Financial Services Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434079 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Financial Services Software Market Size

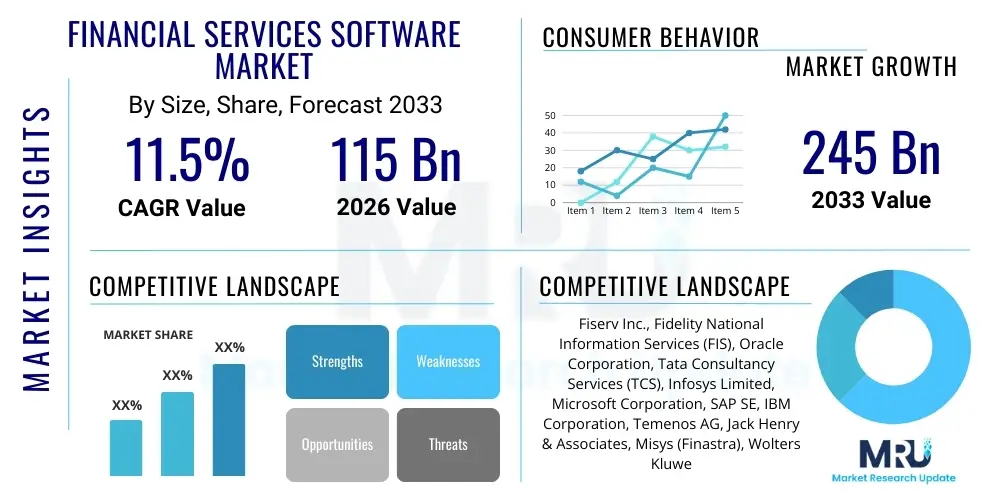

The Financial Services Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $115 Billion in 2026 and is projected to reach $245 Billion by the end of the forecast period in 2033.

Financial Services Software Market introduction

The Financial Services Software Market encompasses a wide range of technological solutions designed to support, automate, and enhance the operations of banking, insurance, and capital market institutions. This software includes core banking platforms, risk management systems, customer relationship management (CRM) tools specific to finance, compliance and regulatory reporting suites, and innovative solutions for digital payments and wealth management. The fundamental purpose of these products is to improve operational efficiency, ensure stringent regulatory adherence, optimize customer experience through digital channels, and mitigate financial risks, thereby enabling institutions to navigate the complex modern financial landscape characterized by rapid technological advancement and intense competition from FinTech disruptors. The continuous need for institutions to modernize legacy infrastructure, driven by high customer expectations for seamless digital interactions and the imperative to leverage data analytics for strategic decision-making, forms the bedrock of market demand.

Major applications of financial services software span across several critical functional areas, including front-office activities such as digital onboarding and loan origination, middle-office functions like risk assessment and anti-money laundering (AML) monitoring, and back-office operations, encompassing general ledger management and regulatory filings. The key benefits derived from the adoption of these solutions include substantial cost reduction through automation of manual processes, improved security posture against increasingly sophisticated cyber threats, and the ability to launch new, personalized products quickly. For instance, modern core banking systems allow banks to consolidate disparate data sources, offering a holistic view of the customer and enabling proactive service delivery, which is vital in maintaining competitive parity in a digital-first economy. The shift towards open banking frameworks globally further necessitates the adoption of robust software solutions capable of managing APIs and ensuring secure data exchange.

The market growth is primarily driven by three compelling factors: the global push for digital transformation within established financial institutions, increasing regulatory complexity necessitating advanced RegTech (Regulatory Technology) solutions, and the accelerating adoption of cloud computing models. Financial institutions are facing immense pressure to transition away from monolithic, often decades-old, legacy systems that inhibit innovation and scalability. The inherent flexibility, lower operating costs, and quicker deployment cycles offered by modern, cloud-native financial software solutions are acting as powerful catalysts. Furthermore, the rising volume of data generated by financial transactions requires sophisticated analytical software, often embedded with artificial intelligence, to extract actionable insights for fraud detection, credit scoring, and personalized marketing, solidifying the software segment's essential role in modern finance.

Financial Services Software Market Executive Summary

The Financial Services Software Market is experiencing robust expansion, fueled by pervasive digital transformation initiatives and the transition of core operations to cloud-based environments, ensuring scalability and reducing capital expenditure for financial institutions globally. Key business trends indicate a significant consolidation of the vendor landscape as large technology firms acquire specialized FinTech players to enhance their offerings in areas like decentralized finance (DeFi) and hyper-personalization tools. Regionally, North America maintains its dominance due to high concentration of major financial hubs and early adoption of advanced technologies such as predictive analytics and blockchain applications in capital markets. However, the Asia Pacific region is demonstrating the highest growth trajectory, driven by mass adoption of mobile banking, penetration into underserved populations, and government mandates supporting financial inclusion through digital platforms. Segment trends highlight that the Solution segment, particularly platforms focusing on Governance, Risk, and Compliance (GRC) and Customer Experience (CX), commands the largest market share, while the Services segment, offering implementation and managed support, is expected to exhibit the fastest growth as complexity demands specialized integration expertise.

AI Impact Analysis on Financial Services Software Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Financial Services Software Market frequently revolve around four central themes: automation and efficiency gains in back-office tasks, the ability of AI to revolutionize customer interactions through hyper-personalized experiences, the integration challenges associated with legacy infrastructure, and, critically, the ethical and regulatory concerns surrounding data bias and explainability (XAI). Users are particularly concerned about how AI-driven tools, such as predictive models for credit risk and automated compliance monitoring, can be deployed reliably and transparently to meet stringent regulatory requirements. Furthermore, a substantial number of questions focus on the shift in workforce skills, recognizing that AI-powered software requires specialized talent for development, maintenance, and interpretation of complex algorithms, indicating a broad expectation that AI will redefine, rather than eliminate, key operational roles within financial institutions.

The integration of AI transforms traditional software offerings by embedding intelligence directly into operational workflows, moving systems from reactive reporting to proactive decision-making. In lending, for example, AI tools analyze thousands of variables far beyond traditional credit scores to assess risk more accurately and instantly, reducing loan approval times significantly. For the software vendors themselves, AI offers a competitive advantage by allowing their platforms to self-optimize and adapt to changing regulatory environments or market conditions without constant manual reprogramming. This capability is paramount in high-stakes fields like algorithmic trading and fraud detection, where milliseconds and subtle patterns dictate success or failure. Consequently, modern financial services software is increasingly being defined by its native AI capabilities, moving away from simple digitalization toward genuine intelligence augmentation.

The pervasive adoption of AI across risk management and customer service verticals necessitates continuous updates to underlying software infrastructure, driving significant investment. In the realm of compliance, AI-powered RegTech solutions are crucial for monitoring large volumes of transactional data in real-time, instantly flagging suspicious activity related to money laundering or market manipulation, significantly reducing the cost and complexity associated with manual reviews. However, the deployment of large language models (LLMs) in customer-facing software, such as advanced chatbots or virtual financial assistants, introduces novel challenges regarding data security and the need to ensure outputs adhere strictly to institutional policies. The successful embedding of AI within financial software is therefore contingent upon achieving a delicate balance between computational power, data governance, and regulatory compliance.

- Automation of routine tasks such as data entry, reconciliation, and claims processing, leading to significant cost savings.

- Enhanced predictive analytics for credit scoring, fraud detection (Anti-Money Laundering/Know Your Customer), and market trend forecasting.

- Hyper-personalization of customer experiences through AI-driven recommendations, customized investment advice, and dynamic pricing models.

- Development of advanced Generative AI capabilities for drafting legal documents, summarizing regulatory changes, and improving internal knowledge bases.

- Integration of Explainable AI (XAI) tools within core banking and risk software to ensure transparency and auditability of automated decisions.

- Accelerated development of Low-Code/No-Code platforms that allow business users to rapidly create AI-powered financial applications.

DRO & Impact Forces Of Financial Services Software Market

The dynamics of the Financial Services Software Market are shaped by a potent combination of driving forces that encourage technological adoption and significant restraining factors related to security and legacy infrastructure, creating a complex risk-reward profile for stakeholders. The primary drivers include the mandatory pursuit of operational efficiency through automation, the overwhelming consumer preference for digital channels (mobile and web), and the critical need for robust compliance systems to meet ever-evolving global regulations such as Basel IV, IFRS 17, and GDPR. Concurrently, the proliferation of Application Programming Interfaces (APIs) and the rise of Open Banking frameworks globally incentivize financial institutions to adopt flexible, modular software that can easily integrate with third-party FinTech solutions, moving the industry away from proprietary monolithic architectures towards collaborative ecosystems. This digital imperative ensures a sustained high demand for modern software solutions designed for integration and scalability.

Despite strong drivers, several major restraints impede market acceleration. Chief among these is the pervasive presence of deeply entrenched legacy systems within established institutions. Replacing or modernizing these core systems is immensely costly, time-consuming, and carries significant execution risk, often leading institutions to opt for piecemeal integration strategies rather than full replacement. Furthermore, the financial sector remains the prime target for sophisticated cyberattacks, making data security and system resilience paramount concerns. The high cost associated with implementing top-tier security protocols, complying with complex data sovereignty laws, and managing the continuous threat landscape often limits the speed of technology deployment. A final restraint is the shortage of specialized talent, particularly in fields combining deep financial domain knowledge with expertise in cloud architecture, AI development, and advanced cybersecurity, hindering effective utilization of cutting-edge software capabilities.

However, substantial opportunities exist, particularly in leveraging emerging technologies and addressing untapped markets. The adoption of Blockchain and Distributed Ledger Technology (DLT) presents a generational opportunity to revolutionize cross-border payments, trade finance, and digital asset management, necessitating new software platforms optimized for decentralized environments. Moreover, the vast potential presented by serving the underbanked and unbanked populations globally, particularly in emerging economies in Asia Pacific and Africa, drives demand for accessible, mobile-first financial software solutions. The impact forces are generally high, characterized by rapid technological substitution—where established software must quickly incorporate AI, cloud-native features, and robust API frameworks or risk obsolescence—and high regulatory pressure, making continuous compliance a non-negotiable feature for all successful software vendors in this domain. These forces collectively ensure that the market remains dynamic, competitive, and highly focused on rapid innovation cycles.

Segmentation Analysis

The Financial Services Software Market is primarily segmented across three major dimensions: Component, Deployment Model, and Application, each reflecting distinct operational needs and market maturity levels. The Component segmentation differentiates between core software Solutions, which are the packaged applications like risk management or CRM platforms, and the accompanying Services, which include consulting, implementation, maintenance, and managed services essential for successful deployment and long-term operation of complex financial systems. The Deployment Model segmentation highlights the ongoing industry transition, dividing the market between traditional On-Premise deployments, often used for legacy or highly sensitive core systems, and the increasingly dominant Cloud-based deployments, favored for their flexibility, scalability, and faster time-to-market. Finally, the Application segmentation categorizes software based on the specific financial sector served: Banking, Insurance, and Capital Markets, each having unique regulatory and functional requirements that necessitate highly specialized software tools.

- By Component

- Solutions (Core Banking Systems, Payments Processing, Wealth Management, GRC)

- Services (Consulting, Implementation, Managed Services, Integration)

- By Deployment Model

- On-Premise

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- By Application

- Banking (Retail Banking, Commercial Banking)

- Insurance (Life Insurance, Property & Casualty Insurance)

- Capital Markets (Trading & Brokerage, Asset Management)

- By Technology

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Distributed Ledger Technology (DLT)

- Application Programming Interfaces (APIs) and Open Banking platforms

Value Chain Analysis For Financial Services Software Market

The value chain for the Financial Services Software Market begins upstream with foundational technology providers, including infrastructure and platform service providers such as hyperscale cloud vendors (AWS, Azure, Google Cloud) and specialized component developers offering AI modules, security frameworks, and database management systems. These suppliers provide the essential technological backbone and raw tools upon which specialized financial applications are built. The core value-adding activities involve intensive research and development, software coding and testing, and the critical processes of ensuring regulatory compliance and integration compatibility. This phase is characterized by high intellectual property investment and the need for specialized financial domain expertise to translate complex financial requirements into robust software features. Effective management of this phase is crucial for product quality and time-to-market.

Downstream analysis focuses on the distribution channels and deployment processes that deliver the software to the end customer. Distribution occurs through a combination of direct sales models, where large enterprise vendors engage directly with major banks, and indirect channels, involving system integrators, value-added resellers (VARs), and strategic partners who often specialize in regional deployment or niche vertical implementations (e.g., credit unions). The final delivery stage includes implementation, data migration from legacy systems, customization, integration with existing IT stacks, and ongoing managed services and support. Direct channels offer vendors maximum control and direct customer feedback, crucial for large, mission-critical systems. Indirect channels provide broader market reach and specialized local expertise, particularly important in geographically diverse markets with varied regulatory landscapes, ensuring comprehensive market penetration and localized support.

Financial Services Software Market Potential Customers

The primary consumers and end-users of Financial Services Software encompass the entire spectrum of the global financial ecosystem, driven by the universal need for digitalization, security, and efficiency across all operational scales. Traditional financial institutions form the largest customer base, including tier 1 and tier 2 commercial banks, savings and loan associations, and credit unions, which rely on this software for core operations, regulatory reporting, and enhancing their digital customer journeys. A secondary, yet rapidly expanding, customer segment includes the entire insurance industry, spanning life, property, and casualty insurers, who utilize specialized software for policy administration, claims processing, actuarial modeling, and meeting complex solvency requirements.

Furthermore, the Capital Markets segment represents a sophisticated demand center, comprising investment banks, asset management firms, hedge funds, brokerage houses, and stock exchanges, requiring ultra-low latency trading platforms, portfolio management systems, risk aggregation tools, and advanced compliance software for market surveillance. Finally, the growing cohort of non-traditional financial entities, such as FinTech startups, challenger banks, Payment Service Providers (PSPs), and specialized lending platforms (e.g., peer-to-peer lenders), represent critical potential customers who often prioritize cloud-native, API-driven software to achieve rapid scaling and operational agility, challenging established institutions and driving market innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115 Billion |

| Market Forecast in 2033 | $245 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv Inc., Fidelity National Information Services (FIS), Oracle Corporation, Tata Consultancy Services (TCS), Infosys Limited, Microsoft Corporation, SAP SE, IBM Corporation, Temenos AG, Jack Henry & Associates, Misys (Finastra), Wolters Kluwer, Broadridge Financial Solutions, Wipro Limited, Capgemini, Accenture plc, Salesforce.com, Intuit Inc., SS&C Technologies, BlackRock (Aladdin Platform) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Financial Services Software Market Key Technology Landscape

The technological landscape of the Financial Services Software Market is rapidly converging around cloud-native architectures, API-driven connectivity, and the integration of artificial intelligence for intelligent automation. Cloud computing is no longer merely an option but a strategic imperative, allowing institutions to shift capital expenditure (CapEx) to operational expenditure (OpEx), enabling continuous innovation, and facilitating global scalability without heavy upfront investment in physical infrastructure. The use of microservices architecture in conjunction with containerization technologies, such as Kubernetes, enables financial applications to be highly resilient, fault-tolerant, and easily updated, crucial for maintaining competitive edge in a fast-paced environment. This shift underpins the modernization of core banking platforms, allowing them to function as agile ecosystems rather than monolithic systems.

Another fundamental technological pillar is the adoption of Application Programming Interfaces (APIs), which are the building blocks of Open Banking and Open Finance initiatives globally. APIs allow seamless, secure data exchange between financial institutions and licensed third-party providers (TPPs), driving the creation of new joint products and personalized customer services. Robust API management software is essential for maintaining security, managing traffic, and ensuring regulatory compliance during data sharing. Furthermore, the rising maturity of Blockchain and Distributed Ledger Technology (DLT) is beginning to offer tangible use cases beyond cryptocurrencies, particularly in areas requiring high transparency and immutable record-keeping, such as cross-border payments, trade finance reconciliation, and supply chain finance, driving demand for DLT-enabled software platforms.

Finally, the proliferation of AI and Machine Learning remains the defining technological trend, embedding predictive capabilities across the functional spectrum. Software vendors are heavily investing in specialized AI toolkits for credit risk modeling, fraud detection (leveraging deep learning techniques), and algorithmic decision-making in trading. Complementary to AI, the adoption of Low-Code/No-Code (LCNC) development platforms is accelerating, democratizing application development within financial institutions. LCNC tools allow business analysts and domain experts, who are not professional software engineers, to quickly develop and deploy functional applications, such as internal workflow tools or customer facing prototypes, drastically reducing development cycles and reliance on scarce IT resources, thereby speeding up the overall pace of digital transformation.

Regional Highlights

- North America: Dominates the global market share, driven by high investment in FinTech innovation, the presence of major global financial hubs (New York, Toronto), and rapid adoption of advanced technologies like AI, blockchain, and robust cybersecurity software due to large transaction volumes and sophisticated fraud prevention needs. The US market leads in both consumption and supply of cutting-edge financial software solutions.

- Europe: Characterized by strong regulatory mandates such as PSD2 (Open Banking) and GDPR, compelling institutions to invest heavily in API platforms and compliance software. The UK, Germany, and the Nordic countries are significant growth contributors, with a focus on sustainable finance solutions (Green FinTech) and integrated cross-border payment platforms.

- Asia Pacific (APAC): Exhibits the fastest growth rate, fueled by massive digital adoption in emerging economies (India, Southeast Asia) and government-backed initiatives for financial inclusion. China and India are technology powerhouses, driving demand for mobile banking solutions, digital wallets, and regulatory technology (RegTech) to handle rapid expansion and vast customer bases.

- Latin America (LATAM): Showing strong potential due to efforts to modernize outdated banking systems and increase digital penetration. Countries like Brazil and Mexico are seeing growth in cloud adoption and FinTech startups focused on improving payment infrastructure and facilitating easier access to credit, often bypassing traditional banking infrastructure.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by large state-led digital transformation visions and diversification efforts away from oil economies, leading to significant investment in smart banking platforms, particularly in the UAE and Saudi Arabia. Africa sees growth through mobile money software solutions addressing vast unbanked populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Financial Services Software Market.- Fiserv Inc.

- Fidelity National Information Services (FIS)

- Oracle Corporation

- Tata Consultancy Services (TCS)

- Infosys Limited

- Microsoft Corporation

- SAP SE

- IBM Corporation

- Temenos AG

- Jack Henry & Associates

- Misys (Finastra)

- Wolters Kluwer

- Broadridge Financial Solutions

- Wipro Limited

- Capgemini

- Accenture plc

- Salesforce.com

- Intuit Inc.

- SS&C Technologies

- BlackRock (Aladdin Platform)

Frequently Asked Questions

Analyze common user questions about the Financial Services Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from On-Premise to Cloud deployment models in financial software?

The primary driver is the need for agility, scalability, and operational efficiency. Cloud-based models offer lower Total Cost of Ownership (TCO), faster deployment of services, enhanced data accessibility for remote workforces, and the ability to integrate easily with modern FinTech ecosystems via APIs, overcoming the limitations of rigid legacy infrastructure.

How significant is the role of Regulatory Technology (RegTech) software in this market?

RegTech is fundamentally significant, acting as a crucial growth catalyst. Increasing global regulatory complexity (e.g., AML, KYC, Basel IV) necessitates sophisticated software that automates compliance, monitors transactional data in real-time, and generates precise regulatory reports, thereby reducing penalties and operational risk exposure for financial institutions.

Which segmentation segment is expected to show the fastest growth rate in the forecast period?

The Cloud Deployment Model segment is projected to exhibit the fastest growth, particularly Hybrid Cloud solutions, as financial institutions strategically migrate non-core applications first while ensuring critical core banking systems remain protected. The Services component segment (implementation and managed services) also shows high growth due to increasing complexity requiring vendor expertise.

What are the main security challenges faced by financial services software providers?

The main challenges involve protecting sensitive customer data and financial assets from increasingly advanced cyber threats, including ransomware, phishing, and denial-of-service (DDoS) attacks. This requires continuous investment in advanced security software, multi-factor authentication, robust data encryption, and maintaining resilience against zero-day vulnerabilities in cloud environments.

How does Open Banking specifically influence the demand for new financial software?

Open Banking, driven by regulatory mandates like PSD2, necessitates the development and deployment of robust, secure API management platforms. This framework fosters innovation by compelling banks to open up data (with customer consent) to third-party developers, increasing demand for software that facilitates secure data sharing, API integration, and collaborative FinTech partnerships.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager