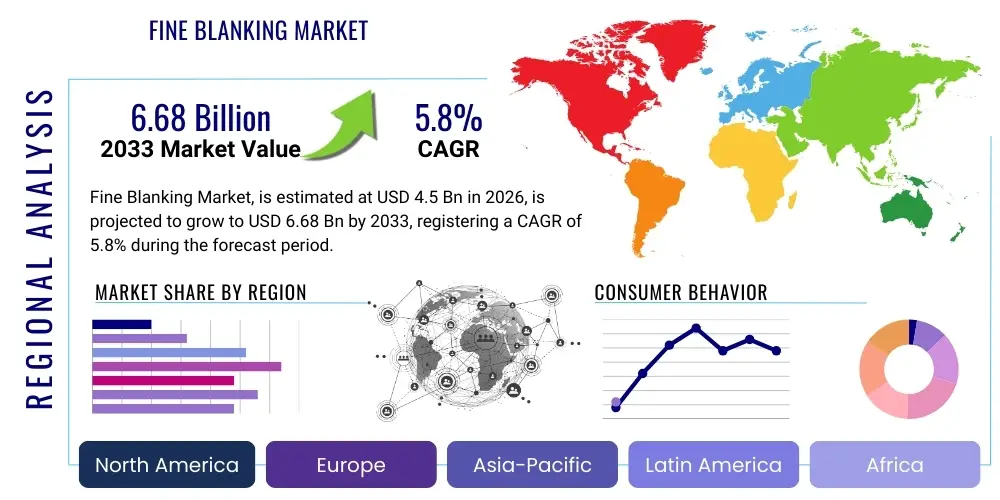

Fine Blanking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438314 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Fine Blanking Market Size

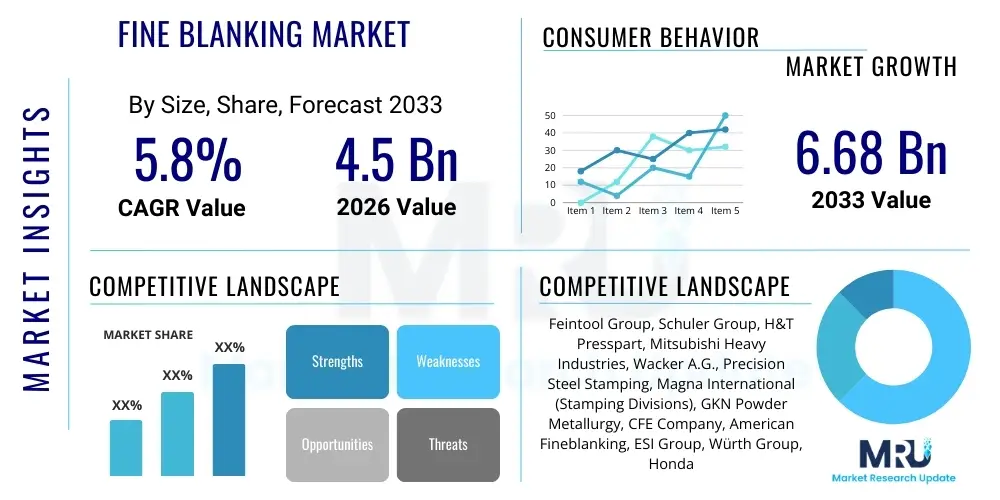

The Fine Blanking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.68 Billion by the end of the forecast period in 2033.

Fine Blanking Market introduction

Fine blanking is a specialized stamping process that allows for the precise cutting of thick material with exceptional dimensional accuracy and superior edge quality, often eliminating the need for subsequent machining operations. This method utilizes a combination of three distinct actions—the application of a V-ring counter-force, the hold-down force, and the blanking force—all within a single press stroke. The resulting components boast extremely smooth, fully sheared surfaces across 100% of the material thickness, making them ideal for high-stress, high-precision applications. This technology is critical in sectors requiring robust, complex components manufactured at high volumes with tight tolerances, particularly within the automotive and industrial machinery sectors.

The primary products manufactured using fine blanking include precision components such as transmission gears, brake system parts (e.g., parking pawls and clutch plates), safety-critical mechanism components, and various linkages and levers used in seating and locking mechanisms. The inherent benefits of fine blanking, such as high material utilization, repeatability, and the ability to integrate complex features like deep draw forms and semi-piercings in a single operation, position it as a highly cost-effective and technically superior alternative to traditional stamping or casting processes. These advantages are particularly potent in the automotive industry, which continually demands lighter, stronger, and more intricate parts to meet evolving fuel efficiency and safety standards.

Driving factors for market expansion include the increasing production of complex parts in the global automotive sector, especially with the transition toward electric vehicles (EVs) which still require precision mechanisms in braking, steering, and battery management systems. Furthermore, growth in sophisticated industrial machinery, medical devices, and high-performance electronics, all of which rely on components with zero-draft, smooth-edge contours, significantly contributes to the escalating demand for fine blanking services and machinery. The ability of fine blanking to process high-strength low-alloy (HSLA) steels and other advanced materials efficiently further solidifies its crucial role in modern manufacturing supply chains globally.

Fine Blanking Market Executive Summary

The Fine Blanking Market is experiencing robust growth driven predominantly by the global automotive sector's increasing need for intricate, safety-critical components and the concurrent shift toward higher-strength materials. Business trends indicate a strong focus on automation and integration of advanced monitoring systems within fine blanking presses to maximize throughput, minimize material waste, and ensure stringent quality control required by Tier 1 and Tier 2 suppliers. Key market players are prioritizing investments in higher tonnage machines capable of processing larger and thicker components, alongside diversifying their service offerings to include assembly and secondary finishing operations, thereby enhancing their value proposition in a highly competitive manufacturing landscape.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive vehicle production volumes in China, India, and Japan, alongside burgeoning industrial infrastructure development. North America and Europe maintain strong market shares characterized by high-value applications, stringent regulatory requirements, and rapid adoption of advanced fine blanking technologies, especially in powertrain and chassis systems. The Middle East and Africa (MEA) and Latin America (LATAM) show promising potential, driven by infrastructure investments and the establishment of local automotive assembly plants, albeit from a smaller base, focusing mainly on importing precision components.

Segmentation trends highlight the dominance of the automotive application segment, specifically within internal combustion engine (ICE) and hybrid vehicle components, though the electric vehicle segment is showing the fastest anticipated growth rate. In terms of technology, hydraulic fine blanking presses continue to hold sway due to their versatility and capacity for complex operations, but the emergence of hybrid and fully electric presses is gaining traction due to superior energy efficiency and enhanced process control. Manufacturers are also observing a trend toward specialized high-tonnage equipment (above 800 tons) necessary for processing advanced, thick materials commonly used in heavy-duty commercial vehicle components.

AI Impact Analysis on Fine Blanking Market

Common user questions regarding AI's impact on fine blanking revolve primarily around enhanced predictive maintenance capabilities, optimization of tool life, and the role of machine learning in reducing process variability. Users frequently ask how AI can analyze stamping force curves and acoustic signatures to detect subtle defects in real-time or predict potential failures in dies and tooling before catastrophic damage occurs. There is significant interest in using AI algorithms to optimize blanking parameters (such as oil pressure, counter-pressure, and punch speed) automatically based on material characteristics and ambient conditions, ensuring consistent 100% shear quality across millions of cycles. Furthermore, stakeholders seek clarification on how AI-driven quality control systems, utilizing computer vision and deep learning, can replace manual inspection processes, thereby accelerating throughput and eliminating human error in quality-critical applications like safety parts production.

The core expectation is that AI integration will fundamentally transform the operational efficiency and reliability of fine blanking operations. By leveraging vast amounts of historical machine data, AI systems can pinpoint correlations between operational parameters and resulting component quality that are invisible to human operators. This capability is expected to drive down operational costs, significantly extend the lifespan of expensive fine blanking tools, and dramatically improve the traceability of components. While initial implementation costs and the need for specialized data infrastructure present challenges, the long-term benefits in terms of maximized uptime and enhanced precision justify the strategic investment in AI-driven smart manufacturing solutions within this niche industry.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by analyzing vibration, temperature, and pressure data to forecast tool and machine component failures.

- Optimized Process Parameters: Machine learning algorithms dynamically adjust counter-pressure and speed based on material batch variation for superior shear quality.

- Enhanced Tool Life Management: AI models predict optimal maintenance cycles for precision dies, reducing wear and extending expensive tooling operational hours.

- Automated Quality Inspection: Utilizes computer vision and deep learning for real-time, non-contact inspection of sheared edges and dimensional accuracy.

- Supply Chain Optimization: AI integrates production scheduling with material inventory to ensure just-in-time delivery and reduce buffer stock requirements.

- Fault Diagnostics: Rapid identification and categorization of stamping defects (e.g., micro-cracks, burrs) to prevent batch-level rejections.

DRO & Impact Forces Of Fine Blanking Market

The Fine Blanking Market is primarily propelled by the relentless demand for high-precision, safety-critical components, especially within the global automotive industry's electrification and lightweighting mandates. However, the market faces significant restraints stemming from the high initial capital investment required for specialized fine blanking presses and the subsequent high cost associated with the precise manufacturing and maintenance of fine blanking tooling. Opportunities are abundant in expanding applications beyond traditional automotive uses into complex medical implants, aerospace components, and advanced battery enclosures for electric vehicles. These dynamics are shaped by impact forces such as stringent regulatory standards for vehicle safety and emissions, driving manufacturers toward zero-defect precision manufacturing, alongside intense competition from alternative manufacturing processes like laser cutting and advanced casting, which continually pressure pricing and technological differentiation.

Drivers: Growing global vehicle production, particularly in emerging markets, creates massive demand for standardized, reliable components. Furthermore, the mandatory push for lightweighting in vehicle structures to improve fuel efficiency and increase EV range necessitates the use of high-strength materials (like HSLA steels), which fine blanking can process efficiently while maintaining tight tolerances. The process inherently offers significant complexity in a single operation, reducing assembly costs and simplifying the supply chain for intricate mechanical systems. Increased adoption of high-tonnage machines also facilitates the production of larger, structural components, expanding the addressable market beyond small linkages and gears.

Restraints: The most prominent constraint remains the significant capital expenditure required to procure modern fine blanking presses, which are substantially more expensive than conventional stamping equipment. Coupled with this is the extreme precision required in die manufacturing, leading to long lead times and high replacement costs for tooling, which deters smaller manufacturers from entry. Additionally, the process is highly material-dependent, and successful fine blanking requires materials with consistent mechanical properties and flatness, creating challenges when working with new or highly specialized alloys, requiring extensive material testing and process development.

Opportunities: Major growth avenues lie in non-automotive sectors such as robotics, medical devices (orthopedic implants, surgical instruments), and high-reliability industrial automation where component failure is unacceptable. The shift toward Electric Vehicles (EVs) presents a specific opportunity for fine blanked busbar connectors, high-precision thermal management components, and complex battery pack enclosures. Geographic expansion, particularly capitalizing on the growing manufacturing hubs in Southeast Asia and Mexico, represents a fertile area for market penetration. Furthermore, developing hybrid processes combining fine blanking with subsequent forming or heat treatment steps offers integrated solutions that increase component value.

- Drivers: Automotive lightweighting trends; increasing demand for safety-critical components; complexity integration in single-pass operation; growth in industrial machinery sectors.

- Restraints: High initial capital investment for machinery; expensive and complex tooling maintenance; limited suitability for very high-volume, thin-gauge materials; reliance on highly skilled operators.

- Opportunities: Penetration into EV battery components and thermal management systems; expansion into medical and aerospace applications; technological advancements in hybrid presses; geographical market expansion in APAC and LATAM.

- Impact Forces: Stringent global safety and quality standards (e.g., ISO/TS 16949); raw material price volatility (steel, aluminum); intense competition from precision casting and CNC machining; technological innovation cycle length.

Segmentation Analysis

The Fine Blanking Market segmentation provides critical insights into the diverse technical specifications and end-use requirements driving demand. The market is primarily segmented based on machine Tonnage, which dictates the size and thickness of components that can be processed; the Application sector, highlighting the dominant role of the automotive industry; and the Material processed, reflecting technological readiness to handle advanced alloys. Understanding these segments is crucial for manufacturers to tailor their production capabilities—for instance, high-tonnage segments cater specifically to structural components in heavy vehicles, while specific material segments address the increasing need for high-strength steel processing mandated by global safety standards.

The Tonnage segmentation reveals that the mid-range tonnage (500-800 tons) remains a high-volume segment catering to standard automotive components like clutch plates and seat recliners. Conversely, the less than 500 tons segment is crucial for producing intricate, smaller parts for electronics and intricate mechanisms. The fastest growing segment, by application, is undeniably electric vehicles, requiring precision fine blanked parts for battery cooling systems and motor laminations, demanding materials like specialized copper and high-grade magnetic steel. Regional differences also influence segmentation, with European manufacturers often focusing on complex components using very high-strength steel, while APAC production often prioritizes high volume for mid-grade carbon steel applications.

- By Tonnage:

- Less than 500 Tons

- 500 Tons to 800 Tons

- Above 800 Tons (High Tonnage)

- By Application:

- Automotive (Braking Systems, Transmission, Seating/Locking Mechanisms)

- Industrial Machinery (Textile, Robotics, Agriculture)

- Electronics and Electrical Components (Connectors, Housings)

- Construction and Heavy Equipment

- Others (Medical, Aerospace)

- By Component:

- Gears and Sprockets

- Clutch Plates and Discs

- Brake and Safety Components (Parking Pawls)

- Leverages and Linkages

- Fine Blanked Housings and Brackets

- By Material:

- Carbon Steel

- Stainless Steel

- High Strength Low Alloy (HSLA) Steel

- Non-Ferrous Metals (Copper, Brass, Aluminum)

- By Operation Type:

- Hydraulic Fine Blanking

- Mechanical Fine Blanking

- Hybrid Fine Blanking Systems

Value Chain Analysis For Fine Blanking Market

The Fine Blanking Value Chain begins with raw material suppliers, predominantly specializing in high-quality steel, aluminum, and copper alloys tailored for stamping, where material consistency is paramount for successful fine blanking. Upstream activities involve specialized steel mills that produce sheet metal and coils with tight tolerances on thickness and mechanical properties, directly influencing the final component quality. Following material acquisition, the key transformative step is tooling design and manufacturing; this requires highly specialized engineering expertise and precision machining capabilities, often outsourced to dedicated toolmakers or maintained in-house by large fine blanking providers, representing a crucial cost and quality nexus.

The core midstream activity involves the actual fine blanking process conducted by primary manufacturers, where the specialized presses operate to produce high-precision components. These manufacturers often include Tier 1 and Tier 2 automotive suppliers or specialized stamping houses. Distribution channels for these components are typically direct, particularly for high-volume automotive contracts, where parts are shipped directly to OEM assembly lines or major system integrators (Tier 1 suppliers). Indirect channels are less common but exist for standard components sold through industrial distributors to smaller machinery manufacturers or maintenance, repair, and operations (MRO) markets.

Downstream analysis focuses on the end-use applications, overwhelmingly dominated by the automotive industry, followed by heavy machinery and electronics. Post-processing activities, such as heat treatment, plating, grinding, deburring, and assembly, often integrated by the fine blanking supplier, add significant value and are necessary to deliver a ready-to-install component. The critical factor across the entire chain is traceability and quality assurance, given the safety-critical nature of many fine blanked parts, necessitating rigorous quality control standards and robust documentation linking raw material properties to the final component performance specifications.

Fine Blanking Market Potential Customers

The primary customers for fine blanking services are large-scale industrial manufacturers that require high volumes of mechanical precision components with exceptional surface finish and dimensional stability, specifically those involved in complex assemblies. Automotive OEMs and their Tier 1 suppliers constitute the largest end-user segment, utilizing fine blanked parts extensively in engine, transmission, brake, and safety systems (seat belts, airbags). These customers demand zero-defect quality and consistency over millions of production cycles, making the reliability of the fine blanking process indispensable for their supply chain integrity.

Secondary potential customers include manufacturers of heavy-duty industrial machinery, such as construction equipment, agricultural machinery, and robotics, where durability and robust performance under high stress are non-negotiable requirements for components like gear teeth, linkages, and hydraulic pump parts. Furthermore, the electronics and electrical sector, including manufacturers of high-voltage switches, specialized connectors, and thermal management hardware, increasingly relies on fine blanking for components that require precise, smooth edges to function reliably in constrained environments. The medical device industry, though smaller in volume, represents a high-value customer base for intricate, high-tolerance stainless steel components used in surgical instruments and implants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.68 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Feintool Group, Schuler Group, H&T Presspart, Mitsubishi Heavy Industries, Wacker A.G., Precision Steel Stamping, Magna International (Stamping Divisions), GKN Powder Metallurgy, CFE Company, American Fineblanking, ESI Group, Würth Group, Honda (Internal Stamping), Kenics Corporation, Kaltenbach & Voigt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fine Blanking Market Key Technology Landscape

The Fine Blanking technology landscape is currently dominated by high-precision hydraulic presses, renowned for their ability to deliver the requisite triple-action forces (blanking, V-ring, and counter-force) independently and with exceptional control, which is crucial for achieving 100% shear quality in thick materials. Recent technological advancements, however, are focused heavily on improving press efficiency and incorporating smart manufacturing features. Hybrid presses, combining the force generation of hydraulics with the control and speed of electrical servo drives, are gaining prominence. These hybrid systems offer faster cycle times, significantly reduced energy consumption compared to pure hydraulics, and superior control over ram speed profile, which is vital when processing advanced, difficult-to-shear materials like HSLA steels or high-nickel alloys.

A critical area of innovation lies in tooling design and material technology. Manufacturers are increasingly utilizing advanced tool steels, surface coatings (such as physical vapor deposition - PVD), and modular tool construction to extend die life, reduce maintenance cycles, and facilitate rapid changeovers. Integrating simulation software, specifically Finite Element Analysis (FEA), into the design process allows engineers to predict material flow, stress distribution, and potential defects (like fracture initiation) before physical tooling is cut, drastically reducing development costs and time-to-market for complex components. Furthermore, the integration of real-time sensor technology (acoustic emission sensors, load cells) directly into the press structure and tooling provides immediate feedback on the blanking process, enabling active control and defect detection at the stroke level.

The future technology trajectory points toward fully automated, digitized fine blanking cells. This includes robotic material handling, automated visual inspection systems (often AI-powered, as discussed previously), and seamless data connectivity (Industry 4.0 standards) for centralized monitoring and global quality control. Developing presses with enhanced capabilities for secondary operations, such as in-press bending, coining, or thread forming, within the same stroke cycle, is a key focus. This process integration minimizes the need for separate machining or forming stages, which is a major driver of cost reduction and manufacturing efficiency in the high-volume precision component market.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the fine blanking market, propelled by its status as the world's leading automotive manufacturing hub (China, India, Japan, South Korea). The region benefits from massive governmental support for manufacturing expansion and significant investment in localized production capacity by global OEMs. The increasing demand for two-wheelers and commercial vehicles, alongside the rapid adoption of EVs, drives the necessity for high-volume, cost-effective precision parts.

- Europe: Europe holds a substantial market share, characterized by high technological maturity and a focus on premium and safety-critical applications. Strict European Union regulations regarding vehicle emissions and safety standards necessitate the use of advanced materials and precision manufacturing processes, driving demand for high-tonnage and hybrid fine blanking equipment. Germany, Switzerland, and Austria are key technological centers for fine blanking machine and tooling development.

- North America: North America represents a mature market, heavily concentrated in the automotive sector (US, Mexico, Canada). Market growth is currently spurred by the revitalization of domestic manufacturing and the massive transition toward electric vehicle production, requiring significant investment in new precision stamping capacity for components like transmission components, battery systems, and structural safety parts.

- Latin America (LATAM): LATAM, particularly Brazil and Mexico, is an important, though smaller, market characterized by growing automotive assembly operations supplying both regional and export markets. The demand is primarily focused on mid-range tonnage components for conventional vehicle platforms, with growth potential tied to foreign direct investment in local manufacturing infrastructure.

- Middle East and Africa (MEA): This region is in the nascent stages of developing a localized fine blanking market. Demand is largely met through imports, though increasing industrialization in Turkey and South Africa, coupled with investment in renewable energy and infrastructure, suggests moderate future growth opportunities for precision component suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fine Blanking Market.- Feintool Group

- Schuler Group

- H&T Presspart

- Mitsubishi Heavy Industries

- Wacker A.G.

- Precision Steel Stamping

- Magna International (Stamping Divisions)

- GKN Powder Metallurgy

- CFE Company

- American Fineblanking

- ESI Group

- Würth Group

- Honda (Internal Stamping Division)

- Kenics Corporation

- Kaltenbach & Voigt

- Precision Resource

- Hytec Fluid Power

- Klass-Pressen

- SMG Hydraulic GmbH

- Toolmakers Technology AG

Frequently Asked Questions

Analyze common user questions about the Fine Blanking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of fine blanking over conventional stamping?

Fine blanking produces components with fully sheared, smooth edges (100% shear quality) and exceptional flatness, eliminating or significantly reducing the need for costly secondary finishing processes like milling, grinding, or shaving. It allows for the production of complex features like zero-draft holes and semi-piercings in a single press stroke, ensuring superior dimensional accuracy compared to conventional stamping methods.

Which industrial sector is the largest end-user for fine blanked components?

The automotive industry is the largest and most critical end-user, accounting for the majority of market consumption. Fine blanking is essential for manufacturing safety-critical components in braking systems, transmission assemblies, seating mechanisms, and powertrain linkages, where precision and reliability are non-negotiable requirements.

How does the shift to Electric Vehicles (EVs) impact the demand for fine blanking?

While some traditional ICE parts are phased out, EVs still rely heavily on precision fine blanked parts for safety, steering, and braking components. Furthermore, fine blanking is increasingly used for new EV-specific applications, including high-precision busbar connectors, specialized cooling system components, and structural elements within the battery pack, driving continued technological adaptation and growth.

What is the main restraining factor affecting market growth?

The primary constraint is the extremely high initial capital investment required for specialized fine blanking presses and the subsequent, ongoing high cost and complexity associated with designing, manufacturing, and maintaining the highly precise and robust fine blanking tooling (dies and punches), which requires specialized engineering expertise.

What role does automation play in the future of fine blanking operations?

Automation, coupled with AI integration, is crucial for future growth. It enables robotic material loading/unloading, automated quality control via computer vision, and predictive maintenance protocols. This enhances operational efficiency, reduces labor costs, maximizes machine uptime, and ensures consistent quality for high-volume production cycles required by Tier 1 suppliers.

What material types are best suited for the fine blanking process?

Fine blanking is highly effective for medium to high-carbon steel, stainless steel, and high-strength low-alloy (HSLA) steels. It can also process non-ferrous metals like copper, brass, and aluminum. Success depends critically on the material's homogeneity and mechanical properties, requiring specific material grades designed for high-shear applications to achieve optimal edge quality.

What tonnage size segment is currently showing the fastest adoption rate?

The segment above 800 Tons (High Tonnage) is experiencing rapid growth. This trend is driven by the need to fine blank larger, thicker, and structural safety components required for heavy-duty vehicles, trucks, and advanced assemblies, especially as manufacturers move towards integrating more complex functions into single, robust parts.

How does Finite Element Analysis (FEA) contribute to fine blanking?

FEA simulation is critical in the upstream process. It allows engineers to digitally model the entire blanking stroke, predicting material behavior, stress distribution, and potential fracture points. This predictive capability significantly optimizes the die design, reduces the number of physical tooling iterations, and ensures the desired component quality is achieved efficiently during the development phase.

What is a hybrid fine blanking press, and why is it preferred over traditional hydraulic systems?

A hybrid fine blanking press combines the high force generation capabilities of hydraulic systems with the superior speed control and energy efficiency of servo-electric drives. It is preferred because it offers faster cycle times, lower energy consumption, and more precise control over the punching speed profile, which is essential for maximizing quality when processing challenging or thin-gauge materials.

Which geographical region dominates the fine blanking market in terms of production volume?

The Asia Pacific (APAC) region, driven primarily by China and India's vast automotive and industrial manufacturing output, currently dominates the fine blanking market in terms of both production volume and sheer installed capacity for high-volume component manufacturing.

What is the significance of the V-ring indentation force in the fine blanking process?

The V-ring indentation force is unique to fine blanking. It applies counter-pressure around the perimeter of the component before the blanking punch descends. This pressure constrains the material, preventing the typical tear fracture zone found in conventional stamping, thus ensuring a complete, smooth shear cut through the entire thickness of the material.

Are fine blanked components suitable for use in high-stress, safety-critical applications?

Yes, fine blanking is specifically utilized for safety-critical components, especially in the automotive sector (e.g., anti-lock brake components, safety belt linkages, transmission parts). The process guarantees superior material integrity, minimal surface cracking, and precise dimensional stability, which are essential prerequisites for parts subjected to high mechanical loads and regulatory scrutiny.

What are the common secondary operations performed on fine blanked parts?

While fine blanking minimizes secondary operations, common processes include heat treatment (for hardening), surface finishing (plating, coating, galvanizing), and light machining such as tapping or deburring. Increasingly, manufacturers offer integrated solutions where subsequent forming or assembly steps are incorporated immediately following the blanking stroke.

How does the fine blanking market address the trend of lightweighting in the automotive industry?

Fine blanking supports lightweighting by efficiently processing high-strength low-alloy (HSLA) steels and advanced aluminum alloys. This allows manufacturers to produce strong, light components with complex geometries in a single step, replacing heavier, multi-piece assemblies previously made from conventional materials.

What is the typical lifespan of fine blanking tooling?

Fine blanking tooling is highly durable, often achieving lifecycles ranging from 500,000 up to several million strokes before major refurbishment is required. Tool life is heavily dependent on the material being processed (hardness, thickness) and the implementation of effective maintenance strategies, including preventative measures and advanced surface coatings.

What certifications are typically required for fine blanking suppliers in the automotive sector?

Automotive fine blanking suppliers are typically required to adhere to stringent quality standards such as IATF 16949 (Quality Management System for the Automotive Industry) and often ISO 9001, alongside specific OEM quality requirements, due to the safety-critical nature of the components produced.

Does the fine blanking process generate more material waste than conventional stamping?

Generally, fine blanking utilizes material very efficiently. While the process requires a specific blank holder and V-ring margin, the ability to integrate multiple features in one part and use minimal subsequent machining often results in better net material utilization compared to alternative processes like machining from solid stock or multi-stage conventional stamping.

How is real-time quality control achieved in modern fine blanking operations?

Modern fine blanking presses integrate sensors (load cells, acoustic emission monitors) directly into the tooling area to monitor the forces applied during each stroke. Any deviation in the force signature indicates a potential defect (such as tool wear or material inconsistency), allowing immediate machine shutdown or component rejection through automated quality gating systems.

What challenges exist when fine blanking new, very high-strength steel grades?

Processing very high-strength steels (VHSS) poses challenges due to increased tool wear, higher press tonnage requirements, and a greater tendency for cracking or springback. Successfully blanking these materials requires advanced tooling materials, specialized press control algorithms (like those found in hybrid systems), and precise temperature management during the operation.

In the value chain, what is the role of specialized toolmakers?

Specialized toolmakers are critical upstream partners, responsible for designing and manufacturing the precision fine blanking dies. Since the die quality directly dictates the final component quality, these partners possess unique expertise in high-precision machining, heat treating, and integrating specialized features like shock absorbers and sensors into the complex tooling assembly.

What impact does raw material price volatility have on the fine blanking market?

As a highly material-intensive process, raw material price volatility (particularly for steel and specialty alloys) directly impacts operating costs and component pricing. Fine blanking manufacturers often employ hedging strategies or utilize long-term supply contracts with steel mills to mitigate this financial risk and ensure stable supply for their automotive clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager