Filtered Pipette Tips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433171 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Filtered Pipette Tips Market Size

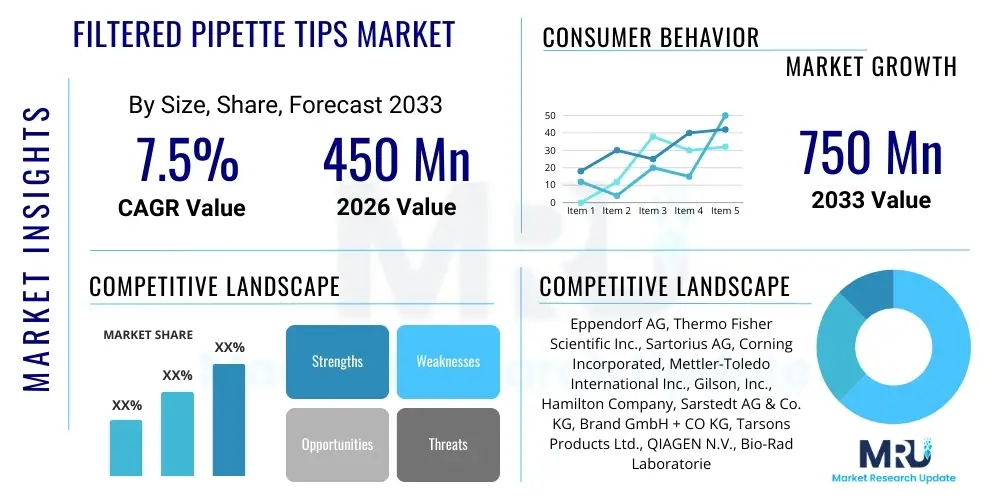

The Filtered Pipette Tips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Filtered Pipette Tips Market introduction

Filtered pipette tips are precision consumables essential in modern molecular biology, microbiology, and clinical diagnostics, designed to prevent aerosol contamination and cross-contamination during liquid handling procedures. These tips incorporate a hydrophobic filter element, typically made of high-density polyethylene (HDPE), positioned proximal to the pipette cone attachment point. This physical barrier prevents droplets and aerosols, which may carry nucleic acids, proteins, or microorganisms, from entering the pipette barrel, thus protecting the mechanical components of the pipette and ensuring the integrity of subsequent assays. The necessity for high-purity, contamination-free results, particularly in sensitive techniques such as Polymerase Chain Reaction (PCR), quantitative PCR (qPCR), and viral load testing, drives the foundational demand for filtered tips globally.

The primary applications of filtered pipette tips span across highly regulated and sensitive laboratory environments. They are indispensable in genomic research where trace amounts of contaminants can severely compromise results, leading to false positives or inaccurate quantification. Furthermore, their use in drug discovery and development, especially high-throughput screening (HTS) processes, ensures reliability and reproducibility across numerous samples. The inherent benefit of using filtered tips lies in significantly reducing the risk of carry-over contamination, thereby improving data quality and reducing the need for costly and time-consuming re-testing. This protection extends the life of expensive pipetting equipment by shielding internal mechanisms from corrosive or biological materials.

Driving factors for this market include the increasing global investment in life sciences research, particularly oncology and infectious disease research, which heavily relies on highly sensitive molecular diagnostic techniques. The rapid expansion of biotechnology and pharmaceutical industries, coupled with stringent quality control standards mandated by regulatory bodies like the FDA and EMA, further necessitates the adoption of filtered tips. Moreover, the increasing automation of laboratory processes, requiring reliable, certified consumables for robotic liquid handlers, significantly boosts the demand for high-quality, certified DNase/RNase-free and pyrogen-free filtered pipette tips, solidifying their role as critical components in laboratory workflows worldwide.

Filtered Pipette Tips Market Executive Summary

The Filtered Pipette Tips Market exhibits robust growth, primarily propelled by escalating research and development activities in genomics and proteomics, coupled with the increasing prevalence of automated high-throughput screening (HTS) systems in the pharmaceutical sector. Business trends indicate a strong shift towards specialized tips, such as low-retention tips and extended-length tips, optimizing accuracy for viscous or difficult-to-handle liquids. Manufacturers are focusing on sustainable production methods and advanced sterilization techniques (e-beam or gamma irradiation) to meet stringent regulatory requirements and growing consumer demand for certified cleanroom products. Supply chain resilience, following recent global disruptions, has become a critical competitive differentiator, pushing key players toward regional manufacturing hubs to minimize lead times and ensure consistent availability.

Regionally, North America maintains market dominance due to substantial government and private funding directed towards biomedical research, the presence of major pharmaceutical and biotech firms, and early adoption of advanced robotic liquid handling systems. However, the Asia Pacific (APAC) region is projected to register the fastest growth, driven by massive investments in developing healthcare infrastructure, expanding academic research capabilities, and the rising establishment of contract research organizations (CROs) and contract manufacturing organizations (CMOs) in countries like China and India. European growth remains steady, supported by rigorous quality standards and centralized funding initiatives for life science projects, particularly in Germany and the UK, focusing on personalized medicine and diagnostics.

Segment trends reveal that the Molecular Biology application segment, particularly PCR/qPCR, commands the largest market share due to the ubiquitous need for high-fidelity amplification and sequencing. The segment defined by volume capacity, specifically 10-200 µl tips, sees the highest volume consumption, balancing versatility across microplate assays and routine benchwork. Furthermore, the End-User segment shows pharmaceutical and biotechnology companies as the dominant revenue generators, leveraging these products extensively in drug screening, quality assurance, and therapeutic development processes. Conversely, academic and research institutes represent a high-volume, albeit price-sensitive, consumption segment, frequently influenced by budgetary cycles and grant availability.

AI Impact Analysis on Filtered Pipette Tips Market

User queries regarding AI's influence in the Filtered Pipette Tips market generally revolve around two main areas: how AI impacts automated liquid handling protocols and whether AI-driven predictive maintenance or inventory management can optimize consumable usage. Users are keenly interested in the integration of machine learning algorithms to enhance the precision and reliability of robotic pipetting, seeking to minimize human error and material waste. Common themes include the expected role of AI in quality control (e.g., automated inspection of filter placement or tip integrity), optimizing logistics for just-in-time delivery of consumables, and the potential for AI models to predict contamination risks based on environmental or procedural data. The core expectation is that AI will drive efficiency, reduce contamination-related failures, and lead to smarter, customized consumption patterns of these essential laboratory disposables.

- AI enhances robotic liquid handler efficiency by optimizing aspiration/dispense parameters.

- Predictive maintenance models for automated platforms reduce downtime associated with consumable malfunction.

- Machine Vision (AI-driven imaging) improves quality control for tip manufacturing (filter alignment, sterility inspection).

- AI optimizes laboratory inventory management and procurement, forecasting filtered tip consumption accurately.

- Data analytics driven by AI identifies procedural bottlenecks and contamination sources in high-throughput workflows.

- Development of 'smart' consumables integrated with RFID/NFC chips for AI-enabled tracking and usage validation.

- AI algorithms assist in protocol design, recommending specific filtered tip types (e.g., low retention) based on sample properties.

DRO & Impact Forces Of Filtered Pipette Tips Market

The Filtered Pipette Tips Market dynamics are defined by a strong emphasis on preventing assay failures in sensitive biomedical applications. The primary drivers include the escalating demand for molecular diagnostics, particularly in oncology and pathogen detection, which necessitate absolute freedom from cross-contamination to ensure valid results. Restraints largely center on the relatively higher cost of filtered tips compared to standard tips, which impacts budget-sensitive academic institutions and certain clinical labs. This cost differential sometimes leads to the limited adoption in regions where funding is constrained. Opportunities are significantly present in the development of advanced filtration materials, such as those optimized for specific biological substances (e.g., magnetic bead handling), and expanding into emerging geographical markets with rapidly modernizing healthcare infrastructure.

Impact forces indicate that technological advancement in filtration media (e.g., specialized hydrophobic polymers with improved pore size uniformity) is a major external factor influencing market growth, enhancing product performance and reliability. The regulatory environment surrounding clinical diagnostics and laboratory accreditation (e.g., CLIA, ISO standards) exerts significant pressure, compelling labs to adopt certified, high-quality filtered tips, thereby strengthening market demand. Economic volatility, particularly affecting R&D budgets globally, can act as a restraint, slowing capital expenditure and consumable purchasing decisions in specific fiscal periods. Overall, the increasing volume of complex biological testing and the continued automation trend solidify the inherent necessity of filtered tips, offsetting most restraint forces.

Strategic growth avenues also involve customization and bulk packaging solutions tailored for specific automated platforms (e.g., Hamilton, Tecan, Beckman Coulter), maximizing compatibility and throughput for high-volume users. The market is also capitalizing on the sustainable laboratory movement, where manufacturers introducing recyclable or environmentally friendlier packaging options are gaining a competitive edge. The COVID-19 pandemic permanently heightened awareness regarding aerosol contamination control, establishing filtered tips as a baseline requirement, particularly in infectious disease research and centralized testing facilities, thus creating a sustained market uplift driven by enhanced safety protocols.

Segmentation Analysis

The Filtered Pipette Tips Market is segmented based on critical characteristics including Type, Technique, Capacity, Application, and End-User. This granular segmentation allows for a precise understanding of market needs, differentiating demand based on the level of assay sensitivity required and the complexity of the laboratory procedure. The segmentation by application, specifically focusing on molecular biology, remains the most influential segment due to the inherent vulnerability of nucleic acid amplification processes (PCR/qPCR) to contamination. Techniques such as low-retention tips represent a growing sub-segment, optimizing the recovery of expensive reagents and viscous samples, thereby adding value beyond just contamination control.

- By Type:

- Sterile

- Non-Sterile

- By Technique:

- Standard Filtered Tips

- Low Retention Filtered Tips

- By Capacity:

- 0.1-10 µl

- 10-200 µl

- 200-1000 µl

- Greater than 1000 µl

- By Application:

- Molecular Biology (PCR, qPCR, Sequencing)

- Microbiology

- Cell Culture

- Drug Discovery & Development

- Clinical & Diagnostic Testing

- By End-User:

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Hospitals & Clinics

Value Chain Analysis For Filtered Pipette Tips Market

The value chain for filtered pipette tips is highly specialized, beginning with the upstream supply of ultra-pure raw materials. Upstream activities involve the procurement and certification of high-grade virgin polypropylene resin, which forms the main body of the tip, and specialized hydrophobic filtration media, usually high-density polyethylene (HDPE) with defined porosity. Key upstream challenges include maintaining consistent material quality (e.g., ensuring absence of heavy metals or biological contaminants) and managing the global supply chain for specialized components like molds and automation equipment used for tip manufacturing and filter insertion. Efficient material sourcing and inventory management are critical here, impacting final product cost and certification claims (e.g., DNase/RNase-free status).

Midstream processes focus on advanced manufacturing, involving high-precision injection molding, automated filter insertion, and subsequent sterilization (typically E-beam or gamma irradiation) within certified cleanroom environments (ISO Class 8 or better). Quality control is stringent, utilizing vision systems to check filter alignment, tip orifice consistency, and sealing integrity, essential for both manual and automated liquid handling. The complexity of manufacturing arises from the need for tips to fit perfectly across various pipette brands while maintaining tight volume tolerances. Packaging—racked, bulk, or nested formats—is also a major midstream consideration, influencing user convenience and compatibility with automated platforms.

Downstream analysis involves distribution and end-user consumption. Distribution channels are bifurcated into direct sales, often utilized by major manufacturers for large pharmaceutical or government contracts, and indirect sales through a network of specialized scientific distributors (e.g., VWR, Fisher Scientific). Direct channels offer better control over pricing and customer service, while indirect channels provide wider geographical reach and logistical efficiency. End-users, including academic labs and diagnostic centers, rely on prompt and reliable supply, making supply chain optimization and localized warehousing critical for customer satisfaction and market penetration. Marketing often emphasizes product certification, compatibility, and technical performance data.

Filtered Pipette Tips Market Potential Customers

Potential customers for filtered pipette tips are institutions and commercial entities engaged in sensitive, high-precision liquid handling where contamination risk is unacceptable. The primary end-users are large Pharmaceutical and Biotechnology Companies. These organizations require massive volumes of sterile, certified tips for drug discovery programs, clinical trials, high-throughput screening, and rigorous quality assurance testing of final biopharmaceutical products. Their demand is generally inelastic concerning volume but highly demanding regarding technical specifications, such as automation compatibility and certification standards.

Diagnostic Laboratories, including hospital labs and independent reference labs, represent another core customer base, particularly those performing molecular diagnostics for infectious diseases (e.g., COVID-19 testing, HIV viral load), genetic screening, and cancer diagnosis. In this segment, speed, reliability, and regulatory compliance (CLIA/CAP) drive purchasing decisions. Filtered tips are mandated in many regulatory contexts to prevent false positive results which could severely impact patient care and public health initiatives. Furthermore, Academic and Government Research Institutes constitute a significant, high-volume consumer group. Although often price-sensitive, their continuous grant-funded research across genomics, microbiology, and cellular biology necessitates the constant use of filtered tips for highly reproducible experimental outcomes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eppendorf AG, Thermo Fisher Scientific Inc., Sartorius AG, Corning Incorporated, Mettler-Toledo International Inc., Gilson, Inc., Hamilton Company, Sarstedt AG & Co. KG, Brand GmbH + CO KG, Tarsons Products Ltd., QIAGEN N.V., Bio-Rad Laboratories, Inc., Greiner Bio-One International GmbH, Nichiryo Co., Ltd., Alpha Laboratories, Socorex Isba SA, VistaLab Technologies, Biotix, Inc., Sorenson BioScience, Inc., Axygen (Corning subsidiary) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filtered Pipette Tips Market Key Technology Landscape

The core technology surrounding filtered pipette tips involves high-precision injection molding of virgin polypropylene coupled with advanced porous filter media fabrication. The polypropylene itself must be optimized for chemical resistance and minimal surface energy to reduce liquid retention, which is critical for accurate dispensing, particularly at low volumes. Manufacturers employ sophisticated multi-cavity molds and highly controlled automated assembly lines to ensure tip geometry consistency and proper sealing between the tip body and the filter barrier. This high degree of technical precision is essential because even minor variations in tip shape or filter placement can compromise volumetric accuracy or lead to filter leakage, negating the primary purpose of contamination prevention.

A key technological differentiator is the composition and integration of the filter element. Most filters utilize sintered porous HDPE, which provides a physical barrier and operates via tortuous path flow dynamics to trap aerosols and droplets. Recent advancements focus on enhancing hydrophobicity through specialized treatments or material blends, ensuring the filter remains dry even during accidental over-pipetting, thereby maintaining the barrier function and preventing media wicking. Furthermore, automated manufacturing processes incorporate sophisticated robotic arms and vision systems for placing the filter precisely within the tip cone, followed by proprietary welding or seating techniques to secure it without deforming the plastic or compromising the filter's porosity, ensuring optimal performance under variable pressure conditions.

Sterilization technology is another critical aspect; the majority of filtered tips are supplied sterile, typically achieved through validated E-beam or Gamma irradiation processes post-packaging. These methods ensure the destruction of microorganisms and biological contaminants (DNase, RNase, Pyrogens) without degrading the plastic integrity or the filter material. Ongoing technological evolution in this space includes the development of environmentally friendly (bio-based or recyclable) polymer substitutes for both the tip body and the racks, addressing the growing laboratory requirement for sustainability without sacrificing performance or certified cleanliness standards, thus maintaining the high quality demanded by clinical and molecular applications.

Regional Highlights

The global market for filtered pipette tips demonstrates varied adoption rates and growth trajectories influenced by regional R&D spending, regulatory frameworks, and healthcare infrastructure maturity.

- North America (Dominant Market): This region, particularly the United States, holds the largest market share due to the highest concentration of leading biotechnology and pharmaceutical companies, robust governmental funding for life science research (NIH, NSF), and advanced adoption of high-throughput automated liquid handling systems. Strict regulatory requirements for clinical diagnostics and strong intellectual property protection further bolster the demand for premium, certified filtered tips.

- Europe (Mature and Stable Growth): Western European nations (Germany, UK, France) represent a highly mature market characterized by stringent quality standards and widespread utilization of filtered tips in academic and public health laboratories. Growth is supported by centralized initiatives such as the European Research Council (ERC) grants and emphasis on personalized medicine research, driving steady, reliable demand for certified sterile consumables.

- Asia Pacific (Fastest Growing Market): APAC is projected to exhibit the highest CAGR, primarily fueled by massive infrastructure development in China, India, and South Korea, coupled with the outsourcing trend favoring CROs/CMOs in the region. Increasing foreign investment in life sciences and the rapid expansion of molecular diagnostic capabilities, especially post-pandemic, are key accelerants, although price sensitivity remains a factor in procurement decisions.

- Latin America (Emerging Potential): Market growth in countries like Brazil and Mexico is steady but constrained by variable healthcare budgets. Adoption is concentrated in major metropolitan areas with sophisticated research centers and private diagnostic facilities. Increased awareness of infectious disease monitoring and local government investments in public health infrastructure are driving modest but consistent demand for contamination control products.

- Middle East and Africa (Niche Market): This region offers nascent opportunities, particularly in Gulf Cooperation Council (GCC) countries, where high oil revenues are channeled into establishing world-class research hospitals and specialized diagnostic facilities (e.g., UAE, Saudi Arabia). The market remains niche, relying heavily on imported consumables, with growth linked directly to government-backed healthcare modernization projects and academic partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filtered Pipette Tips Market.- Eppendorf AG

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Corning Incorporated

- Mettler-Toledo International Inc.

- Gilson, Inc.

- Hamilton Company

- Sarstedt AG & Co. KG

- Brand GmbH + CO KG

- Tarsons Products Ltd.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Greiner Bio-One International GmbH

- Nichiryo Co., Ltd.

- Alpha Laboratories

- Socorex Isba SA

- VistaLab Technologies

- Biotix, Inc.

- Sorenson BioScience, Inc.

- Axygen (Corning subsidiary)

Frequently Asked Questions

Analyze common user questions about the Filtered Pipette Tips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of the filter element in a pipette tip?

The primary function is to prevent aerosol cross-contamination. The hydrophobic filter acts as a physical barrier, stopping droplets and aerosols from reaching the pipette barrel's internal components, thereby protecting the pipette from sample carry-over and ensuring subsequent assay integrity, especially critical for PCR.

Are filtered pipette tips necessary for all laboratory applications?

While not strictly necessary for basic liquid handling, filtered tips are mandatory for high-sensitivity applications such as quantitative PCR (qPCR), genomics, viral testing, and radioactive material handling, where trace contamination severely compromises results or poses safety risks. They are also essential when using automated liquid handlers to protect expensive equipment.

What materials are commonly used to manufacture filtered pipette tips?

The tip body is typically manufactured from high-grade, virgin polypropylene (PP), optimized for clarity and low retention. The filter element itself is most often made from sintered, hydrophobic High-Density Polyethylene (HDPE) or specialized porous polymer blends designed to block aerosols without impeding air flow during pipetting.

How does the adoption of automation affect the filtered pipette tips market?

Automation significantly drives market demand as automated liquid handling systems require large volumes of precisely manufactured, certified filtered tips that meet strict compatibility and dimensional tolerances. Automated systems amplify the consequences of contamination, making reliable, high-quality filtered tips indispensable for maintaining high throughput and accuracy.

Which geographical region leads the global consumption of filtered pipette tips?

North America currently leads the global market in terms of revenue and consumption volume. This dominance is attributed to high expenditure in biomedical R&D, the strong presence of major pharmaceutical and biotech enterprises, and early adoption of advanced clinical diagnostic technologies, particularly in the United States.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager