Fintech-as-a-Service Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431648 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Fintech-as-a-Service Platform Market Size

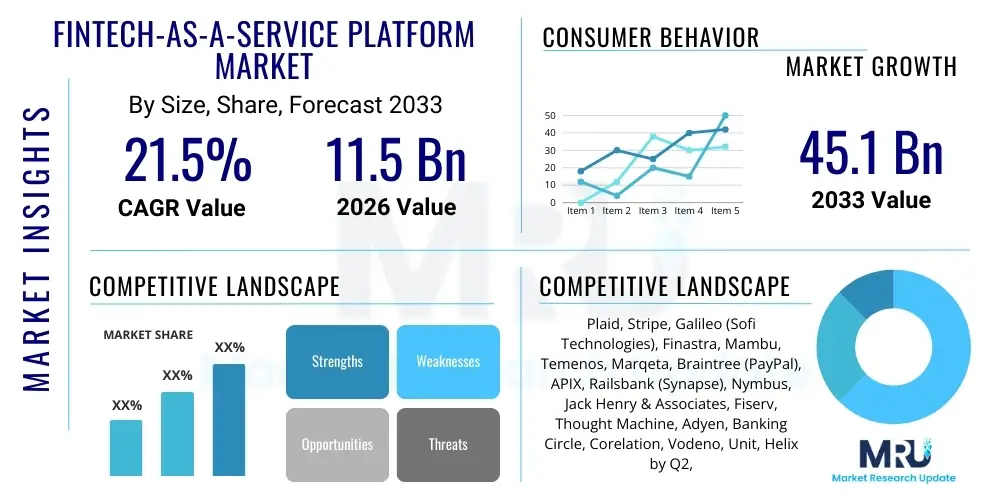

The Fintech-as-a-Service Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 45.1 Billion by the end of the forecast period in 2033.

Fintech-as-a-Service Platform Market introduction

The Fintech-as-a-Service (FaaS) Platform market encompasses technological solutions that allow non-financial entities, traditional banks, and emerging fintechs to offer sophisticated financial services through modular, API-driven infrastructures without the necessity of building complex back-end systems from scratch. These platforms democratize financial innovation by providing standardized tools for payments, lending, banking, and regulatory compliance. The primary product description revolves around cloud-native, scalable APIs and core banking systems that can be integrated quickly, dramatically reducing time-to-market and operational expenditure for deploying new financial products, thereby fostering a highly competitive and responsive digital finance ecosystem. FaaS platforms embody the shift toward composable banking, where institutions piece together specialized functionalities—such as card issuing, KYC verification, or digital wallet management—from various best-of-breed providers, rather than relying on a single vendor's monolithic system. This strategic unbundling of financial services is key to maintaining agility in a rapidly evolving digital landscape and addressing fragmented consumer demand.

Major applications of FaaS platforms span across digital banking solutions, enabling challenger banks and neo-banks to exist; enhanced payment processing systems, facilitating global real-time transfers compliant with ISO 20022; and sophisticated wealth management and lending origination services utilizing AI for underwriting. The core benefit derived from utilizing FaaS platforms is flexibility, enabling seamless integration of specialized services like KYC (Know Your Customer), AML (Anti-Money Laundering), and complex regulatory reporting into existing or nascent digital workflows. This modularity allows institutions to rapidly adapt to shifting consumer preferences for embedded finance and hyper-personalized financial interactions, moving financial services out of traditional bank branches and into daily consumer interfaces such-as e-commerce checkout pages or accounting software dashboards, enabling transactions at the precise point of need.

The market is primarily driven by the escalating demand for digital transformation within traditional financial institutions (FIs) seeking to compete with agile fintech startups, coupled with the profound trend of embedded finance where financial functionalities are integrated into non-financial applications (e.g., e-commerce platforms, ERP systems). Furthermore, the reduction in barriers to entry for launching financial products, facilitated by standardized, secure, and compliance-ready FaaS infrastructures, acts as a significant catalyst. The global shift toward cloud computing and the maturation of regulatory frameworks supporting open banking initiatives further solidify the market's robust growth trajectory across key geographical regions, emphasizing operational efficiency and enhanced customer experience as central tenets. The shift towards Platform-as-a-Service (PaaS) models tailored specifically for regulated financial services simplifies complex compliance overhead, making sophisticated technology accessible to smaller institutions and non-regulated businesses alike, which accelerates overall market democratization and adoption globally.

Fintech-as-a-Service Platform Market Executive Summary

The global Fintech-as-a-Service Platform market is experiencing accelerated growth driven primarily by structural business trends favoring outsourcing of non-core technological infrastructure and the rapid adoption of Application Programming Interfaces (APIs) as the standardized language for financial data exchange. Key business trends include the shift from monolithic core banking systems to composable architecture, allowing FIs to select specialized FaaS modules (e.g., lending, card issuing, payments) from various vendors based on performance and price. This move towards customization and fractional consumption of financial technology resources is lowering capital expenditure and driving market expansion, particularly among large enterprises looking for modernization strategies and startups focused solely on specialized niches within the financial value chain. The emphasis on faster time-to-market for innovative financial products and the ability to scale operations rapidly are crucial business drivers dictating vendor selection and platform design, prioritizing scalability and cloud-native solutions that leverage economies of scale in infrastructure management and maintenance.

Regional trends indicate North America maintaining market leadership due to high technological adoption rates, established open banking precedents, and the concentrated presence of major FaaS innovators and cloud providers. The competitive environment in the U.S. drives continuous investment in advanced technologies such as real-time payments and digital identity verification FaaS. However, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapid digitization, massive underbanked populations accessing services via mobile platforms, and supportive government initiatives promoting digital finance in economies like India and Southeast Asia. Europe is characterized by stringent yet innovation-friendly regulations (like PSD2), which mandate secure API integration, thereby providing a structured environment for FaaS platforms specializing in regulatory technology (RegTech) and open banking solutions, often influencing global standards for data security and technical interoperability across borders.

Segment trends highlight the continued dominance of the Banking-as-a-Service (BaaS) segment, which provides a complete regulatory and technological stack enabling non-banks to offer financial products, acting as a crucial infrastructure layer for embedded finance and neo-bank creation. Furthermore, the Platform component segment consistently leads in revenue contribution, underscoring the necessity for robust, scalable cloud infrastructure managed by FaaS providers to handle transactional loads. Demand is also surging within the Payments FaaS segment, fueled by the complexity of cross-border transaction flows and the global push for instantaneous payment rails across both consumer and B2B contexts. Overall, the market showcases a strong pivot towards secure, highly available cloud deployment models, emphasizing scalability, cost-efficiency, and resilience against systemic shocks, while driving competitive differentiation based on specialized service niches and superior developer experience.

AI Impact Analysis on Fintech-as-a-Service Platform Market

Common user questions regarding AI's impact on the Fintech-as-a-Service Platform Market generally center on several critical themes: how AI enhances security and fraud detection capabilities within FaaS modules, the role of machine learning in customizing user experiences and optimizing credit decisions via lending FaaS, and the potential displacement or augmentation of human roles in compliance and customer service offered through these platforms. Users are keenly interested in quantifying if AI integration leads to measurably higher operational costs or significantly improved profitability metrics and reduced loss rates. They also frequently inquire about the regulatory implications of using opaque AI models (the 'black box' problem) within highly regulated financial environments, particularly concerning fairness, bias mitigation, and explainability (XAI) in automated financial processes deployed via FaaS platforms, focusing on concrete ways AI can drive predictive analytics for enhanced risk management and provide highly precise, automated segmentation for targeted financial product offering.

AI's integration into FaaS platforms is fundamentally transforming infrastructure offerings by embedding sophisticated analytical and operational capabilities directly into the service layers. This transition moves FaaS offerings beyond simple transactional processing toward intelligent automation and risk profiling. For instance, AI algorithms are crucial in real-time fraud monitoring for payment processing FaaS, identifying anomalies and complex collusion patterns that traditional rule-based systems overlook, thereby drastically reducing financial losses and enhancing the platform's reliability and reputation. Furthermore, AI enables hyper-personalization of financial products delivered through FaaS, such as personalized saving goals, tailored investment advice using robo-advisory FaaS modules, and dynamic pricing models for credit products, ensuring higher conversion rates and deeper customer engagement for the platform's clients. These personalization efforts are driven by sophisticated ML models analyzing massive, real-time datasets generated from API interactions.

The core value proposition of AI within the FaaS ecosystem lies in its ability to drive efficiency and regulatory adherence at massive scale. AI and Machine Learning (ML) are being leveraged within Regulatory Technology (RegTech) FaaS to automate complex compliance tasks, such as continuous monitoring of Know Your Customer (KYC) requirements, dynamic Anti-Money Laundering (AML) transaction screening, and automated regulatory reporting generation. This automation not only speeds up the onboarding process but also minimizes human error and significantly reduces the labor cost of regulatory compliance, which is often a heavy burden for financial institutions attempting to scale internationally. The advanced analytical capabilities also provide FaaS providers with unparalleled insights into infrastructure performance, predicting system failures, optimizing resource allocation across multi-tenant cloud environments, and streamlining the client's integration pipeline through automated debugging and testing protocols, ensuring superior resilience and low latency for all mission-critical services.

- AI optimizes fraud detection in Payment FaaS using behavioral biometrics and deep learning pattern recognition, minimizing false positives while maximizing security.

- Machine Learning enhances credit scoring, optimizing loan decision-making in Lending FaaS by incorporating alternative data and improving risk assessment accuracy and speed.

- Natural Language Processing (NLP) is used extensively in customer service, compliance FaaS for rapid document analysis, and automating initial query resolution (chatbots).

- AI-driven automation drastically reduces operational costs associated with continuous KYC/AML monitoring (RegTech FaaS) and complex regulatory report generation and submission.

- Predictive maintenance and resource optimization techniques ensure high uptime, service resilience, and cost-effective cloud resource usage through automated infrastructure scaling.

- Explainable AI (XAI) implementation is becoming essential for maintaining transparency, meeting audit requirements, and addressing bias in automated financial decisions (AEO focus on ethical governance).

- Robotic Process Automation (RPA) is integrated into FaaS back-office modules for efficient data reconciliation, ledger management, and automating tedious, high-volume processes.

DRO & Impact Forces Of Fintech-as-a-Service Platform Market

The Fintech-as-a-Service (FaaS) Platform market is heavily influenced by a potent combination of driving forces and structural constraints, creating a highly dynamic operational environment defined by rapid technological adaptation and mandatory regulatory evolution. The primary driver is the pervasive necessity for traditional financial institutions (FIs) to undertake comprehensive digital transformation to maintain relevance against nimble fintech challengers, coupled with the rising consumer expectation for integrated, seamless financial experiences, often termed 'embedded finance,' where transactions occur contextually within non-financial apps. The opportunity landscape is vast, centered on expanding into rapidly digitizing emerging markets where financial inclusion is low and technological leapfrogging is common, allowing FaaS platforms to serve millions of new digital customers directly through standardized mobile channels. However, this progress is persistently restrained by issues relating to complex, divergent data security mandates, significant regulatory fragmentation across diverse jurisdictions, and the inherent technical difficulties associated with migrating legacy core banking systems to modern cloud architectures, creating substantial implementation friction and high upfront strategic investment costs.

Key drivers include the global push for Open Banking and API standardization, which mandates secure data sharing and interoperability, directly benefitting the modular FaaS architecture by normalizing data exchange protocols. Regulatory directives, particularly in Europe and APAC, compel FIs to expose data securely via robust APIs, generating a necessity for FaaS solutions that facilitate this complex compliance. The core economic advantage of shifting from intensive CapEx (capital expenditure) related to hardware acquisition and proprietary software licensing to flexible OpEx (operational expenditure) through subscription-based FaaS models is highly appealing to organizations of all sizes, allowing for better budgetary planning and resource allocation focused on customer-facing innovation rather than back-end infrastructure management. Conversely, significant restraints include the high costs associated with maintaining robust, multi-jurisdictional compliance frameworks, particularly concerning cross-border data residency requirements (e.g., specific regional cloud zones). Additionally, a persistent and critical shortage of skilled cybersecurity and cloud migration professionals within client organizations often severely hinders the smooth adoption and optimization of advanced FaaS solutions, making implementation timelines longer and riskier than anticipated by vendors, creating a substantial barrier to entry for smaller or less mature institutions.

The resultant impact forces shape competitive dynamics, inherently favoring FaaS providers who can offer highly secure, regulatory-compliant, multi-region platforms that simplify complex financial processes into easily consumable, well-documented APIs. Opportunities are particularly strong in developing specialized FaaS verticals, such as trade finance automation, digital identity verification, institutional investment platforms, and specialized micro-lending platforms, moving beyond generalized BaaS offerings into high-value niche segments with higher margins. The interplay between stringent regulatory pressure (requiring secure and auditable data handling) and rapid technological advancement (enabling sophisticated cloud security features and automated compliance checks) dictates the speed of market adoption, where platforms demonstrating superior resilience, transparent governance models, and rigorously enforced service level agreements (SLAs) gain decisive market share. Ultimately, market acceleration is contingent on resolving fundamental concerns surrounding system integration complexity, providing world-class developer support, and successfully overcoming institutional inertia within traditional banking sectors by convincingly demonstrating the massive operational efficiency gains and scalability afforded by the FaaS paradigm.

Segmentation Analysis

The Fintech-as-a-Service Platform market is intricately segmented across component, service type, deployment model, application, and end-user, reflecting the diverse and specialized requirements of the modern financial ecosystem. This granular segmentation allows FaaS providers to tailor their offerings precisely, ranging from basic identity verification APIs to comprehensive, fully managed core banking infrastructure suites. The analysis of these segments reveals measurable shifts in demand, with the Services component segment demonstrating exceptionally high growth potential as organizations increasingly require specialized support, customized integration consulting, ongoing managed compliance services, and specialized product development assistance alongside the core platform technology. This trend highlights the market move towards "white-label" solutions and strategic outsourcing, where FaaS vendors act as comprehensive technology and compliance partners, rather than merely infrastructure providers, offering higher value-add services to their clientele.

The deployment segmentation clearly underscores the dominance of cloud-based models due to their inherent elasticity, rapid global deployment capabilities, and profoundly reduced infrastructure maintenance costs, aligning perfectly with the highly scalable nature of modern FaaS solutions. Public cloud FaaS models currently offer the lowest total cost of ownership (TCO) and are overwhelmingly favored by agile fintech startups and non-financial corporates aiming for fast growth. While highly regulated legacy financial institutions may initially favor hybrid or on-premise solutions due to existing security protocols, specific regulatory mandates related to data sovereignty, and a desire for perceived control over critical data assets, the inevitable long-term trend strongly favors multi-cloud and public cloud deployment for maximum agility, operational optimization, and access to advanced cognitive services. The transition requires significant strategic investment in advanced cloud security tools, automated governance, and expert migration consultants.

Application segmentation confirms that Digital Banking, encompassing core accounts, real-time ledgers, and mobile interfaces, remains the single largest utilization area, demanding robust core banking FaaS systems capable of processing extremely high transactional volumes and ensuring immediate reconciliation. Closely following are robust Payment FaaS solutions, which are necessary for global e-commerce, sophisticated treasury management, and real-time transaction processing, including integration with new infrastructures like SEPA Instant and FedNow. Demand in the Lending FaaS segment is witnessing rapid acceleration, fueled by AI-driven credit underwriting and the strategic desire to automate the entire loan origination lifecycle, from initial digital application to automated disbursement and servicing, for both consumer and specialized SME financing. This broad application scope confirms the FaaS platform's fundamental role as the next-generation operating system for modern, decentralized financial services.

- Component:

- Platform (Core infrastructure, Comprehensive API suite, Developer Tools, Sandbox Environments)

- Service (Consulting, Customized Integration, Technical Maintenance, Managed Compliance and Security Services, API Governance)

- Service Type:

- API-based FaaS (Financial Data Aggregation, Identity Verification, Credit Scoring APIs)

- Banking-as-a-Service (BaaS - Core Banking Functions, Ledger Management, Account Creation, Regulatory Wrapper)

- Regulatory Technology (RegTech) FaaS (Automated Reporting, Sanctions Screening, Audit Trail Generation)

- Compliance and Security FaaS (AML, KYC, Real-Time Fraud Monitoring, Tokenization)

- Payments FaaS (Card Issuance and Processing, Acquiring Services, Global Gateways, Cross-Border Payments)

- Lending FaaS (Loan Origination Systems, Automated Underwriting, Secondary Market Facilitation)

- Wealth Management FaaS (Robo-advisory Tools, Portfolio Management APIs, Fractional Trading Platforms)

- Deployment:

- Cloud (Public Cloud FaaS, Private Cloud FaaS, Strategically Managed Multi-cloud)

- On-Premise (Used primarily for highly regulated institutions with strict data sovereignty requirements)

- Hybrid (Blending the flexibility of the cloud for non-core functions with on-premise control for core data assets)

- Application:

- Digital Banking (Neobank infrastructure, Mobile banking apps, Account servicing)

- Payments Processing and Gateways (High-volume retail, P2P transfers, B2B cross-border payments)

- Trading & Investments (Brokerage APIs, Automated Asset Management, Cryptocurrency trading infrastructure)

- Lending and Credit Origination (Consumer credit, Mortgage origination, SME loans and factoring)

- Insurance (Insurtech FaaS - Policy administration, Claims processing, Telematics integration)

- Others (KYC/AML Utilities, Digital Identity Verification, Treasury Management for Corporates)

- End-User:

- Financial Institutions (Tier 1 Global Banks, Regional Banks, Credit Unions, Specialty Lenders)

- Fintechs and Startups (Neo-banks, Challenger Banks, Payment Service Providers, InsurTechs)

- Non-Financial Corporates (Retail Giants, E-commerce Platforms, Telecom Operators, Major SaaS Platforms)

- Government/Public Sector (Central Bank Digital Currency projects, Public Service Payments, Regulatory Sandboxes)

Value Chain Analysis For Fintech-as-a-Service Platform Market

The value chain of the Fintech-as-a-Service Platform market begins with upstream activities, primarily involving infrastructure providers and core technology developers, forming the fundamental layer of service delivery. This segment is robustly dominated by major hyperscale cloud service providers (AWS, Azure, GCP) who supply the foundational Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) upon which all FaaS platforms are built. Specialized providers of core banking systems and sophisticated security middleware also reside here. Key upstream activities include provisioning certified secure data management, developing proprietary, high-availability API architectures, and ensuring rigorous, real-time compliance with regional data residency and operational resilience rules, which necessitates heavy investment in certified data centers and advanced cryptographic tools. The cost structure in the upstream segment is heavily skewed towards continuous R&D, achieving exponential infrastructure scalability, and acquiring stringent security certifications (e.g., SOC 2 Type II, ISO 27001), directly influencing the final service reliability and underlying compliance overhead of the eventual FaaS offering.

The midstream involves the FaaS platform providers themselves, who expertly aggregate, refine, and modularize the upstream technology into ready-to-use financial components (APIs for payments, regulatory reporting, or lending functionality). Critically, many providers also incorporate a regulatory wrapper through partnerships with licensed sponsor banks (the Banking-as-a-Service model). Their primary value-add lies in reducing complex technological and regulatory overhead, ensuring automated regulatory adherence, and skillfully managing the seamless integration layer between disparate financial functionalities and the client's existing technology stack. Distribution channels are predominantly direct, involving expert enterprise sales teams and solution architects targeting large Financial Institutions and strategic corporate clients seeking complex, multi-year digital transformation partnerships, focusing on long-term consultative value. However, indirect channels, such as strategic alliances with global system integrators (GSIs), specialized financial services consulting firms, and regional technology resellers, are vital for reaching smaller fintechs and successfully penetrating fragmented international markets, requiring localized expertise in regional payment schemas and regulatory stacks.

Downstream activities focus entirely on the efficient delivery and seamless consumption of the FaaS offering by the diverse end-users—incumbent banks, innovative fintechs, and non-financial corporates. This final stage involves the rapid, secure integration of the FaaS APIs into the end-user's front-end customer applications, extensive product customization, and the provision of mission-critical ongoing technical support, often managed through intuitive developer portals, open source toolkits, and highly responsive, SLA-backed maintenance services. The downstream success metrics are universally focused on business outcomes: achieving rapid time-to-market for new financial products, guaranteeing superior system uptime (often necessitating 99.999% availability), and ensuring a seamless, low-latency end-customer experience, which directly correlates to the end-user's key business success metrics (e.g., increased transaction volume, higher customer acquisition). The simplicity of integration is paramount; providers that significantly reduce integration complexity through robust documentation, comprehensive developer sandboxes, and dedicated DevOps integration services achieve substantially higher customer retention and faster expansion of service utilization across the client organization, thereby maximizing customer lifetime value.

Fintech-as-a-Service Platform Market Potential Customers

Potential customers for Fintech-as-a-Service Platforms represent a broad, segmented spectrum of organizations categorized by their level of financial regulation, technological maturity, and strategic imperatives concerning digital transformation. Traditional financial institutions (FIs), encompassing tier-one global banks, regional credit unions, and community banks, constitute a major and highly lucrative segment. These entities are primarily driven by the urgent need to modernize their decades-old, restrictive core banking systems without engaging in risky, expensive, and protracted full system overhauls. They strategically utilize FaaS for specific modular improvements, such as implementing enhanced AI-driven lending origination workflows, connecting to modernized global payment rails, or deploying efficient, cloud-native fraud detection systems, aiming to drastically reduce operational overhead while enhancing competitive agility against digitally native contenders and maximizing return on essential modernization investment.

The fastest-growing segment consists of emerging fintech startups, specialized InsurTechs, and challenger banks (neo-banks). For these digitally native entities, FaaS, particularly robust Banking-as-a-Service (BaaS) platforms, is not merely an optional enhancement but the essential foundational infrastructure required for legal and technological operation. FaaS allows them to operate regulated financial services immediately, bypassing the onerous, multi-year process of obtaining a full banking license and building complex technological stacks from the ground up, significantly lowering the regulatory and capital barrier to market entry. These customers prioritize API documentation quality, integration speed, and the platform’s inherent ability to scale rapidly and cost-effectively from a minimal user base to millions of concurrent transactions, demanding true pay-as-you-go commercial models with predictable pricing structures to manage initial burn rates.

A rapidly expanding and highly strategic customer base is the non-financial corporate sector, driven relentlessly by the accelerating embedded finance trend. Large retailers, global e-commerce platforms, major telecommunications companies, leading SaaS providers (like specialized ERP or accounting software vendors), and even automotive manufacturers are increasingly integrating sophisticated financial services directly and invisibly into their primary customer journeys. For example, a large logistics firm might use Trade Finance FaaS or a major SaaS platform might offer SME lending via a tailored Lending FaaS API. These non-financial entities seek FaaS solutions that are entirely seamless and deeply integrated, allowing them to monetize customer data, increase ecosystem loyalty, and create significant new revenue streams without inheriting the full regulatory and capital burden of becoming licensed financial institutions, thereby capturing maximum value directly at the critical point of customer need and enhancing overall ecosystem stickiness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 45.1 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Plaid, Stripe, Galileo (Sofi Technologies), Finastra, Mambu, Temenos, Marqeta, Braintree (PayPal), APIX, Railsbank (Synapse), Nymbus, Jack Henry & Associates, Fiserv, Thought Machine, Adyen, Banking Circle, Corelation, Vodeno, Unit, Helix by Q2, Solarisbank, Tink, TrueLayer, Cross River Bank, BBVA Open Platform, Global Processing Services (GPS), i2c Inc., ClearBank, Dwolla, Currencycloud. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fintech-as-a-Service Platform Market Key Technology Landscape

The technological landscape of the Fintech-as-a-Service Platform market is fundamentally defined by microservices architecture and cloud-native computing, which together enable the creation of highly modular, scalable, and resilient financial infrastructure capable of handling millions of transactions per second. Microservices allow FaaS providers to systematically break down complex, multi-stage financial functionalities (like KYC processing, payment authorization, or sophisticated credit underwriting engines) into independent, smaller, and easily manageable services, each managed and updated separately. This architecture, rigorously orchestrated using containerization tools such as Docker and Kubernetes across managed cloud services, ensures that any failure or update in one service does not lead to a systemic shutdown of the entire platform, guaranteeing superior system stability and facilitating rapid, independent deployment cycles via robust Continuous Integration/Continuous Delivery (CI/CD) DevOps pipelines. Utilizing Infrastructure-as-Code (IaC) tools like Terraform further ensures consistency, security, and immediate reproducibility of infrastructure deployment across potentially multi-cloud environments, which is critically important for meeting stringent disaster recovery and mandated high availability standards inherent in financial services operations.

APIs (Application Programming Interfaces) serve as the absolute core connective tissue of the FaaS market, enabling seamless, low-latency, and highly secure communication between the platform’s various modules and the client’s bespoke applications. The quality, comprehensive documentation, and robustness of these APIs, including the provision of dedicated developer sandboxes for rigorous pre-launch testing, and their stringent adherence to advanced security standards (specifically utilizing Financial-grade API – FAPI – standards built on modern OAuth 2.0 protocols), are universally paramount to market success and client trust. Furthermore, the integration of cutting-edge security technologies is mandatory, including zero-trust architecture (ZTA), sophisticated hardware security modules (HSMs) for highly secure cryptographic key management, and specialized cryptographic solutions (like tokenization and potentially homomorphic encryption for confidential computation). Continuous, real-time monitoring of API usage, performance, and security posture is managed via sophisticated APM (Application Performance Monitoring) and Observability tools, ensuring guaranteed, contractually mandated latency thresholds for all mission-critical financial transactions globally.

Blockchain and Distributed Ledger Technology (DLT) are rapidly maturing and emerging technologies within specific verticals of the FaaS space, particularly gaining traction for high-throughput, transparent cross-border payments, complex supply chain finance management, and decentralized digital identity verification systems. While still navigating regulatory complexities in highly regulated environments, DLT offers unparalleled data integrity, immutable record-keeping, and significantly reduced counterparty risk, providing a robust foundation for next-generation, high-efficiency financial services delivered via specialized crypto-FaaS and DLT FaaS modules designed for institutional adoption. Overall, the dominant technological focus is shifting toward "Composability" and "Extensibility"—the ability for FaaS users to select and swiftly combine the best-of-breed components from various established vendors using standardized protocols (Open API specifications) and the built-in ability for providers to offer deep, actionable, real-time insights into system performance. This technological evolution is driven heavily by mature public cloud infrastructure, standardized, documented API design, and fully automated security and governance scanning tools, thereby supporting flexible and future-proof digital finance strategies that can respond instantly to dynamic market demands and unpredictable regulatory shifts.

Regional Highlights

Regional dynamics heavily influence the adoption rates, specialization, and competitive intensity within the Fintech-as-a-Service Platform market, driven by varying regulatory landscapes, deeply entrenched consumer banking habits, and differing levels of technological maturity. North America currently dominates the market share, characterized by exceptionally high investment in financial technology (fueled by private equity and venture capital), rapid consumer adoption of digital banking and ubiquitous mobile payments, and the concentrated presence of numerous pioneering FaaS vendors and large technology integrators, particularly specializing in payments (Stripe, Marqeta) and open banking data aggregation (Plaid). The substantial market growth here is continuously sustained by the relentless drive among incumbent Tier 1 banks to rapidly integrate third-party fintech solutions for specific operational enhancements, alongside significant activity in the embedded finance space led by major e-commerce and retail giants, all demanding highly scalable, specialized payments and lending FaaS solutions, often leveraging new low-latency, real-time payment infrastructures like the FedNow Service for instant settlements.

Europe stands firmly as the second-largest and most regulated FaaS market, primarily defined by proactive, structure-changing regulatory initiatives such as the Payment Services Directive (PSD2), mandated Open Banking frameworks, and the subsequent Payment Services Regulation (PSR). These mandates have fundamentally enforced the necessity for FaaS solutions that facilitate secure API connections and mandated data sharing, dramatically accelerating the growth of specialized Regulatory Technology (RegTech) FaaS and sophisticated Banking-as-a-Service providers (BaaS) that act as regulated intermediaries. Key innovation hubs like the Nordic countries and the UK showcase the most advanced adoption of cloud-native core banking systems. Critically, the European market places extreme emphasis on strict data protection (GDPR compliance), meaning successful FaaS platforms must offer robust data sovereignty features, guaranteed data localization options, and superior, audited security protocols, such as Strong Customer Authentication (SCA), to gain widespread, sustainable market acceptance and enable efficient cross-border European financial operations.

Asia Pacific (APAC) is unequivocally projected to be the fastest-growing region globally, driven by immense, highly digitally literate populations in key economies like China, India, and Southeast Asia, many of whom are rapidly transitioning directly to digital financial services via dominant mobile platforms, entirely bypassing traditional branch banking models (the "mobile-first" phenomenon). This profound leapfrogging effect creates an enormous, immediate demand for highly scalable, low-cost BaaS and Payments FaaS solutions suitable for processing high-volume, extremely low-value transactions and addressing critical financial inclusion initiatives, utilizing local payment methods and embedded mobile wallet integrations crucial to regional success. Government support for comprehensive digital economic frameworks, coupled with the high penetration of mobile internet and the dominance of 'super-apps' (which embed numerous financial services directly within their ecosystems), strongly positions APAC as the primary engine for future FaaS market volume growth. Furthermore, ongoing regulatory harmonization efforts across ASEAN member states are driving demand for FaaS providers capable of supporting multi-country, cross-border digital financial product deployment with automated, localized compliance wrappers.

- North America: Market leader; driven by mature fintech ecosystem, high strategic VC funding, aggressive embedded finance adoption, and large incumbent banks focused on modular core system modernization; specialization in high-throughput payments, data aggregation APIs, and consumer lending FaaS (e.g., US, Canada).

- Europe: Growth intensely fueled by regulatory mandates (PSD2/PSR), strong market demand for specialized RegTech FaaS, mandated GDPR-compliant data solutions, and competitive BaaS providers offering regulatory "passporting" across the EU single market (e.g., UK, Germany, Nordic regions).

- Asia Pacific (APAC): Fastest growing region; propelled by massive digital transformation, world-leading mobile penetration rates, and financial inclusion mandates, driving critical demand for scalable BaaS and localized real-time payment systems (e.g., India, Singapore, Australia, Indonesia).

- Latin America (LATAM): Emerging high-growth market; rapid digitalization, surging fintech adoption, and supportive government-led Open Finance initiatives (e.g., Brazil, Mexico), pushing the modernization of BaaS and core payment infrastructure to serve vast previously unbanked and underbanked populations (e.g., Brazil, Mexico, Colombia, Chile).

- Middle East and Africa (MEA): Growth driven by large-scale government-led smart city projects, concerted efforts toward economic diversification away from traditional sectors, and increasing mobile money/digital payment adoption, requiring robust FaaS platforms for modernization and secure digital identity verification solutions (e.g., UAE, Saudi Arabia, South Africa, Nigeria).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fintech-as-a-Service Platform Market.- Plaid

- Stripe

- Galileo (Sofi Technologies)

- Finastra

- Mambu

- Temenos

- Marqeta

- Braintree (PayPal)

- APIX

- Railsbank (Synapse)

- Nymbus

- Jack Henry & Associates

- Fiserv

- Thought Machine

- Adyen

- Banking Circle

- Corelation

- Vodeno

- Unit

- Helix by Q2

- Solarisbank

- Tink

- TrueLayer

- Cross River Bank

- BBVA Open Platform

- Global Processing Services (GPS)

- i2c Inc.

- ClearBank

- Dwolla

- Currencycloud

- Modulr

Frequently Asked Questions

Analyze common user questions about the Fintech-as-a-Service Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fintech-as-a-Service (FaaS) and how does it fundamentally differ from traditional banking software?

FaaS platforms provide modular, API-driven financial infrastructure components (e.g., payments, lending, core banking) delivered via secure cloud infrastructure. Unlike traditional monolithic banking software, FaaS allows clients to selectively integrate specialized services, dramatically reducing development time and operational expenditure through highly flexible subscription models, facilitating rapid innovation and modern composable finance strategies while adhering strictly to financial regulations.

Which service type is currently driving the most significant revenue growth in the FaaS market and why is it so successful?

Banking-as-a-Service (BaaS) and Payments FaaS are the primary growth drivers. BaaS enables non-financial companies and fintechs to offer regulated banking products by leveraging the FaaS provider's regulatory license and compliant technology stack, while Payments FaaS facilitates real-time, high-volume global transaction processing essential for embedded finance and international e-commerce growth, capitalizing on the shift to instant payment rails worldwide.

What are the main regulatory risks associated with adopting FaaS platforms and how are they effectively mitigated?

Key risks include ensuring absolute compliance with complex data residency laws (e.g., GDPR, CCPA), maintaining robust third-party cybersecurity standards, and navigating the complexity of cross-border financial regulations. FaaS providers mitigate this through specialized RegTech modules, externally audited SOC 2/ISO 27001 certifications, and offering managed compliance services to ensure clients meet their ongoing, dynamic regulatory obligations automatically.

How is Artificial Intelligence (AI) impacting the security and operational efficiency of modern FaaS platforms?

AI significantly enhances FaaS by providing advanced, behavioral-based fraud detection capabilities in real time, optimizing lending risk assessments using predictive analytics based on diverse, often non-traditional data sets, and automating complex compliance tasks (KYC/AML). This integration substantially boosts operational efficiency by minimizing human error and strengthens the overall security and decision accuracy of the platform offerings.

Who are the primary end-users driving exponential demand for FaaS solutions globally and what are their motivations?

The primary end-users are categorized into three major groups: agile fintech startups (neo-banks, seeking low barriers to entry), traditional financial institutions (seeking core modernization and specific API functionality integration), and, increasingly, non-financial corporates (retailers, ERP vendors, telecom) looking to seamlessly embed high-value financial services directly into their customer experiences to create new, synergistic revenue streams and dramatically improve ecosystem loyalty.

What is the key technological role of microservices architecture in supporting the FaaS model?

Microservices architecture allows FaaS platforms to break down core banking functions into independent, scalable components managed via containers (Kubernetes). This ensures system resilience, speeds up development and deployment cycles (CI/CD), and enables clients to select and combine only the specific modular services they require, embodying the principle of composable finance.

Why is the Asia Pacific (APAC) region expected to show the fastest growth rate in the FaaS market?

APAC growth is driven by massive populations rapidly adopting mobile-first banking solutions, the urgent need for financial inclusion among underbanked communities, and strong government support for digital finance ecosystems. FaaS provides the highly scalable, low-cost infrastructure necessary to support the high-volume, low-value transaction economies typical of the region.

What challenges do FaaS platforms face when integrating with a client's existing legacy core banking systems?

Integration challenges involve overcoming incompatible data formats, bridging communication between modern APIs and older mainframe protocols, and managing the inherent risks of data migration. FaaS providers mitigate this by using specialized middleware, abstraction layers, and phased integration strategies that avoid forcing costly and risky 'rip and replace' mandates on the clients' core infrastructure.

How does the FaaS model help financial institutions manage their capital expenditure (CapEx)?

The FaaS model shifts investment from high upfront capital expenditure (CapEx) on hardware, software licenses, and infrastructure build-out to a more predictable, flexible operational expenditure (OpEx) through subscription or pay-as-you-go pricing. This preserves capital, improves budgetary forecasting, and ensures technology costs scale precisely with business growth.

What is the significance of developer experience (DX) for a competitive FaaS platform?

Superior Developer Experience (DX) is crucial for competitiveness, encompassing high-quality API documentation, comprehensive developer sandboxes, robust SDKs, and dedicated support. Excellent DX reduces the client's integration time and costs, accelerates their time-to-market for new financial products, and increases vendor stickiness, making it a critical differentiation point beyond core functionality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager