Film Grade PET Chips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433917 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Film Grade PET Chips Market Size

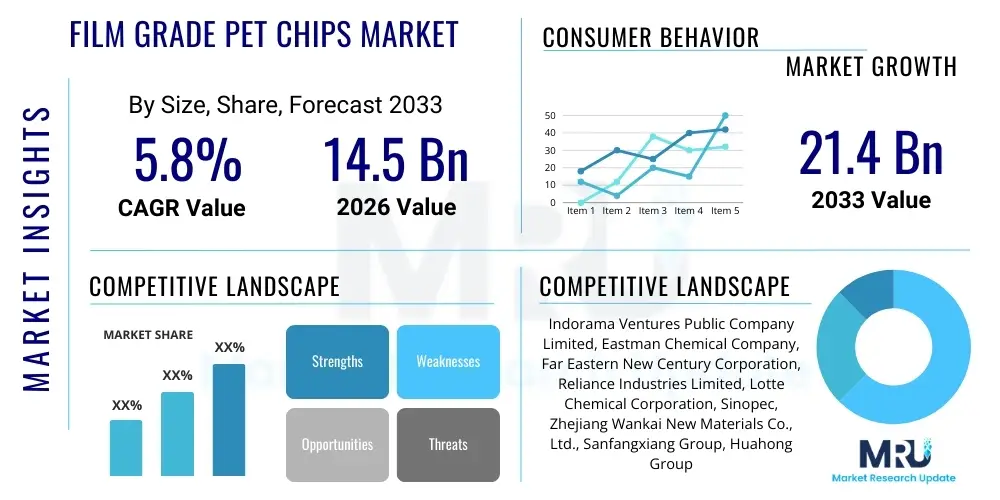

The Film Grade PET Chips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 21.4 billion by the end of the forecast period in 2033.

Film Grade PET Chips Market introduction

Film Grade Polyethylene Terephthalate (PET) Chips are high-purity, thermoplastic polyesters primarily utilized in the production of various films, including packaging films, electrical insulation films, and solar backsheets. These chips are characterized by their superior physical properties, such as excellent dimensional stability, high tensile strength, chemical resistance, and outstanding clarity, making them indispensable in demanding industrial and consumer applications. The production process involves complex polycondensation reactions, yielding a product optimized for high-speed film extrusion and biaxial orientation processes.

The widespread adoption of PET films is heavily driven by the booming flexible packaging industry, particularly in emerging economies where demand for packaged food and beverages is escalating. Additionally, the increasing focus on renewable energy has boosted the application of film grade PET chips in photovoltaic modules and specialty film sectors, serving as durable and cost-effective alternatives to other polymers. Key applications range from metallized films used for barrier packaging to thick gauge films utilized in graphic arts and industrial strapping.

Major driving factors include the lightweight nature and recyclability of PET, which aligns with global sustainability trends and regulatory mandates favoring eco-friendly packaging materials. The continuous technological advancements in polymerization processes, leading to improved intrinsic viscosity (IV) and reduced acetaldehyde content, further enhance the quality and applicability of these chips in high-specification film manufacturing, solidifying their dominant position over substitutes like PVC or PP in numerous high-performance film segments.

Film Grade PET Chips Market Executive Summary

The Film Grade PET Chips market is poised for robust expansion, primarily fueled by the accelerating demand from the flexible packaging and consumer electronics sectors. Business trends indicate a strong move towards increased production capacity, especially in Asia Pacific, driven by favorable feedstock pricing and proximity to end-use manufacturing hubs. Strategic alliances focusing on circular economy principles, such as utilizing recycled PET (rPET) in film production, are becoming crucial differentiators among major suppliers, impacting pricing structures and supply chain resilience. Innovation centers on enhancing specialized grades for applications requiring superior barrier properties or thermal resistance.

Regionally, Asia Pacific maintains the highest market share and growth rate, underpinned by massive industrialization, population growth, and rising disposable incomes leading to higher consumption of packaged goods in countries like China and India. North America and Europe, while mature, exhibit growth driven by stringent sustainability regulations necessitating the transition to mono-material PET solutions and high-quality rPET films. Segment trends highlight the dominance of the packaging film category, although the electrical and electronic films segment is witnessing rapid acceleration due to the global push for advanced displays and electric vehicle components utilizing specialized PET insulation films.

The market faces operational challenges related to volatile raw material costs, specifically purified terephthalic acid (PTA) and monoethylene glycol (MEG), and the need for significant capital expenditure in establishing high-capacity polymerization plants. However, the opportunity landscape is vast, centered on developing ultra-thin films for flexible displays and high-performance films for advanced battery components. Successful market participants are those investing heavily in vertical integration, ensuring stable supply chains, and pioneering specialized film grades that meet increasingly complex technical specifications required by end-users.

AI Impact Analysis on Film Grade PET Chips Market

Users frequently inquire about how AI can optimize manufacturing efficiency, enhance quality control, and predict feedstock price volatility within the Film Grade PET Chips sector. Key concerns revolve around the capital investment required for AI infrastructure and the security of sensitive operational data. There is significant expectation that AI tools, particularly machine learning models, will revolutionize polymerization process control, moving from reactive adjustments to predictive maintenance, thereby reducing energy consumption and minimizing batch variability, which is critical for consistent film quality. Furthermore, user interest extends to AI's role in optimizing supply chain logistics and enhancing the traceability of rPET sources to comply with environmental, social, and governance (ESG) reporting requirements.

AI's primary influence is expected in the optimization of complex chemical reactions during PET synthesis. By analyzing vast datasets related to temperature, pressure, catalyst concentration, and reaction time, AI algorithms can fine-tune process parameters in real-time, achieving tighter specifications on intrinsic viscosity (IV) and molecular weight distribution. This precision is vital for film grade chips, where minor variations significantly affect the end film's mechanical and optical properties. Predictive maintenance systems driven by AI are also anticipated to minimize unplanned downtime in high-throughput polymerization reactors, a major cost driver in this capital-intensive industry.

Beyond the factory floor, AI models are increasingly utilized in demand forecasting and inventory management. By integrating global economic indicators, regional packaging consumption patterns, and seasonal demand variations, AI provides highly accurate predictions for film chip manufacturers. This capability allows companies to optimize production schedules, manage logistics efficiently, and execute proactive hedging strategies against volatile PTA and MEG price fluctuations, ultimately stabilizing profit margins and ensuring consistent supply to major film converters globally.

- AI-driven optimization of polymerization kinetics for intrinsic viscosity (IV) control.

- Machine learning models predicting feedstock (PTA/MEG) price fluctuations for procurement strategy.

- Implementation of computer vision for automated, high-speed inspection of chip quality and consistency.

- Predictive maintenance systems reducing unplanned downtime in continuous polymerization plants.

- Enhanced supply chain transparency and traceability using AI-powered blockchain integration for rPET sourcing.

- Optimization of energy consumption during drying and solid-state polymerization phases.

DRO & Impact Forces Of Film Grade PET Chips Market

The Film Grade PET Chips Market is characterized by strong fundamental drivers centered on the expansion of the packaging and electronics industries, counterbalanced by inherent restraints related to material costs and environmental scrutiny. Key drivers include the superior performance characteristics of PET films, such as high clarity and barrier properties, making them preferred in food packaging, and the rapid growth in specialized applications like photovoltaic backsheets and electronic display films. These demand drivers create substantial opportunities for manufacturers to invest in new, high-efficiency production lines and develop specialized copolymerized PET chips designed for extreme conditions or enhanced biodegradability.

However, the market faces significant restraints. Volatility in the pricing of crude oil and natural gas directly impacts the cost of primary raw materials (PTA and MEG), leading to unpredictable manufacturing costs and pressure on profit margins. Furthermore, increasing regulatory pressures and public sentiment against single-use plastics globally pose a long-term challenge, necessitating massive investment in developing viable chemical recycling methods for PET chips to maintain market relevance and meet ambitious circular economy goals. These factors create an intricate balance, compelling companies to focus on operational efficiencies and sustainable sourcing.

The impact forces within the market are predominantly high-to-moderate, driven by competitive intensity and technological substitution risk. The established market structure, dominated by a few large global players, limits entry for new participants due to the high capital expenditure required. Opportunities arise from geographical shifts in manufacturing, particularly the relocation of film converting facilities to Southeast Asia and India, demanding localized chip supply. Strategic responses involve developing bio-based or chemically recycled PET chips to mitigate environmental impact and secure long-term contracts with major multinational corporations committed to sustainable procurement, thereby leveraging market opportunities against environmental restraints.

Segmentation Analysis

The Film Grade PET Chips Market is comprehensively segmented based on various criteria, including the specific type of manufacturing process, the end-use application requiring specialized film properties, and the grade of the material produced. Understanding these segmentations is crucial for identifying precise market niches and forecasting demand based on evolving industry needs. The primary application segments—packaging, electrical, and industrial—are highly distinct, each requiring chips with tailored intrinsic viscosity and thermal stability. Geographical segmentation reveals disparities in growth rates, with Asia Pacific driving volume expansion while North America and Europe lead in high-value, specialty film production.

- By Type:

- Standard Grade PET Chips

- High-IV Grade PET Chips

- Copolymerized PET Chips (for low heat seal applications)

- Recycled PET (rPET) Chips

- By Application:

- Packaging Films (Food, Beverage, Pharmaceutical)

- Electrical and Electronic Films (Capacitor Films, Insulation Films, Solar Backsheets)

- Industrial Films (Strapping, Graphic Arts, Release Liners)

- By Manufacturing Process:

- Batch Process

- Continuous Polymerization Process

Value Chain Analysis For Film Grade PET Chips Market

The value chain for Film Grade PET Chips is complex, starting with the upstream sourcing of petrochemical feedstocks and extending to the distribution and conversion by downstream film manufacturers. The upstream stage is dominated by the production of purified terephthalic acid (PTA) and monoethylene glycol (MEG), which are highly sensitive to global oil and gas prices. Major integrated petrochemical companies often have a strong advantage here due to vertical integration, ensuring stable supply and cost control. The synthesis of PET chips involves large-scale, continuous polymerization reactors, a capital-intensive process demanding precise quality control to meet the stringent specifications required for film extrusion.

The distribution channel involves both direct sales to large, established film converters and indirect sales through specialized chemical distributors catering to smaller or regional film producers. Direct relationships are common when suppliers offer highly customized grades or volume discounts, ensuring stable long-term agreements. Downstream operations involve biaxial orientation and extrusion, where PET chips are converted into thin films (BOPET films). These films are then further processed (metallization, coating, printing) by converters before reaching end-users in the food, beverage, or electronics industries.

Profitability and market power often reside at the upstream (feedstock) and the specialized downstream (high-barrier film conversion) stages. PET chip manufacturers must strategically manage their production efficiency and maintain consistent quality to avoid yielding leverage to either feedstock suppliers or large multinational film converters. The increasing focus on circularity introduces a new upstream complexity: sourcing and processing high-quality post-consumer PET bottles and waste, adding chemical recyclers and sorting facilities as critical new elements in the supply chain.

Film Grade PET Chips Market Potential Customers

The primary consumers of Film Grade PET Chips are large-scale plastic film converters and manufacturers specializing in biaxially oriented polyethylene terephthalate (BOPET) films. These companies utilize the chips as the fundamental raw material to produce highly specialized films for a multitude of industrial and consumer applications. These films are valued for their mechanical strength, thermal properties, and superior printability, making the consistency of the sourced PET chips a critical determinant of their final product quality and manufacturing yields.

Secondary, yet rapidly growing, customers include companies involved in the electrical and solar industries. Manufacturers of photovoltaic modules require specialized PET films for backsheets, which protect the sensitive cells from environmental degradation. Similarly, producers of thin-film capacitors and high-density flexible circuits rely on ultra-high purity PET films for insulation and structural support. These customers often require customized, high-IV PET grades with stringent thermal stability specifications, driving innovation in copolymer chip production.

Ultimately, the consumption is driven by multinational fast-moving consumer goods (FMCG) corporations and major electronics original equipment manufacturers (OEMs). While these entities do not purchase the chips directly, their procurement policies for packaging and electronic components dictate the demand and specifications passed down the value chain to the film converters, making them the critical demand drivers influencing purchase volumes and technological requirements for Film Grade PET Chips.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 billion |

| Market Forecast in 2033 | USD 21.4 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Indorama Ventures Public Company Limited, Eastman Chemical Company, Far Eastern New Century Corporation, Reliance Industries Limited, Lotte Chemical Corporation, Sinopec, Zhejiang Wankai New Materials Co., Ltd., Sanfangxiang Group, Huahong Group, Jiangsu Sanfame Polyester Material Co., Ltd., Jiangyin Xingyu New Material Co., Ltd., Mitsubishi Chemical Corporation, SK Chemicals, Thai PET Resin Co., Ltd., Nan Ya Plastics Corporation, Jiangsu J&J New Materials Co., Ltd., DAELIM Co., Ltd., Kolon Industries, Ltd., Formosa Petrochemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Film Grade PET Chips Market Key Technology Landscape

The manufacturing technology for Film Grade PET Chips centers predominantly on continuous polymerization processes, offering higher throughput, superior product consistency, and better energy efficiency compared to older batch methods. Advanced technologies focus heavily on achieving highly precise control over the intrinsic viscosity (IV) of the polymer, a critical determinant of the film's mechanical properties. Innovations include utilizing novel reactor designs, such as twin-screw extruders or specialized melt phase reactors, to reduce residence time and energy input while maintaining high molecular weight stability. Controlling acetaldehyde (AA) generation, particularly important for food contact applications, is another major technological focus, often achieved through optimized solid-state polymerization (SSP) processes.

A significant technological shift involves the integration of chemical recycling methods to produce virgin-quality rPET chips suitable for film applications. Depolymerization technologies, such as glycolysis or methanolysis, break down post-consumer PET back into its original monomers (PTA and MEG), which are then repolymerized. This technological pathway addresses environmental concerns and regulatory demands for recycled content, ensuring that the rPET chips meet the same strict quality standards—including purity and IV—as virgin materials, a necessity for high-performance BOPET films.

Furthermore, technology is advancing in the creation of specialty copolymerized PET chips. These chips incorporate co-monomers (like isophthalic acid or cyclohexanedimethanol) to modify the polymer chain structure, resulting in tailored properties such as lower crystallization rates for thick films, enhanced heat sealability, or improved clarity and barrier performance. The adoption of smart factory concepts, leveraging Industrial IoT (IIoT) sensors and advanced analytics for real-time process monitoring and optimization, is the foundation for future improvements in manufacturing efficiency and quality control across major global production facilities.

Regional Highlights

The global Film Grade PET Chips market exhibits distinct consumption patterns and growth dynamics across major regions, heavily influenced by local economic growth, industrial capacity, and regulatory environments concerning plastics and recycling.

- Asia Pacific (APAC): APAC is the dominant market in terms of volume and expected growth rate, driven by expansive manufacturing bases in China, India, and Southeast Asia. The region benefits from lower production costs, proximity to key raw material sources, and exponential growth in the food, beverage, and electronics packaging sectors. India and Vietnam are emerging as critical production and consumption hubs, fueled by rising middle-class disposable incomes and sustained infrastructure investment.

- North America: This region is characterized by high demand for specialized, high-performance films, particularly in the medical, industrial, and electrical insulation sectors. Growth is stable, focusing less on volume expansion and more on high-value products and advanced recycling technologies. Stringent corporate sustainability goals and regulatory pressures for recycled content are accelerating the adoption of premium rPET film chips.

- Europe: European market growth is primarily dictated by strict sustainability legislation, notably the EU Plastics Strategy, pushing manufacturers toward circular economy models. Demand is robust for chemically recycled PET chips and bio-based alternatives. Key applications include sophisticated food barrier packaging and high-end industrial films, prioritizing quality and environmental footprint over sheer volume.

- Latin America (LATAM): LATAM presents moderate growth potential, tied closely to fluctuating economic stability and regional infrastructure development. Brazil and Mexico are the largest consumers, primarily driven by the domestic consumer packaging industry. Market penetration is often hampered by inconsistent recycling infrastructure, although opportunities exist in establishing new polymerization capacity.

- Middle East and Africa (MEA): This region is characterized by high reliance on imported chips but is seeing emerging local production capacity, particularly in the GCC countries, leveraging abundant, cost-effective feedstock supply (MEG). Market demand is driven by local food processing and construction materials, with moderate but steady growth in packaging consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Film Grade PET Chips Market.- Indorama Ventures Public Company Limited

- Eastman Chemical Company

- Far Eastern New Century Corporation

- Reliance Industries Limited

- Lotte Chemical Corporation

- Sinopec

- Zhejiang Wankai New Materials Co., Ltd.

- Sanfangxiang Group

- Huahong Group

- Jiangsu Sanfame Polyester Material Co., Ltd.

- Jiangyin Xingyu New Material Co., Ltd.

- Mitsubishi Chemical Corporation

- SK Chemicals

- Thai PET Resin Co., Ltd.

- Nan Ya Plastics Corporation

- Jiangsu J&J New Materials Co., Ltd.

- DAELIM Co., Ltd.

- Kolon Industries, Ltd.

- Formosa Petrochemical Corporation

- M&G Chemicals

Frequently Asked Questions

Analyze common user questions about the Film Grade PET Chips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the intrinsic viscosity (IV) of Film Grade PET Chips?

The intrinsic viscosity (IV) is primarily determined by the molecular weight and degree of polymerization, which are controlled during the synthesis process by reaction temperature, time, and catalyst concentration. Higher IV chips offer superior mechanical strength and are preferred for demanding film applications.

How is the growth of the solar industry influencing demand for Film Grade PET Chips?

The solar industry significantly drives demand, as specialized Film Grade PET chips are crucial for manufacturing photovoltaic backsheets, which require high UV resistance, thermal stability, and mechanical durability to protect solar panels over their long operational lifespan.

What are the primary differences between bottle grade and film grade PET chips?

Film grade PET chips are typically manufactured with specific molecular weight distributions and lower acetaldehyde (AA) content compared to bottle grade chips. Film grade chips also demand extremely high purity and consistent intrinsic viscosity (IV) for precise film extrusion processes.

What role does chemical recycling play in the Film Grade PET Chips market?

Chemical recycling is increasingly vital as it enables the production of virgin-quality recycled PET (rPET) chips suitable for high-specification film applications, addressing regulatory pressure and corporate sustainability mandates for increased recycled content use.

Which geographic region dominates the global Film Grade PET Chips production and consumption?

Asia Pacific (APAC), particularly driven by China and India, dominates both the production capacity and consumption volume of Film Grade PET Chips, owing to lower manufacturing costs and booming demand from the regional flexible packaging industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager