Fingerprint Punch Card Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435256 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fingerprint Punch Card Machine Market Size

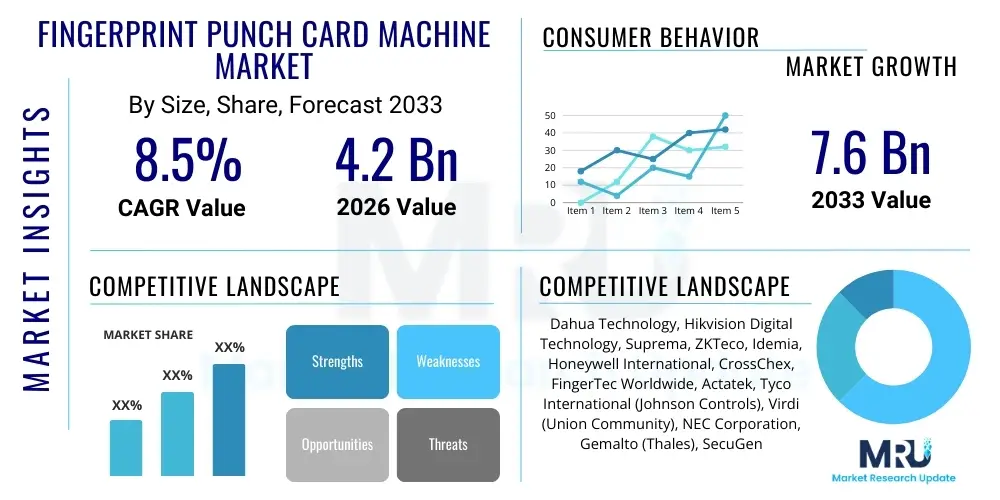

The Fingerprint Punch Card Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Fingerprint Punch Card Machine Market introduction

The Fingerprint Punch Card Machine Market encompasses the manufacturing, distribution, and utilization of biometric time and attendance systems that rely on unique fingerprint authentication for logging employee work hours. These devices, often integrating software for payroll processing and workforce management, are replacing traditional manual logbooks and basic proximity card systems. The core product provides enhanced accuracy, eliminating 'buddy punching' and significantly reducing administrative overhead associated with time tracking. Modern solutions are increasingly network-enabled, offering cloud integration and mobile access, thereby transforming them into comprehensive Human Capital Management (HCM) tools rather than just simple punch clocks.

Major applications of these machines span across diverse sectors, including manufacturing, corporate offices, retail, healthcare, and education. In highly regulated environments, such as government institutions and manufacturing plants, accurate time tracking is paramount for compliance and operational efficiency. The integration capability with existing enterprise resource planning (ERP) systems is a key differentiator, allowing for seamless data flow from the shop floor to the payroll department. Furthermore, the shift towards hybrid work models is driving demand for flexible, secure remote monitoring capabilities often facilitated by integrated biometric solutions.

The market growth is primarily driven by the escalating global focus on workplace security, stringent labor regulations requiring precise documentation of working hours, and the overarching need for operational efficiency improvement. The decreased cost of biometric sensors and improved accuracy rates further accelerate adoption, making these sophisticated systems accessible even to Small and Medium-sized Enterprises (SMEs). The inherent benefits of fraud prevention, combined with streamlined HR processes, position fingerprint punch card machines as indispensable tools for modern workforce management.

Fingerprint Punch Card Machine Market Executive Summary

The Fingerprint Punch Card Machine Market is experiencing robust expansion, fundamentally driven by the global imperative for enhanced workforce accountability and compliance automation. Key business trends include the strong pivot towards cloud-based Time and Attendance (T&A) solutions, which offer superior scalability and real-time data access compared to legacy on-premise systems. Furthermore, market players are increasingly focusing on integrating temperature screening and mask detection features into biometric devices, responding directly to post-pandemic health and safety protocols. Competitive strategies center on software integration capabilities, user experience design (UI/UX), and offering comprehensive service packages rather than just hardware sales, thereby establishing higher barriers to entry for new competitors and fostering long-term contractual relationships.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, burgeoning manufacturing sectors in countries like China and India, and the implementation of stricter labor laws. North America and Europe, characterized by high labor costs and complex regulatory frameworks, represent mature markets focused on sophisticated, integrated solutions that offer advanced analytical capabilities and seamless integration with complex ERP ecosystems. Trends across all regions show a consumer preference for multimodal biometrics (e.g., combining fingerprint with facial recognition) to enhance security and user convenience, suggesting a future where pure fingerprint systems might evolve into blended security platforms. Regulatory alignment, particularly concerning data privacy standards like GDPR and CCPA, is becoming a critical determinant of market success globally.

Segment trends reveal that the Wi-Fi/Network enabled devices segment dominates the market due to their ability to provide centralized data management and scalability across multiple locations. While the hardware component remains crucial, the software platform segment, particularly SaaS solutions for T&A management, is generating the highest recurring revenue streams and showing superior growth rates. Enterprise-level deployments, driven by large organizations seeking standardized global solutions, constitute the largest revenue share, though the SME segment is rapidly catching up, supported by affordable, subscription-based cloud T&A offerings specifically tailored to smaller operational scale and budget constraints.

AI Impact Analysis on Fingerprint Punch Card Machine Market

Common user questions regarding AI's impact on the Fingerprint Punch Card Machine Market frequently center on whether AI will entirely replace fingerprint technology or if it will enhance existing systems. Users often inquire about the reliability of AI-driven biometric verification compared to traditional methods, concerns about bias in AI recognition algorithms, and the potential for predictive analytics in workforce management. There is also significant curiosity about how AI can mitigate common issues like sensor spoofing and false rejection rates, and how advanced analytics derived from AI can optimize scheduling and compliance reporting. Users generally expect AI to transition T&A systems from passive data collection tools to proactive, intelligent workforce optimization platforms.

AI's primary influence is moving the market beyond simple identity verification towards intelligent workforce optimization and enhanced security. Machine learning algorithms are being utilized to refine fingerprint matching processes, improving the speed and accuracy of recognition, especially in challenging environments where finger conditions (e.g., dirt, moisture) might interfere with traditional optical sensors. This predictive capability allows systems to learn individual user patterns, reducing false rejects over time and significantly boosting user acceptance and operational workflow efficiency. Furthermore, AI helps in detecting anomalies—such as irregular punch-in/out patterns or attempts at biometric manipulation—providing a real-time defense against time theft that static verification systems cannot achieve.

The integration of AI is also enabling sophisticated workforce planning. By analyzing historical attendance data collected via fingerprint machines, AI models can forecast staffing needs, identify potential bottlenecks, and automate shift scheduling while adhering to complex labor compliance rules (e.g., mandated breaks, overtime limits). This transformation converts raw biometric data into actionable strategic insights for HR and operations management. While AI-driven facial recognition systems pose competition, AI is more often serving as an enhancement layer for fingerprint systems, embedding robust anti-spoofing countermeasures and facilitating seamless data integration with predictive maintenance schedules for the devices themselves.

- Enhanced Biometric Accuracy: AI algorithms reduce False Rejection Rates (FRR) and improve recognition speed through machine learning refinement.

- Advanced Spoof Detection: AI introduces anti-spoofing mechanisms by analyzing subtle physiological traits and live-ness detection protocols.

- Workforce Optimization: Predictive analytics derived from T&A data automate shift scheduling, optimize staffing levels, and forecast labor requirements.

- Compliance Monitoring: AI continuously audits punch data against regional labor laws, flagging potential non-compliance issues proactively.

- Integration with HCM: Facilitating seamless, intelligent data transfer and decision-making within integrated Human Capital Management platforms.

DRO & Impact Forces Of Fingerprint Punch Card Machine Market

The dynamics of the Fingerprint Punch Card Machine Market are defined by a complex interplay of strong regulatory Drivers and technological Opportunities counterbalanced by significant Restraints, all channeled through high-impact forces that shape adoption patterns and competitive strategy. Key drivers include stringent labor laws globally, such as the Fair Labor Standards Act (FLSA) in the US and similar directives across the EU, which necessitate irrefutable evidence of employee attendance to prevent wage disputes and legal liabilities. The opportunity lies in leveraging cloud technology and multi-modal integration to create scalable, comprehensive HCM solutions, moving beyond basic T&A functions into strategic workforce insights. However, major restraints involve persistent data privacy concerns, particularly concerning biometric data storage and transmission, and the significant initial capital expenditure required for large-scale enterprise deployment.

The primary impact forces stem from technological evolution and competitive intensity. Rapid sensor innovation, especially the transition from traditional optical sensors to capacitive and ultrasonic fingerprint technology, enhances durability and accuracy, thereby increasing customer trust. Competitive forces are driving down hardware costs while simultaneously pushing up the sophistication and subscription cost of integrated T&A software platforms. Regulatory scrutiny, especially in regions like Europe, acts as a powerful external force, compelling manufacturers to invest heavily in data encryption, anonymization techniques, and compliance certifications, which subsequently dictates market entry strategy and operational overhead for vendors.

Another critical impact force is the evolving definition of the workplace itself, particularly the global shift towards remote and hybrid work models. While the traditional "punch clock" model faces pressure, this shift has simultaneously created new opportunities for manufacturers to develop highly secure, mobile-integrated biometric solutions that allow employees to securely clock in from non-traditional locations. The demand for frictionless systems that offer high convenience without compromising security acts as a dual force, driving both product innovation (opportunity) and the need to overcome latency and reliability issues inherent in remote data transmission (restraint). The market's future growth hinges on the ability of manufacturers to address these complex regulatory and technological requirements simultaneously.

- Drivers: Stringent regulatory mandates for workforce time tracking; necessity of eliminating time theft ('buddy punching'); falling cost of advanced biometric sensor technology.

- Restraints: High initial implementation cost for large organizations; severe data privacy concerns regarding biometric data storage (e.g., GDPR compliance); resistance from some employee groups due to privacy infringement perception.

- Opportunities: Expansion into integrated Human Capital Management (HCM) platforms; development of hybrid solutions catering to remote work environments; adoption of multi-modal biometrics (fingerprint + facial) for enhanced security layers.

- Impact Forces: Rapid technological obsolescence of legacy systems; intense pricing pressure driven by APAC manufacturers; increasing need for seamless integration with legacy ERP and payroll software.

Segmentation Analysis

The Fingerprint Punch Card Machine Market is comprehensively segmented based on technology type, connectivity, end-user industry, and deployment model, reflecting the diverse operational requirements across various organizational scales and sectors. The dominant segmentation involves the distinction between standalone systems, which primarily store data locally, and network-enabled systems, which offer centralized control and real-time data synchronization across multiple locations or global offices. Technological segmentation highlights the shift from basic optical recognition towards more secure and robust capacitive and ultrasonic sensing methods. This multi-faceted segmentation allows vendors to tailor their products, offering specialized software and hardware bundles addressing the unique compliance and throughput needs of industries ranging from large-scale manufacturing to dispersed retail chains.

- By Technology Type:

- Optical Recognition

- Capacitive Recognition

- Ultrasonic Recognition

- By Connectivity Type:

- Standalone Systems (USB/Local Storage)

- Networked Systems (Ethernet, Wi-Fi, 3G/4G)

- Cloud-Connected Solutions

- By End-User Industry:

- Corporate Offices (IT & Telecom)

- Manufacturing and Industrial

- Government and Public Sector

- Healthcare

- Retail and Consumer Goods

- Education and Academia

- By Deployment Model:

- On-Premise (Local Server)

- Cloud-Based (Software as a Service - SaaS)

- By Organizational Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Fingerprint Punch Card Machine Market

The value chain for the Fingerprint Punch Card Machine Market begins with upstream activities focused on component manufacturing, particularly the production of high-precision biometric sensors, microprocessors, and memory modules. Key suppliers in this phase include specialized semiconductor companies responsible for sensor fabrication (e.g., optical or capacitive sensors). Efficiency and cost control in the upstream segment are critical, as the quality and price of the sensor directly dictate the final product's performance and market competitiveness. Manufacturers must maintain robust supply chain resilience, especially given the global volatility in semiconductor availability, often entering into long-term strategic partnerships with component suppliers to ensure reliable material flow and competitive pricing structures for core hardware elements.

The midstream phase involves the core activities of product design, hardware assembly, software development, and quality assurance. This is where proprietary algorithms for fingerprint matching, data encryption protocols, and the user interface software are developed and integrated into the physical hardware. Companies often differentiate themselves here by offering superior software platforms that seamlessly integrate T&A data with payroll and HR systems, transforming a commodity hardware product into a high-value integrated solution. Significant investment in research and development is crucial in the midstream to ensure compliance with international data security standards and to maintain a technological edge in biometric accuracy and speed, thus moving the value proposition away from purely hardware considerations.

Downstream activities focus on market penetration, distribution, and post-sales support. Distribution channels are varied, involving direct sales to large corporate clients (for customized, large-scale deployment) and indirect channels utilizing third-party distributors, system integrators, and e-commerce platforms, particularly for the SME market. System integrators play a vital role, as installation often requires network configuration and integration with existing IT infrastructure. Post-sales support, including software maintenance, firmware updates, and regulatory compliance advisory services, significantly contributes to customer retention and creates recurring revenue streams, completing the value chain loop and solidifying the vendor's long-term relationship with the end-user.

Fingerprint Punch Card Machine Market Potential Customers

The potential customer base for Fingerprint Punch Card Machines is broad and highly diversified, primarily comprising entities that manage a large, dispersed, or hourly paid workforce requiring accurate time monitoring for compliance and operational purposes. The largest end-users are concentrated in the manufacturing sector, where precise tracking of production hours is essential for calculating labor costs, adhering to safety regulations, and managing multi-shift operations. Similarly, the retail and consumer goods sectors, characterized by high employee turnover and numerous branch locations, rely heavily on these systems to manage schedules efficiently and prevent payroll errors across distributed sites, making operational ease and scalability critical purchasing factors.

Another major segment of buyers includes government and public sector organizations, which require highly secure and auditable T&A records to comply with public accountability standards and union agreements. The healthcare industry represents a rapidly growing customer segment, driven by the critical need to accurately track time for clinical and non-clinical staff, ensuring adequate coverage and compliance with strict patient-to-staff ratio regulations. For these institutional buyers, the robustness of data encryption, system reliability, and vendor reputation for security are paramount considerations when making procurement decisions.

The growing segment of Small and Medium Enterprises (SMEs) is increasingly becoming a focus area for market players, especially through the proliferation of affordable, cloud-based T&A solutions. SMEs are attracted to these systems due to the immediate cost savings generated by eliminating manual time tracking errors and reducing administrative load. Potential customers are not merely purchasing a clocking device but are seeking a comprehensive solution for Human Resource management—a system that integrates smoothly with existing payroll software and offers immediate, actionable reporting capabilities tailored to their specific labor law jurisdiction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dahua Technology, Hikvision Digital Technology, Suprema, ZKTeco, Idemia, Honeywell International, CrossChex, FingerTec Worldwide, Actatek, Tyco International (Johnson Controls), Virdi (Union Community), NEC Corporation, Gemalto (Thales), SecuGen Corporation, BioEnable, Safran Identity & Security (Morpho), ADT Inc., ISGUS GmbH, Matrix Comsec, Kronos Incorporated (UKG) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fingerprint Punch Card Machine Market Key Technology Landscape

The technology landscape of the Fingerprint Punch Card Machine Market is characterized by continuous evolution aimed at improving accuracy, speed, and security while reducing overall footprint. The foundational technology remains the fingerprint sensor, which has transitioned from bulkier, less reliable optical sensors to advanced capacitive and, increasingly, ultrasonic sensors. Capacitive sensors measure electrical charge differences to map the unique ridge patterns of a finger, offering enhanced security against basic spoofing attempts and better performance in less-than-ideal conditions. Ultrasonic technology, though currently more expensive, represents the pinnacle of current security, using sound waves to create a highly detailed 3D map of the fingerprint, virtually eliminating the possibility of spoofing and ensuring high accuracy even when the finger is dirty or wet. This transition towards advanced sensing methods is crucial for addressing enterprise-level security requirements and compliance mandates.

Beyond the sensor, the most significant technological developments reside in connectivity and data management architecture. The widespread adoption of Wi-Fi and Ethernet connectivity has enabled real-time data synchronization across centralized servers or, more commonly, cloud platforms. Cloud-based solutions (SaaS) are transforming the market by offering automatic software updates, massive scalability, and advanced disaster recovery features, making them highly attractive to multi-location businesses. Furthermore, the integration of edge computing capabilities allows the devices themselves to perform initial biometric matching locally, minimizing network latency and enhancing data privacy by reducing the transmission of raw biometric templates over the internet, a critical feature for compliance-sensitive organizations.

Another pivotal technological component is the development of robust anti-spoofing and liveness detection algorithms. Modern machines utilize AI and machine learning to analyze pulse, temperature, and dermal characteristics during the scanning process to ensure a live finger is present, effectively neutralizing common methods of fraud like using synthetic molds or printed images. Interoperability is also a key technology focus; systems are now built with open APIs and standardized protocols (e.g., SOAP, REST) to ensure seamless integration with broader enterprise systems such as SAP, Oracle HCM, and various third-party payroll software. This holistic technological approach ensures the machines function not as isolated hardware, but as integral, intelligent components of a larger organizational ecosystem.

Regional Highlights

The geographical distribution of the Fingerprint Punch Card Machine Market showcases distinct growth trajectories and maturity levels. North America, encompassing the United States and Canada, represents a mature market characterized by early adoption, high levels of IT infrastructure, and a strong regulatory focus on accurate labor tracking (e.g., FLSA compliance). Market expansion here is driven less by first-time deployment and more by the replacement of legacy time clocks with advanced cloud-integrated, AI-enhanced solutions. The key demand is for solutions that offer robust integration with sophisticated HCM suites and adhere strictly to state-specific privacy laws, particularly for biometric data handling.

Asia Pacific (APAC) stands out as the primary engine of global market growth, driven by rapid urbanization, massive manufacturing sector expansion, and increasing government investments in infrastructure and regulatory modernization. Countries like China, India, and Southeast Asian nations are experiencing massive workforce expansion, necessitating automated T&A solutions for managing high volumes of employees across industrial zones. The market here is price-sensitive but highly scalable, leading to intense competition among local and international vendors. The opportunity in APAC is significant due to the relatively lower penetration rates of advanced biometric systems compared to Western counterparts, offering substantial scope for mass-market deployment.

Europe represents a highly regulated yet substantial market, where demand is strongly influenced by the General Data Protection Regulation (GDPR). European customers prioritize systems offering superior data encryption, explicit consent mechanisms, and clear policies for biometric data minimization and deletion. The market is mature, similar to North America, focusing on technologically advanced, highly secure multi-modal solutions that integrate seamlessly across the European Union's diverse labor law landscape. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, driven by government modernization initiatives and growth in infrastructure projects. Adoption rates in these regions are slower, but the long-term potential is high as local companies prioritize security and formalize labor practices.

- North America: Focus on cloud-migration, advanced integration with HCM platforms, and strict adherence to specific state-level biometric data privacy laws (e.g., Illinois BIPA).

- Asia Pacific (APAC): Highest growth rate driven by massive industrial and manufacturing sector expansion in China and India; price competition is intense; focus on scalable, high-throughput systems.

- Europe: Driven by compliance with GDPR; high demand for secure, privacy-by-design solutions and multi-modal biometrics; mature replacement cycle market.

- Latin America (LATAM): Emerging market potential fueled by regulatory reform aimed at formalizing labor markets and improving operational efficiency in resource-intensive sectors.

- Middle East and Africa (MEA): Growth linked to large-scale construction, governmental projects, and increased corporate focus on securing physical and digital access control in burgeoning economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fingerprint Punch Card Machine Market.- Dahua Technology

- Hikvision Digital Technology

- Suprema

- ZKTeco

- Idemia

- Honeywell International

- CrossChex

- FingerTec Worldwide

- Actatek

- Tyco International (Johnson Controls)

- Virdi (Union Community)

- NEC Corporation

- Gemalto (Thales)

- SecuGen Corporation

- BioEnable

- Safran Identity & Security (Morpho)

- ADT Inc.

- ISGUS GmbH

- Matrix Comsec

- Kronos Incorporated (UKG)

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Fingerprint Punch Card Machine Market?

The Fingerprint Punch Card Machine Market is projected to grow at a robust CAGR of 8.5% between 2026 and 2033, driven primarily by stringent regulatory compliance mandates and technological advancements in biometric accuracy.

How is AI impacting the security and functionality of modern fingerprint time clocks?

AI significantly enhances security by implementing advanced anti-spoofing and liveness detection algorithms, and improves functionality through machine learning to reduce False Rejection Rates (FRR) and enable predictive workforce analytics for optimal scheduling.

Which segmentation segment is expected to show the highest growth in the forecast period?

The Cloud-Based Deployment Model segment, particularly SaaS solutions for Time and Attendance (T&A) management, is anticipated to exhibit the highest growth due to scalability, lower infrastructure costs for SMEs, and real-time data synchronization capabilities.

What are the primary restraints affecting the market adoption of biometric time attendance systems?

The primary restraints include high initial capital expenditure for large-scale implementation and significant concerns surrounding the storage and protection of sensitive biometric data, particularly in regions with strict regulations like GDPR and CCPA.

Which geographical region dominates the market and which is growing fastest?

North America currently holds a significant share of the market due to early technology adoption and advanced regulatory environments, but the Asia Pacific (APAC) region is projected to register the fastest growth rate driven by industrial expansion and increasing workforce formalization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager