Fire Safety Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433293 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fire Safety Products Market Size

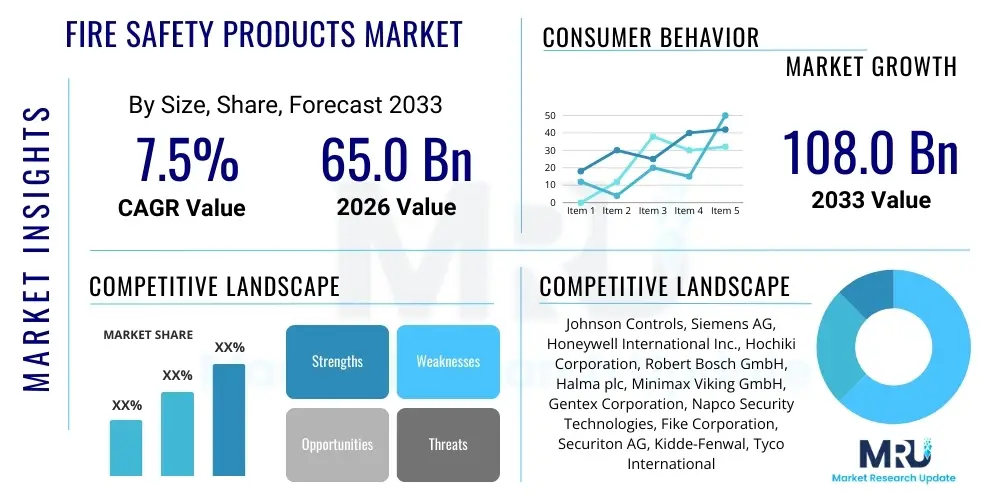

The Fire Safety Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 108.0 Billion by the end of the forecast period in 2033.

Fire Safety Products Market introduction

The Fire Safety Products Market encompasses a wide range of devices, systems, and solutions designed to detect, suppress, and mitigate the damage caused by fire incidents. This market is fundamentally driven by the imperative need to protect human life, assets, and critical infrastructure across all sectors. Key product categories include fire detection systems (smoke detectors, heat detectors, flame detectors), fire suppression systems (sprinklers, chemical suppressants, gas extinguishing systems), and emergency response equipment (fire alarms, emergency lighting, evacuation aids). The increasing urbanization, coupled with stringent building codes and mandatory compliance regulations globally, forms the bedrock of consistent demand in this industry.

The core application of these products spans residential, commercial, and industrial structures. Residential applications focus primarily on localized detection and signaling, whereas commercial and industrial facilities require complex, integrated, and often networked systems capable of quick identification, zonal isolation, and automated suppression. Major applications include data centers where gas suppression is critical, manufacturing plants requiring specialized detection for hazardous materials, and large commercial spaces leveraging intelligent, addressable fire alarm control panels (FACPs). The market growth trajectory is significantly influenced by the lifecycle of existing infrastructure upgrades and the volume of new construction activities, particularly in developing economies.

The primary benefits delivered by advanced fire safety products revolve around minimizing response time and enhancing system reliability. Modern systems, increasingly integrated with IoT and building management systems (BMS), offer predictive maintenance, remote monitoring, and reduced false alarms, ensuring operational continuity. Driving factors include escalating insurance costs related to fire damage, governmental enforcement of safety standards (such as NFPA and EN standards), and technological advancements leading to sophisticated and highly interconnected safety solutions. These advancements focus on integrating sensor technology with communication platforms, thereby creating comprehensive safety ecosystems that provide early warnings and optimized suppression deployment.

Fire Safety Products Market Executive Summary

The global Fire Safety Products Market is witnessing strong expansion, fueled primarily by heightened regulatory scrutiny across developed and developing nations, mandating the adoption of advanced fire mitigation technologies in both new and retrofitted constructions. Business trends indicate a significant shift towards smart, connected fire safety systems, utilizing wireless communication and cloud-based analytics for enhanced monitoring and proactive maintenance. Consolidation remains a defining characteristic, with major industry players acquiring specialized technology firms to integrate capabilities in IoT, AI-driven analytics, and specialized suppression agents. Furthermore, sustainability is becoming critical, leading to demand for environmentally friendly suppression chemicals and energy-efficient detection systems, aligning safety measures with broader ESG (Environmental, Social, and Governance) goals.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by rapid infrastructural development, burgeoning residential sectors, and increasing enforcement of modern fire codes in countries like China, India, and Southeast Asian nations. North America and Europe, characterized by established regulatory frameworks and high safety awareness, maintain substantial market shares, focusing on replacement cycles and the integration of next-generation smart building technologies. Latin America and the Middle East & Africa (MEA) are also showing promising growth, primarily propelled by large-scale commercial real estate and oil & gas projects that necessitate high-specification, reliable fire protection equipment. Investment in resilient infrastructure post-natural disasters also bolsters regional market expansion.

Segment trends underscore the dominance of the Fire Detection segment, particularly addressable smoke and carbon monoxide detectors, due to widespread mandatory installation laws. However, the Fire Suppression segment is growing robustly, supported by specialized products like clean agent systems for sensitive environments (e.g., server rooms and museums). Technology segmentation shows a clear migration from traditional, conventional systems toward networked, integrated, and software-defined safety platforms. The industrial application sector, demanding specialized hazardous area equipment, exhibits the highest average product value and stringent performance requirements, driving innovation in sensor technology and rapid suppression methodologies.

AI Impact Analysis on Fire Safety Products Market

Common user questions regarding AI's impact on fire safety often center on its capability to reduce false alarms, enhance detection speed, predict potential fire risk zones, and automate complex emergency responses. Users are keenly interested in how machine learning algorithms can analyze vast datasets from various building sensors (e.g., temperature, smoke density, air quality, CCTV feeds) to differentiate between a genuine fire threat and environmental nuisances like steam or dust, thereby boosting system reliability and reducing operational interruptions. Furthermore, there is significant interest in predictive analytics—how AI models can assess building occupancy, structural vulnerabilities, and historical incident patterns to dynamically adjust safety protocols or preemptively signal maintenance needs for critical equipment. The synthesis of these user queries reveals a strong expectation for AI to transform fire safety from a reactive measure to a proactive, highly intelligent, and self-optimizing security mechanism.

AI is transforming the fire safety sector by introducing sophisticated algorithmic processing capabilities into detection and response systems. Computer vision, leveraging deep learning techniques, enables fire and smoke detection via existing security cameras, offering faster and more granular spatial analysis than traditional spot detectors, especially in large, open-plan spaces or complex environments like warehouses. These systems can track fire spread dynamics in real-time and provide critical data points to first responders, optimizing evacuation routes and suppression efforts. Moreover, AI-powered systems facilitate predictive maintenance scheduling for suppression systems and detection hardware by monitoring operational parameters and identifying subtle anomalies that precede equipment failure, ensuring maximum system uptime and compliance.

The integration of AI also significantly impacts the overall cost-efficiency and effectiveness of fire safety infrastructure. By minimizing costly false alarms, which lead to unnecessary downtime and deployment of emergency services, AI provides tangible operational savings. For building management systems, AI acts as an intelligent coordinator, integrating fire safety data with HVAC (Heating, Ventilation, and Air Conditioning) control and security access systems to initiate coordinated responses, such as automatically sealing fire doors, adjusting ventilation to inhibit smoke spread, and directing occupants via dynamic signage. This enhanced coordination elevates the overall standard of building safety and resilience, particularly in smart cities and complex multi-use facilities.

- AI-driven computer vision enhances early flame and smoke detection using existing surveillance infrastructure.

- Machine learning algorithms drastically reduce false alarms by distinguishing real threats from environmental anomalies (e.g., steam, dust, welding).

- Predictive maintenance schedules for sensors and suppression equipment are optimized through continuous data monitoring and anomaly detection.

- AI enables dynamic evacuation route optimization based on real-time fire spread modeling and occupancy analysis.

- Integration of AI with Building Management Systems (BMS) facilitates complex, coordinated emergency responses across multiple building functions.

- Advanced analytics provide forensic insights post-incident, aiding in root cause analysis and future system improvement.

DRO & Impact Forces Of Fire Safety Products Market

The market dynamics for fire safety products are fundamentally shaped by a triad of Drivers, Restraints, and Opportunities (DRO), influenced by broader macroeconomic and regulatory forces. Key drivers include increasingly stringent and mandatory fire safety regulations promulgated by governmental bodies and international standards organizations (such as ISO, NFPA, and EN). The rapid proliferation of complex, high-rise, and densely populated urban infrastructure worldwide necessitates advanced and reliable fire protection solutions. Furthermore, heightened public awareness and the critical role of fire safety in achieving corporate risk management and continuity objectives significantly propel market expansion. These external forces generate sustained demand across all end-use sectors, particularly pushing the adoption of advanced networked systems capable of integrating detection and response functions seamlessly.

Conversely, the market faces significant restraints that temper growth. The high initial capital investment required for implementing sophisticated fire suppression and smart detection systems can be prohibitive, especially for small and medium-sized enterprises (SMEs) and in less developed regions. Additionally, the complexity associated with the installation, regular maintenance, and system integration of advanced networked safety technologies requires specialized technical expertise, which presents a challenge in labor markets globally. Compliance with evolving and sometimes disparate regional regulatory standards also adds layers of complexity and cost for multinational corporations operating across different jurisdictions, potentially slowing the adoption rate of cutting-edge solutions.

Opportunities for market innovation and expansion primarily reside in the increasing integration of IoT, wireless technology, and artificial intelligence into fire safety platforms, moving the industry toward 'Fire Safety as a Service' (FSaaS) models. This shift enables remote monitoring, predictive diagnostics, and flexible subscription-based safety management. The growing demand for specialized clean agent suppression systems for sensitive equipment (like batteries, servers, and historical archives) and the substantial opportunity presented by retrofitting older commercial and residential buildings with smart, compliant safety technology represent vast untapped areas. Impact forces are currently dominated by regulatory mandates and technological disruption, specifically the capability of new smart systems to overcome the limitations of traditional, non-addressable fire alarms, thereby maximizing system uptime and minimizing business interruption costs.

Segmentation Analysis

The Fire Safety Products Market is rigorously segmented based on product type, application, end-use industry, and technology, reflecting the diverse requirements and complexities inherent in fire protection across various environments. Segmentation allows manufacturers and service providers to tailor specialized solutions, ranging from simple, battery-operated smoke alarms for residential use to complex, integrated suppression and voice evacuation systems mandated for critical industrial infrastructure. Analyzing these segments is essential for understanding regional market maturity, investment priorities, and the specific technological demands of different consumer groups. The growth rates within segments vary significantly; for instance, smart detection systems currently show a higher CAGR compared to traditional, conventional systems, reflecting the overarching trend towards system intelligence and connectivity.

Product type segmentation typically divides the market into detection, suppression, and response/control categories, with detection often being the highest volume segment due to mandatory installation in virtually all structures. Suppression, while lower in volume, often commands higher average sales values due to the complexity of engineered systems such as water mist, inert gas, and chemical suppression systems. Application segmentation separates residential, commercial, and industrial needs, where industrial applications demand the most durable, robust, and often customized solutions suitable for harsh operating conditions. This granularity helps stakeholders allocate research and development resources toward areas demonstrating the highest return on investment and compliance urgency.

The end-use industry analysis highlights critical sectors such as construction (both residential and non-residential), manufacturing, oil and gas, energy and utilities, and transportation. High-hazard industries, particularly chemical and petrochemical processing, drive demand for explosion-proof and highly reliable detection and suppression systems, often adhering to specialized international standards like ATEX or IECEx. Furthermore, the evolving landscape of sustainable building practices and green construction is increasingly influencing segment growth, demanding products that minimize environmental impact while maintaining optimal safety standards.

- By Product Type:

- Fire Detection (Smoke Detectors, Heat Detectors, Flame Detectors, Multi-Sensor Detectors)

- Fire Suppression (Sprinkler Systems, Chemical Suppressants, Gas Suppression Systems, Water Mist Systems, Foam Systems)

- Fire Response/Safety (Fire Alarm Control Panels (FACP), Voice Evacuation Systems, Emergency Lighting, Firefighting Equipment)

- By Technology:

- Conventional Systems

- Addressable Systems

- Wireless Systems/IoT Connected

- By Application:

- Residential

- Commercial (Offices, Retail, Healthcare, Hospitality)

- Industrial (Manufacturing, Petrochemical, Utilities, Data Centers)

- By Region:

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Fire Safety Products Market

The value chain for the Fire Safety Products Market begins with the upstream segment, primarily involving the raw material suppliers (metals, plastics, electronic components, and specialty chemicals for suppressants) and core technology providers (sensor developers, software and firmware designers). Innovation in this segment focuses heavily on materials science to create more durable, heat-resistant, and aesthetically pleasing product enclosures, alongside developing high-precision sensors that offer faster detection with minimal drift. Key challenges upstream include managing supply chain volatility, particularly for microelectronic components required for smart systems, and ensuring the quality and origin traceability of highly specialized suppression chemicals, which are subject to strict environmental regulations.

The core manufacturing and distribution stages involve original equipment manufacturers (OEMs) who assemble detection panels, suppression systems, and alarms. These products are then channeled through various distribution networks. The primary distribution model utilizes specialized fire safety distributors, value-added resellers (VARs), and system integrators. These intermediaries play a crucial role by providing customization, installation, and ongoing maintenance services, transforming product components into integrated, functioning safety systems tailored to specific building codes and customer requirements. Direct distribution, although less common, is utilized by major global players for large-scale governmental or critical infrastructure projects requiring proprietary technology and high levels of security clearance.

The downstream segment focuses on the installation, servicing, and end-use application of the products. Professional installation and commissioning by certified engineers are mandatory, given the life-critical nature of these systems. Furthermore, ongoing maintenance, inspection, testing, and repair (IT&R) services generate significant recurring revenue for the service providers, often comprising long-term contracts linked to compliance requirements. The interaction between system integrators and end-users (building owners, facility managers) is critical for system performance optimization, software updates, and regulatory adherence. The efficiency of the entire value chain is optimized when manufacturers provide comprehensive training and certification programs to the downstream service network, ensuring seamless operation from design to disposal.

Fire Safety Products Market Potential Customers

The potential customer base for Fire Safety Products is extremely broad, encompassing virtually every sector that involves human habitation or asset storage. The primary end-users or buyers include general contractors, real estate developers, and large commercial property owners who purchase systems for new construction projects, where safety systems are mandated before occupancy permits are issued. Additionally, facility managers for existing commercial buildings—such as office towers, hospitals, educational institutions, and shopping malls—represent continuous customers for replacement, upgrade, and maintenance services, driven by aging infrastructure and evolving safety standards.

A highly critical segment of potential customers is the industrial sector, including petrochemical plants, oil and gas refineries, manufacturing facilities, mining operations, and large logistical centers (warehouses). These environments demand specialized fire protection solutions, often requiring intrinsically safe or explosion-proof equipment (e.g., in Zone 1/Zone 2 hazardous areas) and specialized suppression agents designed to handle unique fire classes (e.g., metal fires or liquid flammable fires). Data centers and telecommunication facilities constitute another high-value customer group, prioritizing non-damaging, rapid suppression systems like inert gas or chemical clean agents to protect mission-critical electronic equipment from water damage.

Finally, the public sector and governmental entities are substantial and non-negotiable buyers. This includes municipal fire departments purchasing firefighting equipment, governmental facilities (military bases, embassies, administrative offices), and infrastructure managers responsible for public transportation hubs (airports, railway stations). Residential consumers, although generally purchasing lower-cost individual units (smoke alarms, fire extinguishers), contribute massive volume to the market, especially with the trend toward interconnected, smart home safety devices integrated via platforms like Wi-Fi or Z-Wave, which offers manufacturers a scalable consumer electronics opportunity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 108.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Controls, Siemens AG, Honeywell International Inc., Hochiki Corporation, Robert Bosch GmbH, Halma plc, Minimax Viking GmbH, Gentex Corporation, Napco Security Technologies, Fike Corporation, Securiton AG, Kidde-Fenwal, Tyco International (now part of Johnson Controls), Amerex Corporation, Ziebart International Corporation, Kentec Electronics, Mircom Group of Companies, System Sensor, Safelincs Ltd., and Firetrace International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fire Safety Products Market Key Technology Landscape

The Fire Safety Products Market is currently undergoing a substantial technological transformation driven by the principles of connectivity, intelligence, and integration, moving far beyond legacy conventional systems. A dominant technological trend is the pervasive adoption of Internet of Things (IoT) platforms, which enable fire safety devices—ranging from smoke detectors to control panels—to communicate wirelessly, report status in real-time, and interface directly with cloud computing infrastructure. This facilitates features such as remote diagnostics, over-the-air firmware updates, and immediate digital notification to facility managers and emergency services, significantly reducing system vulnerability and enhancing response efficiency. IoT connectivity also underpins the development of smart home fire safety ecosystems, where integration with general home automation platforms is becoming standard.

Further innovation is concentrated in advanced sensing technologies. Traditional ionization and photoelectric smoke detection is being augmented by multi-criteria detectors that integrate heat, carbon monoxide, and various gas sensors (e.g., volatile organic compounds) alongside sophisticated algorithms to analyze environmental signatures. This multi-sensing capability is crucial for enhancing detection accuracy while drastically reducing nuisance alarms, a chronic issue in high-traffic commercial spaces. Moreover, video analytics, powered by machine learning and AI, are rapidly maturing as a reliable method for visual fire and smoke detection, especially in challenging environments like tunnels or large outdoor storage areas where traditional point detection is impractical or cost-prohibitive. These systems continuously learn and refine their detection parameters, improving performance over time.

On the suppression front, the focus has shifted towards highly efficient and environmentally sustainable agents. There is growing scrutiny on hydrofluorocarbon (HFC) agents due to their high global warming potential (GWP), driving increased adoption of inert gas systems (e.g., Nitrogen, Argon) and refined water mist technologies. Water mist systems are gaining traction because they use significantly less water than traditional sprinklers, minimizing secondary damage to assets, making them ideal for high-value applications like art galleries, archives, and data centers. Additionally, advanced control panel technology now includes highly resilient, distributed, and redundant network architectures, ensuring that system failure in one zone does not compromise the integrity of the entire fire protection system, a critical requirement for regulatory compliance in high-risk facilities.

Regional Highlights

- North America: This region holds a mature yet dynamically evolving market, characterized by strict adherence to NFPA standards and high consumer awareness regarding life safety. Market growth is sustained primarily through the mandatory retrofitting of existing commercial real estate and continuous technological upgrades, particularly the adoption of advanced addressable and wireless detection systems. The United States leads innovation, driven by significant investment in smart building technology and increasing demand for integrated security and fire systems in the healthcare and IT sectors. Canada follows similar regulatory trends, focusing on high-specification suppression systems for resource extraction industries.

- Europe: Europe is defined by highly specific national regulations harmonized under broader European (EN) standards. The market is driven by strict legal requirements for passive and active fire protection in both public and private infrastructure. Western European countries, particularly Germany and the UK, are early adopters of advanced technology, emphasizing low GWP suppression agents and comprehensive service contracts. Eastern Europe is experiencing growth propelled by new infrastructure projects and the replacement of older, non-compliant systems with modern, interconnected safety platforms, often subsidized or mandated by EU directives.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by unprecedented rates of urbanization and infrastructure development in economies like China, India, and Southeast Asia. While regulatory enforcement historically varied, there is a clear trend toward adopting international best practices and establishing localized, stringent fire codes. The sheer volume of new construction—residential, commercial, and industrial—creates immense demand across all product segments. However, the market is highly price-sensitive, balancing the need for advanced safety with cost-efficiency, which boosts demand for locally manufactured components and integrated systems.

- Latin America: This region is characterized by fragmented regulatory environments but shows consistent growth driven by foreign investment in high-standard commercial and industrial projects, particularly in Brazil and Mexico. The oil and gas and mining sectors are significant consumers of specialized, heavy-duty fire safety equipment. Adoption is often project-specific, leading to market volatility, yet the increasing regulatory oversight, particularly in major urban centers, promises a steadier trajectory towards standardized compliance and system upgrades.

- Middle East and Africa (MEA): Growth in the MEA region is overwhelmingly driven by mega-infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar). These projects, including world-class airports, residential towers, and specialized industrial zones, demand the highest level of international safety standards (NFPA, UL certified). The market is heavily reliant on imported, high-end technology. Africa presents a contrasting picture, with slower adoption rates constrained by economic factors, though South Africa maintains a well-developed fire safety market influenced by established mining and industrial regulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fire Safety Products Market.- Johnson Controls

- Siemens AG

- Honeywell International Inc.

- Robert Bosch GmbH

- Halma plc

- Minimax Viking GmbH

- Hochiki Corporation

- Gentex Corporation

- Napco Security Technologies

- Fike Corporation

- Securiton AG

- Kidde-Fenwal

- Amerex Corporation

- Ziebart International Corporation

- Kentec Electronics

- Mircom Group of Companies

- System Sensor (A Honeywell Brand)

- UTC Fire & Security (Now part of Carrier Global)

- Safelincs Ltd.

- Firetrace International

Frequently Asked Questions

Analyze common user questions about the Fire Safety Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Fire Safety Products Market?

The Fire Safety Products Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033, driven by stringent regulatory frameworks and technological advancements in smart detection and suppression systems.

Which technology segment is expected to show the highest growth in fire safety?

The Wireless Systems/IoT Connected technology segment is anticipated to exhibit the highest growth. This is due to the increasing demand for integrated, remote-monitoring capabilities, reduced installation complexity, and the incorporation of AI for superior false alarm management in modern buildings.

How do global fire safety regulations influence market demand?

Global regulations, notably standards set by NFPA, UL, and EN, are the primary market drivers. Mandatory compliance dictates the replacement of outdated systems, encourages investment in certified technology, and ensures continuous demand, particularly in sectors like construction and critical infrastructure.

What is the primary role of AI and machine learning in modern fire safety systems?

AI primarily enhances system intelligence by utilizing computer vision for quicker, visually verified flame and smoke detection, and by employing machine learning to analyze environmental data to drastically reduce costly false alarms, thereby improving overall system reliability and response speed.

Which region currently dominates the Fire Safety Products Market, and which is the fastest growing?

North America and Europe traditionally dominate the market in terms of value due to established regulatory maturity and high technology adoption. However, the Asia Pacific (APAC) region is currently the fastest-growing market segment, fueled by rapid urbanization and massive infrastructure expansion projects.

The market analysis indicates a clear shift toward predictive, integrated, and sustainable solutions. The convergence of IoT and AI is redefining system capabilities, moving fire protection from a passive requirement to an active, intelligent layer of building management. Companies that invest in robust R&D, focusing on reducing environmental impact while maximizing system connectivity and resilience, are poised for long-term competitive advantage. Regulatory compliance remains the non-negotiable floor for all market activities, ensuring consistent demand across residential, commercial, and industrial segments globally.

The industrial sector, particularly data centers and manufacturing, represents the highest value application due to the catastrophic financial and operational consequences of fire incidents. These sectors drive demand for specialized, high-performance clean agent systems and precise, multi-sensor detection arrays capable of operating in challenging, high-airflow environments. The future growth trajectory is inextricably linked to smart city initiatives and the global focus on enhancing building resilience against external and internal threats, necessitating continuous innovation in sensor fusion, battery technology for wireless devices, and robust cybersecurity protocols for interconnected systems.

Service providers are increasingly leveraging cloud-based platforms to offer Fire Safety as a Service (FSaaS), providing preventative maintenance, regulatory reporting, and remote monitoring through subscription models. This trend lowers the operational entry barrier for smaller enterprises to adopt advanced systems and ensures that safety infrastructure remains perpetually compliant and optimally operational. Overall market health is strong, supported by non-discretionary spending on life safety measures and mandatory insurance requirements, providing a stable foundation for the forecasted expansion through 2033.

The proliferation of high-rise construction in dense urban areas, particularly in APAC and MEA, places unique demands on detection and evacuation systems, favoring addressable systems and complex voice evacuation solutions that can guide occupants efficiently across multiple floors. Furthermore, the increasing focus on the fire safety of electric vehicles (EVs) and large-scale battery storage facilities introduces new challenges, requiring specialized thermal runaway detection and innovative suppression methods tailored to lithium-ion battery fires, presenting a nascent but rapidly growing opportunity within the industrial and transportation segments.

Supply chain resilience remains a key focus for manufacturers, particularly post-pandemic, ensuring consistent availability of critical electronic components and chemical agents. Diversification of sourcing and vertical integration are strategies being adopted by major players to mitigate risks associated with geopolitical instability and trade restrictions. The competitive landscape is characterized by major conglomerates offering comprehensive security and safety portfolios, alongside specialized niche manufacturers focusing on proprietary sensing technology or highly specialized suppression applications. Mergers and acquisitions are expected to continue shaping the market structure, consolidating technological expertise and expanding geographical reach.

Technological advancement in wireless sensor networking (WSN) standards, such as those tailored for low-power, long-range communication (e.g., LoRaWAN), is enabling widespread deployment of sensors without the need for extensive, costly hardwiring. This is particularly appealing for retrofitting historical buildings or large industrial sites where physical wiring presents logistical difficulties. Furthermore, the integration of 5G infrastructure promises to enhance the real-time data transfer capacity and reliability of these wireless systems, further accelerating the adoption of connected safety solutions across diverse geographical settings.

End-user education and training programs are crucial for the effective functioning of complex fire safety systems. Manufacturers and system integrators must prioritize user interface design to ensure intuitive operation and immediate understanding of system alerts by facility management personnel. Compliance documentation and automated digital logging provided by smart systems are essential tools for facility managers facing rigorous audits and regulatory inspections. This shift toward digital documentation and proactive reporting is streamlining the compliance process and minimizing administrative overhead associated with traditional, paper-based inspection records.

In summary, the Fire Safety Products Market is robust and driven by regulatory momentum and technological modernization. The market's future is defined by smart, predictive systems that minimize human intervention, maximize early detection capabilities, and utilize sustainable suppression methods. The geographic shift toward Asia Pacific, coupled with sustained demand for compliance and upgrades in mature markets, ensures stable growth and continuous innovation in life safety technology, reinforcing its status as an indispensable global market sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager