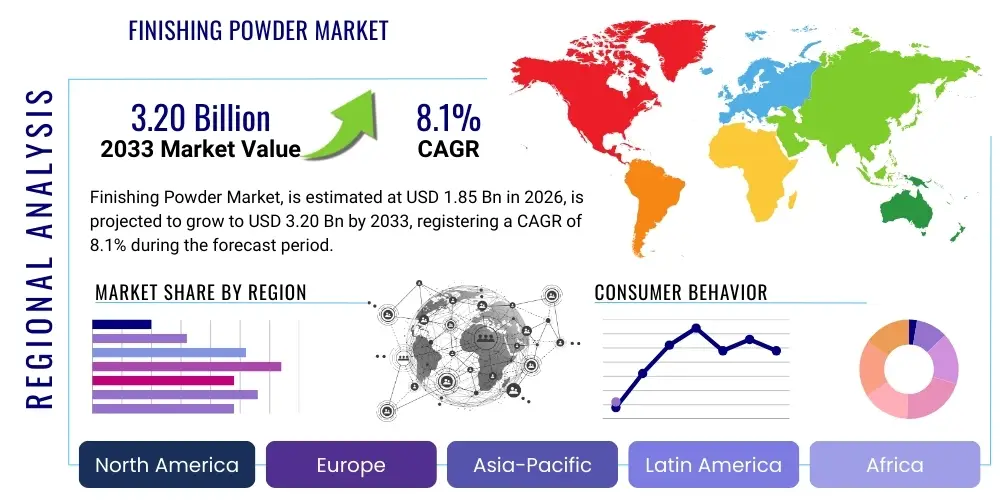

Finishing Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435828 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Finishing Powder Market Size

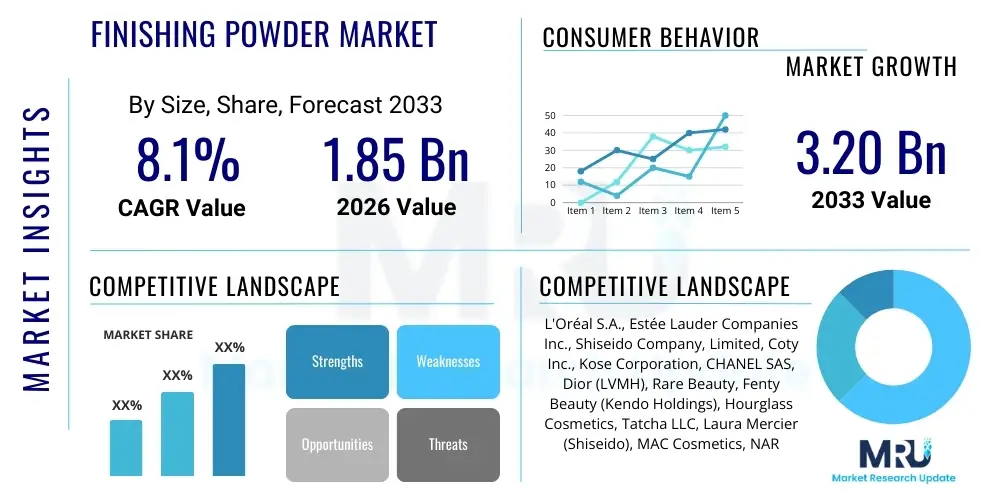

The Finishing Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.20 Billion by the end of the forecast period in 2033.

Finishing Powder Market introduction

The Finishing Powder Market encompasses specialized cosmetic formulations designed to set liquid foundation, control sebum, and impart a final, refined texture to the complexion. Unlike traditional setting powders, modern finishing powders are engineered using advanced micronization techniques to create a translucent or slightly tinted veil that minimizes the appearance of pores and fine lines, offering a critical soft-focus effect demanded by high-definition video and photography standards. These products are crucial for achieving long-lasting wear and preventing makeup from settling into creases throughout the day, driving their consistent incorporation into professional and consumer beauty routines globally.

Key applications of finishing powders extend beyond basic makeup setting; they are increasingly utilized for touch-ups, baking techniques, and targeted oil absorption in specific facial zones. The market is witnessing a strong shift towards formulations that integrate skincare benefits, such as antioxidants, hyaluronic acid derivatives, and non-comedogenic minerals. This evolution is driven by informed consumers who seek multi-functional beauty products that do not compromise skin health. Furthermore, the rising influence of professional makeup artists and beauty influencers on social media platforms continually elevates consumer awareness regarding the differentiating benefits of high-quality finishing powders versus standard setting powders, thereby sustaining market momentum.

Major driving factors include the escalating demand for high-performance, long-wear makeup necessitated by urban lifestyles and environmental challenges, coupled with a growing consumer focus on customized beauty routines. The development of clean beauty finishing powders—free from ingredients like talc, parabens, and sulfates—presents a significant opportunity. Benefits derived from these products include superior oil control, extended makeup longevity, enhanced blurring capabilities, and a weightless feel on the skin. The ongoing technological advancements in powder processing, such as jet-milling and encapsulation, allow manufacturers to create finer, more sophisticated textures that appeal to a diverse global consumer base seeking flawless complexion perfection.

Finishing Powder Market Executive Summary

The Finishing Powder Market is experiencing robust growth fueled by several converging business trends, most notably the shift toward premiumization and ingredient transparency within the cosmetics industry. Key stakeholders are focusing on sustainable packaging solutions, including refillable compacts and post-consumer recycled materials, aligning with global environmental concerns. Business strategies are heavily leaning on digital marketing and influencer collaborations to effectively communicate product benefits, particularly the soft-focus and blurring effects essential for visual media. Furthermore, personalized beauty consultation platforms are guiding consumers towards optimal powder formulations based on individual skin type, climate, and desired finish (e.g., matte, radiant, satin), thereby driving average transaction values across all retail channels.

Regional trends indicate that North America and Europe maintain dominance due to high disposable income, sophisticated beauty standards, and early adoption of innovative clean beauty formulations, particularly those utilizing exotic or ethically sourced botanical extracts. However, the Asia Pacific region, led by China, Japan, and South Korea, is emerging as the fastest-growing market, driven by the pervasive influence of K-Beauty and J-Beauty trends which emphasize poreless, ethereal skin textures often achieved through advanced finishing powders. Regional manufacturers are capitalizing on localized preferences, such as humidity control and unique whitening or brightening effects, ensuring targeted product development tailored to specific climatic and aesthetic demands.

Segment trends highlight the dominance of loose powder formats, attributed to their versatility and superior light-reflecting properties when applied using specialized techniques like 'baking.' Nonetheless, pressed powder formats are gaining traction within the convenience-focused segment, particularly for on-the-go touch-ups and travel retail. In terms of ingredients, the non-talc segment, including silica, rice powder, and corn starch derivatives, is witnessing accelerated growth due to widespread consumer apprehension regarding talc safety. The professional channel segment, comprising salons and makeup studios, remains a crucial segment for testing and validating high-performance, long-wear formulations before they transition into mass-market adoption, ensuring a steady pipeline of proven product innovation.

AI Impact Analysis on Finishing Powder Market

Analysis of common user questions reveals significant interest concerning AI's role in personalizing cosmetic recommendations, particularly for finishing powders where subtle differences in texture and shade matching are paramount. Users frequently ask: "How can AI determine the perfect translucent powder for my unique undertone?" and "Will AI analyze my skin texture to recommend the best blurring agent?" Key themes emerging from these queries revolve around achieving hyper-accurate shade and texture recommendations that account for environmental factors (humidity, lighting) and individual skin characteristics (oiliness, texture irregularities). Users expect AI to move beyond simple color matching to functional suitability, ensuring the powder controls shine precisely where needed without causing dryness or flashback in photography. The expectation is that AI algorithms, utilizing deep learning on vast datasets of consumer usage and environmental variables, will minimize the trial-and-error process currently associated with selecting the optimal finishing product, thereby enhancing customer satisfaction and reducing return rates.

The direct impact of Artificial Intelligence is reshaping the R&D and consumer experience landscapes within the finishing powder market. In research and development, AI algorithms are being used to simulate and optimize complex ingredient interactions, allowing formulators to predict the stability, longevity, and sensorial profile of new powder compounds before extensive physical testing. This capability drastically reduces the time-to-market for innovative products, especially those integrating novel functional ingredients like encapsulated probiotics or highly refined mineral blends for superior light diffusion. Furthermore, AI-driven analysis of social media sentiment and product reviews provides real-time competitive intelligence, enabling brands to swiftly identify gaps in the market, such as the need for non-comedogenic, matte finishing powders tailored for tropical climates, thereby ensuring product relevance and optimizing formulation strategy.

On the consumer front, AI is predominantly applied through augmented reality (AR) virtual try-on applications, which have become increasingly sophisticated, factoring in skin texture and oiliness predictions to simulate how different powder types (matte vs. radiant, loose vs. pressed) will look and settle on the user's face in various lighting conditions. This virtual consulting capability reduces the psychological barrier to purchasing high-end finishing powders online. Beyond virtual try-on, AI powers personalized subscription boxes and dynamic website personalization, suggesting complementary primer and foundation pairs alongside the optimal finishing powder, based on past purchase history and self-reported skin goals. This holistic approach ensures consumers receive a comprehensive recommendation, maximizing the perceived value of the entire makeup routine.

- AI-driven virtual try-on for personalized shade and texture matching, reducing purchasing ambiguity.

- Predictive formulation optimization using machine learning to enhance product stability and performance characteristics (e.g., sebum absorption rates).

- Automated analysis of global beauty trends and consumer feedback to inform agile product innovation cycles (Generative Design Optimization).

- Intelligent inventory management and supply chain forecasting for raw materials, particularly specialized minerals and starches used in non-talc formulas.

- Hyper-targeted digital advertising campaigns based on consumer interaction with AR tools and specific ingredient searches (e.g., "non-nano silica powder").

DRO & Impact Forces Of Finishing Powder Market

The Finishing Powder Market dynamics are governed by a complex interplay of internal and external forces. Drivers largely center on the pervasive influence of digital media, where the requirement for a flawless, airbrushed finish, often termed "skin positivity" or "filter-like" appearance, compels consumers to adopt advanced finishing products. The continuous innovation in formulation science, particularly the ability to create weightless powders with high efficacy in blurring imperfections without settling, sustains consumer interest and encourages repeat purchasing. Furthermore, the rising participation of younger demographics in cosmetic usage, combined with increasing disposable incomes in emerging economies, provides a vast, expanding consumer base eager to invest in specialized complexion products. These drivers collectively create a significant positive momentum, continually pushing the average unit price and category penetration rates upward.

However, the market faces notable restraints, primarily related to the complex and often expensive sourcing of high-quality, ethically-derived mineral ingredients (like responsible mica) and the persistent regulatory scrutiny surrounding certain legacy ingredients (like talc). The transition to clean and sustainable ingredients often incurs higher manufacturing costs, which must be absorbed or passed on, potentially limiting market accessibility in price-sensitive segments. Additionally, the proliferation of counterfeit cosmetic products, particularly in online channels, poses a threat to brand equity and consumer safety, requiring significant investment in anti-counterfeiting technologies and supply chain verification, acting as a frictional force on growth.

Opportunities reside predominantly in product customization and sustainability initiatives. The development of bespoke finishing powders, tailored to geographical climate variations (e.g., humidity-specific formulas) or personalized skin needs, presents a high-value niche. Expanding the product utility through hybrid formulations—powders that also offer SPF protection or environmental pollution defense—opens new market segments. The growing consumer preference for refillable and minimalist packaging solutions offers a critical avenue for brand differentiation and loyalty building. Impact forces, therefore, include the heightened regulatory environment, which pressures brands to ensure ingredient safety and transparency, and the powerful consumer advocacy for sustainability, which necessitates fundamental shifts in packaging and sourcing practices across the entire value chain.

Segmentation Analysis

The Finishing Powder Market segmentation provides a detailed map of consumer preferences and product dynamics, allowing manufacturers to strategically position their offerings. Key segmentation variables include the product format (loose vs. pressed), the primary ingredient type (talc-based vs. non-talc/mineral), the finish achieved (matte vs. radiant/luminous), and the end-user application (professional vs. consumer). This nuanced market view is essential for identifying high-growth segments, such as the non-talc segment driven by clean beauty movements, and the loose powder format, which continues to dominate high-performance applications due to superior blending capabilities and finely milled textures necessary for an invisible finish.

- By Product Format:

- Loose Powder

- Pressed Powder (Compact)

- By Ingredient Type:

- Talc-Based

- Non-Talc Based (Silica, Mica, Corn Starch, Rice Powder, Mineral Blends)

- By Finish:

- Matte Finish

- Radiant/Luminous Finish

- Satin Finish

- By End User:

- Consumer

- Professional (Makeup Artists, Salons, Film Industry)

- By Distribution Channel:

- Offline (Specialty Stores, Department Stores, Drugstores)

- Online (E-commerce Portals, Brand Websites)

Value Chain Analysis For Finishing Powder Market

The value chain for the Finishing Powder Market begins with Upstream Analysis, focusing intensely on the sourcing and processing of raw materials. Critical inputs include highly purified mineral compounds such as cosmetic-grade silica, specialized mica for luminosity, zinc oxide, and titanium dioxide for potential SPF properties, alongside organic materials like modified starches (rice, corn). The quality and particle size distribution (micronization level) of these raw materials directly determine the final product's performance characteristics, such as texture, light reflection, and oil absorption capacity. Ethical sourcing, particularly for mica, is now a non-negotiable factor, placing immense pressure on ingredient suppliers to maintain stringent transparency and certification standards, significantly influencing the initial cost structure of premium finishing powders.

Midstream activities involve formulation, manufacturing, and packaging. Formulation requires precise blending of dry ingredients, often utilizing specialized mixing equipment to ensure homogenous particle dispersion and prevent separation, which is crucial for achieving a smooth, flawless application. Manufacturing processes, including jet-milling or air-spun techniques, are vital for achieving the desired lightweight texture. The packaging stage is equally critical, moving toward innovative solutions like sifter mechanisms that prevent product spillage in loose powders, and aesthetically pleasing, environmentally sustainable compacts for pressed varieties. The complexity of regulatory compliance regarding ingredient safety and labeling in various regions adds a layer of operational challenge and cost during the manufacturing phase.

Downstream Analysis focuses on distribution and sales. The distribution channel is segmented into direct and indirect routes. Direct sales occur through brand-owned e-commerce platforms and flagship stores, offering maximal control over brand narrative and customer data collection. Indirect sales, which form the bulk of the market, utilize specialty beauty retailers (like Sephora, Ulta), department stores, and increasingly, high-traffic drugstore chains. E-commerce platforms are pivotal, offering interactive purchasing experiences through AI/AR tools. The effectiveness of the final stage, including sophisticated logistics for inventory replenishment and targeted marketing campaigns leveraging social media, ultimately determines market penetration and brand loyalty, making efficient, responsive distribution systems a competitive necessity.

Finishing Powder Market Potential Customers

The primary end-users and buyers of finishing powder products span a wide demographic range, categorized primarily by their frequency of makeup use, skin concerns, and preference for product performance. The largest customer segment consists of daily cosmetic users (The Mass Market Consumer) who seek reliable, affordable options that offer basic setting capabilities and moderate oil control. These individuals often prioritize pressed powders for ease of application and portability, purchasing mainly through drugstore chains and high-volume online retailers. This segment is highly responsive to value propositions and accessible distribution, viewing finishing powder as a foundational element of their routine.

A high-value segment comprises the Performance-Driven Consumers, typically Millennials and Generation Z individuals, who are heavily influenced by social media tutorials and high-definition photography trends. These customers demand advanced functionalities such as superior blurring, flawless setting, non-flashback properties, and long-wear endurance. They are willing to invest in premium, high-tech loose powders featuring specialized ingredients (e.g., non-nano particles, advanced silicones) and sophisticated packaging. This segment primarily purchases through specialty beauty retailers and brand direct-to-consumer channels, valuing ingredient transparency and ethical sourcing highly. They are also early adopters of hybrid products that combine makeup artistry with advanced skincare benefits.

The Professional End-Users, including freelance makeup artists, film industry professionals, and theatrical artists, represent a smaller but critical segment. Their purchasing decisions are based strictly on product efficacy under extreme conditions (bright lights, long hours, high humidity). They require robust formulas that guarantee no flashback and consistent performance across diverse skin tones and textures. Their demand drives innovation in ultra-fine, translucent loose powders designed for maximum versatility. While they purchase in higher volumes, their influence extends far beyond their direct sales, as their product endorsements significantly sway the purchasing decisions of the broader consumer market, validating premium brands and specific formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.20 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Estée Lauder Companies Inc., Shiseido Company, Limited, Coty Inc., Kose Corporation, CHANEL SAS, Dior (LVMH), Rare Beauty, Fenty Beauty (Kendo Holdings), Hourglass Cosmetics, Tatcha LLC, Laura Mercier (Shiseido), MAC Cosmetics, NARS Cosmetics, Pat McGrath Labs, IT Cosmetics, Clinique Laboratories, Cover FX, Revlon, Inc., Too Faced Cosmetics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Finishing Powder Market Key Technology Landscape

The Finishing Powder Market is defined by continuous advancements in particulate technology and delivery systems aimed at enhancing texture, longevity, and skin compatibility. One of the most crucial technologies is micronization, specifically jet-milling and air-spun processing. These proprietary techniques reduce raw ingredients (like silica, minerals, or starch derivatives) to ultra-fine particles, often in the sub-micron range, ensuring the powder feels weightless, blends seamlessly, and avoids a chalky appearance. This ultra-fine milling allows for the development of true translucent powders that work across a wide spectrum of skin tones without altering the color of the foundation beneath, a crucial factor for achieving the coveted "invisible" finish in professional makeup applications.

Another significant technological focus is encapsulation technology, which involves coating active ingredients within the powder matrix. This is primarily used for sebum-absorbing agents or skincare ingredients (such as vitamins or anti-pollution complexes). Encapsulation ensures that functional ingredients are released gradually or upon contact with skin oils, providing prolonged performance, such as continuous shine control throughout the day. Furthermore, advancements in silicone elastomer technology allow manufacturers to formulate powders with exceptional "slip" and binding capacity, ensuring adherence to the skin while offering a smooth, soft-focus finish that visually blurs texture without accumulating in fine lines. These elastomers are vital for high-performance pressed powders, preventing fallout and ensuring structural integrity.

The clean beauty movement is driving rapid innovation in developing high-performance talc substitutes. The technology here focuses on utilizing specialized blends of non-nano mineral composites and modified starches that mimic the texture and oil-absorption capacity of talc without the associated consumer concerns. Rice powder and treated mica are central to this technological pivot, requiring extensive R&D to stabilize these natural components against moisture and ensure long shelf life. The integration of patented light-reflecting pigment technology, often leveraging interference pigments or synthetic mica coated with metal oxides, allows finishing powders to achieve targeted effects—from a subtle natural radiance to a high-wattage luminous glow—all while maintaining the skin’s appearance of being perfected, not heavily powdered.

Regional Highlights

North America dominates the Finishing Powder Market, characterized by high consumer awareness regarding premium cosmetic formulations and a robust presence of key international beauty conglomerates. The market here is highly receptive to innovation, particularly clean beauty products, non-talc mineral formulations, and high-tech powders that offer sophisticated blurring and filter effects suitable for digital media. The United States drives the majority of the regional revenue, emphasizing diverse shade ranges and personalized product recommendations, heavily leveraging specialty retail channels and direct-to-consumer e-commerce for new product launches. Consumers in this region readily adopt specialized products like baking powders and setting mists, viewing the finishing stage as essential for makeup longevity and professional-grade results.

Europe represents a mature and highly regulated market, where emphasis is placed strongly on ingredient safety, ethical sourcing (especially mica), and sustainability. Western European countries, particularly France, Germany, and the UK, exhibit high per capita expenditure on luxury and niche cosmetic brands. The demand is strong for refillable finishing powder compacts and formulas that feature certified natural or organic components. The regulatory environment, especially the European Union’s stringent cosmetic directives, influences global product formulation strategies, pushing brands toward verifiable ingredient transparency and dermatological testing before market entry, thereby shaping the quality standards for the entire finishing powder category.

Asia Pacific (APAC) is projected to register the highest growth rate due to rapidly increasing urbanization, rising disposable income, and the profound cultural influence of K-Beauty and J-Beauty trends. Consumers in this region prioritize flawless, "poreless" skin and often seek finishing powders designed specifically for humidity control and brightening effects. South Korea and Japan are leaders in formulation technology, specializing in air-spun, ultra-fine powders optimized for oil absorption and maintaining a smooth texture in humid climates. China’s expanding middle class and enormous digital consumer base are driving explosive demand for both mass-market and premium imported finishing powders, making APAC the key growth engine for the forecast period.

The Latin America and Middle East & Africa (LAMEA) regions show promising growth, driven by youthful populations and increasing exposure to global beauty trends through social media. In Latin America, demand centers around humidity-resistant, long-wear matte formulas due to prevalent warm climates. The Middle East, particularly the Gulf Cooperation Council (GCC) countries, exhibits a strong preference for luxury, high-end finishing powders and prestige brands, often incorporating advanced pigments for optimal performance under intense lighting conditions. Supply chain optimization and establishing strong, localized distribution networks are crucial strategies for maximizing penetration in these dynamic, often geographically fragmented, emerging markets.

- North America: Leads in revenue share; driven by demand for clean beauty, professional-grade blurring effects, and high disposable income.

- Europe: Focuses on regulatory compliance, ethical sourcing, and strong demand for sustainable, refillable packaging solutions.

- Asia Pacific: Fastest-growing region; highly influenced by K-Beauty trends, prioritizing oil control, humidity resistance, and skin brightening effects.

- Latin America: High demand for matte, climate-specific formulas designed for heat and humidity.

- Middle East & Africa: Growing luxury segment; strong preference for prestige brands and intense color payoff testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Finishing Powder Market.- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Coty Inc.

- Kose Corporation

- CHANEL SAS

- Dior (LVMH)

- Rare Beauty

- Fenty Beauty (Kendo Holdings)

- Hourglass Cosmetics

- Tatcha LLC

- Laura Mercier (Shiseido)

- MAC Cosmetics

- NARS Cosmetics

- Pat McGrath Labs

- IT Cosmetics

- Clinique Laboratories

- Cover FX

- Revlon, Inc.

- Too Faced Cosmetics

Frequently Asked Questions

Analyze common user questions about the Finishing Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between setting powder and finishing powder?

Setting powder is primarily used to set liquid or cream foundation, reducing tackiness and enhancing wear time. Finishing powder, conversely, is applied after setting powder (or as a final step) and uses highly micronized particles to blur imperfections, minimize pores, and create a soft-focus or filter effect, crucial for high-definition visual appeal.

How is the clean beauty trend impacting the formulation of finishing powders?

The clean beauty trend mandates ingredient transparency and the exclusion of controversial components. This drives a significant market shift toward non-talc formulations, favoring alternatives like specialized silica, micronized rice powder, and corn starch derivatives, while also emphasizing ethically sourced minerals, particularly mica.

Which geographical region exhibits the fastest growth rate in the Finishing Powder Market?

The Asia Pacific (APAC) region, driven by the strong influence of Korean and Japanese beauty standards and rapidly increasing consumer purchasing power in China, is projected to record the highest Compound Annual Growth Rate (CAGR) during the forecast period.

What is the role of AI and AR technology in purchasing finishing powders online?

AI/AR technologies facilitate virtual try-on experiences, simulating how different powder textures (matte, luminous) interact with the user's specific skin tone and texture in various lighting conditions. This personalization reduces product uncertainty, enhancing consumer confidence in online purchasing decisions.

Is the Pressed Powder or Loose Powder format currently dominating the market?

While pressed powder maintains strong popularity for convenience and portability, the Loose Powder segment currently dominates the market in terms of revenue, primarily due to its superior particle structure, which provides a more effective blurring, light-reflecting, and professional-grade soft-focus finish necessary for high-performance setting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager