade chips. By minimizing deviations in dispersion, AI directly reduces scrap rates and enhances the overall quality consistency demanded by high-speed film processors, ensuring that the final film meets the stringent specifications required for sensitive applications like food contact materials.

Beyond process control, AI is revolutionizing material science R&D for PET masterbatches. Generative AI models and ML tools are used to simulate the performance of various additive chemistries (e.g., UV stabilizers, nucleating agents, barrier enhancers) when compounded with PET, predicting the resulting film characteristics without the need for extensive physical lab trials. This virtual prototyping significantly shortens the development cycle for specialized chips, allowing manufacturers to rapidly respond to market demands for attributes like improved heat sealing or advanced oxygen barrier capabilities. Furthermore, AI-driven supply chain platforms enhance transparency and resilience by modeling complex logistics networks, predicting potential bottlenecks, and optimizing inventory levels for both raw materials and finished goods, thereby ensuring a stable supply of Film Grade Masterbatch PET Chips to global customers.

- AI-driven predictive maintenance optimizes compounding machinery uptime, reducing operational costs.

- Machine learning algorithms enhance the uniformity of masterbatch dispersion, ensuring high film quality and consistent color matching.

- AI simulates novel PET additive formulations, accelerating R&D for advanced barrier and sustainable film chemistries.

- Predictive analytics optimize raw material procurement (PTA/MEG), mitigating cost volatility impacts.

- Computer vision systems enable real-time defect detection in manufactured chips, drastically improving quality assurance standards.

- AI improves supply chain visibility and resilience, optimizing inventory and logistics for global distribution.

DRO & Impact Forces Of Film Grade Masterbatch PET Chips Market

The Film Grade Masterbatch PET Chips market is shaped by a complex interplay of driving forces related to packaging innovation, restraining factors such as environmental scrutiny and raw material cost fluctuations, and significant opportunities emerging from the circular economy and technological breakthroughs in film performance. The primary drivers stem from the lightweighting trend in packaging, where PET films offer excellent strength-to-weight ratios, reducing transportation costs and material consumption. Coupled with this is the growing demand for advanced barrier packaging in emerging markets to extend the shelf life of perishable goods, directly boosting the need for functional additive masterbatches. Restraints largely center on the geopolitical instability affecting petrochemical supply chains (PTA and MEG), leading to volatile input costs that compress profit margins, alongside increasing regulatory pressure concerning plastic waste and microplastics, which forces significant investment into non-fossil fuel alternatives and advanced recycling technologies. Opportunities reside in the rapid commercialization of recycled PET (rPET) suitable for film applications and the development of bio-based PET variants, offering sustainable alternatives that can meet ambitious corporate sustainability targets and consumer preferences.

Key drivers include the surge in demand from the fast-moving consumer goods (FMCG) sector, particularly for high-clarity and aesthetically pleasing packaging films that utilize color and effect masterbatches to enhance brand identity. The pharmaceutical and medical device industries also contribute significantly, requiring ultra-clean, consistent film grade chips for blister packs and sterile barriers, where PET’s inertness and rigidity are highly valued. Furthermore, the global expansion of e-commerce necessitates robust, tamper-evident, and durable secondary packaging, increasingly fulfilled by high-strength PET strapping and protective films. These demand-side pressures continuously fuel investment in manufacturing capacity and process optimization across major producing regions.

Conversely, the market faces structural restraints including the inherent difficulty in achieving food-grade rPET film chips that meet rigorous regulatory standards for direct contact applications, limiting the widespread adoption of recycled content in premium film segments. The capital intensity required for advanced compounding equipment and the high energy consumption associated with polymerization and extrusion also present barriers to entry and operational constraints. The interplay of these forces—high demand versus sustainability requirements and cost pressures—defines the market’s trajectory. The most significant impact force is the regulatory environment, particularly in the EU, where directives promoting mandatory minimum recycled content quotas are forcing immediate technological and logistical adaptations among masterbatch and PET chip producers, fundamentally altering investment priorities toward sustainable material sourcing and circular design principles.

- Drivers: Growing demand for lightweight and high-barrier flexible packaging; expansion of the FMCG and pharmaceutical sectors; superior mechanical properties of PET films over alternative polymers.

- Restraints: Volatility in the price and supply of petrochemical raw materials (PTA/MEG); high cost and technical challenges in producing food-grade rPET film; stringent global regulations on single-use plastics.

- Opportunities: Development of bio-based PET chips and high-purity recycled PET (rPET) for film applications; innovation in functional masterbatches (e.g., antimicrobial, UV protection); expansion into niche markets like specialized agricultural films and technical textiles.

- Impact Forces: Regulatory Mandates (High Impact) forcing sustainable material transition; Raw Material Price Fluctuation (Medium-High Impact) affecting profitability; Technological Advancements in Film Extrusion (Medium Impact) demanding higher quality masterbatches.

Segmentation Analysis

The Film Grade Masterbatch PET Chips market is comprehensively segmented primarily based on the type of masterbatch functionality, the nature of the raw material (Virgin vs. Recycled), and the specific end-use application, providing a detailed view of demand dynamics across various industries. Functional segmentation, encompassing color, white, black, and additive masterbatches, remains crucial, as it dictates the film’s final properties—ranging from simple visual appeal to complex protective functions like UV stabilization or anti-fogging. The segmentation by raw material is gaining immense strategic importance, with the rPET segment experiencing rapid growth due to global legislative push for circular economy practices, although virgin PET chips currently maintain dominance in high-performance or food-contact critical applications where purity is non-negotiable. Geographically, the market analysis spans five major regions, revealing distinct growth drivers and technological adoption patterns influenced by regional regulatory frameworks and industrial maturity.

Further analysis within the functional segment highlights the increasing complexity of additive masterbatches. These specialized chips are designed to enhance processing efficiency (e.g., slip agents, anti-block agents) or impart high-value protective properties (e.g., oxygen scavengers, anti-static agents) essential for sophisticated packaging systems. For instance, PET chips compounded with specific barrier masterbatches are vital for extending the shelf life of sensitive packaged foods, a segment experiencing substantial investment due to global food waste reduction initiatives. The color masterbatch segment, while mature, continues to evolve with demands for high-definition, consistent color matching necessary for global brand identity maintenance across various film formats.

The application segmentation underscores the market's reliance on the flexible packaging sector, which utilizes PET film in almost all forms of food and non-food containment, driven by its excellent printability and robust barrier characteristics. Emerging application areas include specialized thick films for construction or high-strength industrial uses, which require PET chips compounded with high levels of structural additives to withstand extreme environmental conditions. This granular segmentation allows manufacturers and investors to target specific, high-growth niches within the overall polymer film industry, optimizing product portfolios to align with regional consumer behavior and regulatory enforcement.

- By Masterbatch Type:

- Color Masterbatch PET Chips

- White Masterbatch PET Chips

- Black Masterbatch PET Chips

- Additive/Functional Masterbatch PET Chips (e.g., UV Stabilizers, Anti-fog, Barrier Enhancers)

- By Raw Material:

- Virgin Film Grade PET Chips

- Recycled Film Grade PET Chips (rPET)

- By Application:

- Flexible Packaging (Food & Beverage, Consumer Goods)

- Industrial Films (Strapping, Protection)

- Medical & Pharmaceutical Films (Blister Packs)

- Agricultural Films (Mulch, Greenhouse Covers)

- Thermoforming Sheets & Films

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Film Grade Masterbatch PET Chips Market

The value chain for Film Grade Masterbatch PET Chips is complex, initiating with upstream petrochemical synthesis and culminating in the downstream consumption by film processors and consumer packaged goods (CPG) companies. The upstream segment involves the production of primary feedstocks: crude oil derivatives leading to Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG). Price volatility and supply chain stability within this segment heavily influence the final cost of virgin PET chips. Once these feedstocks are polymerized, they form the base PET resin. Simultaneously, the masterbatch component relies on the synthesis of specialized pigments, dyes, and performance additives. The core manufacturing step—compounding—involves integrating the masterbatch concentrate into the PET base resin using high-precision extrusion machinery to produce the specialized film-grade chips, requiring specific technical expertise to ensure optimal dispersion and morphology for film applications.

The midstream sector involves the specialized chip manufacturers and compounders who perform the extrusion and pelletization. Distribution channels are varied, involving both direct sales to major multinational film converters and indirect sales through specialized chemical distributors and agents, particularly reaching smaller, regional film processors. Direct sales are preferred for high-volume, standardized products or highly customized technical compounds where close technical support is necessary. Indirect channels are crucial for reaching dispersed end-users, managing warehousing, and providing localized small-batch deliveries. Efficiency in distribution is critical, as PET chips are sensitive to moisture absorption and require controlled logistics to maintain quality.

The downstream segment encompasses the converters who melt the chips and perform film extrusion, biaxial orientation, and subsequent printing or lamination to create the final flexible packaging or industrial film products. Ultimately, the end-users are the CPG companies, pharmaceutical firms, or agricultural businesses that utilize the finished film to protect and present their products. Shifts in end-user packaging preferences—particularly the demand for recyclable, barrier-enhanced films—send strong signals up the value chain, forcing PET chip producers and masterbatch suppliers to innovate rapidly. A key trend involves increased backward integration by large polymer producers to control feedstock costs, and forward integration by film converters to acquire compounding capabilities for tailored chip production.

Film Grade Masterbatch PET Chips Market Potential Customers

The primary potential customers for Film Grade Masterbatch PET Chips are film converters and specialized packaging manufacturers who utilize sophisticated extrusion and thermoforming lines to produce high-specification films. These customers require PET chips that exhibit exceptional melt stability, low thermal shrinkage, and superior surface quality to meet the demands of high-speed processing and stringent quality control. Within this group, customers serving the food and beverage sectors represent the largest volume consumers, utilizing the chips for shrink sleeves, high-clarity window films, and barrier layers in multi-layer flexible pouches where oxygen and moisture protection are paramount. The choice of masterbatch determines the customer's ability to differentiate their final product, whether through vibrant branding colors or critical functional properties like UV resistance for outdoor applications.

Another significant customer base lies within the pharmaceutical and medical device manufacturing industries. These sectors demand extremely high-purity, sterile, and inert packaging materials for blister packs, unit-dose packaging, and specialized medical barriers. Customers here prioritize chips compounded with regulatory-compliant additives and demand rigorous documentation and batch traceability. The medical segment is less price-sensitive than consumer packaging but requires specialized masterbatches that guarantee compatibility with sterilization processes (e.g., gamma irradiation or ethylene oxide sterilization) without compromising the film’s physical integrity or clarity. These specific requirements necessitate a deep technical partnership between the chip supplier and the medical packaging manufacturer.

Industrial users, including those in construction, automotive, and agriculture, represent niche, high-value customer segments. For instance, agricultural businesses require PET film compounded with highly effective UV stabilizer and anti-drip masterbatches to optimize greenhouse and mulch films, extending their operational lifespan in harsh environments. These customers seek chips that offer durability and specialized performance characteristics, often purchasing in large, cyclical batches based on seasonal demands. The broad application spectrum underscores the necessity for chip suppliers to offer a highly customizable product portfolio catering to diverse technical specifications and regulatory landscapes globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PolyOne Corporation, Americhem Inc., Clariant AG, Ampacet Corporation, Teknor Apex Company, LyondellBasell Industries N.V., Avient Corporation, Penn Color Inc., Sukano AG, RTP Company, Gabriel-Chemie Group, Astra Polymers, Alok Industries Ltd., Plastiblends India Ltd., Tosaf Group, Cabot Corporation, Dainichiseika Color & Chemicals Mfg. Co., Ltd., Polyplastics Co., Ltd., Polybatch, Global Colors Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Film Grade Masterbatch PET Chips Market Key Technology Landscape

The technological landscape of the Film Grade Masterbatch PET Chips market is defined by advancements in compounding extrusion machinery, material science focused on barrier enhancement, and sophisticated quality control systems. The core technology involves highly specialized twin-screw extrusion systems, which are essential for achieving the required homogeneity and dispersion of the masterbatch pigments and additives within the PET polymer matrix. Achieving uniform dispersion is paramount for film applications, as poor blending leads to defects, reduced clarity, and inconsistent mechanical properties in the final thin film. Recent innovations in these extruders focus on optimizing screw geometry, utilizing vacuum degassing to eliminate moisture (critical for PET), and implementing melt filtration systems to remove impurities, thereby ensuring the production of high-purity, film-grade chips necessary for optical applications.

A critical technological thrust is directed toward enhancing the barrier properties of PET films through advanced additive masterbatches. This involves developing proprietary chemistries for oxygen scavengers and moisture absorbers that can be seamlessly incorporated into the PET chips without compromising the polymer's processability or recyclability. For instance, the use of nanocomposites and specialized layered silicates within the masterbatch formulation allows for significantly improved gas impermeability, enabling PET films to compete effectively against traditional barrier materials like EVOH or PVDC, while maintaining PET's inherent advantage in cost and recyclability. The successful integration of these nano-scale materials requires extremely precise compounding techniques and thermal management to ensure they are uniformly distributed at the microscopic level.

Furthermore, technology related to the production of recycled PET (rPET) for film applications is rapidly maturing. Innovations in solid-state polymerization (SSP) and chemical recycling (depolymerization) are enabling the production of rPET chips that meet the high intrinsic viscosity (IV) and low contaminant levels required for film extrusion, which historically posed a major challenge. Suppliers are also employing advanced spectroscopic analysis and automated color matching technology to ensure that colored masterbatches compounded with rPET maintain brand color consistency, regardless of the varied starting color of the recycled flake. These technological improvements are crucial for scaling up sustainable production and meeting global legislative quotas for recycled content.

Regional Highlights

The global Film Grade Masterbatch PET Chips market exhibits significant regional disparities in growth rate, consumption patterns, and technological maturity, primarily driven by localized regulatory environments and industrial infrastructure capacity.

- Asia Pacific (APAC): APAC is the indisputable leader in both manufacturing capacity and consumption, fueled by robust growth in the region’s fast-moving consumer goods (FMCG), electronics, and rapid urbanization trends, which necessitate massive volumes of flexible packaging. Countries like China, India, and Southeast Asian nations are hubs for both large-scale PET chip polymerization plants and specialized masterbatch compounders. The market growth here is volume-driven, with increasing demand for cost-effective white and clear masterbatches for standard packaging, alongside escalating requirements for specialized functional masterbatches to enhance barrier properties in high-end food exports. This region benefits from lower operating costs and government support for polymer manufacturing, although environmental scrutiny is rapidly increasing.

- North America: This region is characterized by high technological adoption and a strong emphasis on sustainability and premium packaging. The demand is heavily skewed toward high-performance, complex additive masterbatches used in pharmaceutical, medical, and specialized industrial films. North American consumers and brands are driving the push for high recycled content (rPET) in film applications, necessitating advanced compounding and purification technologies. Regulatory compliance, particularly concerning food contact and chemical safety, dictates product specifications, favoring established global suppliers who can guarantee purity and traceability.

- Europe: Europe is defined by its stringent regulatory landscape, particularly directives focusing on circular economy and plastic reduction. This has created a dynamic market focused intensely on rPET and bio-based PET film chips. The demand for virgin chips is steadily being replaced by demand for specialized rPET masterbatches that achieve performance parity with virgin materials. Europe leads in the adoption of chemical recycling technologies and sophisticated sorting systems to ensure high-quality feedstock, making it a critical market for technological innovation in sustainable chip production. Flexible packaging for fresh produce and high-barrier dairy products are key application areas.

- Latin America (LATAM): LATAM represents a growing market, driven by expanding middle-class consumption and increasing industrialization, particularly in Brazil and Mexico. Demand for basic color and white masterbatches for consumer packaging is high. Market growth is closely tied to economic stability and investment in modern food processing and packaging infrastructure. Supply chains are often optimized through regional distributors, who manage localized inventory and technical support for smaller converters.

- Middle East & Africa (MEA): This region is heavily influenced by oil and gas exporting nations, which have significant upstream petrochemical capabilities, providing ready access to primary PET feedstocks. Growth is steady, particularly in food preservation films due to climate challenges and the need to transport goods over long distances. Investment focuses on large-scale infrastructure projects and agricultural film applications, where UV stabilization masterbatches are crucial given the high solar intensity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Film Grade Masterbatch PET Chips Market.- PolyOne Corporation (Now Avient)

- Americhem Inc.

- Clariant AG

- Ampacet Corporation

- Teknor Apex Company

- LyondellBasell Industries N.V.

- Avient Corporation

- Penn Color Inc.

- Sukano AG

- RTP Company

- Gabriel-Chemie Group

- Astra Polymers

- Alok Industries Ltd.

- Plastiblends India Ltd.

- Tosaf Group

- Cabot Corporation

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Polyplastics Co., Ltd.

- Polybatch

- Global Colors Group

Frequently Asked Questions

Analyze common user questions about the Film Grade Masterbatch PET Chips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Film Grade Masterbatch PET Chips?

The primary driver is the accelerating global demand for lightweight, high-performance flexible packaging solutions, particularly those requiring superior barrier properties against oxygen and moisture to extend product shelf life in the food and pharmaceutical sectors.

How do sustainability concerns influence the manufacturing of these PET chips?

Sustainability concerns necessitate significant investment in developing high-purity recycled PET (rPET) chips suitable for film extrusion and bio-based PET alternatives, driving market innovation toward fully recyclable and circular material solutions to meet regulatory mandates.

Which type of masterbatch segment is exhibiting the fastest growth?

The Additive or Functional Masterbatch segment is experiencing the fastest growth, driven by the need to integrate specific performance features—such as antimicrobial agents, UV stabilizers, or advanced oxygen scavengers—into films without altering the base PET polymer structure.

What technological advancements are key to improving film grade PET chip quality?

Key technological advancements include sophisticated twin-screw extrusion compounding techniques for achieving ultra-uniform additive dispersion, advanced melt filtration to ensure high optical clarity, and specialized Solid-State Polymerization (SSP) for increasing the intrinsic viscosity of rPET for film applications.

Which geographical region dominates the Film Grade Masterbatch PET Chips Market?

The Asia Pacific (APAC) region dominates the market due to its immense manufacturing capacity, rapid industrial expansion, and high consumption rate in the fast-moving consumer goods (FMCG) sector across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager