Finishing Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432747 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Finishing Machinery Market Size

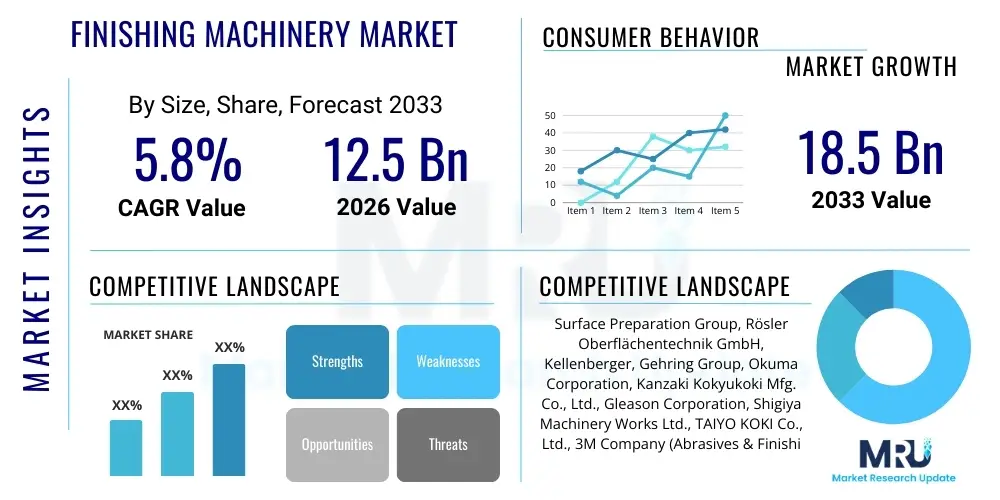

The Finishing Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033.

Finishing Machinery Market introduction

The Finishing Machinery Market encompasses a diverse range of industrial equipment utilized in the final stages of manufacturing to achieve specified surface characteristics, dimensional tolerances, and aesthetic qualities. These machines perform critical tasks such as polishing, grinding, coating, deburring, honing, lapping, and superfinishing on components across various material types, including metals, plastics, wood, and composites. The product description spans highly automated CNC finishing systems, robotic cells, and specialized equipment tailored for high-precision industries like aerospace and medical devices, where surface integrity directly impacts product performance and lifespan. The primary applications of this machinery are prevalent in the automotive industry for powertrain and body components, the electronics sector for semiconductor wafer preparation and device casings, and the heavy machinery segment for large-scale equipment parts requiring wear resistance.

The fundamental benefits derived from employing advanced finishing machinery include improved material performance through enhanced surface hardness and reduced friction, superior aesthetic quality crucial for consumer goods, and the ability to maintain stringent quality control standards mandated by regulatory bodies in high-stakes manufacturing environments. Modern finishing solutions significantly reduce manual labor dependence while maximizing throughput and minimizing waste through precise process control. Furthermore, the integration of Industry 4.0 concepts, such as real-time monitoring and predictive maintenance, ensures optimal equipment utilization and extends the operational life of the machinery itself, providing substantial long-term cost savings for manufacturers.

Key driving factors accelerating the growth of this market include the relentless global push toward lightweight materials in automotive and aerospace sectors, demanding advanced surface treatments for durability and structural integrity. The increasing complexity and miniaturization of components in the electronics and medical industries necessitate ultra-precise finishing capabilities that only automated machinery can provide. Additionally, robust capital investments in emerging economies, particularly in Asia Pacific, focusing on establishing advanced manufacturing infrastructures, further fuel the demand for sophisticated finishing equipment capable of supporting mass production with unwavering quality standards. The need for energy-efficient manufacturing processes also promotes the adoption of modern machinery that optimizes cycle times and material usage.

Finishing Machinery Market Executive Summary

The Finishing Machinery Market exhibits strong forward momentum, primarily driven by transformative business trends centered on digitalization and automation. Global manufacturers are increasingly shifting away from conventional manual finishing techniques towards integrated robotic finishing cells and computerized numerical control (CNC) systems to enhance repeatability, reduce production variability, and address the acute shortage of skilled manual labor. The market is witnessing significant investment in machinery capable of processing novel materials, such as carbon fiber composites and specialized alloys, demanding adaptive control systems and sophisticated abrasive technologies. Furthermore, there is a pronounced trend toward modular and flexible machinery designs that can be rapidly reconfigured to handle diverse product lines, catering to the rising demand for customized manufacturing solutions across multiple end-user industries.

Regionally, the Asia Pacific (APAC) stands as the undisputed powerhouse of the Finishing Machinery Market, primarily propelled by massive manufacturing volumes in China, India, and Southeast Asian nations, spanning consumer electronics, automotive components, and heavy industrial machinery. North America and Europe, while growing at a steadier pace, are leading the adoption of high-value, fully automated finishing systems, emphasizing operational efficiency, traceability, and compliance with stringent quality norms like ISO standards. These mature markets prioritize investments in retrofitting existing equipment with advanced sensors and data analytics capabilities to align with Industry 4.0 frameworks, seeking optimization rather than purely capacity expansion, thus driving demand for software and integration services alongside hardware.

In terms of segments, the robotic finishing machinery segment is anticipated to register the highest CAGR, benefiting from its unparalleled versatility in handling complex geometries and the ability to operate continuously in harsh environments, reducing human exposure to hazardous finishing materials. By application, the automotive segment remains the largest consumer, necessitating high-volume finishing for engine components, transmission parts, and structural elements to ensure optimal performance and fuel efficiency. However, the medical and aerospace segments are experiencing accelerated growth due to the critical need for impeccably smooth, sterile, and high-tolerance surfaces on implants, surgical tools, and structural aircraft components, pushing the technological limits of ultra-precision finishing processes such as micro-deburring and plasma polishing.

AI Impact Analysis on Finishing Machinery Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Finishing Machinery Market predominantly revolve around three critical themes: automation of quality inspection, implementation of predictive maintenance, and optimization of complex process parameters. Users are highly interested in how AI-powered vision systems can replace subjective manual inspection, particularly for microscopic surface defects or texture variations, thereby ensuring zero-defect manufacturing in high-value components. A major concern is the practicality and return on investment (ROI) of integrating AI algorithms into legacy finishing equipment, focusing on whether machine learning models can accurately predict abrasive wear, tooling failure, and ideal cycle parameters without extensive and costly data collection efforts. Expectations center on AI enabling closed-loop finishing control, where machines dynamically adjust speeds, pressures, and media types based on real-time feedback and material variation, moving beyond static, predetermined manufacturing recipes towards fully adaptive, self-optimizing production lines.

The integration of AI fundamentally transforms traditional finishing processes by introducing unprecedented levels of consistency and efficiency. AI algorithms analyze massive datasets derived from sensors monitoring vibration, temperature, current draw, and acoustic emissions to forecast equipment failures far in advance, enabling condition-based maintenance strategies that drastically reduce unplanned downtime and optimize maintenance schedules. This shift from reactive or time-based maintenance to predictive maintenance is crucial in capital-intensive industries where finishing operations are often bottlenecks in the overall production flow. Furthermore, AI enhances process parameter control by learning the subtle correlations between machine inputs and final surface quality outputs, allowing the system to compensate automatically for environmental factors or inherent material inconsistencies, which previously required constant human oversight and iterative adjustments.

AI also revolutionizes automated grinding and polishing by using deep learning models trained on millions of successful finish profiles. These models guide robotic arms to apply precisely the correct force and path trajectory needed for irregular or complex geometries, a task historically challenging for traditional programmed robotics. For instance, in deburring operations, AI can identify the exact size and location of residual burrs using 3D scanning data and generate an optimal tool path in real-time, significantly reducing cycle time while ensuring uniformity across batches. This adoption accelerates the market's transition towards high-mix, low-volume production scenarios, making high-quality finishing economically viable for specialized, customized components.

- AI-driven predictive maintenance forecasts component failure (e.g., abrasive wear, spindle health) based on multivariate sensor data, maximizing uptime.

- Machine Vision systems utilize AI for automated, non-contact surface quality inspection, detecting micro-defects and ensuring adherence to roughness specifications.

- Deep Learning algorithms optimize complex finishing parameters (speed, feed rate, pressure, duration) in real-time for adaptive process control based on material feedback.

- Robotic Path Generation employs AI to calculate optimal tool trajectories for complex, non-uniform surfaces, improving finishing consistency and reducing programming time.

- Energy Consumption Optimization uses machine learning to identify and implement the most efficient operating modes for finishing cycles, supporting sustainability goals.

DRO & Impact Forces Of Finishing Machinery Market

The Finishing Machinery Market is significantly influenced by a dynamic interplay of factors encapsulated in the Drivers, Restraints, and Opportunities (DRO) framework, shaping its current trajectory and future potential. Key drivers primarily stem from the global acceleration of industrial automation and the stringent quality demands across high-precision end-use sectors like aerospace, medical devices, and high-end automotive manufacturing. The necessity to achieve sub-micron level surface finishes, often required for critical components like turbine blades or orthopedic implants, compels manufacturers to invest in state-of-the-art machinery that offers high degrees of control and repeatability, driving technology upgrades across the market. Furthermore, the robust growth of electric vehicle (EV) production mandates specialized finishing equipment for battery components and lightweight chassis parts, opening new avenues for machinery manufacturers focused on novel materials and high-volume processing.

Conversely, significant restraints hinder market growth, most notably the high initial capital investment required for purchasing and implementing advanced CNC or robotic finishing systems. Small and Medium Enterprises (SMEs) often face budgetary constraints that restrict their ability to adopt these expensive technologies, opting instead for refurbished or semi-manual equipment. Another critical constraint is the ongoing shortage of specialized labor trained to operate, program, and maintain complex, digitally integrated finishing machinery. The sophistication of these systems demands operators with interdisciplinary skills in mechanics, programming, and data analytics, creating a talent gap that slows the widespread adoption of advanced automation solutions, particularly in rapidly industrializing regions.

Opportunities for market expansion are abundant, particularly through focusing on sustainable finishing processes, such as dry finishing techniques or processes that minimize chemical usage and water consumption, aligning with stricter environmental regulations worldwide and corporate sustainability commitments. Emerging markets in Southeast Asia and Latin America present vast untapped potential as local manufacturing capabilities scale up and demand higher quality standards for locally produced goods. Additionally, the increasing convergence of Additive Manufacturing (AM) with conventional manufacturing creates a substantial need for specialized post-processing and finishing machinery capable of efficiently removing support structures, improving surface roughness, and densifying 3D-printed parts, a niche market poised for explosive growth over the forecast period. These market forces collectively dictate the innovation pathways and investment priorities for leading finishing machinery manufacturers globally, emphasizing precision, efficiency, and adaptability.

Segmentation Analysis

The Finishing Machinery Market is meticulously segmented based on machinery type, process type, end-user industry, and degree of automation, allowing for a detailed understanding of market dynamics within specific operational niches. Segmentation by machine type often distinguishes between traditional standalone equipment (such as dedicated grinding or polishing machines), flexible Computer Numerical Control (CNC) integrated systems, and highly versatile robotic finishing cells. Process type segmentation is critical as it defines the function and required technology, encompassing vital processes such as deburring, superfinishing, coating application, and abrasive flow machining (AFM), each targeting different levels of surface modification and material removal rates. The underlying segmentation structure reflects the diverse technological needs of a highly varied global manufacturing landscape, ranging from mass production to high-tolerance custom fabrication.

Segmentation by end-user industry is paramount for strategic planning, with the automotive sector typically dominating demand due to the constant need for high-performance engine components and large-scale body finishing operations. The aerospace and defense sector represents a high-value, stringent quality segment, demanding machinery capable of maintaining tight tolerances on critical components like airfoils and landing gear parts. Meanwhile, the growing medical device industry, focused on producing high-precision surgical instruments and implants, drives demand for ultra-precise micro-finishing and biocompatibility surface treatments. The convergence of these industrial demands ensures that machinery manufacturers must offer highly specialized, industry-specific solutions rather than one-size-fits-all equipment.

Finally, segmentation by degree of automation differentiates between manual/semi-automatic equipment, which still holds relevance in repair or low-volume customization shops, and fully automatic or autonomous systems, which are the cornerstone of modern, high-throughput factories adhering to Industry 4.0 principles. The trend clearly favors higher automation levels, driven by labor cost reduction objectives and the critical need for process repeatability and traceability, especially in regulated industries. Understanding these layered segments helps stakeholders identify high-growth areas, such as robotic finishing in complex metalworking, and tailor their research and development efforts to meet evolving industrial requirements for surface integrity and efficiency.

- By Type:

- CNC Finishing Systems

- Robotic Finishing Cells

- Manual/Semi-Automatic Finishing Equipment

- Specialized Finishing Machines (e.g., Lapping, Honing, Superfinishing)

- By Process:

- Deburring and Edge Profiling

- Grinding and Polishing

- Coating and Plating Preparation

- Surface Texturing and Superfinishing

- Cleaning and Washing Systems

- By End-User Industry:

- Automotive (Internal Combustion and Electric Vehicles)

- Aerospace and Defense

- Medical Devices and Implants

- Electronics and Semiconductor

- Heavy Machinery and Industrial Equipment

- Precision Metalworking

- By Automation Level:

- Fully Automatic/Autonomous Systems

- Semi-Automatic Systems

- Manual Systems

Value Chain Analysis For Finishing Machinery Market

The value chain for the Finishing Machinery Market begins with the upstream suppliers responsible for providing essential raw materials and high-technology components, which are foundational to the functionality and performance of the final machinery. Upstream analysis involves assessing the sourcing of high-grade metals (steel, aluminum alloys) for structural frames and moving parts, complex electronic components (sensors, servo motors, control units), and specialized consumables like abrasive media, chemical compounds, and sophisticated tooling heads. The competitiveness in this stage is defined by material quality, consistency, and the ability of suppliers to maintain a steady inventory of highly customized components, as any disruption directly impacts the machinery manufacturer’s production schedule and the ultimate precision capabilities of the finished equipment. Technological advances in control systems and robotic component manufacturing significantly influence the cost and efficiency of the overall value chain.

Midstream activities are dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the finishing machinery. These manufacturers add considerable value through engineering expertise, proprietary software development for machine control (CNC programming, robotic path optimization), and system integration, often tailoring standardized platforms to meet specific customer requirements related to component size, material handling, or desired surface finish parameters. Distribution channels play a critical role here, often involving a mix of direct sales forces for large, custom projects and indirect channels utilizing regional distributors, specialized agents, and system integrators who provide local installation, training, and ongoing maintenance support. The indirect channel is particularly vital in emerging markets where local expertise and established relationships with industrial end-users are essential for market penetration and sustained growth.

The downstream component of the value chain focuses on the end-users and the after-sales service ecosystem. Downstream analysis includes examining how industrial customers—ranging from Tier 1 automotive suppliers to specialized aerospace component fabricators—utilize the machinery to create finished products. Post-purchase activities, including maintenance contracts, provision of genuine replacement parts, software updates, and process optimization consulting, represent a substantial and high-margin revenue stream for OEMs. The ongoing service relationship ensures optimal machine performance and customer loyalty. Efficient distribution of critical spare parts and robust global technical support are crucial differentiators in this competitive market, directly impacting customer uptime and the perceived total cost of ownership (TCO) of the finishing machinery.

Finishing Machinery Market Potential Customers

Potential customers for Finishing Machinery span across highly diversified industrial sectors, united by the universal requirement for precision surface finishing to ensure product function, durability, and compliance. The primary cohort of potential buyers includes large-scale original equipment manufacturers (OEMs) in the automotive industry, encompassing both traditional internal combustion engine component suppliers (e.g., manufacturers of crankshafts, camshafts, transmission gears) and emerging suppliers specializing in electric vehicle drivetrains and battery casings, all demanding high-volume, automated finishing solutions for enhanced reliability and reduced friction. These customers prioritize high throughput, integrated quality control features, and energy efficiency in their procurement decisions for finishing lines.

A secondary, but rapidly growing, customer segment is the high-value manufacturing cluster, specifically aerospace and defense contractors, along with medical device manufacturers. Aerospace clients require finishing machinery capable of maintaining near-perfect surface integrity on mission-critical components, such as turbine blades, structural airframe parts, and landing gear, often involving complex geometries and exotic materials. Medical device manufacturers, on the other hand, necessitate ultra-precision polishing and superfinishing for surgical tools, orthopedic implants (e.g., knee and hip joints), and cardiovascular devices, where surface finish directly relates to biocompatibility, friction reduction, and patient safety. These customers demand advanced traceability features and validated processes.

Furthermore, precision metal fabricators, tool and die makers, and companies within the consumer electronics supply chain represent a significant third tier of potential customers. The electronics sector requires highly accurate wafer polishing and finishing for device enclosures and heat sinks, driving demand for specialized micro-finishing equipment. General industrial machinery manufacturers, involved in producing pumps, compressors, and heavy construction equipment, also rely heavily on finishing machinery for components requiring specific tolerances and resistance to wear, ensuring longevity and performance under strenuous operating conditions. The demand across these sectors confirms the broad applicability and essential nature of finishing machinery in modern global manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Surface Preparation Group, Rösler Oberflächentechnik GmbH, Kellenberger, Gehring Group, Okuma Corporation, Kanzaki Kokyukoki Mfg. Co., Ltd., Gleason Corporation, Shigiya Machinery Works Ltd., TAIYO KOKI Co., Ltd., 3M Company (Abrasives & Finishing), Timesavers, Inc., Grinding Master, ACME Manufacturing Co., Dürr Group, Supfina Grieshaber GmbH & Co. KG, Junker Group, Loeser GmbH, Bosch Rexroth AG (Robotics/Components), ABB Ltd. (Robotics), FANUC Corporation (Robotics). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Finishing Machinery Market Key Technology Landscape

The technological landscape of the Finishing Machinery Market is rapidly evolving, driven by the need for higher precision, efficiency, and flexibility in modern manufacturing. A significant technological shift involves the transition from traditional mechanical abrasion to advanced non-contact or highly controlled methods, such as Laser Finishing and Plasma Polishing. Laser finishing systems utilize high-energy beams for precision surface texturing, cleaning, or localized material removal, offering benefits in processing heat-sensitive materials and achieving highly specific surface characteristics that are crucial for sealing or friction optimization. Simultaneously, the adoption of closed-loop feedback systems incorporating advanced sensors (e.g., in-situ roughness measurement and thermal imaging) is becoming standard. These systems enable real-time process correction, ensuring that the target finish is achieved on the first pass, thereby reducing scrap rates and improving overall material utilization.

Another pivotal technological advancement is the deep integration of robotics and advanced control software, crucial for processing complex geometries resulting from advanced casting or additive manufacturing techniques. Robotic finishing cells are equipped with force-torque sensors and adaptive grinding/polishing heads, allowing them to dynamically adjust pressure and trajectory based on the component's actual geometry and hardness variations, thereby achieving uniform surface quality across highly non-uniform parts, such as complex turbocharger components or customized orthopedic implants. Furthermore, the development of specialized abrasives and media, including engineered ceramic particles and diamond-impregnated tools, extends tool life and enhances material removal rates, contributing significantly to reduced cycle times and improved cost-effectiveness of the finishing operations across all major segments.

The digitalization of finishing machinery, aligning with Industry 4.0 paradigms, is arguably the most impactful trend. This involves equipping machines with Industrial Internet of Things (IIoT) sensors that transmit voluminous operational data to cloud-based analytics platforms. This data facilitates comprehensive process traceability, crucial for meeting regulatory compliance in aerospace and medical sectors, and supports sophisticated predictive maintenance algorithms powered by machine learning. Manufacturers are also implementing advanced simulation software, or digital twins, to model and optimize finishing processes virtually before physical execution. This capability reduces setup time, minimizes costly physical testing, and ensures that complex finishing strategies are robustly validated, accelerating time-to-market for new components and maintaining competitive edge through enhanced operational intelligence and resource efficiency.

Regional Highlights

The global Finishing Machinery Market demonstrates distinct regional dynamics heavily influenced by local manufacturing maturity, capital investment capabilities, and regulatory environments.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by large-scale production volumes in China, India, Japan, and South Korea, particularly across the automotive, consumer electronics, and heavy machinery sectors. The high volume of manufacturing output necessitates continuous investment in high-throughput finishing equipment. While cost sensitivity remains a factor, there is a clear upward trend in adopting sophisticated, automated finishing solutions to meet the rising quality standards of export markets and increasingly discerning domestic consumers. Government initiatives promoting advanced manufacturing (e.g., China’s Made in 2025) strongly support the market expansion.

- North America: North America is characterized by high adoption rates of advanced automation, particularly robotic finishing and CNC precision systems, primarily driven by the stringent quality requirements of the aerospace, defense, and high-end medical device industries. Market growth here is less about volume expansion and more about high-value, high-precision applications. Companies prioritize machinery that offers robust data traceability, minimal human intervention, and integration capabilities with existing enterprise resource planning (ERP) systems, focusing on enhancing overall manufacturing operational excellence and reducing labor costs.

- Europe: The European market is mature and technology-intensive, propelled by Germany, Italy, and Switzerland, which are global leaders in specialized machine tool manufacturing. Europe is a frontrunner in adopting sustainable finishing technologies and stringent occupational safety standards, driving demand for automated systems that minimize worker exposure to abrasives and chemicals. The strong presence of the high-performance automotive sector and specialized industrial machinery manufacturers ensures consistent demand for advanced lapping, honing, and superfinishing equipment, prioritizing energy efficiency and process precision above all else.

- Latin America (LATAM): The LATAM market, while smaller, offers significant long-term growth potential. Growth is concentrated in countries like Brazil and Mexico, driven by foreign direct investment in automotive manufacturing and basic industrial expansion. Demand tends toward robust, cost-effective semi-automatic and standard CNC finishing solutions. Market maturity is accelerating, leading to increasing demand for spare parts, maintenance services, and the eventual upgrade to more modern, automated systems to boost local competitive capabilities.

- Middle East and Africa (MEA): The MEA market is largely driven by large infrastructure projects, oil and gas, and emerging defense manufacturing capabilities. Demand is highly selective, focusing on heavy-duty finishing machinery for pipe preparation, equipment maintenance, and structural components requiring robust anticorrosion coatings. Market penetration relies heavily on international OEMs providing comprehensive turnkey solutions and long-term service agreements, particularly in the Gulf Cooperation Council (GCC) countries investing heavily in industrial diversification strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Finishing Machinery Market.- Surface Preparation Group

- Rösler Oberflächentechnik GmbH

- Kellenberger (Hardinge Inc.)

- Gehring Group

- Okuma Corporation

- Kanzaki Kokyukoki Mfg. Co., Ltd.

- Gleason Corporation

- Shigiya Machinery Works Ltd.

- TAIYO KOKI Co., Ltd.

- 3M Company (Abrasives & Finishing Division)

- Timesavers, Inc.

- Grinding Master

- ACME Manufacturing Co.

- Dürr Group

- Supfina Grieshaber GmbH & Co. KG

- Junker Group

- Loeser GmbH

- Bosch Rexroth AG (Automation Solutions)

- ABB Ltd. (Robotics & Automation)

- FANUC Corporation (Robotics & CNC)

- L. Kellenberger & Co. AG

- Lapmaster Wolters GmbH

- Poli-Film Group

- Trowal GmbH & Co. KG

- Norton Saint-Gobain (Abrasives)

- Osborn International

- Suhner Automation Group

- Finishing Systems Inc.

- C.M. Surface Treatment S.r.l.

- Walther Trowal GmbH & Co. KG

- Kao Corporation (Chemicals)

- Chemetall GmbH (BASF)

- Henkel AG & Co. KGaA

- Nordson Corporation (Coating Systems)

- Wendt Grinding Technologies

- Makino Milling Machine Co., Ltd.

- Mazak Corporation

- GF Machining Solutions

- DMG MORI AKTIENGESELLSCHAFT

- Starrag Group Holding AG

- EMAG GmbH & Co. KG

- Haas Automation, Inc.

- Doosan Machine Tools

- Yamazaki Mazak Corporation

- Sodick Co., Ltd.

- Hwacheon Machine Tool Co., Ltd.

- Hyundai WIA Corporation

- Accu-Cut Diamond Tool Co.

- Diamond Industrial Tools

- Micron Tool & Machine

- Precision Surfacing Solutions

- Sartorius AG

- Mettler Toledo

- Keyence Corporation

- Cognex Corporation

- Hexagon AB

- Zeiss Group

- Olympus Corporation

- Mitutoyo Corporation

- Taylor Hobson (Ametek)

- Alicona Imaging GmbH

- Faro Technologies, Inc.

- 3D Systems Corporation

- Stratasys Ltd.

- EOS GmbH

- Renishaw plc

- Siemens AG (Industrial Automation)

- Rockwell Automation, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Delta Electronics, Inc.

- Omron Corporation

- Beckhoff Automation GmbH & Co. KG

- B&R Industrial Automation GmbH

- Eaton Corporation plc

- Parker Hannifin Corporation

- Bosch Rexroth AG (Hydraulics & Pneumatics)

- SMC Corporation

- Festo SE & Co. KG

- Aalberts N.V.

- Bodycote plc

- Heat Treatment Services Inc.

- Vacu-Braze, Inc.

- Thermion Inc.

- Praxair Surface Technologies, Inc. (Linde)

- Oerlikon Balzers (Oerlikon Group)

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- Yaskawa Electric Corporation

- Epson Robots

- Stäubli International AG

- Comau S.p.A.

- Universal Robots A/S

- KUKA AG

- Rethink Robotics GmbH

- Adept Technology (Omron)

- Teradyne Inc. (Universal Robots Parent)

- Harmonic Drive Systems Inc.

- Nabtesco Corporation

- Sumitomo Heavy Industries, Ltd.

- SKF Group

- Timken Company

- NSK Ltd.

- NTN Corporation

- JTEKT Corporation

- Schaeffler AG

- Federal-Mogul LLC

- Mahle GmbH

- Tenneco Inc.

- Aptiv PLC

- BorgWarner Inc.

- Continental AG

- ZF Friedrichshafen AG

- Magna International Inc.

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Valeo S.A.

- Autoliv, Inc.

- Robert Bosch GmbH

- 3B Tech

- Aeromet International PLC

- GKN Aerospace

- Rolls-Royce plc

- Safran S.A.

- United Technologies Corporation (Pratt & Whitney)

- Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Volkswagen Group

- Daimler AG

- General Motors Company

- Ford Motor Company

- Tesla, Inc.

- BYD Company Limited

- NIO Inc.

- Rivian Automotive, Inc.

- Lucid Motors

- Xometry, Inc.

- Protolabs, Inc.

- Hubs (3D Hubs)

- Manufacturing Market Insider

- Modern Machine Shop

- Machinery Magazine

- Industrial Heating Magazine

- Products Finishing Magazine

- SME (Society of Manufacturing Engineers)

- AMT (The Association For Manufacturing Technology)

- VDA (German Association of the Automotive Industry)

- PMMI (The Association for Packaging and Processing Technologies)

Frequently Asked Questions

Analyze common user questions about the Finishing Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Finishing Machinery Market?

The market growth is primarily driven by the increasing global demand for high-precision components in aerospace and medical industries, mandatory requirements for enhanced efficiency and process control under Industry 4.0 frameworks, and the rapid expansion of high-volume manufacturing sectors, particularly in Asia Pacific economies.

How is Artificial Intelligence (AI) transforming surface finishing operations?

AI is transforming finishing operations by enabling predictive maintenance for zero downtime, facilitating automated quality inspection using advanced machine vision systems, and optimizing complex process parameters in real-time to achieve superior and highly consistent surface quality across different materials.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC) holds the largest market share due to its status as the world's leading manufacturing hub, characterized by massive production volumes across the automotive, consumer electronics, and general industrial sectors, necessitating continuous investment in high-throughput finishing solutions.

What is the main challenge faced by manufacturers adopting advanced finishing machinery?

The primary challenge is the high initial capital investment required for automated and robotic finishing cells, compounded by a critical shortage of skilled technical labor necessary for programming, operating, and maintaining these sophisticated, digitally integrated systems.

What role does sustainability play in the development of new finishing machinery?

Sustainability drives innovation toward technologies that minimize resource consumption, such as dry finishing processes, efficient filtration systems, and machinery optimized for lower energy use, aligning with stricter environmental regulations and industry goals to reduce operational waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager