Fingerprint Recognition Access Control System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431519 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Fingerprint Recognition Access Control System Market Size

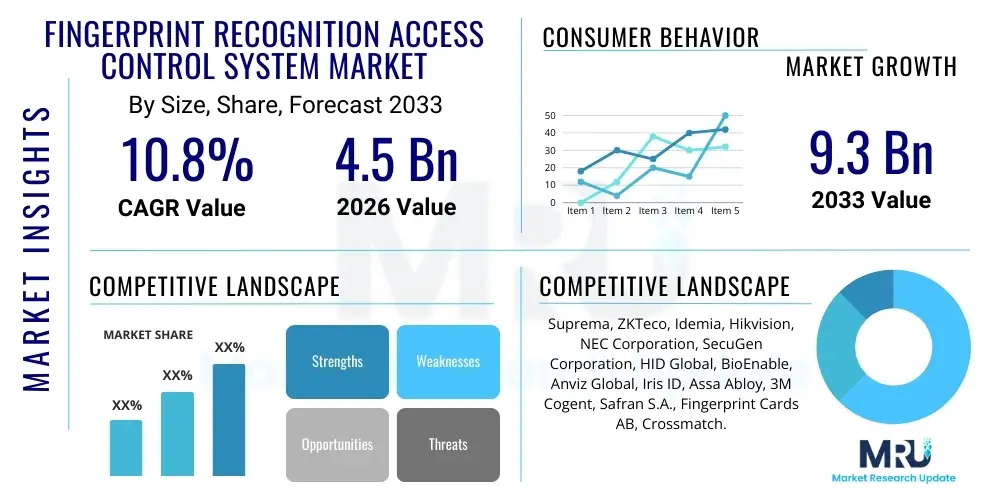

The Fingerprint Recognition Access Control System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.3 Billion by the end of the forecast period in 2033.

Fingerprint Recognition Access Control System Market introduction

The Fingerprint Recognition Access Control System market encompasses biometric security solutions that utilize unique dermal ridge patterns for identity verification and access authorization. These systems are crucial components of modern security infrastructure, replacing traditional methods like key cards and passwords due to their high security, convenience, and non-transferability. The core product involves a sensor module (optical, capacitive, or thermal), processing software, and integration capabilities with existing security frameworks like time and attendance or building management systems. Rapid urbanization, increasing security threats across commercial and governmental sectors, and the growing demand for stringent regulatory compliance are foundational elements driving the adoption of these advanced biometric technologies globally.

Major applications of these systems span across diverse sectors, including high-security government facilities, corporate offices, data centers, healthcare institutions (to protect sensitive patient records), and large-scale manufacturing plants. The primary benefits include enhanced security posture through highly accurate authentication, improved operational efficiency by speeding up entry processes, and reduced instances of security breaches associated with stolen or shared credentials. Furthermore, the inherent accountability associated with biometric access makes these systems invaluable for auditing and compliance mandates. The driving factors include technological advancements in sensor miniaturization and accuracy, the decreasing cost of hardware components, and the imperative for real-time tracking of personnel movement within sensitive environments.

Fingerprint Recognition Access Control System Market Executive Summary

The global market for Fingerprint Recognition Access Control Systems is characterized by robust growth, propelled by the digital transformation across industries and the increasing sophistication of cyber-physical threats. Business trends indicate a shift towards integrated security platforms where fingerprint recognition seamlessly communicates with video surveillance and intrusion detection systems, moving away from standalone solutions. Regional trends show that North America and Europe remain key early adopters due to stringent compliance requirements (like GDPR and HIPAA) and high technology readiness, while the Asia Pacific region is emerging as the fastest-growing market, driven by massive infrastructure development, increasing investment in smart cities, and a rapidly expanding manufacturing base requiring workforce management solutions. Emerging economies are prioritizing centralized security management, thus fueling demand for scalable biometric architectures.

Segment trends reveal that the hardware component segment, particularly advanced capacitive and ultrasonic sensors, holds the largest market share due to ongoing replacements and upgrades of legacy systems. However, the software and services segment, focused on biometric data management, cloud integration, and predictive maintenance, is expected to exhibit the highest CAGR. In terms of application, the commercial sector, encompassing banking, financial services, and corporate offices, dominates the market due to the high value of assets and data requiring protection. Furthermore, government initiatives focused on national security and critical infrastructure protection are providing consistent demand, ensuring sustained growth across all geographic regions.

AI Impact Analysis on Fingerprint Recognition Access Control System Market

User inquiries regarding the integration of Artificial Intelligence (AI) into Fingerprint Recognition Access Control Systems predominantly focus on how AI enhances accuracy, prevents spoofing, and improves user experience. Common concerns center on the reliability of liveness detection techniques powered by AI, the potential for algorithmic bias impacting specific user groups, and the complex challenge of managing vast biometric databases under AI governance models. Users are keenly interested in predictive maintenance—how AI can anticipate sensor failure or performance degradation—and the use of machine learning to continuously adapt to changes in environmental factors or fingerprint characteristics over time. The expectation is that AI will transform access control from a reactive identification method into a proactive, intelligent security layer.

The primary impact of AI is centered on improving the core function of verification. Machine learning algorithms significantly boost the speed and precision of matching processes, drastically reducing False Acceptance Rates (FAR) and False Rejection Rates (FRR), which historically posed limitations to biometric systems. AI also enables sophisticated anti-spoofing and liveness detection by analyzing micro-texture, subsurface features, and subtle behavioral patterns that differentiate a living finger from a synthetic reproduction. This integration is essential for maintaining the integrity and trustworthiness of fingerprint systems in high-security environments, ensuring that biometrics remain a reliable cornerstone of access control infrastructure. Furthermore, AI facilitates automated data purging and compliance verification, streamlining the often-complex regulatory requirements associated with biometric data privacy.

- Enhanced accuracy and reduced False Acceptance Rates (FAR) through deep learning algorithms.

- Implementation of advanced anti-spoofing techniques (liveness detection) utilizing neural networks.

- Predictive analytics for maintenance schedules, forecasting potential hardware failures.

- Improved anomaly detection, identifying unusual access patterns or unauthorized attempts in real-time.

- Optimization of large biometric template databases for faster matching and retrieval processes.

- Personalized access control based on learned user behaviors and context-aware security policies.

- Streamlining regulatory compliance through automated data management and privacy protocol enforcement.

DRO & Impact Forces Of Fingerprint Recognition Access Control System Market

The market is primarily driven by the escalating global demand for high-security solutions, coupled with technological advancements making biometric systems more affordable and easier to integrate. Major restraints include persistent concerns regarding data privacy and the potential for biometric data compromise, alongside high initial implementation costs for large-scale enterprise rollouts. Significant opportunities lie in the expansion into emerging applications like IoT security, smart home systems, and mobile integration. The interplay of these forces—drivers increasing market pull, restraints creating adoption hurdles, and opportunities offering future growth vectors—defines the competitive and developmental trajectory of the fingerprint recognition access control market over the forecast period, emphasizing the need for robust security and privacy frameworks.

The impact forces influencing the market are multifaceted, revolving around technological maturity, regulatory environments, and cost efficiency. The force exerted by technological innovation, particularly in sensor technology and algorithm refinement, is a powerful accelerant, continuously improving the system performance and lowering error rates. Conversely, the impact force of regulatory scrutiny, especially concerning biometric data governance (e.g., in Europe and the US), acts as a dampener, forcing manufacturers to invest heavily in compliance, which can slow down market entry. Economic impact forces, relating to the diminishing cost of biometric hardware, are fundamentally altering market accessibility, enabling widespread adoption not only in high-end security environments but also in small and medium-sized enterprises (SMEs).

Drivers

The proliferation of sophisticated physical and cyber threats necessitates the adoption of authentication methods that are impervious to replication or theft, a fundamental advantage provided by fingerprint recognition systems. Traditional credentials such as proximity cards and PINs are inherently vulnerable to loss, sharing, or unauthorized duplication, leading organizations to seek immutable identifiers for controlled access. The shift towards higher security standards is particularly pronounced in critical infrastructure sectors like energy, telecommunications, and finance, where security breaches can have catastrophic national and economic consequences. Consequently, mandates from governing bodies for enhanced physical access control are significantly accelerating market uptake across regions.

Furthermore, the integration capabilities of modern fingerprint recognition systems with broader enterprise resource planning (ERP) and human resource management (HRM) systems serve as a potent market driver. These integrated solutions enable seamless time and attendance tracking, payroll processing, and compliance reporting, maximizing the return on investment beyond mere security. This functionality transforms the access control system from a pure security expenditure into an operational efficiency tool, appealing directly to organizational goals related to workforce management. Continuous improvements in sensor durability and weather resistance are also expanding application scope to harsh industrial and outdoor environments, previously dominated by ruggedized keypads or mechanical locks.

- Increasing security concerns and the necessity for robust identity verification in high-risk zones.

- Regulatory compliance requirements mandating secure access control in various industries (e.g., healthcare, BFSI).

- Technological advancements leading to lower hardware costs and improved sensor accuracy.

- Demand for integrated workforce management solutions linking access control with HR processes.

- The inherent difficulty in forging or sharing biometric credentials compared to traditional methods.

Restraints

The most significant impediment to market growth is the widespread apprehension surrounding the storage and potential breach of highly sensitive biometric data. Unlike passwords, fingerprints cannot be reset, meaning a compromise represents a lifelong vulnerability for the individual. This inherent risk fuels public skepticism and legislative caution, compelling enterprises to implement expensive, complex encryption and security protocols for biometric databases. Small and medium enterprises (SMEs), in particular, often lack the specialized IT infrastructure and budget required to manage these compliance and security overheads effectively, leading to hesitation in adoption.

Moreover, the performance of fingerprint recognition technology can be susceptible to environmental variables and physical conditions. Issues such as dirt, moisture, skin damage, or extreme temperatures can temporarily impair sensor functionality, resulting in frustrating False Rejection Rates (FRR) for legitimate users. While newer sensors utilize advanced algorithms to mitigate these effects, reliability issues, especially in high-traffic or harsh industrial settings, continue to pose a practical barrier to universal deployment. Additionally, the initial capital outlay required for replacing an entire building's legacy access infrastructure with biometric systems can be prohibitive for budget-constrained public sector organizations or large existing facilities.

- Growing privacy concerns related to the permanent storage and potential security breaches of biometric data.

- High initial investment costs associated with system procurement, integration, and training.

- Susceptibility of fingerprint recognition accuracy to environmental factors (moisture, dirt) and skin conditions.

- The complexity and cost of regulatory compliance (e.g., GDPR, CCPA) for biometric data handling.

- Public resistance or lack of familiarity with biometric technology in certain cultural or operational contexts.

Opportunities

The most lucrative opportunities for market expansion lie in the convergence of fingerprint recognition with Internet of Things (IoT) platforms and the rapidly evolving smart city landscape. As cities become more connected, there is an escalating need for secure, seamless access across public infrastructure, transport hubs, and residential complexes. Integrating biometric access control into smart infrastructure allows for centralized identity management, offering unprecedented levels of convenience and security. Furthermore, the burgeoning demand for secure physical access in the residential sector, driven by smart home technology, presents a new vertical market ripe for biometric penetration, moving access control beyond purely commercial applications.

A secondary, yet significant, opportunity resides in the development of multi-modal biometric solutions that combine fingerprint recognition with other modalities like facial recognition or iris scanning. These integrated systems offer superior security performance and address the limitations of single biometric factors, appealing directly to high-security defense and financial institutions. Furthermore, the massive digital shift accelerated by remote and hybrid work models has created a need for secure, verified access to organizational premises for a decentralized workforce, driving demand for flexible, cloud-managed biometric access services. Developing cost-effective, wireless, and cloud-compatible fingerprint solutions tailored for small and medium-sized businesses will unlock substantial untapped market potential globally.

- Integration of fingerprint recognition with IoT devices and smart building management systems.

- Growing demand from the residential and consumer electronics sectors for enhanced security features.

- Development of cloud-based Biometric-as-a-Service (BaaS) models for flexible deployment.

- Expansion into multi-modal biometric systems for ultra-high-security environments.

- Untapped potential in emerging economies undergoing rapid infrastructure modernization.

Segmentation Analysis

The Fingerprint Recognition Access Control System market is comprehensively segmented based on technology type, component, application, and geographic region, reflecting the diversity of user needs and operational environments. Analyzing these segments provides a clear map of market dynamics, revealing where investment is flowing and which application areas are demonstrating the most accelerated growth. The component segmentation, differentiating between hardware, software, and services, highlights the increasing value placed on long-term service contracts and advanced software analytics, essential for system maintenance and threat intelligence. Understanding the granular differences between capacitive and optical technologies, for instance, is crucial for manufacturers targeting specific use-cases, such as the preference for rugged optical sensors in industrial settings versus sleek capacitive sensors in corporate environments.

Application segmentation remains critical as the requirements for access control vary dramatically across industries. The BFSI sector demands fail-safe, high-speed authentication, while the government and defense sectors prioritize tamper resistance and integration with national databases. Conversely, the commercial and enterprise segments are increasingly focused on scalability and seamless integration with existing IT infrastructure. The strategic partitioning of the market allows stakeholders to customize product development and marketing efforts, ensuring solutions meet sector-specific compliance standards and performance benchmarks. This detailed segmentation analysis confirms that future market leadership will depend on specialization and the ability to deliver highly customized, industry-specific access control solutions.

- By Technology Type: Capacitive, Optical, Thermal, Ultrasonic.

- By Component: Hardware (Sensors, Scanners, Modules, Controllers), Software (Biometric Matching Algorithms, Middleware), Services (Installation, Maintenance, Integration, Consulting).

- By Application: Commercial (Corporate Offices, Retail, Hospitality), Government and Defense, Industrial and Manufacturing, Residential, Healthcare, BFSI (Banking, Financial Services, and Insurance), Education.

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Value Chain Analysis For Fingerprint Recognition Access Control System Market

The value chain for fingerprint recognition access control systems begins with the upstream activities centered on raw material sourcing and the highly specialized fabrication of semiconductor components and biometric sensors. This initial stage involves key suppliers of high-grade optics (for optical sensors) or advanced silicon chips (for capacitive sensors). The complexity and proprietary nature of sensor manufacturing create significant barriers to entry and necessitate robust R&D investment. System integrators and original equipment manufacturers (OEMs) then take these components, developing proprietary matching algorithms and secure middleware that define the product's performance, security, and scalability.

Downstream activities involve the crucial steps of distribution, installation, and post-sales support. Distribution channels are typically bifurcated into direct sales for large, customized government or enterprise projects, and indirect sales through a network of specialized security system distributors and value-added resellers (VARs). VARs play a vital role, often bundling the fingerprint systems with related security infrastructure (CCTV, fire alarms) and providing localized integration and maintenance services. The effectiveness of the distribution channel directly impacts market penetration, especially in fragmented regional markets. The ultimate value delivery is realized through successful system integration at the end-user site and the provision of continuous software updates and compliance assistance.

The distribution network is a critical bottleneck and accelerator in the value chain. Direct channels ensure high profit margins and close customer relationships, particularly for bespoke high-security applications where continuous consultation is required. Conversely, the indirect channel, leveraging global and regional distributors, allows manufacturers to rapidly scale their reach into diverse geographic markets and smaller commercial projects. Specialized system integrators are often the final link, responsible for ensuring the interoperability of the access control system within the client's existing physical and IT infrastructure, highlighting their indispensable role in maintaining system uptime and security integrity. The ongoing shift toward cloud-managed access services is increasing the importance of software licensing and recurring service revenue streams within the downstream value chain.

Fingerprint Recognition Access Control System Market Potential Customers

The primary buyers of Fingerprint Recognition Access Control Systems are organizations requiring high-throughput, non-repudiable identity verification to secure assets, data, or restricted areas. The largest segment of potential customers comprises the Banking, Financial Services, and Insurance (BFSI) sector, which requires layered security for vault access, teller stations, and secure data centers, driven by regulatory mandates to protect sensitive customer information. Similarly, government agencies, including military bases, public administration buildings, and critical infrastructure operators, are perpetual consumers, prioritizing maximum security and robust tamper detection capabilities.

A rapidly expanding customer segment is the broad commercial enterprise base, particularly large multinational corporations and technology firms that need scalable solutions for workforce management, intellectual property protection, and visitor management. Additionally, the healthcare sector represents a significant opportunity, driven by the need to control access to patient records (EHR/EMR) rooms and pharmacies, adhering strictly to privacy laws such as HIPAA. Emerging buyers include residential property managers and specialized retailers, seeking enhanced keyless entry systems and personalized access rights for staff and tenants, emphasizing convenience alongside security.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.3 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suprema, ZKTeco, Idemia, Hikvision, NEC Corporation, SecuGen Corporation, HID Global, BioEnable, Anviz Global, Iris ID, Assa Abloy, 3M Cogent, Safran S.A., Fingerprint Cards AB, Crossmatch. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fingerprint Recognition Access Control System Market Key Technology Landscape

The core technology landscape is defined by the sensor mechanism used to capture the fingerprint image. Optical sensors, which capture a 2D digital image using light, are robust, scalable, and cost-effective, making them highly popular in high-traffic commercial environments. However, they are susceptible to spoofing and can be affected by dirt or residue. Capacitive sensors, on the other hand, measure the electrical properties of the ridges and valleys of the finger using an array of tiny capacitors, providing a higher security level and resistance to residue, making them preferred for high-end corporate and mobile device integration. Thermal sensors represent an emerging subset, utilizing temperature differentials to map the print, which is inherently better at liveness detection but often comes at a higher unit cost.

Beyond the physical capture mechanism, significant technological evolution is occurring in the software layer. Advanced proprietary algorithms, often utilizing AI and machine learning, are essential for template extraction, storage, and matching, dictating the system's accuracy (measured by FAR/FRR). The movement towards template protection, where the fingerprint image is not stored directly but converted into an irreversible mathematical hash (a biometric template), addresses crucial privacy concerns and enhances data security. Furthermore, seamless integration with secure cloud platforms, enabling remote management and large-scale deployment, is rapidly becoming a mandatory technological requirement, allowing for greater system flexibility and real-time security monitoring across distributed locations.

The emerging technological front is dominated by ultrasonic sensors, particularly adopted in mobile devices but gaining traction in stationary access control, which use high-frequency sound waves to create a precise 3D map of the subsurface features of the finger. This provides near-perfect liveness detection and is unaffected by surface dirt or moisture, offering the highest potential security level. Simultaneously, hardware advancements are focused on creating smaller, more durable, and energy-efficient system-on-chip (SoC) solutions that bundle the sensor, processor, and secure memory, simplifying manufacturing and reducing the overall footprint and power consumption of the access device, which is crucial for adoption in battery-powered or space-constrained applications.

Regional Highlights

The Fingerprint Recognition Access Control System market exhibits distinct growth patterns influenced by regulatory frameworks, technology readiness, and security imperatives across major regions. North America currently dominates the market in terms of revenue share, primarily driven by the stringent regulatory environment in the BFSI and healthcare sectors, mandating advanced access control. The early adoption of cutting-edge technology and the presence of major technology providers also contribute to market maturity and high adoption rates. Significant spending on infrastructure upgrades and robust critical national infrastructure protection programs in the United States and Canada ensure sustained demand for highly secure biometric solutions.

Europe represents a highly complex, yet high-value market, characterized by intense focus on data privacy, largely governed by the General Data Protection Regulation (GDPR). While GDPR imposes rigorous requirements on biometric data handling, it simultaneously fuels demand for privacy-by-design solutions, often leading to the adoption of advanced template protection technologies. Western European countries, particularly Germany and the UK, are key contributors, driven by manufacturing and corporate security requirements. The Asia Pacific (APAC) region is projected to register the highest CAGR, propelled by rapid urbanization, massive smart city initiatives in China and India, and surging investment in commercial real estate and manufacturing facilities requiring efficient workforce management solutions. The high volume of population also makes biometric systems an ideal scalable solution for time and attendance monitoring.

Latin America and the Middle East & Africa (MEA) are emerging regions that are beginning to transition away from traditional access methods. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, significant government investment in security and defense, coupled with ambitious infrastructure projects like NEOM, are creating substantial opportunities for high-end access control systems. Latin America’s growth is steadier, driven mainly by the financial and governmental sectors seeking to curb fraud and enhance internal security protocols. These emerging markets often bypass intermediate technologies, moving directly to integrated biometric solutions, positioning them as key growth vectors for specialized manufacturers.

- North America: Market leader driven by regulatory compliance (HIPAA, SOX) in BFSI and Healthcare, and high technology penetration.

- Asia Pacific (APAC): Fastest growing region due to massive infrastructure development, smart city projects, and large industrial workforce requiring efficient T&A management.

- Europe: Growth influenced by strict data protection laws (GDPR), driving demand for advanced, privacy-compliant biometric template technologies.

- Latin America: Steady adoption focusing on anti-fraud measures in the banking sector and government security upgrades.

- Middle East & Africa (MEA): High growth potential fueled by large-scale government security investments and critical infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fingerprint Recognition Access Control System Market.- Suprema

- ZKTeco

- Idemia

- Hikvision

- NEC Corporation

- SecuGen Corporation

- HID Global

- BioEnable

- Anviz Global

- Iris ID

- Assa Abloy

- 3M Cogent (now part of Gemalto/Thales)

- Safran S.A. (now part of Idemia)

- Fingerprint Cards AB

- Crossmatch (now part of HID Global)

- Fujitsu

- Matrix Comsec

- Virdi

- Honeywell International Inc.

- Tyco International (now Johnson Controls)

Frequently Asked Questions

Analyze common user questions about the Fingerprint Recognition Access Control System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Fingerprint Recognition Access Control System Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033, reflecting increased adoption fueled by global security mandates and technological enhancements.

How does AI improve the security of fingerprint recognition systems?

AI significantly enhances security by implementing advanced deep learning for liveness detection and anti-spoofing, ensuring the authenticated finger is real, and improving the accuracy of matching algorithms to reduce error rates (FAR/FRR).

What are the main restraints impacting market growth?

The primary restraints include persistent concerns over biometric data privacy, compliance challenges posed by regulations like GDPR, and the substantial initial capital investment required for comprehensive system deployment across large organizations.

Which application segment drives the highest demand?

The Commercial sector, encompassing corporate offices, technology firms, and especially the Banking, Financial Services, and Insurance (BFSI) industry, drives the highest demand due to stringent security needs for data protection and asset safeguarding.

Which technology type is considered the most secure for access control?

Ultrasonic and advanced Capacitive sensor technologies are considered highly secure because they utilize subsurface data or electrical properties, making them extremely difficult to spoof compared to standard optical sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager