Final Reduction Drive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434832 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Final Reduction Drive Market Size

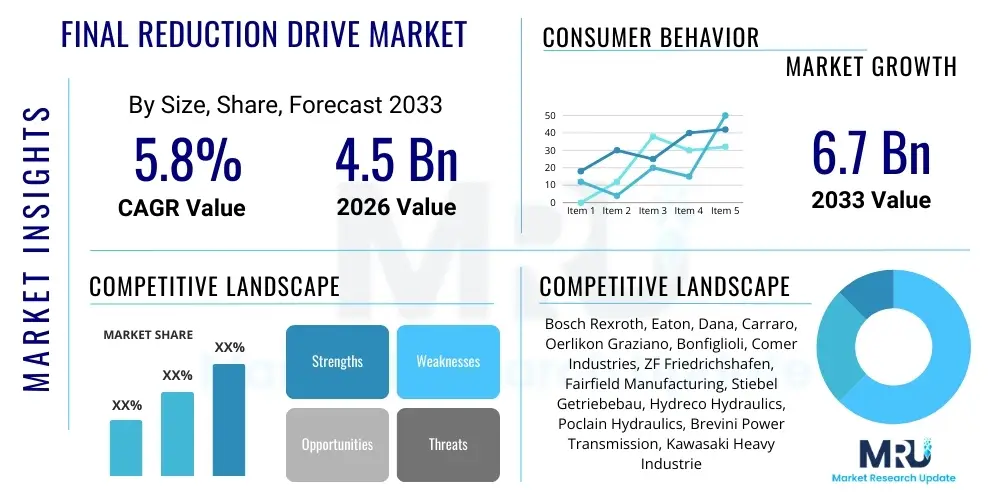

The Final Reduction Drive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for heavy construction equipment, agricultural machinery, and specialized industrial vehicles, all of which rely heavily on robust final reduction drives to manage torque effectively and provide necessary mechanical leverage, especially in demanding operational environments.

The growth trajectory of the Final Reduction Drive Market is closely tied to infrastructural development across emerging economies in Asia Pacific and Latin America. As urbanization accelerates and large-scale public works projects increase, the requirement for reliable excavators, dozers, and material handling equipment surges. Furthermore, advancements in precision agriculture necessitate higher performance and durable drivetrain components, directly boosting the demand for high-specification final drives that offer optimal efficiency and long operational life, thereby minimizing downtime for end-users operating large fleets of heavy machinery.

Final Reduction Drive Market introduction

The Final Reduction Drive Market encompasses mechanical assemblies critical for transmitting power from the vehicle's transmission system to the wheels or tracks, acting as the final stage of gear reduction. These systems are essential for maximizing torque output and efficiently controlling the rotational speed delivered to the traction components, enabling heavy machinery like construction equipment and agricultural tractors to operate effectively under high loads and challenging terrain conditions. Products within this market segment include various configurations, predominantly planetary gear systems, which are favored for their high torque density and compact design, making them ideal for space-constrained applications demanding significant power transfer capability.

Major applications of final reduction drives span across several sectors, including off-highway vehicles such as excavators, wheel loaders, dozers, combine harvesters, and specialized mining trucks. They are indispensable in these environments because they safeguard the main driveline components from excessive stress by ensuring the required torque multiplication occurs near the point of application. The inherent benefits of high-quality final drives include improved operational efficiency, enhanced durability, precise control over movement, and significant reduction in overall equipment wear and tear. These components are foundational to the reliability and performance rating of any heavy-duty machinery, ensuring continuous and safe operation in rigorous duty cycles typically encountered in earthmoving or material handling.

Driving factors propelling market growth include stringent regulatory standards mandating higher fuel efficiency and performance in off-highway vehicles, pushing manufacturers towards advanced gear technologies and lightweight materials in final drive production. The rapid expansion of the global construction industry, particularly in developing nations, coupled with increasing investments in mechanized farming practices, further amplifies the need for durable and efficient final reduction drive systems. Moreover, technological advancements focusing on smart components and predictive maintenance capabilities integrated into modern drives are enhancing product lifespan and operational transparency, attracting greater capital investment from original equipment manufacturers (OEMs).

Final Reduction Drive Market Executive Summary

The Final Reduction Drive Market is experiencing robust business trends characterized by a decisive shift toward highly integrated, modular drive systems that prioritize power density and weight reduction. Key manufacturers are focusing on incorporating advanced sealing technologies and specialized lubrication techniques to extend maintenance intervals and improve component lifespan, directly addressing the end-user requirement for lower total cost of ownership (TCO). Strategic mergers, acquisitions, and technological collaborations dominate the competitive landscape, as companies seek to expand their product portfolios and gain access to proprietary manufacturing processes necessary for producing high-precision, robust gears suitable for electric and hybrid powertrain architectures now emerging in off-highway segments.

Regionally, the Asia Pacific (APAC) market maintains its dominance, driven primarily by massive investments in infrastructure development, rapid industrialization, and the consequential high volume production and sales of construction and agricultural equipment in nations like China, India, and Southeast Asian countries. North America and Europe, while representing mature markets, exhibit strong demand for high-performance, complex drives integrated with electronic control units (ECUs) to meet increasingly strict emissions standards (e.g., Tier 4 Final/Stage V). Segment trends reveal that planetary drives hold the largest market share due to their superior torque density and compact size, while the construction equipment application segment remains the primary revenue generator, closely followed by the growing demand from the agricultural machinery sector as digitalization and automation permeate farming practices globally.

AI Impact Analysis on Final Reduction Drive Market

User questions regarding AI's impact on the Final Reduction Drive Market frequently center on predictive maintenance, the integration of smart sensors, and how machine learning algorithms can optimize the design process for efficiency and durability. Users are highly interested in understanding how AI analyzes operational data—such as temperature, vibration, and load profiles—to predict component failure, thereby minimizing catastrophic downtime. A core concern is the expected initial investment required for integrating AI-driven monitoring systems (like digital twins) into existing heavy machinery fleets. Furthermore, there is significant anticipation regarding AI's potential role in simulating complex load scenarios during the R&D phase, leading to lighter, yet more robust, final drive designs and accelerating the time-to-market for next-generation systems, particularly those tailored for autonomous construction vehicles requiring superior reliability.

- AI-driven Predictive Maintenance: Utilizing machine learning models to analyze sensor data from drives (vibration, temperature, oil quality) to forecast potential failure points and schedule maintenance proactively, significantly reducing unplanned downtime and optimizing asset utilization.

- Optimized Design and Simulation: Employing generative design and AI simulation tools to explore thousands of design iterations, leading to geometrically optimized gears and housings that offer higher power density, reduced weight, and improved thermal management efficiency.

- Enhanced Manufacturing Processes: Implementing AI and computer vision systems in manufacturing lines for real-time quality control, defect detection in gear tooth profiles, and precision assembly, ensuring zero-defect components leave the factory.

- Autonomous Vehicle Integration: AI control systems provide enhanced feedback loops for autonomous vehicles, allowing the final drive actuation and torque application to be micro-managed based on real-time terrain and load conditions, improving traction and energy efficiency.

- Digital Twin Creation: Developing high-fidelity digital models of installed final drives that continuously simulate performance based on real-world operational data, aiding in warranty analysis, lifecycle management, and design validation under various stressors.

DRO & Impact Forces Of Final Reduction Drive Market

The dynamics of the Final Reduction Drive Market are heavily influenced by a balanced interplay of drivers (D), restraints (R), and opportunities (O), creating significant impact forces. The primary driver remains the continuous global investment in infrastructure, demanding robust earthmoving and construction machinery. However, this growth is restrained by the high cost associated with manufacturing precision-engineered components and the intense requirement for specialized heavy lubrication and heat management systems. Opportunities are emerging predominantly from the electrification of off-highway vehicles and the growing adoption of integrated smart drive systems. These forces collectively shape investment decisions, R&D focus, and competitive strategies within the market, pushing manufacturers towards high-efficiency, durable, and technologically advanced solutions.

The key driving forces include stringent government regulations aimed at reducing emissions (e.g., electric vehicle mandates in construction) which necessitate new drive architectures capable of handling instantaneous high torque typical of electric motors. Simultaneously, the global trend towards larger, more powerful agricultural equipment requires final drives with increased load capacity and durability to cope with prolonged, intense duty cycles. This sustained demand from essential sectors like mining and construction guarantees continued volume growth. Furthermore, the shift from conventional hydraulic systems to electro-mechanical actuation provides a favorable environment for innovative final drive designs, enabling better energy harvesting and overall system efficiency.

Restraints primarily revolve around material costs, especially high-grade steel and specialized alloys required for gear manufacturing, which are subject to global commodity price volatility. The technical complexity involved in servicing and repairing highly integrated final drives in remote operating locations also poses a challenge, leading OEMs to invest heavily in specialized training and proprietary diagnostic tools. Opportunities are substantial in the aftermarket service sector, particularly in providing certified replacement parts and refurbishment services for aging fleets. Moreover, emerging markets offer significant potential for modular and standardized final drive solutions that balance performance with cost-effectiveness, enabling localized manufacturing and servicing networks to flourish, thereby mitigating some of the supply chain risks associated with global sourcing.

Segmentation Analysis

The Final Reduction Drive Market is comprehensively segmented based on Type, Application, and End-Use, reflecting the diverse requirements across the heavy machinery sector. The segmentation by Type, encompassing Planetary, Helical, Worm, and Bevel drives, directly addresses specific mechanical requirements concerning torque transfer ratio, efficiency, and physical footprint. Application-based segmentation highlights the major end-user verticals, such as construction, agriculture, and mining, each possessing distinct operational characteristics that mandate specific drive design features, such as enhanced sealing for abrasive environments in mining or specialized efficiency for prolonged use in agriculture. This structured segmentation is critical for market participants to tailor their product development, marketing efforts, and distribution strategies to meet the precise needs of targeted industrial customers.

The structure of demand across these segments indicates a strong preference for Planetary Final Reduction Drives due to their compactness and exceptional ability to deliver high torque multiplication in a small volume, making them the default choice for track drives and wheel hubs in large construction equipment. The growing trend of automation and digitalization in machinery further influences segmentation, demanding drives that can interface seamlessly with sophisticated electronic control systems. Understanding these nuances allows manufacturers to prioritize investments in R&D, focusing on areas like thermal management systems for high-speed drives or developing standardized interfaces compatible across multiple OEM platforms, thereby capturing larger shares across the application segments where efficiency and resilience are paramount operational metrics for end-users worldwide.

- By Type:

- Planetary Final Reduction Drive

- Helical Final Reduction Drive

- Worm Final Reduction Drive

- Bevel Final Reduction Drive

- By Application:

- Construction Equipment (Excavators, Loaders, Dozers)

- Agricultural Machinery (Tractors, Harvesters, Sprayers)

- Mining Equipment (Dump Trucks, Shovels, Drills)

- Material Handling Equipment (Forklifts, Cranes)

- Industrial Vehicles and Robotics

- By End-Use:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Value Chain Analysis For Final Reduction Drive Market

The value chain for the Final Reduction Drive Market begins with the upstream segment, dominated by suppliers of high-grade raw materials such as specialized steel alloys, casting materials, and complex electronic components necessary for modern sensor integration. The quality of these inputs is non-negotiable, given the extreme load and stress conditions under which final drives operate. Following material acquisition, the key manufacturing stages involve precision machining, heat treatment (carburizing, nitriding), and meticulous gear grinding, processes that require substantial capital investment in advanced manufacturing equipment and quality control systems to achieve the necessary tolerances and surface hardness for optimal performance and extended service life. OEMs often maintain highly proprietary manufacturing techniques to gain a competitive edge in durability and noise reduction.

The downstream analysis focuses on integration and distribution. Distribution channels typically involve a direct relationship between the major component manufacturers and large Original Equipment Manufacturers (OEMs), who integrate the final drives into their heavy machinery during assembly. This direct channel facilitates customization and technical collaboration throughout the design and prototyping phases. The indirect channel predominantly handles the aftermarket segment, involving a network of specialized distributors, service centers, and spare parts suppliers who cater to maintenance, repair, and replacement needs globally. The effectiveness of the indirect distribution network, particularly its ability to deliver genuine components rapidly to remote mining or construction sites, significantly impacts equipment uptime and customer satisfaction, making logistics a critical value-added activity within this market.

The shift towards smarter, integrated drives has amplified the importance of collaboration between component suppliers and software providers. This convergence of mechanical and digital capabilities is redefining value creation, moving beyond purely mechanical performance to include data analytics and predictive maintenance services bundled with the physical product. Ultimately, value is captured through product differentiation based on power density, reliability metrics (measured by Mean Time Between Failures, MTBF), and the efficiency of the global service and support infrastructure. Success in the Final Reduction Drive Market requires mastering not only material science and precision engineering but also optimizing a robust, high-availability supply chain tailored for heavy industrial applications globally.

Final Reduction Drive Market Potential Customers

The primary potential customers and end-users of final reduction drives are global Original Equipment Manufacturers (OEMs) specializing in the production of heavy off-highway and industrial machinery. These include major companies producing construction equipment such such as excavators, skid-steer loaders, articulated trucks, and wheel loaders, where the final drive system is a critical, heavy-duty component responsible for converting engine power into usable traction. Given the high criticality of the component, OEMs look for long-term partnerships with suppliers capable of mass-producing components that meet rigorous safety, performance, and durability standards specific to extreme operational environments.

Another significant customer segment is composed of agricultural machinery manufacturers, particularly those focusing on large-scale mechanized farming solutions like high-horsepower tractors, combine harvesters, and specialized forestry equipment. These buyers require drives optimized for efficiency and precise torque control, essential for modern precision agriculture systems. Furthermore, mining operations and heavy material handling sectors (e.g., port cranes, heavy-duty forklifts) represent substantial end-users, demanding ultra-durable final drives that can withstand continuous operation under abrasive conditions and extreme loads. The aftermarket segment, comprising independent repair workshops, fleet maintenance departments, and specialized parts distributors, also forms a crucial customer base, seeking reliable and cost-effective replacement units and service kits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Eaton, Dana, Carraro, Oerlikon Graziano, Bonfiglioli, Comer Industries, ZF Friedrichshafen, Fairfield Manufacturing, Stiebel Getriebebau, Hydreco Hydraulics, Poclain Hydraulics, Brevini Power Transmission, Kawasaki Heavy Industries, Sumitomo Heavy Industries, Reggiana Riduttori, JTEKT, Nabtesco, Parker Hannifin, Bondioli & Pavesi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Final Reduction Drive Market Key Technology Landscape

The technological landscape of the Final Reduction Drive Market is currently defined by a relentless pursuit of higher power density, enhanced efficiency, and integration capabilities for electrified powertrains. A significant area of focus involves advanced gear metallurgy and surface treatments, such as specialized plasma nitriding and coatings, designed to dramatically increase the load-bearing capacity and fatigue resistance of gear teeth while maintaining compact footprints. Furthermore, manufacturers are increasingly adopting computer-aided engineering (CAE) tools and finite element analysis (FEA) during the design phase to optimize stress distribution, leading to lighter components that meet or exceed traditional durability standards, a crucial advancement for reducing the overall weight and improving the fuel economy of heavy machinery.

Another pivotal technological development involves the incorporation of advanced sealing systems and lubrication management techniques. Given that final drives frequently operate in environments characterized by extreme temperature fluctuations and ingress of contaminants (dust, mud, water), modern designs feature multi-lip seals and pressure-compensated breathers to maximize oil retention and minimize external contamination, thereby extending the operational lifespan and maintenance intervals. The move towards synthetic and bio-degradable lubricants is also gaining traction, aligning with stricter environmental regulations and enhancing thermal stability under heavy load conditions, which is particularly relevant for the construction and mining sectors where equipment often operates continuously for long periods.

The most forward-looking technology is the integration of smart components. Modern final drives are being equipped with miniaturized sensors for monitoring key operational parameters such as oil temperature, vibration levels, and rotational speed. This sensor data is relayed via CAN bus networks to the vehicle's central ECU or telematics system, enabling sophisticated condition monitoring and predictive maintenance algorithms. This connectivity transforms the final drive from a purely mechanical component into a critical data-generating node, paving the way for advanced fleet management, remote diagnostics, and the development of customized service plans, significantly enhancing the value proposition for end-users by minimizing costly unplanned breakdowns and maximizing fleet availability.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Final Reduction Drive Market, primarily driven by massive government investments in infrastructure development, particularly in emerging economies such as China, India, and Indonesia. The high volume manufacturing base for heavy construction and agricultural equipment located in this region, coupled with rapid urbanization, ensures sustained demand for both OEM and aftermarket components. The regional market is characterized by intense price competition and a strong focus on high volume, standardized drive solutions suitable for various localized machinery platforms.

- North America: This region represents a mature market focused on high-performance, heavy-duty applications, particularly in the construction, mining, and oil and gas sectors. Demand is shifting towards final drives engineered for compatibility with electric and hybrid powertrains, prioritizing efficiency and advanced telematics integration. Regulatory requirements for lower emissions and safety standards necessitate sophisticated, high-precision drives, often leading to higher average selling prices and a strong emphasis on reliability and extended warranty periods from component manufacturers serving this region.

- Europe: The European market is defined by stringent environmental regulations (like Stage V emissions standards) and a strong push toward advanced automation in agricultural and construction sectors. Demand is high for custom-engineered, specialized final drives that offer superior noise reduction and energy efficiency, supporting the region's focus on sustainable operational practices. Germany, France, and Italy are key manufacturing and consumption hubs, driven by innovation in precision engineering and high-quality, long-life components suitable for premium machinery brands.

- Latin America: This region exhibits growing demand driven by increasing mechanization in the agricultural sector (especially Brazil and Argentina) and significant investments in mining operations. While cost sensitivity is a factor, the necessity for robust, dependable drives capable of handling challenging operating conditions in remote areas ensures consistent market growth. The region relies heavily on imported technology but is seeing increased development of local assembly and service centers to reduce logistical costs and improve lead times for replacement parts.

- Middle East and Africa (MEA): Market growth in MEA is highly dependent on large-scale infrastructure projects (e.g., GCC nations) and substantial mining activities (South Africa). The operating environment demands components with extreme durability and superior protection against dust and high temperatures. Investment cycles in infrastructure and commodity prices heavily influence procurement decisions, leading to fluctuating demand but a consistent requirement for reliable, heavy-duty planetary and helical drives built to withstand harsh desert and high-abrasion conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Final Reduction Drive Market.- Bosch Rexroth AG

- Eaton Corporation plc

- Dana Incorporated

- Carraro S.p.A.

- Oerlikon Graziano S.p.A.

- Bonfiglioli Riduttori S.p.A.

- Comer Industries S.p.A.

- ZF Friedrichshafen AG

- Fairfield Manufacturing Company, Inc.

- Stiebel Getriebebau GmbH & Co. KG

- Hydreco Hydraulics S.r.l.

- Poclain Hydraulics S.A.

- Brevini Power Transmission S.p.A. (Part of Dana)

- Kawasaki Heavy Industries, Ltd.

- Sumitomo Heavy Industries, Ltd.

- Reggiana Riduttori S.r.l.

- JTEKT Corporation

- Nabtesco Corporation

- Parker Hannifin Corporation

- Bondioli & Pavesi S.p.A.

Frequently Asked Questions

Analyze common user questions about the Final Reduction Drive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and technological advantage of a Final Reduction Drive in heavy machinery?

The primary function of a final reduction drive is to act as the last stage of gear reduction, maximizing torque delivered to the wheels or tracks while minimizing rotational speed. The technological advantage, especially in modern planetary drives, lies in their high torque density and compact size, enabling efficient power transfer and mechanical leverage under extremely heavy loads, crucial for earthmoving and mining applications.

How is the electrification of construction equipment influencing the design requirements for Final Reduction Drives?

Electrification requires final drives capable of handling the instantaneous high torque output of electric motors. Designs are evolving to feature improved heat dissipation systems, specialized gearing materials, and greater integration with electronic control units (ECUs) for precise regenerative braking and energy management, necessitating lighter and more durable components.

Which application segment holds the largest market share for Final Reduction Drives globally?

The construction equipment segment, encompassing hydraulic excavators, wheel loaders, and dozers, currently holds the largest market share. This dominance is attributed to continuous global infrastructure development and the mandatory requirement for robust, high-power final drives essential for heavy-duty earthmoving operations.

What are the key differences between OEM and Aftermarket demand in the Final Reduction Drive Market?

OEM demand is volume-driven, focusing on collaborative design, precision, and long-term supply agreements for new equipment assembly. Aftermarket demand is focused on quick availability, cost-effectiveness, and reliable replacement parts for maintenance and repair of existing machinery fleets, often seeking components that match or exceed original specifications for seamless integration.

What role does predictive maintenance technology play in enhancing the lifespan of Final Reduction Drives?

Predictive maintenance utilizes integrated sensors and AI algorithms to monitor operational parameters like vibration and temperature in real-time. By identifying minute variations that precede failure, this technology allows operators to schedule precise, preventative maintenance interventions, significantly extending the drive's service life and drastically minimizing costly unplanned downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager