Fish and Seafood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438397 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fish and Seafood Market Size

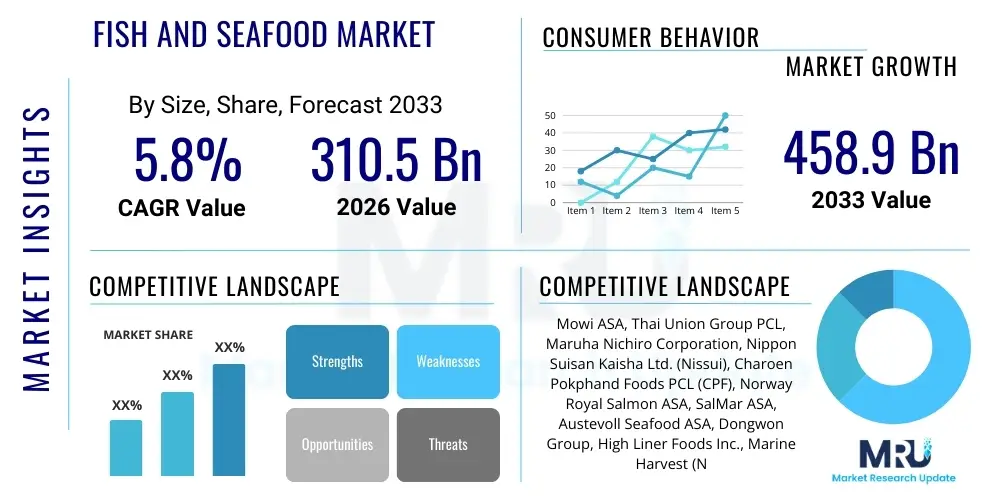

The Fish and Seafood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 310.5 Billion in 2026 and is projected to reach USD 458.9 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global population, rising consumer awareness regarding the nutritional benefits of seafood, and improved aquaculture techniques that ensure sustainable supply. The demand shift towards white meat alternatives and the expansion of cold chain logistics in emerging economies are critical accelerators contributing to this robust valuation growth over the coming years. Furthermore, technological advancements in processing, packaging, and traceability are enhancing product quality and safety, thereby boosting consumer confidence and market penetration worldwide.

Fish and Seafood Market introduction

The Fish and Seafood Market encompasses the commercial harvesting, processing, distribution, and consumption of aquatic organisms, including finfish, mollusks, and crustaceans, sourced from wild capture fisheries and controlled aquaculture operations. Products range from fresh, frozen, and chilled whole fish to highly processed forms such as surimi, canned goods, fish oil, and prepared meals. Major applications span direct human consumption, which accounts for the vast majority of market share, as well as uses in animal feed production, pharmaceuticals, and nutraceuticals, particularly fish rich in Omega-3 fatty acids. The product description emphasizes high protein content, essential vitamins, and healthy fats, positioning seafood as a premium dietary choice globally. Key benefits include improved cardiovascular health, enhanced cognitive function, and superior protein bioavailability compared to many terrestrial meat sources. These inherent nutritional advantages are primary drivers compelling increased consumer adoption, especially in developed markets where health consciousness is paramount. The market structure is highly fragmented yet dominated by a few large multinational processors and distributors, with significant regional variations based on local consumption patterns and accessibility to coastal or aquaculture resources. Innovations in genetic selection for aquaculture species and sustainable fishing practices are constantly reshaping the supply landscape, aiming to meet burgeoning global demand while addressing ecological concerns related to overfishing and marine environmental impact.

Driving factors propelling the Fish and Seafood Market include rapid urbanization and rising disposable incomes, particularly in the Asia-Pacific region, which facilitates access to higher-value protein sources. The increasing recognition of sustainability certifications, such as those provided by the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC), is influencing procurement decisions across retail and food service sectors, pushing the industry towards responsible resource management. Additionally, the expansion of global trade agreements and advancements in transportation infrastructure, especially refrigerated shipping containers, have significantly lowered logistical barriers, allowing fresh and frozen seafood to reach geographically distant markets efficiently. The ongoing efforts by governments and international organizations to combat illegal, unreported, and unregulated (IUU) fishing also contribute to market stability and quality assurance, benefiting legitimate industry players. However, maintaining consistent quality and addressing concerns related to microplastic contamination and ocean acidity remain crucial challenges that the industry must actively mitigate to sustain long-term growth momentum. Regulatory frameworks concerning food safety and international trade standards continue to evolve, necessitating continuous adaptation by all participants across the value chain, from catch to consumer. The consumer shift towards convenience foods is also a noticeable driver, promoting the growth of value-added seafood products that require minimal preparation time, appealing directly to modern, time-constrained lifestyles.

Fish and Seafood Market Executive Summary

The Fish and Seafood Market is characterized by robust resilience and dynamic adaptation to global supply chain challenges, primarily driven by strong consumer demand for high-quality, traceable protein sources. Current business trends indicate a significant consolidation among aquaculture companies seeking economies of scale and vertical integration, aiming to stabilize pricing and ensure reliable output volumes irrespective of fluctuating wild capture yields. Furthermore, there is an escalating investment focus on closed-containment aquaculture systems and offshore fish farming, reflecting a strategic industry response to environmental pressures and the need for biosecurity. Technological integration, especially concerning smart farming monitoring systems utilizing IoT and AI for optimizing feeding patterns and disease detection, is becoming standard practice, leading to enhanced operational efficiencies and reduced mortality rates. The market is witnessing a clear bifurcation in product offerings: high-value premium species (like salmon and shrimp) are gaining traction in developed markets, while affordable, nutritionally dense species are crucial for food security in emerging economies. Retail trends highlight the rapid expansion of e-commerce platforms for fresh and frozen seafood delivery, offering consumers greater transparency and direct access to niche products, which is further amplified by the lingering effects of the global health crisis that accelerated digital adoption across the food sector.

Regionally, Asia Pacific maintains its dominant position, accounting for the largest share of both production and consumption, fueled by dense populations, deep cultural reliance on seafood, and substantial investments in coastal and inland aquaculture development, particularly in countries like China, Indonesia, and Vietnam. Europe and North America represent high-value markets, emphasizing sustainable sourcing, organic labeling, and advanced processing techniques; these regions are primary importers of exotic and premium seafood products and are leaders in establishing high regulatory standards for food safety and environmental protection. Segments trends show that the aquaculture segment is growing faster than wild capture due to its reliability and scalability, making it indispensable for meeting future global protein demand. Within product types, crustaceans and mollusks are experiencing accelerated growth, driven by their increasing popularity in foodservice industries and the high-profit margins associated with these luxury goods. Distribution channel trends reveal an intensified competition between traditional grocery retail and specialized seafood outlets, with the foodservice sector undergoing rapid recovery and demanding consistent, bulk supply of standardized products. The increasing adoption of advanced preservation methods, such as high-pressure processing (HPP) and sophisticated freezing techniques, is extending product shelf life and ensuring quality retention during long-distance global transport, supporting the expansion of market reach across all geographical boundaries.

AI Impact Analysis on Fish and Seafood Market

Analysis of common user questions reveals significant interest concerning AI's role in optimizing resource management, improving traceability, and mitigating environmental risks within the Fish and Seafood Market. Users frequently inquire about how AI models predict fish stock levels, detect illegal fishing activities, and automate tasks in processing plants. Key concerns center around the capital expenditure required for AI adoption, the need for specialized data infrastructure, and ensuring the ethical use of technology in monitoring marine ecosystems. Expectations are high regarding AI's potential to revolutionize aquaculture through precision feeding, disease early warning systems, and automated sorting/grading, drastically improving yields and reducing waste. Furthermore, users are keen to understand AI's capability in enhancing supply chain visibility, particularly in authenticating product origins to combat fraud and ensure compliance with sustainability certifications, thereby building greater consumer trust. The overarching theme is the quest for a more efficient, sustainable, and transparent seafood supply chain enabled by sophisticated computational technologies.

- AI-Powered Precision Aquaculture: Optimization of feeding schedules, oxygen levels, and temperature control using sensor data and machine learning algorithms to maximize growth rates and minimize feed waste.

- Disease Detection and Prevention: Deployment of computer vision and acoustic sensors combined with deep learning models to identify early signs of disease outbreaks in fish farms, facilitating proactive intervention.

- Stock Assessment and Fishery Management: Utilization of AI to analyze satellite imagery, sonar data, and historical catch records, providing more accurate real-time predictions of wild fish populations for sustainable quotas setting.

- Combating Illegal, Unreported, and Unregulated (IUU) Fishing: Implementation of AI systems to monitor vast maritime areas, track vessel behavior anomalies, and verify compliance with designated fishing zones and regulations.

- Supply Chain Traceability and Anti-Fraud: Use of blockchain integrated with AI image recognition and data analytics to verify the authenticity, origin, and history of seafood products from harvest to point of sale.

- Automated Processing and Grading: Robotics and computer vision systems powered by AI for high-speed, accurate sorting, cutting, and grading of fish and seafood based on size, quality, and defect analysis, reducing manual labor costs.

- Market Demand Forecasting: Predictive analytics leveraging AI to forecast consumer demand trends, enabling processors and retailers to optimize inventory management and reduce spoilage rates.

- Environmental Monitoring: Deployment of AI to process data from oceanographic sensors, predicting changes in water quality, temperature, and acidity that might impact fisheries or aquaculture sites.

DRO & Impact Forces Of Fish and Seafood Market

The Fish and Seafood Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate strategic direction and operational viability. The primary drivers revolve around the inherent health benefits of seafood—specifically the high omega-3 fatty acid content—and the accelerating population growth worldwide, which necessitates diversified and scalable protein sources. Simultaneously, the market is constrained by significant ecological challenges, notably the depletion of wild fish stocks due to historical overfishing, climate change impacts affecting marine habitats, and stringent regulatory pressures requiring immediate shifts towards sustainable harvesting and aquaculture practices. These restraints often increase operating costs and necessitate substantial technological investment, particularly in advanced water treatment and waste management systems, creating barriers to entry for smaller enterprises. However, the opportunity landscape is vast, driven by technological breakthroughs in genetic improvement for farmed species, the development of land-based recirculating aquaculture systems (RAS) that minimize environmental risks, and the burgeoning consumer demand for value-added, ready-to-eat seafood products that offer convenience and culinary novelty. The impact forces manifest strongly through price volatility, driven by dependence on global commodity markets and fluctuating fuel costs for fishing fleets, demanding high supply chain efficiency and risk management.

A crucial driver is the aggressive marketing and product innovation targeting health-conscious consumers, exemplified by the proliferation of specialized products like concentrated fish oil supplements, fortified foods, and certified organic seafood lines. This push is strongly supported by global health organizations promoting the integration of lean protein and essential fatty acids into daily diets, creating continuous underlying demand. Conversely, major restraints include widespread consumer perception issues regarding seafood contamination, particularly concerning heavy metals like mercury, antibiotics use in conventional aquaculture, and microplastics found in marine environments, which necessitate rigorous testing protocols and transparent communication. Furthermore, geopolitical tensions and trade tariffs occasionally disrupt established global distribution channels, leading to temporary price spikes or market saturation in specific regions. The primary opportunity lies in market penetration into developing economies, where protein consumption levels are rapidly rising, and in maximizing the utilization of byproducts (e.g., fish waste for fertilizer or collagen extraction), which enhances overall resource efficiency and profitability. These forces compel industry players to prioritize traceability technologies and robust quality control mechanisms to maintain consumer trust and comply with increasingly strict international import standards, ensuring long-term market sustainability. Strategic investment in logistics infrastructure tailored for perishable goods, such as advanced refrigeration technologies and dedicated air freight capacity, remains a significant differentiator among competitors globally.

The cumulative impact forces compel major market participants to adopt proactive strategies focused on diversification of sourcing (balancing wild catch with aquaculture expansion) and investing heavily in sustainability certifications to gain a competitive edge in mature markets like North America and Europe. The shift towards land-based RAS for species like salmon and shrimp, despite the higher initial capital outlay, is a definitive trend demonstrating the industry's commitment to mitigating resource depletion and pollution risks, representing a pivotal long-term opportunity. However, the reliance on affordable feed ingredients, such as soy and other small pelagic fish (which themselves are vulnerable to ecological changes), remains a critical restraint impacting production costs and overall sustainability metrics. Successful navigation of these complex forces requires strong governmental support for sustainable fishery management, fostering private-sector innovation in alternative feed sources (e.g., insect protein, algae), and harmonizing international standards for seafood labeling and inspection. The convergence of digital technology, particularly IoT sensors and big data analytics in supply chain monitoring, offers the most significant leverage point, transforming potential restraints related to fraud and contamination into opportunities for verifiable transparency and premiumization of high-quality products, securing future market growth.

Segmentation Analysis

The Fish and Seafood Market is extensively segmented across multiple dimensions, including product type, source (wild capture vs. aquaculture), form (fresh, frozen, processed), and distribution channel, reflecting the varied nature of supply and consumer preferences globally. Analyzing these segments is essential for identifying specific growth pockets and understanding competitive dynamics. The differentiation based on source is particularly critical, as aquaculture is rapidly gaining share due to its predictable output and ability to cater to increasing demand, while wild capture remains indispensable for certain highly valued species and traditional markets. Furthermore, segmentation by product form highlights the shift towards value-added and processed seafood, driven by the consumer need for convenience and ready-to-eat meals, which carry higher margins for processors. Geographic segmentation also plays a pivotal role, with demand for specific species being heavily influenced by regional culinary traditions and economic development levels, necessitating localized marketing and supply chain strategies. This multifaceted segmentation helps stakeholders tailor production, processing, and distribution investments to maximize returns across diverse market environments, accommodating both luxury, niche markets and high-volume, commodity-focused demands.

Segmentation by product type typically categorizes the market into Finfish, Crustaceans, and Mollusks, each possessing unique market characteristics and growth drivers. Finfish, including species like salmon, tuna, cod, and tilapia, constitutes the largest overall segment, benefiting from established aquaculture practices and widespread availability, forming the backbone of global seafood consumption. Crustaceans, encompassing shrimp, crabs, and lobsters, command premium pricing and are characterized by strong growth in the foodservice sector and in markets with high disposable income, often linked to seasonal or celebratory consumption. Mollusks, such as oysters, mussels, and scallops, are experiencing demand resurgence driven by their low environmental footprint in certain farming systems and their increasing popularity in Mediterranean and Asian diets. Analyzing the differences in demand elasticity, production volatility, and processing complexity across these three major segments allows businesses to diversify their product portfolio strategically, mitigating risks associated with single-species dependence. The relative maturity of the processing infrastructure also varies significantly across these segments; for example, tuna processing relies heavily on canning and freezing technologies, whereas salmon is often sold fresh or lightly smoked, dictating different investment profiles and quality control requirements.

- By Source:

- Wild Capture

- Aquaculture (Farming)

- By Product Type:

- Finfish (Salmon, Tuna, Cod, Tilapia, Carp, others)

- Crustaceans (Shrimp, Crab, Lobster, Prawns)

- Mollusks (Oysters, Mussels, Scallops, Squid, Octopus)

- Others (Seaweed, Algae)

- By Form:

- Fresh

- Frozen

- Chilled

- Processed (Canned, Smoked, Cured, Dried)

- Value-Added (Ready-to-Eat/Cook Meals)

- By Distribution Channel:

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail)

- Food Service (Restaurants, Hotels, Cafeterias, Institutions)

- Industrial (Ingredients for Pet Food, Pharmaceuticals, Nutraceuticals)

- By End-User:

- Household Consumption

- Commercial/Institutional Consumption

- By Technology (Aquaculture):

- Ponds & Cages

- Recirculating Aquaculture Systems (RAS)

- Flow-Through Systems

Value Chain Analysis For Fish and Seafood Market

The Fish and Seafood Market value chain is inherently complex and highly interdependent, beginning with the upstream activities of resource management and primary production (wild capture or farming), moving through intensive processing, and concluding with downstream distribution channels reaching end-consumers. Upstream analysis focuses on inputs such as vessel design, fishing gear technology, fish feed formulation, and genetic development of farmed stock. Critical upstream decisions involve fleet capacity management in wild capture to comply with quotas and the optimization of feed conversion ratios (FCR) in aquaculture, which directly impacts environmental sustainability and operational profitability. Technological innovations, particularly in IoT-enabled monitoring of aquaculture sites and satellite tracking of fishing vessels, enhance efficiency and ensure compliance with environmental regulations. Suppliers of fish feed, often large agricultural or chemical corporations, hold significant leverage, particularly as the demand for sustainable, non-fish-based protein alternatives like insect meal and algae oil increases, driving a substantial shift in the upstream sourcing strategy for aquaculture farms globally. The cost and sustainability profile of the feed input represent one of the most volatile cost centers within the entire value chain.

The midstream stage involves processing, encompassing initial handling, preservation (freezing, chilling), filleting, smoking, canning, and the creation of value-added products. This stage requires significant investment in cold chain logistics and sophisticated processing machinery compliant with rigorous global food safety standards (e.g., HACCP, ISO 22000). Direct and indirect distribution channels dictate how products reach the market. Direct channels involve large integrated producers selling directly to major retailers or food service companies, allowing for greater control over quality and pricing. Indirect channels rely on numerous intermediaries, including wholesalers, importers, exporters, and local markets, which provide necessary market access but often increase handling costs and risks of quality degradation. Downstream analysis focuses on the final points of sale: retail (supermarkets, specialty stores, e-commerce) and food service (restaurants, institutions). Consumer purchasing behavior, driven by factors such as sustainability labeling, price point, and convenience, significantly dictates the demand signals transmitted back up the chain, influencing processing decisions regarding packaging and product form, ultimately emphasizing the crucial role of responsive logistics in maintaining the freshness and integrity of the perishable product.

Fish and Seafood Market Potential Customers

The potential customer base for the Fish and Seafood Market is exceptionally diverse, spanning global demographics and multiple industrial sectors, categorized primarily into household consumers, commercial food service operators, and specialized industrial buyers. Household consumers represent the largest end-user segment, driven by increasing awareness of seafood's health benefits, demanding products across all forms—fresh, frozen, and processed—based on affordability, availability, and culinary familiarity. Within this segment, there is a distinct sub-segment of health-conscious and affluent buyers who specifically seek out premium, sustainably certified, or exotic species, often utilizing specialized retail channels or direct-to-consumer delivery services. Commercial customers, comprising restaurants (fine dining to fast casual), hotels, catering companies, and institutional buyers (schools, hospitals), require consistent, bulk supply of high-quality, standardized products, often prioritizing long-term contracts and traceability assurances to meet their own high standards for presentation and food safety, driving the demand for standardized cuts and portions.

Industrial buyers form a specialized and rapidly growing customer segment, purchasing seafood or its byproducts not for direct consumption but for further processing into non-food products or ingredients. This includes the pharmaceutical industry, which utilizes fish oils rich in Omega-3 fatty acids (EPA and DHA) for supplements and therapeutic applications; the nutraceutical sector, which uses collagen and extracts; and the animal feed industry, particularly for pet food manufacturing. These buyers require specific chemical compositions, quality control documentation, and often purchase large volumes of low-value or byproduct material, contributing significantly to the reduction of waste within the overall seafood production system. The emerging pet food market, driven by premiumization trends in pet ownership, especially demands high-quality, traceable fish protein ingredients. Thus, market players must tailor their sales strategies, product specifications, and pricing models depending on whether they are targeting high-volume commodity retail, specialized B2B industrial ingredient supply, or high-margin, convenience-focused consumer channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 310.5 Billion |

| Market Forecast in 2033 | USD 458.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mowi ASA, Thai Union Group PCL, Maruha Nichiro Corporation, Nippon Suisan Kaisha Ltd. (Nissui), Charoen Pokphand Foods PCL (CPF), Norway Royal Salmon ASA, SalMar ASA, Austevoll Seafood ASA, Dongwon Group, High Liner Foods Inc., Marine Harvest (Now Mowi), AquaBounty Technologies, Cooke Aquaculture Inc., Grieg Seafood ASA, Leroy Seafood Group ASA, Clearwater Seafoods Inc., Fraser Yachts, Grupo Farallon Aquaculture, Tassal Group Limited, Empresas AquaChile S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fish and Seafood Market Key Technology Landscape

The technology landscape of the Fish and Seafood Market is rapidly evolving, moving beyond traditional harvesting and processing methods to embrace advanced digitalization, automation, and bio-engineering techniques, primarily aimed at improving sustainability, yield, and food safety. A fundamental technological shift is evident in aquaculture through the widespread adoption of Recirculating Aquaculture Systems (RAS) and hybrid flow-through systems. RAS technology allows for land-based fish farming in controlled, closed environments, drastically reducing water usage, minimizing discharge pollution, and offering superior biosecurity to mitigate disease outbreaks, which have historically plagued open-net pen operations. Furthermore, the integration of Internet of Things (IoT) sensors and remote monitoring systems is crucial for real-time data collection on water parameters (temperature, pH, dissolved oxygen), allowing farmers to implement precision feeding strategies and proactively manage environmental stressors. This move towards intelligent farming practices, often incorporating Artificial Intelligence (AI) for predictive analytics, is essential for maximizing feed conversion rates and ensuring reliable, year-round production of high-quality fish regardless of external environmental conditions, thus stabilizing supply chains and meeting stringent market demands.

In the wild capture segment and throughout the supply chain, technology focuses heavily on traceability, anti-fraud measures, and improved logistics efficiency. Satellite communication, high-resolution sonar, and advanced mapping technologies are used by fishing fleets to locate target species while minimizing bycatch, contributing to compliance with sustainable fishing quotas. Post-harvest, the implementation of blockchain technology is gaining traction as a secure and immutable ledger for tracking seafood products from the point of capture or harvest through every step of processing and distribution. This verifiable traceability is paramount for consumers and retailers demanding transparency regarding species authenticity, geographic origin, and sustainability certifications, directly addressing the widespread issue of seafood mislabeling. Furthermore, innovations in preservation and packaging, such as modified atmosphere packaging (MAP), advanced vacuum sealing, and cryogenic freezing techniques, are significantly extending the shelf life of highly perishable products, enabling global distribution of fresh-like quality seafood, opening up new export opportunities and reducing overall post-harvest waste across the entire logistical network, which enhances overall industry efficiency.

The third critical technological pillar involves processing automation and genetic innovation. Robotics and sophisticated computer vision systems are increasingly deployed in processing plants for high-speed automated sorting, precise cutting, and quality inspection, reducing reliance on manual labor and enhancing hygiene standards. Bio-engineering technologies, including selective breeding programs and, in some cases, gene editing (like that used in faster-growing AquAdvantage Salmon), are optimized to develop aquaculture strains that exhibit rapid growth, higher resistance to common diseases, and superior nutritional profiles, which is crucial for meeting long-term global protein demand efficiently. The focus on developing sustainable and economically viable alternative fish feeds, utilizing microalgae, microbial biomass, and insect protein, represents a major scientific challenge being addressed through biotechnology and advanced fermentation processes. These technological advancements collectively drive competitiveness, mitigate the environmental impact associated with conventional practices, and establish new standards for product quality and supply chain transparency, positioning the industry for significant capital investment and long-term sustainable growth in the face of resource constraints and climate variability challenges.

Regional Highlights

Regional dynamics within the Fish and Seafood Market are highly diverse, reflecting variations in consumption patterns, production capacities, regulatory environments, and economic factors. The market is primarily segmented into five key regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). The Asia Pacific region stands as the undisputed leader globally, dominating both aquaculture production volumes and consumption levels. This dominance is driven by high population density, deep cultural reliance on seafood as a primary protein source, and significant governmental investment in large-scale coastal and inland aquaculture projects, particularly in China, India, Indonesia, and Vietnam. APAC is also a major exporter of high-value species like shrimp and tuna to Western markets, making it a critical hub for global trade, although challenges related to water pollution and regulatory harmonization remain salient.

Europe and North America represent high-value, mature markets characterized by stringent quality controls, strong demand for sustainability-certified products (MSC/ASC), and a consumer preference for premium, exotic, and value-added seafood. These regions are net importers of many popular species, driving global trade flows. European countries, particularly Norway, Iceland, and the UK, are global leaders in salmon and whitefish production (wild capture and farming), setting high standards for traceability and cold chain infrastructure. North America focuses heavily on combating IUU fishing and promoting consumer awareness regarding sustainable choices, with the United States acting as a major importer and a significant player in seafood processing technology adoption, demanding high levels of transparency from international suppliers and domestic producers alike, often reflected through sophisticated labeling standards.

Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions. Latin America, particularly Chile, Peru, and Ecuador, is a powerhouse in aquaculture, dominating global exports of farmed salmon and shrimp, benefiting from favorable climatic conditions and extensive coastlines. Growth in MEA is driven by increasing population and disposable incomes in urban centers, leading to rising demand for both imported processed fish and local wild catch varieties, particularly in coastal African nations and the Gulf countries. These regions present substantial opportunities for infrastructure development related to cold storage and logistics, crucial for minimizing spoilage and maximizing market penetration. Investment in modern aquaculture techniques and improving local regulatory capacity are critical steps for these regions to fully capitalize on their inherent resource advantages and meet the growing domestic and international seafood demand effectively.

- Asia Pacific (APAC): Dominates global production and consumption; driven by China, Indonesia, and India. Strong reliance on aquaculture (especially carp, tilapia, shrimp). Highest growth potential due to expanding middle class and strong seafood tradition.

- Europe: High-value market focused on sustainability certifications and premium products (salmon, cod). Major import region, but also a leader in technological aquaculture (RAS). Stringent regulations on quality and environment.

- North America: Significant importer, strong consumer focus on health and traceability. High demand for processed and convenient seafood products. Key market for investment in advanced processing and supply chain technology.

- Latin America: Major exporter of farmed species (Chilean salmon, Ecuadorean shrimp). Growth spurred by access to abundant coastal resources and favorable conditions for large-scale farming operations.

- Middle East and Africa (MEA): Emerging markets with growing disposable incomes in urban areas, increasing demand for imported seafood. Opportunities exist in developing local aquaculture and improving cold chain logistics infrastructure to reduce reliance on foreign supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fish and Seafood Market.- Mowi ASA

- Thai Union Group PCL

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha Ltd. (Nissui)

- Charoen Pokphand Foods PCL (CPF)

- Norway Royal Salmon ASA

- SalMar ASA

- Austevoll Seafood ASA

- Dongwon Group

- High Liner Foods Inc.

- Marine Harvest (Now Mowi)

- AquaBounty Technologies

- Cooke Aquaculture Inc.

- Grieg Seafood ASA

- Leroy Seafood Group ASA

- Clearwater Seafoods Inc.

- Fraser Yachts

- Grupo Farallon Aquaculture

- Tassal Group Limited

- Empresas AquaChile S.A.

Frequently Asked Questions

Analyze common user questions about the Fish and Seafood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the aquaculture segment globally?

The aquaculture segment growth is primarily driven by the inability of wild capture fisheries to meet rising global protein demand, coupled with technological advancements like Recirculating Aquaculture Systems (RAS) that ensure predictable, disease-resistant, and environmentally controlled production volumes, crucial for stable supply.

How is sustainability affecting consumer choice in the seafood market?

Sustainability is a critical consumer factor, particularly in North America and Europe. Consumers increasingly prefer seafood certified by organizations like MSC and ASC, driving retailers and producers to invest heavily in verifiable traceability technologies and environmentally friendly farming or fishing practices to maintain market access and premium pricing.

What role does technology play in combating seafood fraud and mislabeling?

Technology plays a vital role through the implementation of blockchain and advanced DNA testing. Blockchain provides an immutable record of product origin and handling, while DNA barcoding is used by regulators and retailers to confirm species authenticity, significantly enhancing supply chain transparency and consumer trust.

What are the primary restraints facing the wild capture fisheries segment?

The primary restraints include the sustained depletion of major wild fish stocks due to historical overfishing, increasingly strict international quotas and regulatory restrictions, and the adverse effects of climate change, such as ocean warming and acidification, which destabilize key marine ecosystems and reduce biomass yields.

Which geographical region holds the largest market share for seafood production?

The Asia Pacific (APAC) region holds the largest market share for global seafood production and consumption, predominantly driven by high volumes of aquaculture output from countries like China, India, and Vietnam, serving both large domestic markets and extensive international export demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager