Fishing Sinker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437341 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fishing Sinker Market Size

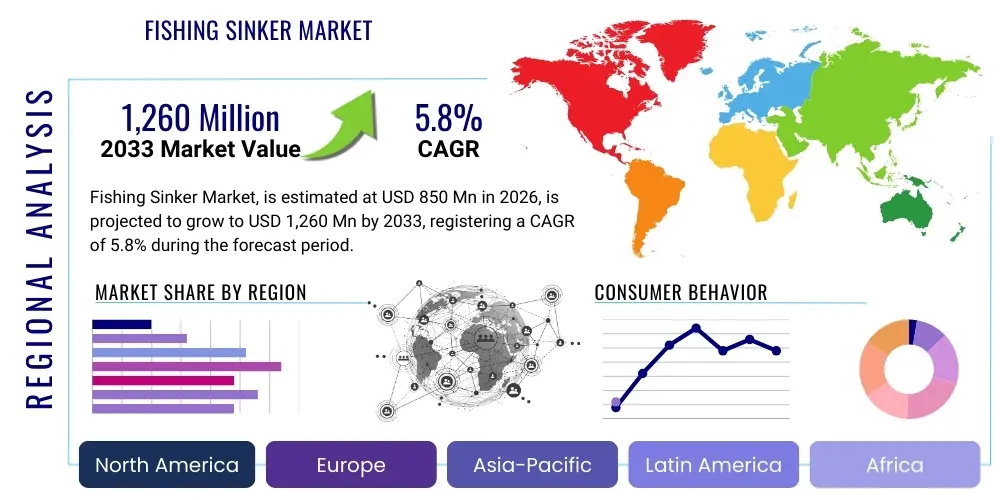

The Fishing Sinker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing participation rates in recreational fishing globally, coupled with ongoing advancements in material science designed to improve fishing performance and comply with evolving environmental regulations.

Market expansion is particularly noticeable across established markets in North America and Europe, where well-developed fishing infrastructure and high disposable incomes support consistent demand for high-quality, specialized sinker types. Furthermore, the rising popularity of competitive angling and professional fishing tournaments necessitates the use of diverse and precisely weighted sinkers, driving innovation in design and manufacturing processes. Manufacturers are increasingly focusing on diversification, offering products optimized for specific environments, such as saltwater versus freshwater, and targeting different species.

While traditional lead-based sinkers still dominate certain cost-sensitive segments, the regulatory push away from lead—due to its toxicity and environmental impact, particularly in freshwater bodies—is accelerating the adoption of alternative materials like tungsten, bismuth, and steel. This shift towards sustainable and non-toxic options presents both a challenge and a significant opportunity for market players, pushing R&D investment towards novel composite materials that offer comparable density and performance to lead without the associated ecological risks, thereby ensuring robust market potential throughout the forecast period.

Fishing Sinker Market introduction

The Fishing Sinker Market encompasses the manufacturing, distribution, and sale of weighted devices used in fishing to cast lines further, maintain bait or lure depth, and hold the terminal tackle in a desired position against water currents. These essential components are critical for both recreational and commercial fishing activities globally. The primary product function is manipulation of the fishing line to ensure effective bait presentation. The market is defined by a diverse array of sinker types, including split shots, egg sinkers, pyramid sinkers, worm weights, and jig heads, each tailored for specific fishing techniques and environmental conditions such as strong currents or deep-sea applications.

Major applications of fishing sinkers span across freshwater angling, which includes lakes, rivers, and ponds, and saltwater fishing, encompassing coastal, offshore, and deep-sea environments. The benefits derived from high-quality sinkers include enhanced casting distance, improved sensitivity to subtle bites, and the ability to effectively troll or anchor bait in turbulent waters. Driving factors for market growth include the rising global interest in outdoor recreational activities, increased governmental promotion of sustainable tourism that incorporates fishing, and continuous innovation in non-toxic materials responding to stricter environmental stewardship mandates.

The market landscape is characterized by moderate fragmentation, featuring a mix of large international sporting goods conglomerates and specialized regional manufacturers. Recent technological advancements focus heavily on integrating eco-friendly materials and developing hydrodynamic shapes that minimize snagging and maximize casting efficiency. The shift towards specialized tackle, driven by sophisticated consumer knowledge disseminated through digital platforms, further propels the demand for premium, application-specific sinkers, ensuring the market remains dynamic and responsive to both performance and sustainability requirements.

Fishing Sinker Market Executive Summary

The Fishing Sinker Market is undergoing a significant transition, driven by robust recreational participation rates and compelling regulatory shifts. Key business trends highlight a decisive move towards premiumization, where consumers are increasingly willing to pay more for performance-enhancing, environmentally responsible sinkers, particularly those made from high-density, non-toxic alternatives like tungsten and steel composites. This shift is reshaping supply chain logistics and manufacturing investments, favoring companies that can rapidly innovate and secure reliable sources of alternative materials. Furthermore, strong growth is observed in the e-commerce sector, which provides specialty manufacturers direct access to global consumer bases, bypassing traditional retail intermediaries and offering tailored product bundles.

Regionally, North America maintains its dominance due to a deeply ingrained fishing culture, vast natural resources suitable for angling, and high consumer spending on recreational gear. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by rising disposable incomes in countries like China and India, coupled with increasing governmental efforts to develop fishing tourism and aquaculture sectors. Europe exhibits high adoption rates of regulatory-compliant, non-lead sinkers, often setting the precedent for sustainability standards globally. These geographical variances necessitate localized marketing strategies that address regional preferences for specific sinker types (e.g., feeder fishing in Europe vs. bass fishing weights in North America).

Segmentation trends indicate that the Material segment is the most volatile and innovation-driven area, with non-lead materials gaining substantial market share at the expense of traditional lead. Within the Application segment, recreational fishing continues to be the bedrock of demand, while the Type segment shows preference differentiation—heavy sinkers for offshore and deep-sea applications are experiencing robust growth alongside highly specialized, low-profile weights for competitive freshwater techniques. Overall, the market's executive outlook remains positive, underpinned by environmental mandates creating structured opportunities for innovative, compliant product offerings.

AI Impact Analysis on Fishing Sinker Market

User queries regarding AI in the Fishing Sinker Market primarily revolve around how machine learning can optimize manufacturing processes, predict consumer demand for specialized tackle, and aid in inventory management to handle the complex variety of sinker weights and types. A central concern is whether AI could influence the design phase, particularly in optimizing hydrodynamic shapes for maximum efficiency and minimum drag, or potentially developing AI-driven systems that recommend the best sinker weight and shape based on real-time factors like water current, depth, and target species. Another key theme involves supply chain resilience, utilizing predictive analytics to manage the sourcing and pricing volatility of alternative materials like tungsten, which are more expensive and subject to complex global commodity markets than lead.

While the product itself—a passive weight—has minimal direct interaction with AI, the manufacturing ecosystem and consumer experience are ripe for optimization. AI-driven vision systems can significantly improve quality control during high-volume production, ensuring weight consistency and defect detection, critical performance attributes for competitive anglers. Furthermore, AI algorithms are being deployed by major e-commerce platforms and tackle shops to analyze user purchasing behavior alongside environmental data (e.g., local fishing reports, weather patterns) to generate highly specific, localized recommendations for sinker purchases, thereby enhancing customer conversion rates and reducing inventory obsolescence for retailers dealing with hundreds of SKU variations.

- AI optimization of manufacturing lines for enhanced weight precision and quality control.

- Predictive analytics assisting in forecasting demand for specific sinker materials (e.g., tungsten vs. steel) based on evolving regulations and consumer trends.

- Machine learning algorithms guiding R&D efforts to design hydrodynamically superior sinker shapes for specific fishing techniques.

- Improved supply chain management using AI to stabilize sourcing and inventory of high-cost alternative materials.

- Personalized digital recommendations (AEO/GEO driven) for sinker selection based on a user's geographical location, target fish, and typical fishing conditions.

DRO & Impact Forces Of Fishing Sinker Market

The Fishing Sinker Market is shaped by a critical interplay of strong environmental drivers pushing for material innovation, juxtaposed against restraints related to the cost and accessibility of high-performance substitutes. The primary driver is the global surge in recreational fishing participation, underpinned by increased leisure time and a focus on outdoor activities, which translates directly into higher demand for terminal tackle. However, the most profound force is the escalating regulatory pressure in developed economies, mandating the phase-out or outright ban of lead sinkers due to proven ecological toxicity, particularly concerning waterfowl ingestion. This regulation acts as a powerful catalyst, compelling manufacturers to invest heavily in R&D for compliant and high-density alternatives like bismuth, steel, and tungsten, effectively structuring the market's future trajectory.

Conversely, significant restraints are tied to the supply chain and consumer perception. Non-lead materials, especially high-density options like tungsten, are substantially more expensive to procure and process than lead, leading to higher retail prices that can deter price-sensitive consumers, particularly in developing markets or for high-volume commercial fishing. The technical challenge of achieving the optimal density and casting characteristics of lead using substitutes also presents a constraint; while alternatives exist, achieving perfect performance parity can be challenging and costly. Moreover, the fragmented nature of global fishing regulations means manufacturers must often produce multiple product lines to cater to varying local compliance requirements, adding complexity to production and distribution logistics.

Opportunities in the market are abundant, centered around sustainable material innovation and market penetration in previously untapped regions. The increasing environmental consciousness among younger anglers creates a substantial market opportunity for brands that proactively champion eco-friendly products, allowing for premium pricing and brand loyalty. Additionally, expanding professional angling circuits and the associated demand for specialized, high-precision equipment offer avenues for premium product growth. The impact forces acting on the market are profound: regulatory requirements are high-impact, driving material substitution; consumer discretionary spending provides moderate, steady growth; and technological material innovation offers a medium-to-high impact by mitigating the technical restraints associated with non-lead alternatives.

Segmentation Analysis

The Fishing Sinker Market is comprehensively segmented based on material type, product shape or type, fishing application (freshwater vs. saltwater), and distribution channel. This multi-dimensional segmentation allows for precise market targeting and analysis of emerging trends, particularly the rapid shift away from commodity materials towards specialized, performance-driven inputs. Understanding these segments is crucial for stakeholders, as regulatory compliance primarily impacts the Material segment, while geographical consumer preferences heavily influence the Type and Application segments. The market dynamics show pronounced differences in price sensitivity and performance requirements across these segments, necessitating tailored manufacturing and marketing strategies.

The transition in the Material segment, from lead dominance to the adoption of high-density polymers, tungsten, steel, and brass, represents the most critical structural change in the industry over the next decade. Similarly, the Product Type segmentation, differentiating between utilitarian shapes (e.g., bank sinkers, pyramid sinkers) and highly technical, specialized weights (e.g., drop shot weights, finesse weights, jig heads), highlights the growing sophistication of the recreational fishing consumer. The growth in specialized techniques, often driven by online instructional content, directly translates into increased demand for specific, often higher-margin, sinker types optimized for those precise methods. The overarching trend is towards specialization and sustainability across all key segments.

- By Material: Lead, Tungsten, Steel/Iron, Brass, Bismuth, Others (Ceramics, Composite Materials).

- By Product Type: Split Shot Sinkers, Egg/Bullet Sinkers, Pyramid Sinkers, Bank Sinkers, Worm Weights/Drop Shot Weights, Jig Heads, Others (Trolling Weights, Specialty Weights).

- By Application: Freshwater Fishing, Saltwater Fishing.

- By End-Use Channel: Recreational Fishing, Commercial Fishing.

- By Distribution Channel: Online Retail, Offline Retail (Specialty Stores, Department Stores, Mass Merchandisers).

Value Chain Analysis For Fishing Sinker Market

The value chain of the Fishing Sinker Market begins with the upstream segment, which involves the sourcing and processing of raw materials. This stage is critical, especially due to the regulatory shift. Historically, lead sourcing was straightforward and low-cost. However, the current emphasis on non-toxic alternatives necessitates securing supplies of specialty metals like tungsten, which often involves complex global commodity trading and geopolitical considerations, leading to higher procurement costs and supply chain volatility. Primary processors transform these raw metals into alloys or usable granular forms before they reach the manufacturing facilities, establishing the baseline cost structure and material quality for the finished product. Effective upstream management is paramount for ensuring both competitive pricing and compliance with environmental standards.

The midstream process, or manufacturing, involves casting, molding, stamping, and finishing. This stage focuses heavily on precision engineering, especially for high-density, small-volume products like tungsten weights, which require specialized tooling and higher temperatures compared to traditional lead casting. Post-manufacturing, products are packaged, often branded, and prepared for distribution. This segment has seen significant investment in automation to achieve the high degree of weight accuracy required by discerning anglers. Manufacturers also engage in substantial quality assurance to ensure product weight conforms exactly to specifications, a key performance indicator in competitive fishing.

Downstream analysis covers distribution channels, linking manufacturers to the end-users. Distribution is bifurcated into direct and indirect channels. Indirect channels historically included wholesalers and large sporting goods retailers (Offline Retail), which still account for a substantial volume of sales, particularly for commodity and low-cost sinkers. The direct channel, predominantly facilitated by e-commerce (Online Retail), has grown exponentially, enabling specialized manufacturers to reach niche consumer segments globally with highly targeted products and often better margins. Specialty fishing stores remain vital as they offer expertise and personalized advice, whereas large mass merchandisers focus on volume and price. Effective channel management requires balancing the high-volume needs of mass retail with the high-margin, tailored service offered by online and specialty outlets.

Fishing Sinker Market Potential Customers

Potential customers for the Fishing Sinker Market are broadly segmented into recreational anglers, commercial fishing operators, and institutional buyers (such as conservation agencies or research bodies). Recreational anglers represent the largest and most diverse customer base, ranging from occasional hobbyists seeking basic, cost-effective lead or steel sinkers, to highly dedicated tournament professionals who demand premium, high-density tungsten weights optimized for precision and technique. This segment is characterized by increasing brand loyalty tied to perceived performance and alignment with environmental values, making them receptive to marketing emphasizing sustainability and innovation. Their purchasing decisions are often influenced by digital content, professional endorsements, and regional fishing trends.

Commercial fishing operators constitute the second major customer group, requiring large volumes of heavy, durable sinkers and weights designed for specific large-scale operations, such as netting or long-lining in deep-sea environments. For these buyers, the primary purchase criteria are durability, sheer weight capacity, and cost-efficiency, often favoring traditional, robust materials capable of withstanding harsh marine conditions and significant wear and tear. While commercial operations are increasingly facing pressure to adopt eco-friendly gear, the immediate transition is slower compared to the recreational segment due to the operational costs and the sheer volume of weights required, though this segment represents a significant long-term opportunity for non-lead heavy-duty weights.

Institutional buyers, while smaller in volume, represent a niche but influential market segment. This includes fisheries management organizations, marine research institutions, and environmental agencies that purchase weights for scientific tagging, sampling equipment, and specific habitat restoration projects. Their requirements are stringent, often demanding certified non-toxic materials (regardless of cost) and precise weight specifications for research accuracy. Furthermore, distributors and retailers—including major sporting goods chains, specialty tackle shops, and online platforms—are critical immediate customers for manufacturers, focusing on purchasing a balanced inventory that meets the diverse needs of the ultimate end-users across different geographical regions and fishing styles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Water Gremlin Company, Acme Tackle Company, TTI Companies, Cabela's (Subsidiary of Bass Pro Shops), Mustad, Eagle Claw Fishing Tackle, Lure Parts Online, VMC (A Rapala VMC Brand), Angler's Choice, SPRO Corp, Gamakatsu, Offshore Angler, Reaction Tackle, Sea Striker, Z-Man Fishing Products, River2Sea, Owner Hooks, Daiwa, Shimano |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fishing Sinker Market Key Technology Landscape

The technology landscape within the Fishing Sinker Market is primarily focused on material science and advanced manufacturing techniques, rather than complex electronics. The most significant technological shift involves the development and processing of high-density alternative materials, such as sintered tungsten alloys. Sintering technology allows manufacturers to compress powdered tungsten metal into extremely dense, small forms, mimicking the performance characteristics of lead (high mass-to-volume ratio) without the toxic ecological impact. Achieving consistent density and shape during the sintering process is crucial and requires specialized machinery and strict quality control protocols, representing a major technological barrier to entry for smaller manufacturers still relying on traditional casting methods.

Beyond material composition, advancements in coating and finishing technologies are essential for product longevity and environmental integration. Manufacturers are utilizing advanced powder coatings and specialized polymers to protect steel and iron sinkers from corrosion, particularly in harsh saltwater environments, thereby extending product lifespan and maintaining consistent weight over time. Furthermore, the technology applied to jig heads—which integrate the hook and the weight—involves sophisticated molding techniques to create intricate, realistic baitfish profiles and employ specialized hook-holding collars, demanding high precision tooling and multi-stage injection processes not commonly used in simple sinker production.

The integration of CAD/CAM systems is now standard for designing hydrodynamically efficient sinker shapes. These software tools allow engineers to simulate drag and casting performance, optimizing shapes to reduce snagging in specific aquatic environments (e.g., streamlined profiles for rocky bottoms). Manufacturing technology is also being upgraded to include automated weight calibration systems. Due to the high value and performance demand of tournament-grade sinkers, precise weight tolerances are critical; automated weighing and sorting mechanisms ensure that every unit sold meets the stated specification, minimizing inconsistencies that could impact competitive anglers. This marriage of material science, precision manufacturing, and digital design tools defines the modern technological edge in the market.

Regional Highlights

North America holds the largest market share in the Fishing Sinker Market, driven by a deeply ingrained culture of recreational fishing, extensive freshwater and saltwater resources, and high consumer expenditure on sporting goods. The United States, in particular, showcases robust demand across all sinker types, particularly specialized tungsten weights favored by competitive bass anglers. Regulatory measures, such as local bans on lead sinkers in certain states and national parks, have accelerated the adoption of alternatives, leading to significant market maturity in non-lead options. The region benefits from a well-established distribution network and high brand awareness, making it a critical area for product launch and premium sales. The market here is characterized by innovation, strong influence from major retail chains (like Bass Pro Shops and Cabela’s), and a consumer base that prioritizes performance and compliance.

Europe represents a mature yet dynamic market, characterized by strict environmental legislation and a preference for specific regional fishing styles, such as feeder fishing and carp angling, which require tailored sinker designs. Countries like the UK, Germany, and Scandinavia have been pioneers in implementing bans on lead sinkers, driving manufacturers to rapidly pivot to materials like steel, brass, and composite materials. This early regulatory adoption has positioned Europe as a leader in sustainable fishing tackle innovation. The market's growth is moderate but stable, supported by high participation rates in leisure fishing and a strong emphasis on ecological responsibility, often resulting in higher average selling prices for compliant products compared to other regions. Local manufacturing remains critical to supply region-specific tackle demands.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is underpinned by rapid urbanization, rising middle-class incomes, and increasing government investment in leisure infrastructure, including fishing tourism. While traditional, low-cost lead sinkers still dominate commercial fishing and local recreational markets in many parts of Southeast Asia, countries like Japan, South Korea, and Australia exhibit high demand for premium, specialized tackle, reflecting global trends in competitive angling. The sheer population size and increasing recreational participation rates offer immense untapped potential. As environmental regulations gradually tighten across developing APAC nations, the shift towards non-lead materials will become a significant growth driver, potentially transforming the region's manufacturing base into a global hub for alternative sinker production.

Latin America (LATAM) and the Middle East and Africa (MEA) currently account for smaller shares of the global market but offer emerging opportunities. In LATAM, Brazil and Mexico are key markets, driven by rich biodiversity and growing domestic recreational fishing. The market is highly price-sensitive, with lead sinkers dominating due to lower manufacturing costs and fewer stringent regulations. However, increasing international tourism and environmental awareness in coastal areas are slowly introducing demand for non-toxic options. The MEA region’s growth is nascent, primarily concentrated around wealthy coastal nations for deep-sea sport fishing and certain freshwater initiatives in South Africa. Future growth is tied to infrastructure development for tourism and the gradual implementation of sustainable fishing practices mandated by international conservation efforts.

- North America: Market leader; driven by high consumer spending, strong bass fishing culture, and advanced adoption of tungsten due to localized lead bans (e.g., New York, Massachusetts).

- Europe: High compliance rate with stringent environmental regulations; strong demand for specialized feeder and carp weights; leading innovation in steel and bismuth alternatives.

- Asia Pacific (APAC): Fastest-growing region; increasing participation in competitive angling (Japan, Korea); significant long-term potential for non-lead substitution as regulatory environment matures.

- Latin America: Price-sensitive market; primary demand for high-volume, cost-effective lead sinkers, slowly introducing premium options via international tourism influence.

- Middle East and Africa (MEA): Niche market focused on deep-sea sport fishing; growth dependent on tourism infrastructure development and localized conservation efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fishing Sinker Market.- Water Gremlin Company

- Acme Tackle Company

- TTI Companies

- Cabela's (Subsidiary of Bass Pro Shops)

- Mustad

- Eagle Claw Fishing Tackle

- Lure Parts Online

- VMC (A Rapala VMC Brand)

- Angler's Choice

- SPRO Corp

- Gamakatsu

- Offshore Angler

- Reaction Tackle

- Sea Striker

- Z-Man Fishing Products

- River2Sea

- Owner Hooks

- Daiwa

- Shimano

- Tungsten Weights Company

- Jig Heads Tackle

- PENN Fishing

- Strike King Lure Company

Frequently Asked Questions

Analyze common user questions about the Fishing Sinker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market shift from lead to alternative fishing sinker materials?

The primary driver is increasingly stringent environmental legislation, particularly in North America and Europe, banning or restricting the use of toxic lead sinkers due to their detrimental effect on wildlife, especially waterfowl and aquatic ecosystems. This regulatory pressure necessitates the adoption of non-toxic substitutes like tungsten and bismuth.

How does the cost of tungsten sinkers compare to traditional lead sinkers, and what justifies the price difference?

Tungsten sinkers are significantly more expensive (often 3 to 5 times the cost of lead). This price difference is justified by the much higher commodity cost of tungsten ore, the specialized high-temperature sintering technology required for manufacturing, and tungsten's superior density and hardness, which provides better sensitivity and a smaller profile for enhanced fishing performance.

Which regional market is showing the highest growth potential for fishing sinkers during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This is primarily fueled by rising disposable incomes, urbanization, and a dramatic increase in participation rates in organized and recreational fishing activities across key economies such as China, Japan, and Australia.

What are the key technological advancements defining the modern Fishing Sinker Market?

Key technological advancements include the development of sophisticated sintering and molding techniques for high-density, non-lead materials (like tungsten), the use of advanced corrosion-resistant coatings for steel and iron products, and the application of CAD/CAM systems to optimize hydrodynamic shapes for specific fishing conditions and reduced snagging.

How is e-commerce impacting the distribution landscape for specialized fishing sinkers?

E-commerce is revolutionizing distribution by providing specialized manufacturers direct access to global niche markets (e.g., competitive bass or finesse anglers). It enables targeted marketing and the sale of high-margin, specialized sinker kits and materials that might not be stocked by traditional mass merchandisers, leading to faster market penetration and better margins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager