First Aid Packaging Kit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432092 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

First Aid Packaging Kit Market Size

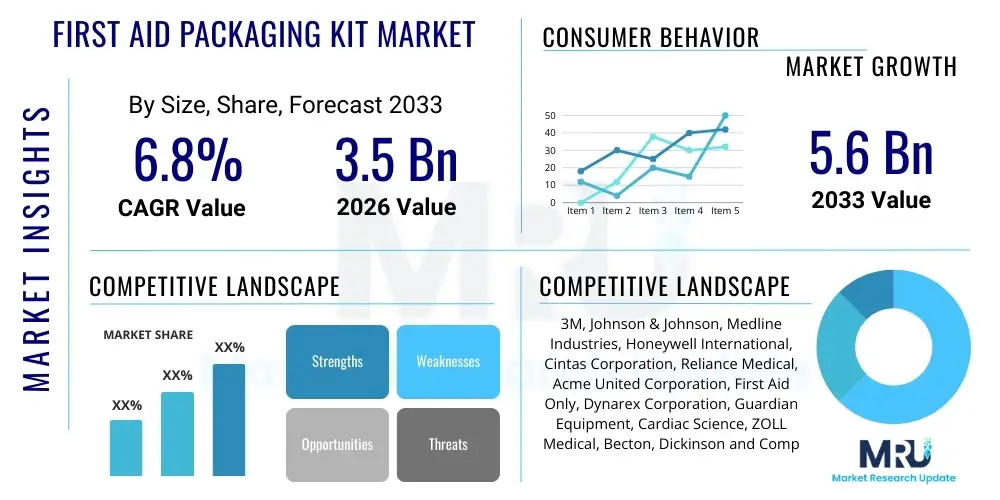

The First Aid Packaging Kit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.6 Billion by the end of the forecast period in 2033.

First Aid Packaging Kit Market introduction

The First Aid Packaging Kit Market encompasses the specialized containers, casings, and materials designed for the organized storage, preservation, and easy deployment of essential medical supplies necessary for treating minor injuries and emergencies. This market is fundamentally driven by stringent governmental safety regulations across industries, coupled with increasing public awareness regarding immediate pre-hospital care, particularly in high-risk environments such as construction, manufacturing, and remote workplaces. The packaging solutions must meet demanding criteria, including durability, moisture resistance, protection against contaminants, and clear labeling, ensuring that life-saving contents remain viable and accessible when required. Key considerations in product design involve optimizing portability and organizational layout to facilitate rapid response times, thereby directly impacting patient outcomes and compliance standards globally. The primary function transcends mere containment, acting as a critical barrier protecting sterile contents from environmental degradation.

Product descriptions within this sector range from compact, soft-sided nylon pouches optimized for portability and outdoor activities to robust, wall-mounted metal or high-density plastic cabinets designed for high-traffic industrial settings or institutional use. The evolution of this packaging increasingly incorporates advanced materials, such as antimicrobial coatings and tamper-evident seals, enhancing the overall safety and integrity of the enclosed sterile components. Major applications span residential use, where basic kits are mandated or highly recommended, through complex specialized kits tailored for marine, aerospace, or chemical environments. These applications necessitate compliance with ISO standards and regional regulatory bodies like the FDA in the US and EMA in Europe, focusing on material biocompatibility and shelf-life extension. Furthermore, the market is characterized by a strong demand for refillable and modular kits, allowing end-users to maintain optimal stock levels efficiently and cost-effectively, reducing waste and ensuring continual readiness.

The core benefits derived from high-quality first aid packaging include assured sterility of medical items, improved accessibility during emergencies, and enhanced organizational efficiency, minimizing the potential for human error under stress. Driving factors include the globalization of occupational safety standards, mandates for public access defibrillator (PAD) housing, and the growing trend of preparedness among individuals and large corporations against unforeseen disasters or workplace accidents. Specific regional dynamics, such as rapid industrialization in the Asia Pacific and established safety cultures in North America and Europe, significantly influence demand patterns and product innovation cycles within the industry. The ongoing development of smart packaging technologies that can monitor inventory or environmental conditions represents a burgeoning opportunity poised to revolutionize the sector's utility and market valuation.

First Aid Packaging Kit Market Executive Summary

The First Aid Packaging Kit Market is currently experiencing robust growth, primarily fueled by the convergence of tightening regulatory frameworks governing occupational health and safety across industrialized economies and a pronounced societal shift toward proactive preparedness for emergencies. Business trends indicate a strong move toward customization and specialization, where manufacturers are increasingly developing modular kits tailored for specific high-risk vocations—such as those involving chemical exposure, high-heat operations, or remote field work—rather than generic solutions. Key market players are heavily investing in material science research, focusing on durable, lightweight polymers and sustainable packaging alternatives that still maintain the necessary barrier properties for sterile medical components. Consolidation through mergers and acquisitions is evident as companies seek to expand their geographic footprint and integrate vertically, capturing greater control over the specialized supply chains necessary for producing regulatory-compliant packaging solutions. Furthermore, digitalization is beginning to influence inventory management within large industrial kits, utilizing QR codes and RFID tags for efficient restocking protocols.

Regionally, North America maintains market dominance, attributed to mature industrial safety standards, high disposable income facilitating premium product adoption, and a strong culture of individual preparedness, leading to high penetration rates in residential and automotive sectors. However, the Asia Pacific region is forecast to exhibit the fastest growth trajectory, driven by massive infrastructure investments, rapid expansion of the manufacturing base (especially in China and India), and the subsequent implementation of mandatory workplace safety laws mirroring international best practices. Europe demonstrates stability, characterized by high demand for ecologically sustainable packaging materials and strict adherence to CE marking requirements for medical devices. Challenges across all regions include navigating complex global logistics chains for packaging components and managing cost pressures associated with high-performance, medical-grade polymers, which are often subject to volatile commodity pricing.

Segmentation trends highlight the increasing importance of the Industrial/Workplace end-user segment, which demands large, comprehensive, and highly durable packaging solutions, often favoring wall-mounted cabinets and specialized trauma kits. In terms of product type, refill kits are witnessing accelerated growth, reflecting the industry's shift from discarding entire kits to more sustainable, cost-effective maintenance models. Material segmentation shows continued reliance on high-impact plastics (e.g., ABS, polypropylene) for exterior casings due to their superior durability and low manufacturing cost, though metal (aluminum) casings are preferred in highly regulated environments like marine or military applications where extreme ruggedness is paramount. Future segment growth is intrinsically linked to the successful integration of advanced barrier technologies, ensuring prolonged sterility and minimizing product expiration, thereby adding intrinsic value to the final packaged kit offered to commercial and institutional buyers.

AI Impact Analysis on First Aid Packaging Kit Market

Common user questions regarding AI's impact on the First Aid Packaging Kit Market primarily revolve around how artificial intelligence can enhance inventory management, predict demand for specific kit components based on demographic or occupational risk data, and optimize supply chain resilience. Users are particularly interested in whether AI can automate the compliance checking process for global regulatory standards, given the complexity of material requirements and sterilization mandates. Key themes emerging include the potential for AI-driven predictive maintenance, where algorithms analyze usage patterns and external factors (like seasonal illnesses or specific industrial accident trends) to automatically prompt restocking or modification of kit contents before an actual need arises. There is also significant curiosity regarding the application of AI in quality control during the manufacturing of packaging components, specifically for identifying micro-defects in seals or barrier films that could compromise the sterile contents. Overall, users expect AI to transition first aid packaging from a passive container into a semi-intelligent, proactive safety asset.

- AI-driven Predictive Inventory Management: Algorithms analyze historical usage, regional accident data, and industrial operational schedules to forecast component depletion rates, automating replenishment orders for packaging contents and reducing unnecessary stock holding.

- Optimized Packaging Design: Utilizing generative AI to simulate stress tests and environmental degradation factors (e.g., UV exposure, humidity) on various packaging materials, accelerating the development of highly durable and hermetically sealed containers.

- Automated Quality Control (QC): Implementing machine vision systems paired with deep learning models on assembly lines to detect microscopic flaws, such as pinholes or uneven sealing, ensuring the packaging maintains aseptic conditions and integrity over its specified shelf life.

- Supply Chain Resilience: AI platforms monitor global supply chain risks, tracking commodity prices and logistics bottlenecks for specialized materials (e.g., medical-grade polymers, aluminum alloys), enabling manufacturers to dynamically source alternatives and maintain production schedules for the packaging kits.

- Regulatory Compliance Assistance: AI tools ingest and interpret complex, evolving global safety standards (e.g., OSHA, ISO 13485) and audit packaging designs and labeling for instant compliance verification, minimizing the risk of costly recalls or market entry delays.

- Smart Kit Functionality: Integration of AI-enabled sensors within packaging to monitor internal environmental conditions (temperature, humidity) or confirm tamper-evidence status, transmitting real-time data on the kit's readiness and integrity to facility safety managers.

DRO & Impact Forces Of First Aid Packaging Kit Market

The dynamics of the First Aid Packaging Kit Market are shaped by a complex interplay of compelling drivers, inherent restraints, and evolving strategic opportunities, collectively defining the impact forces influencing market trajectories. A primary driver is the widespread implementation and strict enforcement of occupational safety and health legislation worldwide, compelling industrial, commercial, and governmental entities to provide comprehensive, accessible, and compliant first aid resources, creating continuous baseline demand for robust packaging solutions. This regulatory pressure is amplified by increasing societal awareness regarding the 'golden hour' of trauma care, elevating the importance of highly visible, well-organized, and durable packaging that allows for rapid identification and access to critical supplies. Conversely, the market faces significant restraints, notably the relatively high cost associated with sourcing medical-grade, specialized packaging materials that must meet stringent sterilization protocols and longevity requirements, often leading to upward pressure on final product pricing and presenting a barrier for smaller consumers or entry into developing markets. Furthermore, the complexities inherent in global supply chain management for specialized medical components, including volatility in polymer costs and logistical challenges, pose a perpetual restraint on scaling production efficiency, demanding manufacturers employ sophisticated risk mitigation strategies.

Strategic opportunities present a vital pathway for market expansion and differentiation. The foremost opportunity lies in the development and integration of advanced barrier technologies and smart packaging features, such as embedded sensors or passive indicators, that can communicate the kit's status (e.g., expiration alerts, inventory levels) to users or central management systems, effectively transforming the kit into a proactive asset. The growth in niche applications, including highly customized trauma kits for specific industries (e.g., mining, remote construction, renewable energy installations), allows manufacturers to command premium pricing based on specialized regulatory compliance and material requirements. Moreover, the increasing global focus on sustainability is driving demand for recyclable, biodegradable, or compostable packaging materials that still maintain the necessary strength and sterile barrier properties, presenting a major innovation opportunity for material scientists within the sector. Successfully capitalizing on these opportunities necessitates substantial investment in R&D, focusing on material innovation and digital integration to create value-added packaging solutions.

The impact forces within this market are thus categorized by the simultaneous push from mandatory safety compliance (Driving Force) and the pull from material science limitations and cost sensitivities (Restraining Force). The overall momentum favors growth, underpinned by non-negotiable legal requirements for safety and the continuous human imperative to mitigate risk. The strongest impact force currently stems from regulatory harmonization, particularly the adoption of international standards (like ANSI/ISEA Z308.1) by disparate regions, simplifying design specifications for global manufacturers but simultaneously requiring higher baseline performance from all packaging types. The competitive landscape is intensely focused on achieving optimal functionality—balancing rugged durability for industrial environments with lightweight portability for personal and travel use—while maintaining absolute barrier integrity, making product innovation in materials science the most potent internal force driving competitive advantage and market share shifts among key players.

Segmentation Analysis

The First Aid Packaging Kit Market is analyzed across critical dimensions including material type, product type, and key end-user applications, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for strategic planning, as distinct packaging requirements are dictated by the environment of use, ranging from the need for high impact resistance in industrial settings to aesthetic appeal and lightweight portability for consumer use. The materials used directly influence the cost, durability, and barrier efficacy of the final product, necessitating complex trade-offs between cost-effectiveness (typically plastic) and extreme ruggedness (metal). The primary segmentation based on end-user demonstrates the highest revenue generation from institutional and industrial customers, reflecting the large volume and mandatory nature of their procurement processes, while the residential segment contributes significantly to unit sales volumes, driven by consumer safety consciousness.

In terms of product type, the market is shifting toward sophisticated organizational systems. Traditional cabinets remain standard in stationary locations, but the fastest-growing segments include modular refill kits and mobile pouches/bags, reflecting the need for adaptability and efficient inventory management in dynamic environments. Manufacturers are optimizing internal layout designs, often using specialized compartments or transparent windows to allow for quick identification of contents, addressing the critical requirement for speed in emergency situations. This organizational focus extends to the packaging itself, which must be clearly labeled and often color-coded according to the contents or application (e.g., burn kits, eye wash stations) to comply with international safety signaling standards. The careful selection of seals, hinges, and locking mechanisms also falls under product type considerations, differentiating heavy-duty, tamper-resistant industrial cases from simple, zippered pouches for domestic use.

The interplay between segmentation criteria reveals specific market niches. For instance, the military and emergency services end-users primarily demand high-durability, ruggedized metal or specialized polymer cabinets (Material: Metal/Advanced Plastic; Product Type: Cabinets/Cases) capable of withstanding extreme environmental stress and temperature fluctuations. Conversely, hospitals and clinics show a higher preference for disposable, sterile packaging refills (Material: Plastic/Fabric; Product Type: Refill Kits) to maintain continuous stock levels under strict aseptic controls. Analyzing these cross-segment demands allows suppliers to develop targeted product portfolios that align proprietary material science capabilities with specific regulatory and operational requirements of high-value end-user groups. This strategic alignment is paramount for securing long-term contracts and establishing market leadership in specialized packaging solutions.

- By Material:

- Plastic (Polypropylene, Polyethylene, ABS)

- Metal (Aluminum, Steel)

- Fabric/Textile (Nylon, Canvas)

- Others (Composite Materials, Biodegradable Polymers)

- By Product Type:

- Cabinets/Cases (Wall-Mounted, Portable Hard Cases)

- Pouches/Bags (Soft-Sided, Vehicle Kits)

- Wall-Mounted Stations (Eye Wash, Burn Treatment)

- Refill Kits and Inserts (Modular Components)

- By End-User:

- Hospitals and Clinics

- Industrial/Workplace (Manufacturing, Construction, Oil & Gas)

- Residential and Consumer Use

- Educational Institutions and Public Facilities

- Emergency Services (Ambulance, Firefighters, Police)

- Military and Defense

- Travel and Automotive

Value Chain Analysis For First Aid Packaging Kit Market

The value chain for the First Aid Packaging Kit Market begins with the upstream suppliers responsible for raw material procurement and conversion, primarily focusing on specialized polymer resins, metal alloys (aluminum and stainless steel), and textile fabrics required for casing, sealing, and organizational components. This upstream segment is characterized by rigorous quality control requirements, as materials must often be medical-grade, non-toxic, and capable of maintaining sterile barriers for extended periods under diverse environmental conditions. Key challenges at this stage include managing material price volatility and ensuring regulatory traceability, particularly for plastics utilized in direct contact with medical supplies. Efficiency in the upstream segment dictates the final manufacturing cost and the ultimate durability specification of the packaging kit, requiring robust supplier qualification processes to ensure compliance with material safety data sheets and environmental standards.

The midstream involves the core manufacturing, assembly, and sterilization processes. Manufacturers acquire materials, perform injection molding or metal fabrication, apply necessary coatings (e.g., antimicrobial finishes), and integrate specialized components like hinges, latches, and seals. This stage also includes the critical step of filling the packaging kits with diverse medical contents sourced from various pharmaceutical and device suppliers, demanding strict adherence to kitting protocols and inventory accuracy. Distribution channels form the crucial link between production and the downstream end-users. Direct channels are commonly employed for large volume contracts with governmental bodies, military organizations, and major industrial corporations, facilitating customized solutions and specialized logistical support. Indirect channels utilize large medical distributors, safety supply houses, and major retail chains (online and physical) to reach fragmented markets like residential users, small businesses, and educational facilities, optimizing reach and inventory management across diverse points of sale.

The downstream analysis focuses on the end-user adoption and post-sale maintenance, which includes the ongoing necessity for refill kits and replacement components, driving recurring revenue. Potential customers (Hospitals, Construction Sites, Households) rely heavily on the durability and intuitive design of the packaging for effective utilization during crises. The packaging itself, therefore, serves as a marketing tool, signaling quality and reliability. Successful supply chain management requires excellent forecasting capabilities, particularly regarding demand spikes related to regulatory changes or public health emergencies. Efficient management of the entire value chain—from sourcing highly regulated barrier plastics to deploying final kits through complex global logistics networks—is fundamental to maintaining competitive pricing, ensuring product availability, and guaranteeing the long-term integrity of the first aid contents.

First Aid Packaging Kit Market Potential Customers

Potential customers for First Aid Packaging Kits are exceptionally diverse, spanning nearly every sector of the global economy where human activity occurs, driven by both regulatory mandate and voluntary safety consciousness. The largest and most demanding customer segments are institutional and industrial buyers, including major manufacturing plants, large construction and engineering firms, petrochemical companies, and transportation hubs. These entities require high-volume, ruggedized, and often highly specialized kits that meet stringent occupational safety standards (such as OSHA or equivalent regional bodies), necessitating packaging that can withstand harsh environments, extreme temperatures, and chemical exposure. Procurement decisions in these sectors are highly technical and compliance-driven, focusing heavily on certifications, material longevity, and the availability of efficient refill programs, which impacts the long-term operational costs associated with safety management.

Another significant group includes healthcare facilities, such as hospitals, urgent care centers, and private clinics, who require specialized trauma kits and packaging inserts for maintaining sterility and organizing diverse supplies within clinical settings. Their primary focus is on aseptic conditions and accessibility, often favoring modular plastic trays and disposable, easy-to-access packaging for immediate use components. Educational institutions (schools, universities) and public facilities (airports, malls, government buildings) represent high-volume purchasers who prioritize visibility, tamper-evidence, and ease of maintenance, usually opting for wall-mounted, clearly labeled cabinets that comply with public access safety standards. This segment often purchases standard commercial off-the-shelf kits, requiring less customization than heavy industrial buyers but demanding reliable large-scale distribution.

Finally, the residential, consumer, and travel segments represent a high-growth area, driven by increased personal preparedness for disasters, road safety mandates (automotive kits), and participation in outdoor activities. While individual purchases are smaller in value, the aggregate volume is substantial, favoring aesthetically pleasing, lightweight, and portable packaging solutions like soft-sided pouches and compact plastic cases. Manufacturers target this demographic through retail distribution and e-commerce platforms, where branding, convenience, and perceived value play a crucial role in purchasing decisions. The key differentiation among these customer groups lies in the packaging requirements: industrial users demand durability and compliance, clinical users require sterility and modularity, and consumer users value portability and simplicity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Johnson & Johnson, Medline Industries, Honeywell International, Cintas Corporation, Reliance Medical, Acme United Corporation, First Aid Only, Dynarex Corporation, Guardian Equipment, Cardiac Science, ZOLL Medical, Becton, Dickinson and Company (BD), Sterintech, Survitec Group, Safetec of America, Lifesystems, Tender Corporation, Beiersdorf AG, H&H Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

First Aid Packaging Kit Market Key Technology Landscape

The technology landscape governing the First Aid Packaging Kit Market is primarily centered on advanced material science and increasingly incorporates digital integration to enhance functionality and compliance. A critical technological focus is the development of high-performance barrier packaging, which utilizes multi-layer polymeric films or specialized coatings to achieve superior resistance against moisture, oxygen, and microbial penetration, significantly extending the shelf life of sterile contents like dressings and pharmaceuticals. Manufacturers are exploring biodegradable and bio-based plastics (e.g., PLA, PHA) that offer the required structural integrity and barrier properties while addressing the growing demand for environmental sustainability, a complex technological challenge given the strict performance requirements for medical packaging. Innovations in sterilization compatibility, such as materials that can withstand gamma irradiation or ethylene oxide processes without degradation, are also paramount, ensuring the packaging itself does not compromise the sterility of the contents before deployment.

Beyond material composition, packaging technology is advancing through mechanical engineering and smart system integration. Modern kits often employ sophisticated, yet user-friendly, locking and sealing mechanisms (e.g., pressure-sensitive seals, specialized hermetic closures) that ensure tamper-evidence while allowing for rapid, single-motion access in an emergency. The most significant emerging technology involves the integration of passive electronic components and Internet of Things (IoT) capabilities. This includes embedding RFID tags or NFC chips into the packaging structure to facilitate automated inventory tracking within large organizational systems, allowing safety officers to conduct audits instantly and manage expiration dates more effectively. Sensor technology, while nascent, is being explored to monitor internal temperature or humidity within specialized kits used in extreme climate conditions, guaranteeing environmental integrity for sensitive components.

Furthermore, digital manufacturing techniques, such as high-precision injection molding and 3D printing, are enabling rapid prototyping and the production of highly customized, ergonomic internal trays and compartments. This allows manufacturers to quickly adapt packaging designs to accommodate new medical device requirements or specific regulatory changes demanding specialized organization. The convergence of these technologies—material innovation for sustainability and barrier protection, mechanical advancement for rapid access, and digital integration for inventory intelligence—defines the leading edge of competition within the First Aid Packaging Kit Market, transitioning the product from a static container to a technologically enabled safety asset that actively contributes to organizational readiness and compliance protocols.

Regional Highlights

Regional dynamics significantly influence the demand, regulatory compliance, and technological adoption rates within the First Aid Packaging Kit Market, reflecting variations in industrial maturity, safety culture, and disposable income. North America, encompassing the United States and Canada, currently holds the largest market share, characterized by extremely rigorous and well-enforced occupational safety regulations (e.g., OSHA, ANSI/ISEA standards) that mandate comprehensive first aid provisions in workplaces, schools, and public access areas. This region exhibits a high demand for premium, durable, and highly organized packaging solutions, often favoring sophisticated wall-mounted cabinets and specialized trauma kits used in high-risk sectors such as oil & gas, construction, and advanced manufacturing. The substantial consumer base also drives strong sales of portable and vehicle first aid kits, emphasizing the cultural priority placed on personal and family emergency preparedness. Innovation here often focuses on compliance tracking and advanced material ruggedness.

Europe represents a mature market with stable growth, driven by the harmonized, though strict, regulatory environment governed by CE marking requirements and various national health and safety authorities. European consumers and businesses demonstrate a strong preference for environmentally conscious packaging, accelerating the demand for sustainable, recyclable, or biodegradable materials in first aid kits, even if they must meet identical barrier performance standards as traditional plastics. Germany, the UK, and France are pivotal markets, showcasing high penetration in industrial and institutional sectors. The region’s focus on high-quality manufacturing means there is less acceptance for lower-cost, less durable packaging, leading manufacturers to invest heavily in advanced plastic formulations and precision engineering for hinges and locking mechanisms to ensure product longevity and reliability, appealing to the European preference for long-term operational value over initial low cost.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by rapid industrial expansion, urbanization, and increasing foreign direct investment in manufacturing across countries like China, India, and Southeast Asia. This growth mandates the adoption of international safety standards, leading to a surge in demand for first aid packaging solutions to equip millions of new workplaces and public infrastructure projects. While cost-sensitivity remains a factor in procurement, the increasing regulatory enforcement and multinational corporate presence are driving the adoption of higher-specification kits, particularly those designed for mass assembly and distribution. Latin America and the Middle East & Africa (MEA) present nascent but emerging opportunities. Growth in MEA is largely linked to infrastructure megaprojects (especially in construction and energy) requiring internationally compliant kits, whereas Latin America is experiencing increased demand driven by regional safety policy reforms and growing middle-class expenditure on personal safety items. These regions present logistical challenges but offer high potential for manufacturers able to localize production or establish robust distribution networks.

- North America: Market leader due to strict OSHA and ANSI/ISEA mandates; high demand for industrial and professional-grade trauma kits; strong consumer preparedness segment.

- Europe: High growth in sustainable and recyclable packaging solutions; mature market driven by CE standards and focus on product quality and longevity; significant institutional procurement.

- Asia Pacific (APAC): Fastest growing market driven by rapid industrialization (China, India), urbanization, and increasing enforcement of occupational safety laws; growing preference for mass-produced, cost-effective, yet compliant packaging.

- Latin America: Emerging market growth linked to industrial development and improving national health and safety reforms; focus on basic, high-volume kits for widespread use.

- Middle East and Africa (MEA): Demand tied heavily to large-scale construction, oil, gas, and infrastructure projects; preference for ruggedized, high-specification packaging designed for extreme desert and maritime environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the First Aid Packaging Kit Market.- 3M

- Johnson & Johnson

- Medline Industries

- Honeywell International

- Cintas Corporation

- Reliance Medical

- Acme United Corporation

- First Aid Only

- Dynarex Corporation

- Guardian Equipment

- Cardiac Science

- ZOLL Medical

- Becton, Dickinson and Company (BD)

- Sterintech

- Survitec Group

- Safetec of America

- Lifesystems

- Tender Corporation

- Beiersdorf AG

- H&H Medical

Frequently Asked Questions

Analyze common user questions about the First Aid Packaging Kit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards primarily govern the manufacturing of first aid packaging kits globally?

The manufacturing and quality control of First Aid Packaging Kits are largely governed by international standards such as ISO 13485 (Quality Management System for Medical Devices) and regional mandates like the U.S. FDA regulations, OSHA standards (for industrial kits), and the European Union’s Medical Device Regulation (MDR) which requires CE marking, focusing heavily on material biocompatibility, sterility maintenance, and labeling accuracy for barrier packaging components.

How is the increasing focus on sustainability impacting material choices for first aid packaging?

The sustainability movement is driving a significant shift towards utilizing biodegradable polymers, recycled plastics (PCR content), and materials designed for easier end-of-life recycling, particularly in consumer and European markets. Manufacturers face the challenge of ensuring these sustainable materials meet the high-performance requirements—durability, barrier efficacy, and sterilization compatibility—essential for medical packaging integrity.

What is the current growth driver for the Refill Kits segment in the First Aid Packaging Market?

The Refill Kits segment is experiencing accelerated growth primarily due to increased cost-efficiency and improved compliance management for large institutional and industrial end-users. Instead of replacing entire, expensive kits, users can maintain perpetual readiness by efficiently replacing only used or expired modular components, supported by digital inventory systems and reducing overall safety expenditure.

How does packaging technology contribute to the shelf life of medical supplies within the kit?

Advanced packaging technology contributes critically to shelf life by providing superior environmental barriers. Utilizing multi-layer films, specialized polymer formulations, and hermetic sealing techniques, modern packaging effectively protects contents from critical degradation factors such as moisture, oxygen ingress, microbial contamination, and ultraviolet light exposure, ensuring the sustained sterility and efficacy of medical contents for their specified duration.

Which geographical region is expected to demonstrate the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, massive infrastructure development, increasing foreign investment, and the subsequent regulatory adoption and strict enforcement of international occupational health and safety standards across major economies like China and India, creating substantial new market demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager