Fire Retardant Treated Wood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433764 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fire Retardant Treated Wood Market Size

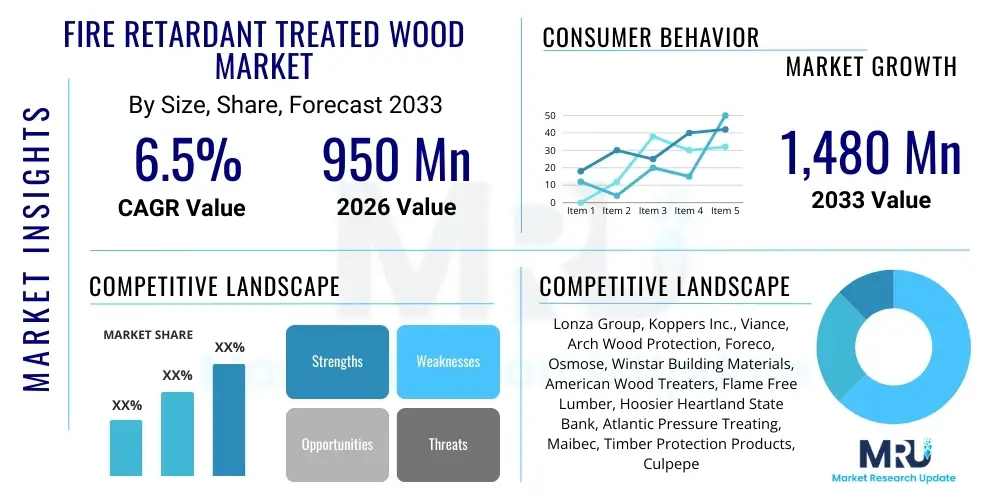

The Fire Retardant Treated Wood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,480 million by the end of the forecast period in 2033.

Fire Retardant Treated Wood Market introduction

Fire Retardant Treated Wood (FRTW) is a specialized building material produced by impregnating lumber and plywood with chemical formulations designed to significantly reduce the flammability and rate of combustion of the wood. These treatments work primarily by promoting the formation of char, which acts as an insulating barrier, and by releasing non-combustible gases upon heating, diluting the flammable gases produced by pyrolysis. The primary goal of FRTW is to comply with increasingly stringent fire safety regulations, particularly in non-combustible construction types where traditional untreated wood would be restricted.

The product description encompasses various species of lumber and panel products, typically treated using pressure impregnation methods. The chemicals used are complex mixtures, often based on inorganic salts like ammonium phosphate or sulfate, or organic compounds such as borates and phosphonates, depending on the desired end-use rating (e.g., Class A fire spread rating). FRTW retains the aesthetic and structural benefits of natural wood while offering enhanced safety. It is typically categorized based on whether it is intended for interior, weather-protected exterior, or full exterior use, as leaching resistance is a critical factor.

Major applications of FRTW span the entire built environment, including structural components such as roof trusses, wall assemblies, floor joists, and non-structural uses like interior millwork, decorative paneling, and architectural finishes. The increasing adoption is significantly driven by mandatory building codes, such as those governed by the International Building Code (IBC) and NFPA standards, which require specific fire resistance in high-occupancy or large-scale structures, especially in areas like attics, plenums, and vertical shaft construction. The enhanced safety profile and increasing acceptance by architects and engineers fuel continuous market growth across commercial and residential sectors.

Fire Retardant Treated Wood Market Executive Summary

The Fire Retardant Treated Wood (FRTW) market demonstrates robust growth, primarily driven by escalating global emphasis on life safety in construction and the implementation of stricter fire safety and building codes across developed and rapidly developing economies. Business trends indicate a shift towards sustainable, non-halogenated chemical formulations, addressing environmental and health concerns associated with traditional treatments. Manufacturers are investing heavily in research and development to improve the long-term efficacy, moisture resistance, and corrosion-inhibiting properties of FRTW products, thereby broadening their application scope in demanding environments.

Regional trends show North America and Europe leading the market, attributed to mature regulatory frameworks and a high volume of commercial and institutional construction projects. The Asia Pacific region, particularly countries like China and India, is emerging as the fastest-growing market segment. This accelerated growth is fueled by rapid urbanization, substantial investment in infrastructure, and the gradual adoption of Western fire safety standards in high-rise residential and commercial developments. Manufacturers are focusing on establishing localized production facilities in APAC to meet regional demand and navigate diverse local certifications.

Segment trends highlight the pressure treatment method dominating the market due to its superior penetration and long-term performance compared to surface coatings. Within end-users, the commercial construction sector, encompassing hospitals, schools, and large office buildings, remains the largest segment owing to stringent fire codes governing public spaces. Furthermore, the market is seeing an increased demand for specialized FRTW products certified for use in exterior structural applications, pushing innovation in treatments that resist UV degradation and moisture leaching without compromising fire resistance or structural integrity over prolonged periods.

AI Impact Analysis on Fire Retardant Treated Wood Market

User inquiries regarding AI's impact on the FRTW market typically revolve around optimizing treatment processes, ensuring quality control, and enhancing supply chain efficiency. Key themes include the potential for AI-driven predictive maintenance of treatment machinery, the use of machine learning to develop next-generation, more effective and sustainable chemical formulations, and utilizing computer vision systems for automated assessment of wood quality and treatment penetration consistency. Users are concerned about the initial investment required for integrating AI systems but anticipate significant long-term benefits in reducing material waste, lowering operational costs, and achieving higher compliance standards in a highly regulated industry.

- AI-driven optimization of chemical dosing parameters based on wood species, density, and moisture content, reducing material waste and ensuring consistent fire rating compliance.

- Implementation of Machine Learning (ML) algorithms for predictive maintenance of pressurized treatment cylinders and drying kilns, minimizing unplanned downtime and extending equipment lifespan.

- Computer Vision systems used in real-time inspection of treated wood to detect surface flaws, incomplete chemical penetration, and visual irregularities post-treatment, enhancing quality assurance.

- AI-enabled supply chain management for optimizing logistics, inventory levels of raw wood and specialized chemicals, and forecasting regional demand patterns for different FRTW product types.

- Use of generative AI models in chemical research to rapidly screen and design novel, non-toxic, bio-based fire retardant chemistries with improved thermal stability and efficacy.

- Automated regulatory compliance checks and documentation generation using Natural Language Processing (NLP) tools, ensuring FRTW batches meet specific global, regional, and local building code requirements seamlessly.

- Predictive modeling of the long-term performance and durability of FRTW under various environmental conditions (humidity, temperature fluctuations) using vast datasets analyzed by ML.

- Enhanced safety monitoring in treatment plants through AI analysis of sensor data, identifying potential chemical spills or hazardous processing conditions before they escalate.

DRO & Impact Forces Of Fire Retardant Treated Wood Market

The Fire Retardant Treated Wood (FRTW) market is propelled by the critical force of stringent global fire safety regulations, which mandate the use of fire-resistant materials in public buildings, high-density residential structures, and concealed spaces like roof framing. This driver is augmented by increasing consumer and governmental awareness regarding the necessity of passive fire protection measures in construction. Simultaneously, the market faces restraints, primarily the higher initial cost of FRTW compared to untreated lumber, which can deter cost-sensitive construction projects. Additionally, concerns regarding the potential for some FRTW chemicals to cause corrosion in metal fasteners under specific environmental conditions present a technical hurdle that requires specialized, corrosion-resistant hardware.

Opportunities for market expansion are substantial, particularly in the development and commercialization of next-generation, eco-friendly FRTW products that utilize bio-based or non-halogenated compounds, addressing environmental sustainability demands without compromising fire performance. The growing global trend toward modular and prefabricated construction also presents a significant avenue for growth, as these methods increasingly require standardized, high-performance materials like certified FRTW. Technological advancements focusing on improved weather resistance and reduced hygroscopicity will further allow FRTW to compete effectively in exterior and exposed structural applications.

Impact forces within the market are predominantly regulatory and technological. Regulatory impact forces continually redefine demand, requiring manufacturers to rapidly adapt formulations and testing procedures to meet updated codes (e.g., changes in ASTM or NFPA standards). Technological forces influence the supply side, pushing manufacturers toward more efficient, closed-loop treatment systems that minimize chemical runoff and improve consistency. Economically, the fluctuating costs of raw wood, coupled with the specialized nature and cost volatility of fire retardant chemicals, exert pressure on pricing and profit margins across the value chain. Societal impact, driven by public demand for safer and greener building practices, reinforces the market shift toward sustainable FRTW solutions.

Segmentation Analysis

The Fire Retardant Treated Wood (FRTW) market is comprehensively segmented based on the type of treatment applied, the specific chemical composition utilized, the intended application area in construction, and the final end-user sector. These segmentations allow stakeholders to analyze market dynamics specific to technology adoption and regulatory compliance. The dominant segmentation factor is the treatment type, which dictates the efficacy and longevity of the fire retardancy, crucial for meeting stringent Class A ratings required in most commercial projects. Furthermore, the chemical type segmentation reflects the industry's evolving response to environmental pressures, favoring less toxic and more sustainable formulations.

By focusing on the application segment, the analysis reveals that structural elements such as roof trusses and framing account for the largest share, as these areas are often mandatory targets for fire treatment under current building codes. Conversely, the millwork and interior finish segment, while smaller in volume, demands higher quality wood species and aesthetically sensitive treatments. End-user segmentation provides clarity on demand drivers; the commercial sector (driven by compliance and safety liability) is the highest volume consumer, while the residential sector, particularly high-density multi-family housing, is experiencing the fastest growth rate.

- By Treatment Type

- Pressure Impregnation Treatment (Deep and durable penetration, dominant method)

- Surface Coating/Dipping Treatment (Used primarily for retrofitting or less demanding applications)

- By Chemical Type

- Inorganic Salt-Based Treatments (Ammonium Polyphosphate, Ammonium Sulfate)

- Borate-Based Treatments (Effective but may have limitations on exterior use)

- Phosphate/Phosphorus-Containing Organic Treatments (Often utilized for enhanced stability)

- Other Non-Halogenated Treatments

- By Application

- Roof Trusses and Sheathing

- Wall Framing and Assemblies

- Interior Finish, Millwork, and Paneling

- Subflooring and Decking (Weather-protected)

- Acoustical and Decorative Components

- By End-User

- Commercial Construction (Office buildings, retail centers, public facilities)

- Residential Construction (Multi-family housing, high-density complexes)

- Industrial Construction (Warehouses, manufacturing facilities)

- Institutional Construction (Schools, hospitals, government buildings)

Value Chain Analysis For Fire Retardant Treated Wood Market

The value chain for the Fire Retardant Treated Wood market begins with upstream activities involving the sourcing of high-quality, sustainably harvested raw wood material, typically lumber and plywood, from certified forests. This stage is crucial as the wood species, moisture content, and density directly impact the effectiveness of the subsequent chemical treatment. Following raw material procurement, the critical midstream step involves the chemical manufacturing and formulation, where specialized companies produce the proprietary fire retardant chemicals, such as inorganic salts or borates, which meet specific regulatory standards (e.g., UL or ASTM standards). Efficient inventory management and ensuring consistent chemical quality are key challenges at this stage.

The core processing activity involves the wood treatment facilities, often utilizing large, highly controlled pressure cylinders to achieve deep and uniform penetration of the fire retardant solution into the wood fibers. Post-treatment processing includes fixation, kiln-drying to reduce moisture content, and quality control checks to ensure the wood meets specified fire ratings (e.g., Class A) and mechanical properties. This manufacturing phase requires significant capital investment and rigorous adherence to safety protocols. Challenges include managing the energy costs associated with kiln drying and preventing chemical leaching during storage.

Downstream activities focus on distribution and end-user delivery. The distribution channel primarily utilizes specialized lumber distributors and construction supply wholesalers who handle bulk orders and manage the complex logistics of transporting large, heavy building materials. Direct sales channels are often employed for large commercial projects where specifications are highly customized, allowing the treatment company to interface directly with architects and general contractors. Indirect channels, through retail building centers, cater more to smaller contractors and specialized applications. The value chain concludes with installation by builders and contractors who must follow specific guidelines regarding cutting, handling, and using appropriate corrosion-resistant fasteners, ensuring the fire rating integrity is maintained until the product is incorporated into the structure.

Fire Retardant Treated Wood Market Potential Customers

The primary potential customers and end-users of Fire Retardant Treated Wood products are large-scale commercial general contractors, specialized sub-contractors focused on framing and roofing, and developers of high-density multi-family residential projects. These customers operate under stringent regulatory mandates, making the use of certified FRTW non-negotiable for obtaining necessary building permits and occupancy certificates, especially for structures over a certain height or occupancy load. Architects and structural engineers play a pivotal role as influencers, specifying the exact type and rating of FRTW required during the design phase, thus becoming indirect but essential customers for market penetration strategies.

Institutional buyers, including state and local governments, school districts, and healthcare facility developers, represent a stable and significant customer base. These entities prioritize public safety and long-term asset protection, readily integrating FRTW into schools, hospitals, libraries, and public administration buildings. Furthermore, industrial facilities, such as large warehouses, manufacturing plants, and processing centers, utilize FRTW for non-structural applications, such as interior partitions and specialized enclosures, where minimizing fire spread is critical to protecting high-value equipment and ensuring operational continuity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,480 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, Koppers Inc., Viance, Arch Wood Protection, Foreco, Osmose, Winstar Building Materials, American Wood Treaters, Flame Free Lumber, Hoosier Heartland State Bank, Atlantic Pressure Treating, Maibec, Timber Protection Products, Culpeper Wood Preservers, Universal Forest Products, Chemonite, Bohn Wood Treatment, McShan Lumber, FRT Wood, Northwest Pipe Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Retardant Treated Wood Market Key Technology Landscape

The technology landscape of the Fire Retardant Treated Wood market is dominated by the vacuum-pressure impregnation method, which ensures deep, consistent penetration of active fire retardant chemicals into the cellular structure of the wood, guaranteeing compliance with high fire safety standards such as ASTM E84 Class A. Advancements in this core technology focus on refining the pressure cycles, temperature controls, and post-treatment fixation processes to minimize residual moisture content and enhance dimensional stability. Furthermore, modern treatment plants are increasingly adopting sophisticated computer control systems to manage the process, allowing for real-time adjustments based on the specific species and density of the wood being treated, leading to higher throughput and greater product uniformity.

A significant technological focus is placed on chemical formulation innovation. Historically, inorganic salts like monoammonium phosphate (MAP) were standard, but current R&D is heavily oriented toward developing non-halogenated chemistries, primarily phosphorus-based organic compounds, borates, and hybrid formulations. These newer treatments aim to improve critical secondary properties, such as resistance to leaching (especially for exterior or high-humidity applications), reduced hygroscopicity (preventing wood from attracting excessive moisture), and enhanced non-corrosive characteristics, making the treated wood compatible with standard metal fasteners and structural connectors, thereby lowering installation complexity and cost for end-users.

Emerging technologies include the application of nano-scale fire retardant materials, which utilize exceptionally fine particles (e.g., nanocomposites of layered silicates or carbon nanotubes) to create a more effective barrier at the microstructural level of the wood fiber. While still in early commercial stages, nanotechnology promises FRTW products with superior fire performance, potentially lower chemical loading, and minimal impact on the wood's aesthetic or mechanical properties. Simultaneously, quality assurance technologies, such as advanced spectroscopic analysis and moisture metering, are becoming integrated into production lines to certify the chemical retention levels and ensure every board meets the rigorous standards demanded by building inspectors and structural engineers.

Regional Highlights

Regional dynamics heavily influence the demand and product specification requirements within the Fire Retardant Treated Wood market, driven primarily by localized building codes, climate conditions, and construction activity levels. North America (NA), comprising the United States and Canada, holds the largest market share and is considered the technology leader. This dominance is due to well-established, mandatory regulatory frameworks (such as the IBC and local state codes) that require FRTW in nearly all types of commercial and multi-family residential construction, particularly in concealed spaces like roof assemblies and floor joists. The region also boasts mature supply chains and high consumer awareness regarding product certification (e.g., by UL and ICC-ES).

Europe represents a mature and highly fragmented market, with strong demand driven by dense urban environments and a historical focus on timber-frame construction. Countries like Germany, the UK, and Scandinavian nations place a high emphasis not only on fire resistance but also on sustainability and low environmental impact. This results in greater demand for advanced, non-toxic, and environmentally certified FRTW solutions. Regulatory standards like the Euroclass system necessitate rigorous testing, influencing manufacturers to develop regionally specific product lines tailored to the different national fire safety standards within the continent. Retrofitting existing historic structures also provides a unique, niche demand stream in this region.

The Asia Pacific (APAC) region is projected to experience the fastest growth rate throughout the forecast period. This rapid expansion is catalyzed by massive infrastructural spending, swift urbanization, and a notable shift in construction methods towards high-rise and standardized commercial buildings, particularly in China, India, and Southeast Asian nations. Although regulatory adoption is often slower and more varied than in NA or Europe, increasing instances of major structural fires are pushing local governments to adopt stricter international building codes, subsequently boosting the mandatory use of certified FRTW materials in commercial and high-density residential projects. Investment in local manufacturing capacity is critical for market success in APAC due to logistical challenges and diverse regulatory requirements.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant future potential. In the MEA region, large-scale public infrastructure projects, especially in the Gulf Cooperation Council (GCC) states, prioritize high safety standards and imported technologies, leading to steady demand for certified FRTW in prestigious commercial developments and tourism infrastructure. Latin American demand is more volatile, tied closely to economic stability and the varying enforcement of building codes, though increasing standardization in major economies like Brazil and Mexico suggests growing long-term opportunities for FRTW application, particularly in large industrial and commercial construction.

- North America: Market leader, driven by rigorous International Building Code (IBC) compliance, high volume of commercial construction, and established supply chains for certified pressure-treated wood.

- Europe: Mature market characterized by a strong focus on sustainability (Euroclass standards) and high demand for non-toxic, aesthetically superior FRTW solutions for both new construction and historical preservation.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, massive infrastructure development in China and India, and increasing adoption of international fire safety standards in high-rise buildings.

- Middle East & Africa (MEA): Growth driven by mega-projects in the GCC prioritizing advanced fire safety measures, relying heavily on imported, internationally certified FRTW products for high-profile commercial developments.

- Latin America (LATAM): Developing market potential dependent on economic stabilization and regulatory enforcement, with primary adoption currently concentrated in large industrial and institutional building projects in key economic centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Retardant Treated Wood Market.- Lonza Group

- Koppers Inc.

- Viance

- Arch Wood Protection

- Foreco

- Osmose

- Winstar Building Materials

- American Wood Treaters

- Flame Free Lumber

- Hoosier Heartland State Bank

- Atlantic Pressure Treating

- Maibec

- Timber Protection Products

- Culpeper Wood Preservers

- Universal Forest Products

- Chemonite

- Bohn Wood Treatment

- McShan Lumber

- FRT Wood

- Northwest Pipe Company

Frequently Asked Questions

Analyze common user questions about the Fire Retardant Treated Wood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fire Retardant Treated Wood (FRTW) and how does it function in construction safety?

FRTW is lumber or plywood impregnated with specialized chemicals, typically inorganic salts or phosphates, designed to slow the combustion rate. Upon heating, these chemicals chemically react, forming a protective insulating char barrier and releasing non-combustible gases, significantly reducing flame spread and smoke generation, thus complying with rigorous building codes like ASTM E84 Class A.

Is FRTW safe to handle, and what are the main environmental concerns regarding its use?

Modern FRTW is generally safe to handle, provided users follow standard wood-working safety protocols. The main environmental concern relates to chemical leaching, especially in exterior applications. The market is shifting towards non-halogenated and bio-based chemistries to mitigate environmental impact and eliminate concerns about traditional toxic components.

Does Fire Retardant Treated Wood corrode metal fasteners, and what precautions are necessary?

Some older or specific FRTW formulations, particularly those high in certain salts, can potentially increase the corrosion rate of metal fasteners under high-humidity conditions. To address this, manufacturers mandate the use of specific, corrosion-resistant fasteners, such as hot-dip galvanized or stainless steel, as specified in the product documentation and recognized by building codes.

What are the primary applications and end-user sectors driving demand for FRTW?

The primary applications include structural components like roof trusses, wall framing, and interior finishes in concealed spaces. Demand is principally driven by the commercial construction sector (offices, retail, healthcare) and high-density residential buildings, mandated by stringent fire safety regulations for public and high-occupancy structures.

How is the quality and compliance of FRTW verified according to international standards?

FRTW compliance is verified through rigorous third-party testing and certification by organizations such as Underwriters Laboratories (UL), ICC Evaluation Service (ICC-ES), and various national standards bodies. Products must achieve specific ratings, typically Class A for flame spread and smoke development, verified through standardized tests like ASTM E84, and carry stamps or labels indicating their certified status.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager