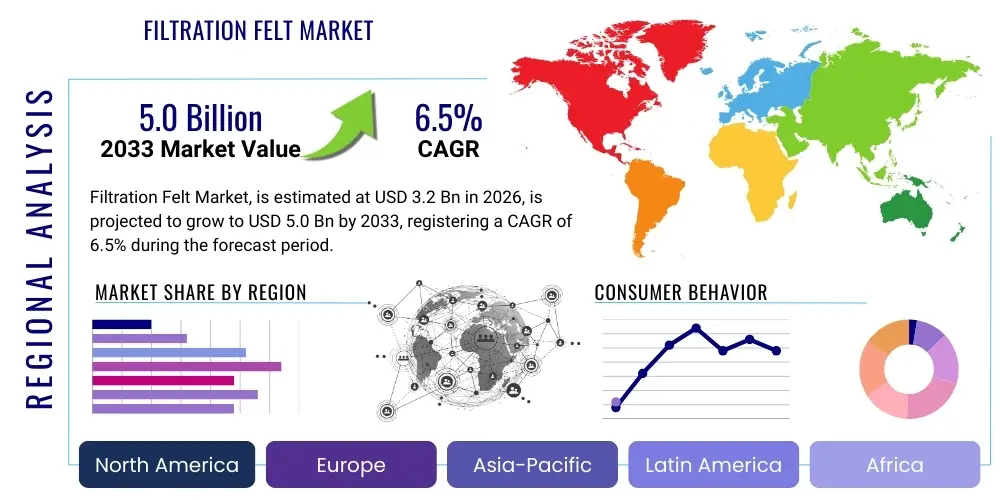

Filtration Felt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438431 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Filtration Felt Market Size

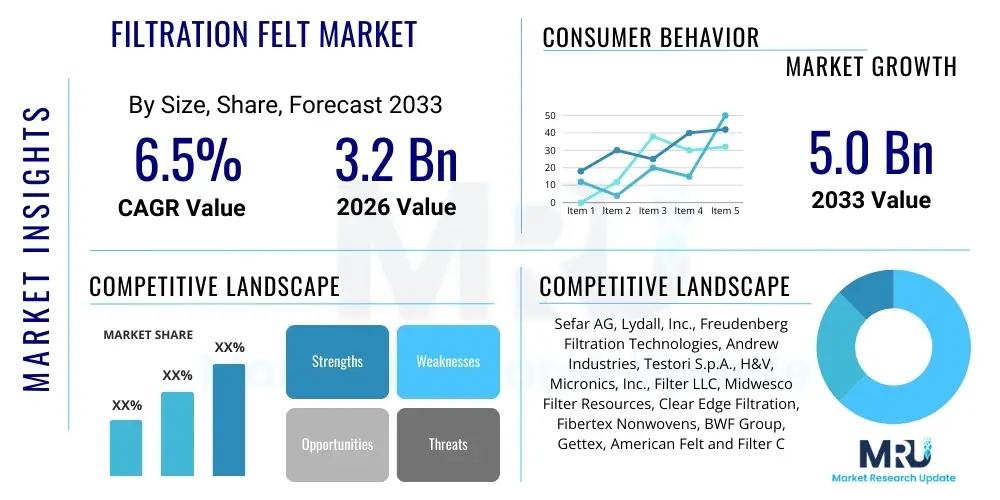

The Filtration Felt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Filtration Felt Market introduction

Filtration felts are highly engineered textile products used primarily for solid-liquid and solid-gas separation processes across diverse industrial applications. These materials are manufactured typically from synthetic fibers such as polyester, polypropylene, acrylic, and aramid, utilizing needle-punching or thermal bonding techniques to create a dense, porous structure with excellent particle retention capabilities and high flow rates. The primary function of these felts is to capture particulates while allowing the fluid or gas phase to pass through, ensuring compliance with environmental regulations and protecting downstream equipment. Key applications span dust collection systems, liquid bag filters, and specialized membrane supports in demanding environments like metallurgy, chemicals, and energy production. The efficacy of filtration felt is defined by intrinsic properties such as fiber denier, specific gravity, porosity, and post-processing treatments like calendering or singeing, which dictate the final permeability and operating characteristics. The complexity of these processes makes filtration felt a specialized, high-value component critical for efficient industrial operation.

The increasing stringency of global environmental regulations regarding industrial emissions, particularly air pollution control (APC) and wastewater treatment, is the foremost driving factor for market expansion. Filtration felt offers superior dirt holding capacity and chemical resistance compared to traditional woven media, leading to extended service life and reduced operational costs for end-users. Unlike woven fabrics, non-woven felts provide depth filtration, capturing particles throughout the entire thickness of the media, which is essential for handling heavy dust loads typical in cement and power industries. This depth structure minimizes particle bypass and increases the time interval between cleaning cycles, optimizing operational expenditures. The sustained demand is also supported by the necessity of these felts in process filtration, ensuring product purity in sensitive sectors like food processing and pharmaceuticals, where contamination control is paramount.

Furthermore, the rising demand for high-efficiency filtration media in pharmaceutical and food & beverage industries, requiring sterile or ultra-clean processes, necessitates advanced polymer blends and specialized surface treatments. Innovations in fiber construction, such as bi-component fibers or micro-fibers, allow for increased filtration efficiency at lower micron ratings while maintaining acceptable flow characteristics and managing differential pressure across the filtration system. The inherent benefits of filtration felts, including customizable permeability, high thermal stability when using materials like PTFE or P84, and robust mechanical strength against continuous pulsing/cleaning cycles, position them as essential components in heavy industrial filtration trains. The shift toward sustainable manufacturing practices is also favoring filtration felts made from recycled or bio-based polymers, introducing new product lines focused on reduced environmental footprint, thereby solidifying the market's trajectory toward significant value growth throughout the forecast period.

Filtration Felt Market Executive Summary

The global Filtration Felt Market is characterized by robust business trends driven primarily by infrastructure development and tightening environmental mandates worldwide. Industrially, the market is witnessing a strong preference shift towards multi-layered composite felts and specialized membranes that offer improved efficiency at sub-micron levels, particularly in high-volume flue gas treatment and industrial dust filtration. Strategic market movements involve substantial capital investment in highly automated needle-punching lines that utilize sensor technology for real-time quality assurance, ensuring product uniformity essential for optimized filter performance. Key competitive strategies currently involve securing long-term supply contracts for specialized fibers like PPS and Aramid and consolidating smaller specialized fabricators to achieve greater control over the downstream customization phase. These trends highlight a market moving toward high specification, premium products designed for maximum efficiency and compliance under demanding operational parameters.

Regionally, the Asia Pacific (APAC) stands out as the epicenter of volume growth, fueled by massive industrial expansion in China, India, and Southeast Asian nations, particularly in coal-fired power generation, cement manufacturing, and chemical processing sectors. These regions are rapidly adopting high-efficiency baghouse technology to meet newly introduced, internationally benchmarked emission standards. North America and Europe, while representing mature industrial landscapes, maintain significant revenue share through strict enforcement of air quality standards (e.g., EU Industrial Emissions Directive, EPA MACT standards), necessitating continuous replacement and upgrade cycles for existing filtration systems. These developed regions lead in adopting highly specialized, high-temperature resistant felts, such as those derived from Polyimide (PI) or Polytetrafluoroethylene (PTFE) fibers, for demanding applications in waste incineration and metallurgical processes, commanding higher average selling prices and focusing on technical consulting services.

Segmentation trends consistently indicate that non-woven filtration felt dominates the market due to its inherent advantages in depth filtration, cost-effectiveness, and adaptability to various surface finishes. By material type, Polyester (PET) remains the single largest segment due to its versatility and favorable cost-performance ratio for general industrial use. However, high-performance materials like Aramid, PPS (Polyphenylene Sulfide), and P84 are experiencing superior growth rates, fueled by their utilization in high-temperature (over 180°C) and chemically aggressive environments where standard synthetics fail. The dust collection application segment, critical for industrial hygiene and pollution control across nearly all manufacturing sectors, represents the largest revenue generator, ensuring sustained R&D investment in innovative filter bag designs, pulse-jet cleaning efficiency, and sophisticated anti-blinding finishes for optimal operational parameters.

AI Impact Analysis on Filtration Felt Market

Common user questions regarding AI's impact on the Filtration Felt Market revolve around predictive maintenance for filtration systems, optimization of manufacturing processes, and quality control. Users are keen to understand how AI algorithms can monitor differential pressure, particulate loading, and cleaning cycle frequency in real-time to accurately predict felt clogging or catastrophic failure, thereby maximizing operational uptime and significantly extending filter service life while minimizing maintenance costs. Furthermore, inquiries focus on using machine learning (ML) to analyze complex production data streams—including fiber blend ratios, needling density, and thermal setting temperatures—optimizing these parameters during felt manufacturing to consistently achieve highly specified permeability and efficiency standards. This translates directly into lower manufacturing variability, reduced waste, and improved final product consistency, addressing the stringent quality requirements of AEO-optimized search queries related to high-efficiency industrial filtration components.

- Predictive Maintenance: AI algorithms analyze sensor data (temperature, pressure drop profiles, flow rate variability) to precisely forecast optimal filter bag replacement times, dramatically minimizing unplanned downtime in critical industrial plants.

- Manufacturing Optimization: Machine learning models optimize complex parameters such as fiber blending ratios, needle penetration depth, and finishing treatments, improving the homogeneity, consistency, and targeted efficiency characteristics of the final felt material product.

- Quality Assurance: Advanced computer vision systems powered by AI are deployed to detect microscopic defects, subtle inconsistencies, or surface irregularities in manufactured felt rolls much faster and with higher repeatability than traditional human inspection methods.

- Supply Chain Resilience: AI systems assist in accurate demand forecasting for specific, high-performance felt types (e.g., PPS, PTFE) based on current end-user industry trends and optimize strategic inventory levels of specialized, high-cost polymer raw materials.

- Energy Efficiency: Implementation of AI allows for the dynamic optimization of dust collector pulsing cycles and fan motor speeds based on real-time particulate load conditions, significantly reducing the overall energy consumption associated with industrial gas filtration operations.

DRO & Impact Forces Of Filtration Felt Market

The market growth is primarily propelled by significant regulatory pressures and pervasive global industrialization, creating a non-discretionary demand for particulate control solutions. Government bodies worldwide are relentlessly implementing stricter emission controls for fine particulates (PM2.5 and PM10) from power plants, cement kilns, and metallurgical operations, mandating the use of high-efficiency baghouse filters that depend entirely on optimized filtration felts. Furthermore, the rapid expansion of manufacturing capabilities across emerging markets, coupled with rising corporate sustainability goals, compels industries to invest heavily in modern air pollution control and liquid effluent treatment systems, securing the core demand base for these engineered textiles. The continuous necessity for specialized felts in applications ranging from basic municipal sewage treatment to highly sensitive aseptic pharmaceutical production provides exceptional market resilience and diversified expansion opportunities that transcend general economic volatility.

However, the market faces notable restraints, chiefly the inherent volatility in the prices of key raw materials, particularly petrochemical-derived polymers used in manufacturing synthetic fibers. Since these costs are directly linked to global oil prices, fluctuating raw material expenditure complicates cost management for felt manufacturers and can temporarily suppress profit margins, leading to pressure for strategic inventory holding or long-term polymer contracts. Additionally, the relatively long service life of high-quality, high-specification filtration felts, especially when made from extremely durable materials like PTFE or with advanced finishes, can extend the replacement cycles in mature industrial markets, slightly constraining consistent volume growth. Competition from alternative filtration technologies, such as ceramics, sintered metals, or highly pleated synthetic cartridges, also presents a constant pressure point requiring ongoing innovation in felt structural integrity and performance benchmarks, particularly concerning the total cost of ownership (TCO).

Significant opportunities for value capture emerge from the increasing global focus on wastewater recycling, resource recovery, and enhanced water scarcity management, which requires robust membrane supports and advanced pre-filtration media for tertiary treatment processes. The growing demand for specialized felts capable of handling extremely high temperatures, chemically aggressive substances, and hydrolytic environments in modern industries like hazardous waste incineration and advanced pyrolysis offers substantial premiumization potential. Furthermore, the development of functionalized filtration felts, engineered with catalytic additives or specialized electrospun nanofiber layers, to achieve simultaneous particulate capture and chemical abatement (e.g., NOx or SOx removal) represents a compelling avenue for technological differentiation and market penetration, especially in high-end industrial sectors seeking integrated, multi-functional environmental compliance solutions and optimized total ownership cost, driving sustainable market evolution.

Segmentation Analysis

The Filtration Felt Market is comprehensively segmented based on material type, technology, application, and end-use industry, providing a detailed view of market dynamics across various specialized needs. Segmentation by material is crucial, as the chemical, mechanical, and thermal resistance requirements of the end application dictate the fiber choice, ranging from cost-effective polyesters for general use to high-performance aramids and PTFE for extreme conditions. Technology segmentation differentiates between high-volume non-woven felt, which offers superior depth filtration characteristics, and specific woven constructions used primarily for support or specific liquid filtration frames. The application segment highlights the dominant usage areas, such as high-volume dust collection, complex liquid filtration systems, and specialized hot gas processes in demanding environments, which are critical inputs for accurate market forecasting and strategic planning.

- By Material Type:

- Polyester (PET)

- Polypropylene (PP)

- Polyphenylene Sulfide (PPS)

- Polyimide (PI)

- Aramid (Nomex, Kevlar)

- PTFE (Polytetrafluoroethylene)

- Others (Acrylic, Fiberglass)

- By Technology:

- Non-Woven Filtration Felt (Needle Punched, Spunbond, Meltblown Composites)

- Woven Filter Media (for specific support and mechanical applications)

- By Application:

- Dust Collection (Air Pollution Control, Baghouses)

- Liquid Filtration (Wastewater Treatment, Chemical Processing, Sludge Dewatering)

- Hot Gas Filtration (Incineration, Pyrolysis)

- Others (Oil & Gas Separation, Food & Beverage Sterilization)

- By End-Use Industry:

- Cement

- Power Generation (Coal Fired, Waste-to-Energy, Biomass)

- Chemicals & Pharmaceuticals

- Metallurgy & Mining

- Food & Beverage

- Wastewater Treatment & Municipal

- Automotive

Value Chain Analysis For Filtration Felt Market

The value chain for the Filtration Felt Market initiates with the upstream sourcing of raw materials, predominantly petrochemical-derived polymers (PET, PP, PPS) and specialized high-performance fibers (Aramid, PTFE). Success in the upstream segment relies heavily on maintaining strategic, long-term relationships with major global polymer manufacturers and effectively managing raw material price and supply chain volatility. Following raw material procurement, the critical midstream phase involves complex, precision manufacturing processes, including highly controlled fiber blending, needle punching or thermal bonding to create the non-woven felt matrix, and various specialized finishing treatments. These treatments—such as singeing, calendering, heat setting for dimensional stability, anti-hydrolysis coatings, and the crucial application of PTFE membranes—are paramount for defining the felt's surface characteristics, optimized permeability, and resistance to harsh operating conditions, allowing manufacturers to differentiate their high-value products.

The downstream component of the value chain focuses on converting the manufactured filtration felt into ready-to-use filter elements, primarily tailored filter bags, precisely dimensioned filter cartridges, or custom-sized media for complex pressure plate filters. This conversion is predominantly performed by specialized fabricators and system integrators who customize the felt media to specific industrial equipment requirements, involving advanced cutting, specialized sewing techniques, and thermal or sonic sealing processes to guarantee structural integrity. Distribution channels are multifaceted, utilizing direct sales channels for large, highly customized industrial projects that require deep technical consultation and specification adherence, and indirect channels relying on a network of specialized filtration distributors and large engineering procurement construction (EPC) companies for standard product distribution.

The efficiency and competitive advantage within the value chain are increasingly dictated by the level of collaborative integration between felt manufacturers and downstream filtration system end-users. This synergy ensures that product specifications meet rapidly evolving regulatory standards and technological demands, particularly concerning maximum permissible emission levels and energy consumption efficiency. Innovations often involve vertical integration or close partnership where performance data gathered from installed filters informs and guides the felt manufacturer in adjusting fiber density profiles or developing new chemical surface treatments. The proliferation of digital platforms is also streamlining the indirect distribution channel, enabling rapid sourcing of standard, AEO-optimized felt products, while the high-value, highly regulated segment continues to rely on expert engineering consultation provided through dedicated direct sales forces, solidifying a sophisticated dual-channel approach for comprehensive market coverage.

Filtration Felt Market Potential Customers

Potential customers for filtration felt are fundamentally derived from industries that generate significant gaseous or liquid effluent streams requiring mandatory particulate removal for environmental compliance, process efficiency, safety, or product purity. Major end-users include the Power Generation sector, specifically large coal-fired, waste-to-energy, and biomass plants, which rely heavily on large-scale baghouse filters utilizing durable, high-temperature resistant felt media for stack emission control. The Cement and Lime industries represent substantial, high-volume buyers, using specialized, mechanically robust felts to efficiently manage extremely heavy, abrasive dust loads in high-temperature air streams throughout the manufacturing process. Furthermore, the Metallurgy and Mining industries purchase felt media designed for superior resistance against chemical corrosion and mechanical abrasion to filter corrosive or high-temperature fumes and dewater high-solids liquid slurries effectively.

In addition to heavy manufacturing and energy, the Chemical Processing sector utilizes filtration felts extensively for precise catalyst recovery, clarification of complex intermediate products, and industrial wastewater polishing, demanding chemically inert and thermally stable materials like PPS, Aramid, and PTFE. The Pharmaceutical and Food & Beverage industries constitute a rapidly expanding premium customer base, requiring highly sterilized, non-leaching, and regulatory-compliant filter media, often utilizing polypropylene or specialized polyester felts with ultra-fine filtration ratings to meet stringent health and purity standards for final products. Municipal and Industrial Wastewater Treatment facilities are also significant long-term users, where durable filtration felts serve as crucial components in belt presses, plate-and-frame filters, and sludge dewatering operations, emphasizing longevity and overall cost-effectiveness.

The procurement decisions of these sophisticated industrial customers are typically driven not merely by initial cost, but by three core metrics: guaranteed filter efficiency (crucial for meeting regulatory PM limits), extended service life (to minimize replacement labor and maintenance costs), and superior resistance to the specific operating environment (high temperature, high humidity, chemical attack, or abrasion). These demanding technical requirements necessitate a consultative sales approach, making filtration felt purchases highly specialized, engineering-driven, and focused on providing the lowest Total Cost of Ownership (TCO) rather than simply the lowest unit price, thereby securing sustained demand for high-specification, technologically advanced products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sefar AG, Lydall, Inc., Freudenberg Filtration Technologies, Andrew Industries, Testori S.p.A., H&V, Micronics, Inc., Filter LLC, Midwesco Filter Resources, Clear Edge Filtration, Fibertex Nonwovens, BWF Group, Gettex, American Felt and Filter Company, Heimbach GmbH, Jiangsu Changzhou No. 4 Nonwoven Fabric Factory, Pall Corporation, AAF International, Hollingsworth & Vose (H&V), 3M Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Filtration Felt Market Key Technology Landscape

The technological evolution within the Filtration Felt Market is intensely focused on maximizing filter media performance characteristics, primarily efficiency, cleanability, durability, and customization for hostile operating conditions. A principal area of innovation involves advanced surface treatments, prominently the application of micro-porous PTFE membranes via lamination or specialized coating techniques. This development shifts the filtration mechanism from inefficient depth capture to highly effective surface filtration, significantly minimizing particle penetration (blinding), allowing for much easier pulse-jet cleaning cycles, and resulting in drastically lower system pressure drops, which directly translates into reduced fan energy consumption and substantial operational cost savings for the end-user. The refinement of these membrane technologies is critical for meeting sub-micron emission standards in power, cement, and waste incineration industries where filtration efficiency is non-negotiable.

Another key area driving technological advancement is the continuous innovation in specialized fiber blends, cross-sectional profiles, and chemical modifications tailored for high-temperature and chemically aggressive environments. Materials such as Polyphenylene Sulfide (PPS), Polyimide (PI), and specialized fiberglass blends are being engineered with enhanced resistance to hydrolysis, oxidation, and acid attack, enabling felt media to perform reliably in environments such as flue gas desulfurization systems and hazardous waste incinerators where sustained temperatures often exceed 200°C. Coupled with this performance focus is the incorporation of advanced functional elements, such as carbon-based or stainless steel fibers into the felt structure, essential for ensuring anti-static and conductive properties, thereby mitigating fire and explosion risks in environments handling combustible dusts like grain or chemical powders, addressing stringent safety compliance requirements.

Manufacturing processes are increasingly leveraging precision engineering and digitalization, moving toward automated needle-punching lines that offer unparalleled control over fiber orientation, entanglement, and density grading within the felt matrix. This precision allows for the creation of gradient density felts—where pore size decreases toward the filter surface—optimizing both deep particle capture and high flow rates simultaneously. The integration of Industry 4.0 principles, utilizing IoT sensors and advanced process control software during manufacturing, ensures real-time monitoring of critical parameters like air permeability, thickness uniformity, and fiber weight distribution. This commitment to highly consistent product quality is foundational for ensuring that filtration felts provide the predictable, optimized performance demanded by modern high-efficiency industrial filtration systems, supporting the sector's competitive edge against alternative rigid media technologies by maximizing lifespan and operational efficiency.

Regional Highlights

The global landscape of the Filtration Felt Market exhibits distinct characteristics across major geographical regions, driven by disparate levels of industrial maturity, environmental policy stringency, and economic growth rates. The Asia Pacific (APAC) region currently dominates the market in terms of volume consumption and is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) during the forecast period. This dominance is primarily attributable to aggressive industrial expansion, particularly in high-pollution sectors like coal power, metallurgy, and construction materials (cement) in populous nations such as China, India, and Indonesia. These nations are simultaneously implementing and rigorously enforcing modern pollution control laws, thereby creating a powerful dual surge in demand for both new installations of high-capacity baghouses and continuous replacement filter media necessary to comply with increasingly stringent national emission reduction targets, fueling massive market activity.

North America and Europe represent mature yet highly regulated markets characterized by a strong focus on high-performance, specialized, and often high-cost materials. In these regions, volume growth is moderate, but revenue growth is primarily driven by the mandatory replacement and technologically driven upgrading of existing filtration systems to comply with ever more stringent legislative limits on fine particulate matter and hazardous air pollutants (HAPs). European markets, significantly influenced by the Industrial Emissions Directive (IED) and carbon neutrality goals, prioritize technologically advanced felt solutions, including PTFE membranes, high-efficiency microfibers, and even catalytic filter media for complex, specialized processes such as municipal waste incineration and high-end chemical manufacturing. The emphasis here is critically placed on high-value, niche product offerings that guarantee ultra-low emission levels and demonstrably extended operational lifetimes.

Latin America and the Middle East & Africa (MEA) are characterized as emerging markets showing nascent but accelerating demand tied directly to infrastructure development and resource extraction activities. Growth in MEA is closely linked to significant regional investments in oil & gas processing, large-scale infrastructure projects, and mining activities, necessitating robust filtration solutions for effective dust suppression and crucial environmental management, often under highly variable climate conditions. Latin America, particularly manufacturing hubs in Brazil and Mexico, presents substantial opportunities due to ongoing industrial modernization and gradual improvements in environmental regulatory frameworks, leading to increased demand for durable and cost-effective filtration solutions. However, these regions often face supply chain challenges and sometimes inconsistent regulatory enforcement, leading to a market structure that balances the adoption of standard polyester and polypropylene felts with premium high-performance materials for critical projects.

- Asia Pacific (APAC): The leading market for volume, driven by unprecedented industrialization, vast capacity expansion in cement, power, and metallurgy sectors, and the rapid, sustained adoption of international-grade air pollution control standards in key economies like China and India.

- North America: A stable, high-value market characterized by stringent EPA compliance, where growth is concentrated in the upgrade and replacement of existing filtration infrastructure with high-efficiency media to meet current federal and state particulate emission mandates.

- Europe: A highly specialized and technologically advanced market, driven by sophisticated demand for chemically resistant and high-temperature compliant felts, often incorporating catalytic functionality, mandated by the EU Industrial Emissions Directive for energy efficiency and emission control.

- Latin America (LATAM): An emerging market experiencing accelerating demand linked primarily to mining, resource processing, and regional manufacturing expansion, focusing on filter media that offer an optimized balance between initial cost and long-term performance durability.

- Middle East & Africa (MEA): Growth spurred by substantial regional investments in oil & gas, large-scale infrastructure, and mining sectors, creating demand for durable, robust filtration media capable of withstanding the harsh, high-temperature, and abrasive operating conditions typical of these industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Filtration Felt Market.- Sefar AG

- Lydall, Inc.

- Freudenberg Filtration Technologies

- Andrew Industries

- Testori S.p.A.

- Hollingsworth & Vose (H&V)

- Micronics, Inc.

- Clear Edge Filtration

- Fibertex Nonwovens

- BWF Group

- Gettex

- American Felt and Filter Company

- Heimbach GmbH

- Jiangsu Changzhou No. 4 Nonwoven Fabric Factory

- 3M Company

- Pall Corporation

- Donaldson Company, Inc.

- AAF International

- Midwesco Filter Resources

- Schoeller Textil AG

Frequently Asked Questions

Analyze common user questions about the Filtration Felt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using non-woven filtration felt over woven media?

Non-woven filtration felt, typically manufactured using needle-punching techniques, offers superior depth filtration capabilities, significantly higher dust holding capacity, and often a more stable, lower pressure drop compared to traditional woven media. This structure facilitates longer filter life, enhanced particulate capture efficiency, and reduced operational costs across industrial dust collection and liquid processing applications.

Which material type dominates the market and why is it preferred?

Polyester (PET) filtration felt dominates the market volume segment due to its excellent cost-to-performance ratio, high tensile strength, and adequate thermal resistance (effective up to 150°C). It is highly versatile and widely adopted in general industrial applications, wastewater treatment, and ambient to moderately heated dust collection systems globally due to its balance of cost and performance attributes.

How do environmental regulations influence the demand for high-performance filtration felt?

Strict government regulations globally, such as the EPA MACT standards and EU Industrial Emissions Directives, enforce extremely low emission limits for particulate matter. This legal framework necessitates the mandatory use of high-performance, specialized filtration media like Aramid, PPS, or PTFE laminated felts, thereby driving both technological innovation and high-value revenue growth in the premium felt segment.

What is the role of PTFE membrane lamination in filtration felt technology?

PTFE membrane lamination applies a durable, micro-porous film to the felt surface, fundamentally transitioning the filtration mechanism to surface filtration rather than depth filtration. This innovation prevents particle penetration, minimizes the risk of blinding (clogging), dramatically improves filter bag cleanability, ensures near-zero emissions, and significantly extends the operational lifespan of the filter media.

Which end-use industry is the largest consumer of high-temperature resistant filtration felt?

The Power Generation (especially coal-fired and waste-to-energy plants) and Cement industries are the largest consumers of high-temperature resistant filtration felt. These sectors rely on vast baghouse systems that operate continuously at high temperatures (often over 180°C), demanding durable media like PPS, P84, or Polyimide to maintain consistent process efficiency and environmental compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager