Fintech Lending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432696 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fintech Lending Market Size

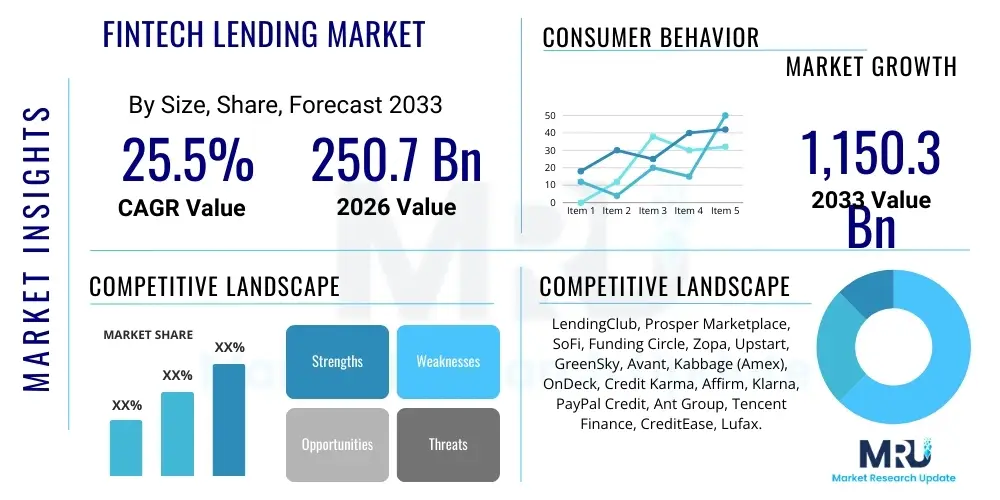

The Fintech Lending Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $250.7 Billion in 2026 and is projected to reach $1,150.3 Billion by the end of the forecast period in 2033.

Fintech Lending Market introduction

The Fintech Lending Market encompasses the provision of credit services facilitated primarily through digital platforms and innovative financial technology, circumventing or supplementing traditional banking structures. These platforms leverage advanced algorithms, big data analytics, and mobile technology to offer personalized and efficient lending solutions, including peer-to-peer (P2P) lending, online marketplace lending, and digital consumer loans. This shift is driven by increasing digital literacy, high smartphone penetration, and consumer demand for faster, more transparent loan origination processes compared to conventional financial institutions. Fintech lenders often cater effectively to underserved segments, such as small businesses lacking collateral or individuals with thin credit files, by utilizing alternative data sources for credit scoring.

Major applications of fintech lending span across consumer finance, small and medium-sized enterprise (SME) funding, and specialized vertical lending like buy-now-pay-later (BNPL) structures embedded in e-commerce platforms. The primary benefits include rapid loan approval and disbursement, lower operational costs translating often into competitive interest rates, and enhanced user experience through seamless digital interfaces. For SMEs, fintech lending offers crucial working capital and expansion funds without the onerous requirements typically imposed by large commercial banks. The digitalization of the entire lending lifecycle—from application and underwriting to servicing and collections—marks the core distinction of this market segment.

Key driving factors accelerating the market’s expansion include favorable regulatory environments encouraging financial innovation, particularly in developing economies seeking to boost financial inclusion. Furthermore, the massive shift towards contactless and digital transactions, particularly following global disruptions, has entrenched digital financial services as the primary mode of interaction for consumers. The continuous advancement in data security protocols and the integration of artificial intelligence (AI) and machine learning (ML) for superior risk assessment are further propelling investor confidence and market penetration, solidifying fintech lending as a transformative force in the global credit landscape.

Fintech Lending Market Executive Summary

The Fintech Lending Market is characterized by robust growth fueled by technological disruption and evolving consumer behavior, demonstrating significant business trends centered on platform diversification and embedded finance models. Key business trends include the convergence of lending with other financial services (e.g., insurtech, wealth management) to create comprehensive digital ecosystems, and a strong pivot toward sophisticated risk management enabled by AI-driven credit scoring models. There is also a notable trend toward institutional investment, as large banks and traditional asset managers increasingly partner with or acquire leading fintech lenders to enhance their digital capabilities and access new borrower pools. This integration is blurring the lines between traditional and non-traditional finance, focusing on speed and personalization as competitive differentiators.

Regionally, Asia Pacific continues to dominate the market in terms of volume and speed of adoption, primarily driven by massive, digitally native populations in China and India, coupled with rapid urbanization and high mobile connectivity. North America and Europe remain key centers for innovation, focusing heavily on regulatory compliance (like GDPR and PSD2) and the maturation of P2P and marketplace models. Emerging economies in Latin America and the Middle East and Africa are experiencing explosive growth, often leapfrogging legacy banking infrastructure directly into mobile-first lending solutions, particularly benefiting micro, small, and medium enterprises (MSMEs) through innovative credit products.

Segment-wise, consumer lending remains the largest segment, but SME lending is experiencing the fastest growth, propelled by the need for quick, unsecured capital. Within technology, the utilization of blockchain for improved transparency and smart contracts for automated loan servicing represents a critical trend. Furthermore, the BNPL subsegment has emerged as a major disruptor, particularly within e-commerce, offering instantaneous micro-credit at the point of sale. Compliance technologies (RegTech) are increasingly vital across all segments, ensuring platforms manage risk and adhere to global anti-money laundering (AML) and know-your-customer (KYC) regulations effectively.

AI Impact Analysis on Fintech Lending Market

User inquiries regarding the impact of Artificial Intelligence on the Fintech Lending Market primarily revolve around four critical themes: enhanced credit risk assessment accuracy, the potential for algorithmic bias in lending decisions, the automation of customer service and loan processing, and the role of AI in fraud detection and compliance. Users frequently ask how AI can utilize non-traditional data (social media, utility payments) to score thin-file customers, while simultaneously expressing concerns about transparency and fairness (explainability and bias). Expectations are high for AI to significantly reduce underwriting costs and accelerate loan approval times, thereby lowering overall operating expenses for lenders and improving accessibility for borrowers. The consensus theme is that AI is moving from being a supplementary tool to the foundational technology governing all core lending operations.

AI’s influence is fundamentally reshaping the competitive landscape. By automating manual processes, AI allows fintech lenders to achieve scalability that traditional institutions struggle to match. Advanced machine learning models can process vast amounts of data in real-time, providing dynamic pricing and risk adjustments previously unattainable. This leads to more precise targeting of profitable customer segments and the immediate identification and mitigation of emerging credit risks across diversified loan portfolios. Consequently, the reliance on outdated FICO-type models is diminishing, replaced by continuous, adaptive scoring mechanisms that offer a more holistic view of borrower solvency and behavior.

The implementation of AI also introduces substantial operational efficiencies in areas beyond risk management. Chatbots and natural language processing (NLP) handle the majority of initial customer interactions, enhancing service scalability while maintaining personalized communication. Furthermore, AI-driven fraud detection systems monitor transactions and behavioral patterns continuously, drastically reducing losses associated with identity theft and synthetic fraud, a persistent challenge in purely digital environments. Ethical AI deployment, ensuring fairness and mitigating algorithmic bias, remains a critical area of focus for sustained market trust and regulatory acceptance.

- Enhanced credit scoring accuracy using alternative data sources (telecom, utility, social).

- Automation of loan underwriting and processing, significantly reducing approval times.

- Superior fraud detection and prevention through real-time behavioral monitoring.

- Personalized loan product recommendation and dynamic pricing adjustments.

- Streamlined regulatory compliance and reporting (RegTech) via automated data auditing.

- Improved customer interaction through AI-powered chatbots and virtual assistants.

DRO & Impact Forces Of Fintech Lending Market

The Fintech Lending Market is propelled by powerful growth drivers, notably the widespread consumer demand for digital, rapid, and transparent financial services, which traditional banks often fail to deliver efficiently. This demand intersects with technological advancements, particularly in big data analytics and cloud computing, allowing lenders to scale operations quickly and affordably. Key restraints include the persistent global macroeconomic uncertainty leading to tightened credit standards and, critically, the evolving and fragmented regulatory landscape across different jurisdictions, which necessitates significant investment in compliance infrastructure. Opportunities abound in capturing the vast unbanked and underbanked populations globally through innovative mobile-first solutions and expanding into specialized niches like green lending and supply chain finance. These forces combine to create a highly competitive environment where rapid adaptation and technological superiority dictate market share.

Impact forces currently shaping the market dynamics are dominated by digitalization and regulatory scrutiny. Digitalization has lowered barriers to entry, increasing competition not just among fintech startups but also from tech giants (GAFA/BAT) entering financial services. Simultaneously, regulatory bodies are increasing oversight, prompted by concerns over consumer protection, data privacy (especially concerning AI-driven scoring), and systemic financial stability, particularly following high-profile platform failures or misuse of funds. The shift toward Open Banking frameworks in regions like Europe and the UK acts as both a driver (by enabling better data access) and an impact force (by redefining data ownership and security standards), forcing incumbent banks and fintechs into necessary collaborations.

Another major impact force is the changing interest rate environment globally. When central banks raise rates, the cost of capital for fintech lenders, who often rely on securitization and institutional funds, increases, potentially reducing their profitability margins and forcing them to price loans higher, thereby challenging their competitive advantage over traditional banks. Conversely, periods of quantitative easing provided a massive tailwind for low-cost funding. The force of cybersecurity risk also remains paramount; as platforms handle sensitive financial data, any major breach can severely undermine consumer trust and regulatory confidence, posing an existential threat to smaller, less capitalized operators in the ecosystem.

Segmentation Analysis

The Fintech Lending Market is primarily segmented based on the type of lending (Peer-to-Peer, Marketplace, Balance Sheet), the end-user (Consumer, SME, Corporate), and the underlying technology platform (Cloud-based, On-premise). This granular segmentation helps in understanding the disparate needs of various customer groups and the technological infrastructure required to service them effectively. Consumer lending, driven by personal loans and BNPL, holds the largest volume, reflecting widespread digital engagement. However, the SME segment is gaining momentum due to the chronic funding gap faced by small businesses globally, which fintechs are uniquely positioned to fill with flexible products like invoice financing and short-term working capital loans.

- By Type of Lending:

- Peer-to-Peer (P2P) Lending

- Marketplace Lending

- Balance Sheet Lending

- By End-User:

- Consumer Lending (Personal Loans, Student Loans, BNPL)

- SME Lending (Working Capital, Equipment Financing)

- Corporate Lending

- By Technology:

- Artificial Intelligence and Machine Learning

- Big Data Analytics

- Cloud Computing

- Blockchain

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fintech Lending Market

The value chain for the Fintech Lending Market begins with upstream activities focused heavily on technological infrastructure and data acquisition. Upstream analysis involves technology providers, cloud services (AWS, Azure), and data aggregators that supply the foundational tools necessary for operation. Lenders require sophisticated software for origination, servicing, and risk modeling, often utilizing third-party vendors specializing in AI/ML model development and KYC/AML verification services. The efficiency and security of these upstream components directly impact the scalability and compliance posture of the lending platform.

The core midstream process involves loan origination, underwriting, funding, and servicing. Distribution channels are predominantly direct, utilizing proprietary websites and mobile applications to engage borrowers directly. Indirect channels include strategic partnerships, such as embedded financing offered via e-commerce retailers or POS systems. Funding models vary; P2P relies on retail investors, marketplace lenders tap into institutional capital, and balance sheet lenders use their own capital or debt funding. Efficient midstream processing is critical, emphasizing minimal friction during application and instant decision-making powered by automated underwriting engines.

Downstream analysis focuses on customer retention, debt collection, and portfolio management. Successful fintech lenders employ data-driven strategies for personalized debt restructuring and effective, yet compliant, collection processes, often relying on automated communication tools. The ultimate goal is maximizing the net interest margin while maintaining low default rates, requiring continuous portfolio monitoring and dynamic risk adjustments. The short, efficient digital distribution channel minimizes traditional overheads like branch networks, creating a leaner and faster lending ecosystem compared to legacy institutions.

Fintech Lending Market Potential Customers

Potential customers for the Fintech Lending Market are broadly defined but intensely targeted through digital channels, primarily encompassing digitally native individuals and underserved small and medium-sized enterprises (SMEs). For consumers, the ideal end-users are those requiring fast access to unsecured personal loans, refinancing options, or flexible, short-term point-of-sale financing (BNPL). This often includes younger generations who value convenience over brand loyalty and individuals seeking alternatives to high-interest credit card debt. These users are typically comfortable sharing digital footprints in exchange for superior service and speed.

The second major cohort consists of SMEs, particularly those excluded or poorly served by traditional banks due to complex requirements or insufficient operating history. These businesses require rapid access to working capital, inventory financing, or equipment loans to manage cash flow fluctuations. Fintech lenders are uniquely positioned to serve these buyers by leveraging alternative credit data, such as sales invoices, transaction history, and operating account data, allowing for risk assessment that is independent of traditional collateral requirements. The growing e-commerce ecosystem further expands this customer base, linking digital lenders directly to merchants needing capital based on their platform sales data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.7 Billion |

| Market Forecast in 2033 | $1,150.3 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LendingClub, Prosper Marketplace, SoFi, Funding Circle, Zopa, Upstart, GreenSky, Avant, Kabbage (Amex), OnDeck, Credit Karma, Affirm, Klarna, PayPal Credit, Ant Group, Tencent Finance, CreditEase, Lufax. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fintech Lending Market Key Technology Landscape

The operational efficiency and competitive edge of fintech lenders are fundamentally rooted in a few core technological pillars. Chief among these is the utilization of sophisticated Artificial Intelligence and Machine Learning models. These technologies move beyond traditional statistical credit models, incorporating hundreds of variables from alternative data sources to assess risk with greater precision and inclusivity. AI is crucial not only in underwriting but also in dynamic loan pricing, minimizing the risk-adjusted cost of capital. This continuous optimization allows platforms to cater to diverse risk profiles rapidly, a key differentiator against legacy banking systems.

Cloud computing architecture is another vital component, providing the necessary scalability, flexibility, and cost efficiency for digital lending platforms. By leveraging public and private cloud solutions, fintechs can handle massive spikes in transaction volumes, manage large datasets efficiently, and deploy new features rapidly without substantial upfront hardware investment. This elasticity is crucial for global expansion and maintaining competitive pricing structures. Furthermore, the integration of Application Programming Interfaces (APIs) facilitates seamless connections with external data providers, identity verification services, and bank accounts, enabling the "instant loan" experience consumers now expect.

Finally, blockchain technology is emerging as a powerful tool, though its adoption is still maturing outside specific pilot programs. Blockchain offers unparalleled benefits in terms of data immutability, transactional transparency, and reduced settlement times, particularly useful in cross-border lending and securitization. Smart contracts, built on blockchain, allow for the automation of loan servicing, payment distribution, and collateral management, minimizing human intervention and operational error. While not yet ubiquitous, blockchain promises to further reduce fraud and enhance the trust factor within digital lending ecosystems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by sheer population size, high mobile penetration, and a significant proportion of unbanked individuals, especially in Southeast Asia and India. Countries like China (despite recent regulatory tightening) and India are global leaders in digital payments and mobile-first lending solutions, often leveraging government-backed digital infrastructure (like India’s Aadhaar and UPI). The market is characterized by rapid adoption of P2P and embedded finance models targeting consumer credit and MSME financing gaps.

- North America: This region is mature and highly innovative, focusing on sophisticated risk modeling (AI/ML) and regulatory technology (RegTech). The US market is dominated by marketplace lenders (LendingClub, Prosper, Upstart) and specialized fintechs (SoFi) that cater to prime borrowers, student loan refinancing, and SME lending. High regulatory requirements (e.g., state-specific lending laws) necessitate robust compliance infrastructure, driving investment into sophisticated AI governance tools.

- Europe: Europe exhibits strong growth fueled by the Open Banking initiative (PSD2), which mandates data sharing and fosters collaboration between fintechs and established banks. The UK and Germany are the primary hubs, with a strong emphasis on consumer protection and transparent lending practices. BNPL players (like Klarna and Affirm in Europe) hold substantial market sway, transforming e-commerce payment infrastructure and accelerating the shift away from traditional credit card usage.

- Latin America (LATAM): LATAM presents high growth potential due to chronic financial exclusion and high smartphone usage. Mexico and Brazil lead the charge, where fintechs are aggressively addressing the credit needs of individuals and micro-businesses often ignored by large commercial banks. This region sees heavy reliance on mobile lending apps and non-traditional data for scoring, mitigating the issues associated with underdeveloped credit bureau coverage.

- Middle East and Africa (MEA): This region is rapidly professionalizing its fintech landscape, supported by governmental initiatives (e.g., Dubai International Financial Centre, Abu Dhabi Global Market) promoting digital finance hubs. Islamic finance principles often guide lending practices, requiring specialized fintech solutions. Key growth areas include payment-linked lending and capital financing for oil and gas or sustainable energy projects, focusing on high-net-worth individuals and large corporate finance needs, alongside basic financial inclusion efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fintech Lending Market.- LendingClub Corporation

- Prosper Marketplace Inc.

- SoFi Technologies Inc.

- Funding Circle Holdings PLC

- Zopa Bank Limited

- Upstart Holdings Inc.

- GreenSky (Goldman Sachs)

- Avant LLC

- Kabbage (American Express)

- OnDeck Capital (Enova International)

- Affirm Holdings Inc.

- Klarna Bank AB

- PayPal Credit

- Ant Group (Ant Financial)

- Tencent Finance

- CreditEase Holdings Limited

- Lufax Holding Ltd.

- Plaid Technologies Inc.

- OakNorth Bank PLC

- NerdWallet Inc.

Frequently Asked Questions

Analyze common user questions about the Fintech Lending market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Fintech Lending Market?

The primary driver is the demand for rapid, friction-less digital lending experiences coupled with the superior risk assessment capabilities afforded by Artificial Intelligence and machine learning, enabling fintechs to serve previously underserved market segments efficiently.

How does AI reduce risk for fintech lending platforms?

AI reduces risk by utilizing alternative data sources to generate more accurate credit scores, identifying fraudulent activity in real-time through behavioral analysis, and continuously optimizing loan portfolios by dynamically adjusting pricing and exposure based on macro-economic shifts.

What is the significance of Open Banking in the European Fintech Lending Market?

Open Banking, primarily through PSD2, mandates secure data sharing, allowing fintech lenders to access comprehensive financial data from traditional banks, leading to faster, more personalized loan decisions and fostering greater competition and collaboration in the European market.

Is Peer-to-Peer (P2P) lending still the dominant model in the market?

No, while P2P lending was foundational, Marketplace Lending and Balance Sheet Lending models have grown significantly, often attracting institutional investors and incorporating advanced AI underwriting to mitigate risks previously associated with pure P2P retail funding.

What are the main regulatory challenges faced by global fintech lenders?

Key regulatory challenges include managing compliance with fragmented international data privacy laws (e.g., GDPR), navigating anti-money laundering (AML) and know-your-customer (KYC) requirements across borders, and addressing growing concerns regarding algorithmic bias and consumer protection in automated lending decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager