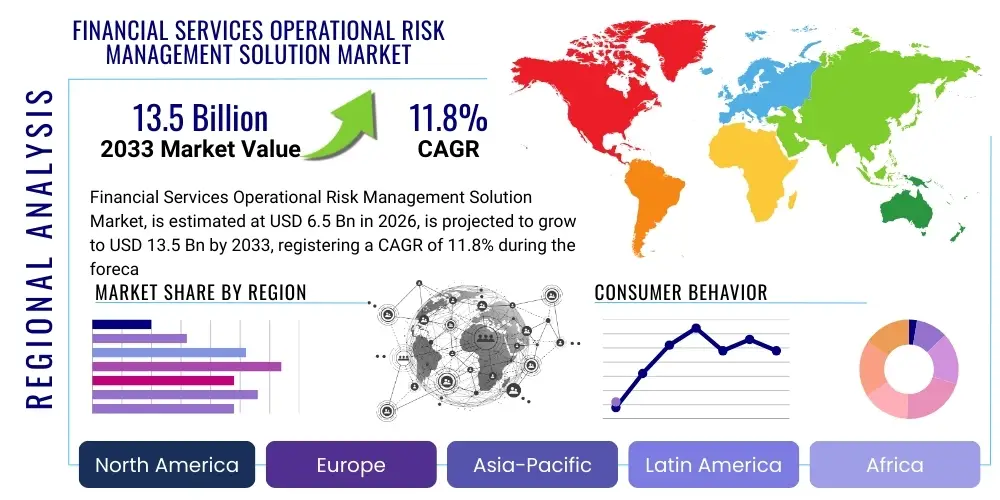

Financial Services Operational Risk Management Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438970 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Financial Services Operational Risk Management Solution Market Size

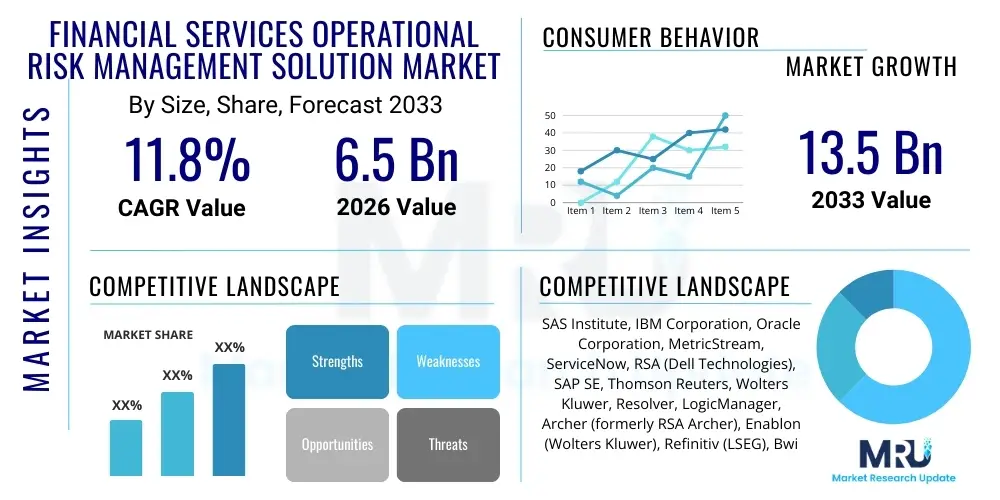

The Financial Services Operational Risk Management Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Financial Services Operational Risk Management Solution Market introduction

The Financial Services Operational Risk Management (ORM) Solution Market encompasses specialized software and services designed to help banking, insurance, and capital market firms identify, assess, monitor, and mitigate operational risks. Operational risk includes potential losses resulting from inadequate or failed internal processes, people, and systems, or from external events. These solutions integrate governance, risk, and compliance (GRC) frameworks, providing quantitative and qualitative tools for risk modeling, loss data collection, scenario analysis, and reporting to satisfy stringent regulatory requirements set by bodies like Basel Committee on Banking Supervision (BCBS) and local regulators globally.

The core objective of ORM solutions is enhancing organizational resilience and efficiency by providing a unified view of risk exposure across the enterprise. Key functionalities include advanced risk control self-assessment (RCSA) capabilities, comprehensive Key Risk Indicator (KRI) monitoring dashboards, and sophisticated incident management systems. The demand is primarily fueled by the increasing complexity of global financial operations, the rise in cyber threats and fraud, and the continuous evolution of regulatory mandates which necessitate proactive rather than reactive risk mitigation strategies. Modern solutions are increasingly shifting towards cloud-based platforms offering enhanced scalability and real-time data processing capabilities.

Major applications of these solutions extend across crucial areas such as IT risk management, third-party risk management (TPRM), business continuity planning (BCP), and internal audit management. The adoption of advanced technologies like Artificial Intelligence (AI) and machine learning (ML) within these platforms is driving significant market benefits, including automated identification of emerging risks, predictive modeling of loss events, and improved resource allocation for risk mitigation efforts. These drivers collectively position the ORM market as essential infrastructure for maintaining stability and trust within the volatile global financial ecosystem.

Financial Services Operational Risk Management Solution Market Executive Summary

The Financial Services Operational Risk Management (ORM) market is experiencing rapid expansion, driven by regulatory modernization and the imperative for digital transformation within financial institutions (FIs). Business trends indicate a strong move toward integrated GRC suites rather than standalone ORM tools, allowing FIs to streamline compliance and risk functions. Furthermore, there is a pronounced focus on solutions that specialize in addressing non-financial risks, particularly cyber risk and compliance with environmental, social, and governance (ESG) mandates. Strategic acquisitions and partnerships among technology providers are defining the competitive landscape, aiming to offer holistic, end-to-end risk management platforms capable of handling heterogeneous data sources and complex modeling requirements.

Regionally, North America maintains the largest market share due to the early adoption of advanced GRC technologies and the presence of strict regulatory frameworks enforced by bodies like the Federal Reserve and the SEC. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid expansion of banking sectors in emerging economies, increased foreign investment, and regulatory harmonization efforts across countries like China, India, and Southeast Asia. Europe remains a significant market, influenced heavily by GDPR requirements and robust banking union regulations, pushing demand for solutions that ensure data privacy compliance alongside traditional operational risk monitoring.

Segment trends reveal that the Services component (including implementation, consulting, and managed services) is growing faster than the Software component, reflecting the specialized expertise required to tailor complex ORM systems to unique organizational structures and regulatory environments. Deployment-wise, Cloud-based solutions are rapidly gaining traction over traditional on-premise deployments, particularly among Small and Medium-sized Enterprises (SMEs) and progressive large enterprises seeking cost efficiency, rapid deployment, and enhanced computational power necessary for advanced risk analytics. Large financial institutions, while retaining substantial on-premise infrastructure, are increasingly transitioning mission-critical ORM functions to hybrid cloud environments to maximize flexibility and scalability.

AI Impact Analysis on Financial Services Operational Risk Management Solution Market

User queries regarding AI's influence on ORM solutions frequently center on automation potential, accuracy in risk prediction, reduction of false positives, and the ethical implications of using autonomous systems in critical decision-making processes. Key concerns revolve around how effectively AI can interpret unstructured data (such as emails or news articles) to identify emerging risks that human analysts might miss, and whether machine learning models can be adequately governed and audited to satisfy regulatory scrutiny. Users also inquire about the ability of AI to seamlessly integrate with existing legacy ORM systems and enhance capabilities like conduct risk monitoring and real-time anomaly detection across vast transaction volumes.

The consensus suggests that AI and Machine Learning (ML) are not merely incremental improvements but foundational shifts for the ORM market, enabling a transition from historical data analysis to predictive and proactive risk management. AI algorithms drastically improve the capability to process large datasets for identifying subtle patterns indicative of impending operational failures, fraudulent activities, or compliance breaches. This automation significantly reduces manual data processing time, freeing up risk professionals to focus on strategic mitigation. However, successful implementation requires robust data governance and explainable AI (XAI) models to ensure transparency and trust in AI-driven risk outputs, addressing the inherent 'black box' problem associated with complex ML architectures.

- AI enhances predictive modeling by utilizing deep learning to forecast potential operational loss events based on internal and external leading indicators.

- Machine learning improves real-time anomaly detection in transaction monitoring, significantly minimizing instances of fraud and misconduct.

- Natural Language Processing (NLP) is employed to analyze unstructured data (e.g., regulatory updates, communication logs) for early identification of emerging risks and compliance gaps.

- Automation through AI streamlines Risk Control Self-Assessment (RCSA) processes, ensuring more frequent and consistent risk identification across the enterprise.

- AI-driven behavior analysis models help detect potential conduct risk among employees, improving internal control effectiveness.

DRO & Impact Forces Of Financial Services Operational Risk Management Solution Market

The dynamics of the Financial Services ORM market are shaped by a powerful interplay of drivers, restraints, and opportunities. The primary driver is the exponentially increasing volume and sophistication of cyber threats and evolving regulatory standards worldwide, demanding constant upgrades and investment in advanced risk tools. Opportunities arise from the convergence of risk domains (operational, credit, market) into integrated platforms, coupled with the potential to leverage cloud infrastructure for enhanced data handling and deployment flexibility. However, significant restraints include the high initial implementation costs associated with complex enterprise software and the persistent challenges of integrating modern solutions with legacy IT infrastructure deeply entrenched within many large financial institutions.

A major driving force is the global regulatory environment, particularly the refinement of capital adequacy frameworks (like Basel IV) which impose stricter requirements on modeling and reporting operational risk capital. Financial institutions are mandated to demonstrate sophisticated risk quantification techniques, necessitating the adoption of specialized ORM solutions. Furthermore, the increasing reliance on third-party vendors and cloud service providers accelerates demand for robust Third-Party Risk Management (TPRM) modules integrated within ORM suites, focusing on vendor due diligence, continuous monitoring, and supply chain resilience against operational disruptions.

The primary impact forces include technological inertia and skilled talent shortages. While the opportunity for advanced analytics is high, the scarcity of data scientists and risk modeling experts capable of effectively managing and interpreting outputs from complex AI-driven ORM systems acts as a restraint on rapid adoption. Conversely, the opportunity to deploy blockchain technology for enhancing transparency and auditability in cross-border transactions and data trails presents a long-term growth catalyst. Addressing these restraints through managed services and user-friendly interface designs is crucial for market vendors aiming for widespread penetration beyond tier-one financial institutions.

Segmentation Analysis

The Financial Services Operational Risk Management Solution Market is segmented across several critical dimensions, including Component, Deployment Type, Organization Size, Application, and End-User, reflecting the diverse needs and technical maturity levels across the financial services sector. The segmentation allows providers to tailor solutions specifically to address the unique compliance requirements, scale of operations, and preferred infrastructure models of different banking and insurance entities. Analysis shows strong segment growth in cloud-based solutions due to cost-effectiveness and scalability, while the banking sector remains the largest end-user due to high regulatory pressure and systemic risk exposure.

- By Component:

- Software (Platform, Modules)

- Services (Professional Services, Managed Services)

- By Deployment Type:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Risk Assessment

- Audit Management

- Compliance Management

- Incident Management and Loss Data Collection

- Key Risk Indicators (KRIs) Management

- Policy Management

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Capital Markets

- Insurance

- Others (FinTechs, Credit Unions)

Value Chain Analysis For Financial Services Operational Risk Management Solution Market

The value chain for Financial Services ORM solutions begins with upstream activities focused on foundational technology development and intellectual property creation. This stage involves specialized software developers, data scientists, and risk modeling experts who design the core algorithms, predictive models, and regulatory mapping frameworks. Key upstream players include specialized GRC software vendors and cloud infrastructure providers (like AWS, Azure, Google Cloud) that supply the scalable, secure computing environments necessary for deploying advanced risk analytics platforms. Innovation at this stage is focused on integrating AI/ML capabilities for enhanced risk sensing and optimizing platform performance for high-volume data processing.

The midstream and downstream activities involve solution delivery, integration, and ongoing support. Midstream players include system integrators, consulting firms (e.g., specialized Big Four consulting arms), and value-added resellers (VARs) who customize the generic software platforms to meet the specific operational nuances and regulatory jurisdictions of individual financial institutions. Distribution channels are complex, involving both direct sales (for major enterprise software contracts with tier-one banks) and indirect channels facilitated by channel partners for reaching regional banks and mid-sized institutions. The effectiveness of the distribution channel hinges on the partner network's domain expertise in finance and regulatory compliance.

The final stage involves extensive post-deployment services, including ongoing maintenance, frequent software updates to incorporate new regulatory mandates (e.g., updates to IFRS 9 or Basel guidelines), and continuous managed services for outsourced ORM functions. Direct interaction provides vendors with crucial feedback for product improvement, particularly concerning user experience and the accuracy of risk models. The value chain emphasizes expertise, security, and scalability, as financial institutions demand platforms that are not only effective in mitigating risk but also fully auditable and compliant with evolving global technology standards and data localization laws.

Financial Services Operational Risk Management Solution Market Potential Customers

The primary customer base for Financial Services Operational Risk Management solutions spans the entire spectrum of the BFSI industry, mandated by regulators to maintain robust risk control environments. This includes universal banks, investment banks, retail banks, and specialized financial services firms whose operations involve complex transaction processing, interaction with large volumes of sensitive customer data, and high levels of regulatory oversight. Large, multinational banking conglomerates are the most significant buyers, often requiring highly customized, integrated GRC platforms capable of managing risk exposure across multiple geographical regions and business lines under varied regulatory regimes.

Secondary but rapidly growing customer segments include the Insurance sector (life, property and casualty, and reinsurance firms) and Capital Markets entities (asset managers, hedge funds, brokerage firms). Insurance companies increasingly require ORM solutions to manage catastrophic risk modeling, compliance with solvency regulations (like Solvency II in Europe), and managing large agent networks. Capital market firms utilize ORM platforms heavily for algorithmic trading monitoring, surveillance, and mitigating technological risks associated with high-frequency trading platforms and market volatility events.

Furthermore, the emergence of FinTech companies and smaller, regional financial institutions represents a substantial growth opportunity, particularly for cloud-based ORM vendors. These smaller entities often lack the deep IT resources for on-premise solutions and prefer subscription-based, scalable services. Their operational risk profile is unique, often centered on API security, digital platform resilience, and rapid scaling challenges. Therefore, the ideal ORM solution must be highly configurable, easy to deploy, and cost-effective, offering specialized modules that address digital operational risk (DORA) requirements and technology risk specifically.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAS Institute, IBM Corporation, Oracle Corporation, MetricStream, ServiceNow, RSA (Dell Technologies), SAP SE, Thomson Reuters, Wolters Kluwer, Resolver, LogicManager, Archer (formerly RSA Archer), Enablon (Wolters Kluwer), Refinitiv (LSEG), Bwise (Nasdaq), Fusion Risk Management, Riskonnect, ProcessUnity, Cura Software Solutions, Qualys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Services Operational Risk Management Solution Market Key Technology Landscape

The technological landscape of the ORM market is undergoing fundamental transformation, moving away from static database management systems towards dynamic, analytical platforms. Key technological pillars include Advanced Analytics, Artificial Intelligence, and Cloud Computing. Advanced analytics, leveraging statistical modeling and large datasets, provides the basis for quantitative operational risk calculations and scenario analysis required for regulatory compliance (e.g., Basel requirements). The ability to perform complex calculations rapidly and efficiently necessitates high-performance computing capabilities, driving the widespread adoption of specialized analytical engines within ORM software suites.

Cloud infrastructure is crucial for scalability, cost management, and facilitating rapid deployment of ORM solutions. Hybrid and public cloud models offer financial institutions the elasticity required to handle peak periods of data processing (like quarterly reporting cycles) and accommodate the massive datasets generated by enterprise-wide transaction monitoring. Furthermore, Cloud-native ORM solutions inherently improve collaboration and data sharing across disparate departments, supporting the integrated GRC vision. Security, however, remains paramount, requiring vendors to provide robust encryption, access control mechanisms, and compliance with regional data residency laws within their cloud offerings.

The integration of emerging technologies like Robotic Process Automation (RPA) and Blockchain is increasingly defining the competitive edge. RPA is utilized to automate repetitive compliance tasks and data entry for loss event collection, reducing human error and improving data integrity. Blockchain technology holds significant promise for creating immutable audit trails and enhancing transparency in third-party and supply chain risk monitoring, especially in cross-border finance. Successful market players are those who can effectively synthesize these disparate technologies into a unified, user-friendly interface that provides actionable, predictive insights to both front-line risk managers and executive leadership.

Regional Highlights

- North America: Dominates the market, driven by the presence of large global financial institutions, stringent regulatory oversight (Dodd-Frank Act, OCC guidelines), and high technological maturity. Early adoption of GRC integration and significant investment in cybersecurity ORM modules characterize this region.

- Europe: A mature market characterized by complex, harmonized regulations (GDPR, MiFID II, Solvency II). Demand is high for solutions that manage cross-border operational risks, conduct risk, and compliance with data privacy mandates. The transition to cloud computing is slower than in North America but accelerating.

- Asia Pacific (APAC): Expected to register the fastest growth due to the rapid digitization of financial services, expansion of the regional banking sector (especially in China and India), and increasing governmental efforts toward regulatory harmonization and financial stability. Focus areas include technology risk and fraud management solutions.

- Latin America (LATAM): Growth is primarily driven by the need to combat high rates of financial fraud and regulatory modernization efforts aimed at improving transparency and stability. Brazil and Mexico are key markets, showing growing demand for modular, affordable cloud-based ORM services.

- Middle East and Africa (MEA): Emerging market characterized by significant growth in the Gulf Cooperation Council (GCC) countries, driven by large infrastructure projects and increasing complexity in Islamic finance. Demand focuses on robust compliance solutions and IT operational risk management specific to digital banking initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Services Operational Risk Management Solution Market.- SAS Institute

- IBM Corporation

- Oracle Corporation

- MetricStream

- ServiceNow

- RSA (Dell Technologies)

- SAP SE

- Thomson Reuters

- Wolters Kluwer

- Resolver

- LogicManager

- Archer (formerly RSA Archer)

- Enablon (Wolters Kluwer)

- Refinitiv (LSEG)

- Bwise (Nasdaq)

- Fusion Risk Management

- Riskonnect

- ProcessUnity

- Cura Software Solutions

- Qualys

- SureCloud

- Check Point Software Technologies

- Logicgate

- Quantivate

- Fiserv, Inc.

- Nice Ltd.

- PegaSystems

- Capgemini

- Deloitte (Consulting Services)

Frequently Asked Questions

Analyze common user questions about the Financial Services Operational Risk Management solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Operational Risk Management (ORM) market?

The core driver is the escalating complexity and frequency of regulatory changes (e.g., Basel IV, DORA), coupled with the increasing sophistication of non-financial risks, particularly cyber attacks and technological failures within financial institutions.

How is cloud computing impacting the deployment of ORM solutions?

Cloud adoption is accelerating rapidly as it offers enhanced scalability, lower total cost of ownership (TCO), and the required computing power for advanced analytical models, enabling faster deployment and updates compared to traditional on-premise systems, especially for mid-sized FIs.

Which application segment holds the largest share in the market?

The Compliance Management and Risk Assessment segments consistently hold the largest market share, reflecting the foundational necessity for financial institutions to meet mandated regulatory requirements and systematically identify and quantify potential operational loss exposures.

What role does Artificial Intelligence (AI) play in modern ORM platforms?

AI, through machine learning and NLP, enables predictive risk modeling, real-time anomaly detection, automated loss data aggregation, and efficient analysis of unstructured data, moving ORM from reactive reporting to proactive risk sensing and mitigation.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-scale digital transformation initiatives, rapid economic expansion, and maturing regulatory frameworks across key regional markets.

The comprehensive analysis of the Financial Services Operational Risk Management Solution Market reveals a crucial reliance on technological integration to navigate the current risk environment. Financial institutions globally recognize that traditional manual processes are insufficient to handle the velocity and volume of modern operational threats, demanding sophisticated, AI-driven solutions deployed on flexible cloud infrastructures. This shift is not just an IT upgrade but a strategic imperative to maintain regulatory compliance, competitive advantage, and client trust in an increasingly digitized financial landscape. Future market success will be defined by vendors who can seamlessly merge GRC capabilities with advanced predictive analytics, ensuring explainability and auditability to meet the stringent demands of regulators and stakeholders. The continued regulatory pressure, particularly concerning digital operational resilience, guarantees sustained high growth and innovation across the forecast period.

In conclusion, the ORM market is transitioning towards a hyper-integrated ecosystem where risk, compliance, and internal audit functions operate on a single, unified platform. This integration is vital for eliminating silos, enhancing the overall risk culture, and achieving operational efficiency. The market’s resilience is underpinned by the continuous cycle of regulatory change and the persistent emergence of new risk vectors, particularly those stemming from cloud adoption, third-party reliance, and complex geopolitical factors. Investment in specialized professional services to manage complex implementations and adapt to bespoke regulatory environments will remain a critical sub-segment, ensuring market vitality and strategic adaptation across all financial segments.

The strong momentum in cloud migration, particularly the move towards hybrid models among Tier 1 institutions, signifies a long-term commitment to flexible and powerful ORM infrastructure. This trend, combined with the deepening application of machine learning for behavioral and conduct risk analysis, sets the stage for a market defined by predictive insights rather than historical analysis. The APAC region's swift regulatory catch-up and digital acceleration promise significant market opportunities, offsetting the relative maturity seen in North America and Europe, thereby ensuring a globally robust growth trajectory for Operational Risk Management solutions through 2033. Strategic mergers and acquisitions will likely consolidate key technology offerings, driving further platform integration and specialized solution deployment.

The focus on environmental, social, and governance (ESG) factors is emerging as a material operational risk, compelling financial institutions to integrate ESG data and metrics into their existing ORM frameworks. This integration requires software capabilities to track non-financial data, assess reputational risks, and ensure alignment with global sustainability standards. Vendors must rapidly develop modules that facilitate ESG risk scoring and reporting, transforming these externalities into quantifiable operational metrics. This trend is driven heavily by investor demand and regulatory mandates, particularly in Europe, signaling a permanent expansion of the traditional ORM scope beyond just IT and process failures to encompass broader societal and environmental impacts of financial operations.

Furthermore, technology risk, including system failure and data breach vulnerability, now constitutes the most significant operational risk category, often exceeding traditional fraud losses in impact. Consequently, ORM solutions are evolving into highly specialized technological risk platforms, integrating deep monitoring of IT infrastructure, cyber security posture, and resilience testing (e.g., penetration testing results and business continuity plans). The solutions are increasingly required to provide real-time alerts and automated response protocols, minimizing downtime and mitigating cascading failures within interconnected banking systems. This convergence of cyber security management and operational risk is a defining characteristic of the current market evolution.

The development of open APIs and low-code/no-code platforms within ORM suites is improving accessibility and customization, enabling financial institutions to build proprietary risk models and integrate third-party data sources without extensive vendor reliance. This technical flexibility caters specifically to the unique requirements of niche financial firms and allows for quicker adaptation to sudden market or regulatory shifts. The ability to integrate external data feeds, such as geopolitical risk indicators or supply chain disruption data, enhances the predictive accuracy of operational risk models, offering a comprehensive view of macro-level risks impacting daily operations. This open architecture approach is crucial for future proofing ORM investments.

Finally, the challenge of measuring and quantifying 'culture risk' or 'conduct risk' continues to drive innovation in ORM behavioral analytics. Solutions are employing ML to analyze employee communications, transaction patterns, and HR data to flag potential instances of misconduct or compliance lapses before they materialize into major losses. This proactive surveillance requires sophisticated ethical frameworks and strict data privacy controls to ensure compliance with employee protection laws. The refinement of these conduct risk modules represents a significant opportunity for vendors, providing financial institutions with the tools to manage intangible risks that have historically led to massive fines and reputational damage. The successful deployment of these sensitive tools will hinge on transparent governance and employee acceptance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager