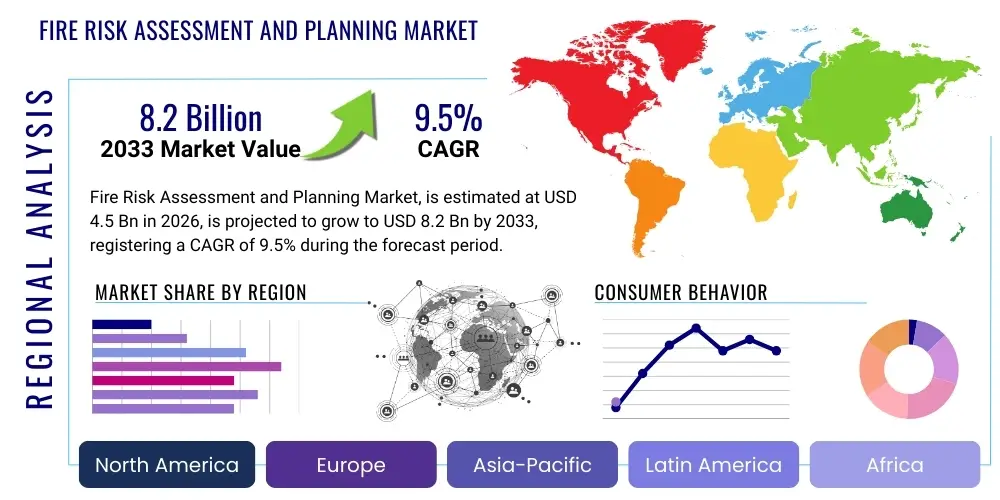

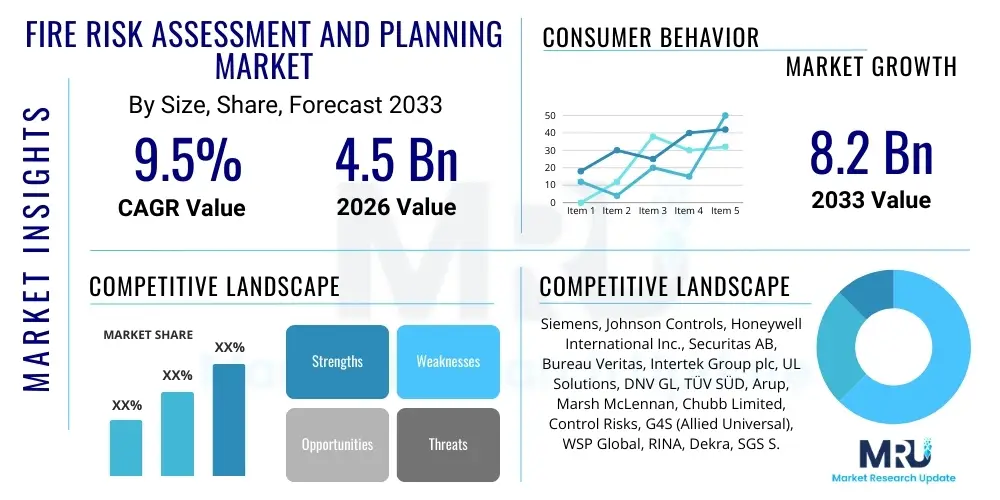

Fire Risk Assessment and Planning Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437985 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fire Risk Assessment and Planning Market Size

The Fire Risk Assessment and Planning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This robust expansion is fueled by increasingly stringent global regulatory frameworks mandating comprehensive fire safety measures across commercial, industrial, and residential infrastructures. The growing complexity of modern buildings, which often incorporate integrated smart technologies and specialized materials, necessitates expert assessment services to identify unique hazards and develop proactive mitigation strategies, thereby supporting market valuation growth.

The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.2 Billion by the end of the forecast period in 2033. This significant upward trajectory is not solely reliant on mandatory compliance but is also driven by the private sector’s focus on business continuity and liability reduction. Enterprises, especially those operating critical infrastructure or large manufacturing facilities, are investing heavily in advanced digital assessment tools and ongoing consulting services to maintain the highest safety standards, positioning assessment and planning as essential operational expenditures rather than mere compliance costs.

Furthermore, the increasing frequency of catastrophic weather events globally, which can exacerbate fire risks (such as wildfires impacting urban fringes), compels governments and insurance bodies to enforce higher standards of preparedness. This environmental factor, coupled with technological advancements in predictive modeling and digital twin simulations, accelerates the adoption of sophisticated planning services, solidifying the market’s financial expansion throughout the designated forecast period.

Fire Risk Assessment and Planning Market introduction

The Fire Risk Assessment and Planning Market encompasses specialized services, software, and hardware solutions designed to systematically identify, evaluate, and mitigate potential fire hazards within constructed environments. This critical domain involves thorough inspections, hazard identification, probabilistic risk modeling, and the formulation of detailed emergency response plans (ERPs) and passive and active fire protection strategies. The core objective is to ensure the safety of occupants, protect physical assets, and guarantee regulatory compliance, minimizing potential damage and disruption caused by fire incidents. Products within this market range from conventional site auditing services to cutting-edge digital platforms utilizing Building Information Modeling (BIM) and IoT data for real-time risk visualization and dynamic planning.

Major applications span diverse sectors, including high-density commercial properties like office towers and retail centers, complex industrial environments such as chemical plants and data centers, and public infrastructure like hospitals and schools. The inherent benefits of these services are manifold: they drastically reduce the likelihood of fire events, lower insurance premiums, ensure legal compliance with local and international fire codes (e.g., NFPA, EN standards), and significantly enhance organizational resilience and business continuity following an incident. By translating complex safety requirements into actionable, site-specific strategies, assessment and planning services act as the foundational step in any effective fire safety management system.

Key driving factors accelerating market expansion include the global urbanization trend, which results in higher building density and complexity, thereby increasing intrinsic risk factors; the harmonization and tightening of international fire safety regulations, compelling standardized adoption across multinational corporations; and technological integration, particularly the use of drones, laser scanning, and sophisticated data analytics for more accurate and less intrusive assessment processes. Furthermore, the rising awareness among property owners and facilities managers regarding the catastrophic human and financial costs associated with major fire losses serves as a continuous demand catalyst for proactive risk assessment solutions.

Fire Risk Assessment and Planning Market Executive Summary

The Fire Risk Assessment and Planning Market demonstrates robust growth, primarily driven by mandatory compliance coupled with the increasing integration of digital technologies. Business trends indicate a strong shift toward continuous monitoring and assessment models, moving away from single-point, annual audits. This is facilitated by Software-as-a-Service (SaaS) platforms that offer real-time data integration with building management systems (BMS) and IoT sensors, allowing for predictive risk identification and immediate corrective actions. Large engineering consultancies and certification bodies are strategically acquiring specialized software providers to offer comprehensive, end-to-end digital solutions, standardizing complex assessment procedures across vast property portfolios and demonstrating a clear trajectory towards consolidation and technological enhancement.

Regionally, North America and Europe maintain market dominance due to established, mature regulatory bodies and high standards of building safety codes, characterized by high adoption rates of advanced services and strict insurance liability requirements. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid infrastructural development, burgeoning smart city projects, and the implementation of initial foundational fire safety mandates across China, India, and Southeast Asia. Market expansion in APAC is largely service-driven initially, with increasing investment expected in software tools as regulations mature and urbanization intensifies, demanding scalability in risk management.

Segment trends highlight the Services segment's enduring dominance, encompassing consulting, auditing, and maintenance, which remains critical given the need for certified expertise in compliance interpretation. Nonetheless, the Software/Digital Tools segment is exhibiting the highest CAGR, driven by solutions for automated compliance tracking, sophisticated evacuation modeling (e.g., computational fluid dynamics), and fire scenario simulation. End-user demand is strongest from the Industrial and Commercial sectors, which face the highest financial risks and most complex operational environments, necessitating advanced, tailored planning solutions that integrate operational technology (OT) safety protocols with conventional fire assessment methods.

AI Impact Analysis on Fire Risk Assessment and Planning Market

Common user inquiries regarding AI's influence in the Fire Risk Assessment and Planning Market center on three critical themes: efficiency gains, accuracy improvements, and ethical implications related to data privacy and automated decision-making. Users frequently ask how AI-driven predictive modeling can surpass traditional qualitative assessments, whether machine learning can accurately forecast ignition probabilities based on historical and environmental data, and how automated assessment tools maintain compliance with varying local regulations. The primary expectation is that AI will minimize human error, reduce the time required for assessments, and enable dynamic, rather than static, risk management plans. However, concerns persist regarding the reliability of algorithms in novel situations and the need for certified human oversight to validate AI-generated recommendations, particularly in high-stakes regulatory environments. Overall, the consensus leans toward AI serving as a powerful enhancement tool rather than a full replacement for human expert judgment.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the assessment landscape, moving it from reactive compliance checks to proactive, predictive safety management. AI algorithms analyze vast datasets, including historical fire incidents, weather patterns, building material properties, occupant behavior models, and real-time sensor data from IoT devices, to calculate dynamic risk scores. This enables assessment professionals to identify nuanced hazard correlations that are undetectable through conventional methods, such as the probability of electrical faults escalating under specific environmental stress conditions. Furthermore, natural language processing (NLP) is being utilized to quickly process and summarize complex regulatory documents, streamlining the compliance auditing phase, significantly reducing the administrative burden, and enhancing the speed of report generation.

AI's primary transformative effect is enabling continuous assessment. Instead of relying on annual assessments, AI platforms constantly ingest data from installed systems (fire alarms, CCTV, access control) to flag anomalies and changes in the risk profile in real-time. For instance, if an occupancy level suddenly exceeds the planned threshold or if a critical ventilation system fails, the AI instantaneously updates the risk plan and alerts facility management, simulating the impact on evacuation routes and suppression system effectiveness. This shift toward dynamic, data-driven planning allows for adaptive responses, making buildings fundamentally safer and significantly optimizing resource allocation for maintenance and preventative measures across large asset portfolios.

- AI algorithms enable predictive modeling of fire propagation and risk probability based on environmental and structural data.

- Machine Learning enhances accuracy by analyzing complex, multi-source data inputs from IoT sensors and BIM models.

- Automated compliance checking utilizes NLP to rapidly cross-reference assessment findings with thousands of regulatory codes.

- Computer vision and deep learning systems monitor premises for behavioral anomalies (e.g., unauthorized access, blockage of exits).

- AI facilitates dynamic evacuation simulations, optimizing routes in real-time based on incident location and severity.

- Optimized resource allocation for fire suppression maintenance and inspection scheduling based on calculated risk prioritization.

DRO & Impact Forces Of Fire Risk Assessment and Planning Market

The dynamics of the Fire Risk Assessment and Planning Market are governed by powerful structural forces originating from regulatory requirements, technological innovation, and economic pressures. Driving forces center primarily on increasingly stringent global mandates and legislative efforts to enforce higher levels of public safety, particularly after high-profile, catastrophic fire events globally that highlight systemic safety failures. Restraints mainly stem from the significant initial investment required for adopting advanced digital assessment tools and the scarcity of highly specialized personnel capable of interpreting complex modeling data and integrating diverse technologies. Opportunities are vast, focused on the expansion into emerging markets, the successful commercialization of IoT-enabled, continuous assessment platforms, and the specialized demand arising from new technologies like green buildings and advanced manufacturing facilities (e.g., battery factories). These impact forces collectively dictate the market’s pace of growth, favoring service providers who can effectively navigate the interplay between compliance rigidity and technological flexibility.

The structural impact forces influencing this market include both macro-economic and micro-industry pressures. The threat of substitutes is relatively low, as regulatory mandates ensure that professional assessment and planning services are indispensable; informal or non-certified assessments carry too high a liability risk for major corporations. However, internal capability development by large enterprises (insourcing assessment services) presents a moderate competitive force. Supplier power is moderate, as specialized software and sensor manufacturers hold proprietary technology, yet consultancies often leverage multiple vendors. Buyer power is high, especially among large facility owners and government bodies who require comprehensive, competitively priced, long-term contracts for portfolio management, driving service providers toward integrated pricing models.

Technological advancement acts as a powerful accelerating force. The move towards digitalization—incorporating drones for external inspections, augmented reality (AR) for site walkthroughs, and sophisticated data visualization tools—is enhancing efficiency and depth of assessment, justifying higher service fees and expanding the scope of actionable insights. Conversely, market entry is becoming more difficult for traditional firms lacking digital capabilities, as modern clients increasingly expect assessments to be data-driven and integrated into digital asset management systems. This necessitates continuous investment in technology and certified training, creating an environment where specialization and digital maturity are paramount determinants of market success and overall competitive positioning.

Segmentation Analysis

The Fire Risk Assessment and Planning Market is extensively segmented based on the type of offering, the specific service delivered, the end-user profile, and the application scenario. The segmentation reflects the diverse needs of different industries and the varied levels of regulatory complexity across geographies. This allows vendors to specialize and tailor solutions, ranging from basic compliance checklists to highly sophisticated engineering simulations for complex infrastructure projects like nuclear facilities or advanced data centers. Understanding these segments is crucial for strategic planning, as distinct purchasing criteria and growth rates characterize each sector, with software and digital services demonstrating accelerated uptake across all end-user categories due to the push for efficiency and continuous monitoring capabilities.

The segmentation by Offering, divided into Hardware, Software, and Services, is particularly important, as it delineates the shift from capital expenditure (CAPEX) on equipment to operational expenditure (OPEX) on subscription-based digital tools and expert consulting. While Services remain the largest revenue driver due to the mandate for certified human expertise, the Software segment (encompassing BIM integration tools, simulation platforms, and compliance management systems) is projected to record the highest CAGR, reflecting industry investment in scalable, repeatable assessment processes. The End-User segmentation provides insight into where regulatory pressure and financial risk intersect, positioning the Industrial and Commercial sectors as primary demand generators due to the high value of assets and the potential for catastrophic losses.

- By Offering

- Hardware (Sensors, Detectors, Monitoring Equipment used during assessment)

- Software/Digital Tools (Simulation Software, Compliance Management Systems, Digital Twins)

- Services (Auditing, Consulting, Certification, Maintenance Planning, Emergency Response Planning)

- By Service Type

- Fire Safety Audits and Inspections

- Fire Engineering Consulting

- Regulatory Compliance Certification

- Emergency Planning and Training

- Post-Incident Analysis

- By End-User

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Facilities (Manufacturing, Oil & Gas, Power Generation)

- Residential Complexes (Multi-unit Housing, High-rise Residential)

- Government & Public Sector (Healthcare, Education, Defense)

- Transportation Infrastructure (Airports, Railways, Ports)

- By Application

- Regulatory Compliance

- Insurance Risk Assessment

- New Construction Planning and Design

- Existing Infrastructure Retrofitting

Value Chain Analysis For Fire Risk Assessment and Planning Market

The value chain for the Fire Risk Assessment and Planning Market is complex, involving multiple specialized stages starting from technology development and culminating in the delivery of certified, actionable risk mitigation strategies to the end client. The upstream segment is dominated by highly specialized technology providers, including manufacturers of advanced sensing equipment (e.g., gas detection, thermal cameras), specialized software developers creating Computational Fluid Dynamics (CFD) simulation engines, and data analytics firms that process the environmental and structural data. These upstream entities focus heavily on R&D, patenting proprietary algorithms and hardware components that enhance the accuracy and speed of data collection, setting the technological foundation for the entire assessment process and providing core tools to service providers.

The midstream of the value chain is characterized by the integration and assessment phase, which is primarily controlled by certified engineering consultancies, risk management firms, and globally recognized certification bodies. These players acquire the technology (both hardware and software) from upstream suppliers and deploy highly skilled fire safety engineers and certified risk analysts. Their core value proposition lies in the interpretation of raw data, applying professional judgment to regulatory requirements, conducting physical site audits, and translating complex technical findings into strategic plans. Key activities here include data modeling, compliance verification, scenario planning, and the issuance of formal certification reports, which often carry legal and insurance implications, thereby adding significant intellectual value.

The downstream segment involves the distribution and implementation channels. Distribution is split between direct engagement (large global consultancies dealing directly with multinational clients for portfolio management) and indirect channels (local and regional firms utilizing vendor software licenses and working with facility management companies). The final customers, or end-users, utilize the assessment report to guide subsequent activities, such as fire protection system installation, staff training, and ongoing maintenance—the execution of which may be outsourced to specialized contractors (the implementation phase). The efficiency of the downstream relies heavily on clear communication and integration between the assessment firm and the facility management team, ensuring that the fire risk plan remains a living document integrated into daily operational protocols.

Fire Risk Assessment and Planning Market Potential Customers

Potential customers for fire risk assessment and planning services are predominantly organizations that operate assets with high intrinsic risk, high asset value, or stringent regulatory compliance obligations, where business continuity is paramount. The primary end-users or buyers include large industrial conglomerates, particularly those in high-hazard sectors like petrochemicals, energy generation (nuclear, fossil fuels, and renewables), and chemical manufacturing. These customers require highly specialized, performance-based fire engineering services, often mandated by international standards and environmental safety protocols, to manage risks associated with complex operational processes and hazardous materials handling.

Secondly, the Commercial sector, encompassing owners and operators of high-rise office towers, large-scale data centers, retail mall portfolios, and hospitality chains, represents a massive market segment. For these buyers, the motivation is dual: mandatory life safety compliance for dense occupancy areas and minimizing financial liability and potential revenue loss due to downtime. Data centers, in particular, require specialized assessments focusing on inert gas suppression systems and ensuring continuity of cooling and power, positioning them as high-value, sophisticated clients demanding the latest in digital assessment tools and predictive modeling services.

Government and Public Sector entities, including national defense facilities, healthcare systems (hospitals), and educational institutions, constitute another critical segment. While often driven by public procurement regulations and budget constraints, these customers place high value on comprehensive planning that ensures public safety and long-term asset integrity. Insurers and financial institutions also act as indirect but influential buyers, often mandating specific risk assessment standards as prerequisites for coverage or underwriting large construction projects, thereby directing their clients (the property owners) toward certified assessment service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, Johnson Controls, Honeywell International Inc., Securitas AB, Bureau Veritas, Intertek Group plc, UL Solutions, DNV GL, TÜV SÜD, Arup, Marsh McLennan, Chubb Limited, Control Risks, G4S (Allied Universal), WSP Global, RINA, Dekra, SGS S.A., FM Global, Jensen Hughes, Verisk Analytics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Risk Assessment and Planning Market Key Technology Landscape

The technological landscape of the Fire Risk Assessment and Planning Market is rapidly evolving, shifting away from purely manual inspections toward data-intensive, digitized assessment protocols. Core technologies include advanced sensor networks, commonly referred to as the Internet of Things (IoT), which are integrated into building management systems (BMS) to provide continuous, real-time data streams on temperature, air quality, humidity, occupancy rates, and system performance (e.g., sprinkler pressure). This constant influx of high-fidelity data provides the raw material necessary for modern predictive risk modeling, moving the market paradigm from static compliance reporting to dynamic, predictive safety management, thereby significantly enhancing the accuracy of risk profiles and emergency plan efficacy.

Further innovation is driven by sophisticated visualization and modeling tools. Building Information Modeling (BIM) platforms are now essential, allowing fire engineers to integrate assessment data directly into digital twin representations of the structure. This permits highly accurate fire simulation using Computational Fluid Dynamics (CFD), where virtual fire and smoke spread scenarios are modeled under varying conditions, enabling the optimization of passive fire protection design (compartmentation, material selection) and the validation of active systems. The combination of BIM and simulation technology ensures that planning recommendations are performance-based and verifiable, satisfying increasingly stringent regulatory requirements that focus on outcomes rather than prescriptive solutions.

Emerging technologies, especially Artificial Intelligence (AI) and Machine Learning (ML), are playing a transformative role by enhancing data analytics and automating repetitive compliance checks. AI is used to analyze patterns of system failures or human behavior that might correlate with increased fire risk, offering an early warning system far exceeding the capabilities of traditional alarm systems. Additionally, remote inspection technologies, such as drones equipped with thermal imaging cameras and LiDAR scanners, are used to safely and quickly assess large or inaccessible structures, significantly reducing the time and cost associated with preliminary site assessments and providing precise geometric data essential for accurate modeling.

Regional Highlights

Regional dynamics significantly influence the Fire Risk Assessment and Planning Market, primarily dictated by the maturity of regulatory frameworks, levels of infrastructural investment, and economic development. North America, driven by the stringent standards set by organizations such as the National Fire Protection Association (NFPA) and high insurance liability standards, represents a dominant market share. The region exhibits high demand for advanced, integrated digital solutions and continuous monitoring services, often purchased by large commercial and industrial facility owners focusing on comprehensive risk mitigation and minimization of business interruption costs. The presence of major global risk consultancies and technology providers further cements its leadership position in service sophistication and technological deployment.

Europe holds a substantial market position, characterized by highly prescriptive national fire safety codes and a strong focus on sustainable and "green" building regulations, which require specialized fire risk assessments for engineered timber structures and energy storage systems. Countries like the UK, Germany, and France show high adoption rates, supported by well-established certification bodies (e.g., TÜV, DNV). The European market is seeing increasing convergence in standards, driven by EU directives, pushing for greater cross-border standardization in assessment methodologies and facilitating the growth of international service providers capable of managing pan-European portfolios effectively. The emphasis on passive fire protection and life cycle assessment is a key differentiator in this region.

Asia Pacific (APAC) is projected to be the fastest-growing region due to unprecedented urbanization rates and massive infrastructure investments, particularly in China, India, and Southeast Asia. While regulatory enforcement historically varied, governments are rapidly implementing and enforcing stricter national fire codes, often influenced by Western standards, to address the safety challenges posed by burgeoning high-rise construction and industrial parks. The market here is currently characterized by high demand for basic consulting and compliance services but is quickly transitioning toward adopting software solutions for scalability, driven by the need to manage thousands of new construction projects efficiently. Economic development in MEA is also showing steady growth, primarily focused on large-scale governmental and energy infrastructure projects demanding international-standard assessments.

- North America: Market leader due to strict NFPA codes, high liability insurance standards, and strong adoption of predictive AI/IoT assessment tools, particularly in the commercial and technology sectors.

- Europe: Mature market with prescriptive national codes, high demand for life safety assessment, and strong regulatory pressure toward integrating fire safety into sustainable building practices (e.g., timber construction risk).

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid urbanization, massive infrastructure development, and governmental initiatives to strengthen nascent fire safety regulatory frameworks across key emerging economies.

- Latin America (LATAM): Growth driven by increasing foreign investment in industrial facilities and gradual modernization of building codes, leading to rising demand for international-standard consulting and auditing services.

- Middle East and Africa (MEA): Growth concentrated in GCC nations, linked to large government-backed mega-projects (smart cities, tourism infrastructure) requiring specialized risk assessments aligned with international engineering standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Risk Assessment and Planning Market.- Siemens

- Johnson Controls

- Honeywell International Inc.

- Securitas AB

- Bureau Veritas

- Intertek Group plc

- UL Solutions

- DNV GL

- TÜV SÜD

- Arup

- Marsh McLennan

- Chubb Limited

- Control Risks

- G4S (Allied Universal)

- WSP Global

- RINA

- Dekra

- SGS S.A.

- FM Global

- Jensen Hughes

- Verisk Analytics

- Fire Protection Systems Inc.

- Hochiki Corporation

Frequently Asked Questions

Analyze common user questions about the Fire Risk Assessment and Planning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market growth for Fire Risk Assessment and Planning?

The primary driver is the increasing stringency and global harmonization of regulatory mandates (such as NFPA and EU directives) coupled with rising insurance and legal liability concerns for property owners. Proactive compliance is essential for business continuity and avoiding severe legal penalties, forcing consistent investment in professional assessment services and advanced planning methodologies across all high-value assets and infrastructure projects.

How is digital transformation impacting traditional fire risk assessment methods?

Digital transformation, particularly through the adoption of IoT, BIM, and AI, is shifting assessments from periodic manual audits to continuous, predictive monitoring. This change enhances accuracy, reduces human error, and allows engineers to run complex fire simulations (CFD) on digital twins of buildings, providing performance-based insights that optimize structural design and emergency response plans in real time, moving beyond traditional prescriptive checks.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest CAGR due to rapid urbanization, immense infrastructural investment, and the recent introduction and stricter enforcement of modern building safety codes across major economies like China and India. The immense volume of new construction projects necessitates both initial planning consultation and ongoing compliance management services, driving exponential market demand.

What is the role of insurance companies in the demand for fire risk assessment?

Insurance companies play a crucial role by acting as influential demand generators. They often mandate comprehensive, certified fire risk assessments and detailed mitigation plans as a prerequisite for underwriting large commercial and industrial policies. These assessments directly influence premium pricing and coverage terms; higher standards of risk planning result in better insurable conditions and reduced financial exposure for both the insurer and the policyholder.

What are the key technological segments within the assessment market?

The key technological segments are Software/Digital Tools and Services. Software includes BIM integration platforms, CFD simulation packages, and compliance management systems utilizing AI for data analysis. The Services segment, which remains the largest by revenue, involves the human application of these tools through fire engineering consulting, site auditing, and the formal certification process required by regulatory bodies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager